Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Australian biotech company Kazia Therapeutics stock rocked the market after reporting encouraging results from a Phase II/III trial for its glioblastoma brain cancer therapy Paxalisib.

The positive results extended the life of patients by over three months compared to the current standard of care. Because the patients were a difficult-to-treat population, the results gave the oncology biotech developer cause to arrange a meeting with the Food & Drug Administration (FDA) to pursue an accelerated pathway for approval.

As a result, Kazia Therapeutics stock surged 730% on the news, jumping from 19 cents per share to as high as $1.58 before eventually tumbling lower. Shares stand 110% above where they traded before it posted the results.

Because glioblastoma treatment is seen as a $10 billion market opportunity according to some estimates, producing a treatment that is better than the current level of care is a major achievement.

As such, there are numerous avenues for Kazia Therapeutics to exploit this market if Paxalisib gains approval. What can’t be ignored is the possibility a pharmaceutical giant that is looking to bolster its portfolio of oncology drugs could step up and acquire Kazia Therapeutics stock.

A New Lease on Life

Glioblastoma (GBM) is reportedly one of the most common and aggressive forms of brain cancer. It represents nearly half of all brain cancers. Tumors form in the brain or spinal cord though they most often occur in the frontal and temporal lobes. Left untreated, GBM can be fatal in six months or less.

Kazia Therapeutics’ Paxalisib is itslead drug candidate and has been the subject of 10 clinical trials for this disease. The FDA previously granted the therapy Orphan Drug status in 2018 and it gained fast-track designation in 2020. It has received various other designations from the regulatory authorities for various diseases.

In the Phase II/III study, Paxalisib resulted in a median survival rate of over 15.5 months compared to 11.9 months under the current standard of care. This is in line with an earlier Phase II study that found similar longevity by administering Paxalisib.

A Hotbed of M&A Activity

According to analysts at White & Case, the field of oncology is setting a fire underneath mergers and acquisitions. Dealmaking will reach $375 billion in 2027 as demand for treatments grows.

In less than a year, Bristol Myers Squibb acquired Mirati Therapeutics for $5.8 billion to gain possession of its lung cancer treatment. It also paid $800 million upfront to China’s SystImmune for its signal-blocking therapy for cancer cells. It could be worth up to $8.4 billion.

AbbVie also acquired ImmunoGen for $10 billion and Johnson & Johnson bought Ambrx Biopharma for $2 billion. Previously, AstraZeneca , Gilead Sciences and Merck all made acquisitions in the cancer space to shore up their portfolios.

As patent expirations approach a critical stage for pharmaceutical stocks, Kazia Therapeutics could gain attention for Paxalisib.

Still a Risky Bet

Kazia Therapeutics stock has now traded in the 40-cent per share range for several days. Most of the gains were wrung out of the stock immediately after the results were published.

There could be a more massive upside in KZIA shares. Yet it still has the late-stage trials to go through, gaining permission from the FDA for fast-track approval and ultimately getting marketing approval.

Each step could excite the stock market again if the results are just as positive. Arguably staking a small claim to Kazia Therapeutics stock isn’t a bad idea. I wouldn’t go all-in because biotech investing is risky and full of unknowns. But for the speculative portion of your portfolio, buying a small tranche of the stock might not be a bad idea.

On the date of publication, Rich Duprey did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor did not have (either directly or

indirectly) any positions in the securities mentioned in this article.

Rich Duprey has written about stocks and investing for the past 20 years. His articles have appeared on Nasdaq.com, The Motley Fool, and Yahoo! Finance, and he has been referenced by U.S. and international publications, including MarketWatch, Financial Times, Forbes, Fast Company, USA Today, Milwaukee Journal Sentinel, Cheddar News, The Boston Globe, L’Express, and numerous other news outlets.

More from InvestorPlace

Four major pharmaceutical companies involved in the first U.S. negotiations over Medicare drug prices expect limited business impact despite anticipated price cuts.

Bristol Myers Squibb & Co , Johnson & Johnson , AbbVie Inc , and AstraZeneca Plc expressed this outlook after reviewing confidential government pricing set to take effect in 2026.

Reuters noted that executives shared their perspectives during recent quarterly conference calls.

The Medicare program, covering 66 million Americans aged 65 and older or with disabilities, spends billions annually on medications.

It plans to cut drug list prices by at least 25% in 2026, with official announcements expected by Sept. 1.

“I think the drugmakers were frightened (these prices) would be a big deal. But now, the ones who have reported or commented have actually said it seems to be OK and in line with expectations,” Reuters noted, citing a UBS analyst’s interview.

Under President Joe Biden’s 2022 Inflation Reduction Act, the Medicare agency identified the 100 most expensive drugs and selected 10 for price negotiations.

Chris Boerner, CEO of Bristol Myers, expressed confidence in navigating the impact on the blood thinner Eliquis, co-marketed with Pfizer Inc .

