Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

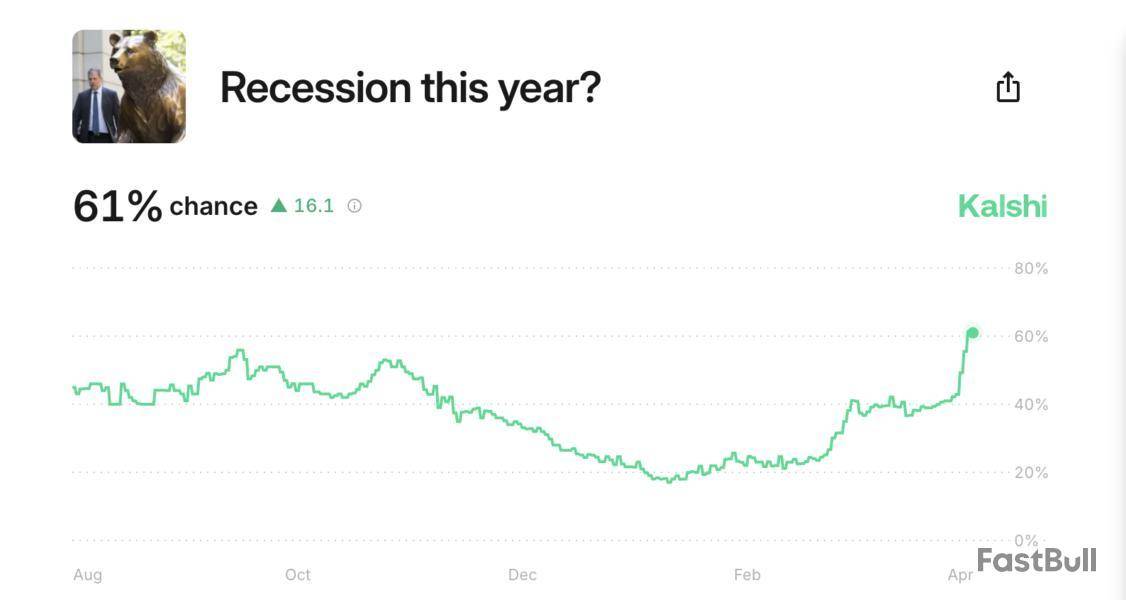

Traders on the Kalshi prediction market place the odds of a US recession in 2025 at 61%, following the sweeping tariff order signed by President Donald Trump on April 2.

Kalshi uses the standard criteria of a recession, two business quarters of negative gross domestic product (GDP) growth, as reported by the United States Department of Commerce.

Odds of a US recession on the prediction platform have nearly doubled since March 20 and mirror the current 2025 US recession odds on Polymarket, which traders on the platform currently place at 60%.

The macroeconomic outlook for 2025 deteriorated rapidly following US President Donald Trump's sweeping tariff order and the ensuing sell-off in capital markets, sparking fears of a prolonged bear market.

Trump's executive order throws markets in disarray

The US President's executive order established a 10% baseline tariff rate for all countries and different "reciprocal" tariff rates on trading partners with existing tariffs on US import goods.

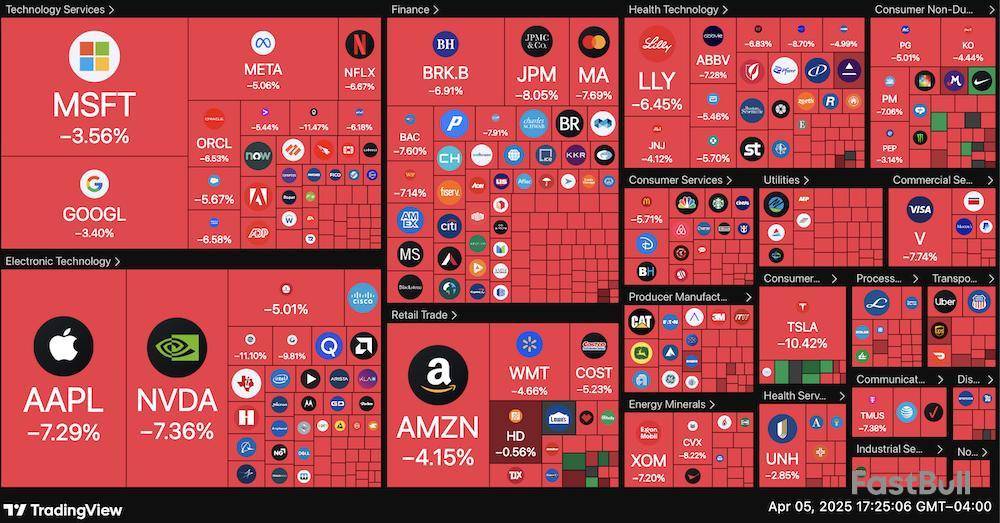

Trump's announcement triggered an immediate stock market sell-off, wiping away over $5 trillion in shareholder value in a matter of days.

