Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

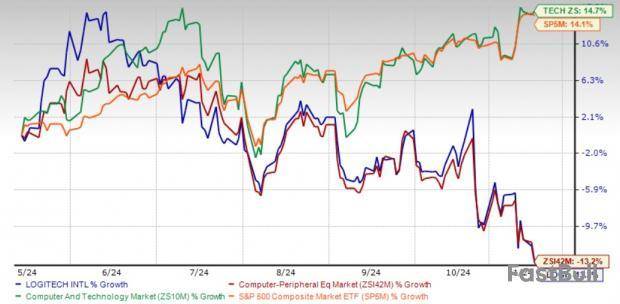

Logitech LOGI shares have plunged 13.3% in the past six months, underperforming the Zacks Computer Technology sector and the S&P 500’s return of 14.7% and 14.1%, respectively. LOGI also underperformed the Zacks Computer - Peripheral Equipment industry’s decline of 13.2% in the past six months.

Given Logitech’s position as one of the established players in the computer peripheral market, this underperformance is disappointing. This raises a crucial question for investors: Is it the right time to buy or sell LOGI stock?

LOGI Faces Competitive and Economic Pressures

Logitech has been a recipient of the challenges posed by the weakening global economy amid ongoing macroeconomic uncertainties and geopolitical issues. These factors have affected consumer spending leading to lower consumption of consumer electronics, negatively impacting Logitech’s top line throughout the fiscal 2024.

LOGI is also facing headwinds from the growing popularity of smaller and mobile computing devices with touch interfaces, which is diminishing the demand for desktop PCs — Logitech's primary market for peripheral products.

The market where Logitech operates is highly competitive and characterized by short product life cycles. The peripheral market is also treaded with multiple competitors including Bose, Sony Group SONY, Apple AAPL, Corsair CRSR, Microsoft, Philips, HP, Dell, Cisco and many more.

HP and Dell produce pointing devices, keyboards and other peripheral equipment like Logitech. Sony, Bose and Corsair have their impressive lineup of headsets and Cisco competes with Logitech in the webcam market. These brands constantly launch new products, rapidly change technology per the evolving customer demands, and promote through aggressive promotional and pricing practices.

These factors also force Logitech to take in aggressive marketing tactics. Logitech’s marketing and selling costs have been on a rising trend for the past eight quarters.

Logitech 6 Month Performance

Strong Portfolio and Partnerships Aid LOGI

All these challenges have not stopped Logitech from improving its revenues. LOGI’s revenues are on the path of recovery. Amid all the above headwinds, Logitech is navigating the computer peripheral market with innovative product launches. In the past year, Logitech has launched several innovative audio equipment that include EVERBOOM portable speaker with 360° sound, EPICBOOM Bluetooth speaker, Logitech G ASTRO A50 X LIGHTSPEED wireless headset, Zone Wireless 2 headsets for work and software like Streamline plugin for Loupedeck users.

Alongside its audio portfolio, LOGI has also enriched its consumer electronic portfolio, including gaming products and office work accessories. Logitech has stormed the gaming market with LIGHTSPEED Gaming Mouse, Logitech G515 next-generation gaming keyboard and PRO X 60 Gaming Keyboard.

So far this year, Logitech contributed to the webcam market with its AI-powered USB conference camera, MeetUp 2. Other webcams include MX Brio/MX Brio 705 for Business and Mevo Core 4K camera. With all these innovations in place, Logitech is expected to serve a wide customer base.

For the office electronic accessories market, LOGI launched the Casa Pop-Up Desk, Signature Slim K950, Slim Combo and Slim Combo for Business keyboards. Furthermore, Logitech dedicated an entire lineup of products for Apple’s Mac under the brand Logi for Mac products.

To gain market share among Apple users, Logitech has enhanced the compatibility of its product lineup with Mac OS and iPadOS. Logitech has launched dedicated macOS keyboards for the Apple ecosystem. LOGI’s portfolio for Mac users includes MX Anywhere 3S keyboards, MX Keys S, MX Keys S Combo, MX Keys Mini and Ergo Series Wave Keys.

