Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key takeaways

Stablecoin attestation reports provide third-party verification that each token is backed by real-world assets like cash and US Treasurys.

Attestation ≠ audit: Attestations are point-in-time checks, not deep financial audits, so users should still perform broader due diligence.

Not all tokens are redeemable. Time-locked, test or frozen tokens are excluded from reserve calculations to reflect only actively circulating coins.

USDC sets an industry benchmark with regular third-party attestations, transparent reserve reporting and compliance with MiCA regulations.

Stablecoins play a crucial role in the digital asset ecosystem, bridging traditional fiat currencies and the decentralized world of cryptocurrencies.

How can you be confident that each stablecoin is backed by real-world assets? This is where stablecoin attestation reports come in.

Understanding how to read attestation reports is essential for anyone interacting with stablecoins like USDC or Tether USDt .

This guide explains everything you need to know about stablecoin attestation reports, how they work and why they matter.

What is a stablecoin attestation report?

A stablecoin attestation report is a formal document issued by an independent third party — a certified public accountant (CPA) firm — that verifies whether the stablecoin issuer holds sufficient reserves to back the coins in circulation.

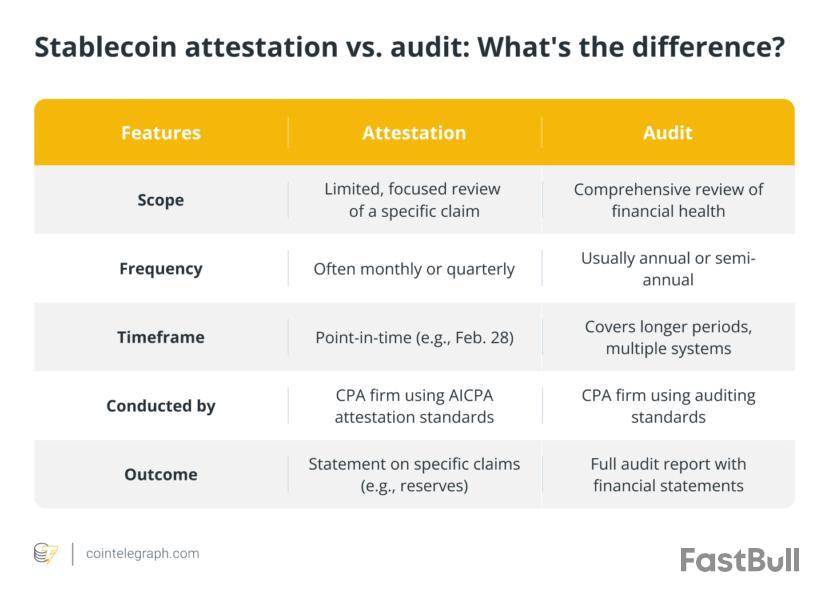

Unlike full audits, which evaluate broader financial systems and controls, attestations are narrower in scope. They confirm specific facts, like whether reserve balances match circulating supply at a single point in time.

Think of an attestation as a snapshot taken by accountants saying, “Yes, we’ve checked, and the money is there right now.”

It’s not as deep or wide as an audit, but it still builds trust.

For example, if a stablecoin issuer claims that each token is backed 1:1 by US dollars, an attestation report would provide evidence supporting that claim. Stablecoins like USDC regularly publish such reports to prove that their coins are fully backed, helping to build trust in their ecosystem.

Attestation reports are especially critical for investors and institutions that depend on stablecoins for cross-border settlements, collateral in lending protocols and participation in decentralized finance (DeFi) applications. Without confidence in the reserves’ authenticity, the stablecoin system risks collapse, which can impact the broader crypto market.

Purpose of stablecoin attestations: Why transparency matters?

Transparency is essential in the crypto space, especially for stablecoins, which serve as a medium of exchange, a store of value and collateral on DeFi platforms. Attestation reports offer a window into a stablecoin issuer’s reserves and disclosure practices, allowing users, regulators and investors to evaluate whether the issuer is operating responsibly.

Issuers like Circle, the company behind USDC, publish attestation reports to demonstrate compliance with regulatory expectations and assure users that the coins they hold are not only stable in name but also in substance. In doing so, they promote stablecoin investor safety and support market integrity.

This transparency builds the foundation for regulatory trust and helps attract traditional financial institutions into the space. It also aligns with broader industry goals for increasing stablecoin compliance, particularly as governments worldwide explore stablecoin-specific regulations.

