Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

TL;DR

Can XRP Break Above $100?

Before we head into the first two massive price predictions, let’s quickly recap XRP’s most recent movements. The asset reached a new all-time high a month ago at $3.65 before it corrected to under $2.8 on a couple of occasions. However, it defended that level earlier this week andbouncedabove the crucial $3 support, where it currently sits as well.

Consequently, Cobb, who is among the loudest XRP fans on X, indicated that this particular level “feels like the new $0.60.” Recall that Ripple’s token was stuck at $0.60 for several months last year before the US elections, with little to no deviations. However, it went on a massive run as it became known that Trump would return to the White House, and then-SEC Chair Gary Gensler would leave.

Cobb categorized the $3 support as an essential consolidation level, which will be followed by a surge to $20 per token.

While that sounds like a big price prediction, let’s now head into a much bolder one. John Squire, a social media influencer also known for his pro-XRP comments, outlined a future price tag for the cross-border token at $134.50. Yes, that’s a triple-digit XRP.

He cited information by Gemini, which put such a mindblowing price tag for the asset in case Ripple’s XRPL captures 20% of all tokenization in the RWA niche by 2026. If that’s to occur, XRP’s market cap would skyrocket to $8 trillion, which would make it 3 times bigger than BTC’s current valuation.

Google Gemini Projection #XRP Price Could Reach $134.5 if #XRPL Secures 20% of Tokenized RWA by 2026.

1️⃣ XRPL RWA Value: $14B (20% of $70B market) 2️⃣ Market Cap Projection: $7.99T 3️⃣ Price Projection: $134.5 per $XRP

This isn’t hype — it’s math. #XRP #Crypto pic.twitter.com/wlQboUqhFO

— John Squire (@TheCryptoSquire) August 24, 2025

Back to Reality

Not that we are saying these numbers above are impossible to reach, ever, but we would take them with a pinch of salt. As such, we will also provide a more realistic and less flashy (at least in the short-term) view of what could be next for Ripple’s token.

Ali Martinez, whonotedon a couple of occasions in the past week that XRP had flashed a buy signal at $2.80, doubled down on his forecast, saying that the asset is in the “middle of a rebound to $3.6.” If such a price pump materializes, Ripple’s coin will be inches away from a new all-time high.

$XRP is in the middle of a rebound to $3.60! pic.twitter.com/OhOLwmoWkd

— Ali (@ali_charts) August 23, 2025

According to Glassnode data, the daily transaction fees on the BTC network (14-day SMA) recently dropped to 3.5 BTC, marking the lowest level since late 2011. The decline usually suggests a lack of demand and could be hinting at a price drop in the foreseeable future.

Bitcoin may retrace further to test the 100-day EMA in the $111,000-$112,000 range if the rejection at this level indicates a breakdown in short-term support. In technical analysis, the failure to hold above the 50 EMA frequently serves as a bearish trigger since it indicates that buyers are becoming weaker in the face of increasing sell pressure.

Next Bitcoin battle

The next logical support test for Bitcoin may occur at the 100 EMA, as its inability to recover this level now suggests greater market vulnerability. Similar to corrections in previous cycles, the market may face more intense downside pressure if this level also fails.

With momentum moving in favor of sellers, the consolidation phase between $120,000 and $116,500 has been invalidated from a structural standpoint. Additionally, patterns of trading volume show a decline in buyer activity, with no notable inflows to offset the deteriorating technical picture.

From correction to bear market

As market momentum has cooled, the RSI has been steadily declining, suggesting that the current correction may continue. Market confidence would be shaken by a decline toward the 100 EMA, which could also lead to wider altcoin weakness.

The $111,000 zone, however, becomes a crucial test for the market as a whole if it fails. Bitcoin is currently at a pivotal point in its history. The market will be closely observing, a recovery might restore confidence, but a more severe decline toward the 100 EMA might signal a longer corrective phase.

