Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

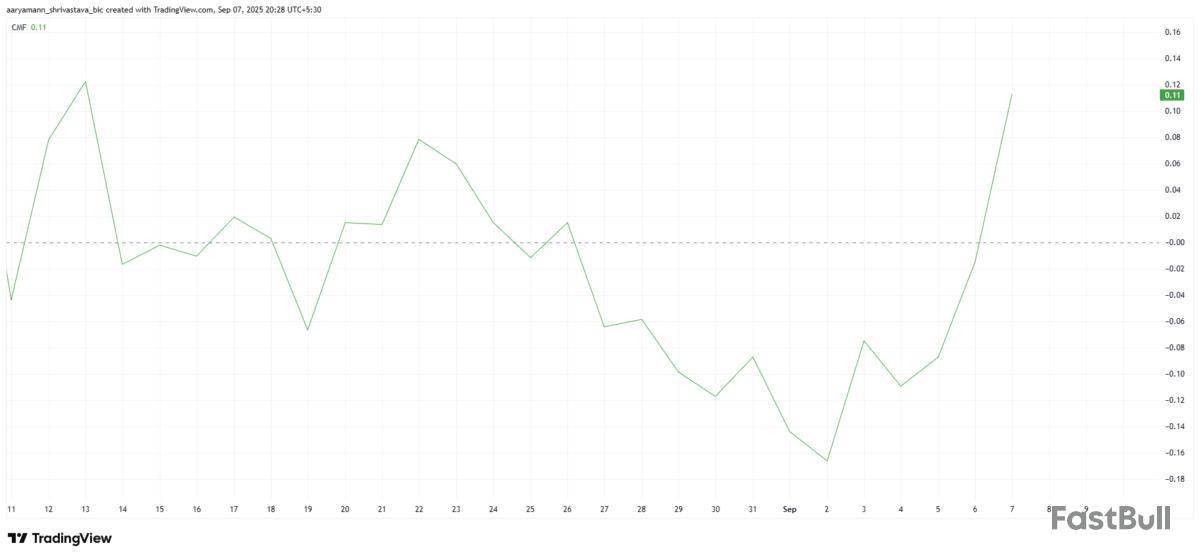

The Ripple-linked XRP token has experienced strong buy pressure, with more than $10 million worth of net buy pressure in less than 10 minutes.

Dom@traderview2Sep 07, 2025Found the spark

3M $XRP market buy in 100ms on Binance perps pic.twitter.com/SccAgGFEOj

Earlier today, a $3 million XRP market buy order was recorded on Binance perpetual futures. Notably, the mammoth buy order was executed in just 100 milliseconds.

The order, which has absorbed a significant amount of sell liquidity, managed to push the price of the token to an intraday high of $2.91.

XRP is currently changing hands at $2.86 after giving up some gains, according to CoinGecko data.

Bullish catalysts for XRP

Even though September is typically a bearish month for Bitcoin and other major cryptocurrencies, XRP could end up outperforming in October.

As reported by U.Today, the SEC is widely expected to greenlight XRP ETFs in the fourth quarter of this year. Franklin Templeton, Bitwise, and some other key issuers have joined the XRP race, but BlackRock and Fidelity have remained on the sidelines.

If XRP ETFs prove naysayers wrong and end up outperforming expectations in terms of inflows, this could create a powerful narrative for the token and potentially set the stage for a rally toward a new record high.

Pepenode has decided to change the presale model. Instead of leaving participants idle, it gives them ways to earn right away. From the very first day of the presale, you can start generating rewards.

Mining, staking, and rising presale prices all work together to create activity before the project is even live. This makes this presale very different from what most people are used to.

Mining From Day One

The first revenue stream is mining. Many people did not get to mine because it required expensive hardware, high electricity costs, and technical knowledge. PEPENODE removes those barriers by offering a mining simulator.

Inside a simple dashboard, you can set up virtual nodes and facilities that begin producing rewards immediately. You are not waiting for the token to go live; you are mining from the day you join the presale.