However, he and Robert Michael, CEO of AbbVie, reiterated concerns about government “price setting” potentially stifling innovation.

The IRA empowers Medicare to negotiate prices for costly drugs, potentially leading to price cuts ranging from the statutory minimum of 25% to a significant 60%.

AbbVie CEO Michael confirmed that the anticipated sales impact of its leukemia drug Imbruvica has been factored into its forecasts, while Jennifer Taubert, a J&J executive, maintained a positive long-term growth outlook despite the expected discounts for Stelara and Xarelto.

Citing an analyst at J.P. Morgan, Reuters noted that the responses from Bristol Myers and J&J indicate more manageable price cuts than initially feared.

An AstraZeneca executive indicated that minimal impact is expected by the time new prices take effect due to competition from generic versions of its diabetes drug Farxiga.

Guggenheim Partners analyst added that other drugs on the initial list, including Merck & Co Inc’s Januvia and Amgen Inc’s Enbrel, are also expected to face generic competition by 2029.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Read Next:

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AbbVie has been one of the most searched-for stocks on Zacks.com lately. So, you might want to look at some of the facts that could shape the stock's performance in the near term.

Shares of this drugmaker have returned +6.8% over the past month versus the Zacks S&P 500 composite's +0.1% change. The Zacks Large Cap Pharmaceuticals industry, to which AbbVie belongs, has lost 2.1% over this period. Now the key question is: Where could the stock be headed in the near term?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Here at Zacks, we prioritize appraising the change in the projection of a company's future earnings over anything else. That's because we believe the present value of its future stream of earnings is what determines the fair value for its stock.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock's fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

AbbVie is expected to post earnings of $2.94 per share for the current quarter, representing a year-over-year change of -0.3%. Over the last 30 days, the Zacks Consensus Estimate has changed +1.8%.

The consensus earnings estimate of $10.85 for the current fiscal year indicates a year-over-year change of -2.3%. This estimate has changed -3.6% over the last 30 days.

For the next fiscal year, the consensus earnings estimate of $12.10 indicates a change of +11.5% from what AbbVie is expected to report a year ago. Over the past month, the estimate has remained unchanged.

With an impressive externally audited track record, our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for AbbVie.

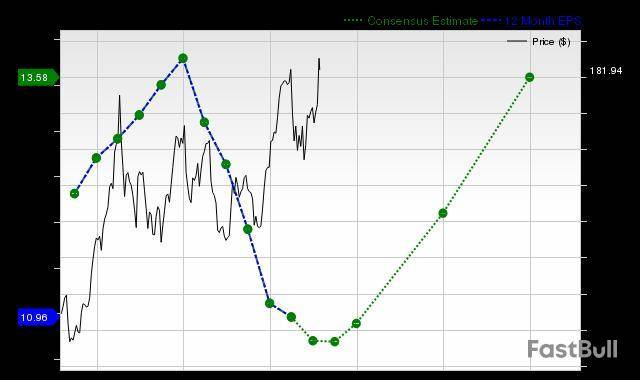

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Revenue Growth Forecast

Even though a company's earnings growth is arguably the best indicator of its financial health, nothing much happens if it cannot raise its revenues. It's almost impossible for a company to grow its earnings without growing its revenue for long periods. Therefore, knowing a company's potential revenue growth is crucial.

In the case of AbbVie, the consensus sales estimate of $14.23 billion for the current quarter points to a year-over-year change of +2.2%. The $56.85 billion and $58.93 billion estimates for the current and next fiscal years indicate changes of +4.7% and +3.7%, respectively.

Last Reported Results and Surprise History

AbbVie reported revenues of $14.46 billion in the last reported quarter, representing a year-over-year change of +4.3%. EPS of $2.65 for the same period compares with $2.91 a year ago.

Compared to the Zacks Consensus Estimate of $14.05 billion, the reported revenues represent a surprise of +2.96%. The EPS surprise was +3.11%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates each time over this period.

Valuation

No investment decision can be efficient without considering a stock's valuation. Whether a stock's current price rightly reflects the intrinsic value of the underlying business and the company's growth prospects is an essential determinant of its future price performance.

Comparing the current value of a company's valuation multiples, such as its price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), to its own historical values helps ascertain whether its stock is fairly valued, overvalued, or undervalued, whereas comparing the company relative to its peers on these parameters gives a good sense of how reasonable its stock price is.

The Zacks Value Style Score (part of the Zacks Style Scores system), which pays close attention to both traditional and unconventional valuation metrics to grade stocks from A to F (an An is better than a B; a B is better than a C; and so on), is pretty helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

AbbVie is graded C on this front, indicating that it is trading at par with its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

Bottom Line

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about AbbVie. However, its Zacks Rank #3 does suggest that it may perform in line with the broader market in the near term.

Zacks Investment Research

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up