Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Lido DAO will hold a community call on August 14 at 14:00 UTC.

The agenda includes discussion of the protocol’s roadmap, strategic priorities, financial overview and initiatives aimed at enhancing the long-term alignment of the LDO token with protocol performance.

Refer to the official tweet by LDO:

Lido@LidoFinanceAug 06, 2025Coming Soon: Lido Tokenholder Update Call

Join Lido’s first Tokenholder Update Call, by Lido Labs, to discuss the roadmap, strategic priorities, financials, and work on long-term LDO alignment with protocol success.

📆 August 14, 2:00 PM UTChttps://t.co/ptpZFHgnVt pic.twitter.com/KhCdIXTVYj

LDO Info

The Lido project is a liquid staking platform for PoS (Proof-of-Stake) cryptocurrencies, which enables users to stake their tokens on Lido and receive tokenized versions of their staked assets at a 1:1 ratio. Lido supports Ethereum 2.0 staking and other Layer 1 PoS blockchains, such as Solana, Polygon, Polkadot, and Kusama. By issuing these tokenized assets, users maintain liquidity and are able to participate in DeFi activities for additional yield while earning staking rewards.

The mechanism of operation for Lido revolves around its unique liquid staking solution. Users can stake any amount of PoS assets, addressing the issues of illiquidity, complexity, and centralization present in traditional PoS staking. When a user deposits assets to Lido, they’re staked on the relevant blockchain via Lido’s smart contract, which manages deposits, withdrawals, fund delegation, fees, token minting and burning, and more. Users receive a tokenized version of their deposited funds (stAsset tokens), which can be used in DeFi protocols and dApps to earn additional rewards.

Regarding the LDO token, it’s important to note that LDO is the native governance token of the Lido protocol. Holders of LDO tokens have the power to vote on proposals in the Lido DAO (Decentralized Autonomous Organization). The DAO governs the protocol and makes crucial decisions regarding its operation, ensuring alignment with stakeholder interests. The DAO manages fee parameters and distribution, addition and removal of node operators, and other aspects of the protocol, maintaining transparency and decentralization.

US President Donald Trump is reportedly considering four people to replace Federal Reserve Board of Governors member Adriana Kugler after her resignation becomes effective on Friday.

According to a Thursday Reuters report, Trump was weighing economic adviser Kevin Hassett, former Fed governor Kevin Warsh and two other people to replace Kugler by the end of the week. Whomever Trump nominates and is confirmed by the US Senate would have significant influence over the country’s monetary policy, including federal interest rates.

Hassett, also director of the National Economic Council under Trump, disclosed holding a stake in Coinbase Global worth between $1 million and $5 million as of June. Warsh, who served as a Fed governor from 2006 to 2011, reportedly said that blockchain technology could benefit the US central bank with its payment systems.

“Congress gave the Fed a monopoly over money,” Warsh said in 2018, according to The New York Times. “And if the next generation of cryptocurrencies look more like money and less like gold — and have less volatility associated with them so they would be not just a speculative asset but could be a reliable unit of account — as a purely defensive matter I wouldn’t want somebody to take that monopoly from me.”

The incoming nomination follows Kugler's resignation on Aug. 1. No reason was given for her departure.

Related: Trump to sign executive order punishing financial institutions for 'debanking': Report

Fed rates to influence US markets, including digital assets?

Trump has clashed with Fed Chair Jerome Powell, whom he nominated during his first term. The president has been publicly challenging the Fed’s independence in determining federal interest rates.

Many legal experts have suggested that Trump does not have the authority to fire Powell without cause, though an April Supreme Court decision expanded presidential powers over agencies previously considered independent from the presidency. That decision upheld Trump’s decision to remove members of the National Labor Relations Board and the Merit Systems Protection Board.

Magazine: China mocks US crypto policies, Telegram’s new dark markets: Asia Express

Bitcoin (BTC) price led the wider altcoin in a mild rebound on Thursday against the U.S. dollar. The flagship coin surged as much as 2% in the past 24 hours to reclaim a crucial support level above $116k during the mid-North American session.

Ethereum (ETH) led the wider altcoin market in a mild rebound amid the anticipated crypto summer. Furthermore, the crypto market has attracted more organic investors amid regulatory clarity in major jurisdictions led by the United States, and China.

Top Reasons Why Bitcoin and Altcoins Gained Today?

Bitcoin price led the wider altcoin market in a mild rebound during the past 24 hours fueled by a basket of fundamentals amid bullish technicals. Earlier on Thursday, crypto traders reacted on the news that the U.S. President Donald Trump will sign an executive order that aims to allow private equity, real estate, cryptocurrency and other alternative assets in 401(k)s, which has over $8.7 trillion in retirement accounts.

