Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

United Kingdom-based crypto trade association CryptoUK welcomed reports that the Bank of England (BoE) plans to launch a consultation on stablecoin regulation in November, saying alignment with United States policy would strengthen confidence in the country’s digital asset industry.

In comments sent to Cointelegraph, a CryptoUK spokesperson said that matching the US’s approach to stablecoin oversight would “provide more confidence to the industry” and ensure that the UK “keeps pace” with its global peers.

“Ultimately, it is important that the UK keeps pace with the US and other jurisdictions – the crypto industry is truly global and that means the competitive landscape shifts quickly for our members,” the spokesperson said.

The group added that the crypto sector is already benefitting from “regulatory tailwinds coming from the US,” a nod to the US’s more assertive push under the GENIUS Act to integrate stablecoins into mainstream finance.

UK central bank targets end of 2026 for stablecoin regime

On Friday, Bloomberg reported that the Bank of England (BoE) aims to have new stablecoin regulations in place by the end of 2026.

According to the report, the central bank plans to open a consultation on Nov. 10 to propose a framework closely modeled on US rules.

Citing anonymous sources, Bloomberg said the BoE wants to make sure that the UK’s regulatory framework keeps pace with the US, where policymakers are advancing stablecoin legislation.

This means the upcoming rules may require issuers to hold government bonds or bills with maturities, mirroring US standards.

The move follows pressure from the UK Treasury, which has reportedly urged the central bank to act swiftly amid fears that the country risks losing ground to other jurisdictions.

BoE Governor Andrew Bailey has recently acknowledged the potential role of stablecoins in modern payments.

On Oct. 1, Bailey wrote in a Financial Times op-ed that stablecoins could reduce the UK's reliance on commercial banks, signaling a shift in the bank’s stance toward digital assets.

A friendlier turn for crypto finance

The push for a stablecoin framework follows a broader shift to a more crypto-friendly environment in the UK’s financial sector.

On Oct. 9, the Financial Conduct Authority (FCA) lifted its four-year ban on crypto exchange-traded notes (ETNs), allowing investors to gain exposure to digital assets through regulated venues like the London Stock Exchange.

The move was followed by asset manager BlackRock launching its Bitcoin exchange-traded product (ETP) in the UK.

In addition, the FCA also authorized asset managers to use blockchain for fund tokenization. This aligns with the government’s vision of turning the UK into a hub for tokenized finance.

These developments suggest that the UK is inching closer to an innovation-friendly and regulated model, which aims to compete with other jurisdictions in attracting crypto capital.

New York, New York, October 21st, 2025, Chainwire

Simplifying access to the $50B yield vault market, the user-owned neobank connects 80+ DeFi protocols through one interface to make earning onchain effortless.

Superform, the first user-owned neobank, has upgraded its Web App to give users a faster, more efficient way to earn onchain. Since its launch in 2024, Superform has helped 80,000 users automate high-yield strategies across leading DeFi protocols, giving them a one-click, set-and-forget way to grow their assets.

DeFi has created powerful ways to earn, but managing yield across chains can be tedious. Most users spend hours tracking multiple wallets, chasing the best rates, and rebalancing positions by hand. The result is time lost on what should be passive income.

Superform’s new Web App changes that. It brings yield discovery, deposits, and performance tracking into an interface that connects to more than 65 trusted protocols. Users can sign in with Coinbase, social accounts, or passkeys, fund positions in a single click, and pay gas in stablecoins. Everything happens in one place, so users can focus on earning instead of managing.

The upgraded app features a redesigned Earn page that displays both base and reward APYs, historical vault performance, and a unified cross-chain portfolio view. This is also the first application that allows any action across chains to be bundled into a single signature. It supports smart accounts that automate multi-chain activity behind the scenes, reducing the need for manual rebalancing or gas management.

Superform combines the simplicity of fintech with the performance of decentralized finance. Its SuperVaults automate and optimize yield across trusted DeFi protocols. The flagship vault, SuperUSDC, delivers secure and effortless returns on Circle’s USDC stablecoin. In the coming months, Superform will introduce SuperVaults v2, Superform Mobile, and the $UP token to expand access, safety, and ownership across its ecosystem.

Together, these upgrades strengthen Superform’s mission to make onchain asset management accessible to everyone. As the $50 billion yield vault market becomes the gateway to DeFi, Superform is building the tools to help anyone participate effortlessly.

Start earning more on the app at v2.superform.xyz.

