Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Prediction marketplace Kalshi has sued gaming regulators in Nevada and New Jersey after receiving cease-and-desist orders prohibiting it from offering sports-related contracts in those states.

Kalshi received a letter from Nevada's Gaming Control Board (GCB) on March 4 with orders to cease and desist offering events-based contracts in the state. "Kalshi is in the business of offering event-based contracts which constitute a system or method of wagering on sporting events and other events. Therefore, by offering event-based contracts in Nevada, Kalshi is operating as an unlicensed sports pool in violation of NRS 463.160(1)(a) and NRS 463.245(2)," the letter states.

Kalshi received a similar notice from the New Jersey Division of Gaming Enforcement (DGE) on March 27, ordering the marketplace to cease offering sports-related contracts. Kalshi's activity "...constitutes a violation of the New Jersey Sports Wagering Act, which only permits licensed entities to offer sports wagering to patrons located in New Jersey," the letter states.

In response to the notices, Kalshi filed suit against the gaming regulators, arguing that as a federally-regulated commodities exchange, the Commodity Exchange Act supersedes the authority of the states to regulate the sports- and events-based contracts. "New Jersey’s attempt to regulate Kalshi intrudes upon the federal regulatory framework that Congress established for regulating futures derivatives on designated exchanges," the New Jersey-based lawsuit states, echoing the language of the Nevada lawsuit. "New Jersey law is both field-preempted and conflict-preempted."

"The threatened actions in Nevada and New Jersey seek to undermine not just Kalshi’s contracts, but the authority granted by Congress to the Commodity Futures Trading Commission, which has safely and effectively governed commodities markets for decades," Kalshi CEO Tarek Mansour said in a statement. The Nevada GCB and New Jersey DGE did not immediately respond to a request for comment.

The core of the dispute revolves around whether trading on event- or sports-based contracts constitutes gambling, subject to state control, or financial derivatives trading, regulated exclusively by federal authorities.

Nevada’s GCB argues in part that Kalshi’s contracts amount to gambling because the payouts depend solely on the outcome of external events, rather than actions taken by contract participants. "The payouts for picking the winner of a sporting event or an election are not based on the actions of the person entering the 'contract' with Kalshi," the board stated.

New Jersey's letter cites a state constitution provision which says "...wagering shall not be permitted on a college sport or athletic event that takes place in New Jersey or on a sport or athletic event in which any New Jersey college team participates regardless of where the event takes place."

Sports betting regulation traditionally comes under the purview of states; Kalshi admits, in its lawsuit, that "[the regulators'] actions would subject Kalshi to the patchwork of state regulation that Congress created the CFTC to prevent."

However, Kalshi argues in its lawsuits that its platform "...offers consumers the chance to invest in many types of event contracts, including, as relevant here, political-outcome contracts and sports-outcome contracts. These contracts are subject to extensive oversight by the CFTC, and—critically—they are lawful under federal law." (Emphasis in original.)

Kalshi maintains that prediction markets represent an important financial innovation rather than gambling. "Prediction markets are a critical innovation of the 21st century, and like all innovations, they are initially misunderstood. We are proud to be the company that has pioneered this technology and stand ready to defend it once again in a court of law," said Mansour. "We have been targeted before, we have fought before, and we have won before. This time will be no different."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The Cardano price has been on a slow roll lately, falling out of its $0.7 – $0.8 range over the past week. However, a crypto analyst has emerged with a bullish projection, expecting the altcoin to recover in the coming days.

How ADA Price Can Reclaim $0.77

In a video posted on the X platform, popular crypto analyst Ali Martinez shared an exciting analysis of the Cardano price, putting forward a short-term target for the altcoin. According to the online pundit, the ADA token is trading at a critical support level and could be on its way to $0.77 over the next few days.

This bullish projection is based on the formation of a horizontal channel pattern for the ADA price on the 3-hour timeframe. This channel is characterized by two major boundaries with at least four contact points, including two connecting lows and two connecting swing highs.

Typically, the upper boundary where the pivot highs form represents the resistance for the asset’s price while the lower channel trendline acts as the support cushion. A sell signal goes off when the asset’s price hits the top of the horizontal channel, while traders tend to buy when the price is at the channel’s lower boundary.

According to Martinez, the Cardano price has fallen into a horizontal channel since mid-March, trading within the $0.69 – $0.77 range. As shown in the chart below, the price of ADA is hovering around the support cushion (the lower boundary) at the $0.69 level.

Using the earlier logic, the Cardano token seems to be at a perfect buying spot, with the price currently at the channel’s lower trendline. Typically, when the asset’s price is at the bottom of the channel, it tends to bounce back toward the upper trendline.

