Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Switzerland has opened its doors to digital currencies in many ways, especially Bitcoin, particularly with favorable cryptocurrency policies. However, the European country has recorded slower economic growth recently, a development that crypto market onlookers believe Bitcoin could solve.

Bitcoin technology firm JAN3 took to X to break down the possibilities for the Central European country if it decides to follow in El Salvador’s footsteps and adopt Bitcoin as a legal tender.

For existing Bitcoin users in the country, the asset is tax-favored, as there has been no capital gains tax for private transactions or VAT on transactions for Bitcoin holders since 2018.

Regarding sustainability, Switzerland’s current energy structure could help smoothly integrate Bitcoin into the country’s financial system. With its energy mix relying on renewable energy, with 60% stemming from hydroelectricity, sustainable mining could be achieved, especially during winter when power production outpaces demand.

“With 15,000 MW of energy capacity (60% from hydro), Switzerland has the potential to scale sustainable #Bitcoin mining. It can do this by surplus renewable power that could help stabilize the grid while unlocking new revenue streams for the country.” – JAN3.

Is Switzerland on its way to adopting Bitcoin as legal tender?

While the Swiss government has yet to make any official statement regarding Bitcoin as a substitute for the Swiss Franc, its national currency, multiple Bitcoin—and crypto-friendly developments have been implemented in the region over the years.

A rise in Bitcoin adoption has resulted in 11% of the Swiss population, around 1.6 million Swiss people, holding Bitcoin. Bitcoin and blockchain-related activities have also been sustained in physical locations like the canton of Zug, also known as Crypto Valley. In 2022, a Plan B initiative was launched in Lugano to host over 260 Bitcoin merchants.

Although the Swiss bank recently rejected Bitcoin as an asset for its reserves over volatility concerns, the growing demand for the asset amongst Swiss nationals could continue to drive integration across different sectors.

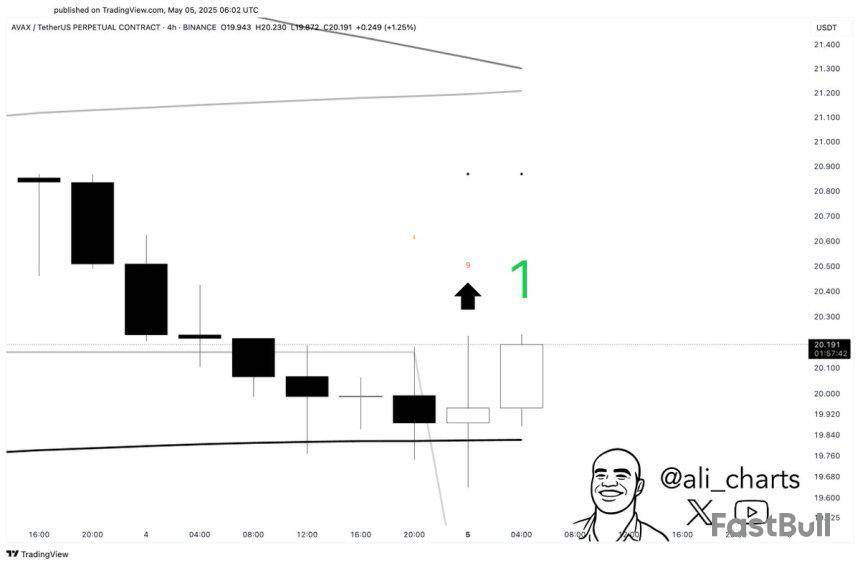

Avalanche (AVAX) is now testing a critical support zone at the $20 level after a strong 55% surge from local lows registered in early April. This level could determine the next phase of price action, as bulls aim to reclaim control and push prices into higher territory. Holding this support is essential to maintain the bullish momentum built over the past few weeks.

However, macroeconomic tensions and persistent global market volatility continue to weigh heavily on investor sentiment. With financial markets responding to rising geopolitical uncertainty and interest rate concerns, altcoins like Avalanche face mounting pressure.

Despite the headwinds, some analysts remain optimistic. Top crypto analyst Ali Martinez recently shared a technical setup highlighting that AVAX is bouncing off the 200-day Simple Moving Average (SMA) on the 4-hour chart — a level often watched closely by traders. According to Martinez, this bounce could act as a pivot point for bulls, especially if volume increases and price action confirms strength above short-term resistance. A clean move higher from here could reignite AVAX’s uptrend and bring it back into focus as one of the leading altcoins in the Layer-1 ecosystem. The coming days will be crucial to confirm the direction.

Avalanche Bounces From Key Level As Bulls Regain Momentum

After months of volatility and sustained selling pressure, Avalanche is trading at a pivotal juncture that took the asset down from its earlier highs. Despite the difficult environment, sentiment appears to be shifting. Over the past few weeks, AVAX has drawn renewed attention from traders and analysts who believe the current structure could lead to a meaningful recovery. Market participants are closely watching for a confirmed reversal from the local lows to signal the beginning of a broader move into higher supply zones.

