Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China Foreign Ministry: 'Strongly Condemns' The Attack, Supports Pakistan Government Effort To 'Maintain National Security'

Trump: Have Close Partnership With Asfura On Security, Working Together To Counter Cartels And Drug Traffickers, Deporting Illegal Migrants & Gang Members Out Of USA

[Bank Of Canada Governor: Canada Faces Recession If It Loses Cusma Access] Bank Of Canada Governor Tiff Macklem Stated That If Canada Loses Its Preferential Trade Access To The US Through The US-Mexico-Canada Agreement (USMCA), The Canadian Economy Is Likely To Fall Into Recession. However, He Emphasized That Despite Recent Trade Frictions, This Is Not The Bank Of Canada's Baseline Scenario—the Central Bank's Baseline Forecast Still Assumes Canada Will Maintain Its Exempt Status. Under This Assumption, The Central Bank Projects Economic Growth Of 1.1% In 2026 And 1.5% In 2027

South Africa Keen For Access To New European Central Bank Repo Lines: Central Bank Governor Kganyago

Egypt Signs Record Frequencies Deal With Four Telecom Operators Worth About $3.5 Billion - Cabinet

French Foreign Affairs Minister Barrot Acknowledges Resignation Of Former French Culture Minister Jack Lang

Netanyahu Believes Any Negotiations Must Include Limiting Ballistic Missiles And Halting Support For 'Iranian Axis'

Israeli Prime Minister Netanyahu Expected To Meet USA President Trump On Wednesday In Washington

Greenland Foreign Minister On Talks With The USA: We Are Not Where We Want To Be Yet, Too Early To Say Where We Will Land

[State Grid: New Energy Vehicle Charging Volume Expected To Reach Record High During Spring Festival Holiday] This Year's Spring Festival Holiday Is Expected To See A Record High In New Energy Vehicle Charging Volume. According To Predictions From The State Grid Smart Vehicle Networking Platform, The Platform's Daily Peak Charging Volume For New Energy Vehicles During The Holiday Is Expected To Exceed 34 Million Kilowatt-hours, A Year-on-Year Increase Of 17%. The Platform's Daily Peak Charging Volume On Highways Is Expected To Exceed 11 Million Kilowatt-hours, A Year-on-Year Increase Of Over 23%. The Peak Charging Periods During The Spring Festival Holiday Are Expected To Be Concentrated On February 14-15 And February 21-23. Highway Charging Volume In Jiangsu, Zhejiang, And Anhui Provinces Is Expected To Reach Record Highs, With The Changchun-Shenzhen Expressway, Shenyang-Haikou Expressway, And Shanghai-Kunming Expressway Being The Busiest Charging Stations

Pakistan Minister Of Interior: Five People Who Helped Facilitate Islamabad Suicide Bomber Arrested

Syrian Energy Minister Says Syria To Sign Deal With Saudi Arabia's Acwa Power, Wtco For Water Desalination Project

Saudi Investment Minister Says Syria's Aleppo Airports Will Be Developed In Several Investment Stages Worth 7.5 Billion Saudi Riyals

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

No matching data

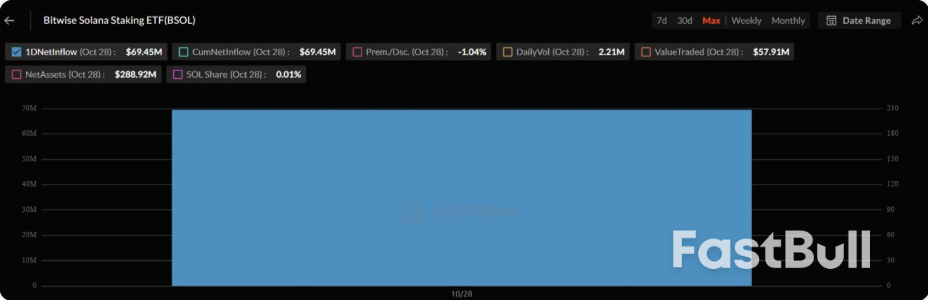

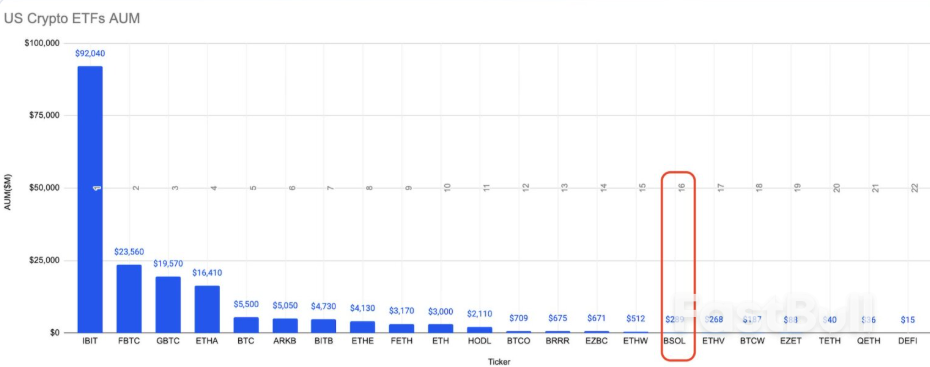

On Oct. 28, Bitwise’s Solana Staking ETF (BSOL) debuted with $69 million in first-day inflows, the strongest launch among roughly 850 ETFs introduced this year, according to SosoValue data.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up