Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

An IEO, or exchange offering, can quickly drive price moves for a project. This is because many people want to get the token early, and exchanges often promote new listings. The fact that LAAI will have a limited token amount could make even more buyers come in. If there is hype and strong interest, price may shoot up around the IEO. But high prices may not last if people sell for fast profit. If the project is strong, it might keep value after launch. source

Dex-Trade@dextrade_Sep 19, 2025LAURA AI AGENT (LAAI) IEO BOOM SOONhttps://t.co/W0C9qz4P6h

We are ready to announce the new IEO SOON

Be ready to buy LAURA AI AGENT (LAAI).

The number of LAAI is limited!

Your lovely Dex-Trade team! pic.twitter.com/4hKBFNMXfC

A snapshot means the team will record who owns the token at a given time. Many times, this is for an airdrop or new reward, and it can increase the price because people want to buy before the snapshot. Sometimes after the event, price goes down as people sell. If this snapshot leads to a good reward or special game feature, price could move up even more. But if there are no strong benefits for holders, price might not react much. Watch for more details from the team. source

Wolf Game@wolfdotgameSep 19, 2025The next chapter for Wolf Game is on the horizon.

There will be a snapshot for $WOOL and Pouches on Monday, Sept 22nd at 10 AM ET / 2 PM UTC.

Stay tuned for more information!

Sahara AI's new roadmap brings more features, plans for the mainnet, and better use for the SAHARA token. When projects show clearer plans and new steps, people often get excited and think the price could go up. Mainnets and new tools can bring more users and money. But, if the team does not deliver on time, or if users are not impressed, there might not be a price move. Traders will watch how the project keeps its promises. More news or actions by the team will likely drive short-term price changes. source

Sahara AI@SaharaLabsAISep 19, 2025New roadmap just dropped!

From new vertical-domain agents → to expanding $SAHARA utility → to Mainnet launch and more!

Here’s everything coming up in Q4 2025 and beyond for Sahara AI https://t.co/0rMMe88nQT

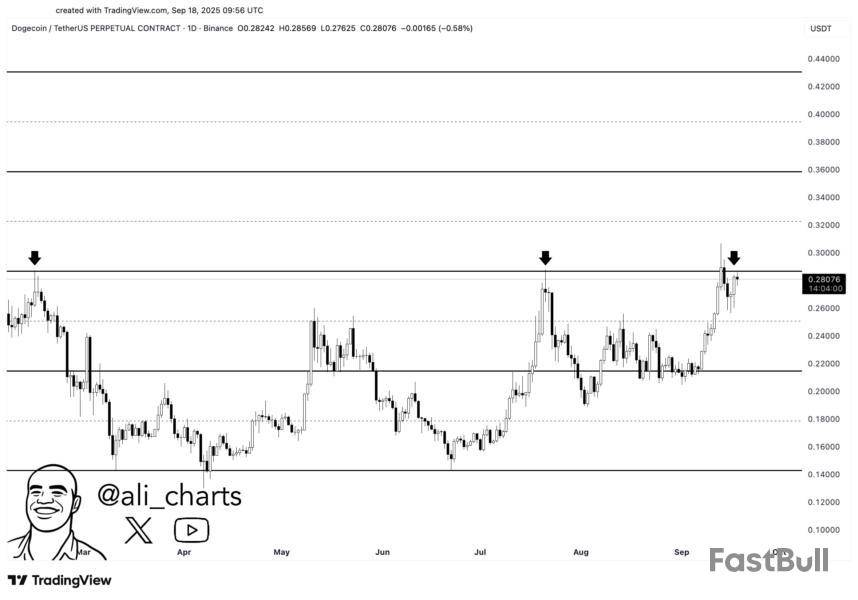

An analyst has pointed out how Dogecoin could see a rally to $0.36 or even $0.45 if its price can manage to break past this resistance barrier.

Dogecoin Is Retesting Upper Boundary Of A Parallel Channel

In a new post on X, analyst Ali Martinez has shared a technical analysis (TA) pattern forming in the 1-day price of Dogecoin. The pattern is a “Parallel Channel,” which forms when an asset observes consolidation between two parallel trendlines.

There are a few different types of parallel channels, each with a distinct orientation of the trendlines in respect to the graph axes. The Ascending Channel forms when the trendlines are angled upward. That is, when the price travels to a net upside inside the channel. Similarly, the Descending Channel has trendlines that have a negative slope.

In the context of the current topic, neither of these versions of the Parallel Channel is of interest, but rather the most simple case of the pattern: a channel parallel to the time-axis.

When the asset is moving inside this type of channel, it observes resistance at the upper line and support at the lower one, and moves in an exactly sideways manner trapped between the two.

Now, here is the chart shared by Martinez that shows the Parallel Channel that Dogecoin has been stuck inside for the last few months:

As is visible in the above graph, Dogecoin retested the upper line of the Parallel Channel earlier in the month, but found rejection. The memecoin now appears to be approaching another retest of this line situated at $0.29.

