Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

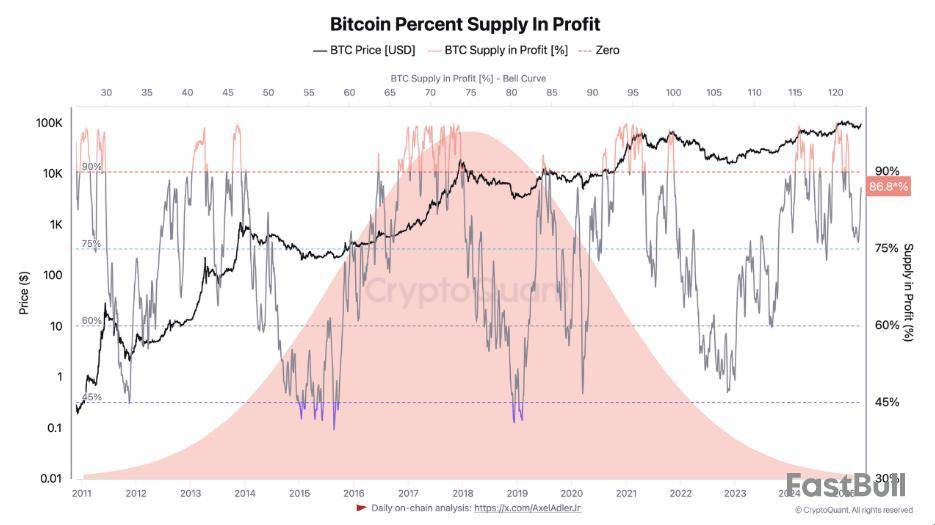

Bitcoin continues to attempt to breach the $95,000 barrier with investors looking out for indicators that it might indeed do so. The digital money has failed to breach the point of resistance at this level since last Friday, market data revealed.

Still, despite this strain, a very impressive 91% of entire supply of Bitcoins are in the black, reflecting what market strategists describe as the “euphoria phase” of market activity.

Profits Soar As Market Rebounds

The strong percentage of profitable Bitcoin holdings is during a recent market recovery, according to data from analytics firm CryptoQuant. Technical expert Darkfost notes that when Bitcoin supply in profit is over 90%, it generally represents the last phase of a bull market.

This phase usually sees large price rises before any correction takes place. During recent price drops, the supply in profit nearly fell to 75%, a level that analysts believe could have triggered widespread selling if breached.

Market Pressure Eases On Holders

The current context provides room to breathe for Bitcoin holders. Since the majority of holdings are in profit, investors are less pressed to offload their coins during times of market uncertainty.

This diminished pressure might assist in sustaining Bitcoin’s price stability near the $95,000 level and gaining steam for future upside potential. As per various experts, this period of diminished selling pressure tends to lead to significant price action in cryptocurrency markets. Analysts Project Possible $250,000 Bitcoin

Some institutions have made some high-profile Bitcoin price predictions. Standard Chartered is predicting that the cryptocurrency will hit $120,000 by the second quarter of 2025.

Other market analysts have predicted higher prices, in the range of $200,000 to $250,000, before the year’s end. These are some of the predictions as Bitcoin traded at $94,900, just below the psychological $95,000 mark that has been challenging to crack. History Indicates Caution Following Euphoria

Although the market mood is positive today, CryptoQuant cautions that history indicates a pattern of corrections after these euphoria periods.

Historical data from past Bitcoin bull cycles suggest that after such periods of high profitability, corresponding massive price declines usually ensued.

In previous cycles, the proportion of Bitcoin supply in profit has dropped to approximately 50% at these times of correction – a characteristic of bear market situations.

The euphoria phase is not permanent, with CryptoQuant CEO Ki Youn Ju intimating such periods usually last from three to 12 months before the corrective action sets in.

The ongoing Bitcoin cycle has witnessed consistent growth over the past few months, driving the percentage of profitable holdings to levels that indicate both opportunity and caution.

As investors observe the $95,000 resistance level, many are asking whether history will repeat itself in another spectacular price spike before an eventual correction.

With 91% of Bitcoin currently in profit, the market is at a critical point that will challenge both bullish forecasts and historical trends in the coming months.

