Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By Myra P. Saefong

Lumber buyers placed unsuccessful bets on tariffs and interest rates

Lumber prices have dropped by more than 14% from a record high in early August.

Many home builders, contractors and retailers wagered that higher U.S. tariffs on imports would boost the cost of lumber, while lower interest rates would lift demand for the building material.

But those bets have failed to pay off - and lumber prices have tallied a steep decline from a record high reached only three weeks ago.

That price decline could lead to a drop in production at a time when home-building and housing demand starts to heat up.

The demand component for spring 2025 was a "complete swing and a miss," said Greg Kuta, president and chief executive officer at lumber broker Westline Capital Strategies.

The industry has been hoping that interest rates will be lower and that there will be more structural demand, but it keeps "hoping for something that's not there yet," said Kuta, who believes the lumber market is oversupplied.

The market had rallied on classic "buy the rumor, sell the fact" action, he told MarketWatch. Prices for lumber had been higher just a few weeks ago based on the idea that tariffs were going to be attached to lumber and people were going to have to pay substantially higher costs - yet the underlying demand isn't there, Kuta said.

People also overestimated where interest rates would be and their impact on lumber demand, which continues to slide lower, he added, with the "swing and a miss" he referred to based on housing statistics and earnings for publicly traded companies that supply lumber.

Builders FirstSource Inc. (BLDR), for example, reported a year-over-year fall in second-quarter net sales and income. Meanwhile, second-quarter earnings from Home Depot Inc. (HD) and UFP Industries Inc. (UFPI) missed market expectations.

See: Home Depot says tariffs will lead to price increases, but they won't be across the board

On Tuesday, lumber futures for September delivery (LBR00) (LBRU25) settled at $595.50 per thousand board feet, down 14.3% from a record-high settlement of $695.50 per thousand board feet on Aug. 1, according to Dow Jones Market Data. That's based on data covering lumber futures contracts that have been trading since August 2022. Lumber futures have declined about 14% overall for the month so far, sharply pairing their year-to-date gain to 8.2%.

'Wait and see' phase

To stabilize lumber prices in a perfect world, you would have to have "organic demand," and the earlier the market may see that is probably the spring of 2026 - and probably more in multifamily than single-family home construction, said Kuta.

As far as interest rates, he added, the industry is in the "wait and see" phase.

Fed-funds futures suggest that there could be a 25-basis-point rate cut in September, but the problem is that the market probably needs anywhere from a full basis point to one-and-a-half basis points cut to "ultimately have that trickle-down effect into 30-year mortgage rates," Kuta said.

With lumber demand faltering so far in 2025, the industry has set its sights to 2026, with expectations for a stabilization and a move higher in lumber prices likely predicated on supply disruption, he noted.

Canadian mills are losing out with lumber prices well under the cost of production, so there will be more production likely to come out of this market to "put us into equilibrium with demand and supply," Kuta said.

Tariff worries

However, Steve Loebner, vice president of forest products and risk management at Sherwood Lumber, believes lumber demand has been "fairly consistent" and that there isn't a massive oversupply in the market overall.

Price volatility, he said, has been driven by uncertainty around tariffs and future supply levels.

Prices "got ahead of themselves with some overbuying on the way up, and a very large and unsustainable futures premium" developed, said Loebner.

Canadian Prime Minister Mark Carney in early August announced measures, including loan guarantees and investments, to support the domestic lumber market. Combined with that "overbuying" of lumber, prices have been in "free fall" since early August, said Loebner.

And as U.S. "tariff language became more acute," lumber buyers were "proactive in procuring supplies," said Walter Kunisch, lead strategist at HTS Commodities, a division of Hilltop Securities.

President Donald Trump threatened new tariffs on Mexico, Canada and China in early February. By March, the Trump administration started an investigation into the potential threat that lumber imports pose to U.S. national security.

The presidential action said the nation's softwood lumber industry has the "practical production capacity to supply 95 percent" of the U.S.'s 2024 softwood consumption - but even so, the U.S. has been a net importer of lumber since 2016. The presidential action called for recommendations on actions to mitigate threats from lumber imports, which may include potential tariffs or export controls.

But even before the outcome of that investigation, there are pre-existing duties on U.S. lumber imports from Canada that have nothing to do with the current presidential administration, said Westline's Kuta.

In late July, the U.S. Commerce Department lifted its antidumping duties on Canadian lumber imports to 20.56% from 7.66%. Earlier this month, the Commerce Department also said it was more than doubling its countervailing duties, also known as antisubsidy duties, on Canadian lumber imports to 14.63% from 6.74%.

Indications for the housing market

But prices and demand for lumber aren't quite where some buyers expected it to be against this backdrop of higher U.S. tariffs on imports and high interest rates.

If the lower prices for lumber do lead to a significant loss in lumber production, then the market will be "dramatically undersupplied if and when housing demand does increase into next year," said Loebner of Sherwood Lumber.

