Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A Brazilian judge has handed down a record 128-year prison sentence to the man convicted of leading the money laundering operation behind the Braiscompany cryptocurrency Ponzi scheme, which operated from June 2018 until its collapse in early 2023.

Joel Ferreira de Souza, the scheme’s financial mastermind, was found to have used shell companies and proxy accounts to launder proceeds from the Braiscompany fraud. Brazilian prosecutors estimate that more than 20,000 investors were defrauded of 1.11 billion reais, or about $190 million. His sentence is among Brazil's longest ever handed down for financial crimes.

De Souza’s son, Victor Augusto Veronez de Souza, was sentenced to 15 years in prison for his role in the scheme. Top broker Gesana Rayane Silva received a sentence of 27 years and 10 months, in addition to earlier convictions, bringing her total sentence to more than 40 years, according to local media reports. Mizael Moreira Silva and Clélio Fernando Cabral do Ó were acquitted on money laundering charges due to insufficient evidence.

The leaders of Braiscompany, married couple Antônio “Neto” Ais and Fabrícia Farias Campos, were sentenced in February 2024 to 88 years and 7 months and 61 years and 11 months, respectively. The couple, who were apprehended in Argentina after more than a year on the run, are currently under house arrest awaiting extradition to Brazil..

Braiscompany promised investors monthly returns of about 8% on cryptocurrency they “locked up” with the company for one year. The firm aggressively recruited new clients with slick marketing materials and claims of high-profile crypto partnerships. But in 2022, Braiscompany began delaying payments, and by January 2023, payouts had nearly stopped altogether.

In February 2023, Brazil’s federal police launched a nationwide crackdown known as Operation Halving, executing search warrants at the company’s offices and prompting its founders to flee. The recent sentence against de Souza stems from a separate case focused on Braiscompany’s money laundering network.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

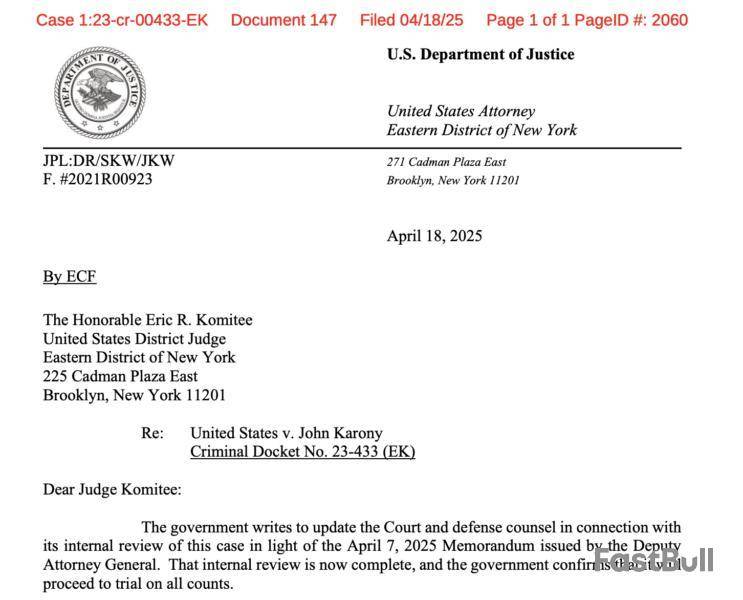

Federal prosecutors said they will continue pursuing their case against Braden John Karony, the former CEO of crypto firm SafeMoon, despite the US Justice Department issuing a memo suggesting a policy of abandoning “regulation by prosecution” related to digital assets.

In an April 18 filing in the US District Court for the Eastern District of New York, US Attorney for EDNY John Durham said his office had reviewed the April 7 DOJ memo issued by Deputy Attorney General Todd Blanche and intended to proceed with a trial against Karony.

The former SafeMoon CEO faces securities fraud conspiracy, wire fraud conspiracy, and money laundering conspiracy charges for allegedly “divert[ing] and misappropriat[ing] millions of dollars’ worth” of the platform’s SFM token between 2021 and 2022.