Users can also carry out upgrades to enhance their mining experience. Every time you upgrade a facility, 70% of the tokens spent are burned. This permanent cut in supply makes the token deflationary and helps support the value of the remaining PEPENODE tokens. Put simply, while you earn mining rewards, you also help strengthen the system for the long term.

High-Yield Staking

The second way to earn is through staking, which is already live during the presale. Current staking rewards are very high, above 3,000%. This encourages early commitment and helps balance the system. More than 220 million tokens are already staked. People show strong trust in the ecosystem’s future, and they also want to benefit from the high-reward system.

Additionally, the high-staking response can help stabilize the price following the exchange listing since it reduces the number of tokens in circulation. Staking provides rewards, builds loyalty among holders, and adds stability.

Rising Presale Price

The third way to earn comes from presale pricing. Instead of one flat price, PEPENODE uses progressive rounds. Each stage raises the price slightly higher. This model allows early buyers to gain value as soon as the next stage begins.

Even without mining or staking, tokens rise in value simply because the presale has advanced. Late buyers are also motivated, as they see the price climbing and want to join before it goes higher.

The $PEPENODE token is currently worth $0.0010366 at this stage of the presale, and it will continue to rise steadily until the end of the presale.

Why the Three Layers Together Are a Game-Changer

On their own, mining, staking, and progressive presale pricing are not new. What is new is combining all three before launch and the impact they can have on the $PEPENODE token’s long-term value.

The three streams work together: mining provides constant rewards, staking locks tokens and builds scarcity, and presale pricing ensures automatic gains. Together, they keep momentum alive throughout the presale and add strength after launch.

Investors already see how unusual this presale is. The numbers prove it, with hundreds of millions of tokens staked before trading. That level of activity shows that people are recognizing what could be coming.

This multi-revenue system makes the presale itself a way to earn, grow loyalty, and support the ecosystem. Tokens are active from day one, working for holders. This early momentum matters.

By launch time, Pepenode will already have miners, stakers, and holders deeply involved. That level of commitment could set it apart and give it a much stronger start on exchanges.

The buzz that is already surrounding the presale could also be helpful following the entire event. People could start to spread the word about the project through word of mouth, and this could eventually be reflected after the presale, allowing tokens to spike very high within a short time.

How to Join the Presale and Start Earning

To join the ecosystem, all you need is a wallet such as MetaMask or Trust Wallet. Once you connect it to the Pepenode website, you can choose how to buy tokens. Payment options include ETH, BNB, USDT, and even card payments.

After purchasing, you do not have to wait for launch day. You can immediately stake your tokens or begin mining through the simulator. From that moment, you are earning through one or all of the three revenue streams.

VISIT THE PEPENODE ECOSYSTEM

Website | Telegram | X (Twitter)

The post Crypto Presale That Lets You Earn Three Ways: PEPENODE’s Multi-Revenue System appeared first on 99Bitcoins.

The spotlight in crypto right now is on exchange-traded funds. A lot of money is flowing into Ethereum and Bitcoin ETFs. Major financial players like BlackRock, Fidelity, and Grayscale are putting serious weight behind these coins. It’s no longer just about trading but about Wall Street recognizing crypto as a regulated investment class.

XRP is also riding the ETF wave. The potential approval of an XRP spot ETF has captured attention, with the SEC expected to deliver a final decision by October 24, 2025. If approved, it could mark another pivotal step in crypto’s integration into mainstream finance.

While all eyes are on these ETFs, something quieter yet powerful is unfolding. SpacePay is steadily building a project that addresses real problems in the crypto space. Its presale has passed $1 million, showing strong investor interest. Despite the ETF hype, new projects like SpacePay are gaining ground. Innovation and practical solutions are still attracting solid support.

Why SpacePay Deserves Attention Despite the ETF Hype

SpacePay deserves all the attention it can get because, while ETFs focus on tracking the specific performance of cryptocurrencies, SpacePay provides solutions to obvious issues in the crypto community.

SpacePay is building a bridge between crypto and everyday transactions. With its practical approach, the project could become one of the first payment solutions to make using crypto as effortless as swiping a card.

