Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Prominent commodity trader Peter Brandt has made waves with his most recent XRP price chart, which shows that a massive surge could potentially be in the cards.

The one-week chart, which spans from 2014 to 2027, shows the performance of the XRP token on a logarithmic scale.

It shows two multi-year symmetrical triangles. The first one spans the period from 2014 to 2017, which represents price consolidation before the eventual breakout during the 2017 bull run.

The second triangle shows another lengthy period of consolidation that lasted from 2018 to 2025. The price has now seemingly broken out above the upper boundary, which makes the pattern rather notable.

Peter Brandt@PeterLBrandtOct 13, 2025As a student of classical charting principles and history, has there ever been a purer long-term chart? $XRP pic.twitter.com/rbA2Mp955A

Brandt's extremely prescient call

As reported by U.Today, Brandt identified XRP as the top short candidate in early October, predicting that its price could plunge all the way to $2.2.

On Oct. 10, the XRP price briefly plunged to $1.77, the lowest level since November, before seeing a quick recovery. The massive drop was in line with the rest of the market, which was absolutely hammered by the escalation in trade tensions between the US and China.

Brandt was quick to "mock" XRP trolls following his prescient call, but some critics argued that the trader simply got extremely lucky.

Bhutan is now the first country to use the Ethereum network to operate a national digital identity system.

Ethereum Foundation head Aya Miyaguchi confirmed the news on her X account, stating that she attended the launch ceremony for Bhutan’s National Digital Identity (NDI) system.

Why Bhutan Is Adopting Ethereum for Its NDI

The Ethereum-based identity system is now fully operational. All authentication information will be migrated by the first quarter of 2026.

Bhutan’s King Jigme Khesar Namgyel Wangchuck, Prime Minister Lyonchen Tshering Tobgay, and Ethereum co-founder Vitalik Buterin attended the launch ceremony, among others.

Prime Minister Tobgay said the nation has set a new milestone in becoming a leader in digital governance by launching NDI on Ethereum. He explained that the goal was to leverage Ethereum’s globally distributed, decentralized infrastructure. This would enhance Bhutan’s key systems’ security, transparency, and availability.

He added that the milestone underscores the country’s vision to create an interoperable, user-owned identity system. This system will connect Bhutan to the global ecosystem and support the King’s vision for a safe, inclusive, and digitally empowered society.

Global Leader in Digital Assets

Miyaguchi emphasized that the integration of Ethereum is a world first. She stated that “this milestone marks not only a national achievement but a global step toward a more open and secure digital future for the long term.”

After its 2023 election, Bhutan’s NDI became the world’s first and only national system to provide self-sovereign identity (SSI) to its entire population. The country had been operating its identity system on the Polygon network since August last year, after using Hyperledger Indy. The shift to Ethereum was a decision to enhance transparency, immutability, and privacy.

The Bhutanese government aims to migrate its entire NDI platform to Ethereum by early 2026. Once the platform is complete, citizens can use cryptographic proof for authentication instead of traditional ID checks. This will allow them to prove specific things about themselves without revealing their personal information.

Bhutan has recently been accelerating the adoption of digital assets. The country directly mines Bitcoin using its hydropower plants and currently holds 11,286 Bitcoin, worth approximately $1.31 billion. This makes Bhutan the fifth-largest national holder of Bitcoin after the US, China, the UK, and Ukraine.

October 14, 2025 07:02:12 UTC

Bitcoin Sell-Off Differs from FTX and Luna Crashes, Says Glassnode

According to Glassnode, the recent Bitcoin sell-off happened while over 90% of supply remained in profit, with losses mainly concentrated among top buyers. Unlike the FTX and Luna collapses, when under 65% of supply was profitable, this event was not a broad market capitulation. Instead, it was a structurally different, leverage-driven correction, highlighting how concentrated positions and borrowing can amplify volatility even when the majority of holders remain in the green.

glassnode@glassnodeOct 14, 2025The recent sell-off occurred with over 90% of Bitcoin supply still in profit, with most losses coming from top buyers. Unlike the FTX and Luna crashes, when under 65% of supply was in profit, this was not a broad capitulation but a structurally different, leverage-driven event. https://t.co/Z6ar0S3Mgl pic.twitter.com/oi26MMznMF

October 14, 2025 06:59:43 UTC

Crypto News Today: Ripple Launches $200K Attackathon to Secure XRP Ledger Lending Protocol

Ripple has partnered with Immunefi to launch a $200,000 Attackathon, aimed at testing and strengthening the proposed XRP Ledger Lending Protocol. The initiative invites security researchers and white-hat hackers to identify vulnerabilities, ensuring a more secure and robust platform. This move underscores Ripple’s commitment to protocol safety and community-driven security, while advancing the development of decentralized lending solutions on the XRP Ledger.

