Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Orki Finance, a new version (fork) of Liquity V2, will go live on Swell Network on May 15, 2025. This could be important because the move brings a licensed DeFi lending product to a new place. The launch can increase use for both Liquity and Swell, which could mean more activity and possibly higher prices for LQTY and SWELL tokens. If OrkiFi brings big new users or funds, prices may rise. But, if trading stays low, the price effect might not last. Keep an eye on user and TVL numbers after launch. source

Liquity@LiquityProtocolMay 12, 2025another one to kickstart a $BOLD summer

This time on @swellnetworkio.@OrkiFi , the Liquity V2 fork on Swell, goes live May 15.

Full details https://t.co/rP1FqA7B4A

Router Protocol will launch its Trade Page on May 15, 2025. This new page can make trading easier for many users. More trading could mean more interest in the ROUTE token, and higher use usually supports price moves. But, if the page does not have new or better tools, the effect may be small. Users and traders looking for better products could drive demand if they like the new feature. Watch for news and strong first-day numbers. Overall, this event could help price, but much depends on user reaction. source

Router Protocol@routerprotocolMay 12, 2025We’re calling it Trade Page, and it’s 3 days away. You all make this epic.

What tokens are you eyeing? pic.twitter.com/0oBA6o5jIg

Centrifuge will let CFG and wCFG holders move to a new token between May 20 and November 30, 2025. This might help price in two ways. First, new tokens often come with extra features for users, pushing interest higher. Second, more support for protocol growth can attract new investors. But, some holders may sell old tokens, causing price swings. Watch for news from the team on migration steps; fast action from users could lead to high trading. If successful, this event could start stronger demand for CFG. source

Centrifuge@centrifugeMay 12, 2025The next chapter for $CFG is here.

Starting May 20, 2025, holders of CFG and wCFG will be able to migrate to the new CFG token, designed to support governance and expansion of the Centrifuge protocol.

The migration window will remain open until November 30, 2025.

More details…

The Bitcoin price and the entire crypto and stock market have been operating at the mercy of the tariff wars ignited by US President Donald Trump after being sworn into office. The initial wave of tariff increases on countries such as China triggered massive crashes across financial markets, plunging the Bitcoin price below $80,000. However, the tariff wars are nearing their end with the latest announcement from the White House regarding trade between the United States and China.

White House Announces Reduction Of China Tariffs

In April 2025, US President Donald Trump had announced a drastic increase of tariffs on Chinese goods to a high 145%, with over 180 countries also seeing tariff increases. This triggered a wave of panic and retaliation, triggering what is now known as the ‘tariff wars.’ As discussions progressed, another announcement in April revealed a 90-day pause on tariffs for other countries, with the exception of China.

While China was yet to exempt, the 90-day pause did have a positive effect on the market as the Bitcoin price recovered, taking the crypto market up with it. Since then, the Bitcoin price has since recovered above $100,000, as well as the stock market seeing multiple green days.

Trade talks have since been ongoing between China and the United States and there has been a stopgap put in place for now. In a statement on the White House website, it was announced that both the Chinese and United States government at the US-China Economic and Trade Meeting in Geneva had agreed to modify their respective applications and implement a suspension of 24 percentage points of tariffs.

This agreement is expected to be in place for an initial period of 90 days, giving both parties time for more discussions toward a resolution. The statement read that this was done in “the spirit of mutual opening, continued communication, cooperation, and mutual respect.”

Why The Bitcoin Price Could Explode

Currently, the rally of the Bitcoin price is being driven by the positive news surrounding the tariffs. So, it is expected that more positive news will continue to drive up the price. The agreement between the US and China states that both countries should have implemented the tariff reduction by May 14, 2025. With only a day left, this deadline could trigger another rally.

As the news of the suspension begins to make the rounds, it signals no negative news coming out regarding tariffs for the next three months at least. This gives time and most importantly, confidence in risk assets such as Bitcoin for investors looking for gains. With the return of investors into the risk market, the Bitcoin price could quickly cross $110,000 as early as Wednesday.