Featured image from Gemini Imagen, chart from TradingView

As May 2025 arrives, all eyes are on Shiba Inu - and one question dominates: could the meme coin be heading for a bounce back?

Historically, May has not exactly been kind to SHIB, as seen by data from CryptoRank. In 2022, it plunged -42.1%. In 2023, a softer decline of 15.4% followed. But 2024 brought a shift: a 13.2% gain, breaking the pattern and resetting expectations.

That is the setup investors are walking into now. SHIB has already dropped 10.9% in January, 26.1% in February and 11.1% in March of 2025. Not a great Q1, confirmed by the quarterly return of -41.4%. But Q2 has started with a modest 6.07% gain in April.CryptoRank">

Where does $0.0000236 come in? That target would require a major recovery, but not an unprecedented one. In March 2024, SHIB spiked 145.2% - one of the largest single-month jumps in meme coin history. That kind of spike, however, does not tend to arrive without a catalyst. Right now, SHIB is lacking a clear one.

On the other hand, if May 2025 mirrors 2024’s trajectory, and SHIB posts another positive month, the target could be within reach - or at least approached. Even more so if June continues the climb, bucking its typical red pattern.

What is different this time? Volatility has compressed, and traders are not jumping as fast. But volume is quietly rising again. SHIB’s previous breakouts - in April 2021 and March 2024 - both came on low-confidence setups that flipped hard.

Still, this is SHIB we are talking about. Timing matters more than fundamentals. If it moves, it moves fast.

Could we see $0.0000236 for Shiba Inu in May? History does not rule it out.

TL;DR

Silence Before the Roar?

Solana’s SOL has been on a slight downtrend in the past week, with its valuation slipping by 3% and currently trading at roughly $148 (per CoinGecko’s data). Over the last several hours, it experienced little to no volatility, ranging from $145 to $149.

One important metric, though, suggests this calmness could be a precursor of a massive price action in the short term. The indicator in question is the Bollinger Bands, which, according to the popular X user Ali Martinez, has squeezed on SOL’s four-hour chart.

Developed by John Bollinger in the 1980s, this technical tool helps traders identify when an asset may be overbought or oversold, signaling a potential trend reversal. When the bands tighten, it typically indicates a period of low volatility, which could be imminently followed by a substantial resurgence or a considerable pullback.

This pattern has also appeared on the charts of other cryptocurrencies and, on some occasions, has been followed by a notable bull run. For example, in December last year, XRP’s Bollinger Bandstightenedsignificantly when the price hovered around $2.10. Just a few weeks later, the assetsoaredto nearly a new all-time high of approximately $3.40.

We have to make a disclaimer that the squeezing bands might have played their role, but the entire cryptocurrency market was also rallying at that time. Bitcoin (BTC), for instance, reached an ATH of just south of $110K.Price Targets

Despite the setback on a weekly scale, SOL is up almost 20% for the month, and some analysts believe the uptick is about to continue.

Jelle told his over 100,000 followers on X that Solana’s monthly candle “is not looking too shabby,” indicating it might be time for another test of $240. The last time the price was trading so high was at the end of January this year.

Earlier this month, BitBull also chipped in. They assumed that SOL could be gearing up for a “massive move” this year, which might mimic Ethereum’s explosive performance in 2021. The analyst thinks the $120-$130 was an accumulation zone, setting a target of over $300.

Recall that Ethereum (ETH) traded at around $730 at the start of 2021, whereas by the end of the year, it hit an ATH of almost $5,000, representing a 560% price increase.

Bill Morgan, a renowned pro-crypto lawyer, has provided crucial insight into the delay in the U.S. Securities and Exchange Commission (SEC) decision on XRP and crypto ETF filings. Notably, the SEC has shifted the decision date on the Franklin Templeton-linked spot XRP exchange-traded fund (ETF) to June 17, 2025.

SEC's timing raises strategic concerns

Morgan, in a post on X, noted that this new date coincides with the deadline for a status report in the SEC v. Ripple appeal case. He suggests that the timing could be odd or potentially strategic.