Martinez noted that if the $0.69 support level holds, the Cardano price could make a bullish run toward the $0.77 mark. This rebound toward the upper boundary would represent an over 12% move from the current price point.

Cardano Price Overview

As of this writing, the price of ADA stands at around $0.685, reflecting an over 2% decline in the past 24 hours. While the altcoin seemed to be recovering nicely early in the week, it has witnessed a deep retracement toward its March lows.

According to data from CoinGecko, the Cardano price is down by nearly 4% in the past week. This sluggish weekly performance underscores the altcoin’s outlook over the past few months, with the ADA token seemingly moving farther away from the psychological $1 level.

XRP’s price has slipped by 4.7% in the past 24 hours, continuing a pattern of high volatility that has defined much of March. Amid this decline, however, some see opportunity, with one popular analyst identifying an interesting reversal pattern that could turn the tide to bullish trajectory.

Inverse Head And Shoulders Pattern Appears On XRP Chart

XRP has extended its decline run from $2.47 into the past 24 hours. Particulary, XRP is currently down by 13.8% in the past three days and now looks like it could easily break below $2.10.

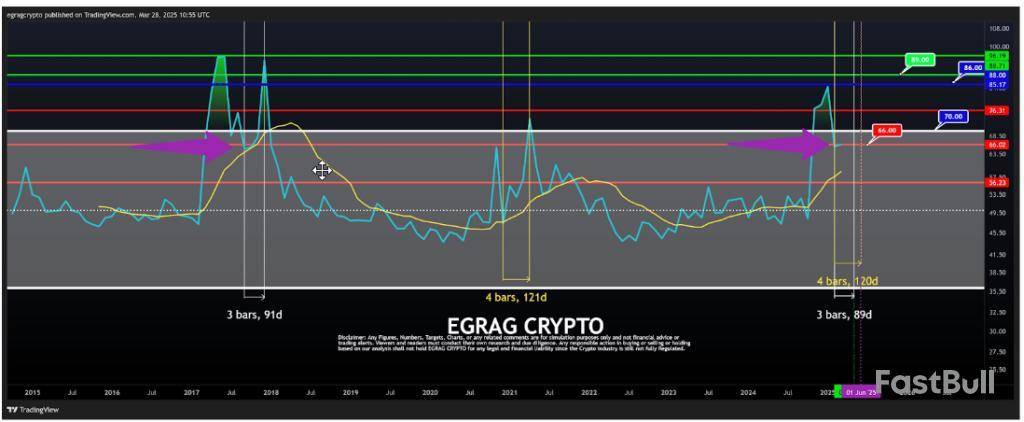

Crypto analyst Egrag Crypto took to social media platform X to highlight what he called a “most probably inverse head and shoulders” pattern currently unfolding on XRP’s daily timeframe. The pattern, which has been developing since early March, is now in the final stages of forming the second shoulder. As such, this phase might still see further short-term downside, as XRP potentially dips again to complete the structure of the second shoulder before a breakout rally.

If confirmed, the inverse head and shoulders would lead to a strong bullish reversal, which is going to be significant given XRP’s recent price retracement. According to Egrag Crypto, the measured move from the completion of this formation could send the price to a price range between $3.7 and $3.9.

Analyst Says XRP Could Reach All-Time High In 90 To 120 Days

The inverse head and shoulder analysis is part of a bullish outlook that suggests that the XRP price can reach a new all-time high within the next 90 to 120 days. This prediction, also made by Egrag Crypto, is based on a recurring pattern observed in XRP’s Relative Strength Index (RSI) across past bull markets.

He pointed out that during the 2017 and 2021 cycles, the RSI indicator on XRP exhibited two distinct peaks, with the second peak coming between 90 to 120 days after the first peak. The second RSI peak in 2017 occurred about 120 days after the first peak. A similar scenario occurred in 2021, although the interval between the first and second RSI highs was shorter at just 90 days. This trend sets the stage for a historic surge that could align with the breakout from the current inverse head and shoulders setup.

So far in this cycle, XRP has already completed its first RSI peak, reaching as high as 85.17 toward the end of 2024. Following that, the RSI has been on a long cooldown phase, dipping to a low of 65. At the time of writing, the RSI sits around 66, and a bounce is expected from here, which is to peak sometime around June.

RSI typically rises with increased market participation, capital inflow, and bullish price movement. If the trend plays out again within the next 90 to 120 days, XRP’s RSI could peak again around June. At the time of writing, XRP is trading at $2.12, down by 4.7% in the past 24 hours.