In the past couple of years, LOGI has certified its peripherals to work seamlessly with Microsoft and Intel products. It gained certifications from these industry leaders for its peripherals.

Logitech has certified its Sight AI Camera from Microsoft Teams. LOGI also verified its mouse and keyboard for Intel Evo laptops that meet strict requirements for reliability, interoperability and security.

With all these innovative products in place, Logitech expects fiscal 2025 sales in the band of $4.39-$4.47 billion. The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $4.39 billion, indicating year-over-year growth of 3.11%.

The Zacks Consensus Estimate for LOGI’s fiscal 2025 earnings is pegged at $4.48, suggesting year-over-year growth of 7.8%.

What Should Investors Do?

Although Logitech faces stiff competition and macroeconomic challenges, the company is on the path of recovery on the back of its innovative products. LOGI is also fairly valued at present with Zacks’s Value Score of B.

Considering all these factors, we suggest investors to buy this Zacks Rank #2 (Buy) stock at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Investment Research

After years of limited advancements in chronic obstructive pulmonary disease (COPD) treatment, patients now have new options.

Regeneron Pharmaceuticals Inc and Sanofi SA’s Dupixent recently gained FDA approval for COPD, marking its sixth U.S. indication since its first use for atopic dermatitis seven years ago.

This expansion positions Dupixent as the first targeted therapy for COPD, a significant leap in treating this progressive lung condition that impedes breathing due to obstructed airflow.

COPD often manifests as chronic bronchitis and emphysema, typically developing from prolonged exposure to irritants like cigarette smoke, air pollution, or occupational dust.

Also Read: Regeneron’s Dupixent COPD Sales To Reach $20B By 2026, Analyst Sees Larger Addressable Market

The condition impacts millions globally, with a 2023 analysis by DelveInsight reporting around 44 million diagnosed cases across seven major markets, with projections of continued growth at a 1.4% CAGR through 2034.

COPD management typically involves medications like bronchodilators, which ease breathing by relaxing airway muscles.

These drugs, often used in inhalers, can include steroids to reduce inflammation in severe cases. Common options include short—and long-acting bronchodilators like Albuterol, Ipratropium, and Aclidinium. LABAs and LAMAs are also prevalent, with combinations such as LABA+ICS (e.g., AstraZeneca Plc’s Symbicort, GSK Plc’s Advair) and LABA+LAMA (e.g., GSK’s Anoro Ellipta, Boehringer Ingelheim’s Stiolto Respimat) available for comprehensive treatment.

The introduction of Dupixent changes the treatment landscape by specifically targeting type 2 inflammation pathways (IL-4 and IL-13), which play a role in COPD patients with elevated eosinophils prone to frequent exacerbations.

The Phase 3 BOREAS trial demonstrated that DUPIXENT reduced moderate-to-severe exacerbations by 30% over 52 weeks and improved lung function, with prebronchodilator FEV1 increasing by 160 mL compared to 77 mL in the placebo group.

The drug also had a favorable safety profile, indicating its potential as a game-changer for those with type 2 inflammation.

Further boosting the pipeline, mid-stage drugs like Sanofi/Regeneron’s itepekimab, AstraZeneca’s benralizumab, Amgen Inc NASDAQ: AMGN/AstraZeneca’s tezepelumab, and GSK’s mepolizumab are in development, promising more options to transform COPD management.

On Wednesday, Regeneron announced that new and updated data from its hematology pipeline will be presented in 23 abstracts at the American Society of Hematology 2024 Annual Meeting.

Price Action: REGN stock traded lower by 0.98% to $812.92 at the last check on Wednesday.

Read Next:

Photo by Minerva Studio via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Taking full advantage of the stock market and investing with confidence are common goals for new and old investors, and Zacks Premium offers many different ways to do both.

Featuring daily updates of the Zacks Rank and Zacks Industry Rank, full access to the Zacks #1 Rank List, Equity Research reports, and Premium stock screens, the research service can help you become a smarter, more self-assured investor.

Zacks Premium also includes the Zacks Style Scores.

What are the Zacks Style Scores?

