Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Polygon’s price action over the past week has been characterized by a moderate pullback following what initially appeared to be a decisive breakout above the $0.20 level. This dip, rather than signaling weakness, may in fact represent a healthy retracement as the cryptocurrency prepares for a new upward move.

The price structure appears bullish on higher timeframes, especially after POL recently rebounded off the lower boundary of a long-term descending channel. According to a crypto analyst, Polygon could be on the verge of an explosive rally toward the $1 mark.

Classic Bullish Divergence Points To Imminent Breakout

According to technical analyst MasterAnanda on TradingView, the Polygon ecosystem token (POLUSDT) is currently flashing one of the strongest technical reversal signals in the form of a textbook bullish divergence on the 3-day chart. Price action hit a new low on April 7, 2025, but the Relative Strength Index (RSI) had already bottomed earlier in July 2024 and has since been forming higher lows.

As noted by the analyst, this mismatch between the price and the momentum indicator is a classic signal that the downtrend may be losing steam. The signal is reinforced by the recent increase in volume and the broader bullish recovery observed across the cryptocurrency market.

Zooming in on the 3-day chart structure, POLUSDT experienced a notable rebound after reaching its low on April 7. The price climbed steadily to $0.267 by April 22 before encountering resistance. What followed were two successive bearish candlesticks that appeared to trace a measured pullback, likely a retest of the upper boundary of the descending channel.

This movement is significant because retests of this nature often precede major breakouts. Keeping this in mind, the analyst predicted a successful bounce from the trendline support, which could start a sustained rally toward $1.

Polygon To $1: Window Of Opportunity Narrowing

Analyst MasterAnanda noted that the current price action is merely a calm before a massive move. “The market is giving us one last chance to buy all we want before massive growth,” the analyst said, implying that a strong impulsive wave could be next. The RSI is currently in the mid-40s, and if the bullish setup plays out, a swift move to the 70+ zone could occur.

In terms of a price target, the analyst predicted a full recovery above $1 with a specific target of $1.15. This would mark a full recovery for POL holders who have been holding throughout the downturn in 2025. This level corresponds to the 1.618 level on the Fib extension projected from the April 7 low. The Fibonacci extension levels plotted on the chart show other smaller price targets on the way to $1.15. Most notable are the $0.461 and $0.534 regions, representing the 0.5 and 0.618 extension levels, respectively, which could serve as interim consolidation zones.

At the time of writing, Polygon is trading at $0.2420.

Not everyones welcome to buy JAV porn stars controversial memecoin

Japanese porn star and pop singer Yua Mikami has launched a new memecoin project on Solana, raising more than $2.9 million (over 19,000 SOL) in its presale at the time of writing, despite mounting concerns over its management.

The presale was announced on Mikamis X account, which boasts 8.2 million followers. She did not promote the project on her other major social platforms, TikTok and Instagram, which are followed by 4.5 million and 3.7 million accounts, respectively.

Blockchain analyst EmberCN raised several red flags. The presale doesnt have a fixed exchange rate or fundraising cap, meaning investors receive a share of the 20% token allocation based on how much is raised. EmberCN also observed that some participants sent SOL directly from centralized exchanges, despite explicit warnings not to do so. Since the project also lacks a refund mechanism, those users may lose their funds.

While the projects disclaimer states that Japanese investors are not allowed to participate, no technical restrictions have been implemented to prevent them from doing so. Researcher AB Kuai.Dong claimed that the rights to Mikamis memecoin project have been acquired by Chinese entities, and that the project is being marketed specifically to Chinese investors.

This comes amid growing skepticism around celebrity-endorsed memecoins, particularly on Solana, which has been plagued by scams in recent months. In March, a now-banned X account accused an unnamed Shenzhen celebrity memecoin factory in China of running coordinated pump-and-dump schemes. Some users have speculated (without confirmation) that Mikamis token may be linked to the same network.

However, some crypto traders welcomed the project, with one calling it a sign that otaku culture has officially come to crypto. Despite the enthusiasm, this isnt Mikamis first blockchain rodeo. She and other Japanese adult film stars previously launched non-fungible token projects during the 2021 NFT boom.

Ant Digital launches Jovay layer-2 to join Ethereums real-world assets party

Ant Digital Technologies, a subsidiary of Alibabas fintech arm Ant Group, unveiled a new Ethereum layer-2 network called Jovay on April 30 to compete in the growing race to tokenize real-world assets (RWAs).

Ant Digital said its new layer-2 network is capable of handling 100,000 transactions per second with a 100-millisecond response time. It forms part of Ants broader Dual Chains and One Bridge strategy, alongside its AntChain asset layer and crosschain bridge infrastructure.

