Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

21Shares, a Switzerland-based asset manager and issuer of crypto exchange-traded products (ETPs), has listed the Hyperliquid ETP on the SIX Swiss Exchange. The product gives investors exposure to the Hyperliquid token without the need for wallets or onchain custody.

In a Friday announcement, the company described Hyperliquid as one of the major venues for decentralized derivatives, claiming it processes more than $8 billion in daily volume, with $2 trillion in trades since its 2023 launch, and roughly 80% of the total decentralized perpetuals activity.

The listing, which marks the first institutional-grade product offering exposure to the Hyperliquid protocol, comes just days after Hyperliquid’s token (HYPE) hit a record high of $50.99.

Mandy Chiu, the head of financial product development at 21Shares, said Hyperliquid’s “growth has been nothing short of extraordinary, and the underlying economics are among the most compelling we’ve seen in the space.”

Founded in 2018, 21Shares has a track record of launching regulated crypto products, including the first physically backed crypto ETP. It offers spot Bitcoin and Ether exchange traded funds (ETFs) in the US, alongside a suite of crypto ETPs in Europe ranging from single-asset products like Solana (SOL) and Dogecoin (DOGE) to diversified baskets and staking-focused funds.

The rise of Hyperliquid

Hyperliquid, launched in late 2022, is a layer-1 blockchain with a decentralized exchange for perpetual futures. Unlike most DeFi platforms that use automated market makers, it runs a traditional onchain order book that matches buy and sell orders directly, clearing trades in under a second without outside oracles or off-chain infrastructure.

Users connect via wallets to place spot or perpetual orders, which settle natively onchain. Trading fees are funneled into daily buybacks of the HYPE token, the protocol’s native asset.

That model has fueled rapid growth, with Hyperliquid setting records in trading volume, revenue and user activity over the past few months.

In July, the exchange processed $319 billion in trades, the highest monthly volume ever for a DeFi perpetuals platform, helping push total decentralized perp volume to nearly $487 billion, per DefiLlama. It also captured 35% of all blockchain revenue that month, a share analysts at VanEck said came at the expense of Solana, Ethereum and BNB Chain.

The platform emerged as the seventh-largest derivatives exchange overall by daily activity, surpassing 600,000 registered users in July. While a 37-minute outage on July 29 temporarily sidelined traders, Hyperliquid reimbursed $2 million in losses, drawing praise from its community for the quick response.

However, concerns about Hyperliquid’s market integrity emerged on Wednesday, when four large traders pocketed nearly $48 million in suspected manipulation of Plasma’s XPL token. The token briefly spiked 200% to $1.80 before smaller traders absorbed large losses.

Still, optimism around the protocol’s long-term trajectory continues to build. Speaking at the WebX 2025 conference in Tokyo, BitMEX co-founder Arthur Hayes, known for his bold and sometimes controversial market calls, told an audience he expects the platform’s native token to rise 126-fold over the next three years, citing the expansion of stablecoins and the exchange’s surging fee revenue.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs — Inside story

The current crypto market cycle has shown signs of slowing for the past week or so, with BTC losing roughly $15,000 since its peak.

Despite this, experts anticipate a major rally in fall 2025.Record-Breaking Peak This Fall

Upon analyzing Bitcoin’s long-term holding trends, measured by the percentage held for over a year based on realized market cap, CryptoQuant found that past cycles (phase 1 and 2) experienced sharp surges, which led to pronounced peaks.

On the other hand, the current Phase 3 displays a gradually flattening uptrend and a lengthening cycle. Major factors behind this pattern are the introduction of spot ETFs, growing institutional adoption, and even nation-level engagement with Bitcoin.

An important feature of this cycle is that inflows into altcoins often coincide with pauses in overall market momentum, which has been observed repeatedly. Unlike 2023-2024, when Bitcoin dominated market attention, capital is increasingly shifting toward altcoins, as broader diversification continued.

Looking ahead, a rate cut expected in September, alongside potential approval of spot ETFs for altcoins in October, points to a favorable environment for renewed growth. From a cycle perspective, the current consolidation phase may be a precursor to a stronger uptrend in late 2025.

In fact, CryptoQuant believes that investors could view any additional corrections during this period as potential entry points.Late 2025 Crypto Rally

This aligns with CryptoBirb’s recent observation, whichrevealedthat Bitcoin’s bull market could be approaching its final stage. After briefly surpassing $124K earlier this month, Bitcoin has faced choppy trading, briefly dipping below $109K as momentum turned fragile.

However, historical data indicate that the current cycle is 93% complete, and a potential blow-off top is projected between late October and mid-November 2025. The crypto analyst referenced prior bull runs and noted that the 2010-2011 cycle lasted for 350 days, the 2011-2013 cycle lasted for 746, the 2015-2017 one went on for 1,068 days, and the 2018-2021 cycle lasted for 1,061 days.