October 14, 2025 06:45:29 UTC

Crypto News Today: Whales Short Bitcoin and Ethereum After Market Crash

Following the recent crash, major crypto whales are aggressively shorting the market. The #BitcoinOG made over $160M shorting BTC and ETH, while two other Hyperliquid whales are also cashing in. Whale 0x9eec9, with $31.8M in profits, holds $98M in shorts across DOGE, ETH, PEPE, XRP, and ASTER. Meanwhile, Whale 0x9263, with $13.2M in profits, maintains $84M in shorts on SOL and BTC, signaling continued market volatility ahead.

Lookonchain@lookonchainOct 14, 2025Besides the #BitcoinOG who made over $160M shorting BINANCE:BTCUSDT and BINANCE:ETHUSDT during the crash, two other whales with significant profits on #Hyperliquid are also heavily shorting the market.

Whale 0x9eec9 — with $31.8M in profit — currently holds $98M in shorts across BINANCE:DOGEUSDT, BINANCE:ETHUSDT, BINANCE:PEPEUSDT,… pic.twitter.com/qZfJIbO6ba

October 14, 2025 06:33:25 UTC

Crypto News Today : Ethereum and Bitcoin Spot ETFs See Massive Outflows

On October 13, Ethereum spot ETFs experienced a total net outflow of $429 million, marking their third consecutive day of outflows. Bitcoin spot ETFs also faced withdrawals, totaling $327 million, with BlackRock’s IBIT being the only fund to record a net inflow. The continued outflows highlight growing investor caution in crypto ETFs amid market volatility, signaling potential short-term pressure on digital asset prices.

Wu Blockchain@WuBlockchainOct 14, 2025On October 13, Ethereum spot ETFs recorded a total net outflow of $429 million, marking the third consecutive day of outflows, while Bitcoin spot ETFs saw a total net outflow of $327 million, with BlackRock’s IBIT being the only fund to post a net inflow.https://t.co/Tvs2oCSxTg pic.twitter.com/kGnUK3d69k

October 14, 2025 06:24:25 UTC

Crypto News Today : China Sends Final Call to the US Amid Rising Global Tensions

China warns the US: “Negotiate, and we’ll listen; push a trade war, and we’ll fight to the end.” As global economic cycles tighten, the battle over tariffs, supply chains, tech flows, and currency dominance is intensifying. The conflict is not just on battlefields or in boardrooms—it will shape the rules for the next decade. Investors and traders should stay alert, as markets face high volatility. Holding assets wisely is crucial in this uncertain environment.

October 14, 2025 06:23:35 UTC

Crypto News Today : Crypto Regulation in Kenya

Kenya’s parliament has approved the Virtual Asset Service Providers Bill, creating a formal regulatory framework for the country’s digital asset sector, Reuters reports. The legislation aims to attract investment and standardize trading practices. Under the bill, the Central Bank of Kenya will be authorized to license the issuance of stablecoins and other virtual assets. At the same time, the Capital Markets Authority will oversee the licensing of crypto exchanges and trading platforms, marking a significant step toward regulated crypto adoption in Kenya.

October 14, 2025 06:22:41 UTC

Crypto News Today : BlackRock CEO Larry Fink Calls Bitcoin “Alternative Asset Like Gold”

BlackRock CEO Larry Fink told CBS that he now views Bitcoin as an alternative asset similar to gold. While he acknowledged that Bitcoin is “not a bad asset,” he cautioned investors against allocating a large portion of their portfolios to it. Fink also revealed that roughly half of BlackRock’s Bitcoin ETF demand came from retail investors, with 75% of them never having owned an iShares product before, highlighting growing mainstream crypto adoption.

October 14, 2025 06:21:42 UTC

Crypto News Today : Bhutan Shifts National Digital ID System from Polygon to Ethereum

Bhutan is migrating its national digital identity system from Polygon to Ethereum, covering about 800,000 residents. The integration with Ethereum is already complete, and the full migration is expected by Q1 2026. Ethereum Foundation Chair Aya Miyaguchi and co-founder Vitalik Buterin attended the launch event. Miyaguchi described it as the world’s first national-level Ethereum identity integration, marking a major milestone in blockchain-based digital governance.

