Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. hiphop artist Ye, better known by his previous name Kanye West, has apparently launched his own Solana cryptocurrency named Yeezy Money (YZY).

"Yeezy Money is here … A new economy, built on chain," said a Wednesday post on West's X.

His social media post also attached an image showing what appears to be the address for his cryptocurrency, and a link to a website that allows people to buy, sell and send the cryptocurrency. According to data from the GMGN.Ai analytics platform, the token's market capitalization currently stands at around $2 billion.

"YZY Money is a concept to put you in control, free from centralized authority," the website said. It also said the YZY ecosystem includes Ye Pay, a crypto payments processor that allows merchants to accept credit and crypto payments at a lower fee, and a YZY credit card.

Meanwhile, in its disclosure, the website states that YZY is intended to function as an "expression of support for and engagement with" the ideals embodied by the symbol, and is not intended to be an investment opportunity.

If confirmed to be legitimate, this marks a pivot from West's previous stance on memecoins. In February, West said he is not launching a coin as they "prey on the fans with hype," after seemingly teasing the idea a couple days prior. West also said he was approached to scam the social media community to promote a fake Ye cryptocurrency for $2 million. These posts came amid multiple erratic social media posts that hiphop artist has been publishing on X at the time.

Following the announcement, X users quickly grew suspicious of the new crypto venture, speculating that Kanye West's account had been compromised. However, West's official website and his online store list YZY as a potential payment option, which suggests the venture might be legitimate.

The Block has reached out to West to confirm if YZY was indeed launched by West himself.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Cross-blockchain bridge Wormhole is looking to bid against LayerZero’s $110 million bid to acquire crypto protocol Stargate, arguing LayerZero’s bid doesn’t “create a compelling offer.”

The Wormhole Foundation said in a post on Stargate’s forum on Wednesday that it deserves “a more competitive process” after the LayerZero Foundation’s initial $110 million bid earlier in August to buy the platform failed to resonate with the community. LayerZero updated its offer on Sunday to a greater reception.

“It doesn’t create a compelling offer, which values Stargate’s ongoing business at an unreasonably low number,” Wormhole wrote of LayerZero’s bid. “We are prepared to submit a meaningfully higher bid.”

The impending bid could set up a bidding war for Stargate, which LayerZero developed and launched in 2022. LayerZero’s deal would see the platform come back under its umbrella, but many Stargate Finance (STG) tokenholders slammed its initial offer as unfair.

Wormhole asks for vote pause on LayerZero’s bid

Wormhole asked the Stargate community to suspend the vote on LayerZero’s bid for five business days to allow it time to finalize its offer.

It added that it “would appreciate additional time to conduct research and to speak with the Stargate team,” and it could “improve upon the current offer if more time is allowed to conduct a proper process.”

It asked for a list of assets, its financials since its launch, user and traffic metrics, its liabilities and if it’s facing any ongoing lawsuits or regulatory actions.

Wormhole pitched its potential acquisition of Stargate as forming a “market-dominant ecosystem.”

“Stargate brings deep, unified liquidity pools and proven user demand, while Wormhole commands broad ecosystem integration across dozens of blockchains and protocols, as well as key growth areas in crypto, like RWAs [real world assets],” it wrote.

Wormhole did not immediately respond to a request for comment. The LayerZero Foundation could not be reached for comment.

Stargate community backs LayerZero’s updated bid

LayerZero updated its proposal to acquire Stargate on Sunday to include a revenue-sharing period for those who had staked their Stargate tokens, which has seen wide support from Stargate’s community.

LayerZero’s final proposal said it would give staked Stargate tokenholders half of all top-line Stargate revenue for six months, with the remaining half used to buy back its LayerZero (ZRO) token.

In comparison, its initial proposal pitched using Stargate’s excess revenue for a ZRO buyback program.

LayerZero said all circulating STG would be swapped for ZRO at a ratio of 1 STG to 0.08634 ZRO — aligning with its original proposal.

The new proposal has seen 88.6% of STG holders vote in favor, accounting for 6.6 million tokens.

Some Stargate community members had called LayerZero’s original pitch “not attractive at all” as it didn’t give advantages to STG holders, while others said the token swap should be upped to a 1:1 basis.

Wormhole, Stargate, LayerZero tokens gain

The tokens tied to all three platforms all saw gains on the day alongside a modest lift in the wider crypto market.

The Wormhole (W) token is up 6.3% in the past 24 hours to just over 8 cents, having seen a boost around the time of its post to Stargate’s forum, according to CoinGecko.

Stargate’s token has gained 6% on the day, also climbing around the time of Wormhole’s forum post to a 24-hour high of over 18 cents, which has since cooled to just over 17 cents.

