Investing.com – Indonesia stocks were lower after the close on Monday, as losses in the Infrastructure, Financials and Agriculture sectors led shares lower.

At the close in Jakarta, the IDX Composite Index lost 0.84%.

The best performers of the session on the IDX Composite Index were Cipta Sarana Medika Tbk PT (JK:DKHH), which rose 34.83% or 31.00 points to trade at 120.00 at the close. Meanwhile, Mnc Sky Vision Tbk (JK:MSKY) added 29.07% or 25.00 points to end at 111.00 and Soho Global Health Tbk Pt (JK:SOHO) was up 24.85% or 410.00 points to 2,060.00 in late trade.

The worst performers of the session were PT Solusi Kemasan Digital Tbk (JK:PACK), which fell 91.71% or 3,008.00 points to trade at 272.00 at the close. Aviana Sinar Abadi PT Tbk (JK:IRSX) declined 14.81% or 100.00 points to end at 575.00 and Habco Trans Maritima Tbk PT (JK:HATM) was down 14.68% or 64.00 points to 372.00.

Falling stocks outnumbered advancing ones on the Jakarta Stock Exchange by 473 to 270 and 109 ended unchanged.

Shares in PT Solusi Kemasan Digital Tbk (JK:PACK) fell to 52-week lows; falling 91.71% or 3,008.00 to 272.00. Shares in Mnc Sky Vision Tbk (JK:MSKY) rose to 52-week highs; rising 29.07% or 25.00 to 111.00. Shares in Soho Global Health Tbk Pt (JK:SOHO) rose to all time highs; gaining 24.85% or 410.00 to 2,060.00.

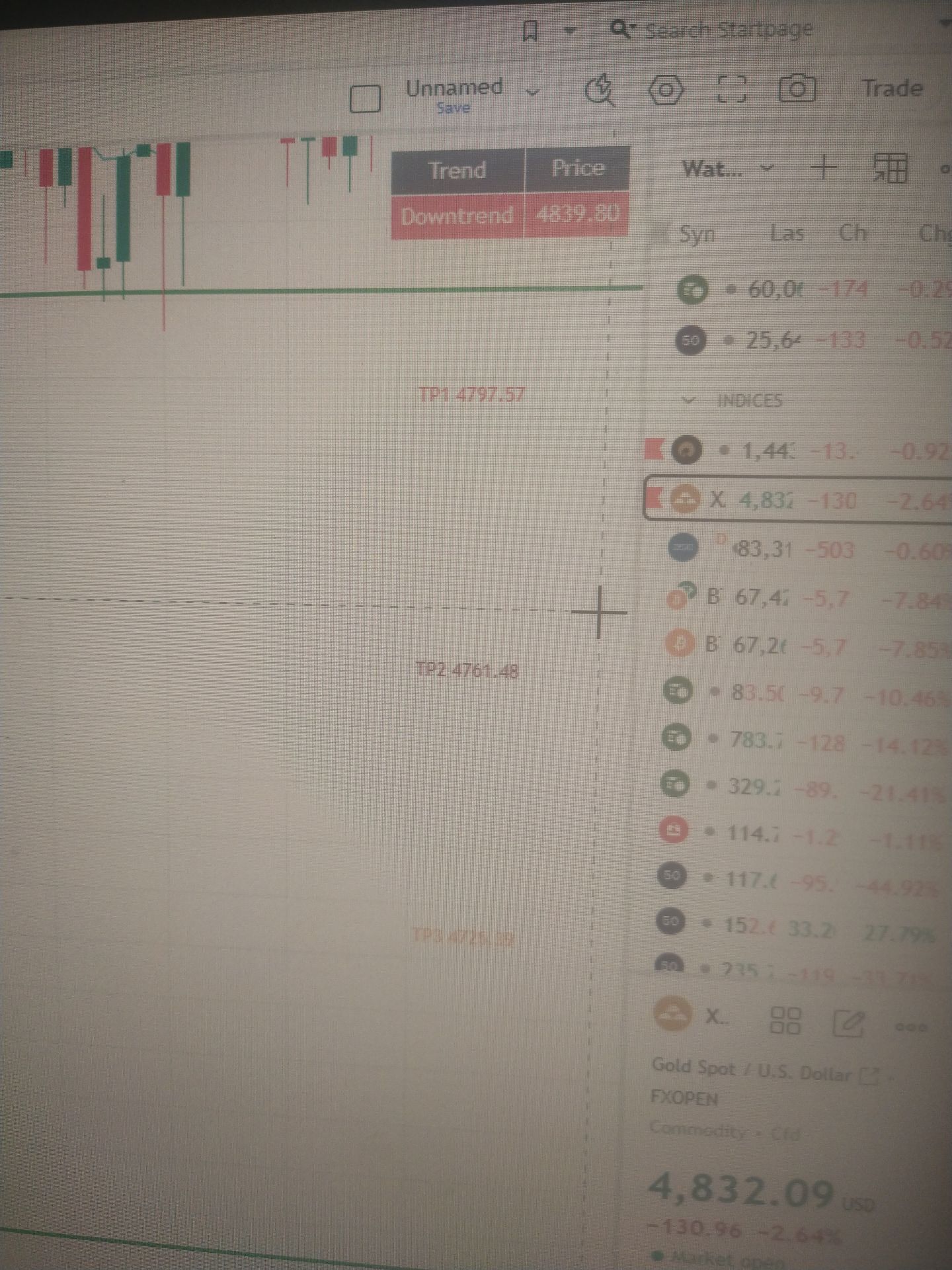

Crude oil for March delivery was up 0.05% or 0.03 to $58.97 a barrel. Elsewhere in commodities trading, Brent oil for delivery in March fell 0.22% or 0.14 to hit $63.20 a barrel, while the February Gold Futures contract rose 2.07% or 92.96 to trade at $4,593.86 a troy ounce.

USD/IDR was up 0.25% to 16,823.30, while AUD/IDR rose 0.46% to 11,282.84.

The US Dollar Index Futures was down 0.33% at 98.57.