Jovay is currently operating as a layer-2 solution on Ethereum, emphasizing performance and security as core pillars of our platform, Cobe Zhang, head of Jovay, told Magazine.

Looking toward the future, we are excited about broadening our horizons through integrations with different layer-1 networks to elevate our scalability even further.

Zhang says the Jovay team is aiming to release the mainnet in the third quarter of 2025.

Ant Digitals layer-2 announcement comes amid a strategic expansion. It recently set up a global headquarters in Hong Kong and is using Dubai as its Middle East base. Both regions are fast becoming hubs for digital asset regulation.

Just a week before the unveiling of its layer-2 project, the company also introduced its new smart contract infrastructure, the AI-powered DeTerministic Virtual Machine (DTVM) Stack, which uses large language models to automate and accelerate development.

Currently, Ethereum leads adoption in the RWA space, accounting for the vast majority of tokenized US Treasurys and institutional asset flows.

Read also FeaturesReformed altcoin slayer Eric Wall on shitposting and scaling Ethereum

Features Wild, Wild East: Why the ICO Boom in China Refuses to DieExpect more selling pressure from South Korea in June

South Koreas Financial Services Commission (FSC) has reportedly finalized a new set of guidelines that will allow nonprofit corporations and registered cryptocurrency exchanges to legally sell digital assets starting in June.

The move is part of a broader effort to gradually open the countrys digital asset market to institutional investors, formerly constrained by local regulations.

Under the new guidelines, nonprofit corporations with over five years of operating history and subject to external audits will be permitted to accept and sell cryptocurrency donations. These organizations must establish internal donation review committees to assess the legitimacy of incoming funds and evaluate liquidation plans in advance. Only crypto assets listed on at least three of the five licensed fiat-to-crypto exchanges will be eligible for donation.

Crypto exchanges will also be allowed to sell digital assets, but under strict conditions aimed at preventing market disruption and conflicts of interest. Only exchanges registered as virtual asset service providers (VASPs) under local regulations will be eligible. Sales can only be made to cover operational expenses and must be limited to the top 20 cryptocurrencies by market capitalization. Additional restrictions include a daily sales cap and a prohibition on selling tokens directly through the exchanges own platform.

The FSC also introduced new listing standards to address the extreme price volatility often seen when tokens debut on domestic exchanges. So-called listing pumps have drawn regulatory scrutiny due to rapid price surges caused by limited initial circulating supply. As a response, token issuers will now be required to secure a minimum circulating supply before trading begins, and market orders may be restricted during early trading phases.

Read also Features 1 in 6 new Base memecoins are scams, 91% have vulnerabilities Features Thailands crypto islands: Working in paradise, Part 1Sky Mavis messy divorce with Ragnarok Monster World

A public rift has emerged between Singapore-based Vietnamese startup Sky Mavis the developer behind the Ronin blockchain and Ragnarok Monster World, after Sky Mavis accused the Web3 game’s creators of secretly cutting a deal with a rival blockchain.

In an April 27 X post, Sky Mavis co-founder Aleksander Larsen said the team behind RMW, known as 0x&, ignored advice and lost favor with the community. As a result, the company announced it would end its professional ties, remove the games assets from Sky Mavis products within 48 hours, and delist RMW NFTs from the Ronin Market. The company also distanced itself from the games upcoming ZENY token launch, stating that its presence on Ronin should not be interpreted as endorsement or affiliation.

In a follow-up post, Larsen said that instead of removing NFTs entirely, Sky Mavis would revoke the games verification badge on the Ronin Market, marking its unaffiliated status going forward.

The move prompted an immediate rebuttal from Ragnarok Monster World. It denied engaging in secret agreements and said that all discussions with other blockchain networks had been shared with Sky Mavis. The developers further stated they had honored all contractual obligations and committed to continue operating the game on Ronin.

The public spat highlights a core irony in Web3 games. One of the spaces founding promises is that blockchain games are meant to be immune to bans and shutdowns. Ronin is moving toward that vision with a permissionless architecture that lets anyone deploy smart contracts or launch games without Sky Mavis’ approval. However, the ecosystem still revolves around Sky Mavis platform power. Projects may be technically permissionless, but without marketplace verification or ecosystem support, they risk losing exposure to the Ronin community. RMW still exists onchain, but is stripped of the networks stamp of approval.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

The final week of April delivered a jolt of optimism to a crypto market that has spent most of the year wrestling with macro cross-currents. Bitcoin’s resilience above the psychological $90,000–$95,000 level, an unexpected surge in stablecoin issuance and a swarm of textbook bullish patterns across large-caps and meme names have converged to create what veteran chartist Josh Olszewicz calls “one of the cleanest multi-asset breakout tapes we’ve seen since late 2023.”