The platform fixes problems that have slowed crypto payments for years. These include price swings, high fees, and slow settlements. Even platforms that claim decentralization sometimes run on centralized systems with little transparency. Scalability remains another constant challenge, especially during periods of high demand.

SpacePay’s model addresses these pain points directly. When crypto payments are made, the platform allows users to get paid in fiat currency automatically. This removes the chances of the token value dipping during and after the transaction.

Also, users pay no fees, while merchants are charged just 0.5% per transaction, far below industry norms. Integration doesn’t require expensive new infrastructure; a simple APK allows existing POS terminals to process payments.

Convenience and scale are built into the technology. SpacePay supports spending from over 325 wallets, making crypto use as simple as traditional payment methods. Businesses don’t need to overhaul systems, and the setup works seamlessly with existing processes.

The platform also acts as a crypto-fiat bridge, letting crypto holders spend freely while giving retailers stability. For users and SPY holders, the benefits extend beyond payments.

There is a monthly loyalty airdrop that will reward active use of the platform. Token holders will also be able to vote on major decisions, giving the community real influence over the project’s future.

SPY holders will have access to new features before the general public, and they will also be paid a share of the platform’s revenue. SpacePay is not chasing hype but aiming to fit naturally into how people shop and pay.

SpacePay’s Achievements Standing Out Amid ETF Attention

SpacePay has built real achievements. It raised $750,000 from private investors, which is a show of confidence in its vision. Early support laid the foundation for growth and proves SpacePay focuses on practical solutions, not hype.

The project also completed a reinvestment buy-back. It is committed to long-term development and value preservation. A functional Minimum Viable Product has already been developed. Having something tangible in action can help it build trust and credibility early, especially at a time when big ETF inflows are grabbing all the attention.

SpacePay secured its intellectual property and follows global financial rules. It won “New Payment Platform of the Year” in 2022/23 from the CorporateLiveWire Global Awards.

Together, these milestones show that SpacePay is steadily gaining momentum. The over $1 million is a testament to the platform’s strong foundation and its readiness to make real-world crypto payments easier and more reliable.

How to Buy SpacePay During the Presale

1. Connect Your Wallet

Start by linking a supported wallet like MetaMask directly through the official SpacePay website.

2. Fund Your Wallet

Make sure it has one of the accepted tokens — ETH, BNB, MATIC, AVAX, BASE, USDC, or USDT. If you prefer, you can also use a bank card.

3. Choose the Number of SPY Tokens

Enter the amount of SPY tokens you’d like to buy in the presale.

4. Approve and Confirm the Swap

Approve the transaction in your wallet and confirm it on the site.

5. Leave Extra for Network Fees

Always keep a little extra balance to cover blockchain gas fees so the transaction goes through smoothly.

6. Receive Your Tokens

Once confirmed, your SPY tokens will be credited to your wallet, securing your spot in the ongoing presale.

JOIN THE SPACEPAY (SPY) PRESALE NOW

Website | (X) Twitter | Telegram

The post Everyone’s Focused on ETF Inflows, Yet SpacePay’s Presale Quietly Crosses the $1 Million Mark appeared first on 99Bitcoins.

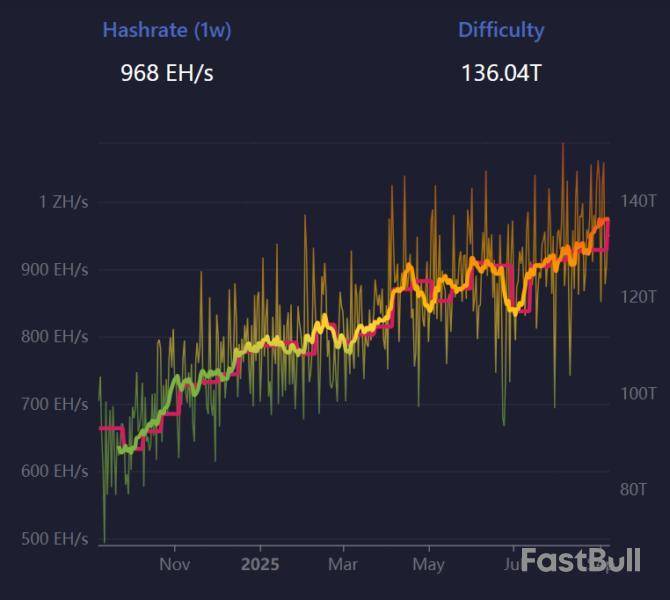

Bitcoin’s network difficulty has surged to a record high above 136 trillion, creating tougher conditions for miners already dealing with shrinking revenues.