Aya Miyaguchi@AyaMiyagotchiOct 13, 20251/ Today, Bhutan celebrates a historic milestone, becoming the first nation to anchor its national digital identity system on Ethereum. 🇧🇹@VitalikButerin and I were honored to join the launch ceremony on behalf of the Ethereum community, graced by His Royal Highness. pic.twitter.com/KA4tOYbsJ4

October 14, 2025 06:14:19 UTC

Crypto News Today : Binance Launches 52nd HODLer Airdrop Project, Enso (ENSO)

Binance has announced its 52nd HODLer Airdrop project, Enso (ENSO). Spot trading for ENSO will begin on October 14, 2025, at 17:00 (UTC+8) with pairs including ENSO/USDT, ENSO/USDC, ENSO/BNB, ENSO/FDUSD, and ENSO/TRY. Enso is a unified network designed to connect all social and DeFi ecosystems, offering users seamless interaction and interoperability across multiple blockchain platforms.

Binance@binanceOct 14, 2025Binance is excited to announce the Enso HODLer Airdrop – @EnsoBuild $ENSO

BNB Holders, get ready! The Airdrop page will be available on the Binance Airdrop Portal in 24 hours. Plus, this token will be listed on #Binance soon!

October 14, 2025 06:14:19 UTC

Crypto News Today : $200K Binance Charity Fund Now Worth $39M Remains Unclaimed in Malta

Coinbase executive Conor Grogan revealed that $200,000 worth of BNB donated by Binance and crypto users in 2018 to Malta’s terminal cancer fund remains untouched. The donation, now valued at around $39 million, is still accessible but unclaimed. Grogan urged Maltese citizens to notify their government about the funds, emphasizing that the charity wallet is active and the substantial amount could still be used to support cancer patients in need.

Conor@jconorgroganOct 13, 2025In 2018, Binance and crypto users donated $200,000 in BNB to Malta Terminal Cancer Patients.

The funds were never withdrawn and remain untouched, now worth $39M due to the appreciation of BNB!

Any Malta citizens, please let your government know that these funds are accessible pic.twitter.com/jRqLz7vy4M

October 14, 2025 06:14:19 UTC

Crypto News Today : DeFi Activity Surges After Flash Crash Despite Drop in Open Interest

According to DeFiLlama, after the October 11 flash crash, Perp DEX open interest plunged from $26 billion to below $14 billion. However, DeFi activity soared—lending protocols earned over $20 million in fees, hitting an all-time high, while DEX weekly trading volume reached a record $177 billion. Total borrowing across cross-chain lending protocols slipped under $50 billion for the first time since August, and stETH APY briefly jumped above 7%.

DefiLlama.com@DefiLlamaOct 14, 2025What Friday's flash crash looked like in onchain metrics: pic.twitter.com/aNZF7mKvVk

October 14, 2025 06:14:19 UTC

Crypto News Today : Silver Price Surges Past $52 as Shorts Face Mounting Losses

Silver prices skyrocketed over $2 today, climbing above $52, with December futures trading at $50.40. The market remains in backwardation, signaling tight supply and rising demand. According to economist Peter Schiff, short sellers are now in serious trouble and may soon scramble to cover their positions, potentially triggering further price spikes. The rally has also raised concerns about possible counterparty risks in the market as volatility intensifies.

OpenSea users must link Ethereum Virtual Machine (EVM) wallets by October 15 or risk missing out on NFT and SEA token rewards as the Treasure Chests program ends.

This critical deadline is part of OpenSea’s strategy to re-engage its community and build excitement for the upcoming SEA token launch. Many in the NFT ecosystem see this as a pivotal opportunity for OpenSea’s comeback.

Why Users Must Act Before the Deadline

To receive the largest rewards, OpenSea users must connect an EVM-compatible wallet by October 15. Failure to do so will result in missing nearly all major new incentives.

Only limited rewards remain for users logged in via Solana or Web2 accounts. Most token and NFT drops, including the $SEA token, are tied to EVM chains.

OpenSea has increased its reminders as the deadline approaches. Official messaging leaves no room for doubt: users without an EVM wallet connection will not access EVM rewards.

“We know degens don’t read. So here’s your reminder: connect an EVM wallet to your OpenSea rewards profile. Most rewards are on EVM chains. No EVM wallet? No EVM prizes,” the marketplace articulated.

Meanwhile, those using only Web2 or Solana logins see in-app alerts urging them to add an EVM address before time runs out. These notifications clarify that airdrop allocations heavily favor EVM chains.

Treasure Chests Program Ends, Raising the Stakes

October 15 also marks the end of the Treasure Chests program, adding urgency for users. Each chest, especially in the Solar tier, affects the number of SEA tokens awarded at the token generation event (TGE).