Crypto Bull Run Back?

Olszewicz’s argument begins and ends with liquidity. Two consecutive one-billion-dollar Tether mints on 29 April pushed combined USDT + USDC supply to a fresh all-time high, an event he frames as an unequivocal tailwind for speculative assets. “Tether’s been printing, printing, and minting, baby,” he said, emphasising that the dual $1 billion tranches arrived alongside a clear premium in the USDT/USD pair on Kraken—evidence, in his view, of real demand rather than opportunistic treasury rebalancing. “Typically that means people are deploying it in alts. That’s why stable-coin mints—specifically Tether—[are] generally bullish for alts because people are using it to speculate.”

The liquidity pulse arrives just as several macro obstacles appear to be receding. Bitcoin survived a negative-print US GDP release, sticky PCE inflation data and what Olszewicz called “some jobs numbers that came out this week,” without surrendering its three-month up-trend. Meanwhile gold has rolled over and the Dollar Index remains pinned near cycle lows, recreating the “everything-rally” backdrop that powered crypto’s late-2023 melt-up. Funding markets, however, are delivering a curious split: “We still have negative funding on the BTC side on crypto exchanges. We have positive funding in legacy land with futures. So that’s very bizarre right now, but so far so good.”

Against that backdrop, Olszewicz drills into the Ichimoku-cloud mechanics that underpin his altcoin watch-list. The premise is as old as the indicator itself: a daily candle close inside the cloud accompanied by a bullish Tenkan-Kijun (TK) cross triggers a mean-reversion target to the opposing edge of the cloud. “All these trades are always the same. I never treat them differently,” he said. “You get a better entry… it’s just a game of probabilities.” The strategy sets clear invalidations—either the Kijun line or a lower-low—and provides what he characterises as Dow-theory mean-reversion framed through an Ichimoku lens.

That formula is now flashing across a surprising breadth of assets. Solana And Curve

Solana sits at the top of his list. The layer-one token has posted six consecutive red daily candles, sculpting the “right shoulder” of an inverted head-and-shoulders whose neckline rises toward $200. “What I’ve got to laser focus on is this potential edge-to-edge move,” he explained, noting that ideal entries would materialise between $140 and $120 but are not essential. “Within the next week or two, you should get a great signal on an entry here on SOL just from the cloud.”

Curve, by contrast, is already in motion—up double-digits on a day when most altcoins bled. “Why is it up 10 percent today and everything else is down? I don’t have a good answer for that,” he admitted. Yet the technical structure leaves little to interpret: a multi-month flat-bottom accumulation, a candle close inside the cloud near its lower boundary and a bullish TK cross. “You’re on your journey to somewhere up here—the other edge of the cloud,” he said, implying a measured-move objective near $1.20 that would represent a near-doubling from current levels. Ethereum And Litecoin

Where Solana and Curve show imminent triggers, Ethereum remains the quintessential laggard, still chiselling out what Olszewicz labels a bottoming process. “It’s going to take ETH kicking and screaming to get started here […] but this is a bottom in process. Certainly may take you into June.” The calculus is familiar: traders intent on rotation may find better risk-adjusted returns elsewhere, returning to ETH only once its own daily cloud admits a candle close.

Litecoin exhibits a similar dynamic, with an inverted head-and-shoulders outline that “feels a little early,” perhaps ripening by early June. FET, LINK, ALGO

Fetch.ai breached the cloud on April 23 and already sports a bullish TK cross, yet Olszewicz acknowledges it arrives “after two or three weeks of up-move,” reducing risk-reward.

Chainlink shows a textbook right-shoulder still under construction—“alerts at fifteen,” he suggests—while Algorand edges toward a 32-cent cloud target, one daily close away from confirmation.

In each instance, the analyst reiterates that until the formal triggers print, the probability of follow-through remains statistically lower. DOGE, PEPE And WIF

The most combustible corner of the market—the meme cohort—is, in his telling, already foreshadowing a retail return. Dogecoin intrigues him most. “Along with ENA, one of the best bang for your bucks is Doge,” he said, though he concedes the pattern needs another week to sculpt a complete right-shoulder. He is explicit about his trigger: “Give it another week or two and this is definitely one of the better-looking setups,” with attention fixed on the $0.175 area.

PEPE presents fewer moving parts: it is inside the cloud with a bullish TK cross and a clear neckline at the Kijun. “If ETH even sneezes higher, I expect this to just be up twenty-five percent one day,” he said, while cautioning that a transitional “negative twenty percent day” could precede the pop.