Karony, initially indicted in October 2023 under former US Attorney for EDNY Breon Peace, argued in February that his criminal trial should be delayed, hinting that securities laws enforcement under the Donald Trump presidency could see “significant changes.” The judge denied the motion and later ordered jury selection for the trial to begin on May 5.

However, Karony’s legal team made its claims about securities laws under Trump potentially undergoing “policy changes” before the Securities and Exchange Commission (SEC) dismissed cases and dropped investigations into many crypto firms facing allegations of violating securities laws. Blanche’s April 7 memo also suggested that the DOJ under Trump would direct jurisdictions not to pursue many crypto enforcement cases.

“[T]he parties may learn within days or hours of the commencement of trial that DOJ no longer considers digital assets like SafeMoon to be ‘securities’ under the securities laws,” said Karony’s legal team on Feb. 5. “Worse, the parties may learn this during or shortly after a trial, half of whose charges rest on the government’s claim that SafeMoon is such a security.”

Crypto enforcement by the SEC and DOJ under Trump

Since being appointed acting SEC chair by Trump in January, Mark Uyeda has led the agency to drop cases against Ripple Labs, Coinbase, Kraken, and others. The SEC has also launched a crypto task force headed by Commissioner Hester Peirce to explore a regulatory framework for digital assets, and issued a memo saying memecoins were not securities.

The agency’s actions suggest a more permissive approach to digital assets than that under former chair Gary Gensler.

“By directing the SEC to abdicate its critical mission of investor protection, Mr. Trump is unnecessarily endangering our financial system,” said former SEC official John Reed Stark in an April 18 New York Times op-ed with Duke University lecturing fellow Lee Reiners. “Whether he is doing so to keep his promise to crypto-donors or in a zeal to cash in (or perhaps even both), that is a troubling development not just for investors and banks, but for all of us.”

Whether Trump’s appointees in the Justice Department intend to step in and move to halt Karony’s case, as the DOJ did in the corruption case with New York City Mayor Eric Adams, is unclear. At the time of publication, the former SafeMoon CEO was set to go to trial in May and has been free on a $3 million bond since February 2024. He has pleaded not guilty to all charges.

This week in crypto recorded several key events across various ecosystems that will continue shaping the industry.

From major partnerships to investment decisions and scam allegations, the following is a comprehensive roundup of crypto news this week.

Mantra Crash: From Billion-Dollar Hype to Fragile Liquidity

This week in crypto Mantra’s powering token lost $90% of its value amid allegations of insider dealing and liquidity fragility. Once hailed as a rising star in the RWA (real-world asset) narrative, OM’s collapse wiped out over $5.5 billion in value.

Reports revealed a disturbing pattern of concentrated wallet activity and low liquidity pools, which made OM highly vulnerable to sudden exits.

On-chain sleuths identified one trader whose aggressive selling triggered a cascade of liquidations. This highlights the risks of low-float, high-hype tokens in an illiquid market environment.

“This was due to an entity(s) on the Binance perpetuals market. That’s what triggered the entire cascade. The initial drop below $5 was triggered by a ~1 million USD short position being market-sold. This caused over 5% of slippage in literal microseconds. That was the trigger. This seems intentional to me. They knew what they were doing,” the analyst stated.

Pi Network: From Chainlink Buzz to Transparency Fears

Pi Network recorded strong optimism this week as its native Pi Coin surged by double digits. BeInCrypto attributed the surge to the announcement of a key integration with Chainlink.

They pitched this strategic collaboration as a gateway to real-world utility. Specifically, it positioned Pi closer to the broader DeFi and smart contract ecosystem. However, the euphoria proved short-lived.

Market sentiment quickly soured as analysts began comparing Pi Network and the recently collapsed OM token.

Allegations suggest that, like the OM token, Pi coin lacks full clarity around circulating supply, wallet distribution, and centralized control. To some, these are potential red flags in an increasingly regulation-sensitive industry.

