Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Litecoin (LTC) has, in the last 30 days, shed 6.113% of its value as the coin continues to experience volatility. However, the asset is showing the potential to register a bullish rally as the open interest has, in the last 24 hours, jumped to a new weekly high.

Rising open interest signals investor confidence in Litecoin

According to CoinGlass data, 8.44 million LTC valued at about $958.02 million were committed to the asset’s futures market by investors. For context, open interest refers to the sum of unsettled active futures contracts that investors have committed to Litecoin.

The bullish spike signals that investors are anticipating continued upward movement for LTC. According to available data, the majority of these investors are on the Binance exchange, with 2.44 million LTC valued at $276.93 million. This represents 28.9% of the total open interest within this time frame.

Bitget and Bybit are next, with 15.87% and 14.78% of the total share, respectively. In asset terms, Bitget investors committed 1.34 million LTC valued at $152.05 million, while Bybit registered 1.25 million LTC worth $141.65 million.

The uptick in open interest coincides with increased optimism of a possible approval of the pending exchange-traded fund (ETF) approval by the Securities and Exchange Commission (SEC). Notably, there is anticipation that the U.S. SEC will decide on applications, with Nate Geraci placing approval probability at 95%.

Litecoin price action and future outlook

The uptick in open interest and other bullish developments have triggered a slight increase in price. As of press time, the Litecoin price was changing hands at $113.00, a 0.26% increase in the last 24 hours. The coin previously traded at a peak of $114.63 before the correction.

Investors are also actively engaging with the coin as trading volume climbed by 2.31% to $636.73 million.

There was anticipation in some quarters when Litecoin traded at $129 that it could record a 100% increase, as it mirrors Ethereum’s trend. Ali Martinez, the renowned analyst, has predicted a possible rise to $220. Whether it can climb that high only time will reveal.

Binance, the world’s largest crypto exchange, is integrating Ethena Labs' USDe synthetic dollar across its platform, initially as a spot trading pair with the USDT stablecoin. Ethena Labs referred to the move as "one of our most important integrations to date," in a statement on Tuesday.

Notably, USDe will be integrated directly with Binance Earn, enabling users to earn dollar-denominated rewards payments. Binance will also offer USDe rewards, which will begin paying out at the end of the month, for using the asset as collateral in futures and perpetuals trading.

"USDe is set to completely transform trading on Binance as the first externally-developed dollar asset made available as collateral on the platform with native rewards," Ethena Labs wrote in a statement. "Similar to other exchange partnerships, Binance users will be able to earn rewards paid weekly by Binance for simply holding USDe anywhere on the exchange, including within portfolio margin on futures and perpetuals trading."

USDe is the largest non-fiat-backed dollar asset in the space with nearly $13 billion in supply. The asset earns yield and maintains its peg to the U.S. dollar through hedging crypto positions.

The move comes as Ethena mulls flipping a so-called "fee switch" for its governance token, ENA, that would share protocol revenues with holders. Former BitMEX CEO Arthur Hayes said the Binance integration could accelerate this fee switch, which could "unlock $500m of buybacks."

ENA is up nearly 2% at press time to trade at $0.79. This is up from a recent low in June of around $0.23, according to The Block’s price page. The token has an all-time high of $1.52.

Trading on Binance, which has an estimated 280 million users, has historically been dominated by Tether's USDT. The Ethena team argues this status quo could be upended by offering USDe as collateral for futures and perpetual contracts, which theoretically boosts capital efficiency by earning on margin balances. Users can trade any asset "with USDe collateralising their entire portfolio," Ethena noted.

The team pointed to an earlier integration on rival exchange Bybit in 2024 that saw USDe overtake USDC among users due to built-in rewards. USDe now reportedly accounts for 12% of total USD balances on Bybit, Ethena said.

According to the announcement, additional spot trading pairs using USDe on Binance are underway.

Last week, TLGY Acquisition Corp. and StablecoinX Assets Inc., which are looking to merge and list on Nasdaq as StablecoinX (ticker USDE), announced they are raising $530 million through a private placement to build out an ENA treasury.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The U.S. Federal Reserve is widely expected to cut interest rates after weak jobs data last week. Investors are already reacting. Gold prices touched a new record at $3,600 as markets bet heavily on easier monetary policy.

The question now is how this shift will affect cryptocurrencies like XRP. Analysts argue rate cuts won’t matter much for long-term holders. Others believe lower rates could unleash a wave of new investors.

