Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Japanese yen appreciated toward 144 per dollar on Friday, recouping losses from the previous session as stronger-than-expected economic data reinforced expectations of a more hawkish stance from the Bank of Japan.

Household spending jumped 4.7% year-over-year in May, sharply rebounding from a 0.1% decline in April and beating forecasts for a 1.2% gain.

The increase reflects Tokyo’s intensified efforts to stimulate domestic consumption.

The yen also drew support from a softer US dollar, which weakened as renewed concerns over tariff policy weighed on sentiment.

President Donald Trump announced plans to begin issuing letters on trade matters, potentially setting unilateral tariff rates.

Trump has previously threatened to impose tariffs of up to 35% on Japanese goods, citing dissatisfaction with Japan’s limited purchases of American rice and automobiles.

The Japanese yen traded near 145 per dollar on Friday after falling nearly 1% in the previous session, weighed down by trade-related uncertainties despite Tokyo’s efforts to secure a deal with Washington ahead of next week’s deadline.

US President Donald Trump announced plans to begin sending formal letters on trade tariffs as early as today, potentially signaling new tariff rates or extensions of existing deadlines.

He has previously threatened to raise tariffs on Japanese goods to as much as 35%, citing Japan’s limited imports of American rice and automobiles.

Adding to the yen’s weakness, the US dollar strengthened following a stronger-than-expected June jobs report, which eased recession fears and reduced expectations of imminent rate cuts by the Federal Reserve.

On the domestic front, data showed that household spending in Japan rebounded more than anticipated in May, supported by government measures to stimulate consumption.

The latest Market Talks covering Equities. Published exclusively on Dow Jones Newswires throughout the day.

2013 ET - Japanese stocks are higher in early trade after solid U.S. jobs data boost optimism over the U.S. economic outlook. Bank and electronics stocks are leading the gains. Mizuho Financial Group is up 1.7% and Advantest is 1.8% higher. USD/JPY is at 144.70, up from 143.89 as of Thursday's Tokyo stock market close. Investors are closely watching any developments related to U.S. tariffs as well as domestic policymaking ahead of the upper-house election later this month. The Nikkei Stock Average is up 0.3% at 39920.82. (kosaku.narioka@wsj.com; @kosakunarioka)

1946 ET - Hub24's bull at Bell Potter reckons that consensus forecasts for the Australian wealth platform haven't fully factored in share markets' recent recovery. Analyst Hayden Nicholson points out in a note to clients that all major indexes gained over the June quarter. Reeling off a list of significant moves by global indexes, Nicholson observes with hindsight that the S&P/ASX 200's performance is a strong predictor of Hub24's funds under management. The Australian benchmark index gained 9.5% over the three months through June, he adds. Nicholson raises his fiscal 4Q funds under management assumption by 3%. Bell Potter raises its target price 33% to A$100.00 and keeps a buy rating on the stock. Shares are at A$89.21 ahead of the open. (stuart.condie@wsj.com)

1941 ET - Japanese stocks may rise after solid U.S. jobs data boosts optimism over the U.S. economic outlook. A weaker yen may also support the market. Nikkei futures are up 0.7% at 39975 on the SGX. USD/JPY is at 144.79, up from 143.89 as of Thursday's Tokyo stock market close. Investors are focusing on any developments related to U.S. tariffs as well as domestic policymaking ahead of the upper-house election later this month. The Nikkei Stock Average rose 0.1% to 39785.90 on Thursday. (kosaku.narioka@wsj.com)

1930 ET - Pro Medicus loses its bull at Bell Potter despite confidence that the medical imaging-tech provider will maintain its strong positive momentum. Analyst John Hester tells clients in a note that the Australia-listed company's revenue visibility and earnings growth support his confidence, with one of the two new contracts announced this week ranking as its second largest. However, the stock's recent surge prompts Hester to lower his recommendation to "hold" from "buy." Bell Potter raises its target price 14%, to A$320.00. Shares are at A$307.39 ahead of the open. (stuart.condie@wsj.com)

1923 ET - Domino's Pizza Enterprises' bear at Citi is concerned that the business could suffer if costs are cut too far. Analyst Sam Teeger points out that the fast-food franchiser has already removed A$90 million in costs over the past three years. This raises the risk that further cuts could hit customer experience or the quality of services the company offers its franchisees. Teeger sees sales growth as the best driver of sustainable improvements to franchisee profitability, but notes that Domino's Pizza Enterprises has acknowledged uncertainty over whether this will occur. Citi has a "sell" rating and A$14.20 target price on the stock, which is at A$17.33 ahead of the open. (stuart.condie@wsj.com)

1921 ET - Boss Energy keeps passing milestones on the way to becoming a producer of 3 million lb of uranium/year by the end of this decade, but Jefferies sees its stock as fully priced for now. Jefferies downgrades Boss to "hold," from "buy." "Following a period of sustained sector outperformance and rising uranium prices, we believe Boss's current valuation captures much of the organic growth and improving market backdrop," analyst Daniel Roden says. Boss is well run but the ability of the stock to move much higher appears to be linked more to swings in uranium prices than company catalysts, Jefferies says. Boss shares have roughly doubled in value to A$4.18 since their April low. Jefferies trims its price target by 7.4%, to A$5.00/share. (david.winning@wsj.com; @dwinningWSJ)