Bitcoin’s rebound above $116k, which is a major supply sell-wall, triggered a renewed buying pressure. The bullish speculative greed happened amid the return of cash inflow to the U.S. spot BTC ETF issuers.

Meanwhile, Bitcoin and the wider altcoin market gained bullish sentiment on Thursday after the Bank of England announced the Monetary Policy Committee voted by a majority of 5-4 to cut interest rates to 4 percent. Crypto traders begun factoring in a potential rate cut by the Federal Reserve in the United States before the end of this year.

Has the 2025 Altseason Started?

With Bitcoin price expected to rally furthermore to hit a new all-time high in the coming weeks, the altcoin industry is much more likely to outshine. Furthermore, the 2025 crypto rally has been likened to the 2017 bull market, which was filed by retail FOMO.

According to market data from CoinGlass, while Bitcoin price rallied 65 percent in August 2017, Ethereum price recorded a 92 percent surge in the same month. With the ongoing demand for altcoins by institutional investors, as observed through the altcoin treasuries, a parabolic 2025 altseason is around the corner.

Centibillionaire Elon Musk has given a fresh nod to Bitcoin, reposting the animated version of the famous "Magic Internet Money" meme.

The clip, which was originally posted by the official X account of cryptocurrency exchange Coinbase, was recently created with the help o of of the Grok Imagine tool, which makes it possible to turn images into short video clips.

Musk has also reacted with the laughing emoji to the animated "Bitcoin wizard."

OG meme

The cartoonish character, which was crudely drawn with the help of Microsoft Paint, first gained prominence after a contest on the r/bitcoin. The contest was meant to pick the best advertisement for the rapidly growing subreddit.

Despite its frivolous, low-quality look, the "Bitcoin wizard" emerged as the winner, and "magic internet money" has since become almost synonymous with Bitcoin.

How it got brought to life

Earlier this August, Grok launched its new multimodal tool that makes it possible to animate images.

Over the past few days, Musk has been busy hyping up the new AI toy, and it seems like his latest post is meant to attract cryptocurrency enthusiasts.

According to The Verge, U.S. users can temporarily try out the new video generation feature for free.

It is worth noting that, according to Mashable, Grok Imagine actually severely underperforms other AI video generation models of the likes of Google's groundbreaking Veo 3 and OpenAI's Sora.

Bitcoin is showing signs of short-term consolidation or mild downside risk after reaching an all-time high of over $123,000 last month, according to onchain analytics firm CryptoQuant.

"Bitcoin has entered a bullish cooldown period, as the Bull Score Index declined from 80 to 60. While conditions remain positive, momentum has softened," CryptoQuant said in a report shared with The Block on Thursday.

CryptoQuant's Bull Score Index gauges the strength of the bitcoin market based on various on-chain indicators. Scores closer to 100 suggest strong buying momentum and bullish sentiment, while scores near zero indicate heavier selling pressure and negative outlooks.

At its current level of 60, the index still points to a broadly bullish regime, but with fading momentum. CryptoQuant said the dip in the index reflects both profit-taking after bitcoin's recent all-time high rally and a seasonal slowdown in trading activity during the summer.

"If Bitcoin’s price weakens further, this indicator could dip into negative territory, dragging the Bull Score Index below 40 — a shift that would formally signal bearish market conditions for the first time since April 2023," the firm noted.

What’s driving BTC's cooldown?

The fading momentum is being confirmed by multiple onchain indicators, CryptoQuant said.

Stablecoin liquidity has stalled, with the signal turning red — suggesting fresh capital inflows into the market are drying up. That's often an early sign of weakening buying power, the firm said. Tether (USDT) liquidity has grown by $9.6 billion over the past 60 days, but the pace has now slowed and fallen below trend.

At the same time, the onchain profit margin signal has also flipped red, CryptoQuant said, indicating that traders have recently realized significant gains and are no longer sitting on large unrealized profits — a classic sign of profit-taking.

New bullish catalysts may be needed to push the uptrend forward, the firm said. When asked what those catalysts might be, Julio Moreno, head of research at CryptoQuant, told The Block: "I think one important catalyst would be the Fed [The U.S. Federal Reserve) lowering interest rates in the next meeting (September), as this is something markets have been expecting."

Bitcoin is currently trading at around $116,340, up about 0.8% over the past 24 hours, according to The Block’s BTC price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

MetaMask, one of the most widely used Web3 wallets with over 100 million users, has officially integrated the Sei Network, a Layer-1 blockchain known for its speed and scalability.