“If rates fall, more money flows into the system,” said James Rule on Paul Barron Podcast. “That cash won’t just stay in banks. People will look to gold, metals, and crypto. We’re already seeing new, first-time users flooding in.”

Why XRP Could Benefit From Rate Cuts

In recent months, XRP has attracted retail investors who view the asset as a hedge against inflation and a bridge for cross-border finance. Lower borrowing costs could accelerate this trend by pushing savers to diversify.

“We’re getting newcomers every day. A rate cut is fuel for that growth,” Rule said.

Ripple’s Lawsuit Legacy

Beyond macroeconomics, XRP’s story is tied closely to Ripple’s landmark battle with the U.S. Securities and Exchange Commission. Ripple faced allegations that its XRP sales were unregistered securities. The case sparked a fierce defense from the company and the broader “XRP Army.”

Lawyer John Deaton became a central figure, rallying thousands of XRP holders to formally challenge the SEC’s claims. “We all fought that fight,” Rule recalled. “And it wasn’t just about Ripple. It set the tone for all of crypto.”

The victory for Ripple is now seen by many as a turning point. It provided clarity that has emboldened other projects and signaled to Wall Street that digital assets could withstand regulatory scrutiny.

Wall Street, Nasdaq, and Institutional Adoption

Signs of mainstream adoption are hard to ignore. Nasdaq has unveiled a proposal for tokenized securities, a step toward blending traditional markets with blockchain infrastructure. Stripe has hinted at launching its own blockchain network.

Meanwhile, Ripple’s upcoming Swell conference is drawing top institutional speakers, seen as a signal of growing corporate interest in XRP and blockchain adoption.

“From Capitol Hill to Wall Street, the groundwork was laid by Ripple’s fight,” the experts said.

TL;DR

VivoPower International PLC announced the move on September 8, indicating that its EV subsidiary – Tembo e-LV – has started to accept payments in Ripple’s stablecoin, RLUSD, which launched less than a year ago.

Tembo describes itself as a company seeking practical solutions to real-life challenges that affect conventional international wire transfers, which include longer waiting periods and high transaction costs.

The statement reads that RLUSD will allow for international wire transfers to be completed “almost instantaneously” at a “fraction of the cost” of conventional ones. The stablecoin also provides security to users as it’s pegged 1:1 to the US dollar and is fully backed by greenback deposits, short-term US treasuries, and other cash equivalents.

According to the announcement, the expected benefits of relying on RLUSD instead of traditional wire transfers will be as follows:

The move, which was also announced on X, led to some questions from users about why the company has opted only for the stablecoin and has left Ripple’s much more popular and bigger in market cap asset – XRP – out of the picture.

Although the statement doesn’t address this, the most probable reason is likely related to the lack of price fluctuations against traditional options like the USD. Both assets operate as cross-border tokens, but RLUSD maintains its value against the greenback, while XRP can be highly volatile.

Nevertheless, VivoPower, which said it “is undergoing a strategic transformation into the world’s first XRP-focused digital asset enterprise,” has already started to accumulate the asset. Itmade a $30 million purchaseearlier this month, and plans to expand that number to $200 million worth of XRP.

Coinbase has acqui-hired the two founders of Sensible, a crypto yield-earning platform, as part of its push to build what it calls the "everything exchange." The pair, Jacob Frantz and Zachary Salmon, will join Coinbase as Sensible winds down operations.

Founded in 2022 and backed by Coinbase Ventures and Dragonfly, Sensible let users earn yields through staking rewards as well as through DeFi protocols. At Coinbase, Frantz and Salmon will focus on advancing the company’s onchain consumer strategy.

"The pair bring unique expertise in building DeFi-powered consumer applications and will lead key teams shaping our onchain consumer strategy," Coinbase said. "Onboarding more users to the onchain economy requires simplifying access to DeFi, and the team’s experience will help strip complexities, elevate use cases, and make crypto that much easier for our users."

Frantz and Salmon said they will continue their focus on making crypto something people can use, not just own. Sensible will shut down in October, with users required to withdraw funds by Oct. 10. It is not clear what will happen to the rest of Sensible’s employees; its LinkedIn page shows the startup employed between two and 10 people. A Coinbase spokesperson declined to comment on the broader employee base, saying the scope of the deal was limited to the founders.