1915 ET - Beach Energy could be a winner of the Santos takeover regulatory process, suggests Macquarie. It identifies Santos's operations in the Cooper Basin and the Narrabri gas project as assets that the XRG-Carlyle bid consortium may not want to own long term. As a result, the consortium could sell these assets to Beach, which knows them intimately and can value them comfortably. Beach should be able to raise A$1.5 billion-A$2.0 billion debt for any transaction, Macquarie says. Beach could also commit to developing more gas wholly for the domestic market, Macquarie says. This "could be a win" for shareholders of Santos and Beach, as well as the government. (david.winning@wsj.com; @dwinningWSJ)

1904 ET - Australia's S&P/ASX 200 is shaping for an opening rise after U.S. stocks hit fresh highs following stronger-than-expected jobs data. ASX futures are up by 0.3% ahead of Friday's session, suggesting that the benchmark index also has a shot at a fresh record. The ASX 200 set its highest close Wednesday before edging less than 0.1% lower on Thursday. Ahead of the open, Magellan reported flat institutional outflows for June, with total assets under management rising by A$300 million. In the U.S., the S&P 500 climbed 0.8% and the Nasdaq Composite added 1.0% as both closed at records. The Dow Jones Industrial Average gained 0.8%. (stuart.condie@wsj.com)

1859 ET - The global uranium market is about to enter a lull, says Jefferies. Uranium demand remains structurally strong, and sentiment in the sector continues to improve, analyst Daniel Roden says. Still, Jefferies expects the market to seasonally soften over the next few months as utilities in the Northern Hemisphere buy less over their summer. It forecasts a 3Q uranium price of US$72.5/lb. "Transaction volumes typically decline in this period," Jefferies says. It expects a more robust market from September. "The persistence of firm term prices throughout the current dip reinforces the tightness in forward supply and underpins our constructive outlook for uranium into late 2025," says Jefferies. (david.winning@wsj.com; @dwinningWSJ)

1858 ET - Value is starting to emerge in ASX-listed diversified miners, says UBS. Still, iron ore and copper prices are a near-term worry. UBS raises estimates for the iron ore price in 2025 and 2026 by 4% and 6% to US$97/ton and US$90/ton, respectively. But it expects the start up of the new Simandou iron-ore mine in Guinea to put pressure on prices, driving them some US$10/ton lower in 2026. "On copper, we are cautious near-term on potential U.S. S232 investigation of copper import tariffs to weigh on LME pricing in the short term," analyst Lachlan Shaw says. It prefers BHP to Rio Tinto, given the latter's exposure to Mongolia and Guinea and geopolitical risk in both of those countries. (david.winning@wsj.com; @dwinningWSJ)

1856 ET - Paladin Energy gets a new bull in Jefferies as production from the Langer Heinrich uranium mine in Namibia recovers rapidly. Lower-than-expected feed grades from stockpiled ore and water supply issues led Paladin to cut FY 2025 guidance to 3.0 million-3.6 million lb in late 2024. The operation was then hit by wet weather. Now, Jefferies thinks Paladin could produce 975,000 lb of U3O8, a common compound of uranium, in 4Q. That is 27% above consensus hopes. "Following a period of sector underperformance, we see improved production recovery and ramp-up could lift consensus earnings outlook, and see a mean reversion in sector share price performance," analyst Daniel Roden says. Jefferies upgrades Paladin to "buy," from "hold." (david.winning@wsj.com; @dwinningWSJ)

1811 ET - In late 2012 Jones Soda lost its Nasdaq listing, but not its enthusiasm for creative beverages. Now on the OTCQB and the Canadian Securities Exchange, it filed for a stock offering and plans to return to Nasdaq. Even its proposed stock symbol hints at its non-soda evolution, as it looks to switch to JBEV from JSDA. The filing discusses growth plans for the modern soda category including Pop Jones and Fiesta Jones, and alternative adult beverages Mary Jones and Spiked Jones, which contains alcohol. The company recently sold its cannabis beverage business, but retains hemp-derived THC products that include Mary Jones sodas, shooters and gummies. Even as it pursued edgier drinks, Jones hasn't forgotten its family-friendly offerings. Even as it pursued edgier drinks, Jones hasn't forgotten its family-friendly offerings, such as last year's limited-edition S'mores-flavored soda that combined, "the taste of melted chocolate, gooey marshmallows and crisp graham crackers." (josh.beckerman@wsj.com)