The chest level at the cutoff sets airdrop rewards; Solar chests may offer the greatest gains, but still pose risk if their contents disappoint.

Community excitement is high, as some NFT veterans explain the appeal and risk of the highest chests.

“I’m at Solar (the last chest). Thus, no matter how you see this, in my opinion, yes, it’s still a gamble, but the risk-reward chances are just too nice to pass up. I’m betting on OS actually doing well, a big fat drop, and the potential of opening a good NFT,” wrote Cape, an NFT and airdrops farmer.

As the chests program ends and SEA launches, users could break even or see gains or losses, depending on OpenSea’s relaunch outcome.

Impact on OpenSea and the NFT Ecosystem

The SEA airdrop and rush to link EVM wallets form OpenSea’s biggest push since its earlier days as a leading NFT marketplace. The campaign aims to boost participation and help OpenSea keep pace with rivals like Magic Eden, introducing their own rewards and tokens.

With the token event drawing near, the NFT community is weighing the risks and rewards of holding Solar chests or opting for lower tiers.

OpenSea’s approach emphasizes rewarding active users, signaling new standards for marketplace incentives. However, users who delay wallet linking may miss these opportunities, potentially for months or even forever.

October 15 is the decisive moment. After the deadline, OpenSea’s success with the $SEA token will depend on user participation, how rewards are distributed, and whether the platform can reclaim its place as a market leader.

The spotlight today is firmly on Federal Reserve Chair Jerome Powell, who is scheduled to speak at 12:20 PM ET, in what could be a pivotal moment for both traditional and crypto markets. Investors are bracing for any mention of monetary easing—a term that could reignite bullish sentiment across risk assets. With the US dollar index (DXY) cooling near 105.1 and Treasury yields dipping, the setup is ideal for a liquidity-driven rally if Powell strikes a dovish tone.

The last time Powell hinted at easing, Bitcoin surged over 6%, while Ethereum posted a 4% weekly gain. Traders are now watching closely for clues on when the Fed may start cutting rates, which could unleash a fresh wave of capital into crypto.

Bitcoin price currently trades around $112,700, consolidating after rebounding from last week’s $126,199 high. The whales and the institutions have been constantly accumulating, signalling the rising interest in the token.

If Powell signals readiness for easing, BTC could rally toward $116,500–$117,000, its next key resistance range. A stronger-than-expected dovish statement might even push it toward $119,500. However, if Powell stresses inflation risks or dismisses near-term rate cuts, BTC may slide below $110,000, erasing short-term gains.

The Ethereum price trades near $4000, holding firm despite recent market volatility. According to some data, staking inflows have risen by 3.2% this week, reflecting sustained confidence among long-term holders. ETH’s derivatives volume has also grown 8% week-on-week, pointing to renewed speculative interest.

A dovish Powell could propel ETH back toward $2,550 and possibly $2,700 in the coming sessions. On the flip side, a cautious tone could trigger a retest of the $2,250 support.

Final Thoughts

As Jerome Powell prepares to address the markets, the crypto community stands on edge. Bitcoin and Ethereum have entered a critical zone where macro cues could determine their next decisive move. A dovish signal—even a subtle acknowledgment of easing—could act as the spark that propels both assets into a new bullish phase, reaffirming crypto’s sensitivity to global liquidity trends. However, if Powell reiterates his cautious stance or emphasizes inflation control, the market may retreat into consolidation.

In essence, today’s speech could mark the turning point for crypto’s next big trend—bullish if liquidity returns, stagnant if caution prevails.

On October 13, both U.S. spot ETFs, Bitcoin, and Ethereum recorded heavy outflows. According to data from SoSoValue, Bitcoin ETFs withdrew $326.52 million, while Ethereum ETFs transferred $428.52 million.

Bitcoin ETF Breakdown

With only six out of twelve ETFs posting action, Bitcoin ETFs recorded a net outflow of $326.52 million. BlackRock IBIT was the only ETF to post $60.36 million in inflows for the session. Following ETFs posted outflow:

Despite moving off a heavy amount, Bitcoin ETFs recorded $6.63 billion in trading value with total net assets of $157.18 billion. This marks 6.81% of the Bitcoin market cap.

Ethereum ETF Breakdown

Ethereum ETFs posted a sell-off of $428.52 million, with no inflows for the day. Seven out of nine ETFs posted action for the day.

Total trading volume in Ethereum ETFs reached $2.82 billion with net assets of $28.75 billion. This represents 5.56% of the Ethereum market cap.