The Zacks Style Scores is a unique set of guidelines that rates stocks based on three popular investing types, and were developed as complementary indicators for the Zacks Rank. This combination helps investors choose securities with the highest chances of beating the market over the next 30 days.

Based on their value, growth, and momentum characteristics, each stock is assigned a rating of A, B, C, D, or F. The better the score, the better chance the stock will outperform; an A is better than a B, a B is better than a C, and so on.

The Style Scores are broken down into four categories:

Value Score

Value investors love finding good stocks at good prices, especially before the broader market catches on to a stock's true value. Utilizing ratios like P/E, PEG, Price/Sales, Price/Cash Flow, and many other multiples, the Value Style Score identifies the most attractive and most discounted stocks.

Growth Score

Growth investors, on the other hand, are more concerned with a company's financial strength and health, and its future outlook. The Growth Style Score examines things like projected and historic earnings, sales, and cash flow to find stocks that will experience sustainable growth over time.

Momentum Score

Momentum trading is all about taking advantage of upward or downward trends in a stock's price or earnings outlook, and these investors live by the saying "the trend is your friend." The Momentum Style Score can pinpoint good times to build a position in a stock, using factors like one-week price change and the monthly percentage change in earnings estimates.

VGM Score

What if you like to use all three types of investing? The VGM Score is a combination of all Style Scores, making it one of the most comprehensive indicators to use with the Zacks Rank. It rates each stock on their combined weighted styles, which helps narrow down the companies with the most attractive value, best growth forecast, and most promising momentum.

How Style Scores Work with the Zacks Rank

The Zacks Rank is a proprietary stock-rating model that harnesses the power of earnings estimate revisions, or changes to a company's earnings expectations, to help investors build a successful portfolio.

It's highly successful, with #1 (Strong Buy) stocks producing an unmatched +25.41% average annual return since 1988. That's more than double the S&P 500. But because of the large number of stocks we rate, there are over 200 companies with a Strong Buy rank, plus another 600 with a #2 (Buy) rank, on any given day.

This totals more than 800 top-rated stocks, and it can be overwhelming to try and pick the best stocks for you and your portfolio.

That's where the Style Scores come in.

To have the best chance of big returns, you'll want to always consider stocks with a Zacks Rank #1 or #2 that also have Style Scores of A or B, which will give you the highest probability of success. If you're looking at stocks with a #3 (Hold) rank, it's important they have Scores of A or B as well to ensure as much upside potential as possible.

The direction of a stock's earnings estimate revisions should always be a key factor when choosing which stocks to buy, since the Scores were created to work together with the Zacks Rank.

For instance, a stock with a #4 (Sell) or #5 (Strong Sell) rating, even one that boasts Scores of A and B, still has a downward-trending earnings forecast, and a much greater likelihood its share price will decline as well.

Thus, the more stocks you own with a #1 or #2 Rank and Scores of A or B, the better.

Stock to Watch: Logitech (LOGI)

Based in Switzerland, Logitech International S.A. is the parent holding company of Logitech. The company is a global leader in peripherals for personal computers and other digital platforms. It develops and markets innovative products in PC navigation, Internet communications, digital music, home-entertainment control, video security, interactive gaming and wireless devices.

LOGI is a #3 (Hold) on the Zacks Rank, with a VGM Score of A.

It also boasts a Value Style Score of B thanks to attractive valuation metrics like a forward P/E ratio of 16.71; value investors should take notice.

For fiscal 2025, five analysts revised their earnings estimate upwards in the last 60 days, and the Zacks Consensus Estimate has increased $0.20 to $4.63 per share. LOGI boasts an average earnings surprise of 32.5%.

With a solid Zacks Rank and top-tier Value and VGM Style Scores, LOGI should be on investors' short list.

Zacks Investment Research

Immersion Corporation IMMR is expected to report third-quarter 2024 results this week.

The Zacks Consensus Estimate for revenues is pegged at $10.13 million, suggesting a 6.9% year-over-year increase. The consensus mark for earnings stands at 15 cents per share, unchanged over the past 60 days, implying an impressive 87.5% surge from the year-ago figure of 8 cents.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

As a leading developer and licensor of touch feedback (haptic) technology, Immersion has shown a consistent performance in surpassing earnings expectations. The company’s earnings have topped the Zacks Consensus Estimate three times in the past four quarters, with an average surprise of 50.6%.