Who conducts the attestation?

Stablecoin attestation reports are prepared by independent accounting firms. For instance, Circle’s USDC attestation reports are conducted by Deloitte (as of April 13, 2025), a leading global audit and advisory firm. These firms follow professional standards set by bodies like the AICPA (American Institute of Certified Public Accountants).

Independent attestors are essential because they remove conflicts of interest. Having a third-party review reserves ensures that the information is unbiased, credible and aligned with global assurance standards.

AICPA’s 2025 criteria: Standardizing stablecoin attestations

In response to growing concerns over inconsistent stablecoin disclosures, the AICPA introduced the 2025 Criteria for Stablecoin Reporting, a standardized framework for fiat-pegged, asset-backed tokens.

These criteria define how stablecoin issuers should present and disclose three key areas:

Redeemable tokens outstanding.

The availability and composition of redemption assets.

The comparison between the two.

What makes the 2025 Criteria important is its emphasis on transparency and comparability. For example, token issuers must clearly define redeemable versus nonredeemable tokens (such as time-locked or test tokens), identify where and how reserves are held and disclose any material legal or operational risks affecting redemption.

By aligning attestation reports with this framework, accounting firms ensure that evaluations are conducted using suitable, objective and measurable criteria, a key requirement under US attestation standards. This gives investors, regulators and DeFi users a more consistent and reliable basis for evaluating stablecoin solvency and trustworthiness.

As adoption grows, the 2025 Criteria may become the industry benchmark, especially as regulatory bodies increasingly rely on standardized reporting to assess stablecoin risks and enforce compliance.

Did you know? Not all stablecoins in circulation are redeemable. Some, like time-locked tokens, are temporarily restricted and can’t be accessed until a specific date. Others, known as test tokens, are used only for internal system testing and are never meant to be redeemed. These tokens are excluded from reserve calculations in attestation reports to ensure an accurate picture of what’s backing user-accessible stablecoins.

Behind the peg: How to read a stablecoin report and spot real backing

Reading a stablecoin attestation report isn’t just about scanning numbers. It’s about knowing whether the stablecoin you’re holding is backed.

Here’s how to break it down step by step and spot what really matters:

Check the report date: Attestations are point-in-time reviews. Look for the exact date the report covers (e.g., Feb. 28, 2025). It confirms reserves on that day only, not before or after.

Compare circulating supply vs reserves: Find the number of tokens in circulation and the total value of reserves. The reserves should be equal to or greater than the supply. If not, that’s a red flag.

Look at what backs the reserves: Reserves should be held in safe, liquid assets like US Treasurys or cash in regulated financial institutions. Watch out for risky or vague asset descriptions.

Review custodian and asset details: Check who’s holding the funds (e.g., major banks or money market funds) and where they’re stored. Remember, reputable custodians add credibility.

Understand the methodology: The report should explain how the review was conducted, what data was verified, what systems were used and which standards (like AICPA) were followed.

Identify excluded tokens: Some tokens, like test tokens or time-locked tokens, are excluded from circulation counts. Look for notes explaining these exceptions.

Check who performed the attestation: An independent and recognized accounting firm (like Deloitte or Grant Thornton) adds legitimacy. If the attestor isn’t disclosed or independent, treat with caution. A signed statement from the accounting firm verifies the accuracy of the issuer’s claims.

Investors may also look for supplementary notes within the report, such as jurisdiction of reserve accounts, legal encumbrances on assets or clarification of valuation techniques. All these elements help paint a fuller picture of risk and reliability.

What the February 2025 USDC attestation report reveals

In March 2025, Circle released its latest reserve attestation report, offering a transparent look at what backs one of the most widely used digital dollars in crypto.