WIF, for its part, is “slamming against the cloud,” on the cusp of its own TK cross. Having retraced from $4.80 to current levels, it offers what he calls “a great-looking setup,” albeit one where “the greed in me always wants an entry down here”—a reference to a hypothetical bid parked at the cloud’s lower edge. BTC Dominance

Bitcoin dominance, still pressing cycle highs, complicates the rotation narrative. “Does it really matter that you’re not all-in BTC if this is an extreme in dominance?” he asked rhetorically. His answer is temporal. Dominance mattered enormously at the October 2023 bottom, and he suspects it will matter again once it rolls over.

“Come May, June, I think we will start to see the outperformance of the altcoins,” he predicts, but he tempers that with a blunt reminder: “It hasn’t made sense to sit in these BTC pairs.” The exception is Solana’s BTC chart, which mirrors the USD thesis with a half-formed inverted head-and-shoulders and a cloud target significantly higher.

At press time, SOL traded at $151.90.

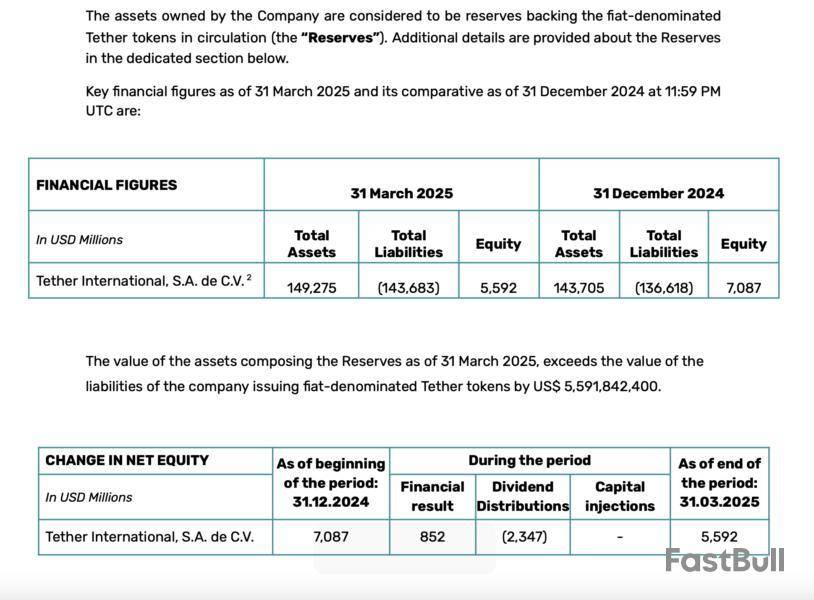

Tether, the company behind the world’s largest stablecoin by market capitalization, has released its financials for the first quarter of 2025, disclosing nearly $120 billion in exposure to US Treasurys and over $1 billion in operating profit.

According to Tether’s Q1 2025 financial report, the company’s assets include $98.5 billion in direct US Treasury bills, along with over $23 billion in additional exposure through repurchase agreements and other cash-equivalent assets.

According to the announcement, Tether holds $5.6 billion in excess of reserves for its USDt (USDT) stablecoin, down from $7.1 billion in excess from the last quarter of 2024. The stablecoin has a market capitalization of $149 billion as of May 1.

“Circulating supply of USDT grew by approximately $7 billion in Q1, with a 46 million increase in user wallets,” it said.

The company's excess capital continues to fund strategic investments, with more than $2 billion allocated in renewable energy, artificial intelligence, peer-to-peer communications, and data infrastructure.

The stablecoin market is broadly dominated by tokens pegged to the US dollar, with USDT and Circle’s USDC holding a combined 87% share. According to the US Treasury’s Q1 2025 report, the market cap for dollar-backed stablecoins is poised to reach $2 trillion by 2028.

European Union officials have recently raised concerns about the risks of overreliance on dollar-pegged stablecoins. According to the Bank of Italy, disruptions in the stablecoins market or the underlying bonds could have “repercussions for other parts of the global financial system.”

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Key takeaways:

Despite weak US manufacturing data, Federal Reserve liquidity plans and strong corporate earnings keep equities and crypto afloat.

The total crypto market capitalization rose 8.5% since March.