Market Context

Bitcoin is trading at $113,499.05, after a 1.3% drop in 24 hours. Its market cap has reached $2.260 trillion, which also dipped this week. The daily trading volume has reached $69.02 billion, showing a slow market.

Meanwhile, Ethereum is priced at $4,142.32, with a market cap of $500.809 billion. Its trading volume has dropped to $48.3 billion, marking a 21.25% dip compared to the previous day.

Why BTC and ETH prices plunged:

After President Donald Trump threatened new tariffs on imports from China, investors feared a trade war between the two countries. This triggered investors to sell off risky assets like tech stocks and crypto, which resulted in a crypto market crash.

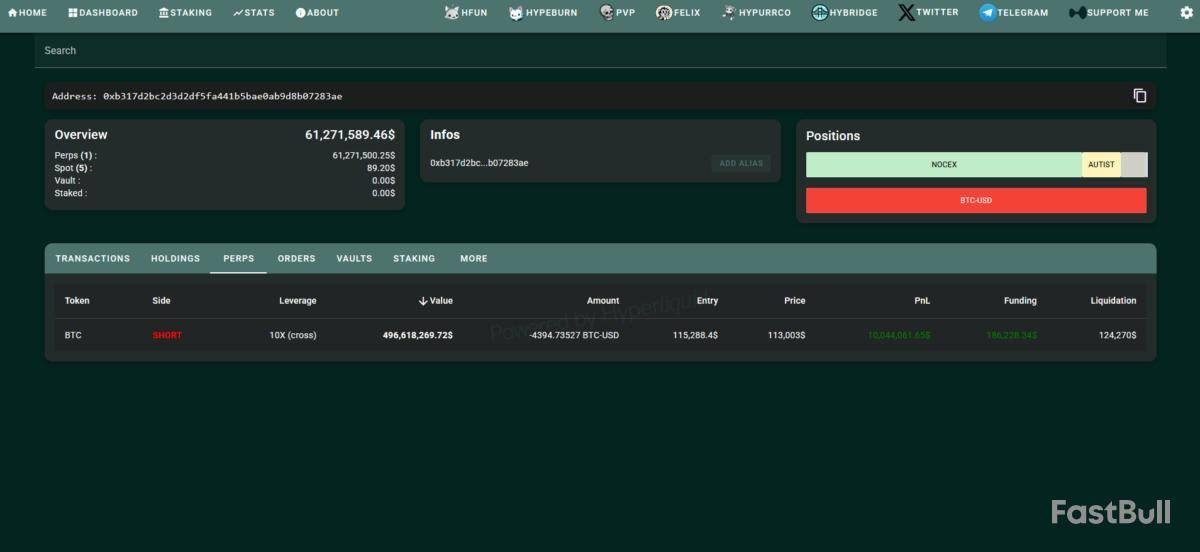

The Hyperliquid whale that banked $192 million shorting the recent market crash has doubled down on their new short position, having now loaded up almost half a billion over the past two days.

According to data from Hyperliquid block explorer Hypurrscan, the whale now has a short position worth around $496 million, at 10x leverage and a Bitcoin (BTC) liquidation price of $124,270.

The whale has more than doubled their bet since yesterday, after initially opening the position with $163 million. It marks yet another aggressive move betting against the market over the past week.

The crypto investor shot up on the radar two months ago with a whopping $11 billion worth of BTC in their holdings. Last week, they opened up $900 million worth of shorts on BTC and Ether (ETH).

The whale gained attention again after opening a curiously timed short position less than an hour before US President Donald Trump’s tariff announcement on Friday, which led to the crypto market crashing in its aftermath.

The community has dubbed the wallet owner as “insider whale,” given the strange timing of the short.

Who is this infamous whale?

The identity behind the wallet has not been confirmed; however, blockchain sleuths over the weekend pointed to a potential connection to Garrett Jin, the former CEO of BitForex, a now-defunct crypto exchange.

While crypto researcher Eye initially alleged that it was Jin, which led Binance CEO to repost the thread on X and request verification, later commentary from sleuths like ZachXBT suggested it was more likely to be one of Jin’s friends.

Jin essentially confirmed the connection on Sunday, after he fired back at CZ on X.

“@cz_binance, thanks for sharing my personal and private information. To clarify, I have no connection with the Trump family or@DonaldJTrumpJr — this isn’t insider trading,” he wrote.

Less than 20 minutes later, Jin followed up with another post stating that “the fund isn’t mine — it’s my clients’. We run nodes and provide in-house insights for them.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up