LayerZero’s token has also seen gains, a modest 3.6% on the day to $2, joining gains in the wider crypto market as Bitcoin (BTC) and Ether (ETH) are up 1% and 5.2%, respectively.

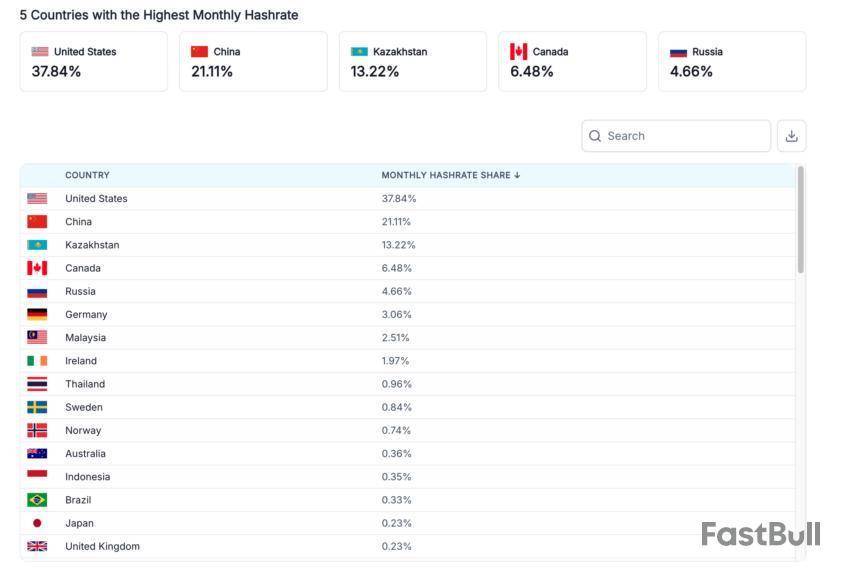

Bitcoin mining remains the backbone of the crypto economy. In the Asia-Pacific (APAC) region, abundant hydropower, gas reserves, and surplus electricity create opportunities and friction.

The region offers “green hash” potential yet faces high electricity costs and fragmented rules. For global investors, APAC bitcoin miners now sit at the center of debates over energy use, transparency, and capital access.

APAC Bitcoin Mining Overview

Latest Update – In July 2025, Bitdeer expanded hydropower mining capacity in Bhutan to more than 1,200MW, positioning the country as a renewable mining hub. Marathon Digital and Zero Two began operating a 200MW immersion-cooled site in Abu Dhabi, showing how advanced cooling and flare-gas integration sustain operations in extreme climates. Meanwhile, Iris Energy in Australia reported 50EH/s, signaling how APAC miners scale alongside Western peers.

Background Context – The Cambridge Bitcoin Mining Map shows that after China’s 2021 crackdown, bitcoin mining shifted across Asia-Pacific economies while underground activity in China persists. Energy data, published by Asia-Pacific Economic Cooperation, projects rising renewable penetration, creating conditions where bitcoin mining can align with decarbonization goals if policy supports it.

Deeper Analysis – China remains opaque. Despite the ban, seasonal hydropower in Sichuan and underground clusters persist. The Cambridge Digital Mining Industry Report 2025 warns of underreported activity in China, complicating global hash power and concentration risk assessments.

In fact, despite the 2021 ban on crypto mining, the country still accounts for more than 21% of global hashrate. This persistence is driven by underground hydropower operations in regions like Sichuan, dispersed small-scale farms that avoid detection, and local utilities quietly selling surplus electricity. While Beijing maintains a prohibition on paper, in practice, it appears to tolerate a shadow bitcoin mining industry, adding significant opacity and transparency risks to global assessments.

Japan’s high electricity prices limit domestic farms. However, firms such as SBI Crypto and GMO operate overseas, at renewable-powered sites. Domestically, SoftBank’s 300MW data center in Hokkaido illustrates how AI infrastructure overlaps with mining-scale energy loads. PTS signed agreements to supply telecom-grade hashrate over three years in Japan’s enterprise segment, indicating steady demand for stable capacity.

South Korea is exploring power-system integration. A May 2025 arXiv study suggests that monetizing surplus electricity through bitcoin mining could help KEPCO reduce debt while lowering grid losses. This model reframes mining as a grid-balancing tool rather than a burden.

Green Hash in Asia: Hydropower, Flare Gas, and Renewable Expansion

Bhutan’s hydropower expansion with Bitdeer signals how Asia can brand bitcoin mining as environmentally sustainable and attract ESG-minded capital. Abu Dhabi’s immersion-cooled site shows how flare gas and advanced infrastructure redefine efficiency in hot climates. Australia’s Iris Energy demonstrates a hybrid model by combining renewable-powered mining with AI computing, positioning itself across digital and energy markets. These cases show that Asia-Pacific bitcoin mining is growing more flexible, diversified, and sustainability-driven.