About Superform

Superform is a user-owned neobank, enabling anyone to save, swap, send, and earn the best returns in a single tap while keeping full control of their assets. Trusted by more than 150,000 users, Superform aggregates $50B+ across 80+ protocols so you can earn the most, easily and instantly. With SuperVaults, the best strategies are bundled into a single tap, delivering optimized yields with ease. Currently, users are earning an average APY over 9%. Superform has raised $10M in funding from leading investors including VanEck Ventures, Circle Ventures, Polychain Capital, BlockTower Capital, Maven11 Capital, CMT Digital, and Arthur Hayes. For more information, users can visit https://www.superform.xyz/.

Contact

Kayla Gill

kayla@serotonin.co

Ethereum price has spent most of October struggling to build strength above $4,000. Despite holding its broader uptrend, ETH trades around $3,935 at press time, down 6.6% this week, showing hesitation as Bitcoin recovers.

The signals on-chain and on the chart tell a clear story: Ethereum’s rally is still waiting for confirmation. Here are three reasons why ETH hasn’t broken $4,000 in the near term with conviction — and why the real test lies slightly higher.

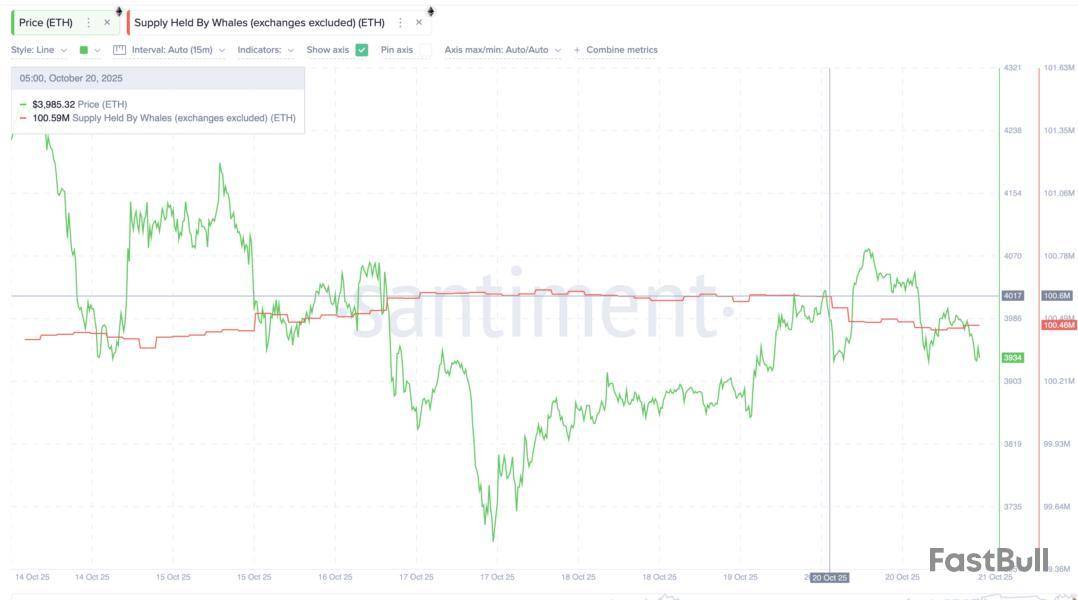

Whales Are Selling, And Accumulation Has Slowed Down

The first sign of pressure comes from Ethereum’s largest holders. Since October 20, whale addresses have reduced their combined holdings from 100.60 million ETH to 100.46 million ETH — a drop of about 140,000 ETH, or roughly $550 million at current prices. This steady selling adds quiet resistance to any short-term rally attempt and keeps the market cautious.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