“The OM incident is a wake-up call for the entire crypto industry, proof that stricter regulations are urgently needed. It also serves as a huge lesson for the Pi Core Team as we transition from the Open Network to the Open Mainnet,” wrote Dr Altcoin.

Pi coin reversed gains within days, falling 18% from its weekly high. At the time of writing, PI was trading at $0.6112, up by a modest 0.7% in the past 24 hours, per CoinGecko.

Grayscale’s Altcoin Shake-Up: 40 Tokens Under Review

This week in crypto also showed that institutional investor interest in altcoins is heating up again, with Grayscale leading the charge.

The digital asset manager unveiled its updated list of assets under consideration for the second quarter (Q2) 2025. BeInCrypto reported that the list featured zero altcoins across sectors such as DePIN, AI, modular blockchains, and restaking. Among the notable tokens being eyed are SUI, STRK, TIA, JUP, and MANTA.

The update reflects Grayscale’s growing thesis around emerging crypto trends, particularly as the firm seeks to expand beyond its core Bitcoin and Ethereum products.

This announcement follows a broader strategic overhaul from three weeks ago when Grayscale reshuffled its top 20 list of altcoins by market exposure. Several older names were dropped at the time, while newer narratives like Solana-based DePIN and Ethereum restaking plays were pushed to the forefront.

The expansion into 40 coins signals Grayscale’s recognition of renewed retail and institutional appetite for differentiated assets. However, inclusion in the list does not guarantee a fund launch. It only indicates Grayscale’s active research.

XRP and SWIFT Partnership: Breaking Down the Rumors

There was speculation this week about a possible partnership between Ripple’s XRP and banking giant SWIFT in crypto.

This narrative was based on a misinterpreted document. A series of cryptic social posts exacerbated the speculation, which some took as confirmation of collaboration between the global payments network and the XRP ledger.

However, BeInCrypto’s in-depth reporting sank the rumors. While Ripple has long pursued banking institutions and SWIFT has shown openness to blockchain innovations, there is no verified partnership between the two.

SWIFT’s public-facing projects around tokenization and digital asset settlement do not include XRP.

Despite the debunking, the rumors sparked an important conversation about XRP’s long-term positioning. The token remains a top-10 asset and a favorite among retail investors banking on utility-driven price appreciation.

With Ripple’s legal battles with the SEC nearing resolution and international CBDC partnerships in the works, the project is far from irrelevant.

US Dollar Dives: What the DXY Crash Means for Bitcoin

The US Dollar Index (DXY) hit a three-year low this week, sending ripples through the crypto markets. Historically, a falling DXY has been bullish for Bitcoin, and this week was no different, with BTC reclaiming above the $84,000 range.

The greenback’s weakness reflects growing fears of fiscal deterioration in the US, as rate cuts loom and Treasury debt soars.

However, that is just the surface. The global M2money supply has been quietly increasing again, especially across Europe and Asia. This reignites the liquidity conditions that fueled previous bull runs.

Japan’s 10-year bond yields hit multi-decade highs, forcing the Bank of Japan (BoJ) into increasingly precarious interventions. As Japanese liquidity spills outward, crypto and risk assets have become inadvertent beneficiaries.

This macroenvironment is ideal for Bitcoin. Weakening fiat, rising global liquidity, and crumbling bond market confidence create a perfect storm.

ZURICH, Switzerland, April 18, 2025 (GLOBE NEWSWIRE) — The final countdown is officially on. With only 3 days remaining until the XploraDEX $XPL Presale closes, the race is heating up fast. Traders across the XRPL ecosystem are moving swiftly to secure what’s left of the allocation before the window slams shut. The presale has already crossed the 80% mark, and with demand at an all-time high, the remaining supply is vanishing by the hour.

XploraDEX isn’t just another token launch, it’s the dawn of a new trading experience for XRP users. As the first AI-powered decentralized exchange built on XRPL, XploraDEX brings intelligent automation, real-time data analysis, and predictive execution to the DeFi landscape. It’s a major leap forward for traders who demand speed, strategy, and smarter tools.