The current cycle, which has already spanned around 1,010 days, aligns with expected post-halving peaks, which historically occur 366-548 days after the event. Following the April 2024 halving, the anticipated peak window is October 19-November 20, 2025.

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

Happy Friday! U.S. PCE data came in as expected, but crypto prices still slipped. However, a soft jobs report could give the Fed room to ease — a potential boost for bitcoin, with $150k to $200k still in play this cycle, according to 21Shares' Matt Mena.

In today's newsletter, Eric Trump calls China a "hell of a power" in crypto despite its bans, Ethereum's monthly onchain volume reaches its highest level since 2021, Eliza Labs sues Elon Musk's X, and more.

Meanwhile, Ethereum ETFs are on course for $4 billion in August inflows while Bitcoin funds face outflows.

Let's get started.

P.S. Don't forget to check out The Funding, a biweekly rundown of crypto VC trends. It's a great read — and just like The Daily, it's free to subscribe!

Eric Trump calls China a 'hell of a power' in crypto, sticks to $1 million bitcoin price prediction

The U.S. President's second-oldest son, Eric Trump, praised the impact of Hong Kong and China on the cryptocurrency industry during a fireside chat with David Bailey at Bitcoin Asia on Friday.

Ethereum onchain volume tops $320 billion in August, highest since mid-2021

Ethereum's onchain volume has topped $320 billion in August, hitting its highest monthly level since May 2021 and third-largest overall amid a surge in ecosystem activity as ETH rose to new all-time highs.

IREN run-rate tops $1 billion in annualized bitcoin mining revenue

IREN reported $187.3 million in revenue and $176.9 million in net income for the quarter ending June 30, with annualized bitcoin mining revenue now above $1 billion under current mining economics.

Eliza Labs sues Elon Musk's X over alleged anticompetitive actions

Crypto AI software company Eliza Labs and its founder, Shaw Walters, sued Elon Musk's X, accusing it of stealing technical intel to build rival AI products before banning Eliza from the social media platform.

NFT brand Pudgy Penguins waddles into mobile gaming with launch of Pudgy Party

Pudgy Penguins has teamed up with Mythical Games to launch Pudgy Party, a fast-paced, lighthearted web3 mobile title packed with mini-games, digital collectibles, and customizable penguins.

Looking ahead to next week

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: This article was produced with the assistance of OpenAI’s ChatGPT 3.5/4 and reviewed and edited by our editorial team.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The Ethereum Foundation is pausing its grants programs, initially launched in 2018, as it rethinks its strategy. According to an announcement on Friday, the so-called Ecosystem Support Program awarded over $3 million across over 100 projects in grants alone.

"Our mission is to enable work that strengthens Ethereum’s foundations and empowers future builders, in domains such as developer tooling, research, community building, infrastructure, and open standards," the foundation wrote in a blog post signed by the Ecosystem Support Program.

Much of the funding the EF supported through grants involved finding technical and scalable problems to the world's most used chain, including developer tools like Commit-Boost, an analytics program called BundleBear, and cutting-edge cryptographic research like ZK Playbook.

The program also funded the semi-official Ethereum Cypherpunk Congress, a collection of Ethereum cultural, academic, and technical leaders that worked to spread information about Ethereum and the foundation.

While it is difficult to determine how much worth of grants that EF supplied over the years — largely due to discrepancies in naming conventions, like community outreach, education, and technical research — one recent report shows that in 2023, EF's largest expenditure was on “new institutions,” totaling $47.4 million compared to $28.6 million in 2022.

An even more recent financial report indicated the organization intended to spend approximately 15% of the treasury funds while also aiming to maintain a 2.5-year spending buffer in fiat terms, gradually reducing the spending ratio thereafter towards a sustainable level of around 5% per year.

Overall, the grants program overhaul appears to be part and parcel of the Ethereum Foundation's recommitment to running a leaner and more focused organization. Perhaps most notably, the organization hired co-executive directors Hsiao-Wei Wang and Tomasz K. Stańczak to lead the organization.

Over the coming months, Stańczak and Hsiao-Wei will focus on scaling the Ethereum mainnet and blobs, the transaction storage system, as well as pushing UX improvements, including at the Layer 2 interoperability and application layers.

"[A]s an open grants program with a lean team and broad scope, the high volume of inbound applications has consumed most of our time and resources, leaving limited capacity to pursue new strategic opportunities," Friday's blog reads.