According to Martinez’s insights, Avalanche is currently bouncing off its 200-day Simple Moving Average (SMA) on the 4-hour chart — a level often seen as a key dynamic support in trending markets. This bounce is further supported by the TD Sequential indicator, which has flashed a buy signal, indicating that bullish momentum could be building at this critical price level.

For this reversal to gain real traction, AVAX must not only defend current support but also break through short-term resistance zones to establish a bullish continuation pattern. This week’s price action will be crucial, as the broader crypto market also seeks direction amid macroeconomic uncertainty.

If bulls step in with conviction and volume confirms strength, Avalanche could position itself for a significant push toward the $25–$30 range. However, a failure to hold above the $20 level could result in further downside and a retest of previous lows. With technical indicators aligning and market sentiment improving, the next few sessions could define AVAX’s trajectory for the coming weeks.

AVAX Price Details: Technical Levels To Watch

Avalanche is currently trading at $19.98, testing a key psychological support level after a significant recovery from its local bottom in early April. Despite a modest bounce, AVAX remains well below both the 200-day simple moving average (SMA) at $29.80 and the 200-day exponential moving average (EMA) at $26.30. This confirms that the broader trend is still bearish, and bulls have yet to reclaim any major technical ground.

The recent price rejection near the $22–$23 zone suggests that sellers are still in control. Volume appears to be tapering off, signaling weakening momentum. The declining slope of both the SMA and EMA reinforces the structural weakness in the medium term. Unless AVAX can break above the $26–$30 resistance cluster, the path of least resistance remains to the downside.

For now, the market appears to be consolidating in a lower range between $18 and $23. If this support at $20 fails, AVAX could revisit March lows near $16. On the flip side, a decisive breakout above the EMA could spark renewed interest from bulls and signal a potential trend reversal. Traders should watch for increased volume and a close above $26 to confirm a shift in sentiment.

Featured image from Dall-E, chart from TradingView

Cardano is once again in the spotlight as the Lace wallet has arrived on Mozilla Firefox — a major milestone that brings the Web3 wallet to the popular browser. This was made possible through the latest Lace 1.22.1 release, which brings the wallet to the Firefox browser for the very first time.

In a tweet on Monday, the Lace team announced the Lace 1.22.1 release, which adds a host of features to the Web3 wallet.

lace.io@lace_ioMay 05, 2025🚨 Lace 1.22.1 is live — now on Firefox!

We’ve officially landed on one of the world’s most popular browsers 🦊

Whether you're a crypto newbie or a DeFi pro, Lace on Firefox brings you everything you need to manage your digital assets with ease.

🔑 Create & restore wallets

💪…

This new release adds Firefox Extension Support, allowing Lace to be fully available on Mozilla Firefox and thus enabling users to interact with Lace without switching browsers. The previous Lace release (v.1.22) brought Lace to Chrome, Brave and Edge.

Last month, the Lace team released Lace 1.22 version, which rolled out Bitcoin integration (beta) and included performance enhancements.

Lace goes multichain

Cardano web3 wallet Lace recently revealed its intention to go multichain, beginning with Bitcoin. The Bitcoin support in beta, released in v.1.22, marked the beginning of Lace’s multichain evolution. Users in the beta program can store and manage BTC directly within Lace on a test network, allowing for multichain asset management. This also lays the groundwork for future Bitcoin DeFi capabilities.

With support for Cardano, Bitcoin and multichain features on the horizon, expanding to Firefox would open Lace to millions of new users, increasing Cardano's visibility.

Cardano is evolving under full community governance in 2025, with eyes on transformative upgrades that would achieve significant scalability and throughput.

Ouroboros Leios, a major redesign of Cardano’s Ouroboros consensus, currently in the research and development stage, is a transformative upgrade intended to achieve significant scalability and throughput, pushing Cardano far beyond its existing boundaries.

Cryptocurrency just got a new label - and it might be the one that finally sticks, for government purposes. Coinbase’s Chief Legal Officer Paul Grewal described it in three simple words: financial transaction device.

It is not just a catchy phrase but a nod to what is happening right now in Ohio, where top state officials are pushing to officially allow crypto payments for government services.

On April 25, Secretary of State Frank LaRose and Treasurer Robert Sprague called on the State Board of Deposit to recognize cryptocurrency, like Bitcoin, as a legitimate way to pay state fees.