Jose Cabranes, a New York Circuit judge, had on April 16 ordered that the SEC file a status report on the Ripple lawsuit appeal within 60 days. This sets the deadline to around June 15, two days before it decides on the Franklin Templeton filing.

bill morgan@Belisarius2020Apr 30, 2025Oddly, the delay of the ETF approval to 17 June 2025 is to a date that falls just after the expiry of the 60 day period by which a status report must be filed by the SEC in the SEC v Ripple appeal pursuant to the court order dated 16 April 2025. https://t.co/Rrn0MAHwBv pic.twitter.com/gmVDOSg74H

According to Morgan, this timing might suggest that the regulatory body wants to see how the Ripple appeal unfolds before deciding on the XRP ETF. The SEC is likely buying time before deciding on the pending applications.

Although the SEC has a new pro-crypto chair, Paul Atkins, the community is keen to see how this Ripple lawsuit ends. A favorable ending could provide a precedent and legal clarity to XRP and the broader cryptocurrency industry.

Could Ripple lawsuit outcome shape ETF landscape?

The crypto community and XRP holders, in particular, look forward to having the lawsuit settled. Many believe the lingering appeal is limiting XRP’s potential to grow like its peers. They think that XRP ETF approval will further strengthen adoption, which could impact the price.

For instance, when Brad Garlinghouse, Ripple Labs’ CEO, announced that the SEC would drop its case in March, the market reacted positively. XRP saw its price spike by about 14% to $2.59 as investors flocked to acquire the coin.

As of press time, XRP was changing hands at $2.19, representing a 3.56% decline in the last 24 hours. However, the trading volume has recorded a slight uptick worth 2.10% to $3.04 billion as market participants anticipate a rally.

Sony’s Soneium blockchain and Plume Network said Wednesday they have partnered to allow users to stake real-world assets and earn yield.

"With the integration of SkyLink, Plume’s native interoperability layer that allows real world asset value and yield to be streamed cross-chain in a secure manner, Soneium joins Plume’s RWAfi infrastructure and brings real world assets to the chain," the companies said in a statement. "Soneium users will gain seamless exposure and access to asset-backed yield products such as yield from tokenized U.S. Treasuries and private credit directly from the Plume chain."

Plume, a modular, Ethereum Virtual Machine (EVM)-compatible Layer 2 network, specializes in tokenizing real-world assets. Its testnet has over 18 million wallets, the firm said earlier this month. Sony's blockchain platform launched its mainnet earlier this year.

"We’re excited to partner together with Soneium by Sony Block Solutions Labs to accelerate previously inaccessible yield opportunities for over 5.1 million users in their ecosystem," Plume CEO Chris Yin said in a statement. "The future of RWAfi isn't just about assets living on a single chain, but enabling real yield to flow seamlessly wherever users are."

Soneium also recently partnered with Plume's partner Moca Network "to expand into digital identity, anime like Solo Leveling, and gaming experiences," the statement said.

When Soneium's mainnet debuted in January, the platform said its testnet, launched last August, had over 15 million active wallet addresses and had generated more than 50 million total transactions to date.

Singapore-based Sony Block Solutions Labs is a subsidiary of the multinational conglomerate. Initially, the company said Soneium was focused on addressing issues such as creators’ rights and equitable value distribution between creators and fans.

In February, Soneium launched a collection of music NFTs. Then last month, Sony's blockchain platform said it was working with LINE to integrate the messaging firm's mini-apps into the Soneium ecosystem.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Re7 Capital, a decentralized finance-focused investment firm managing over $600 million in digital assets, has launched a new $10 million venture fund dedicated to SocialFi — the intersection of social media and decentralized finance. The fund aims to back around 30 early-stage startups building in the category.

The launch is notable, given SocialFi's limited traction to date. But Luc de Leyritz, general partner of SocialFi at Re7 Capital, told The Block that it is "the most important category" in crypto investing today — while acknowledging that this is a "non-consensus view." Leyritz joined Re7 Capital last month after leaving Cherry Ventures earlier this year, where he was an investment manager.

At $10 million, the fund size seems modest for a category-focused vehicle. But Leyritz said Re7 Capital is a first-check investor and will typically write $100,000–$300,000 checks at early valuations, allowing it to support 25–30 teams with high conviction and focus, with additional capital reserved for follow-on support.