Generally, a break above the upper line of a Parallel Channel is considered to be a bullish signal. Thus, if DOGE can manage to surge above the pattern, it may see a sustained rally.

Martinez has suggested two potential targets for the memecoin: $0.36 and $0.45. These are based on the fact that Parallel Channel breakouts can be of the same length as the height of the channel; the former corresponds to half this distance and latter to the full one. It now remains to be seen whether Dogecoin can surpass this huddle in the near future and if any sustained bullish momentum will follow.

In some other news, Dogecoin whales have been buying recently, as the analyst has pointed out in another X post.

From the above chart, it’s visible that DOGE whales have added a total of 158 million tokens of the cryptocurrency (worth $41.9 million) to their holdings with this accumulation spree.

DOGE Price

At the time of writing, Dogecoin is trading around $0.265, down more than 6% over the last 24 hours.

XRP surprised the market this week by setting a new record with its first U.S. spot ETF launch, but the token’s price has still declined. As of today, XRP is trading at $2.99, down from recent highs, leaving many investors puzzled.

Spot XRP ETF Breaks Day-One Record

On its first day of trading, the $XRPR ETF recorded $37.7 million in volume, edging out $IVES to claim the biggest first-day natural trading volume of any ETF launched in 2025. Dogecoin’s new ETF ($DOJE) also impressed with $17 million, placing it in the top five launches out of 710 so far this year.

Analyst Zach Rector said the first Spot XRP ETF did set a record for day-one trading volume in 2025, but XRP has since faced three straight days of outflows totaling $68.63 million. He explained this is the main reason the price has fallen, moving in line with the rest of the market.

Why Did XRP’s Price Fall?

Despite the record debut, XRP has seen three straight days of outflows totaling $68.63 million. This selling pressure, combined with broader weakness across crypto, has weighed heavily on its price.

Attorney Bill Morgan explained it simply: “There is no mystery why XRP price is down the last 24 hours. Just playing follow the leader.” He pointed to Bitcoin’s recent slide as the key driver, saying XRP’s movements remain strongly correlated with the wider market, a point Ripple itself emphasized during its SEC lawsuit.

Technical Picture: Important Levels to Watch

For now, XRP is trading just below a critical resistance zone at $3.20. Analysts note:

Bitcoin (BTC), the leading cryptocurrency, has experienced a notable decline, erasing the gains it achieved following the recent decision by the US Federal Reserve (Fed) to cut interest rates.

After soaring to nearly $118,000—just 5% shy of its all-time high—the market has faced renewed uncertainty. Despite this setback, experts emphasize that the long-term outlook for Bitcoin remains optimistic, especially as September 21 approaches, a date identified as pivotal for Bitcoin’s price trajectory.

Will September 21 Mark The Start Of A New Bull Run?

Market analyst Timothy Peterson highlights that historically, Bitcoin has finished the year higher 70% of the time after September 21, with a median increase exceeding 50%. He has dubbed this date “Bitcoin Bottom Day,” suggesting that the odds of a price increase are significantly favorable.

Peterson notes that two of the three downturns in Bitcoin’s history occurred during established bear markets in 2018 and 2022, conditions that do not reflect the current market situation. This leads him to believe that the chances of a price rise are closer to 90% this year.

Furthermore, Bitcoin’s track record suggests it has a nearly perfect chance of holding its gains six months post-September 21. Peterson estimates there is at least a 70% probability that Bitcoin will not drop below the $100,000 mark again.

Analysts Warn Of ‘Sell the News’ Bitcoin Phase

Ryan Lee, chief analyst at cryptocurrency exchange Bitget, also points to the recent 25-basis-point rate cut by the Fed as a factor that initially boosted Bitcoin’s price, briefly pushing it above $117,000. This cut, the first in nine months, reflects increased liquidity in the market.

However, Lee cautions that the median projection of only 50 basis points in total cuts for the year could temper some of the optimism, introducing potential volatility as traders adjust their strategies.

Historically, Bitcoin has experienced a dip of 5% to 8% following rate cuts before resuming its upward trend, suggesting a possible “sell the news” phase in the coming days.

Despite these fluctuations, Lee remains bullish about the macroeconomic environment, asserting that lower yields on money-market funds (MMFs) are likely to direct capital toward alternative investments, such as cryptocurrencies.

He emphasizes Bitcoin’s role as a hedge in this risk-on climate, especially with approximately $7.2 trillion currently held in cash-like instruments.

Looking ahead, Lee predicts that the cryptocurrency may consolidate in the near term before targeting prices between $123,000 and $150,000, should additional rate cuts materialize.

Analysts at Bitfinex also share a positive outlook, projecting that with three anticipated rate cuts by the end of the year and steady inflows into exchange-traded funds (ETFs), Bitcoin could reach between $125,000 and $135,000 by year-end.