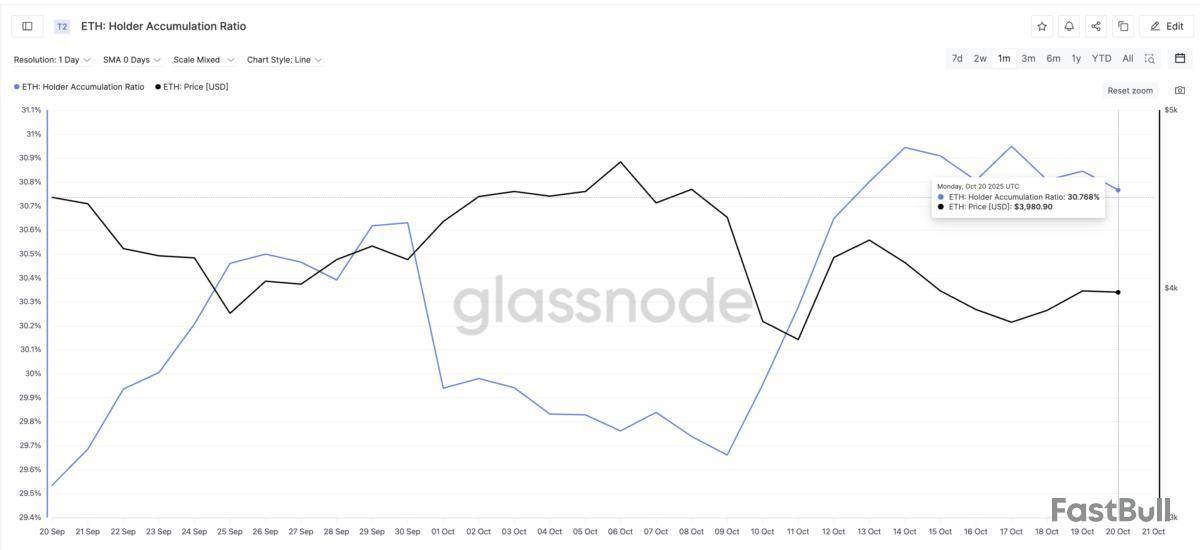

At the same time, Ethereum’s Holder Accumulation Ratio (HAR) — which tracks the share of active holders adding to their positions versus trimming them — has stalled near 30.77%. It had been rising earlier in October but has flattened since mid-month, showing that new accumulation is slowing. In simple terms, existing holders are not buying aggressively, and fresh money isn’t stepping in yet.

When the HAR trends sideways after a steady climb, it often signals that traders are waiting for a clear breakout before committing again. This cautious stance from both whales and active holders explains Ethereum’s recent hesitation near $4,000.

Heavy Resistance Band Above $3,955 Keeps Price In Check

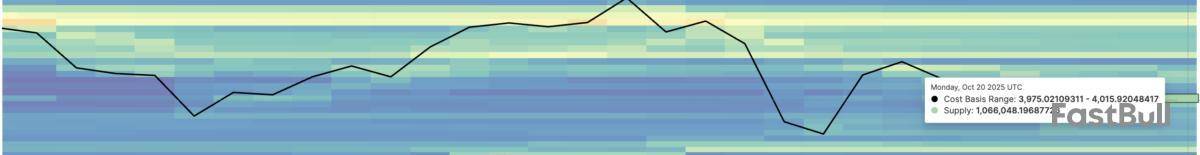

The second reason lies in Ethereum’s Cost Basis Distribution (CBD) map — a tool that shows where most ETH supply last changed hands. This helps identify “supply walls,” or price zones where many holders might sell to recover earlier losses.

Right now, a dense resistance band exists between $3,955 and $4,015, with about 1.06 million ETH purchased in this range. This makes the area just above the current ETH price difficult to break, as every move toward $4,000 brings more selling pressure.