Behind the Scenes – APAC miners balance local politics and global scrutiny. Japan and Korea focus on energy integration rather than pure scale. Bhutan markets sustainability, while China’s hidden activity raises transparency concerns. The UAE and Australia leverage their energy mixes to attract institutional capital and lower marginal costs.

Broader Impact – Institutional investors demand high disclosure standards. US-listed miners win trust with SEC filings and market liquidity, while APAC firms must bridge fragmented frameworks. However, if Asian miners deliver ESG-backed transparency, capital flows could diversify more evenly between East and West.

Looking Forward – By 2026, more APAC miners could approach parity with Western peers if they combine efficiency with credible disclosure. Competitiveness will depend on rapid upgrades to next-generation ASICs, integration with renewable grids, and establishment of regional reporting standards that reduce perceived risk for global investors.

Policy Costs and Regional Risks

Data Breakdown—The CCAF 2025 report highlights hardware efficiency gains and geographic reshuffling of mining capacity. The region’s intergovernmental forum’s Energy Outlook shows how regional energy trajectories can reshape bitcoin mining’s cost base and carbon profile.

Possible Risks –

Expert Opinion –

“The most significant risk for Asian miners remains regulatory unpredictability. Without long-term clarity, capital costs rise and global investors hesitate.”— Cambridge Centre for Alternative Finance, Digital Mining Industry Report 2025

“Our facility in Abu Dhabi demonstrates how immersion cooling and flare gas integration can redefine mining economics in challenging climates.”— Marathon Digital Holdings, press release

“By monetizing surplus power through mining, utilities could improve their financial health while stabilizing electricity networks.”— ArXiv research, Bitcoin Mining and Grid Efficiency in Korea (May 2025)

Ming Shing Group Holdings Limited, a Nasdaq-listed construction service provider specializing in wet trades, announced Wednesday that it has entered a bitcoin purchase agreement to buy 4,250 BTC.

The Hong Kong-based company's agreement involves a $482.9 million transaction with Winning Mission Group, a company registered in the British Virgin Islands, which will sell the 4,250 BTC at an average price of $113,638 per bitcoin.

The deal, which is expected to close by the year-end, will not be paid for in cash. Instead, Ming Shing will issue convertible promissory notes and stock warrants to the seller, the announcement said.

The transaction extends to a third party, Rich Plenty Investment Limited, which will receive half the value of the deal. Both the original seller and the new assignee will each get a convertible note worth over $241 million and a warrant to purchase more than 200 million of Ming Shing's shares, according to the press release.

“We believe the Bitcoin market is highly liquid and the investment can capture the potential appreciation of Bitcoin and increase the Company’s assets," said Wenjin Li, CEO of Ming Shing. "We are devoted to creating additional value for our shareholders and actively exploring options for the Company to grow further.”

The company's stock MSW momentarily jumped 29% on the news on Wednesday. It closed the day 11.5% higher to trade at $1.65.

Ming Shing's pivot adds to the long list of public companies that have incorporated bitcoin into their treasury strategy. Led by Michael Saylor's Strategy, public bitcoin treasury companies hold 3.93% of bitcoin's entire supply, according to The Block's data dashboard.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Core Foundation and Hex Trust have expanded their partnership to offer institutional Bitcoin staking services across the Asia-Pacific and MENA regions.

The collaboration combines Core’s Dual Staking technology with Hex Trust’s regulated custody platform. Core provides Bitcoin staking services, and Hext Trust is an institutional crypto custody service in Hong Kong.

Institutional Appeal: Yield with Compliance

Banks, family offices, and institutional investors can timelock Bitcoin to support the Core network. At the same time, they can maintain full custody and earn protocol rewards. By integrating Core’s staking technology within Hex Trust accounts, clients can stake BTC, CORE, or both without transferring assets to unregulated platforms.

The value is clear for institutions: earn yield on idle Bitcoin while staying compliant and keeping custody secure. Rewards are issued from blockchain activity, not opaque off-chain programs.

Core is positioning itself as a leading Bitcoin-focused DeFi ecosystem. It bridges Bitcoin security with EVM-compatible programmability. Recent data shows that over $500 million in total DeFi value is locked, over 7,000 timelocked BTC is securing the network, and roughly 75% of Bitcoin mining hash power is backing it. These figures highlight why custodians and institutions are paying attention.

With its regulatory footing in APAC and MENA, Hex Trust says the integration could drive larger, compliant flows into BTCFi, or decentralized finance built on Bitcoin security. Asset managers can use time-locked Bitcoin as a regulated source of yield while preserving custody relationships.