Dubai, UAE – May 2025 — TheBlock, the International Chamber of Virtual Assets, has announced a strategic partnership with Cointelegraph, the world’s leading Web3 media platform. The collaboration brings together two major players in the blockchain and virtual asset space, with the shared goal of amplifying the global adoption of tokenisation, advancing regulatory dialogue, and supporting builders entering the MENA region.

The agreement, signed during Token2049 Dubai, highlights Cointelegraph’s growing collaboration with key players in the UAE. This new partnership will foster deeper collaboration and mutual support across TheBlock’s ecosystem.

As part of the collaboration, Cointelegraph will set up a presence at TheBlock’s headquarters in Dubai World Trade Center, offering opportunities for engagement with founders, partners, and clients within the ecosystem. The partnership also includes joint participation in educational panels, roundtables, and summits focused on real-world assets (RWAs), compliance, and capital allocation.

“This partnership is not just about media,” said Farbod Sadeghian, Founder of TheBlock. “It is about building an access layer for the global virtual asset economy. By working with Cointelegraph, we are strengthening how the industry connects, informs, and grows — from regulatory frameworks to investment pipelines.”

Cointelegraph will engage with TheBlock’s ecosystem through media coverage, speaker participation, and collaborative events. The partnership reflects ongoing efforts to support the growth of Dubai’s virtual asset sector, where regulatory developments and real-world applications continue to evolve.

“The partnership reflects Cointelegraph’s ongoing efforts to broaden its network of like-minded collaborators, all working toward the shared goal of strengthening and advancing the ecosystem,” said Yana Prikhodchenko, CEO of Cointelegraph. “We aim to grow the community by leveraging this partnership while also expanding our regional presence in the UAE. This collaboration will help strengthen both efforts.”

With over 100 events planned annually, a growing portfolio of international members, and over $8 billion in projects deal flow, TheBlock continues to serve as a launchpad for startups, enterprises, and institutions looking to expand their presence in the region.

The partnership represents a new step in aligning media and access to foster trust, facilitate knowledge sharing, and support progress in the virtual asset space.

About TheBlock:

As an international chamber of virtual assets based in Dubai, TheBlock connects regulators, founders, investors, and institutions shaping the future of virtual assets. It provides a structured platform for dialogue, collaboration, and access across key pillars of the virtual asset economy. Through membership programs, strategic partnerships, and curated events, TheBlock offers its members direct engagement with the people and policies driving the industry forward. With a growing global network and strong regional footprint, it supports meaningful growth and influence in the virtual asset landscape.

Website | Twitter | Instagram | Linkedin

TL;DR

No Resistance Ahead?

Until this time last week, analysts indicated that $2 is crucial support in XRP’s future price performance, while noting that a surge past the resistance at $2.26 could become pivotal in reaffirming the asset’s bull run restart.

Such a price surge indeed transpired several days ago and the third-largest non-stablecoin cryptocurrency has remained above the latter ever since. Although it was stoppedon its way to $2.7yesterday, it still trades above $2.5 now and is among thefew altcoins in the greentoday.

According to Martinez, there’s only clear sky ahead for XRP. In a recent post, the analyst with nearly 140,000 followers on X indicated that “on-chain data shows XRP has no major resistance clusters ahead.” On the other hand, the zone around $2.38 has become a key support level.

On-chain data shows $XRP has no major resistance clusters ahead, while the key support zone to watch sits at $2.38. pic.twitter.com/vvXjsSUYG1

— Ali (@ali_charts) May 13, 2025

In accordance with this bullish news came a few big price predictions for XRP. AllInCrypto said the asset is on its way to turn the previous all-time high of $3.4 into support, which would “lead it further along its way to our $19 price target in the long term.”

Others were a bit more modest, posting price targets of up to $5.4.Futures-Driven Rally?

Glassnode noted earlier today that the XRP Futures Open Interest had skyrocketed by over $1 billion in just a week, up to $3.42 billion, representing a 41.6% increase. Given the underlying asset’s price rally that drove it to over $2.5, the analytics company determined that most of it was driven by leveraged positions, which suggests “growing directional conviction.”