JOIN $XPL Presale Now

Designed from the ground up with machine learning integration, XploraDEX empowers users to:

The $XPL token is the engine powering this innovation. Holding $XPL gives users access to the platform’s core features, including advanced analytics, trading fee discounts, early staking pools, and governance rights. It’s not just a utility—it’s a passport to the most sophisticated trading protocol on XRPL.

Since the start of the presale, momentum has accelerated exponentially. Whale wallets have steadily accumulated significant $XPL positions, and community participation has surged across Twitter and Telegram. As the final 72-hour countdown begins, latecomers are racing to claim their spot before launch.

Participate in $XPL Presale

Once the presale concludes, $XPL will be listed on XRPL-based DEXs at a higher valuation. With platform deployment, staking rewards, and AI dashboard features rolling out in phases shortly after, early participants will be the first to benefit from the full capabilities of the ecosystem.

This is more than a presale—it’s your opportunity to be early to the most advanced DeFi project to launch on XRPL. XploraDEX has the tech, the timing, and the traction. And now, with 3 days left, the door is closing fast.

If you’re reading this, you still have a chance. But in 72 hours, this chapter will be over—and those who acted will be the ones shaping what comes next.

Join the $XPL Presale While You Still Can: https://sale.xploradex.io

Stay connected and Join the XploraDEX AI Revolution

Website | $XPL Token Presale | X | Telegram

Contact:

Oliver Muller

oliver@xploradex.io

contact@xploradex.io

Disclaimer: This press release is provided by the XploraDEX. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.

Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed.

Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2eed35d3-2094-4423-8621-972b9b5fa255

XploraDEX

XploraDEX

Bonk (BONK), one of the more energetic players in the meme coin space, is showing signs of a potentially explosive move as it coils tighter within a symmetrical triangle pattern. This classic chart formation, characterized by converging trendlines of lower highs and higher lows, often acts as a pressure booster for price action — the longer the squeeze, the more powerful the breakout tends to be.

The symmetrical triangle squeeze is a technical signal that often precedes sharp breakouts, and in BONK’s case, it couldn’t come at a more pivotal moment. With the broader meme coin market showing signs of strength and sentiment slowly shifting, a decisive move from this setup could define the next chapter for BONK. A breakout above the upper trendline might ignite fresh bullish momentum and open the door to new highs, while a break below support could trigger a sell-off toward lower key levels.

Bonk’s Recent Price Action: The Setup For A Big Move

According to a recent post by Whales_Crypto_Trading on X (formerly Twitter), Bonk is currently forming a symmetrical triangle pattern on the 1-hour chart. The price has just rebounded from the lower support trendline of the triangle, suggesting that buyers are stepping in to defend the structure and potentially build momentum for an upward breakout.

What makes this pattern particularly noteworthy is the potential upside. Whales_Crypto_Trading highlighted a profit target range of 70–80%, should BONK successfully break above the upper resistance trendline. With volatility tightening and volume starting to show signs of recovery, such a breakout could offer a substantial short-term trading opportunity.

However, traders are advised to keep a close eye on volume confirmation and key breakout levels to avoid possible fakeouts, as symmetrical triangles can break in either direction.

Will The Meme Coin Explode Or Fizzle Out?

Bonk’s symmetrical triangle pattern has reached a critical stage, raising speculations about whether the meme coin will break free with force or lose steam under pressure. The recent bounce off the support trendline suggests bullish interest is still alive, and if momentum continues to build, BONK could be gearing up for a powerful breakout, potentially delivering gains in the 70–80% range as projected by traders.

However, it’s important to remain cautious. Symmetrical triangles are neutral by nature, meaning a breakdown is still on the table if buyers fail to push through resistance. The next few candles on the 1-hour chart could provide key confirmation of BONK’s direction.