Immersion Corporation Price and EPS Surprise

Immersion Corporation price-eps-surprise | Immersion Corporation Quote

Factors Shaping IMMR’s Upcoming Results

Immersion’s third-quarter performance is likely to have benefited from the rising demand for its haptic technology across key sectors such as gaming, automotive and consumer electronics. The push for enhanced user experiences, propelled by new product launches and strategic partnerships, is likely to have bolstered sales of its patented solutions.

The increasing adoption of virtual reality (VR) and augmented reality (AR) technologies, which rely on haptic feedback for immersive experiences, may have driven demand for Immersion’s offerings. Revenue growth in the to-be-reported quarter is also expected to have been supported by expanded licensing agreements and royalty income from prominent OEMs (original equipment manufacturers) in these emerging tech markets.

Immersion’s strategic initiatives aimed at broadening its product range and entering new markets, coupled with efficient cost management, could have enhanced operational efficiency and improved profit margins. The company’s focus on expanding its intellectual property (IP) portfolio and securing new licensing deals is likely to have played a pivotal role in boosting revenue and earnings growth in the third quarter.

Immersion’s Price Performance & Valuation

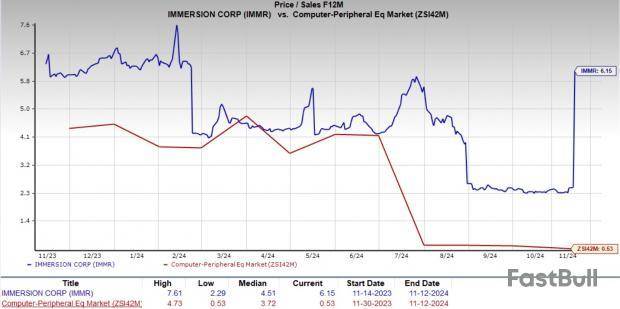

Year to date (YTD), shares of Immersion have soared 22.4%, outperforming the Zacks Computer - Peripheral Equipment industry’s decline of 35.7%. The IMMR stock has also outperformed other players in the space, including Logitech LOGI, TransAct Technologies TACT and Identiv INVE, which have registered a decline of 18.7%, 42.1% and 54.2%, respectively, YTD.

YTD Price Return Performance

Let’s look at the value Immersion offers investors at the current levels. IMMR is trading at a premium with a forward 12-month P/S of 6.15X compared with the industry’s 0.53X, reflecting a stretched valuation.

Investment Consideration for Immersion

Immersion’s technology is integral to many advanced haptic applications, positioning the company to capture growing demand across diverse markets. According to a Fortune Business Insights report, the global haptic technology market is expected to witness a CAGR of 13.6%, expanding from $2.99 billion in 2023 to $7.31 billion by 2030.

With a robust IP portfolio encompassing numerous patents, Immersion maintains a competitive advantage and generates substantial licensing revenues. The company’s technology is widely licensed, ensuring a consistent income stream that supports growth and innovation.

Immersion’s strategic push to broaden its product range into new sectors, such as medical devices and industrial applications, underscores its versatility. This diversification reduces reliance on any single industry and opens up multiple revenue channels.

Strong partnerships also bolster Immersion’s growth prospects. Over the past year, it has secured agreements with top smartphone manufacturers, gaming firms and automotive leaders, highlighting the widespread adoption of its technology. These partnerships validate Immersion’s product quality and secure long-term revenue potential.

The company boasts more than 15 award-winning designs and products used in more than three billion devices globally, with more than 150 licensed customers contributing to its expansive reach.

Conclusion: Hold IMMR Stock Ahead of Q3 Earnings

While Immersion’s stock has shown solid performance YTD and maintains strong growth drivers, holding the stock ahead of the Q3 earnings release could be a prudent strategy. This Zacks Rank #3 (Hold) company’s strong positioning in key markets, strategic partnerships and robust IP portfolio support a positive long-term outlook despite its premium valuation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Investment Research

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up