However, they also caution that if inflation or economic growth data hinder the Fed’s ability to proceed with further cuts, Bitcoin might stabilize within a range of $110,000 to $115,000 as institutional participation and ETF assets under management provide a solid floor.

Featured image from DALL-E, chart from TradingView.com

Earlier this week, the US Federal Reserve (Fed) cut interest rates by 25 basis points, providing the much-required impetus to the economy after a cycle of raising interest rates to keep inflation under check. A cut in interest rates is likely to benefit risk-on assets, including Bitcoin (BTC).

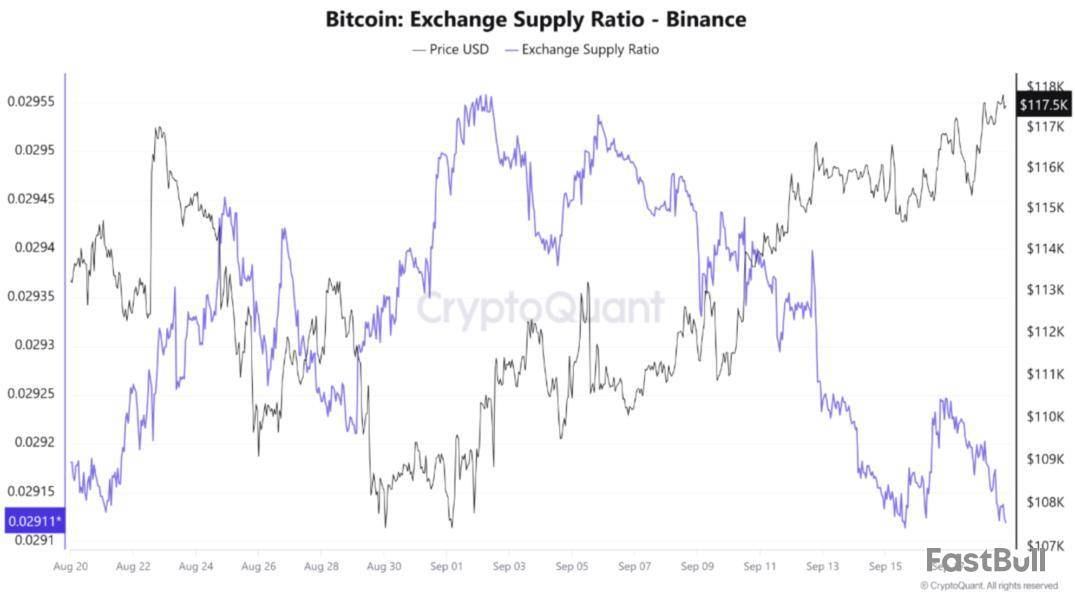

Fed Cuts Interest Rate, Bitcoin Supply Ratio Falls

According to a CryptoQuant Quicktake post by contributor Arab Chain, the latest data from Binance shows that the interest rate cut has rekindled investors’ interest in BTC. Notably, the exchange supply ratio has declined to 0.0291, hinting that investors are choosing to withdraw their BTC from exchanges and hold it for the long-term instead of selling it.

To support their analysis, Arab Chain shared the following chart, which shows a tumbling exchange supply ratio while the BTC price continues to shoot up. The analyst noted that the interest rate cut has increased risk appetite and improved liquidity in the market.

This behavior shows that the Fed’s monetary policy will remain dovish for the near term, which could mitigate selling pressure on BTC for the time being. Low exchange supply is creating relative buying pressure, as Bitcoin’s stability above $115,000 further supports this trend.

The analyst remarked that if BTC outflows from crypto exchanges continue at the current pace, then the digital asset may target the $120,000 resistance level. However, liquidity must continue to flow into digital assets, driven by the Fed’s decision. Arab Chain added:

The continued decline in the Exchange Supply Ratio for Bitcoin, coupled with a rising price, reinforces the bullish scenario, especially if traditional markets stabilize after the Fed’s decision. Conversely, if the Exchange Supply Ratio turns upward again (if Bitcoin reenters exchanges), it could signal that investors are preparing to take profits at levels near 118K–120K.

Meanwhile, crypto analyst Titan of Crypto had similar thoughts. In an X post, the analyst shared the following chart, saying that BTC is currently stuck under the bearish fair value gap. A daily close above this gap – highlighted in red – could pave the way for a new high for BTC.

Is BTC Facing A Supply Crunch?

A declining exchange supply ratio further suggests that BTC may be approaching a bullish ‘supply crunch’ that could lead to significant price appreciation for the digital asset in the near term.

Recently, the Bitcoin Scarcity Index recorded its first spike since June 2025, indicating potential upward price pressure on BTC. Meanwhile, BTC outflows from Binance continue at a rapid pace, further reducing the digital asset’s active circulating supply.

That said, some concerns still linger, specifically due to the lack of participation of whales in recent BTC price action. At press time, BTC trades at $116,374, down 1.3% in the past 24 hours.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up