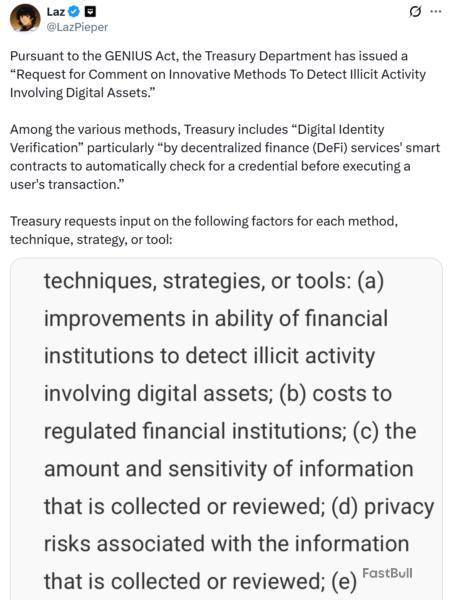

The US Treasury is exploring whether identity checks should be built directly into decentralized finance (DeFi) smart contracts, a move critics warn could rewrite the very foundations of permissionless finance.

Last week, the agency opened a consultation under the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), which was signed into law in July. The Act directs the Treasury to evaluate new compliance tools to fight illicit finance in crypto markets.

One idea was embedding identity credentials directly into smart contracts. In practice, this would mean a DeFi protocol could automatically verify a user’s government ID, biometric credential, or digital wallet certificate before allowing a transaction to proceed.

Supporters argue that building Know Your Customer (KYC) and Anti-Money Laundering (AML) checks into blockchain infrastructure could streamline compliance and keep criminals out of DeFi.

Fraser Mitchell, Chief Product Officer at AML provider SmartSearch, told Cointelegraph that such tools could “unmask the anonymous transactions that make these networks so attractive to criminals.”

“Real-time monitoring for suspicious activity can make it easier for platforms to mitigate risk, detect and ultimately prevent money launderers from using their networks to wash the proceeds from some of the world’s worst crimes,” Mitchell said.

DeFi ID checks: protect data or risk surveillance?

Mitchell acknowledged the privacy tradeoff but argued that solutions exist. “Only the necessary data required for monitoring or regulatory audits should be stored, with everything else deleted. Any data that is held should be encrypted at row level, reducing the risk of a major breach.”

However, critics say the proposal risks hollowing out the core of DeFi. Mamadou Kwidjim Toure, CEO of Ubuntu Tribe, compared the plan to “putting cameras in every living room.”

“On paper, it looks like a neat compliance shortcut. But you turn a neutral, permissionless infrastructure into one where access is gated by government-approved identity credentials. That fundamentally changes what DeFi is meant to be,” Toure told Cointelegraph.

He warned that if biometric or government IDs are tied to blockchain wallets, “every transaction risks becoming permanently traceable to a real-world person. You lose pseudonymity and, by extension, the ability to transact without surveillance.”

For Toure, the stakes go beyond compliance. “Financial freedom relies on the right to a private economic life. Embedding ID at the protocol level erodes that and creates dangerous precedents. Governments could censor transactions, blacklist wallets, or even automate tax collection directly through smart contracts.”

Who gets left behind?

Another concern is exclusion. Billions of people globally still lack formal identification. If DeFi protocols require government-issued credentials, entire communities, migrants, refugees and the unbanked risk being locked out.

“It may restrict access for users who prefer anonymity or cannot meet ID requirements, limiting DeFi’s democratic nature,” Toure said.

Data security is also a flashpoint. Linking biometric databases to financial activity could make hacks more catastrophic, exposing both money and personal identity in a single breach.

Critics stress that the choice isn’t binary between crime havens and mass surveillance. Privacy-preserving tools like zero-knowledge proofs (ZKPs) and decentralized identity (DID) standards offer ways to verify eligibility without exposing full identity.

With ZKPs, users can prove they are not on a sanctions list or over 18 without revealing who they are. DID frameworks allow users to hold verifiable credentials and selectively disclose them. “Instead of static government IDs, users hold verifiable credentials they selectively disclose,” Toure said.

Bitcoin’s price actions have calmed over the weekend as the asset has stalled around the $115,000 mark following the massive volatility experienced on Friday.

Most altcoins are also sluggish on a daily scale, which is why we will focus on their weekly performances, and OKB stands in a league of its own.BTC Stalls at $115K

The business week didn’t go all that well for the primary cryptocurrency as its price started to lose traction from Monday. It first dipped to $115,000, and after an unsuccessful bounce, it quickly resumed its downfall with a nosedive to $113,000 by Wednesday and Thursday.