$XRP Futures Open Interest has surged by over $1B in the past week, rising from $2.42B to $3.42B (+41.6%). This sharp increase in leverage coincides with a price rally from $2.14 to $2.48, suggesting elevated speculative activity and growing directional conviction, pic.twitter.com/QbsaOM9oxE

— glassnode (@glassnode) May 13, 2025

Recall that the last time the Open Interest for XRP hadshot upthis fast led to a price surge from $2.3 to $3.3 within a week or so back in January.

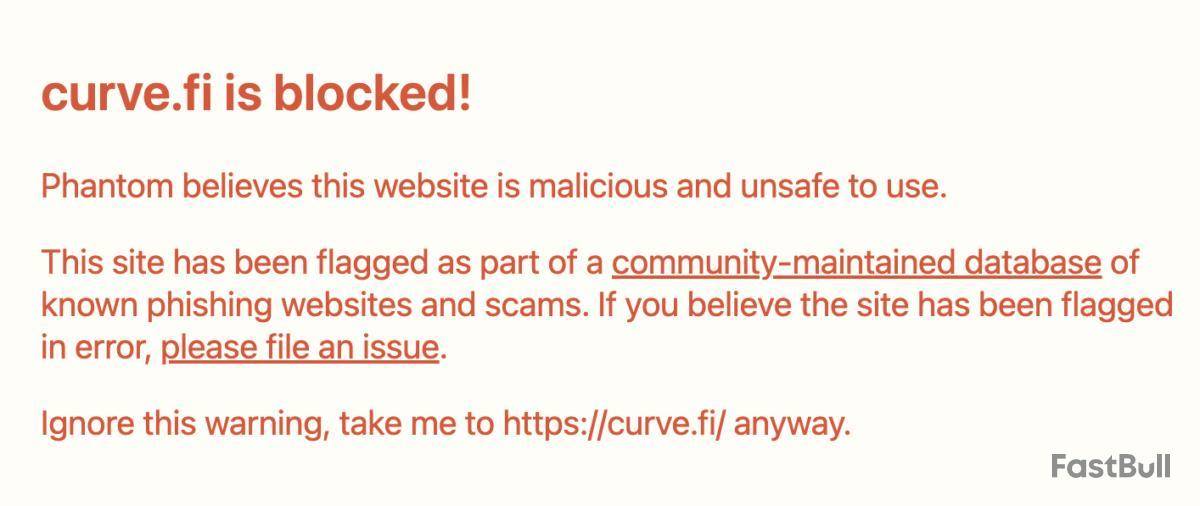

Curve Finance has flagged a Domain Name Service (DNS) attack on its website, days after unknown actors gained access to the protocol’s X account.

Reported late on Monday, Curve said its “curve[.] fi” domain was compromised in an apparent DNS spoofing attack.

In the meantime, users were advised against interacting with the website until further notice. Curve has also switched to its curve[.}finance site, per a tweet from the team. Wallet providers like Phantom have blocked the curve[.] fi domain and displayed a warning message for users.

“The incident has not affected the protocol’s infrastructure and is strictly limited to the DNS layer,” Curve’s team announced on Tuesday, adding that user funds were secure and the protocol remained operational.

The platform said it has opened a full investigation and contacted its domain registrar to resolve the matter. Security partners and industry players were also engaged to help contain the issue, according to the team’s latest update seen on its X page.

Phantom Warns Curve Finance Users Amid DNS Exploit

It’s not the first time Curve Finance has suffered a DNS breach. In 2022, hackers compromised the platform's DNS and hosted a new IP address to steal funds from decentralized finance users.

Last week, scammers also infiltrated the protocol’s X account to promote a wallet-drainer link, but the team regained control shortly after. Curve Finance is the 20th largest DeFi application by total value locked (TVL), holding over $2.3 billion across 22 networks, according to DefiLlama.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up