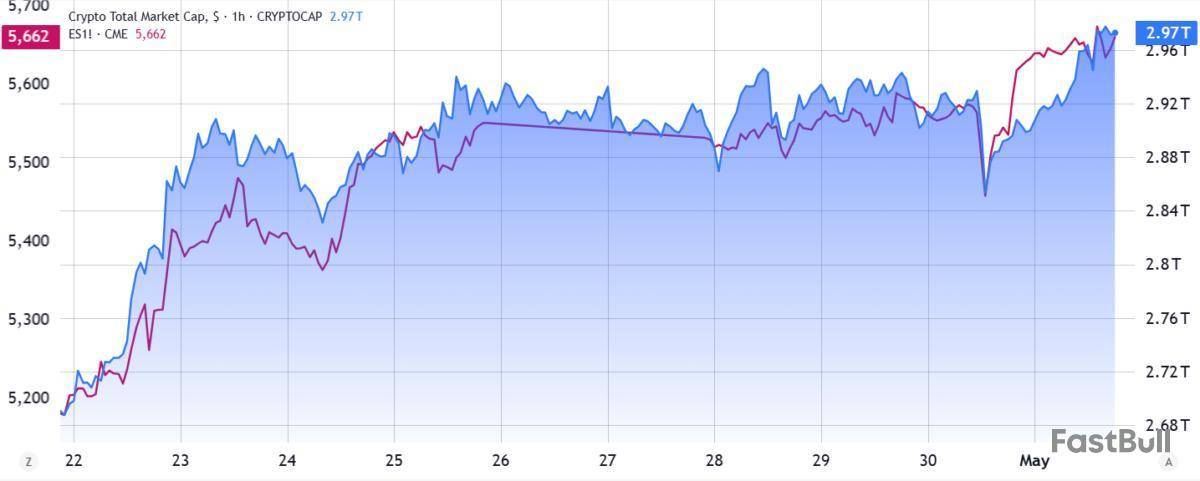

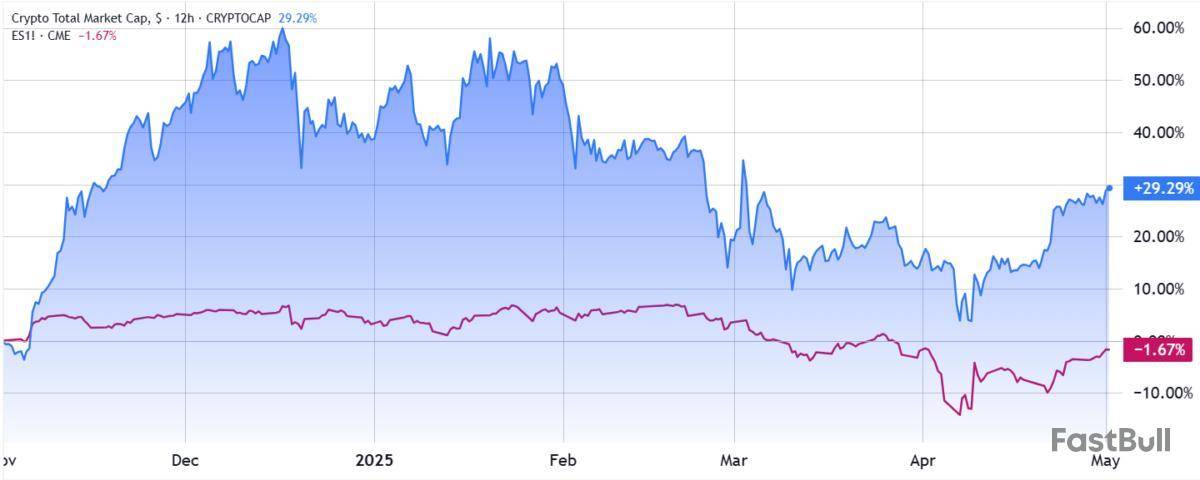

Cryptocurrency traders have frequently zoomed in on the need for crypto to show a clear “decoupling” from the stock market, and over the past 10 days, the intraday movements of Bitcoin and major altcoins have closely tracked those of the S&P 500, even as trade war developments have dominated market sentiment.

A decoupling would validate digital assets as an independent class and address growing concerns about a potential global economic recession. This ongoing correlation has led market participants to question whether the cryptocurrency market is destined to follow the stock market’s lead indefinitely, and what conditions would be necessary for a genuine decoupling to occur.

Stock market shows strength despite trade tensions

The S&P 500 reached its peak on Feb. 19 and has since struggled to reclaim the 5,800 level, a support that had held for four months. Despite persistent pressure from US trade disputes with Canada and Mexico, as well as the imposition of new tariffs affecting nearly every major economic region, equities have demonstrated notable resilience.

Chinese state media recently reported that the United States has quietly initiated trade negotiations. Although China officially maintains a 125% retaliatory tariff on US imports, it has granted waivers for sectors such as ethane, semiconductors, and certain pharmaceuticals. The United States, in turn, has partially exempted automakers from new tariffs. These actions suggest that both sides are gradually making concessions.