Friday was expected to be an even more volatile trading day and didn’t disappoint. At first, bitcoin dug a new local low,droppingbelow $112,000 for the first time since early July. However, as Jerome Powell took the stage to address the nation about the Fed’s upcoming monetary policy changes, the cryptocurrency began to recover lost ground rapidly.

Within an hour, the assetskyrocketedto over $117,000 as Powell hinted about potential rate cuts comingas soon as September.

Nevertheless, BTC’s momentum has cooled off since then, and the asset is just under $115,000 as of press time, which is essentially the same as yesterday. Its market cap has slipped below $2.290 trillion, while its dominance over the alts has taken another hit and is down to 56.3%.Alts Going Wild

Following Powell’s speech on Friday, many altcoins produced even more impressive gains than BTC. This included ETH, which rocketed to just under $4,900 to set a new all-time high. Although it has retraced slightly since then, it’s still 5% up weekly. SOL has performed even better, gaining nearly 8% since this time last Sunday.

XMR, TRX, LINK, and AVAX have jumped by around 3-5%, while AAVE has soared by 14% weekly to $350. OKB has stolen the show as a 60% pump has driven it to almost $200 as of now.

In contrast, XRP, DOGE, HYPE, ADA, SUI, and XLM have declined by up to 7.5% in the case of Hyperliquid’s native token.

The total crypto market cap has lost over $40 billion since yesterday and is down to $4.060 trillion on CG.

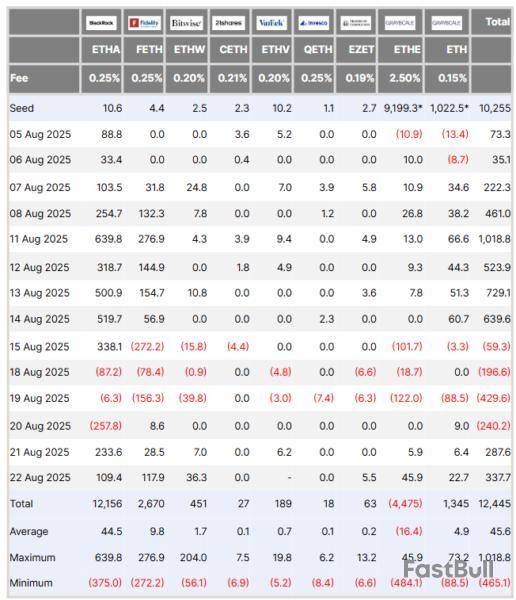

US-listed Ethereum exchange-traded funds (ETFs) have logged their first week of outflows in 15 weeks, marking a pause in what had been a steady run of institutional inflows.

Data from Farside Investors shows that investors pulled $241 million from the products during the week of August 22, even as a late-week rebound in demand softened the overall impact.

Ethereum ETFs Suffer Rare Setback of $241 Million Outflow

The week began with heavy selling pressure, with the nine funds registering a combined $866.4 million outflow between Monday and Wednesday.

Notably, Tuesday alone accounted for $429 million in redemptions, the second-largest daily outflow since the products went live.

By Thursday, however, sentiment began to shift. The funds recorded two consecutive days of inflows totaling $625.3 million.

While this reversal reduced the scale of the withdrawals, it was not enough to erase the earlier damage. The result was a net weekly outflow of roughly $241 million.

This shift tracked broader macro signals and Ethereum’s market moves. The early-week selloff stemmed from concerns about US inflation data, which heightened speculation over the Federal Reserve’s next policy decision and triggered expectations of a short-term price correction in ETH.

Later in the week, Fed Chair Jerome Powell delivered a more dovish message, calming fears of prolonged tightening. Ethereum responded with a rally to a fresh all-time high, which in turn spurred the late-week inflows.

Despite the setback, Ethereum ETFs continue to show stronger relative performance compared with their Bitcoin counterparts.

Last week, Bitcoin ETFs saw more than $1.1 billion in outflows, underlining the diverging investor appetite for the two leading crypto products.

Nate Geraci, president of investment advisory firm The ETF Store, pointed to the broader trend.

Since the start of August, spot Ethereum ETFs have attracted $2.8 billion in inflows, while spot Bitcoin ETFs have registered $1.2 billion in outflows. Looking back to July, Ethereum has pulled in $8.2 billion, compared with $4.8 billion for Bitcoin.