If that happens, prices for lumber could be significantly higher in the longer term, he noted.

U.S. confidence among home builders slipped in August as home-buying demand remained weak, data from the National Association of Home Builders released on Monday showed. July housing starts were stronger than expected, while building permits were lower than forecast.

Privately owned housing starts in July were at a seasonally adjusted annual rate of 1.43 million. The market had previously become accustomed to booming demand conditions - though if you take a bigger-picture view of current conditions, we are "actually in the middle of the range," said Loebner.

Typically, the industry sees an increase in demand going into the end of the year as builders gear up for first-quarter builds, he said, and there's "slightly better visibility" on projects for the fourth quarter of this year and first quarter of next year. That's "encouraging for future demand growth," he added.

-Myra P. Saefong

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

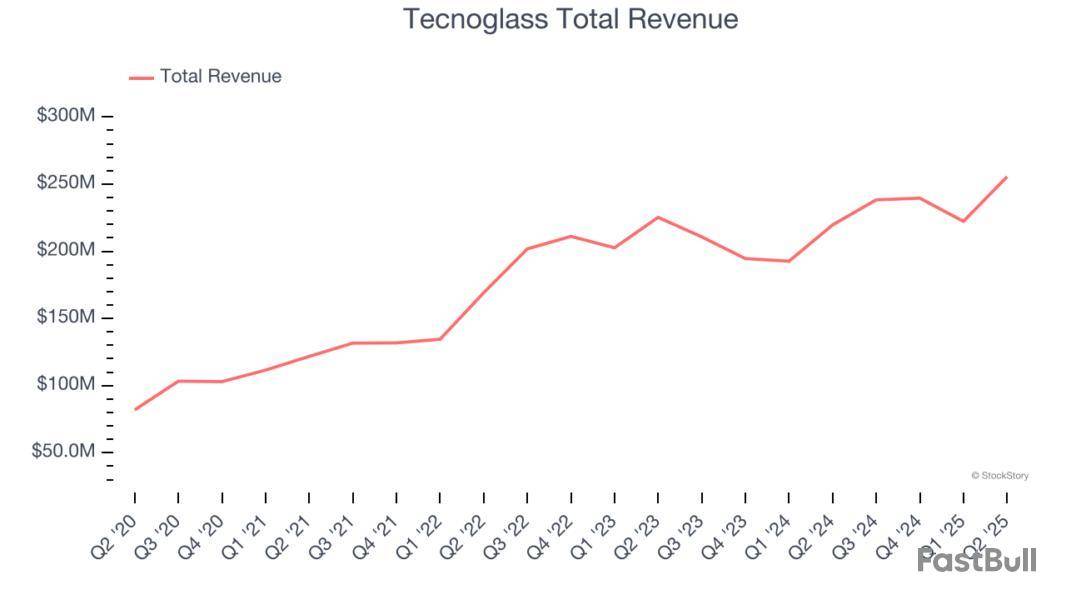

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Tecnoglass and the best and worst performers in the building materials industry.

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

The 8 building materials stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.3% on average since the latest earnings results.

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass is a manufacturer of architectural glass, windows, and aluminum products.

Tecnoglass reported revenues of $255.5 million, up 16.3% year on year. This print exceeded analysts’ expectations by 4.3%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

Unsurprisingly, the stock is down 7.4% since reporting and currently trades at $72.51.

Is now the time to buy Tecnoglass? Access our full analysis of the earnings results here, it’s free.