The adjustment, logged at block height 913,248, marked a 4% rise from 129.6 trillion and extended a run of five consecutive increases since June, according to figures from Mempool.

Bitcoin Miners Face Tight Margins With Record Difficulty And Weakening Income

This mechanism is central to Bitcoin’s design. Difficulty levels are recalibrated every 2,016 blocks—roughly once every two weeks—to keep block production close to the ten-minute target.

A rise signals that more computing power has joined the network, while a drop reflects miner exits. In both cases, the adjustment ensures stability in the pace of new block creation.

Meanwhile, the rising threshold comes at a challenging time for Bitcoin miners.

Data from Hashrate Index shows that hashprice—the benchmark for miner revenue per unit of computing power—has slipped to around $51.

That level is the weakest since June, underscoring how revenue pressure is building even as competition intensifies.

According to Hashrate Index, August’s numbers highlighted this squeeze. During the month, Bitcoin’s hashprice average across the period settled at $56.44, about 5% lower than July.

At the same time, the firm noted that BTC’s transaction fees offered little to no support during the period.

Hashrate Index pointed out that BTC miners collected just 0.025 BTC per block on average—a 19.6% slide from July and the weakest performance since late 2011. In dollar terms, that translated to $2,904 in average daily fee income, down nearly 20% month-on-month and the lowest since early 2013.

Considering the above, Bitcoin miners are in a bind as the combination of record difficulty levels and weaker revenue streams leaves their operations on tight margins.

This means miners may face mounting pressure to maintain profitability through the remainder of the year unless Bitcoin’s price climbs meaningfully or on-chain activity generates higher fees.

Shiba Inu has seen a 0% surge in one of its closely watched ecosystem metrics, sparking questions in the crypto community.

According to Shibburn, Shiba Inu has seen a surprising 0% surge in its daily burn rate as only 69,613 tokens were burned in the past day. Contributing to this figure is a single transaction of 69,420 SHIB tokens burned.

Shibburn@shibburnSep 07, 2025HOURLY SHIB UPDATE$SHIB Price: $0.00001231 (1hr 0.31% ▲ | 24hr -0.85% ▼ )

Market Cap: $7,254,604,904 (-0.86% ▼)

Total Supply: 589,247,711,761,922

TOKENS BURNT

Past 24Hrs: 69,613 (0.00% ▼)

Past 7 Days: 20,241,091 (81.32% ▲)

The 69,613 SHIB tokens burned in the last 24 hours bear same with the figure tallied the day before. On Sept. 6, only 69,808 SHIB tokens were burned, hence the 0% surge.

However, in the last seven days, 20,241,091 SHIB tokens were burned, representing an 81.32% surge in weekly burn rate.

Out of an initial total supply of 1 quadrillion SHIB tokens, over 41% have been burned, leaving Shiba Inu's total supply at 589,247,711,692,117 SHIB.

SHIB price action

At the time of writing, SHIB was up 1.12% in the last 24 hours to $0.0000124 as price continues to consolidate near $0.000012. In the last 24 hours, 9.17 trillion SHIB or $113.74 million in SHIB has been traded, marking a 21.92% drop in trading volume as traders await the next move on the market.

Shiba Inu recently completed a death cross on its daily chart, a flip following a golden cross that emerged on its chart in late August. With the current signals being mixed for Shiba Inu, traders will turn to the broader market to adjudge the sentiment and thus predict Shiba Inu's next major move.