This pattern reflects a notable shift in institutional positioning. Investors appear increasingly willing to rotate into Ethereum products, even as broader market volatility continues to influence weekly flows.

Bitcoin has emerged as one of the go-to cryptocurrency assets for treasury strategies by different companies in the past few years.

This trend has intensified recently, and here are some of the latest additions.Slowly Climbing Up

One of the more recent procurements comes from Ming Shing Group, a publicly traded Hong Kong-based company listed on the NASDAQ (MSW), specializing in wet trades, such as plastering, tiling, and bricklaying, among others.

The purchase agreement is for 4,250 bitcoins, worth approximately $482 million, with an average price of $113,638 per unit. It is currently ranked 45th on the BitcoinTreasuries leaderboard, with 833 BTC, having started accumulating in early January, trailing the Nordic healthcare company H100 Group’s stash of 911 BTC.

Its stock has reacted positively to the announcement, rising over 11% daily earlier tshi week, according to the most recent data from Google Finance.A Known Face

Earlier in the week, KindlyMD increased its holdings by a notable 5,744 BTC, with an estimated cost of $679 million, at an average cost per bitcoin of $118,204. It’s an American healthcare and healthcare data company, also trading on the NASDAQ (NAKA), having merged with its Bitcoin-native holding company, Nakamoto Holdings Inc., at the start of May.

The firm joined the race later in the same month, with the mission of accumulating a million of the leading crypto asset. They’re much further ahead in the rankings, holding 5,765 BTC and currently sitting in 16th place, with a notable lead over Semler Scientific, which owns 5,021 BTC at print time.

“This acquisition reinforces our conviction in Bitcoin as the ultimate reserve asset for corporations and institutions alike.

Our long-term mission of accumulating one million Bitcoin reflects our belief that Bitcoin will anchor the next era of global finance, and we are committed to building the most trusted and transparent vehicle to achieve that future,” noted the CEO and Chairman, David Bailey.

The company’s stock, however, did not react so well to the news and has been declining since the start of the week, as indicated by data from Google Finance at the time of writing.

Ethereum-based gaming network Xai has filed a lawsuit against Elon Musk’s artificial intelligence company xAI, accusing it of trademark infringement and unfair competition.

The complaint, lodged in the Northern District of California on Thursday, claims Musk’s xAI company has created widespread market confusion, damaging Xai’s brand.

Ex Populus, the Delaware corporation behind Xai, said it has used the XAI trademark in US commerce since June 2023, including through its blockchain gaming ecosystem and the $XAI token. “This is a classic case of trademark infringement that requires the Court’s intervention to remedy,” the filing said.

Ex Populus operates the Xai ecosystem, which includes a blockchain-powered network designed for video gaming and digital transactions, offering infrastructure to support game logic, AI-driven decisions, rewards and data management across multiple applications, per the filing.

xAI gaming studio triggers further confusion

The complaint alleges that confusion began after Musk announced his company, xAI, in July 2023 and deepened when he said in November 2024 that xAI planned to launch a gaming studio.

The filing states that “marketplace confusion abounded as to whether Defendants/Musk were associated with, owned, or sponsored Plaintiff’s XAI Trademark or the associated goods and services.” It cited examples of consumers, publications and even Musk’s AI assistant Grok incorrectly linking the two ventures.

Ex Populus argued that the reputational harm goes beyond lost goodwill. The complaint says Xai has faced “significant negative consumer sentiment” due to Musk’s polarizing public image and controversies involving xAI products.

“Plaintiff is not only being irreparably harmed by the loss of control over its hard-earned goodwill in its XAI Trademark… but also Plaintiff is damaged because the confusing association with Elon Musk is resulting in significant negative consumer sentiment,” the filing notes.

Musk’s team pressured Xai over trademark rights

The filing accuses Musk’s legal team of trying to pressure Ex Populus into relinquishing rights by threatening cancellation of its registration earlier this month.

The lawsuit also mentioned that the US Patent and Trademark Office has already suspended several of Musk’s xAI trademark applications due to a likelihood of confusion with Xai’s existing mark.

Ex Populus is seeking cancellation of xAI’s pending applications, damages for infringement, and a court order to prevent Musk’s company from using the disputed name in gaming and blockchain contexts. “There is no remedy at law for the sheer magnitude of harm Defendants have caused,” the company told the court.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up