Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After a somewhat sluggish start to 2025, the Bitcoin price has begun to impress in the year’s second quarter. The premier cryptocurrency reclaimed the $100,000 mark earlier this week and seems to be making a play for its all-time high price at $108,786 over this weekend.

The price of BTC appears to have flipped the switch in the market, with investors feeling that the world’s largest crypto market is back to where it was at the end of 2024. According to a popular crypto expert, the sell-side pressure experienced in the first few months of the year is all part of a broader price breakout.

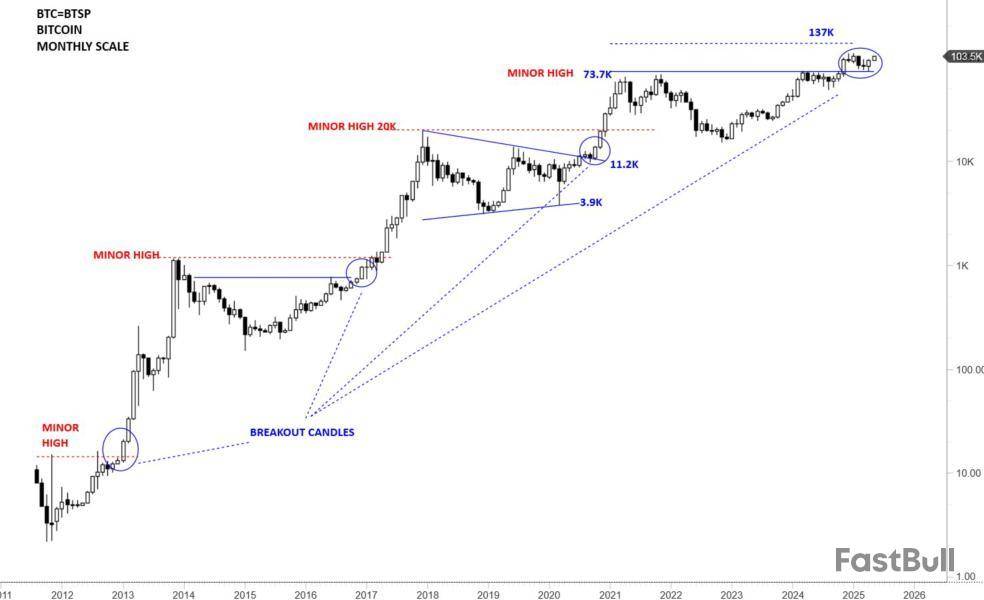

Is BTC Following This Cup And Handle Pattern?

In a May 9 post on X, chartered market technician (CMT) Aksel Kibar shared an interesting update on his recent Bitcoin price analysis. The market expert revealed, in a late November 2024 post on the social media platform, a long-term breakout signal for the BTC price.

Following the election victory of Donald Trump as United States President, the Bitcoin and crypto markets witnessed a significant amount of bullish momentum. Kibar highlighted that BTC, as a result of the post-election rally, was breaking above a significant price level on a large (monthly) timeframe.

As shown in the chart above, the Bitcoin price broke above its “minor high” around the former all-time high of $73,737 in November. Based on historical patterns, Kibar highlighted in his chart that the flagship cryptocurrency goes on a parabolic run whenever it surpasses the minor high in the cycle.

Interestingly, this November 2024 breakout has formed a cup and handle pattern, a technical analysis pattern that resembles a cup in the shape of the letter “u,” and the handle has a slight downward drift. The cup and handle is considered a bullish pattern, which signals the continuation of an upward trend.

In this particular iteration of this pattern, the price of BTC continued to rally after breaking the $73.737 till it reached a six-figure valuation. However, the Bitcoin price witnessed a severe correction to around $74,000 after reaching its current all-time high in January.

However, it appears that Bitcoin only witnessed a minor pullback to the “minor high” before resuming its primary upward trend. In this scenario, Kibar put the cup and handle target for the market leader at around $137,000, which represents an over 33% rally from the current price point.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $103,071, reflecting a nearly 1% increase in the past 24 hours. According to data from CoinGecko, the market leader is up by more than 6% on the weekly timeframe.