Featured image from Gemini Imagen, chart from TradingView

Revuto's upcoming app update on April 2 could trigger significant price movements. The introduction of Visa Debit Cards for subscriptions and a Custodial Wallet may create strong demand, making it easier for users to manage and pay for services within the app. Additionally, the REVU Pro update promises enhanced features, further encouraging current and new users to engage with the ecosystem. These upgrades may boost user growth and adoption rates, which are likely to influence REVU's market value positively. To know more about the app update, see the detailed announcement here.

Revuto@get_revutoMar 20, 2025On April 2nd, the #Revuto team will announce the official date of its most significant app update ever, the public launch of @Visa Debit Cards for managing Subscription Payments with Crypto/FIAT, the Custodial Wallet supporting most popular cryptocurrencies including $ADA and… pic.twitter.com/0HQFKPAxJr

The end of the $S to $FTM migration on March 31 might have notable market implications. With no further migration possible after the deadline, $S holders must decide quickly to convert to $FTM, potentially intensifying trading activities. This cut-off could stabilize $S’s market structure while redirecting funds back to $FTM. Such a change could elevate trading volumes for both tokens, possibly impacting prices. Investors might reassess their strategies as the migration closes. For more specifics on the migration deadline, refer to the announcement here.

Sonic Labs@SonicLabsMar 29, 2025After March 31 (2 PM UTC), $S can no longer be migrated back to $FTM. https://t.co/BWWjPX564J

The Supra Community Call scheduled for March 31 could be pivotal for SUPRA's market position. With anticipated announcements regarding product launches and future growth plans, the call may enhance investor confidence. Details on new dApps may signify technological advances and increasing platform utility, potentially attracting developers and users. The synergy from these updates could stir market excitement, leading to bullish sentiment. However, if updates fail to meet expectations, adverse effects on price could follow. More details on the community call can be accessed here.

Supra@SUPRA_LabsMar 29, 2025Supra Community Call incoming! ️

Join @JoshuaTobkin and @JonEvansJones on March 31 at 8pm (HKT) for a big update on all things Supra.

> Supra product launches

> Lineup of dApps launching soon

> Upcoming growth plans

Catch it all live on X and YouTube (link in thread) pic.twitter.com/qVgLiO8CHA

Shiba Inu’s Layer-2 blockchain, Shibarium, is approaching a major milestone, nearing 1 billion total transactions. According to ShibariumScan, the Shibarium network has processed 992,561,156 transactions, leaving only about 8 million more to reach the 1 billion mark.

The recent increase in daily transactions has accelerated Shibarium’s progress toward this landmark. In the last 24 hours alone, transactions surged to 3.84 million, signaling increased network usage and engagement.

Other Shibarium measures are also reporting growth. According to ShibariumScan, total blocks have surpassed 10 million, with the latest count at 10,188,747 and total addresses at 191,626,796.

Shibarium is expected to undergo a variety of advancements, including its expansion into a roll-up hub, allowing developers to deploy custom Layer-3 rollups directly on it.

Shibarium Updates 📢@ShibizensMar 29, 2025Shibarium: Expanding Into a Rollup Hub

🟡 Developers will be able to deploy custom Layer 3 rollups directly on Shibarium

🟡 Each rollup settles its transactions on Shibarium and uses $BONE as gas

🟡 This expands BONE’s role from a utility token to a foundational asset for new… pic.twitter.com/T4pSOoxL0n

Each rollup will settle its transactions on Shibarium and use BONE as gas. This expands BONE’s role from a utility token to a foundational asset for new chains. Shibarium will also function as a data availability layer, storing and reliably serving rollup data. This architecture enables multiple chains to operate in parallel while staying connected.

However, the long-term vision remains a modular, interoperable ecosystem where Shibarium acts as both execution and data backbone.

With momentum growing, all eyes are on Shibarium as it gears up to hit the 1 billion transaction milestone, cementing its position as a key player in the Shiba Inu ecosystem.

SHIB's latest price action

Shiba Inu price reversed course after five days of advances, with the token reaching highs of $0.00001567. However, profit-taking in the market has triggered a pullback, leading to a decline in SHIB’s price.

After its strong upward momentum, Shiba Inu is set to post its third consecutive day of losses, with the price falling to a low of $0.0000125 during Saturday's trading session. This decline highlights increased market volatility and selling pressure as traders capitalize on recent gains.

At the time of writing, SHIB was down 3.61% in the last 24 hours to $0.0000128, wiping out weekly gains, and only up 0.49% in the last seven days.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up