Analysts say the key challenge will be scale and operational controls. Institutions demand predictable rewards, clear custody separation, and strong accounting before allocating significant Bitcoin. By combining Core’s yield layer with Hex Trust’s compliance infrastructure, this partnership may shift institutional Bitcoin engagement from passive holding to active, yield-focused strategies. Security and regulatory comfort remain central to adoption.

US Federal Reserve Governor Christopher Waller told his peers and the private banking sector that there’s “nothing to be afraid of” about crypto payments despite it operating outside the traditional banking system.

“There is nothing scary about this just because it occurs in the decentralized finance or DeFi world — this is simply new technology to transfer objects and record transactions,” he said during a speech at the Wyoming Blockchain Symposium 2025 on Wednesday.

Leveraging innovative tech to build new payment services isn’t a “new story,” Waller said as he pitched policymakers and the private banking sector to work together on crypto payment infrastructure. “There is nothing to be afraid of when thinking about using smart contracts, tokenization, or distributed ledgers in everyday transactions.”

Waller’s comments reflect the Fed’s steady pivot toward embracing crypto and its future role in the US payments system. In April, it withdrew guidance from 2022 that served to deter banks from engaging in crypto and stablecoin activities.

Last week, the Fed ended its risk-focused “novel activities supervision program” overseeing crypto-related activities, while Fed vice chair for Supervision Michelle Bowman on Tuesday suggested staff should be allowed to hold small amounts of crypto to better understand the technology.

Waller’s pro-crypto views could soon have more weight, as he is considered a front-runner to replace Jerome Powell as Fed chair. Powell’s term ends in May 2026 and can only be extended if he is renominated by President Donald Trump and confirmed by the Senate. However, Trump has reportedly been pressuring Powell to resign.

Buying memecoins with crypto like buying apples with fiat: Waller

Waller said DeFi transactions follow the same logic as everyday debit card purchases, comparing the use of stablecoins to buy a memecoin to tapping a debit card at a grocery store to pay for an apple.

“I can go to the grocery store and buy an apple and use a digital dollar in my checking account to pay for it. I tap my debit card on a card reader to conduct the transaction. Finally, the machine prints out a receipt, which is the record of the transaction. The same process applies to the crypto world.”

GENIUS bill an “important step” for stablecoin adoption

The recent signing of the Guiding and Establishing National Innovation for US Stablecoins Act marked an “important step” for stablecoin adoption, Waller said, adding that it could help stablecoins “reach their full potential.”

He noted that stablecoins could help maintain and expand the dollar’s role internationally — especially in high-inflation countries or those with limited access to physical dollars — while improving retail and cross-border payments.

Stablecoin market tipped to increase 615% by 2028

The stablecoin market currently sits at $280 billion — a market the US Treasury estimated in April would reach $2 trillion by 2028.

The department supported its projection by stating that a stablecoin regulatory framework could rapidly accelerate demand for US Treasury bills.

Tether (USDT) and Circle’s USDC (USDC) currently dominate the stablecoin industry, boasting market caps of $167 billion and $67.5 billion, respectively, CoinGecko data shows.

Gemini cryptocurrency exchange co-founders, Cameron Winklevoss and Tyler Winklevoss, have donated 188.4547 Bitcoin , valued at about $21 million, to the Digital Freedom Fund PAC. The recently created Digital Freedom Fund PAC received strategic funding from the Winklevoss brothers to help crypto-friendly leaders be elected during the upcoming midterm elections in the United States.

According to the announcement, the funds are crucial to enabling President Donald Trump to make the United States the crypto capital of the world. Moreover, President Trump has delivered on several crypto promises since his re-election for a second term.

“We want this unprecedented progress and momentum to continue. Our goal is to support President Trump and his Administration’s efforts to continue to usher in America’s Golden Age,” Tyler noted.

Key Areas that the Digital Freedom Fund Will Pay Attention

The Digital Freedom Fund will primarily focus on enabling President Trump to retain control of both the Senate and the House of Representatives in the upcoming midterm elections. Furthermore, President Trump has managed to deliver on his campaign cryptocurrency promises, including the GENIUS Act, largely due to the Republicans’ control in the Senate and the House of Representatives.

The Digital Freedom Fund will also focus on advocating for the protection of software developers. According to the Winklevoss brothers, liability should not fall on software developers but on the specific bad actors.

With the latest funding, the Digital Freedom Fund will help fight for open banking to enable a fair access to banking services for the crypto industry. The Digital Freedom Fund will work with other similar funds to facilitate the common goal of enabling mainstream adoption of digital assets.

“The Digital Freedom Fund will work with similarly aligned pro-crypto groups and look to identify and support other issues, like the de minimis tax exemption for bitcoin and other crypto transactions, that will unleash the potential of these technologies, our industry, and America. And our private position will always be the same as our public position on these matters,” the announcement highlighted.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up