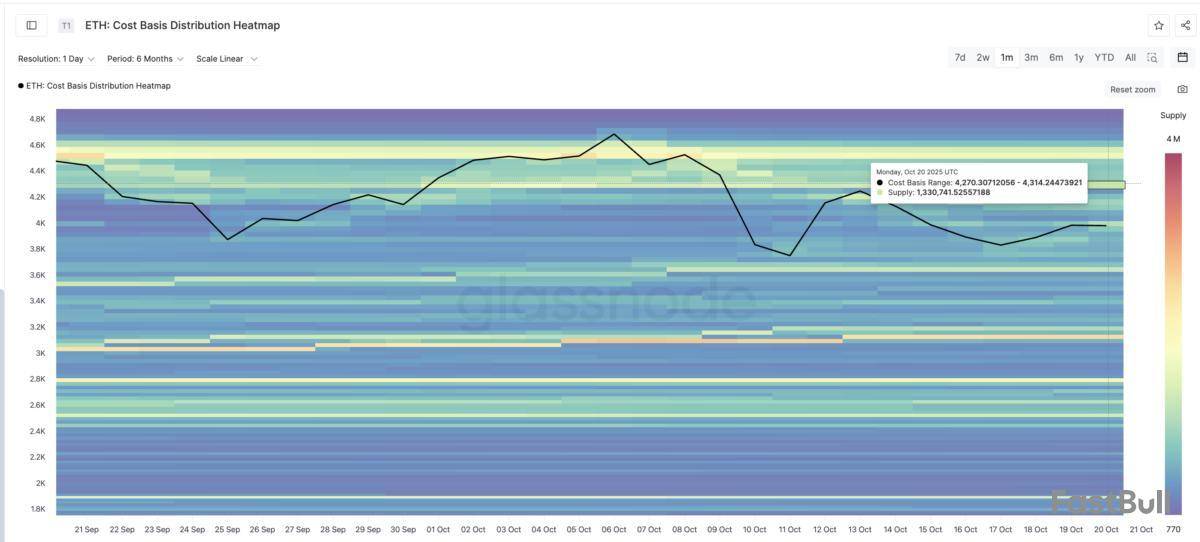

But this isn’t the only challenge. Another large cluster sits between $4,270 and $4,314, where nearly 1.33 million ETH were bought. This second zone aligns closely with the technical resistance at $4,340 (which we will discuss later), meaning Ethereum could face its true breakout test there.

Until ETH clears these layers, traders are likely to keep taking profits near $4,000, preventing any sustained move higher.

Ethereum Price Setup Is Still Bullish, But Needs A Close Above $4,340

Despite these hurdles, Ethereum’s structure remains constructive. The price continues to respect an ascending trendline that has held since early August, keeping the broader uptrend intact.

The daily chart shows ETH reacting to Fibonacci retracement levels drawn from its previous rally. The 0.618 Fibonacci level sits around $4,200, while the 0.786 level is near $4,340 — both overlapping with the key resistance zones seen on-chain (per the CBD heatmap). A daily candle close above $4,340 would confirm a breakout and could open the path to $4,520 and even $4,960, retesting the all-time high range.

However, the first hurdle to cross is $4,000, aligning with the 0.382 Fib level. It is also the zone ETH price has been trying to cross convincingly since October 16.

Momentum indicators also support this view. The Relative Strength Index (RSI) — which measures the balance between buying and selling pressure — shows a hidden bullish divergence. That means while price has made higher lows since August 2, RSI has made lower lows, often signaling an ongoing uptrend beneath short-term weakness.

The last time this divergence appeared, between August 2 and September 25, Ethereum rallied nearly 24%, moving close to $4,880. A similar move from current levels could send ETH toward the $4,960 zone. But that could only happen after a confirmed breakout above $4,340.

If ETH fails to hold $3,880, however, short-term sentiment could turn negative. That would expose support at $3,680 — the base of its long-term trendline.

After two years of development, Ark Labs, backed by investors including Draper Associates, Axiom, and Fulgur Ventures, has launched Arkade in public beta — introducing what it describes as Bitcoin's most advanced native Layer 2 since the Lightning Network's debut nearly a decade ago.

Built on the Ark Protocol specification, originally proposed in 2023, Arkade's launch delivers the first mainnet implementation of that vision. It virtualizes Bitcoin's transaction layer through Virtual Transaction Outputs (VTXOs) — offchain representations of Bitcoin's native Unspent Transaction Outputs (UTXOs). Importantly, Arkade achieves this without requiring a change to Bitcoin's consensus rules, operating entirely within its existing security framework.

In Bitcoin, coins aren't stored in accounts but as UTXOs — individual amounts of bitcoin created by previous transactions. Each UTXO is fully spent when used, with any remaining value returned as new outputs, forming the basis of how ownership is recorded and moves across the network.

By virtualizing these outputs offchain, Arkade allows users to move, lend, or trade assets instantly while leveraging Bitcoin's security model and the ability to unilaterally exit onchain. Each VTXO represents a user's offchain claim derived from an onchain UTXO, coordinated through Ark Service Providers (ASPs). Analogous to Lightning Service Providers — which help users route payments on the Lightning Network — ASPs coordinate the creation and settlement of thousands of offchain transactions by batching them into periodic single Bitcoin transactions onchain, dramatically reducing costs. Crucially, ASPs never take custody of user funds — every VTXO is backed by a presigned Bitcoin transaction — ensuring users retain custody and can unilaterally reclaim their assets onchain at any time, even if an ASP goes offline or acts maliciously.

While Bitcoin has seen a wave of projects branded as "Layer 2s" in recent years, most operate as sidechains or bridge systems that custody bitcoin through multisig arrangements or issue wrapped versions of BTC on external blockchains, often EVM-compatible networks with their own tokens and governance, and others remain in research and development. Like the Lightning Network, Arkade differs by remaining native to Bitcoin's security model, extending its capabilities beyond payments to broader financial applications without introducing new trust assumptions or custodial and bridge risks.