Official Trump (TRUMP) will make an announcement about the 'next Era' of the project on May 22 in Washington D.C. Announcements like this can create big price changes, especially if they include important news or partnerships. If the news is positive, more people may buy TRUMP and the price could rise fast. But if the news is not clear or below what people hoped, traders may sell. Right now, there is excitement, but the true effect will depend on what is shared at the event. source

TrumpMeme@GetTrumpMemesMay 09, 2025The next Era of $TRUMP will be announced on the Day of the Dinner, on May 22, in Washington D.C. Thank You!

Cute Asian Girl (CAG) NFT will launch on the Ronin Launchpad. NFT minting events often bring excitement and fast trading as people want to buy early. If demand is high, the floor price of CAG NFTs could rise after mint. Since Ronin has a strong gaming and NFT community, CAG may get good support. But if interest falls short or there are too many NFTs, prices might not go up much. The next days after mint are key for seeing the real impact on price. source

Cute Asian Girl $CAG@thetickeriscagMay 09, 2025THE DAY HAS FINALLY COME

No more wen, no more soon — it’s REAL.

CAG NFT IS HERE

May 16 on Ronin Launchpad

You’ll finally be able to mint your CAG NFT — a historic, beautiful collectible you don’t want to miss.

From a total supply of 3,333 NFTs, only 33 iconic… pic.twitter.com/PGyCZ0YKca

Shardeum (SHM) will list on Bitfinex with SHM/USD and SHM/USDT pairs. A big exchange listing can bring new buyers and better trading volume. Many traders watch for these events, so SHM might become more popular and the price could rise when trading starts. Sometimes the price jumps before the listing as people get excited, but there can also be a quick drop after if early buyers sell. This listing is a good chance for SHM to gain attention and liquidity, but price moves depend on market interest. source

Bitfinex@bitfinexMay 09, 2025$SHM is joining Bitfinex!

Say hello to @shardeum - the future-ready smart contract platform that’s breaking boundaries in scalability, decentralisation, and affordability.

Find out more about SHM token on Bitfinex:https://t.co/oIMphk63Jf pic.twitter.com/OIGFOZkIQt

The government of El Salvador continues stacking Bitcoin for its national crypto reserve, despite an ongoing deal with the International Monetary Fund (IMF) stipulating that the Central American country stop using public funds to purchase Bitcoin as one of the conditions for a loan agreement.

According to data from the El Salvador Bitcoin Office, the country acquired an additional seven BTC in the last seven days, bringing its total holdings to 6,173 BTC, valued at over $637 million.

El Salvador's Bitcoin Office has continued its steady pace of Bitcoin acquisitions months after the IMF agreement was signed and shows no sign of halting its Bitcoin purchases.

The Central American country is one of the only nations actively purchasing Bitcoin in open market operations, and its national Bitcoin treasury strategy will serve as a blueprint for other countries also considering Bitcoin strategic reserves, according to crypto industry executives.

El Salvador remains defiant against IMF pressure

El Salvador signed a $1.4 billion loan agreement with the IMF in December 2024. As part of that agreement, the government of the country agreed to rescind its Bitcoin legal tender law and make Bitcoin payments voluntary.

The agreement also stipulated that El Salvador must scale back its Bitcoin accumulation, refraining from using public funds to finance Bitcoin purchases.

Additionally, the deal required the government privatize the Chivo Wallet, which was publicly funded but saw little use among residents.

In January 2025, lawmakers in the Central American country repealed the Bitcoin legal tender law in a 55-2 Congressional vote, although this did nothing to pause or slow Bitcoin acquisitions.

The IMF issued another request to the country to halt Bitcoin buys in March 2025, reiterating the original terms of the agreement. However, El Salvador's President Nayib Bukele pushed back against the requests.

Bukele emphasized that the country would not stop its Bitcoin purchases or slow down its accumulation of BTC in the face of mounting pressure from the supranational financial institution.

"No, it’s not stopping. If it didn’t stop when the world ostracized us and most 'Bitcoiners' abandoned us, it won’t stop now, and it won’t stop in the future," Bukele wrote in a March 4 X post.