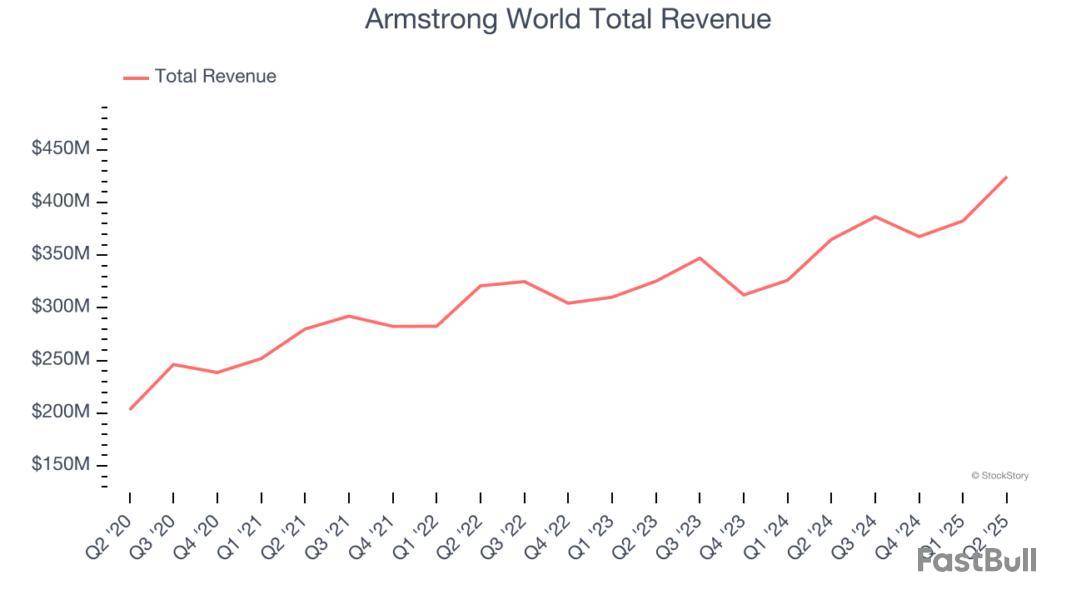

Started as a two-man shop dating back to the 1860s, Armstrong provides ceiling and wall products to commercial and residential spaces.

Armstrong World reported revenues of $424.6 million, up 16.3% year on year, outperforming analysts’ expectations by 5.2%. The business had a stunning quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 15.6% since reporting. It currently trades at $195.27.

Is now the time to buy Armstrong World? Access our full analysis of the earnings results here, it’s free.

Originally founded as Carlisle Tire and Rubber Company, Carlisle Companies is a multi-industry product manufacturer focusing on construction materials and weatherproofing technologies.

Carlisle reported revenues of $1.45 billion, flat year on year, falling short of analysts’ expectations by 3.2%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 5.4% since the results and currently trades at $387.

Read our full analysis of Carlisle’s results here.

Widely known for its success in the paint industry, Sherwin-Williams is a manufacturer of paints, coatings, and related products.

Sherwin-Williams reported revenues of $6.31 billion, flat year on year. This print was in line with analysts’ expectations. More broadly, it was a softer quarter as it logged full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ adjusted operating income estimates.

The stock is up 7.6% since reporting and currently trades at $367.93.

Read our full, actionable report on Sherwin-Williams here, it’s free.

Beginning as a lumber supplier in the 1950s, UFP Industries is a holding company making building materials for the construction, retail, and industrial sectors.

UFP Industries reported revenues of $1.84 billion, down 3.5% year on year. This result missed analysts’ expectations by 1.9%. It was a disappointing quarter as it also recorded a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EPS estimates.

UFP Industries had the slowest revenue growth among its peers. The stock is up 1.1% since reporting and currently trades at $105.51.

Read our full, actionable report on UFP Industries here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

By Heard Editors

What Happened in Markets Today

Tech sinks the market. Big tech made its weight felt Tuesday as a notable decline among megacap tech stocks pushed major indexes into the red. The eight companies valued at more than $1 trillion lost a combined $385 billion in market capitalization for the day. The Nasdaq closed down 1.5%.

Valuations chipped away. More expensive tech names saw even greater pressure. Palantir, which trades at more than 200 times projected earnings, led S&P 500 decliners with a 9.4% drop. Oracle, whose own multiple is historically high following a 49% run-up this year, dropped 5.8% on Tuesday.

Home Depot sends a message. The retail giant's shares rose 3% Tuesday following its quarterly results. But the company also said that it would be raising some prices due to tariffs and that homeowners are putting off big projects.

Intel finds more friends. Softbank is investing $2 billion in Intel, following news that the company is also in discussions for the federal government to take a stake. Intel's shares jumped nearly 7% Tuesday-leading gainers on the S&P 500.

This analysis comes from the Journal's Heard on the Street team. Subscribe to their free daily afternoon newsletter here.

This item is part of a Wall Street Journal live coverage event. The full stream can be found by searching P/WSJL (WSJ Live Coverage).

Wall Street fell further from its records.

The S&P 500 lost 0.6% Tuesday, its third straight loss after setting its all-time high last week. The Dow Jones Industrial Average inched up less than 0.1%, and the Nasdaq composite sank 1.5%.

Drops for Palantir Technologies, Nvidia and other stars bid up because of the mania around artificial-intelligence technology led the declines.

Home Depot helped keep the Dow steadier after standing by its forecast for profit and revenue this year.

On Tuesday:

The S&P 500 fell 37.78 points, or 0.6%, to 6,411.37.

The Dow Jones Industrial Average rose 10.45 points, or less than 0.1%, to 44,922.27.

The Nasdaq composite fell 314.82 points, or 1.5%, to 21,314.95.

The Russell 2000 index of smaller companies fell 17.86 points, or 0.8%, to 2,276.61.

For the week:

The S&P 500 is down 38.43 points, or 0.6%.

The Dow is down 23.85 points, or 0.1%.

The Nasdaq is down 308.02 points, or 1.4%.

The Russell 2000 is down 9.92 points, or 0.4%.

For the year:

The S&P 500 is up 529.74 points, or 9%.

The Dow is up 2,378.05 points, or 5.6%.

The Nasdaq is up 2,004.16 points, or 10.4%.

The Russell 2000 is up 46.45 points, or 2.1%.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up