This major update now allows users to access Sei’s decentralized applications (dApps), tokens, NFTs, and perform SEI transactions directly from MetaMask, without the need for third-party tools or bridges.

With this integration, the total number of supported blockchains in MetaMask rises to 11, further strengthening its position as a leading multi-chain wallet. A dedicated Sei section within the MetaMask Portfolio now offers users a smooth entry point to the network’s gaming, DeFi, and NFT ecosystem.

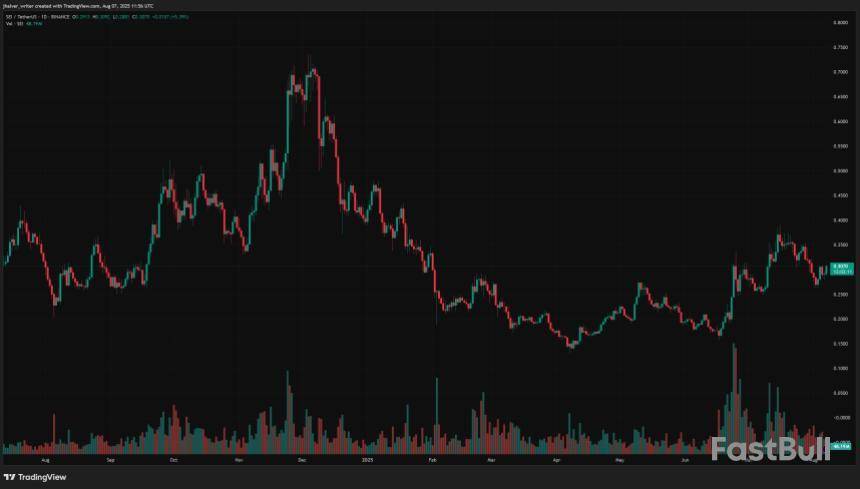

Sei’s Ecosystem Growth Fuels Investor Optimism

The timing of this integration couldn’t be better for the token. The network has recently achieved significant growth milestones: over 4.2 million daily transactions, a TVL surpassing $600 million, and 11 million monthly active users, all since launching its EVM-compatible chain less than a year ago.

The tokenimproved accessibility through MetaMask is expected to attract more developers and users alike, expanding the reach of its high-performance blockchain infrastructure. According to Justin Barlow of the Sei Development Foundation, this marks a strategic leap toward making Sei the “best EVM ecosystem.”

Market interest in the SEI token has already responded positively, with a 2.5% uptick post-announcement, and more upside could be in play.

Several technical indicators are flashing green for the token. The Supertrend indicator has flipped bullish on the weekly chart, a signal previously followed by substantial price increases. Supporting metrics include:

Crypto analyst @ali_charts predicts SEI could soon reach $0.54, citing strong chart structure and renewed investor confidence. With growing on-chain activity, seamless MetaMask access, and technical support, the SEI token appears poised for a breakout.

The MetaMask’s Sei integration is not just a win for convenience, it signals a bullish bet on the future of decentralized interoperability as Web3 shifts toward a multi-chain reality.

Cover image from ChatGPT, SUIUSD chart from Tradingview

Web3-powered AI project Perle has raised an additional $9 million in a seed round led by Framework Ventures. This brings the startup’s funding to a total of $17.5 million as it looks to build a product that “rewards users for reviewing and contributing accurate data sets to AI systems.”

With the fresh injection of capital, Perle will launch Perle Labs, a product using blockchain rails and incentives for user payments and onchain attributions in an attempt to improve how AI models are trained. Perle offers "curated" data and human reviewers, according to its website.

“As AI models grow more sophisticated, their success hinges on how well they handle the long tail of data inputs — those rare, ambiguous, or context-specific scenarios,” said Ahmed Rashad, CEO of Perle and former Scale AI employee. “By decentralizing this process, we can unlock global participation, reduce bias, and dramatically improve model performance.”

The product is based on the idea that the progress in AI “will be driven more by better data than by simply scaling models,” Framework co-founder Vance Spencer said in a statement.

"LLMs aren't failing because they run out of room to think—they're failing because they don't know how to think when abstraction breaks their training patterns," Perle wrote in a recent paper. "Instead of asking LLMs to magically reason through complexity, we need to feed all AI systems better, more structured inputs."

Although companies like Anthropic, OpenAI, and xAI have released powerful closed-source text and image generation models, it is sometimes unclear for casual users to judge the quality of the input data — a process Perle thinks can be improved through “high-quality human feedback.”

The startup will offer a “self-serve platform” for the full AI development lifecycle — from multimodal audio, image, and text data collection to model fine-tuning, according to the announcement.

Perle previously raised an $8.5 million pre-seed round in October 2024 led by CoinFund.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up