If the board agrees, it would mark the first time Ohio designates digital assets as an authorized “financial transaction device." That is the exact term Grewal recently spoke out, saying cryptocurrency could and should be recognized this way.

paulgrewal.eth@iampaulgrewalMay 05, 2025State governments are embracing crypto payments. Good on Ohio Secretary of State @FrankLaRose and @OhioTreasurer Robert Sprague in calling on the Buckeye State to do just this. Cryptocurrency could and should be designated as an authorized “financial transaction device” by the… https://t.co/7pkhycT7O3

Ohio’s not new to crypto. A few years back, the state briefly let businesses pay taxes in Bitcoin, but the effort was shut down after legal issues over how it was set up. This time, officials say they are following the right process from the start.

The idea is simple: let people and businesses use crypto through a state-approved payment processor, just like they would with a credit card. The value gets converted to dollars, and the state gets paid - clean and by the book.

Grewal's framing in three words captures something straightforward - crypto does not need to be viewed as something different, and Ohio's initiative is all about incorporating digital payments into their daily government operations. If it works, it could set a precedent for other states to follow.

Opinion by: Tracy Jin, Chief Operating Officer, MEXC

Market manipulation is everywhere and yet nowhere to be seen. It is an invisible threat affecting crypto and traditional markets, leaving ordinary traders counting the costs. Sometimes, manipulation is obvious — illiquid tokens being pumped high before being dumped just as fast — but often, it's subtler and more challenging to detect.

What's more concerning is that these schemes are no longer the domain of rogue whales or amateur pump groups. Signs increasingly point to highly organized, well-funded networks coordinating activities across centralized exchanges, derivatives platforms, and onchain ecosystems. As these actors grow in sophistication, their threat to market integrity expands exponentially.

A tale as old as time

Market manipulation is as old as markets themselves. In ancient Greece, a philosopher named Thales of Miletus used his knowledge of weather patterns to predict a bumper olive harvest, quietly leasing all the olive presses in the region at a low rate before the season started. Then, when the harvest came in, and demand for presses spiked, he rented them out at inflated prices, pocketing the difference.

For a more recent historical example, albeit still 300 years in the past, see the South Sea Company bubble in which company directors dumped shares at peak prices, leaving regular investors rekt. Or the Dutch tulip bubble of a century earlier.

Market manipulation has existed in crypto since the first exchanges came onstream around 2011. Those who were around back then may recall the pump-and-dump schemes on the BTC-E exchange orchestrated by a notorious trader called Fontas. Or they might remember Bear Whale, whose 30,000 BTC sell wall crashed the market at a time when total daily trading volume was less than $30 million — for all of crypto combined. While not technically market manipulation, it showed how easily one individual could move the crypto market.

Fast forward to today, and crypto is a multi-trillion dollar asset class, rendering manipulation of large-cap assets virtually impossible for solitary whales. But when a group of nefarious traders team up, it's still possible to move markets — and well-organized insiders are doing just that.

Manipulators make their move

The days when a single whale could set a BTC sell wall that took weeks to topple are long gone. While crypto is magnitudes more liquid these days, it's also much more fragmented. This presents opportunities to enterprising traders who hunt in packs to move markets to their advantage. Often working through private Telegram groups, people coordinate activities targeting markets where they can have the most effect. The trend highlights the growing participation of major players in market manipulation schemes, presenting a new level of risk for the crypto industry.

Recent: What are exit liquidity traps — and how to detect them before it is too late

In February, analyst James CryptoGuru warned of large-scale manipulation risks involving spot Bitcoin ETFs. He explained that these instruments could put downward pressure on Bitcoin's price — particularly when traditional financial markets are closed. Such a strategy could trigger liquidations among leveraged traders and create temporary imbalances, allowing large players to accumulate BTC and ETH at discounted prices.

Because crypto — both onchain and on-exchange — is highly interconnected, the ripple effects of a successful manipulation attempt extend far and wide. If a trading pair queried by APIs for feeding other markets is knocked out of sync on one centralized exchange, it can generate arbitrage opportunities elsewhere, including on perps markets. As a result, an attack can be initiated on one exchange, and the profits claimed on another, making it extremely hard to catch the culprits.

The integrity of the cryptocurrency market faces increased risk. Coordinated groups have deep pockets, technical tools, and cross-platform access to execute and mask complex operations. The troubling part is that most exchanges remain reactive by design since it's virtually impossible to prevent market manipulation. As a result, attackers have a high chance of retaining the advantage, even if the window in which they're free to run amok is becoming increasingly smaller.

Not all manipulators break the rules

Just as Thales of Miletus wasn't breaking the rules when he profited off olive season, much of what constitutes crypto manipulation isn't illegal. When a large fund starts buying a particular token through one of their public wallets to attract attention — is that manipulation? Or when market makers go beyond simply matching bid-ask spreads to actively propping up a token's price at the request of a project? Many things move markets, but mostly things that aren't illegal — at least not now.