Ethereum prices have surged by over 19% in the past day, reaching almost $2,500 as a general crypto market resurgence continues. Amidst investors’ euphoria, prominent crypto analyst and OKC Partner Ted Pillows has tipped the prominent altcoin to sustain its bullish form, reaching a market price of $12,000 in 2025.

Institutional Adoption, DeFi Status To Drive Ethereum Market, Among Others

In an X post on May 9, Ted Pillows provided some valuable insights into the bullish potential of the Ethereum market. The angel investor and KOL stated there are five reasons ETH investors should be expecting profits of about 600% before 2025 runs out.

Firstly, Pillows has hinted that Ethereum is likely to experience the highest level of institutional adoption among altcoins. Amidst a pro-crypto US government and the growing chances of a digital asset regulatory framework, institutional investors are likely to start diversifying their capital to other cryptocurrencies aside from Bitcoin.

As seen with the spot exchange-traded funds (ETFs), Ethereum ranks high ahead of other altcoins for portfolio additions, considering its position as the second-largest cryptocurrency with a 7.24% market share, and an extensive smart contract application. In particular, Ted Pillows emphasizes Ethereum’s dominance in smart contract programmability as another reason for investors to be highly bullish.

According to DefiLlama, the Ethereum blockchain currently holds 80.17% of RWA, 51.01% of circulating stablecoins, and 53.29% of total value locked (TVL) in DeFi, indicating much potential for network adoption and price growth amidst a crypto bull market.

Another possible market trigger highlighted by Ted Pillows centers on the potential introduction of Ethereum ETF staking. Deadlines for the SEC’s decision on the proposed staking option lie in late May & late August. However, Bloomberg analyst James Seyfart has indicated there is much potential for the Commission to wait till the final deadline in October, as seen with the ETH options trading.

The introduction of staking is likely to drive inflows into the Ethereum ETFs as it provides an additional means of income for investors. Staking would allow ETFs custodians to lock up ETH on the Ethereum network to serve as a validator for a defined period and earn a commission in return.

Token Burn Post-Pectra Upgrade Signals Good Times Ahead

Among other potential bullish drivers, Ted Pillows also points to the high level of ETH Burn following the launch of the Pectra network upgrade on May 7. A high burn rate indicates rising scarcity, which is always good for the market price appreciation.

Finally, Ted Pillows hints at the growing potential of a risk-on environment later in 2025 as the US Federal Reserve is expected to cut interest rates and begin quantitative easing, which would encourage investments in volatile assets such as cryptocurrencies.

At press time, Ethereum continues to trade at $2,334 following a slight market retracement in the last few hours. Notably, the asset’s trading volume is up by 62.81% and valued at $49.85 billion.

Related Reading: Sovereigns Are Buying Billions Of Bitcoin, Says Anthony Scaramucci

Top Stories of The Week

Mashinskys 12-year sentence sets tone of enforcement in Trump era

The US federal court for the Southern District of New York has sentenced former Celsius CEO Alex Mashinsky to 12 years in prison for fraud.

Mashinskys legal team sought a light sentence. They highlighted his spotless record before the Celsius incident, along with his military service and willingness to plead guilty. But US prosecutors were less inclined to leniency, suggesting on April 28 that the judge deliver a 20-year sentence for his actions.

Betting markets predicted a light sentence ahead of the May 8 hearing. Polymarket showed only 11% odds for a 20-year sentence or higher.

US VP Vance to speak at Bitcoin conference amid Trump crypto controversies

US Vice President JD Vance will speak at the Bitcoin 2025 conference in Las Vegas, roughly a year after then-presidential candidate Donald Trump spoke at the same event.

According to a May 9 notice from the events organizers, Vance will address conference attendees in person on May 28, making him the first sitting US vice president to speak at a digital asset conference.

Trump provided a pre-recorded video of himself from the White House to the organizers of the Digital Asset Summit in March his first appearance at a crypto event since taking office in January and spoke in person at the Bitcoin 2024 conference in Nashville while campaigning.

Former FTX exec’s wife says gov’t induced a guilty plea

Michelle Bond, the wife of former FTX Digital Markets co-CEO Ryan Salame, who faces federal campaign finance charges, is pushing for dismissal on the grounds that US prosecutors deceived her husband in a plea deal.