"A small fund keeps incentives on carry, not fees, forces discipline, and lets us move fast," Leyritz said. "This venture sleeve is a high-conviction scout vehicle, not an AUM [assets under management] vanity play. If the thesis proves out, we'll scale the next vintage."

The fund is anchored by Re7 Capital, with other backers including Lens (a SocialFi platform founded by Aave's Stani Kulechov), Dan Romero (Farcaster co-founder), and existing Re7 Capital limited partners, among others, according to Leyritz.

While the full $10 million fund has not yet been raised, over 60% of the target has already been committed, primarily by Re7's existing limited partners, Leyritz said. He added that a second close is expected in June, and the hard cap may later be "modestly" increased.

Why Re7 Capital is betting on SocialFi now

"The timing is right: infrastructure, talent, and user behavior are finally aligned," Leyritz said. "Many different approaches have emerged."

On the infrastructure front, he highlighted recently launched Lens Chain — a Layer 2 blockchain purpose-built for SocialFi, developed by Avara, the parent company of Aave. "Lens Chain provides an AWS [Amazon Web Services]-style stack — near-zero fees, instant finality, account abstraction, embedded wallets and plug-and-play social/financial primitives — so builders can spin up standalone SocialFi apps with their own brand, economics and UX [user experience] in days, not months," Leyritz said.

He also pointed to Farcaster, noting that its mini-apps, embedded directly into posts through "frames and deep links," transform social interactions into interactive, lightweight experiences. It gives builders a sandbox for experimenting with users inside the core client — similar to Telegram apps, he added.

According to Leyritz, top builders are now entering the SocialFi space, with more than 200 teams actively building. User behavior is also shifting toward attention-based incentive models layered on social platforms, he said, citing the rising popularity of apps like PumpFun, Polymarket, and Kaito.

"At some point, creators notice they can monetize attention directly in new ways that can add to their content rather than subtract from it," he said. "Once the first tier-one creator makes more on-chain than via ads or brand deals, things can snowball fast as they bring their own audiences to these platforms."

He expects to see broader SocialFi adoption within the next 12–24 months.

The new fund will invest in SocialFi startups building across blockchain ecosystems, including projects on Lens Chain and Farcaster.

While Re7 Capital's core expertise remains in liquid and on-chain strategies, it sees SocialFi venture fund as a timely expansion. "For the first time in five years, we see a structural opportunity in early-stage crypto venture — driven by the convergence of attention, composability and capital flows in SocialFi," Leyritz said.

The Funding newsletter: Stay updated on the latest crypto funding news and trends with my free bimonthly newsletter, The Funding. Sign up here!

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Opinion by: Fraser Edwards, co-founder and CEO, Cheqd

Brutal honesty has its place, especially when confronting discomfort, so here’s one that can’t be sweetened with honey: 96% of imported honey in the UK is fake! Tests found that 24 of 25 jars were suspicious or didn’t meet regulatory standards.

Self-sovereign identity (SSI) can fix this.

The UK Food Standards Agency and the European Commission both urge reform to tackle this concern by creating a robust traceability database within supply chain networks to ensure consumer transparency and trust. Data, however, is not the problem. The issue is people tampering with it.

This is not the first time products have been revealed to be inauthentic, with the Honey Authenticity Network highlighting that one-third of all honey products were fake in 2020, a fraudulent industry amounting to 3.4 billion euros ($3.65 million) of counterfeit goods entering the EU in 2023, as reported by the European Commission.

What is EMA, and how does it affect honey?

Economically motivated adulteration (EMA) involves intentionally substituting valuable ingredients for less expensive products such as sweeteners or low-quality oil. This practice leads to severe economic and health complications — and, in some cases, disease — due to the poisonous additives from substitute products.

The adulteration often involves creating an ultra-diluted blend containing minimal nutritional value, and counterfeiters call it… honey.

Fraudsters dilute the product with high fructose corn syrup or increase the thickness with starch or gelatine. These adulterants closely mimic honey’s chemical profile, making it extremely difficult to detect with traditional tests such as isotope ratio mass spectrometry. Fake honey lacks the essential enzymes that give real honey its flavor and nutrients. To make matters worse, honey’s characteristics vary based on nectar sources, the harvest season, geography and more.