In the end, BONK is approaching a defining moment. Whether it explodes into a bullish run or fizzles out into another rejection will largely depend on volume, sentiment, and the strength of the breakout. Traders should stay alert, as a big move may be closer than it seems.

Crypto investor sentiment took another significant hit this week after Mantra’s OM token collapsed by over 90% within hours on Sunday, April 13, triggering knee-jerk comparisons to previous black swan events such as the Terra-Luna collapse.

Elsewhere, Coinbase’s report for institutional investors added to concerns by highlighting that cryptocurrencies may be in a bear market until a recovery occurs in the third quarter of 2025.

Mantra OM token crash exposes “critical” liquidity issues in crypto

Mantra’s recent token collapse highlights an issue within the crypto industry of fluctuating weekend liquidity levels creating additional downside volatility, which may have exacerbated the token’s crash.

The Mantra (OM) token’s price collapsed by over 90% on Sunday, April 13, from roughly $6.30 to below $0.50, triggering market manipulation allegations among disillusioned investors, Cointelegraph reported.

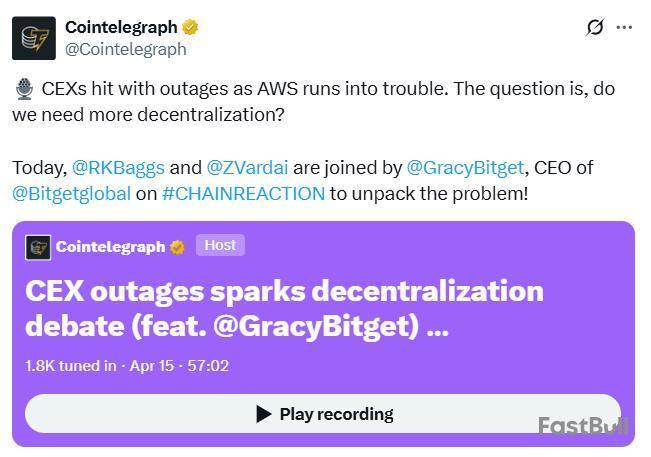

While blockchain analysts are still piecing together the reasons behind the OM collapse, the event highlights some crucial issues for the crypto industry, according to Gracy Chen, CEO of the cryptocurrency exchange Bitget.

“The OM token crash exposed several critical issues that we are seeing not just in OM, but also as an industry,” Chen said during Cointelegraph’s Chainreaction daily X show, adding:

Crypto in a bear market, rebound likely in Q3 — Coinbase

A monthly market review by publicly traded US-based crypto exchange Coinbase shows that while the crypto market has contracted, it appears to be gearing up for a better quarter.

According to Coinbase’s April 15 monthly outlook for institutional investors, the altcoin market cap shrank by 41% from its December 2024 highs of $1.6 trillion to $950 billion by mid-April. BTC Tools data shows that this metric touched a low of $906.9 billion on April 9 and stood at $976.9 billion at the time of writing.

Venture capital funding to crypto projects has reportedly decreased by 50%–60% from 2021–22. In the report, Coinbase’s global head of research, David Duong, highlighted that a new crypto winter may be upon us.

“Several converging signals may be pointing to the start of a new ‘crypto winter’ as some extreme negative sentiment has set in due to the onset of global tariffs and the potential for further escalations,” he said.