In a May 7 filing in the US District Court for the Southern District of New York, Bonds lawyers reiterated some of the claims Salame made in opposing his plea deal with the government, which ultimately still led to him serving time in prison. She claimed that prosecutors obtained a deal with Salame through stealth and deception by allegedly agreeing they would not file charges against Bond.

Mr. Salame and Ms. Bonds attorneys were advised that the agreement to cease investigating Ms. Bond could not be placed within the four corners of the Salame plea or other written agreement, but the government still offered it as an inducement to induce the plea, said the filing.

Zerebro devs death in question as proof surfaces on X

Members of the crypto community are circulating apparent proof that Zerebro developer Jeffy Yu faked his suicide as he promoted his new memecoin during a Pump.fun livestream on May 4.

The belief appears to come from an unverified private letter supposedly sent by Yu to a Zerebro investor, trading activity linked to crypto wallets owned by Yu, and the removal of his obituary from Legacy.com.

Others speculate that Yu used a tool to pass off a pre-edited video as if it were filmed in real-time during the Pump.fun live stream.

The unverified letter from Yu to an early investor states that he deliberately created a livestream pretending to shoot himself as it was the only viable exit from persistent harassment, blackmail, threats and hate crimes.

North Korean spy slips up, reveals ties in fake job interview

For months, Cointelegraph took part in an investigation centered around a suspected North Korean operative that uncovered a cluster of threat actors attempting to score freelancing gigs in the cryptocurrency industry.

Read also Features Why are crypto fans obsessed with micronations and seasteading? Features Tornado Cash 2.0: The race to build safe and legal coin mixersThe investigation was led by Heiner Garcia, a cyber threat intelligence expert at Telefnica and a blockchain security researcher. Garcia uncovered how North Korean operatives secured freelance work online even without using a VPN.

Garcias analysis linked the applicant to a network of GitHub accounts and fake Japanese identities believed to be associated with North Korean operations. In February, Garcia invited Cointelegraph to take part in a dummy job interview he had set up with a suspected Democratic Peoples Republic of Korea operative who called himself Motoki.

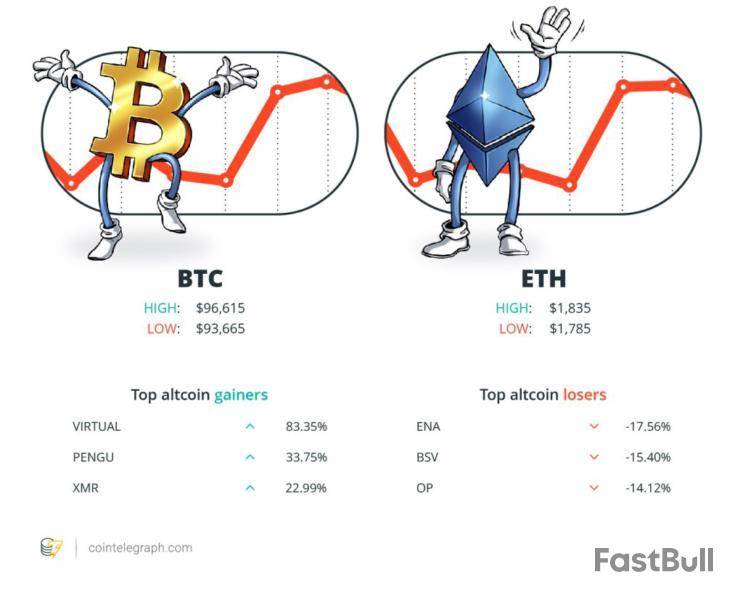

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $103,024, Ether (ETH) at $2,338 and XRP at $2.35. The total market cap is at $3.26 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Pepe (PEPE) at 46.63%, dogwifhat (WIF) at 27.96% and Ether (ETH) at 27.723%.

The top three altcoin losers of the week are Kaia (KAIA) at 2.26%, UNUS SED LEO (LEO) at 1.63% and XDC Network (XDC) at +0.41%. For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

But today, people are more comfortable to borrow against Bitcoin because were nowhere near the levels that would trigger liquidation.

Seamus Rocca, CEO of Xapo Bank

I feel the team is doing well and doesn’t need me back.