There is a reasonable possibility that the S&P 500 established a bottom at 4,835 on April 7, with further gains from the current 5,635 level remaining plausible. The stock market has responded positively to robust first-quarter earnings, as companies adapt to tariffs by relocating production outside China or expanding operations within the United States.

For instance, Microsoft reported a 13.2% year-over-year increase in revenue, with higher margins and strong demand for artificial intelligence. Meta also delivered earnings and revenue that exceeded market expectations on April 30. These results have alleviated concerns about a potential AI bubble or the risk that the trade war could force companies to reduce investment.

The market’s focus shifts to the Federal Reserve

Rather than concentrating on the recent decline in US PMI manufacturing data-which reached a five-month low in April, market participants are closely monitoring the Federal Reserve’s next policy moves. Following a year of balance sheet reduction, the Fed is now considering asset purchases to help ease selling pressure.

An increase in liquidity is typically favorable for risk-oriented assets. Therefore, even if a full decoupling does not occur, cryptocurrencies could still benefit from a more supportive macroeconomic environment.

Despite the short-term correlation, the cryptocurrency market has outperformed equities in recent months. Since March, the total crypto market capitalization has risen by 8.5%, while the S&P 500 has declined by 5.3%. Over a six-month period, this divergence becomes even more pronounced: the total crypto market cap is up 29%, while the S&P 500 is down 2%. It is therefore inaccurate to suggest that these markets move in perfect synchrony, particularly when viewed over longer timeframes.

It is still premature to declare a definitive bottom for the S&P 500 or to conclude that the trade war has been resolved. An economic recession would likely have negative implications for both markets. However, the current strength in equities indicates reduced risk aversion among investors. For the time being, the elevated correlation between cryptocurrencies and stocks may represent the most favorable scenario.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

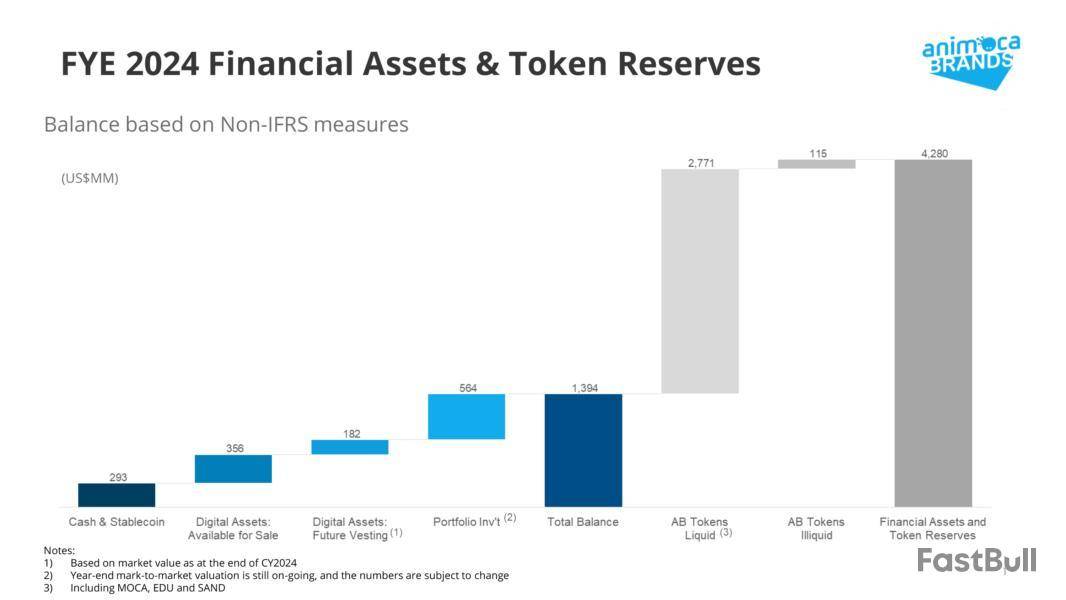

Animoca Brands is looking at trends in real-world tokenized assets, AI projects, and the gaming sector to invest in and develop, according to Omar Elissar, the company's managing director for the Middle East and the head of Global Strategic Partnerships.

In an interview with Cointelegraph's Sam Bourgi at Token2049, Elissar said that stablecoins, real-world asset tokenization, the intersection between AI and crypto, alternative use cases such as decentralized science, and Web3 gaming were all niches the company is exploring.

Gaming is "part of our DNA," the executive said before reflecting on the current state of the Web3 gaming industry:

Animoca Brands is one of the foremost crypto-native venture capital firms in the space and can serve as a barometer of hot or emerging market trends for crypto investors.