Some companies filter out pollen content, a key identifier of a honey’s geographical origin, before exporting it to intermediary countries like Vietnam or India to further obfuscate the process. Once this is done, the products are brought to supermarket shelves and labeled with false certifications to command higher prices. This tactic exploits the fact that many regulatory bodies lack the means to verify every shipment.

The hidden cost of food fraud

The supply chain is profoundly fractured, as a jar of honey passes six to eight key points in the supply chain before it arrives on the shelves in the UK. Current practices make authenticity verification extremely difficult. Coupled with the inefficient paper-based bureaucracy that makes it hard to track origin obscuration attempts in intermediary countries, we cannot reliably determine the true extent of food fraud.

One Food and Drug Administration (FDA) estimate suggests that at least 1% of the global food industry, potentially up to $40 billion per year, is affected — and it could be even higher.

Recent: What is decentralized identity in blockchain?

Fraudulent practices don’t just harm consumers — they destroy beekeepers’ livelihoods, flooding the market and destroying profitability for legitimate traders. Ziya Sahin, a Turkish beekeeper, explained the frustration with food fraud regulation:

“Our beekeepers are angry, and they ask why we’re not doing something to stop it. But we have no authority to inspect,” he said. “I’m not even allowed to ask street sellers whether their honey is real.”

While there’s a growing appetite for more reliable testing and stricter enforcement, solutions are lagging. The EU’s latest attempt to fix this? Digital product passports are designed to track honey’s origins and composition, but they are already being criticized as ineffective and easy to manipulate, ultimately leaving the door open for fraud to continue.

EU passports are an ineffective solution

The European Union’s Digital Product Passport aims to tackle this by enhancing traceability and transparency in its supply chains. By 2030, all goods in the EU must have a digital product passport containing detailed information on the product’s lifecycle, origins and environmental effects.

While the idea sounds promising, it fails to recognize the extent to which fraudsters can forge certificates and obscure origins by passing products through intermediary countries alongside officials who turn a blind eye.

At the core of this issue is trust. Despite history showing that these rules can and will be bent, we rely on governments to implement laws and regulations. Technology, on the other hand, is agnostic and doesn’t care about money or incentives.

This is the fundamental flaw of the EU’s approach — a system built on human oversight that is vulnerable to the corruption these supply chains are already known for.

Self-sovereign identity (SSI) for products

Many people are already aware of the scalability trilemma, but the trust triangle is a key concept in SSI that defines how trust is established between issuers, holders and verifiers. It makes fraud much more challenging because every product must be backed by a verifiable credential from a trusted source to prove it’s real.

Issuers, like manufacturers or certification bodies, create and sign verifiable credentials that attest to a product’s authenticity. The holder, typically the product owner, stores and presents these credentials when required. Verifiers — such as retailers, customs officials or consumers — can check the credentials’ validity without relying on a central authority.

Verifiable credentials are protected by cryptography. If someone tries to sell fake products, their missing or invalid credentials will immediately reveal the fraud.

Government reforms must extend beyond current regulatory oversight and explore the approach outlined in the trust trilemma to safeguard supply chains from widespread adulteration and fraud.

SSI provides the underlying infrastructure necessary to reliably track the identity of products across multiple bodies, standards and regions. By enabling tamper-proof, end-to-end traceability in every single product — whether a jar of honey or a designer handbag — SSI ensures sufficient validators confirm the data is correct to tackle fraud and obfuscation attempts.

SSI also empowers consumers to independently verify products without relying on third-party databases. Buyers can scan the product to authenticate its origin and history directly via the cryptographic certifications confirmed by the validators to further reduce the risk of misinformation even if it reaches the shelves. This would also help reduce corruption and inefficiencies, as many checks are made on paper, which can be easily altered and is a slow process.

As honey fraud methods continue to expand, so do these products’ harm to consumers and local businesses. Steps taken to tackle these methods must thus also broaden. The EU’s Digital Product Passports aim to improve traceability; but unfortunately, they fall short of fraudsters’ sophistication. Implementation of SSI is a necessary step to effectively address the extent fraudsters take to ensure their product arrives on shelves.

Opinion by: Fraser Edwards, co-founder and CEO, Cheqd.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up