"The Bitcoin L2 landscape has been full of promises but light on shipping," Ark Labs CEO Marco Argentieri said in a statement shared with The Block. "Today's release marks the beginning of Bitcoin's evolution as programmable money."

Ark Labs argues that while Bitcoin's $2 trillion market cap underscores its role as digital gold, base-layer limits have kept its financial potential largely untapped, leaving room for other blockchains like Ethereum to dominate application development.

"Arkade unlocks Bitcoin's full potential without compromising what makes it valuable," Argentieri added. "By virtualizing Bitcoin's transaction layer, we're enabling developers to build directly on Bitcoin, not around it."

Not simply a Lightning Network alternative

Originally introduced as an alternative to the Lightning Network, Ark's architecture has evolved into something broader than a payment system. While both aim to scale Bitcoin through offchain transactions secured by the main chain, Arkade's virtualization model supports more complex financial operations such as lending, trading, and asset issuance.

Rather than replacing Lightning, Arkade complements it — the two are interoperable through integrations like Boltz, allowing liquidity to move seamlessly between Lightning channels and Arkade's offchain environment, broadening the potential use cases. Other launch partners include Breez, BlueWallet, BTCPayServer, and exchanges such as BullBitcoin.

"We realized we weren't just building another payment rail," Ark Labs Ecosystem Lead Alex Bergeron explained. "Arkade supports lending protocols, trading platforms, and smart wallets directly on Bitcoin. These are applications that were previously impossible without wrapped tokens or custodial compromises."

The public beta marks the start of a broader rollout for Arkade, with Ark Labs planning to add enhanced scripting tools, additional security features, and support for more advanced financial applications in the months ahead.

"We're not just launching a product. We're establishing infrastructure for the next decade of Bitcoin development," Bergeron said. "Every major financial application needs a programmable foundation. That's what we're building."

Bringing stablecoins back to Bitcoin with Arkade Assets

Alongside the mainnet launch, Ark Labs also introduced Arkade Assets on Tuesday, a new framework extending Arkade's virtualization model to support multiple asset types — including stablecoins and other tokens.

Stablecoins now form core infrastructure for digital finance, with more than $200 billion in circulation, but most activity has shifted to other blockchains because of Bitcoin's limited programmability, the firm argued. Similar in purpose to Lightning Labs' Taproot Assets protocol, Arkade Assets aims to re-establish Bitcoin as a primary home for stablecoin infrastructure, with Tether USDT support in the pipeline.

"Tether pioneered stablecoins on Bitcoin over a decade ago, but the ecosystem lacked the infrastructure to support the sophisticated applications users demand," Argentieri said. "Arkade finally provides that foundation. We're building the rails to bring stablecoins back to the world's most secure blockchain, where they belong."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The checkout counter tells you everything about where payments are headed in 2025. Digital wallets have replaced cash. Contactless cards dominate transactions. Yet cryptocurrency – despite millions of holders worldwide – remains stuck on the sidelines.

SpacePay thinks it figured out why and built something to fix it. The London fintech lets businesses accept crypto payments through the card readers they already own. No new equipment. No complicated setup. Just regular merchants are suddenly able to serve the 400 million people holding digital currencies that they can barely spend anywhere useful.

The platform works with over 325 different wallets, converts everything to regular money instantly, and charges just 0.5% in fees. Early supporters have already put over $1.3 million into the project during its presale phase, and the $SPY tokens are currently available at $0.003181.

Why Crypto Payments Keep Failing

Most crypto payment solutions ask businesses to tear out their current systems and start over. That means buying expensive new terminals, training confused staff, and explaining to your accountant why revenue keeps bouncing around based on Bitcoin’s mood swings.

Small business owners look at that mess and decide that credit cards work fine. The technology exists to process crypto payments, but the practical reality makes it unusable for regular shops.

There are also the customers to consider.

Crypto holders want to actually spend their digital money somewhere besides online marketplaces. Walking into a local store and hearing “we don’t take that here” gets old fast.

SpacePay Makes Crypto Payments Actually Work

The clever part about SpacePay’s approach is recognizing what businesses already have. Millions of shops use Android-based payment terminals sitting on their counters right now. SpacePay works through a software update to those existing systems.

A coffee roaster, bookstore, or auto repair shop can start accepting crypto payments this afternoon. Download the app, connect it to the current terminal, done. Staff keeps using the familiar interface they know, just with expanded options for customers.