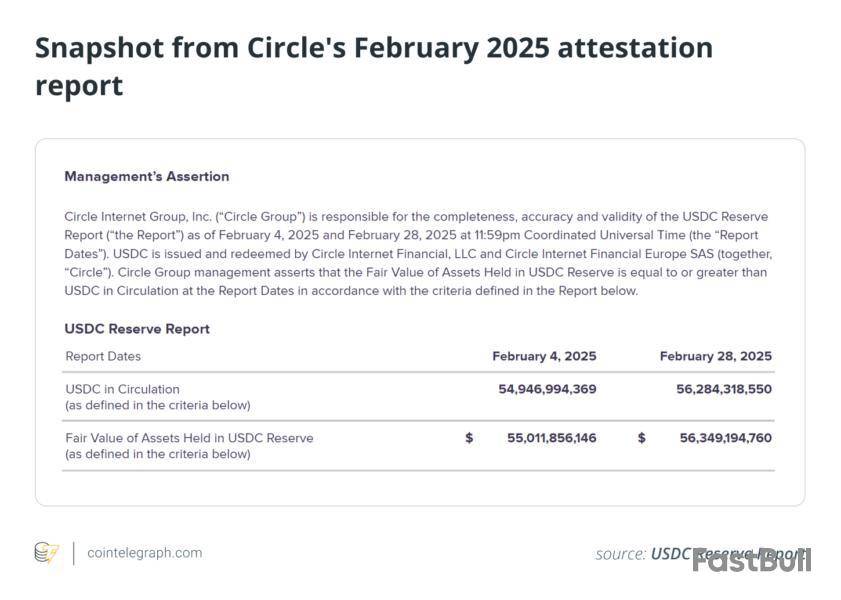

The report was independently examined by Deloitte, one of the “Big Four” global accounting firms. Deloitte confirmed that, as of both Feb. 4 and Feb. 28, 2025, the fair value of Circle’s reserves was equal to or greater than the amount of USDC in circulation.

The below snapshot from Circle's February 2025 attestation report shows that the amount of USDC in circulation stood at $54.95 billion on Feb. 4 and $56.28 billion on Feb. 28. The fair value of reserves held to back USDC exceeded these figures, totaling $55.01 billion and $56.35 billion on the respective dates.

What’s in the reserves?

Circle holds its USDC reserves mainly in:

US Treasury securities

Treasury repurchase agreements

Cash at regulated financial institutions

These assets are kept separate from Circle’s corporate funds and are managed through the Circle Reserve Fund, a regulated money market fund.

The attestation also accounts for technical factors like “access-denied” tokens (e.g., frozen due to legal or compliance reasons) and tokens not yet issued, ensuring an accurate measure of circulating USDC.

For users, this means greater confidence that every USDC token is backed by high-quality, liquid assets, just like the company claims.

Did you know? As of Feb. 4 and Feb. 28, 2025, 993,225 USDC remained permanently frozen on deprecated blockchains, including the FLOW blockchain. These tokens are excluded from the official USDC in circulation totals reported by Circle.

How are stablecoin reserves verified?

Stablecoin attestation reports serve as a form of proof of reserves, providing independent confirmation that a stablecoin issuer holds enough assets to back the tokens in circulation. The verification process typically involves several key steps:

Reviewing bank statements and financial records.

Confirming cash balances held by custodians.

Cross-checking reported reserves with third-party documentation.

Comparing the supply of stablecoins onchain with the reported reserve amount.

As mentioned, these procedures are carried out by independent accounting firms and are designed to ensure that the reserves are not only sufficient but also liquid and accessible.

Some attestation reports also include details on the tools and technologies used to maintain transparency, such as real-time API integrations with custodians and onchain monitoring systems. These advancements are helping bridge the gap between traditional finance and blockchain, reinforcing trust through verifiable, tamper-resistant data.

What happens if reserves don't match supply?

If an attestation report reveals that a stablecoin issuer does not hold sufficient reserves, the consequences can be severe. The issuer may face:

Regulatory scrutiny: Noncompliance with financial regulations.

Market sell-offs: A drop in user confidence may lead to mass redemptions.

Price instability: The stablecoin may lose its 1:1 peg.

These concerns highlight the need for regular, transparent crypto reserve reports. For instance, Tether has faced ongoing criticism for the lack of clarity surrounding its reserves, fueling demands for greater disclosure. This opacity has also led to Tether’s delisting in Europe under Markets in Crypto-Assets (MiCA) regulations as exchanges brace for stricter compliance requirements.

Lack of transparency can also invite speculation and misinformation, which can cause unnecessary panic in the markets. As a result, proactive disclosure is not just a best practice; it’s a business imperative for stablecoin issuers.

Limitations of stablecoin attestation reports

While attestation reports are crucial, they are not a cure-all. Here are some limitations:

Point-in-time snapshots: Reports only verify reserves on a specific date.

No forward-looking guarantees: Attestations don’t predict future solvency.