Fears of a recession continue to grow as market analysts warn of a potentially protracted trade war that negatively impacts global markets and suppresses risk asset prices, including cryptocurrencies.

Meanwhile, President Trump has expressed confidence that the tariffs will strengthen the US economy long-term and correct any trade imbalances.

"The markets are going to boom," the President said on April 3, describing the current market sell-off as an expected part of the process.

Asset manager Anthony Pompliano recently speculated that President Trump deliberately crashed markets to bring down interest rates.

Pompliano cited the reduction in 10-year US Treasury bonds as evidence that the President's strategy of forcing a recession to impact rates is working.

Interest rates on 10-year US Treasury bonds declined from approximately 4.66% in January 2025 to just 4.00% on April 5. President Trump is also pressuring Federal Reserve chairman Jerome Powell to lower short-term interest rates.

"This would be a perfect time for Fed chairman Jerome Powell to cut interest rates," Trump wrote in an April 4 Truth Social post.

Market prices of Cardano (ADA) increased by over 3% on Friday amid a general bullish wave in the crypto market. However, this minor uptick only follows the largely negative performance earlier seen in the week. Notably, popular crypto analyst Ali Martinez postulates the ninth-largest cryptocurrency could still experience steeper market losses if certain technical support fails to hold.

Cardano Critical Support Break Could Lead To 36% Decline

In a recent post on X, Martinez shares a cautionary insight on the current ADA market structure hinting at a potential price fall. Based on the Fibonacci retracement levels, Martinez’s analysis indicates that Cardano still trades near a vital support zone despite recent gains.

The Fibonacci retracement levels are horizontal lines commonly used to identify potential support and resistance zones. They are based on the Fibonacci sequence and are widely used in anticipating a price fall, gain, consolidation, or reversal.

Looking at the chart below, ADA currently trades at $0.66 which is just above the 50% Fibonacci retracement level at $0.63 – a price zone that has acted as a resilient support level in recent weeks. Ali Martinez warns a daily close below $0.63 would signal a bearish shift in market control at this level paving the way for a further decline.

In this case, Cardano could fall to test the next significant support at the 61.8% Fibonacci retracement level around $0.53. If the selling pressure prevails at this zone, ADA prices could potentially slide to $0.42 representing the 78.6% Fibonacci retracement level.

What Next For ADA?

Cardano has struggled to maintain a prolonged bullish form after reaching a local peak of $1.30 in early December 2024. Since then, ADA prices have been in a corrective phase alongside the broader crypto market.

For ADA bulls, defending the $0.63 price level is crucial to sustaining any valid bullish outlook. However, a successful price reclaim of the $0.78-$0.80 price zone would signal an impending price rally and market rebound for the altcoin.

At the time of writing, Cardano trades at $0.66 as earlier stated. Amid recent gains, ADA is down by 5.00% on its weekly chart and 33.58% on its monthly chart reflecting a domineering bearish influence in recent weeks.

Meanwhile, daily trading volume has gained by 19.56% in the past 24 hours indicating a rise in market interest. This development suggests the recent price rally might be sustainable due to a strong conviction among buyers.

Tony “The Bull” Severino has issued a cautionary reminder to the crypto community not to fall into the trap of comparing Bitcoin’s current cycle with its historic 2017 bull run. According to the technical analyst, a critical indicator on the monthly chart paints a very different picture from the one many investors hope for. Severino’s warning comes as Bitcoin continues to consolidate between $81,000 and $84,500, with the buying trend suggesting that it might be topping out.