September remains a mixed month in terms of price performance for Shiba Inu, marking two out of four Septembers in green since 2021. Last September, Shiba Inu had a positive close with a gain of 26.97%, and the market is now eager to see if SHIB will sustain this trend.

Shiba Inu is currently up 1.80% so far this September.

Worldcoin price surged 16% in the past 24 hours, following the launch of its anonymized multi-party computation (APMC) initiative. The project includes contributions from Nethermind, the University of Erlangen-Nuremberg (FAU), and UC Berkeley’s Center for Responsible Decentralized Intelligence (RDI).

It also brings in the Korea Advanced Institute of Science and Technology (KAIST) and the University of Engineering and Technology in Peru (UTEC). The APMC launch is designed to strengthen Worldcoin’s quantum-secure technology, adding momentum to the cryptocurrency’s growth.

Worldcoin Holders Remain Bullish

Long-term holders (LTHs) are showing renewed conviction, with data from the MCA highlighting a clear preference for accumulation over selling. This behavior reflects increasing confidence in WLD’s future, particularly as major institutions endorse its security-focused developments.

The steady incline in the MCA suggests that committed holders are not only preserving but also expanding their stakes. Such behavior strengthens the foundation for WLD’s current recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain activity also supports Worldcoin’s broader momentum. The Chaikin Money Flow (CMF) indicator has recorded a sharp uptick in recent sessions, pointing to strong inflows into the cryptocurrency. A positive CMF signals sustained demand that could extend the rally.

The timing coincides directly with the APMC announcement, which appears to have catalyzed buying interest. By pushing the CMF well above the zero line, the development confirms a bullish stance for WLD in the near term.

WLD Price Can Continue Rising

WLD climbed by nearly 16% over the last 24 hours, emerging as one of the best-performing altcoins. The altcoin is changing hands at $1.06, with $1.08 acting as a key barrier that may shape its immediate price direction.

The factors mentioned above suggest that WLD could note a successful breakout above $1.08, pushing it toward $1.11, marking a monthly high. This would likely boost investor sentiment and potentially draw further capital into the asset.

On the other hand, profit-taking could reverse the recent rally. If selling pressure builds, WLD may retreat to $1.03 or lower to $0.96, wiping its recent gains and invalidating the bullish thesis.

With the crypto market showing signs of a potential rebound, Bitcoin and other top altcoins have moved to the green zone. Amid this positive price trajectory, Bitcoin whales appear to have relented from market sell-offs as data provided by on-chain monitoring firm Whale Alert shows major BTC buy activity.

The source revealed it has spotted a huge Bitcoin transaction, which involved 500 BTC being emptied from the world's largest cryptocurrency exchange Binance in a matter of minutes.

While the transaction happened during the mid hours of Sept. 7 when Bitcoin was trading at $111,132, the large BTC scooped out of Binance during the time was worth about $55,566,215.

Although the intention behind the major Bitcoin transaction was not specified, market watchers have perceived the move to be a Bitcoin buy activity from a high profile investor or an institution due to the nature of the transfer.

Bitcoin rebound restores market confidence

With the major BTC accumulation coming at a time when the leading cryptocurrency is moving upward, showing signs of a potential price resurgence, the move comes as no surprise.

While Bitcoin had experienced mixed price action during the week, surging to about $113K and falling as low as $107,000, it appears to be closing the week on a positive note.

After falling below the $110,000 mark in the previous day amid a broad market bloodbath, it appears to be regaining momentum as it returns slowly to the upside, trading at $111,374 as of press time, according to data from CoinMarketCap.CoinMarketCap">

Though slow, Bitcoin's price appears to be gradually headed for a major breakout. Hence, the whale's decision to buy and move such a large amount of BTC from a top exchange hints at a bullish shift in investor sentiment in preparation for a major price move.

Over the last day, Bitcoin has been moving slowly in its trading price, but on a positive path as it shows a decent price surge of 0.27%. However, the asset’s trading volume during the period has slumped massively by about 18.45%, suggesting that the demand for the asset is still outweighed by speculative trading from exiting investors.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up