Animoca Brands inks stablecoin, blockchain deals

In February 2025, Animoca Brands, Standard Chartered Bank, and Hong Kong Telecommunications (HKT) signed a deal to develop a Hong Kong dollar stablecoin that will be overcollateralized and pegged to the Hong Kong dollar at a 1:1 ratio.

The stablecoin must first be approved by the Hong Kong Monetary Authority (HKMA) before it begins trading. Hong Kong's financial authorities are currently working on establishing comprehensive stablecoin regulations.

On March 27, Animoca Brands inked a deal with Soneium, a layer-1 blockchain network developed by Japanese tech company Sony, to develop a digital identification system that features pictures of anime characters that can be assigned to an onchain user to signify identity.

Animoca reported that it recorded 12% year-over-year growth during the 2024 fiscal year in "bookings" — a figure that accounts for the sum of all revenue plus revenue that has been booked but not yet received by the company.

Despite reports in February suggesting that 2 million pro-crypto voters could decide the outcome of this week’s Australian Federal Election, crypto has barely rated a mention during the campaign.

“I think it’s a missed opportunity,” Independent Reserve founder Adrian Przelozny told Cointelegraph. “Neither side has made crypto a headline issue because they’re wary of polarizing voters or sounding too niche.”

But the good news is that after more than a decade of inaction, both the ruling Australian Labor Party (ALP) and the opposition Liberal Party are promising to enact crypto regulations developed in consultation with the industry.

In April, Shadow Treasurer Angus Taylor promised to release draft crypto regulations within the first 100 days after taking office, while the Treasury itself has draft bills on “regulating digital asset platforms” and “payments system modernization” scheduled for release this quarter.

Amy-Rose Goodey, CEO of the Digital Economy Council of Australia, said that both parties “are equally invested in getting this draft legislation across the line.”

Pro-crypto voters have choices in the Senate, too, with the Libertarian Party issuing a 23-page Bitcoin policy in March — calling for the creation of a national Bitcoin (BTC) Reserve and the acceptance of Bitcoin as legal tender.

The minor party is fielding five Senate candidates in different states, including former Liberal MP Craig Kelly, but doesn’t currently have anyone in the Senate.

The progressive left-wing Greens party has not outlined a position on crypto, while the conservative right-wing One Nation party has campaigned against debanking and CBDCs.

More than a decade of inaction on crypto

Australia’s first parliamentary inquiry into digital assets was held back in 2014, but there’s been more than a decade of regulatory inaction since. The industry says this has led to stagnation and a brain drain of talent to jurisdictions like Singapore and the UAE.

The former Liberal Government was considering the landmark Digital Services Act, based on the 2021 Senate Committee’s crypto recommendations, when it lost office in 2022. Despite ongoing consultations since, the ALP government, led by Prime Minister Anthony Albanese, hasn’t put forward any legislation to parliament.

But there has definitely been a vibe shift from the ALP recently, with Treasurer Jim Chalmers telling Cointelegraph that digital assets “represent big opportunities for our economy.”

His office said exposure draft legislation would be released “in 2025” for consultation, introduced into Parliament “once that feedback has been considered” with the subsequent reforms “phased in over time to minimize disruptions to existing businesses.”

The shadow assistant treasurer, Luke Howarth, said the ALP has been slow to act because it didn’t have a blockchain policy when it was elected.

“It wasn’t until the FTX collapse that they acknowledged the need for regulation,” he told Cointelegraph. “The Albanese government initially promised it would put in place regulation by 2023 but have failed to draft legislation or give a clear time-frame for action. After three years, all that was offered to industry was a six-page placeholder document.”

He’s referring to Treasury’s March statement “on developing an innovative Australian digital asset industry.” It provides for the licensing of Digital Asset Platforms (DAPS), a framework for payment stablecoins and a review of Australia’s Enhanced Regulatory Sandbox.

While short on detail, those aims are broadly similar to the crypto regulation priorities that Howarth outlines to Cointelegraph — the big difference being that the opposition has committed to a faster time frame.

Przelozny praised the 100-day promise as “exactly the kind of urgency we need.”

If elected, the Liberal Party’s legislation is expected to take some of its cues from Senator Andrew Bragg’s private members bill in 2023 and some from the more recent work done by the Treasury.

The government steps up efforts

The Treasury has been quietly drafting legislation this year, which Goodey understands is “almost complete.”

Przelozny characterizes the ALP’s approach as “cautious and methodical, but it’s been slow,” prioritizing consumer protection and risk management.