Limited operational insight: They typically don’t cover risks like hacking, mismanagement or liquidity issues.

For example, the latest USDC attestation (as discussed in this article) confirms full reserves as of Feb. 4 and Feb. 28, 2025, but it says nothing about what happens on March 1 or any day after. Users must understand these limitations and avoid assuming that attestation equals absolute safety.

This is why combining attestation reports with other forms of due diligence like reading legal disclaimers, following regulatory updates and tracking company behavior is key for responsible crypto participation.

Not just a report — A roadmap to trust in crypto

Reading a stablecoin attestation report is more than scanning numbers; it's a key step in assessing the trustworthiness of a digital asset. By understanding how to read attestation reports, crypto users can make informed decisions, avoid unnecessary risks and support projects that prioritize stablecoin compliance and transparency.

With clearer frameworks from institutions like the AICPA and growing public pressure for stablecoin disclosure practices, the ecosystem is moving toward greater accountability. As regulators sharpen their focus and investors demand more visibility, learning to navigate crypto attestation reports will become an essential skill for all participants in the crypto economy.

Whether you're a retail investor, developer or institutional player, mastering these reports helps protect your assets and support a more transparent and trustworthy crypto future.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

JPMorgan's blockchain division, Kinexys (formerly Onyx), has rolled out British pound-denominated blockchain deposit accounts in the U.K., marking a key expansion of its real-time settlement infrastructure following earlier euro and dollar offerings.

"The new GBP-denominated blockchain accounts enable clients to conduct seamless cross-border transactions, including 24/7 foreign exchange," JPMorgan said in a statement shared with The Block on Monday. "Clients can access funds on demand with weekend processing and extended same-day FX settlements, offering enhanced flexibility, speed and efficiency."

With the GBP addition, JPMorgan's corporate clients can now move funds between pounds, euros and dollars around the clock — regardless of traditional market hours. The London Stock Exchange Group's (LSEG) SwapAgent and global commodities firm Trafigura are the first clients to open GBP accounts with Kinexys.

The launch comes as Kinexys continues to grow its blockchain-based services. Since its debut in 2019, the platform has processed more than $1.5 trillion in total transaction volume, with average daily activity exceeding $2 billion and payments volume growing tenfold year over year, JPMorgan said. That's still just a small fraction of the roughly $10 trillion in daily transactions that JPMorgan's payments division handles.

"This is one of the first blockchain offerings of its kind in the U.K. and the first to have clients actually live, opening GBP blockchain accounts in London," a JPMorgan spokesperson told The Block.

SwapAgent, LSEG's post-trade unit, is incorporating the GBP blockchain accounts into a pilot for its digital settlement services. "Integrating the innovative Kinexys Digital Payments blockchain deposit accounts into our SwapAgent offerings could allow us to operate beyond traditional branch cut-off times and manage settlements in a programmable manner in the future," Nathan Ondyak, CEO at SwapAgent, said in a statement.

Trafigura will use the GBP accounts to enable real-time payments across financial hubs in London, New York and Singapore. The firm also plans to adopt programmable payment tools to automate liquidity management and transaction execution. Kinexys' programmable payments feature allows clients to automate treasury actions through a self-serve "if-this-then-that" interface — designed to improve cash flow efficiency and control.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

According to CoinGlass, the $85,800 level remains crucial for Bitcoin price action since much liquidity is concentrated around it.

The significant liquidity around the $85,800 level suggests activity at this point, where traders may have set stop or limit orders. This might result in a scenario where the market moves toward this level to trigger orders and generate momentum.

CoinGlass@coinglass_comApr 14, 2025There is a lot of liquidity around $85800.🤣https://t.co/z9WYoWpH6h https://t.co/ZpD7lcFJHa pic.twitter.com/Imv0m60XJc

A liquidity hunt might be watched for, a scenario where the market "flushes out" leveraged positions, particularly longs or traders speculating on price increases. In a separate tweet, CoinGlass pointed out high-leverage liquidity, citing the 24-hour BTC Liquidation Heatmap.

With Bitcoin trading just below this price point, a move toward $85,800 could trigger a bullish breakout if BTC clears the level with significant volume, potentially pushing the price to new highs. Alternatively, it can act as a trap if bears enter to defend the zone, resulting in rejection and a short-term correction.

In any case, $85,800 is shaping up to be an inflection point for Bitcoin's price, given the significant liquidity at this level.