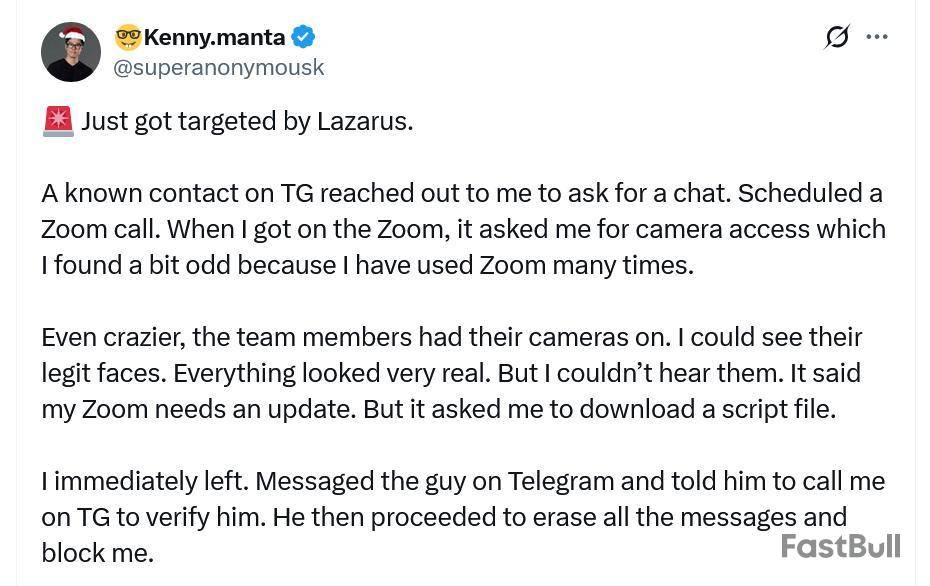

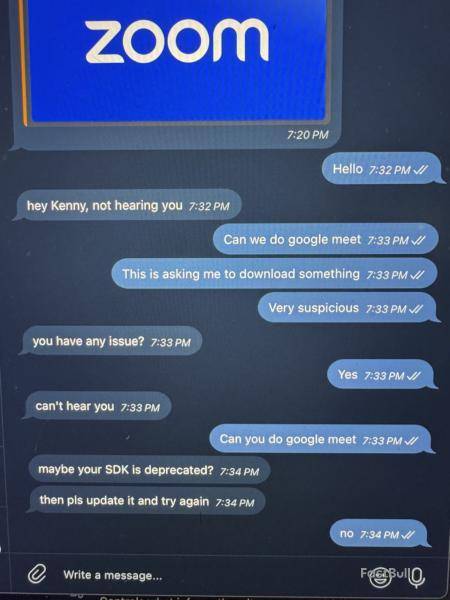

Manta founder details attempted Zoom hack by Lazarus that used very real “legit faces”

Manta Network co-founder Kenny Li said he was targeted by a sophisticated phishing attack on Zoom that used live recordings of familiar people in an attempt to lure him to download malware.

The meeting seemed real with the impersonated person’s camera on, but the lack of sound and a suspicious prompt to download a script raised red flags, Li said in an April 17 X post.

“I could see their legit faces. Everything looked very real. But I couldn’t hear them. It said my Zoom needs an update. But it asked me to download a script file. I immediately left.”

Li then asked the impersonator to verify themselves over a Telegram call, however, they didn’t comply and proceeded to erase all messages and block him soon after.

Li said the North Korean state-backed Lazarus Group was behind the attack.

The Manta Network co-founder managed to screenshot his conversation with the attacker before the messages were deleted, during which Li initially suggested moving the call over to Google Meet.

Speaking with Cointelegraph, Li said he believed the live shots used in the video call were taken from past recordings of real team members.

“It didn’t seem AI-generated. The quality looked like what a typical webcam quality looks like.”