When someone pays with Ethereum or Bitcoin, the business gets dollars immediately. The crypto gets converted to regular currency before price swings can cause problems. Restaurant owners set menu prices in dollars and receive exactly that amount regardless of what happens in crypto markets five minutes later.

Supporting 325+ wallets was smart thinking. Most payment systems pick a few popular options and ignore everyone else. SpacePay works with practically anything customers already have installed. MetaMask users, Trust Wallet fans, people using that random app they downloaded months ago – everyone can pay.

Visit SpacePay Presale

Best New Crypto to Buy: Real Utility Changes Everything

The $SPY token does actual work instead of just hoping prices go up. Token holders vote on platform decisions about which features get built next. They receive monthly rewards for participating in the community. Revenue sharing means holders get paid when SpacePay processes more transactions.

That last part matters more than people realize. Most crypto projects depend entirely on speculation and hype cycles. The platform collects fees from every payment it processes. Token holders pocket a share of these earnings, so they make more as the platform gets busier.

The team structured the tokenomics sensibly. Out of 34 billion total tokens, founders only kept 5% for themselves. Compare that to typical crypto projects where teams grab huge chunks. Public sale participants get 20%, with the rest funding development, partnerships, user rewards, and marketing efforts.

Quarterly video calls let token holders ask tough questions directly to leadership. Most crypto projects take your money and vanish. These folks stick around to explain their progress and plans.

Transaction Fees That Actually Help Businesses

Credit card companies typically charge merchants between 2% and 4% per transaction. A busy retail shop processing $25,000 monthly could be losing $750 just to payment processors. SpacePay charges 0.5%.

Run those numbers and the savings add up fast. The math is simple: $125 versus $750. That extra $625 sitting in your account each month means lights stay on, shelves stay stocked, or you can afford someone for Saturday shifts.

Traditional processors also make merchants wait days for money to clear. SpacePay settles everything immediately. Businesses get their cash right away instead of checking their bank account wondering if yesterday’s sales will show up before rent is due.

Lower fees combined with instant settlements create real financial advantages for merchants. Word spreads quickly when business owners find ways to keep more of their own money.

Getting Started With SpacePay’s Presale

People interested in the $SPY token can visit SpacePay’s official website to participate in the presale. The current price sits at $0.003181 per token, though that increases with each new stage.

Connect a compatible wallet like MetaMask or WalletConnect to the presale platform. The system accepts various cryptocurrencies, including ETH, BNB, USDT, and USDC. People new to crypto can use regular bank cards, too. Enter your investment amount, review the token allocation, and confirm the transaction through your wallet.

JOIN THE SPACEPAY ($SPY) PRESALE NOW

Website | (X) Twitter | Telegram

The post How SpacePay Became the Best New Crypto to Buy for 2025’s Payment Boom appeared first on 99Bitcoins.

After weeks of sharp swings, the broader crypto market appears to be entering a phase of cautious stability. Bitcoin price continues to trade resiliently above the $100,000 mark, while Ethereum and major altcoins remain range-bound amid cooling market momentum.

Investor sentiment has shifted from extreme optimism to measured consolidation as traders reassess their positions following months of aggressive leverage and speculation. On-chain data shows steady accumulation among long-term holders, even as speculative activity in derivatives markets begins to unwind.