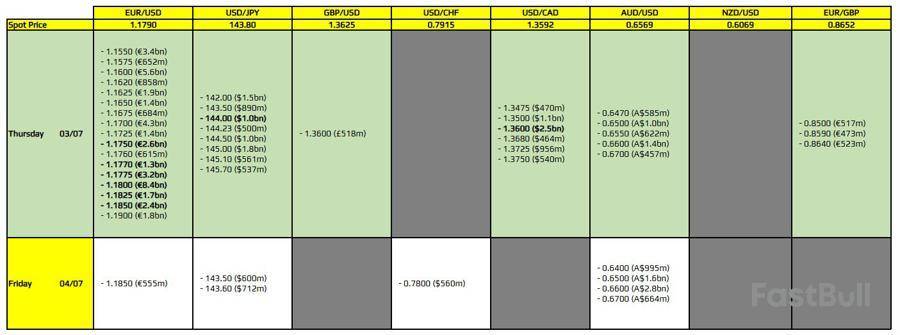

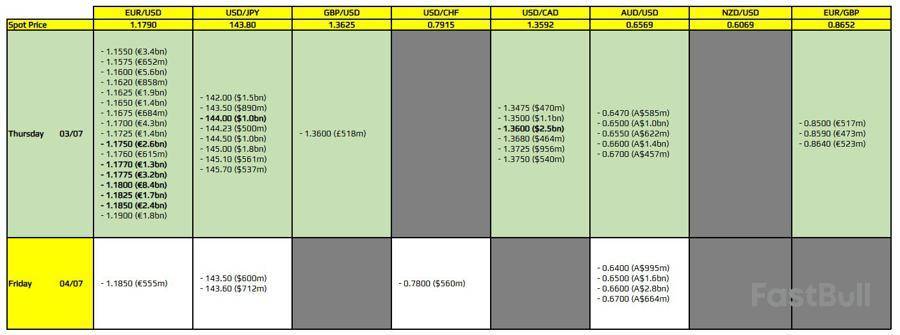

There are a couple to take note of on the day, as highlighted in bold.

With it being the final trading day of the week of sorts, since we do have a US holiday tomorrow, there are some large expiries to be wary of coinciding with the US jobs report release as well.

The first ones are for EUR/USD lumped around 1.1750 through to 1.1850. However, the massive one at 1.1800 is the most notable as warned yesterday. That is still putting a magnet on price action and will likely do so until we get to the non-farm payrolls data later in the day.

Then, there is one for USD/JPY at the 144.00 level. It's not the biggest of expiries but could well just keep a lid on price action alongside the 100-hour moving average at 143.95 currently.

And finally, there's one for USD/CAD at the 1.3600 level. The expiries here should help to keep price action more muted in European trading until we get to the US jobs report before dollar sentiment takes over.

As for tomorrow, the expiries board is relatively thin considering that broader markets are going to settle down a bit with US will be out until next week.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at www.forexlive.com.

There are a couple to take note of on the day, as highlighted in bold.

With it being the final trading day of the week of sorts, since we do have a US holiday tomorrow, there are some large expiries to be wary of coinciding with the US jobs report release as well.

The first ones are for EUR/USD lumped around 1.1750 through to 1.1850. However, the massive one at 1.1800 is the most notable as warned yesterday. That is still putting a magnet on price action and will likely do so until we get to the non-farm payrolls data later in the day.

Then, there is one for USD/JPY at the 144.00 level. It's not the biggest of expiries but could well just keep a lid on price action alongside the 100-hour moving average at 143.95 currently.

And finally, there's one for USD/CAD at the 1.3600 level. The expiries here should help to keep price action more muted in European trading until we get to the US jobs report before dollar sentiment takes over.

As for tomorrow, the expiries board is relatively thin considering that broader markets are going to settle down a bit with US will be out until next week.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at investinglive.com.

The Japanese yen stabilized around 143.7 per dollar on Thursday after facing some pressure in the previous session, as optimism over trade developments and a softer US dollar supported sentiment.

Japanese officials reaffirmed their commitment to pursuing a “win-win” trade agreement with Washington, although they provided no details on potential concessions.

President Donald Trump increased pressure on Tokyo, describing the negotiations as “really hard” and threatening tariffs of up to 35% on Japanese imports, citing dissatisfaction with Japan’s limited purchases of American rice and automobiles.

Adding to the positive tone, the US finalized a trade deal with Vietnam that includes a 20% tariff on imports, boosting hopes for further trade breakthroughs.

The yen also benefited from broad-based dollar weakness as investors looked ahead to the June US jobs report, which could strengthen the case for a Federal Reserve rate cut as early as July.

USD/JPY remains in a bearish trend, based on the daily chart, says Fawad Razaqzada, market analyst at City Index and FOREX.com, in an email. The currency pair is still below its key moving averages including the 50- or 200-day, the analyst says. With a short-term bullish trend line also broken earlier this week, this has added "another layer of bearish flavor to the mix," the analyst says. However, support at the 142.80-142.00 area has to give way now for the bearish trend to gather momentum. Resistance is now pegged at around 144.00, the analyst adds. USD/JPY is 0.1% lower at 143.56. (ronnie.harui@wsj.com)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up