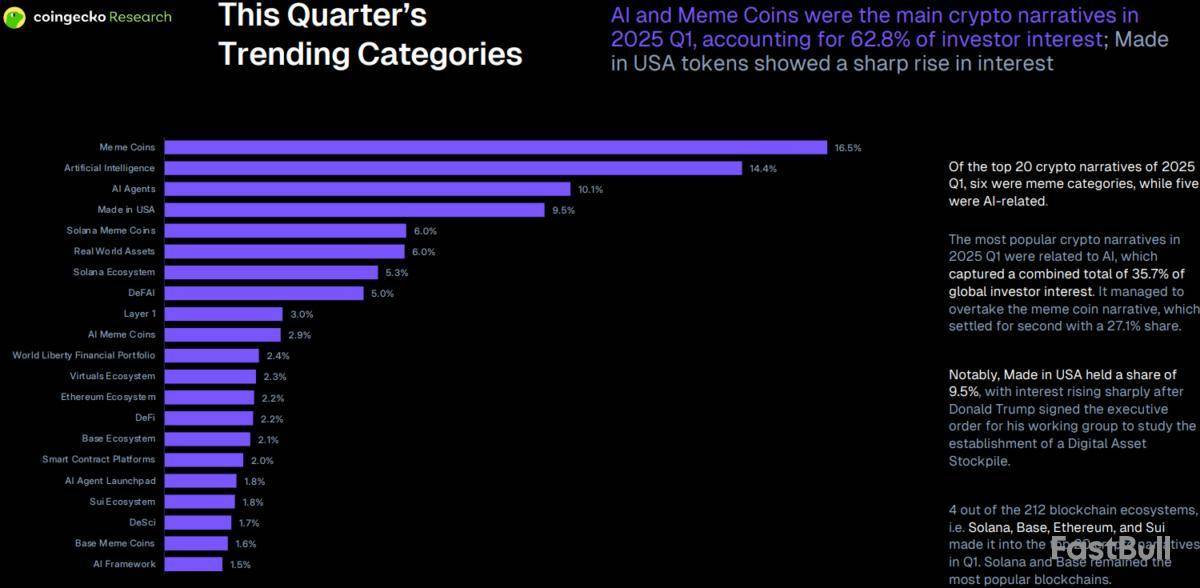

AI tokens, memecoins dominate crypto narratives in Q1 2025: CoinGecko

The cryptocurrency market is still recycling old narratives, with few new trends yet to emerge and replace the leading themes in the first quarter of 2025.

Artificial intelligence tokens and memecoins were the dominant crypto narratives in the first quarter of 2025, accounting for 62.8% of investor interest, according to a quarterly research report by CoinGecko. AI tokens captured 35.7% of global investor interest, overtaking the 27.1% share of memecoins, which remained in second place.

Out of the top 20 crypto narratives of the quarter, six were memecoin categories while five were AI-related.

“Seems like we have yet to see another new narrative emerge and we are still following past quarters’ trends,” said Bobby Ong, the co-founder and chief operating officer of CoinGecko, in an April 17 X post. “I guess we are all tired from the same old trends repeating themselves.”

