Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

Japan Chief Cabinet Secretary Kihara: United Arab Emirates Notified Japan That United Arab Emirates President's State Visit To Japan Will Be Delayed From Originally Scheduled Feb 8

[Bitcoin Surges Past $79,000] February 3Rd, According To Htx Market Data, Bitcoin Broke Through $79,000 With A 24-Hour Gain Of 1.52%

Korea Exchange Activates Sidecar On KOSPI After KOSPI 200 Futures Rise 5%, Programme Trading Halted For 5 Mins

Spot Gold Rose Above $4,800 Per Ounce, Up $130 On The Day; Spot Silver Is Currently Up 5.11% At $83.3 Per Ounce

Japan Finance Minister Katayama: If Necessary, Appropriate Action Will Be Taken In The Foreign Exchange Market

Japan Finance Minister Katayama: Expecting Excess Of 4.5 Trillion Yen From Currency Reserves In This Fiscal Year

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

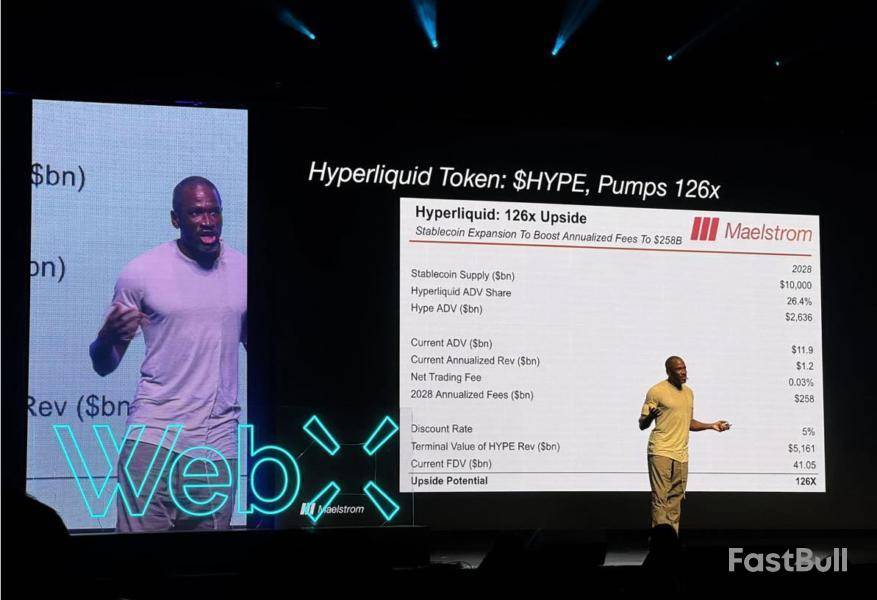

The native token powering the decentralized derivatives exchange Hyperliquid was one of the few tokens to post a gain over the 24 hours, as crypto entrepreneur Arthur Hayes told an audience in Tokyo he expects it to 126x over the next three years.

Hyperliquid (HYPE) has gained almost 4% over the last 24 hours and is now trading at $45.64 — though it briefly reached over $47 earlier in the day.

BitMEX co-founder Arthur Hayes made the forecast at the WebX 2025 conference in Tokyo on Monday local time.

Hayes said that stablecoin expansion would push the DEX’s annualized fees to $258 billion while its current annualized revenue is just $1.2 billion.

Hyperliquid is a decentralized exchange for perpetual futures, derivative contracts without an expiry date, allowing speculators to take leveraged positions on crypto assets without owning them.

Open perps, DEX volume at an all-time high

Hyperliquid total open positions hit an all-time high of 198,397 on Monday, according to the Hypertracker analytics platform.

Meanwhile, open interest, or the value of contracts yet to be settled, climbed above $15 billion, and total wallet equity peaked at $31 billion.

Hyperliquid DEX volume also hit an all-time high of $1.56 billion over the weekend, according to DefiLlama. Transaction fees have also reached July’s all-time high of $93 million so far this month.

DefiLlama also shows that the total value locked for the derivatives DEX is currently $685 million, just shy of its February peak.