Stochastic Oscillator Says Bitcoin No Longer In Same Phase As 2017

At the core of Severino’s argument is the stochastic oscillator, a momentum indicator commonly used by technical analysts to analyze whether a cryptocurrency is overbought or oversold relative to its recent price range. When applied to Bitcoin on the monthly candlestick timeframe, the oscillator offers a broader view of long-term momentum trends stretching back to 2013. In the chart shared by Severino, this timeframe includes every major bull and bear cycle, with many recurring patterns.

His outlook is in response to market participants who link the 1-month Bitcoin stochastic oscillator’s movement to its past levels in 2017 as a sign of what they expect in the current market. As seen in the chart below, the oscillator has been undergoing the same 2017 downtrend since the beginning of 2025. At the time of writing, the oscillator is sitting around 60, the same level it fell to during the correction in the 2017 bull market.

However, he argues that this level has little in common with the 2017 bull run’s momentum peak and aligns more closely with the beginning of the 2018 bear market. During that point in the cycle, Bitcoin suffered a staggering 49% drop within a single month, from wick high to wick low.

Severino implies that any current similarities to the 2017 bull market are misleading from a bullish technical standpoint, as the implication is that the leading cryptocurrency is at risk of entering a similar corrective or bearish phase now.

Recent price action has seen Bitcoin struggling to receive strong inflows and buying momentum. On-chain data shows that many short-term holders have halted their buying activity due to the extended consolidation, which does not bode well for bullish prospects. Furthermore, the realized price model says the ongoing correction may still have weeks to run.

Nonetheless, Bitcoin has managed to hold and reject a break below $80,000 amid the recent turmoil that shook the markets. The announcement of US President Donald Trump’s proposed tariffs rattled markets, causing volatility not only in crypto but across major US equity markets.

As the Dow Jones, S&P 500, and NASDAQ pulled back in response, Bitcoin also slipped toward the $81,000 level. However, unlike its equity counterparts, it has since rebounded and reclaimed ground above $83,000, which can be interpreted as early signs of decoupling from traditional financial indices.

Cory Bates@corybates1895Apr 04, 2025This is actually wild to see— for the first time, Bitcoin is decoupling right before our eyes pic.twitter.com/b4G3HWqWBo

At the time of writing, Bitcoin is trading at $83,693.

Featured image from Pexels, chart from TradingView

Data shared by the public Shibburn blockchain tracking platform, which traces SHIB burn transactions on Etherscan, and then accumulates that data on its website, has reported that the level of daily SHIB burns has shown a major plummet.

This decline has taken place amid the overall stock market crash, which has wiped more than $5 trillion off the market within the last couple of days. Bitcoin, however, demonstrates resilience, holding well above the $80,000 price level, while Nasdaq and other leading indexes around it are bleeding.

SHIB burns go deep down

The above-mentioned data source revealed that over the past 24 hours, the level of SHIB burns has plunged by 42.07%, sinking in red, while a total of 21,613,189 SHIB meme coins has been transferred to unspendable wallets and locked out of circulation.

The two largest burn transactions on this short list of transfers carried 9,999,999 and 9,684,002 SHIB. There was also one that moved 1,000,001 SHIB, while the remaining two transferred less than a million meme coins each.

However, on Friday, the same metric showed an impressive contrasting rise of 1,906.97% with 48,251,324 SHIB transferred to dead-end wallets.

As for the weekly burns, over the past seven days, the community has managed to dispose of 187,900,543 SHIB. Still, that indicated a 90.99% decline compared to the previous week, when a staggering 2 billion Shiba Inu were burned out of the circulating supply.

Shibarium arrives at crucial milestone

Today, the SHIB team bragged about the Layer-2 solution Shibarium reaching an important milestone — the total number of blocks generated on the network surpassed the 10 million level and currently stands at 10,306,430.

Shibarium Updates 📢@ShibizensApr 05, 2025Shibarium Hits 10.3M Blocks

But What Does It Mean?

Each block is like a new page in the blockchain’s history, containing a batch of verified transactions. With blocks created every ~5 seconds, this milestone shows:

•Consistency: The chain is alive and actively processing.… pic.twitter.com/hsf6kj20fi

A post published on the X account Shibarium Updates (@Shibizens) affiliated with the SHIB team shared more details of this new record, emphasizing the importance of it.

The post deciphered that each block in this chain contains a batch of verified transactions and it is created roughly every five seconds. It shows Shibarium’s constant consistency: “The chain is alive and actively processing.” The post adds that each block adds a new level of security: “Each block adds another layer of protection.” Besides, the increase in blocks proves the growth of Shibarium itself behind it: “Millions of on-chain actions, contracts, and transfers have been secured.”