Changpeng CZ Zhao, former CEO of Binance

We see potential for BNB to serve as a form of benchmark, or average, for digital asset prices more broadly.

Geoff Kendrick, analyst at Standard Chartered

AI could soon challenge the traditional dominance of DeFi and Gaming, signaling a new era in the DApp landscape.

Sara Gherghelas, blockchain analyst at DappRadar

We do not yet see convincing signs that Solana would be the preferred choice as Ethereums security, stability and longevity are highly prized.

Sygnum

It kind of feels weird. […] Normally in the press, Bitcoin mining is destroying the environment. Its being used by money launderers. [] And instead, you’ve got the president encouraging Bitcoin.

Dan Held, Bitcoin OG and entrepreneur

Prediction of The Week

Is Bitcoin about to go parabolic? BTC price targets include $160K next

Bitcoin is attracting parabolic price targets as bulls continue to hold six figures on May 9. Data from Cointelegraph Markets Pro and TradingView shows barely any consolidation taking place on over the past 24 hours.

Reacting, market participants have begun to restore their faith in the broader Bitcoin bull market.

November 2024 monthly candle was the breakout signal on long-term charts, popular economist Aksel Kibar told X followers in his latest post.

An accompanying chart compares November 2024 to similar breakout events in the past, with Kibar reiterating his existing $137,000 target.

Trader and analyst Matthew Hyland joined those forecasting new all-time highs in Q2 in his latest video update.

$160,000 or other crazy numbers, he said, could come into play if bulls stay in control and a key leading indicator, the relative strength index, supports further upside.

FUD of The Week

60K Bitcoin addresses leaked as LockBit ransomware gang gets hacked

Almost 60,000 Bitcoin addresses tied to LockBits ransomware infrastructure were leaked after hackers breached the groups dark web affiliate panel.

The leak included a MySQL database dump shared publicly online. It contained crypto-related information that could help blockchain analysts trace the groups illicit financial flows.

Ransomware is a type of malware used by malicious actors. It locks its targets files or computer systems, making them inaccessible. The attackers typically demand a ransom payment, often in digital assets like Bitcoin, in exchange for a decryption key to unlock the files.

$45 million stolen from Coinbase users in the last week ZachXBT

Pseudonymous onchain sleuth and security analyst ZachXBT claims to have identified an additional $45 million in funds stolen from Coinbase users through social engineering scams in the past seven days alone.

Read also Features Real AI use cases in crypto: Crypto-based AI markets, and AI financial analysis Features Thailands crypto islands: Working in paradise, Part 1According to the onchain detective, the $45 million figure represents the latest financial losses in a string of social engineering scams targeting Coinbase users, which ZachXBT said is a problem unique among crypto exchanges:

Over the past few months, I have reported on nine figures stolen from Coinbase users via similar social engineering scams. Interestingly, no other major exchange has the same problem.

Voltage Finance exploiter moves $182K in ETH to Tornado Cash

A hacker involved in the $4.67 million exploit of the decentralized finance lending protocol Voltage Finance in 2022 has moved some of the stolen Ether to Tornado Cash after a short hibernation.

Blockchain security firm CertiK said in a May 6 post to X that the 100 Ether, worth $182,783 at current prices, was moved from a different address initially used in the exploit but can be traced back to the hacker.

In March 2022, the exploiter took advantage of a built-in callback function in the ERC677 token standard and allowed them to drain the platforms lending pool through a reentrancy attack, according to CertiK.

Top Magazine Stories of The Week

Adam Back says Bitcoin price cycle 10x bigger but will still decisively break above $100K

Adam Back says asking him if he’s Satoshi isn’t “crazy speculation,” and that he has “empathy” for those who buy Bitcoin via the ETFs.

Finally blast into space with Justin Sun, Vietnams new national blockchain: Asia Express

Justin Sun the astronaut, Vietnamese TradiFi firms launch national blockchain, Korean crypto exchanges delay withdrawals due to scammers and more.

ChatGPT a schizophrenia-seeking missile, AI scientists prep for 50% deaths: AI Eye

Mentally ill users might be accidentally jailbreaking ChatGPT into reinforcing their delusions. Enkrypt uncovers new LLM exploit embedded into images.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up