While the moral code governing influencers, market makers, trading firms, and other players of serious size can be debated at length, other cases require less nuance. The last time anyone checked, using thousands of exchange accounts staffed by dozens of users to inflate a particular asset is blatant manipulation. Exchanges, aided by increasingly sophisticated AI-powered tooling, are fighting back.

The days when one user would cause mayhem on the markets may be over. The threat hasn't, however, dissipated in the multichain, multi-exchange era — it's multiplied. As a result, exchanges are now locked into a game of whack-a-mole, trying to detect suspicious behavior initiated by hundreds or thousands of accounts simultaneously.

Thankfully, exchanges don't have to do it alone, as successful collaboration cases show. When Bybit was hacked in early 2025, other platforms stepped in to lend ETH and help it meet its withdrawal obligations — a rare but powerful sign of solidarity in the face of crisis.

As well-funded, highly organized groups continue to test the system, one thing becomes clear: manipulating the market may be relatively easy — but doing so without being detected is increasingly difficult. Collective vigilance, data sharing, and early detection are becoming the most effective tools in safeguarding the integrity of the crypto trading ecosystem.

Opinion by: Tracy Jin, Chief Operating Officer, MEXC.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Shiba Inu has witnessed price volatility in the past 24 hours as the coin dropped below the $0.0000128 support. IntoTheBlock data suggests that this decline could have been triggered by a sell wall that has emerged for the asset.

Shiba Inu sell wall emerges at critical price level

Notably, the sell wall has emerged between a minimum price of $0.000012 and a maximum of $0.000013. The average price of SHIB is set at $0.000013, placing a total of 35,270,000,000,000 SHIB "At the Money."SHIB Sell Wall. Source: IntoTheBlock">

The holders are neither making a profit nor incurring a loss from the asset and might consider dumping some of their holdings on the market. Such a development could trigger bearish signals for the meme coin, as many remain concerned if SHIB is broken.

Currently, a massive 56,900 SHIB addresses are facing a sell wall, and this development could either create consolidation for SHIB or prove a resistance.

Ecosystem activities could trigger reluctance among SHIB holders to sell, resulting in a consolidation. These more 56,000 addresses could be reluctant to sell at a loss or very little profit, reducing selling pressure.

However, with the sell wall having a maximum price of $0.000013, this could prove a significant resistance for the dog-themed meme coin. Market participants should take profit and avoid further losses.

Trading volume rises amid uncertainty

As of press time, the SHIB price was changing hands at $0.00001268, a 2% decline in the last 24 hours. Despite the price decline, SHIB investors are still actively engaging with the coin, as trading volume has recorded a 4.09% uptick to $127.94 million.

The current data for SHIB suggests that the meme coin is in a critical consolidation zone. If SHIB receives ecosystem support and holders refrain from selling, the price could soar.

If SHIB rises above $0.000013, it could trigger a breakout, as many holders who were previously at a loss may decide to hold instead of selling.

SHIB is currently in a make-or-break zone, and market participants could either make this happen or delay it. If SHIB sees accumulation, it could help reclaim its position in the rankings by market cap from Toncoin.

Real-estate software firm and SOL accumulator DeFi Development Corporation has agreed to acquire a Solana validator business for a purchase price of $3.5 million. The acquisition will be financed via a $3 million restricted stock offering as well as $500,000 in cash.

The SOL validator business held an average delegated solana stake of about 500,000 SOL, worth around $75.5 million at the time of writing, according to a Monday release. The acquired firm will allow DeFi Development Corp. to self-stake its SOL holdings. Additionally, DeFi Development Corp. will absorb all the acquired firm's Solana staking rewards.

"This acquisition doesn’t just add a new line of protocol-native cashflow, it amplifies our alignment with the infrastructure underpinning tomorrow’s decentralized economy,” said Parker White, chief investment officer and chief operations officer of DeFi Dev Corp., in a statement. “Owning and operating validators with significant delegated stake puts us at the core of Solana — while furthering our mission of effectively accumulating SOL to deliver superior risk-adjusted returns relative to holding SOL directly."

The Block reached out for comment and to confirm the name of the SOL validator business.

DeFi Development Corp. has pivoted from solely providing data and software subscriptions to the real estate industry to becoming the "Strategy of Solana" earlier this year. Whereas Michael Saylor's firm Strategy owns more than half a million in BTC — slowly grows its holdings through occasional bitcoin lot purchases, DeFi Development Corp. gradually accrued more SOL tokens in the past few months for its crypto treasury strategy.

DeFi Dev Corp. holds 317,273 SOL solana, valued at $46.2 million, as of May 1. The firm rebranded from "Janover" on April 22 after former Kraken executives took a majority stake in the company, The Block previously reported.

Solana traded at around $145 per token as of publication time, and it saw about $2.3 billion in trading volume in the past 24 hours, according to The Block's solana price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up