NEW YORK, NY / ACCESS Newswire / April 5, 2025 / FUN Token, a pioneer at the intersection of Web3 and gaming, has revealed its ambitious roadmap for 2025-2026, marking a bold new chapter in the evolution of digital entertainment. With a clear mission to revolutionize the gaming landscape, FUN is building a closed-loop, player-first ecosystem where games are more than play-they're a pathway to real value.

Gaming is Broken-FUN Token is Here to Fix It

In a world where players are bombarded with ads and pushed into endless in-app purchases, FUN flips the script. We're building a player-first ecosystem where gamers get paid to play. No more paywalls, no more attention traps-just seamless gameplay, real rewards, and a token economy that values your time and skill. FUN Token is re-empowering the player and redefining what gaming should be.

Mission: Play With Purpose, Earn With FUN

At the heart of the FUN Token project is a simple but transformative idea: empower gamers to earn tangible value doing what they love. By embedding FUN as the core currency across a growing portfolio of games, the team aims to unify the fragmented Web3 gaming space into a seamless, rewarding experience for players worldwide.

The Core Strategy: How FUN is Redefining the Game

The FUN roadmap is anchored on four powerful pillars:

Closed-Loop Ecosystem: One wallet. One login. Endless games. FUN is creating a frictionless environment where players can move effortlessly between titles, with all progress, rewards, and identity preserved.

Token Utility & Buy-and-Burn Engine: Players earn FUN tokens in-game. Revenues from those games are then used to buy FUN on the open market and burn it-reducing supply and boosting token value over time.

Gamified Rewards & Retention: XP systems, loot boxes, streaks, and seasonal quests all reward active participation. FUN is building for stickiness-turning casual players into loyal, lifetime users.

Strategic Partnerships: By integrating FUN into third-party titles, the team is positioning the token as the "Universal Currency of the Gamingverse." One token to connect them all.

The FUN Grand Plan: From Foundation to Domination

The roadmap is aggressive, high-impact, and laser-focused on scaling:

Q2 2025 - Launch the Foundation

Release 10 mobile games across Android and iOS

Launch web-based FUN Wallet

Introduce Unified Login for cross-game access

Kickstart the "Earn-While-You-Play" movement

Q3 2025 - Spark the Network Effect

Add 10 more viral/hyper-casual games

Reach 1M+ players and 100K+ wallet users

Launch achievement systems and daily missions

Begin Buy-and-Burn token mechanics

Establish first wave of third-party game partnerships

Q4 2025 - Scale the Ecosystem

Expand to 30 total games

Hit 5M+ users, 500K+ wallets

Launch mobile FUN Wallet (iOS & Android) with staking and rewards

Introduce NFTs, leaderboards, and community quests

Onboard mid-size external studios

Q1 2026 - Dominate Web3 Gaming

Grow to 40 games across genres

Reach 10M+ players, 1M+ wallet holders

Add multi-chain and fiat support in FUN Wallet

Integrate FUN into external game economies

Host the inaugural Global FUN Gaming Summit

A Universe of FUN Awaits

FUN Token invites players, developers, and investors to join the movement and be part of the ecosystem that's set to reshape the future of entertainment.

About FUN Token

FUN Token is on a mission to become the default digital currency of gaming. Powered by Web3 technology and backed by a vibrant, self-sustaining economy, FUN is creating a unified ecosystem where every game, action, and user contributes to a dynamic gaming universe. Learn more at https://funtoken.io/

FUNToken.io Socials:

X.com/FUNtoken_io

t.me/officialFUNToken

Media Contact:

pr@funtoken.io

+14072346663

SOURCE: FUN Token

View the original press release on ACCESS Newswire

Prominent market analyst and XRP enthusiast Egrag Crypto has rolled out a robust bullish prediction for the XRP market. Amid recent gains, Egrag Crypto postulates that XRP could surge to around $5 but not without resistance at certain price levels. At press time, the popular altcoin continues to trade around $2.12 reflecting a 3.99% gain in the past day amid a widespread price bounce in the crypto market.

Fibonacci Levels Reveal $2.70 As Key To Major XRP Rally – Details

In an X post on Friday, Egrag shares a positive technical outlook on the XRP market suggesting a potential massive price rally. This projected bullish run comes in multiple phases each barred by the clearance of a new resistance level.