BTC Markets CEO Caroline Bowler said the election of a pro-crypto Trump administration and the UK’s draft regulations (released this week) likely forced both sides of politics to finally get serious.

”Australia has ground to make up, and I would anticipate this also being a factor in the savvy move by both parties,” she said.

Stand With Crypto campaign and ASIC

The Stand With Crypto campaign is active in Australia but has been fairly low-key during the campaign, with a focus on debanking.

Coinbase managing director for APAC John O’Loghlen called on whoever wins the election to launch a “Crypto-Asset Taskforce (CATF) within the first 100 days.” This would include industry and consumer representatives to finally get crypto regulations over the line.

“If Australia doesn’t move now, we risk falling even further behind,” he told Cointelegraph.

The Australian Securities and Investments Commission (ASIC) is the local equivalent of the US Securities Exchange Commission (SEC). It released its own crypto regulatory proposals in December.

Joy Lam, Binance’s head of global regulatory and APAC legal, told Cointelegraph she doesn’t expect ASIC to suddenly change direction if a new government comes in, as the SEC did.

“ASIC doesn’t make the law,” she said. “I don’t expect a complete kind of 180 because ASIC, it is independent, and it does have its own mandate, but it obviously operates within the legislative framework that the government is going to be setting.”

Who should single-issue crypto voters back?

In February, a poll by YouGov and Swyftx found that 59% of crypto users would vote for a pro-crypto candidate in the federal election above all other issues. That equates to around 2 million Australians and would be enough to determine the outcome of the election one way.

But the similarities between the major parties on crypto regulation are much greater than the differences. Goodey said both sides of politics have genuinely engaged with the industry about its concerns and priorities.

“You can see in some of the language with their media releases that they both released in March, April this year, that they are in agreement on what the industry issues are,” she said.

Owing to Senator Bragg’s campaigning on crypto, the industry sees the Liberal Party as more enthusiastic about digital assets, but after three years in government, the ALP looks to have arrived at roughly the same place.

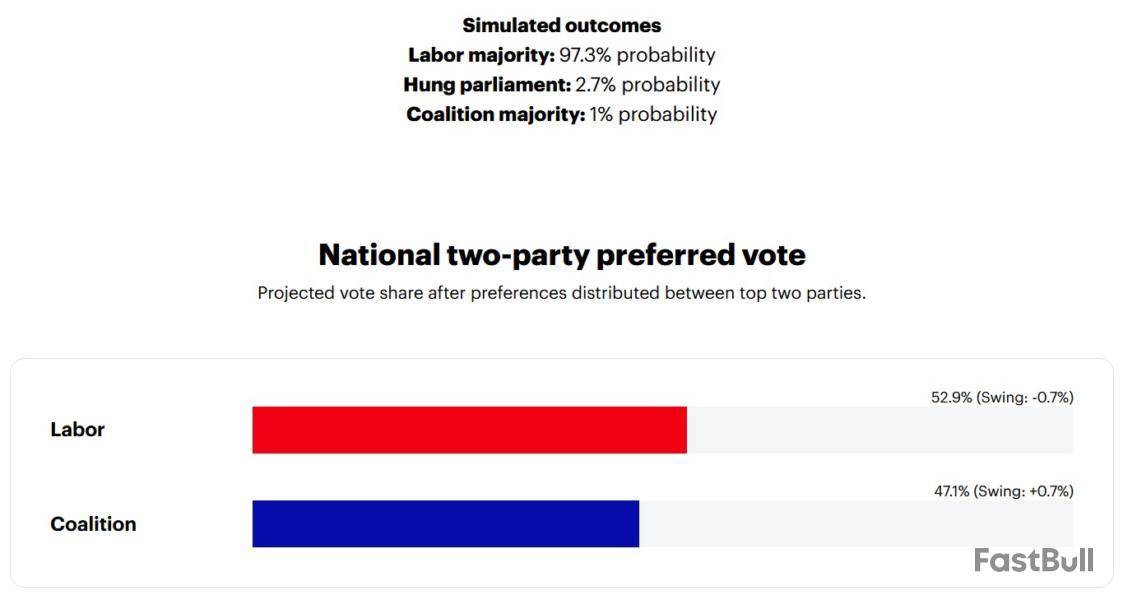

Recent YouGov and Resolve polls suggest the government is likely to be reelected.

While internal Liberal polling suggests an ALP minority government is a genuine possibility, the major parties would have enough votes between them to pass bipartisan crypto legislation.

Whatever happens, 2025 looks like the year Australia will finally provide the crypto industry with the certainty it needs.

“For industry, the timing is really quite critical now because obviously it’s something that has been discussed and kicked around for quite a few years,” Lam said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up