"We remain deeply committed to supporting the Ethereum ecosystem and the public goods that sustain it. While these changes mark a new chapter for ESP, we are energized by the opportunities ahead to better support the incredible builders, researchers, and contributors driving Ethereum’s growth," the blog added.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

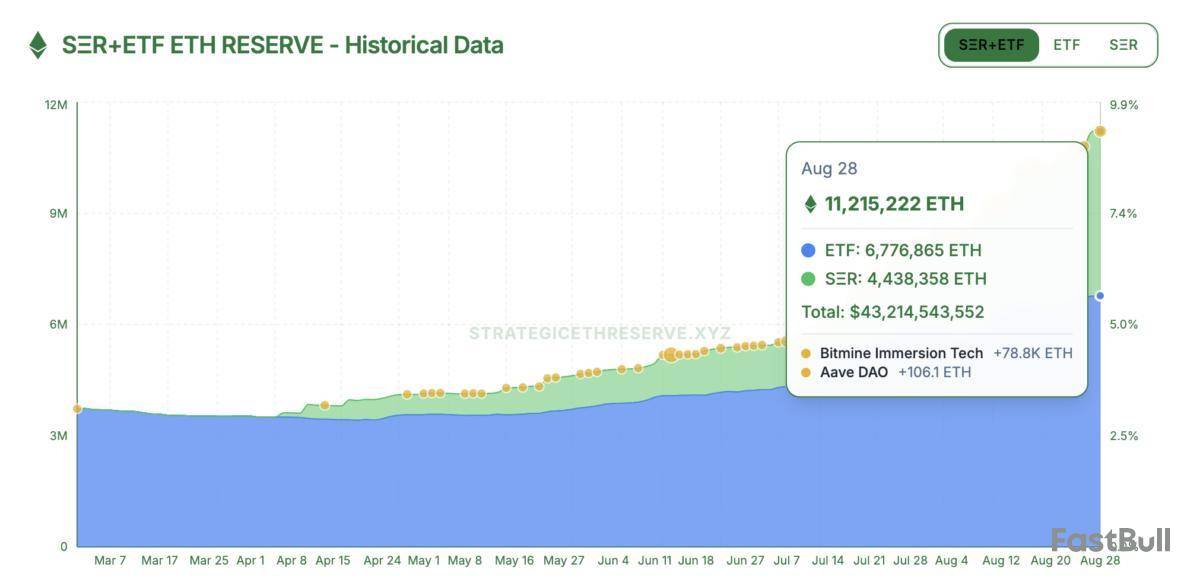

Ether spot exchange-traded funds (ETFs) have seen steady growth since their US debut in July 2024, while corporate treasuries tied to the token are also on the rise.

Inflows into Ether (ETH) funds climbed 44% this month, rising from $9.5 billion on Aug. 1 to $13.7 billion on Aug. 28, according to cryptocurrency research platform SoSoValue. Market participants say renewed institutional demand is fueling the momentum.

“After an extended period of underperformance relative to Bitcoin and a souring investor sentiment, Ethereum has recently experienced a significant revival in the recognition of both its adoption rate and value proposition,” Sygnum Chief Investment Officer Fabian Dori told Cointelegraph.

Behind investors appetite is a growing number of companies adopting ETH based corporate treasuries. While Bitcoin (BTC) is the cryptocurrency most associated with treasury companies, Ether treasuries among corporations are gaining steam.

According to StrategicETHReserve, companies now hold 4.4 million ETH or 3.7% of the supply, worth $19.18 billion at this writing.

“A strong driver for that is regulation such as the Genius Act that provides traditional investors with the comfort to build infrastructure and use cases on this new technology,” said Dori.

Supported by investors’ demand through corporate treasuries and ETFs, Ether’s price gained nearly 27% in August, to $4,316 on Friday, from about $3,406 on Aug. 1, according to Cointelegraph Markets Pro.

“Treasury companies are a massive buyer,” Standard Chartered’s global head of digital assets research, Geoffrey Kendrick, told Cointelegraph. “They won’t sell. So, yes, the impact will stay,”

Related: ETH possibly bullish ‘for years’ as megaphone pattern to $10K emerges: Analyst

Ethereum roadmap entering ‘critical inflection point’

Industry watchers are optimistic about Ethereum’s prospects but say the coming months will be critical for the network’s ecosystem. “Ethereum’s roadmap is entering a critical inflection point,” a Bitfinex analysts told Cointelegraph.

“The upcoming upgrades are set to significantly improve smart contract efficiency and validator usability advancing Ethereum’s competitiveness as an institutional settlement layer,” they said, adding:

Ethereum is steadily advancing its upgrade cadence, with key milestones toward scalability and long-term global utility.

The Pectra upgrade in May expanded validator caps and introduced account abstraction, with the Fusaka hard fork set for Nov. 5, which will implement PeerDAS to ease node workloads and improve data availability.

Meanwhile, Ethereum’s revenue generation has yet to catch up with the momentum. In the past 30 days, the network generated $41.9 million in fee revenue, a fraction of Tron’s $433.9 million over the same period.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up