Hyperliquid eating competition

Data provider Redstone published a comprehensive report on the exchange last week in which they said, “In a span of less than two years, they went from zero to consistently capturing over 75% of the entire decentralized perpetual exchange market,” previously held by dYdX.

Hyperliquid now processes up to $30 billion daily, “getting close to matching Binance’s volume on some pairs,” it added.

HYPE hit an all-time high of just below $50 on July 14 and is currently just 7% away from that peak.

SBI Group, one of Japan’s largest financial giants with over $200 billion in assets, has announced a major partnership with Chainlink, the leading oracle network in blockchain. The collaboration begins in Japan, known for its advanced financial system, and is expected to expand into global markets.

A survey by SBI Digital Asset Holdings recently showed that 76% of institutions are interested in tokenized securities. However, many hesitate due to weak infrastructure. The SBI–Chainlink partnership aims to solve this by building secure and reliable systems that allow institutions to confidently step into the world of digital assets.

Tokenized Assets Take the Lead

The first focus will be on tokenizing real-world assets like real estate and bonds. With Chainlink’s Cross-Chain Interoperability Protocol (CCIP), institutions can move these assets securely across multiple blockchains while meeting compliance requirements.

Fund operations are also set to become smoother. By bringing Net Asset Value (NAV) data on-chain using Chainlink SmartData, asset managers will gain better liquidity, transparency, and efficiency.

Stablecoins and Faster Payments

The partnership also extends into stablecoins and cross-border transactions. With Chainlink’s Proof of Reserve, institutions can verify stablecoin reserves in real time, ensuring trust and transparency.

On the payments side, CCIP will power payment-versus-payment (PvP) settlements for foreign exchange and international transfers. This development enables safer, faster, and compliance-friendly cross-border transactions. Notably, these transfers can be settled without using a bridge currency like XRP or USDT, marking a major shift in how global payments may evolve.

Chainlink co-founder Sergey Nazarov praised SBI as one of the most forward-thinking companies in the blockchain space, highlighting its role in advancing tokenization and stablecoin settlement projects.

SBI CEO Yoshitaka Kitao echoed this view, describing Chainlink as a “natural partner” capable of delivering secure and compliant solutions for cross-border finance.

This is not the first time the two groups have worked together. In Singapore, under Project Guardian, SBI Digital Markets, Chainlink, and UBS Asset Management successfully tested automated fund administration. That achievement laid the groundwork for today’s larger-scale partnership.

Crypto Community’s Take

Crypto analyst Zach Rynes pointed out a striking detail from the announcement: with CCIP, cross-border payments can happen directly through PvP settlement, eliminating the need for a middle currency. This innovation could reshape global finance and further boost institutional adoption of blockchain technology.

FAQs

What is the SBI and Chainlink partnership about?SBI Group teamed with Chainlink to boost tokenized assets, stablecoins, and cross-border finance in Japan and globally.

Why is SBI interested in tokenization?76% of institutions want tokenized securities; SBI aims to solve infrastructure gaps with Chainlink’s secure tech.

What assets will SBI and Chainlink tokenize first?They plan to tokenize real-world assets like real estate, bonds, and funds using Chainlink’s CCIP.

How does the partnership impact payments?SBI and Chainlink enable fast PvP cross-border payments without bridge currencies like XRP or USDT.

Has SBI worked with Chainlink before?Yes, they collaborated in Singapore under Project Guardian to test automated fund administration.

Japanese-listed company Metaplanet Inc. has added another 103 Bitcoin to its treasury, spending around 1.736 billion yen ($11.78 million). With this latest move, the company’s total Bitcoin stash has climbed to 18,991 BTC, representing a massive investment of nearly 285.8 billion yen ($1.94 billion).

This purchase is part of Metaplanet’s ongoing Bitcoin Treasury Operations, a strategy that uses metrics like BTC Yield and BTC Gain to track performance. Over the past few quarters, these numbers have shown strong results, providing a direct boost to shareholder value.

A Steady Bitcoin Accumulation Strategy

Metaplanet Bitcoin’s holding journey began in April 2024 and has been steadily stacking BTC ever since. This isn’t a one-time gamble but a clear sign the company sees Bitcoin as a long-term store of value. Fast forward to August 2025, and Metaplanet now holds nearly 19,000 BTC, putting it in 7th place worldwide among corporate Bitcoin holders, right up there with some of the biggest global names that also keep Bitcoin on their balance sheets.