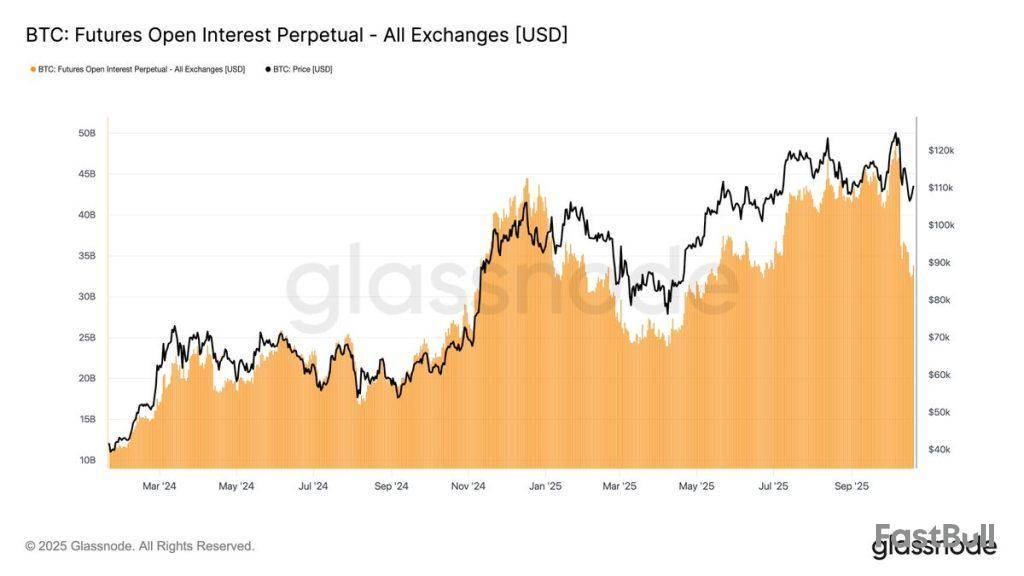

Against this backdrop, one key metric—Bitcoin Futures Open Interest (OI)—has caught analysts’ attention, signaling a potential leverage flush that could influence BTC’s next move.

Bitcoin Futures Open Interest Plunges 20%

Throughout 2025, Bitcoin’s open interest has shown a strong correlation with price action — expanding during rallies and contracting during corrections. Earlier peaks in January and July saw similar patterns: when OI crossed the $45–47 billion range, leverage-driven rallies eventually cooled off, leading to minor pullbacks before the next breakout.

According to the latest Glassnode data, Bitcoin’s futures open interest across major exchanges has dropped from nearly $45 billion to $35 billion, marking a significant 20% decline in just a few weeks.

This contraction comes even as Bitcoin’s spot price remains stable, suggesting traders are reducing leverage rather than exiting the market entirely. Historically, such declines in OI have occurred during periods of profit-taking or liquidations.

Healthy Market Cooling, Not Panic

Despite reduced futures activity, Bitcoin’s spot price structure remains strong. The asset has maintained a support zone between $95,000 and $100,000, suggesting that long-term holders and institutions continue to accumulate during periods of leverage flush.

This is a healthy sign for the market—rather than a panic-driven sell-off, this phase reflects risk reduction and profit realization, key ingredients for sustainable growth. If open interest stabilizes near $30–35 billion, it could mark the beginning of a base-building phase before Bitcoin targets $115,000–$120,000 once again.

On-Chain & Derivatives Data Confirm Consolidation

Additional metrics support this consolidation narrative:

Together, these trends highlight a cooling but fundamentally strong market environment—the kind that often precedes large directional moves.

Price Outlook: Short-Term Caution, Long-Term Strength

In the short term, Bitcoin is expected to consolidate between $95,000 and $110,000, with occasional volatility driven by futures repositioning. A breakout above $112,000–$115,000 could ignite the next bullish wave toward $120,000–$125,000, while a drop below $95,000 would likely invite strong spot buying interest. Long-term outlook remains bullish, supported by ETF inflows, institutional accumulation, and declining exchange supply—all pointing toward growing structural demand for Bitcoin.

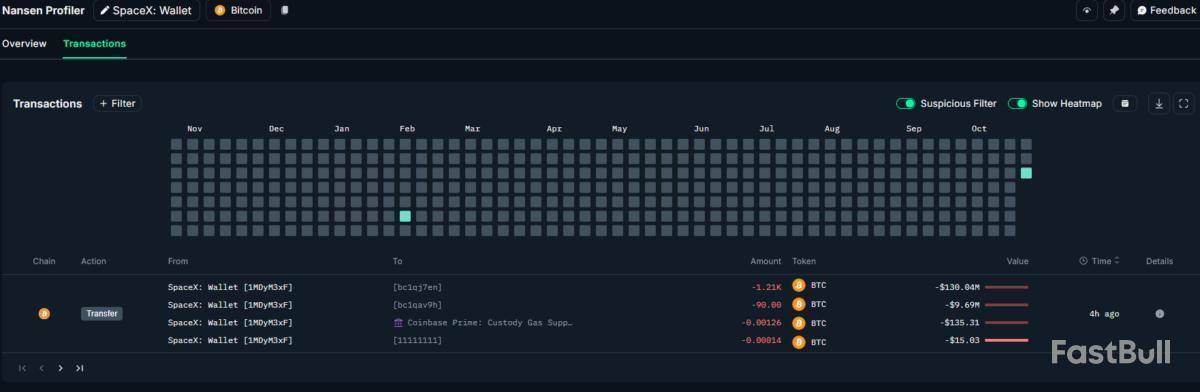

Elon Musk’s aerospace company SpaceX has moved $257 million worth of Bitcoin, its second large-scale transfer in three months, prompting speculation of a potential sale as the company faces mounting financial and political pressure.