The Sensible deal is Coinbase’s seventh of 2025, adding to full acquisitions of token management platform Liquifi, web3 adtech firm Spindl, and crypto derivatives exchange Deribit, alongside acqui-hires of Iron Fish, Opyn, and Roam.

"At Coinbase, we believe the future of finance is onchain," the company said. "Our vision is clear: to make Coinbase an everything exchange, the gateway to a thriving onchain economy, and the best place to grow your money and manage everyday finances."

Coinbase's 'everything exchange' vision

Coinbase has recently laid out its ambition to become an "everything exchange" — a one-stop platform where users can trade, borrow, stake, spend, and earn. Plans include adding tokenized stocks, prediction markets, and early-stage token sales.

"We're building an exchange for everything," Max Branzburg, vice president of product at Coinbase, recently said. "Everything you want to trade, in a one-stop shop, on-chain. … We’re bringing all assets onchain — stocks, prediction markets, and more. We’re building the foundations for a faster, more accessible, more global economy."

Last month, Coinbase announced a decentralized exchange integration to give traders access to “millions” of digital assets not previously available on its platform. The move followed second-quarter results that showed revenue down 26% from the prior quarter, with transaction revenue falling 39% and spot trading volumes dropping more than 30%. The company also disclosed a highly publicized data theft that cost $307 million.

Coinbase shares, listed on Nasdaq, rose about 3% today to $311, giving the company a market cap of more than $80 billion, according to The Block's COIN price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

XRP exchange reserves jump by 300 million tokens in 24 hours

XRP is back in the news after 300 million tokens, worth almost $885 million, were moved into crypto exchanges in just 24 hours. The surge lifted exchange reserves above $10.3 billion and set the stage for what may be a major price swing for the popular cryptocurrency.

Scale of inflows: 300,000,000 XRP entered exchanges in 24 hours, raising liquidity to multi-month highs.

Price reaction: XRP rebounded from $2.77 to $2.95 but has yet to break the $3.07 resistance.

Risk ahead: Extra supply on exchanges could tilt the balance toward selling pressure.

XRP's position at the moment is tricky, to say the least. On the one hand, bouncing back from $2.77 and holding the 100-day EMA suggests that bulls are still in charge. But if there is fresh supply coming into exchanges, it might increase the risk of sell pressure if whales decide to offload.

What to watch out for next is the $3.07 barrier, which lines up with the 50-day EMA. Should it break, the path toward the $3.30-$3.50 region will open, and that is where selling picked up during previous rallies. If XRP does not clear that line, though, it risks falling back to $2.77, with the 200-day EMA at $2.53 acting as a deeper support "cushion."

For now, with relative strength holding near the midline and trading volumes low, the market is waiting for confirmation of direction. It is pretty likely that there will be some volatility, but the endgame will depend on whether the reserves are used to aggressively sell or to keep as strategic liquidity.

Bitcoin faces "quantum threat" again, but it's still only theory

The "FUD of the week" award goes to Josh Mandell, a former Wall Street trader, who caused a big stir in the crypto community, by saying that quantum computing is already being used to steal coins from old Bitcoin wallets.

Mandell’s claim: Quantum tech has apparently let a "big player" drain some long-dormant wallets.

Community reaction: Bitcoin analysts dismissed the idea as unrealistic and mocked the theory online.

Reality check: Breaking Bitcoin security still requires technology decades away.

What happened is that Mandell argued on X that stolen Bitcoin is being quietly accumulated off-market, with on-chain analysis as the only safeguard. However, experts immediately pushed back, stressing that the millions of qubits needed to break Bitcoin simply do not exist today.

In particular, security researchers like Harry Beckwith and Matthew Pines labeled the suggestion false, while other commentators openly ridiculed it.

There are some concerns in place as quantum computing is advancing — Microsoft and Google recently unveiled new chips — but specialists agree it will take decades before such machines could threaten Bitcoin’s encryption.

Some, like cypherpunk Jameson Lopp, still urge long-term preparation in case quantum attacks become feasible, but even he points to the distant horizon, not the present. For now, Bitcoin’s cryptography remains safe, according to common knowledge.

Shiba Inu's 2025 breakout setup comes into focus

Being the biggest meme coin on Ethereum means always headlining the news, and Shiba Inu delivers. In today's digest, the highlight is the fact that the meme cryptocurrency's price is tightening inside a symmetrical triangle pattern, preparing for one of its biggest moves of the year.