With each reporting period, the company has revealed consistent accumulation, showing that Bitcoin is no longer just an investment for Metaplanet; it has become a core pillar of its business strategy.

Metaplanet Q2 2025 Revenue Jumps 41%, Net Income Hits ¥11.1B

The company’s growing Bitcoin position comes alongside impressive financial results. In the second quarter of 2025, Metaplanet reported revenues of 1.2 billion yen ($8.4 million), marking a 41% increase from the previous quarter. Net income also turned around dramatically, reaching 11.1 billion yen ($75.1 million), compared to a 5 billion yen ($34.2 million) loss in the first quarter.

In its quarterly report, the company reaffirmed its full-year projections of 3.4 billion yen in revenue and 2.5 billion yen in operating profit. Executives credited recurring cash-secured put premiums and strong operational performance as the main drivers of growth.

The company also tapped capital markets to fuel its treasury growth. It redeemed parts of its the 19th bond series in July and funded those redemptions through proceeds from stock acquisition rights. Heavy share exercises followed, including 9 million shares on July 10 and 14, 14.9 million shares between August 12–15, and another 4.9 million on August 20.

Boosted by Strong Financial Results

Alongside their Bitcoin plays, Metaplanet’s financial performance has garnered attention. A standout moment came in mid-August when the company was upgraded from small-cap to mid-cap in the FTSE Japan Index, leading to inclusion in the FTSE All-World Index as well.

By steadily expanding its reserves and boosting them with improved financials, Metaplanet has firmly positioned itself as a pioneer among Japanese corporations in the digital asset space.

FAQs

How much Bitcoin does Metaplanet hold in 2025?Metaplanet holds 18,991 BTC, worth about ¥285.8B ($1.94B), ranking 7th among corporate holders.

When did Metaplanet start buying Bitcoin?Metaplanet began its Bitcoin accumulation strategy in April 2024 and has added steadily since.

How did Metaplanet perform in Q2 2025?Q2 2025 saw revenue jump 41% to ¥1.2B, net income ¥11.1B, making it a top-performing crypto stock.

Why was Metaplanet added to the FTSE Index?Strong Bitcoin holdings and profits upgraded Metaplanet to FTSE mid-cap, a key Japanese Bitcoin stock.

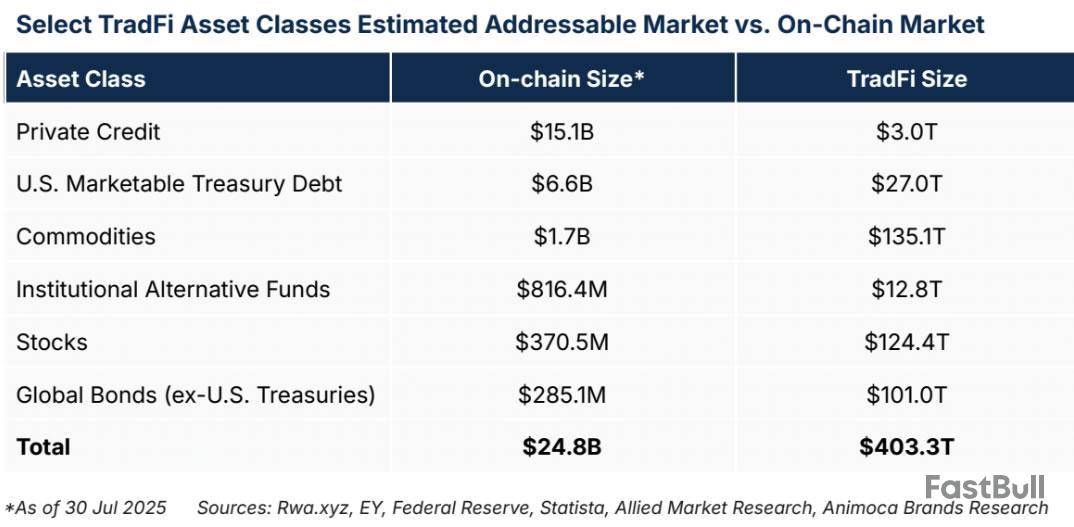

Tokenized real-world assets could eventually represent trillions of dollars worth of traditional finance assets in a multichain future, according to Animoca.