SpaceX transferred $257 million worth of Bitcoin on Tuesday, marking the company’s first wallet movements since July.

The SpaceX-labelled wallet “1MDyM” transferred $130 million worth of Bitcoin to address “bc1qj,” while another SpaceX wallet “1AXeF” sent $127 million in Bitcoin to address “bc1qq,” according to data from blockchain intelligence platform Nansen.

The two receiving addresses haven’t transferred or sold the Bitcoin, and SpaceX has not commented on the reason for the latest transactions.

The wallet movement marks SpaceX’s second transfer in three months after the aerospace company moved $153 million worth of Bitcoin in July, its first fund movement since 2022.

Cointelegraph has approached SpaceX for comments on the reason behind the Bitcoin transfer.

While Elon Musk has recently touted Bitcoin for its energy-based, inflation-proof economic model, the billionaire’s relationship with the cryptocurrency industry has been complicated.

Musk’s SpaceX first disclosed its BTC holdings in July 2021, alongside electric car manufacturer Tesla, which purchased $1.5 billion worth of BTC earlier that year.

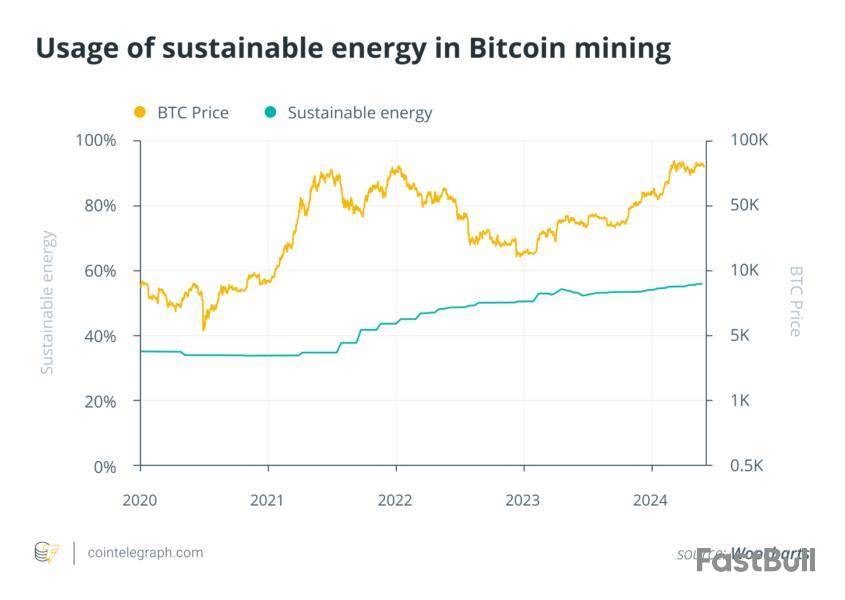

In May 2021, Tesla suspended Bitcoin payments for vehicle purchases, citing environmental concerns, which caused Bitcoin’s price to drop by 6% within an hour, from $54,800 to roughly $51,600.

While Tesla hasn’t sold the majority of its Bitcoin holdings, the car maker has yet to comment on reinstating Bitcoin payments, as Musk previously pledged to do if the mining network’s use of renewable energy grew.

Bitcoin mining’s sustainable energy usage reached an all-time high of over 55%, according to the above graph modeled by climate tech venture capitalist Daniel Batten and Bitcoin analyst Willy Woo.

SpaceX faces growing pressure as NASA opens moonlander contract

SpaceX’s Bitcoin holdings have received increased attention since the aerospace company faces growing political and financial pressure.

On Monday, NASA’s acting chief, Sean Duffy, said that his agency will open the moon lander contract to other competitors beyond Elon Musk’s SpaceX, which has been experiencing delays in the Starship lunar lander timeline.

“We are competing with China, so we need the best company to let us land on the moon as soon as possible. SpaceX has won a contract to build HLS, but the progress is slow,” said Duffy in a CNBC interview on Monday.

SpaceX entered into a $4.4 billion agreement with NASA in 2021, which included a 2027 moon landing deadline through the firm’s fully-reusable Starship vehicle.

Blue Origin and Lockheed Martin are expected to bid for the same contract as SpaceX’s main competitors.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up