To show any signs of a price uptrend, the market analyst states that XRP bulls must first reclaim the $2.24 price level which aligns with the 21-day exponential moving average – a key trend indicator. Egrag explains that a daily close above this level would show sufficient base demand to kickstart a price recovery.

Thereafter, another successful XRP daily price close above $2.30 would solidify bullish intent signaling a stronger upside continuation. This is because this price level represents the Fib. 0.382, which is a key retracement zone in technical analysis and typically acts as a resistance in a downtrend and support in an uptrend.

Moving on, the next crucial resistance lies at $2.47 which aligns with Fib. 0.5. A convincing breakout above this price resistance zone would further increase the potential of a sustained uptrend. However, the strongest signal for a major rally and a new all-time high price will come only after XRP closes above $2.70 which coincides with both the yellow resistance line and the Fib. 0.618.

Interestingly, Fib. 0.618, known as the golden ratio, is considered another important Fibonacci level that acts as support in an uptrend, and failure to break past which could signal a price reversal and halt the uptrend. However, if XRP successfully surpasses the listed resistance zones, Egrag forecasts a potential surge to $5.00 at Fib. 1.618, representing a 133% gain from the current market price and signaling strong potential for new price discovery.

Related Reading: Is The Solana Bottom In? Experts Answer

XRP Price Overview

As earlier stated, XRP currently trades around $2.12 following the minor gains in the past day. Based on the daily trading chart, the altcoin remains far below its 100-day simple moving average suggesting a dominant bearish force. However, the Relative Strength Index (RSI) which stands at 42.69 moving upward, signals the potential for more price growth before a possible reversal. With a market cap of $123.06 billion, XRP continues to rank as the fourth largest cryptocurrency.

Featured image from EXMO, chart from Tradingview

Mark Uyeda, acting chair of the US SEC, has directed staff to review several crypto-related regulatory statements, including guidance on the investment contract analysis of digital assets and the treatment of Bitcoin futures under the Investment Company Act.

Other key documents under review are crypto market disclosure letters, digital asset securities oversight, and custody standards tied to Wyoming’s no-action letter, according to an April 5 statement posted on the SEC's X account.

The action is being taken under Executive Order 14192 , titled "Unleashing Prosperity Through Deregulation," and on recommendations from the Department of Government Efficiency (DOGE).

President Trump issued the order on January 31, aimed at reducing regulatory burdens on businesses and individuals in the US. The executive order encourages federal agencies to cut back on unnecessary regulations that could stifle innovation or economic growth.

The order targets regulatory rollbacks with a sweeping “10-for-1” mandate, requiring federal agencies to eliminate at least ten existing rules for every new one proposed. It marks a sharp escalation from the “2-for-1” policy implemented during Trump’s first term.

The SEC staff's review could lead to simplified or clarified rules for crypto companies, or possibly less oversight depending on the outcome.

"The purpose of this review is to identify staff statements that should be modified or rescinded consistent with current agency priorities," Uyeda stated.

Under the second Trump administration, the SEC is expected to undergo plenty of changes in its priorities and regulatory approach. The regulator has adopted a more crypto-friendly approach compared to previous administrations.

Over the past few weeks, the SEC has dismissed pending cases against major crypto companies like Coinbase, Consensys, and Kraken, to name a few.

The securities watchdog is also working to clarify the status of various crypto assets, determining which are securities and which are not.

On April 4, the SEC declared that 'covered' stablecoins, such as Tether's USDT and Circle's USDC, are not classified as securities.

These tokens, fully backed by fiat reserves or liquid instruments and redeemable at a 1:1 ratio with US dollars, will not require transaction reporting with the commission.

The criteria exclude algorithmic stablecoins that use software for their dollar peg. The guidelines also restrict covered stablecoin issuers from mingling reserves with operational funds or offering yields to token holders.

With pro-innovation Paul Atkins potentially leading the SEC, there may be a more accommodating stance toward digital assets. Market observers hope that Atkins' appointment could lead to more approvals of digital asset ETFs.

The Senate Banking Committee on Thursday approved Paul Atkins' nomination as US SEC Chair, with proceedings moving to a full Senate vote.

Atkins could assume his position shortly after he is confirmed by the Senate.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up