“The estimated $400 trillion addressable TradFi market underscores the potential growth runway for RWA tokenization,” said researchers Andrew Ho and Ming Ruan in an August research paper from Web3 digital property firm Animoca Brands.

The researchers found that the tokenized real-world asset (RWA) sector is just a small fraction ($26 billion) of the total addressable market currently, which is over $400 trillion.

These asset classes include private credit, treasury debt, commodities, stocks, alternative funds and global bonds.

There is currently “a strategic race to build full-stack, integrated platforms” by large asset managers, and long-term value will accrue to those who can “control asset lifecycle,” the researchers said.

RWA value hits an all-time high

The nascent RWA tokenization market is currently at an all-time high of $26.5 billion, having grown 70% since the beginning of this year, according to industry tracker RWA.xyz.

This is “signaling clear momentum and rising institutional confidence,” the researchers said.

The current RWA landscape is dominated by two categories: private credit and US Treasurys, and together, they account for nearly 90% of tokenized market value.

RWA future is multichain, not just Ethereum

Ethereum is the market leader for RWA tokenization with a 55% market share, including stablecoins, and $156 billion in onchain value.

When Ethereum layer-2 networks such as ZKsync Era, Polygon, and Arbitrum are included, that share grows to 76%, according to RWA.xyz.

“Its leading position is likely due to its security, liquidity, and the largest ecosystem of developers and DeFi applications,” the researchers said.

The growth of the RWA tokenization could drive further demand for related crypto assets such as Ether , which hit an all-time high on Sunday, and oracle provider Chainlink (LINK), both of which have seen gains outpace the wider crypto market in recent weeks.

However, the researchers said that RWA tokenization activity is “unfolding across a multichain ecosystem encompassing public and private blockchains,” adding that Ethereum’s current lead is being challenged by “high-performance and purpose-built networks, indicating that interoperability will be key to success.”

Animoca Brands launched its own tokenized RWA marketplace called NUVA earlier this month.

The Story Foundation plans to spend $82 million buying back $IP tokens from the market between August 15 and November 16, 2025. This is a large amount for a crypto buyback, and it could lower selling pressure and raise the $IP price. Buybacks often show the team believes in their token’s value. Still, the real impact depends on when and how fast they buy and overall market mood. Regular updates about progress may help keep attention on $IP during the buyback period. More information can be found in the official statement here.

Story@StoryProtocolAug 24, 2025On August 15, 2025, Nasdaq: $CASK officially closed the PIPE financing to establish a treasury strategy focused on $IP.

As promised, the Story Foundation will carry out the $82M buyback program on the open market, running through November 16, 2025. The 90-day window began on… https://t.co/e031WOEtW4

On August 26, 2025, Bitget Token will be a focus in an AMA discussing new crypto trends. Events like this do not always move the token price by themselves. But, if news or updates are shared that excite traders, it could help price go up. Much depends on what is said during the live talk and if big investors join the conversation. If it is only general talk, price movement is likely small. Check the official invitation here.

CryptoRank.io@CryptoRank_ioAug 22, 2025Narratives Behind Crypto Products – Live AMA!

August 26

11:00 AM UTC

AMA link: https://t.co/caugSa7XEO

We’re diving deep into the hottest narratives shaping crypto – from product-market fit to security, adoption, and what truly drives user trust.

Guests:… pic.twitter.com/4OWVHIg5RP

Cross Protocol will remove more than 14 million $CROSS tokens from supply on August 29, 2025. These tokens were left unsold after the public sale. A token burn like this makes the total number of tokens lower. This can be good for price, because fewer tokens means higher value if demand stays the same. However, if not many people pay attention or care about the burn, the impact may not be big. But usually, a burn event is seen as positive by holders. You can see the announcement here.

CROSS@cross_protocolAug 24, 2025CROSS Announcement

This Friday, August 29, we are delivering on our commitment. A total of 14,777,110 unsold $CROSS from the Public Sale will be permanently removed from circulation. pic.twitter.com/HaVKDRtdG7

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up