Bitcoin price action

At press time, BTC was down 0.48% in the last 24 hours to $84,393. Bitcoin fell on Sunday, sliding to $83,010 as investors digested conflicting signals.

CryptoQuant examines Bitcoin's price action using the Perpetual-Spot Gap, which estimates the difference between Binance's perpetual futures price and the spot price of BTC. It provides a clear picture of trader sentiment: a negative gap frequently indicates caution, while a positive gap suggests increasing optimism.

Currently, the gap is negative, signaling selling pressure on futures markets. However, there is good news: the gap is narrowing. This could be one of the first indications that bearish sentiment might be fading.

However, to determine Bitcoin market direction, traders should consider volume, macro context and other indications.

After enduring weeks of heavy selling pressure and bearish sentiment, Dogecoin is beginning to show signs of stability. The broader crypto market is hinting at a potential recovery, though many analysts argue this could simply be a relief rally within a longer-term bear market that began after Bitcoin reached its all-time high in January.

Despite the uncertainty, some assets—including Dogecoin—are starting to build bullish momentum. Investors are closely watching key technical levels as meme coins attempt to recover lost ground. According to crypto analyst Ali Martinez, Dogecoin could be poised for a significant breakout this week. In his recent analysis, Martinez noted that a decisive daily close above $0.17 could unlock upside potential toward $0.21, provided that DOGE maintains support above a critical support level.

This setup could mark a turning point for Dogecoin, which has lagged behind many altcoins during the recent downturn. However, the market remains volatile, and traders should remain cautious until confirmation of a sustained breakout. Whether this is the start of a new uptrend or just a temporary bounce remains to be seen—but for now, Dogecoin bulls have something to watch closely.

Dogecoin Eyes Breakout As Bulls Target Higher Levels

Dogecoin is now facing critical supply levels as the entire crypto market shows signs of recovery following last week’s announcement from US President Donald Trump of a 90-day pause on reciprocal tariffs for all countries except China.

While this news injected short-term optimism and triggered a bounce across risk assets, macroeconomic uncertainty continues to dominate the global landscape. With tariffs still on the table and rising geopolitical tensions, the market remains vulnerable to sharp volatility and unpredictable swings.

Within this context, Dogecoin is positioning itself for a potential breakout. After weeks of selling pressure that saw DOGE drop to the $0.13 level, bulls have finally stepped in with renewed momentum. According to Martinez, the coming days could be pivotal for Dogecoin. His technical analysis indicates that a close above the $0.17 mark would trigger a bullish breakout, opening the door to $0.21 or even $0.29, as long as the price maintains the $0.13 support.

This setup is drawing attention from both retail and institutional traders who are now eyeing DOGE as a potential high-beta play during this recovery phase. Still, confirmation is needed. If Dogecoin can hold above $0.17 with volume, the meme coin may finally leave its consolidation zone behind and regain market momentum.

DOGE Price Tests Key Resistance After 30% Rally

Dogecoin is currently trading at $0.162, marking an impressive 30% surge from last Monday’s low of approximately $0.129. The bounce comes amid broader market optimism following a temporary pause in tariff escalation announced by US President Donald Trump. However, for DOGE to fully confirm a recovery phase, bulls must continue the momentum and reclaim critical resistance levels ahead.

The next upside targets for DOGE sit at $0.185 and $0.205. A sustained close above these levels would signal a strong reversal and potentially kick off a broader uptrend. These price zones align with previous supply areas where selling pressure intensified during past rallies, making them essential hurdles for bullish continuation.

Despite the recent rally, risks remain. If Dogecoin loses support at the $0.15 level, it would indicate weakening bullish control and open the door for a decline toward the $0.12 zone—close to its recent bottom. Such a move would likely invalidate the recovery narrative and reinforce the view of DOGE remaining in a broader downtrend.

For now, the market watches closely. Holding above $0.15 and breaking $0.185 will be crucial to confirm whether Dogecoin is truly gearing up for a sustained reversal.