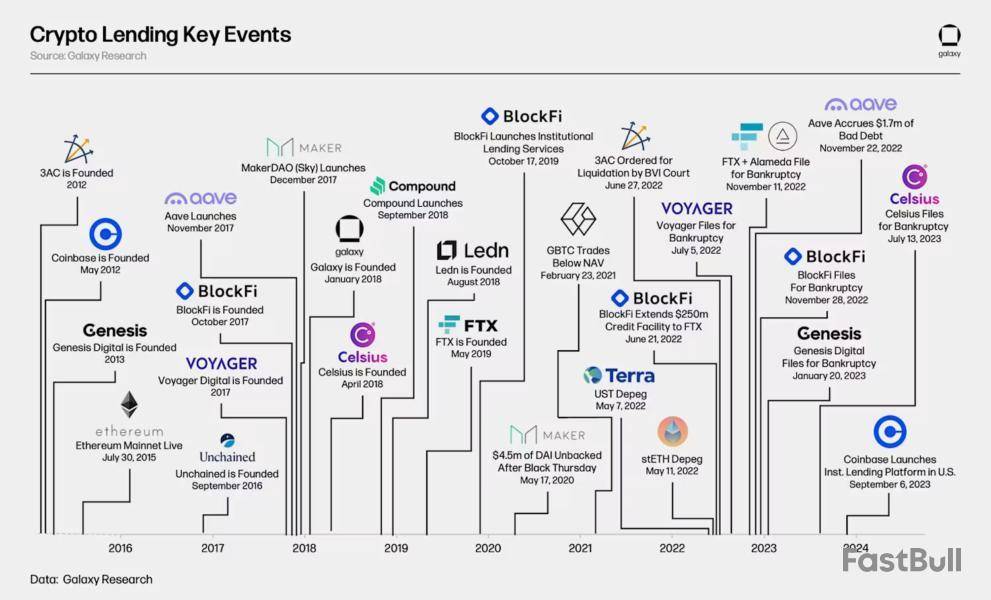

Crypto lending down 43% from 2021 highs, DeFi borrowing surges 959%

The crypto lending market’s size remains significantly down from its $64 billion high, but decentralized finance (DeFi) borrowing has made a more than 900% recovery from bear market lows.

Crypto lending enables borrowers to use their crypto holdings as collateral to obtain crypto or fiat loans, while lenders can use their holdings to generate interest.

The crypto lending market was down over 43%, from its all-time high of $64.4 billion in 2021 to $36.5 billion at the end of the fourth quarter of 2024, according to a Galaxy Digital research report published on April 14.

“The decline can be attributed to the decimation of lenders on the supply side and funds, individuals, and corporate entities on the demand side,” according to Zack Pokorny, research associate at Galaxy Digital.

The decline in the crypto lending market started in 2022 when centralized finance (CeFi) lenders Genesis, Celsius Network, BlockFi and Voyager filed for bankruptcy within two years as crypto valuations fell.

Their collective downfall led to an estimated 78% collapse in the size of the lending market, with CeFi lending losing 82% of its open borrows, according to the report.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

Decentralized exchange (DEX) Raydium’s (RAY) token rose over 26% as the week’s biggest gainer, followed by the AB blockchain (AB) utility token, up over 19% on the weekly chart.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Following President Trump’s April 9th announcement of a 90-day halt on new tariffs, market sentiment rebounded sharply, especially for Bitcoin. The surge appears mainly fueled by strong spot market activity, with little influence from derivatives.

According to Bitfinex Alpha, this suggests genuine interest from real-money investors, rather than speculative bets, indicating confidence in the market’s direction.Textbook Mid-cycle Reset

Bitcoin has now spent 88 days in a correction phase since hitting its all-time high of $109,590 on January 20th. The cryptocurrency has dropped just over 25% during this period. Bitfinex’s latest report revealed that, historically, the depth and duration fit well within typical bull market retracements, and make the current move more of a healthy pause than a major trend shift.

Past Bitcoin cycles often featured 25-35% drops from local highs, followed by 3-4 months of consolidation before fresh rallies emerged.

By those standards, this correction matches prior market behavior both in magnitude and timing. While the decline is sharp, it remains consistent with a mid-cycle pause rather than a breakdown of the ongoing bullish trend.Broad-Based Buying Amidst Consolidation

A notable trend over the last week has been the persistent rise in Spot Cumulative Volume Delta (CVD), which reflects the net imbalance of aggressive buy versus sell orders. Across top spot exchanges, buyers were found to have been consistently lifting offers, which depicts a strong intent to absorb supply, even from large-scale sellers.

Despite this clear buying pressure, Bitcoin’s price action continues to staytrappedin a tight $75,000 to $85,000 range, with high-timeframe charts reflecting sideways consolidation rather than any decisive directional shift.

This “divergence” between strong buying activity and stagnant price action points to quiet but meaningful accumulation. Despite aggressive buy orders, prices remain capped, which suggests that supply is not being met with significant resistance from sellers.

This rising Spot CVD, observed across a wide array of exchanges, signals that accumulation is taking place on a broad scale, not isolated to a single platform or region. This type of steady accumulation, which is occurring beneath the surface, can create conditions for a powerful breakout.

If the order book starts to thin and passive sell pressure declines, the market may see a sharp upward reaction. However, a macroeconomic catalyst may be necessary to trigger this shift. Similar setups in the past, which are marked by rising CVD and price consolidation, have been followed by sharp upward moves once resistance breaks. So while the surface appears quiet, there’s growing potential energy building beneath the market structure.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up