Key resistance: The upside targets are defined by $0.00001297 (100-day EMA) and $0.00001388 (200-day EMA).

Support levels: The base is still at $0.00001200, but if SHIB loses that, it could be exposed to $0.00001150 and $0.00000950.

Indicators: The RSI is at 47 and falling, and there has been a bit of indecision before a breakout.

The way things are set up right now puts SHIB in a bit of a tricky position, just like XRP. The bullish scenario is that a breakout above $0.00001297 backed by strong volume drives Shiba Inu toward $0.00001450-$0.00001500, the same region where sellers capped the July rally. Clearing that ceiling shifts the broader picture back toward bullish control for the Shiba Inu coin.

Failure to defend $0.00001200, however, turns the structure bearish, exposing $0.00001150 per SHIB as the next stop and reopening the path down to $0.00000950, last touched in early summer. With RSI neutral and volume thinning, the pattern is nearly at its peak, and the outcome promises to be SHIB’s most significant move of 2025. Call it the potential Breakout of the Year.

Bitcoin and Ethereum fell sharply on Tuesday after Israel launched an unprecedented strike in Qatar, targeting senior Hamas officials. The escalation rattled global markets, sending investors rushing into gold and oil while crypto prices sank.

Bitcoin and Ethereum immediately dropped over 1%, while Solana and XRP each lost 1.5%. Dogecoin led losses, sliding 3.2%. Liquidation data reveals more concerning risks ahead.

Another Geopolitical Conflict To Derail The Bull Market?

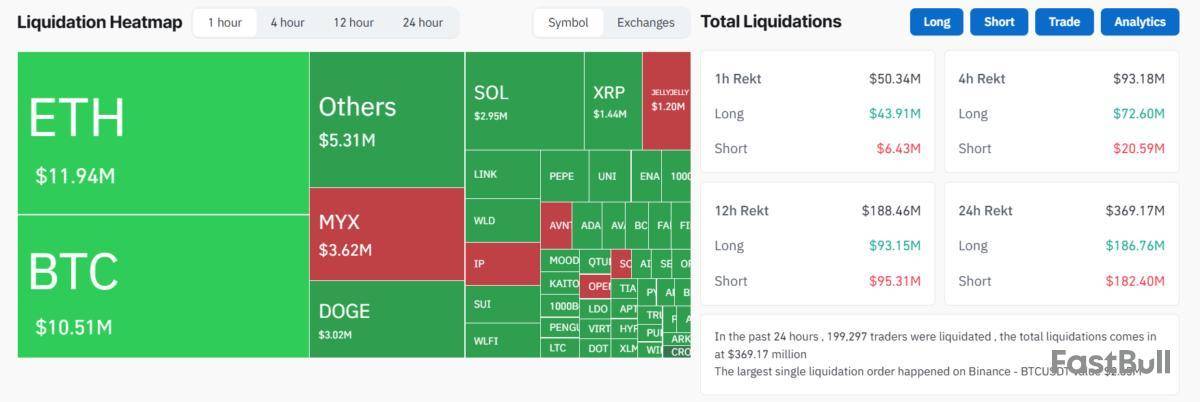

Data from Coinglass showed heavy liquidations as volatility surged. Nearly $52 million in leveraged positions were wiped out in the last hour.

Long traders bore the brunt, with $44 million liquidated. Ethereum accounted for $11.9 million in liquidations, followed by Bitcoin with $10.5 million.

The scale of losses highlights how quickly leverage unraveled. In total, liquidations amounted to $370 million over the past 24 hours. Most positions were long bets on continued gains, exposing optimism ahead of the strike.

In contrast, gold surged to a record high immediately after Israel attacked Qatar as demand for safe-haven assets spiked.

Oil prices climbed by $1 per barrel, trading just under $67. Analysts called these moves rational responses to geopolitical risk, though oil gains may prove short-lived.

The divergence reflects Bitcoin’s struggle to live up to its “digital gold” label. While gold rallied, Bitcoin behaved like a high-beta risk asset.

Correlation data confirms the shift, with the 30-day rolling link between the two assets turning slightly negative.

The strike on Doha carries major diplomatic implications, but markets reacted first to its immediate risk signals. Traders rapidly de-risked, moving out of volatile tokens into stablecoins and traditional havens.

Until confidence in its safe-haven qualities strengthens, Bitcoin is likely to follow equities and risk assets during crises, rather than diverge from them.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up