Featured image from Dall-E, chart from TradingView

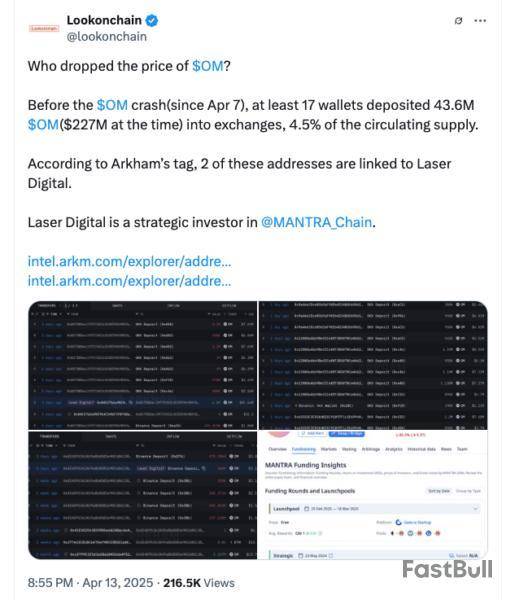

Blockchain analysts have identified large-scale token transfers by major Mantra investors in the days leading up to the sharp collapse of the OM token, raising questions about insider activity and the stability of the project.

Laser Digital, a strategic Mantra investor, reportedly cashed out large portions of Mantra (OM) tokens before the cryptocurrency collapsed on April 13, onchain data suggests.

At least two wallets linked to Laser Digital were among 17 wallets that moved a combined 43.6 million OM tokens — worth about $227 million at the time — to exchanges before the crash, according to blockchain analytics platform Lookonchain, citing Arkham Intelligence data.

Laser Digital is a digital asset business backed by Nomura. The firm announced a strategic investment in Mantra in May 2024.

Millions in OM moved to Binance, OKX

According to Arkham data, one Laser Digital-linked wallet has moved about 6.5 million OM tokens ($41.6 million at the time) to OKX in seven transactions since April 11.

Another wallet sent about 2.2 million OM (worth $13 million) to Binance in a series of transfers starting April 3.

The data also indicates that Laser Digital may have started reducing its OM holdings as early as February. The wallets linked to the firm reportedly received a large portion of their OM from crypto trading firm GSR in 2023.

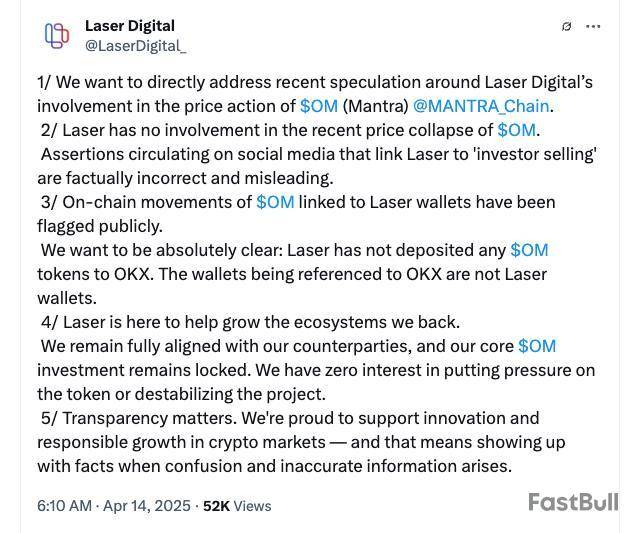

Laser Digital subsequently denied reports alleging its involvement in the OM volatility, claiming that the referenced wallets did not belong to it.

“Laser has no involvement in the recent price collapse of $OM,” Laser said in an X post on April 14. “Assertions circulating on social media that link Laser to ‘investor selling’ are factually incorrect and misleading,” the firm added.

Arkham did not immediately respond to Cointelegraph’s request to comment on Laser Digital’s wallets’ tags.

Action from other Mantra investors

Laser Digital wasn’t the only Mantra investor active before the OM collapse.

According to Lookonchain data, a wallet associated with Shane Shin, a founding partner of Shorooq Partners, received 2 million OM tokens hours before the crash.

The tokens came from a previously dormant wallet that received 2.75 million OM in April 2024, Lookonchain reported.

Both Laser Digital and Shorooq are among the investors in the $109 million Mantra Ecosystem Fund (MEF) announced on April 7.

“It is important to note up front that Shorooq (its funds and founding partners) and Mantra (management and team members) have not sold OM tokens in the lead up to, or during, this crash,” a spokesperson for Shorooq told Cointelegraph.

The representative also emphasized that Shorooq is an equity investor in Mantra, not solely a token investor. “This means that our focus is on the long-term growth of the project,” the spokesperson added.

Cointelegraph contacted Mantra regarding the OM token collapse and its implications for the MEF but had not received a response by the time of publication.

Binance attributes OM collapse to “cross-exchange liquidations”

As OKX and Binance were among exchanges that saw significant OM activity before and during the crash, both exchanges addressed the issue directly. OKX founder Star Xu called the incident a “big scandal to the whole crypto industry.”

While Mantra CEO John Mullin attributed the OM crash to one exchange, Binance hinted at “cross-exchange liquidations.”

“Our initial findings indicate that the developments over the past day are a result of cross-exchange liquidations,” Binance said in an announcement on April 14.

In an update on April 14, OKX said that Mantra’s tokenomics had gone through major changes since October 2024 and flagged suspicious activity across multiple exchanges.

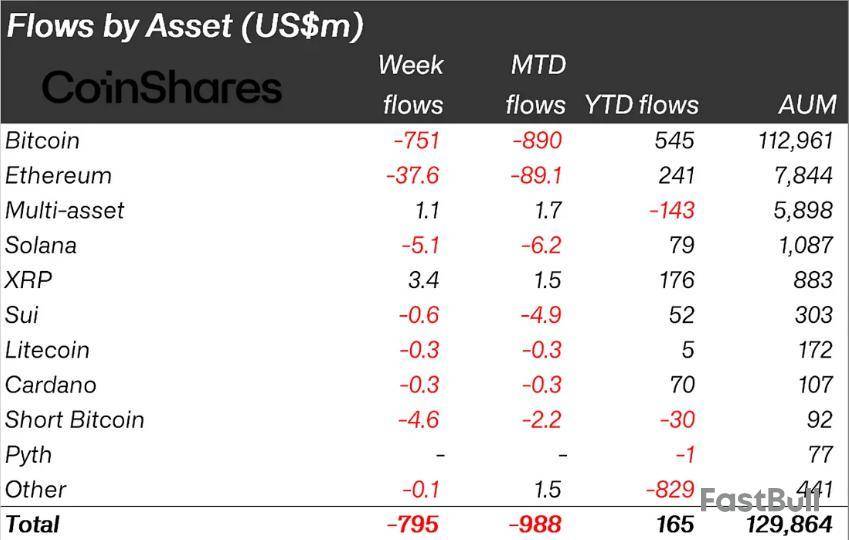

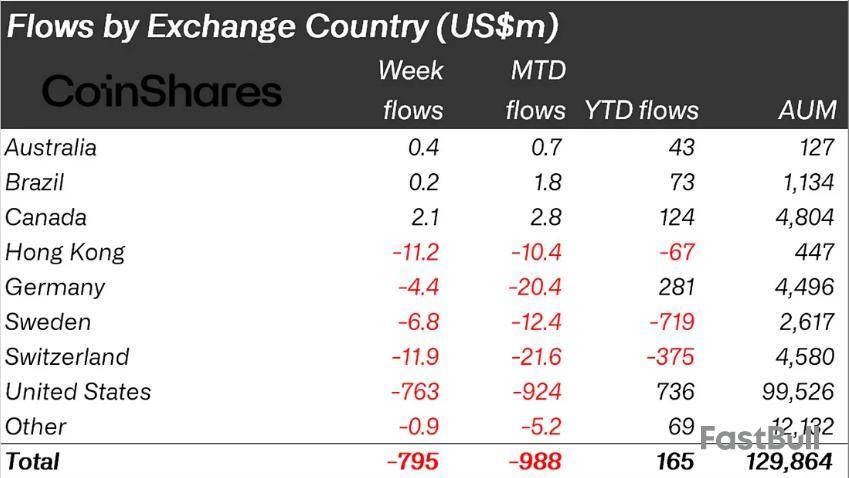

According to the latest CoinShares research, crypto outflows hit $795 million last week. This marks the third consecutive week of negative flows, as financial uncertainty continues to weigh heavy on investor sentiment.

This report aligns with the outlook for Bitcoin spot ETFs (exchange-traded funds), which saw $713 million in outflows last week, a 314% surge from the prior week’s $172.69 million.

Crypto Outflows Reached $795 Million Last Week

CoinShares’ researcher James Butterfill reveals that while Bitcoin led the outflows at $751 million, some altcoins, including XRP, Ondo Finance (ONDO), Algorand (ALGO, and Avalanche , managed positive flows.

It suggests investors adjust their investment strategies, pivoting to altcoins as broader economic chaos bombards the Bitcoin market.

“…recent tariff activity continues to weigh on sentiment towards the asset class,” wrote Butterfill.

This trend is not new, as altcoins have outperformed Bitcoin on flow metrics in the past. Two weeks ago, altcoins broke a five-week streak of negative flows, catapulting crypto inflows to $226 million.

Meanwhile, the influence of Trump’s tariffs on digital asset investment products has been consistent. In the week ending April 7, crypto outflows hit $240 million in the backdrop of Trump’s trade chaos.

Investor sentiment took a particularly sharp turn after President Donald Trump’s tariff pause announcement sidelined China, reigniting fears of a US-China trade war. This spooked markets across traditional and digital assets, along with China’s retaliatory move, exacerbates the sentiment.

Nevertheless, despite sidelining China, Trump’s temporary rollback of tariffs helped lift assets under management (AuM) by 8% to $130 billion, up from the lowest point seen since November 2024.

“… a late-week price rebound helped lift total AuM from their lowest point on April 8 (the lowest since early November 2024) to $130 billion, marking an 8% increase following President Trump’s temporary reversal of the economic calamitous tariffs,” Butterfill added.

Bitcoin Bleeds, ETF Flows Confirm Sentiment

As indicated, Bitcoin bore the brunt of last week’s bearish turn. Outflows surged in line with a 314% week-over-week increase in Bitcoin ETF outflows. The consistent bleed highlights that institutional interest is cooling, particularly among US-based ETF providers.

Short-Bitcoin products also suffered, with $4.6 million in outflows. This suggests traders may retreat to the sidelines entirely rather than taking leveraged bets on downside movement.

CoinShares emphasized that last week’s outflows spanned multiple regions and product providers. This signals that the bearish tone is not isolated to any one market. It aligns with broader risk-off behavior across equities and commodities in response to the volatile US trade stance.

Trump’s unpredictable tariff moves have reintroduced uncertainty into a fragile macro environment. Crypto markets, particularly institutional products, are responding with a broad withdrawal of capital.

SAN SALVADOR, El Salvador, April 14, 2025 (GLOBE NEWSWIRE) — Bitget Wallet, a leading Web3 non-custodial wallet, has launched a 24-hour onchain campaign to support the upcoming launch of WCT, the native token of the WalletConnect protocol, aiming to drive early user engagement ahead of the Token Generation Event (TGE) scheduled for April 15.

WCT is designed to serve as a governance and incentive token for the WalletConnect ecosystem, a key piece of infrastructure enabling connectivity between crypto wallets and decentralized applications. The token's launch marks a significant milestone in WalletConnect's decentralization roadmap, expanding opportunities for community-driven participation.

To coincide with the TGE, Bitget Wallet's 24-hour campaign invites users to send 5 USDT or 1 BGB to a designated address between April 14 at 7:00 and April 15 at 7:00 (UTC). A total of 2,000 eligible participants will have a chance to win WCT rewards, while non-winning entries will be fully refunded. The activation reflects a broader trend toward wallet-native experiences that simplify access to emerging token ecosystems.

The WCT campaign offers a simplified entry point into WalletConnect's evolving ecosystem. Alvin Kan, COO of Bitget Wallet, stated, "As WalletConnect moves toward greater decentralization, we see its role in connecting the Web3 stack becoming even more critical. By supporting WCT launch, we aim to make it easier for users to engage with foundational infrastructure in a secure and intuitive way."

About Bitget Wallet

Bitget Wallet is the home of Web3, uniting endless possibilities in one non-custodial wallet. With over 60 million users, it offers comprehensive onchain services, including asset management, instant swaps, rewards, staking, trading tools, live market data, a DApp browser and crypto payment solutions. Supporting over 130 blockchains, 20,000+ DApps, and millions of tokens, Bitget Wallet enables seamless multi-chain trading across hundreds of DEXs and cross-chain bridges, along with a $300+ million protection fund to ensure safety of users' assets.

For more information, visit: X | Telegram | Instagram | YouTube | LinkedIn | TikTok | Discord | Facebook

For media inquiries, please contact media.web3@bitget.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0fa9ab3d-c94b-499d-bef3-fec1dae9afe4

Bitget Wallet Supports WalletConnect's Token Launch via WCT Activation

Bitget Wallet Supports WalletConnect's Token Launch via WCT Activation

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up