Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum’s recent surge toward its previous all-time high has created extraordinary opportunities for traders and long-term investors alike.

On August 17, blockchain analytics platform Lookonchain reported a remarkable story of one trader who transformed a $125,000 stake into $29.6 million in just four months.

Ethereum Rally Fuels Record Profit For Hyperliquid Trader

This impressive 236x return came from going long on ETH via Hyperliquid, a decentralized perpetual exchange. According to Lookonchain, the trader initially deposited $125,000 across two accounts when Ethereum traded below $2,000.

However, as ETH’s price climbed above $4,000, the trader compounded profits by rolling every gain back into their positions. This aggressive reinvestment strategy resulted in a massive 66,749 ETH holding valued at approximately $303 million.

As a result, Lookonchain reported that the combined equity of both accounts has skyrocketed from the original $125,000 to nearly $30 million.

This trader’s gains highlight how strategic leverage and market timing can produce outsized returns in volatile conditions. Meanwhile, not all gains in the Ethereum market come from trading activities.

Lookonchain also tracked an early ETH investor who recently moved a dormant wallet holding nearly $1.5 million worth of the digital asset.

According to the firm, the investor’s stash was untouched for over a decade, and the initial investment was just $104 during the ETH ICO in 2014. This represents a staggering return of roughly 14,269x at current prices.

These contrasting examples underscore the diverse paths to profit in the crypto ecosystem. Traders can leverage market swings for rapid growth, while patient holders continue to benefit from long-term price appreciation.

Still, BeInCrypto reported that Ethereum may have upside potential, with sentiment indicating a possible move toward $5,000. In fact, analysts at Standard Chartered believe ETH’s value could end the year at above $7,500.

Due to this, institutional interest is climbing, with major funds reportedly acquiring around $900 million in Ethereum to expand exposure and capitalize on potential gains.

Max Keiser is one of those figures in the crypto industry who doesn't limit himself neither in predictions nor in brutality when it comes to expressing opinions. And it's not like such a manner did not work for him as he is one of those who was calling for Bitcoin supremacy when the leading cryptocurrency was worth as much as $1.

Now, Keiser is back with another huge number for BTC, and this time the target is set at $2,200,000. Literally, x10 from his long-standing trademark $220,000 BTC prediction.

He links the new seven-figure prediction directly to what he sees as America’s runaway interest bill, where borrowing costs are now climbing so fast they are reshaping the government’s spending priorities in real time.

Bitcoin versus data

According to new data, the U.S. has already burned through $1 trillion in interest payments over just the first 10 months of the fiscal year 2025. That is the highest level ever seen for this point in the year and puts the country on pace to finish above $1.2 trillion in annual interest expense for the first time in history.

The slope of the chart for 2025 tells the story in a way words barely need to: A red-dashed line running ahead of every previous year, pulling away from the pack in a steep climb. For Keiser, the consequence is straightforward.

Max Bitcoin@maxkeiserAug 16, 2025They want to lower rates so they can ramp this to $5 trillion.

BITCOIN $2,200,000 incoming. https://t.co/EHnrO3Mgwc

He believes that policymakers will eventually be forced to cut rates to allow for more borrowing. In doing so, they will create the kind of monetary expansion that Bitcoin was designed to protect against. That's why, according to Keiser, every increase in the debt bill is an argument for Bitcoin’s limited supply.

The number is shocking, but the basis is clear: balance sheets, interest payments. The bigger the bill, the clearer the case for why BTC's ceiling could also be high.

The Solana network is reviewing a new governance proposal, SIMD-0326, which introduces the Alpenglow Consensus protocol to accelerate block finality.

The initiative comes as Solana’s transaction volume is surging, positioning the network ahead of most major regional exchanges.

Solana Governance to Vote on Alpenglow for Faster Finality

According to the proposal, Alpenglow aims to replace Solana’s current system, which relies on proof-of-history combined with TowerBFT.

The upgrade introduces Votor, a streamlined voting protocol that can finalize blocks in one or two rounds depending on network conditions. Developers behind the proposal cite limitations in TowerBFT, including long confirmation times and gaps in formal safety guarantees.

Alpenglow is expected to cut block finality from 12.8 seconds to 100–150 milliseconds and reduce network congestion by eliminating excessive gossip messaging.

“Solana’s validator incentives are currently asymmetric: all validators perform the same work, but leadership (and rewards) are proportional to stake. Alpenglow fixes this- validators now do work proportional to their stake, aligning cost with reward,” Raye Hadi, a blockchain analyst with Ark Invest, said.

The plan is now in the community governance stage. Voting for the proposal is scheduled to take place between Epochs 840 and 420.

The protocol upgrade will move forward if it secures two-thirds of the votes in favor. This would mark a major step in Solana’s network evolution and address long-standing performance bottlenecks.

Solana Wants to Flip Nasdaq

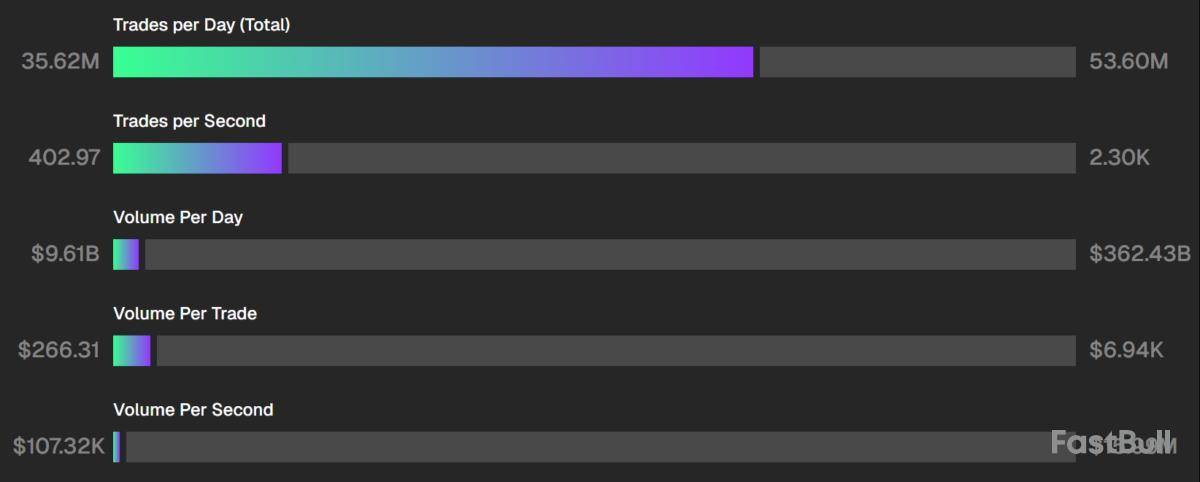

This development comes as Solana recently hit a major milestone of processing 35 million transactions. This exceeds the daily combined volume of most major regional stock exchanges.

For context, the Tokyo Stock Exchange averages 5 million trades per day, the NSE sees 3 million, the Hong Kong Exchange sees 2.5 million, Shenzhen 1.7 million, Shanghai 1.5 million, Toronto 1.2 million, and London 600,000.

The network is now eyeing the US-based Nasdaq, which still outpaces Solana in both trade frequency and volume.

Nasdaq executes roughly 2,290 trades per second, while Solana averages 402. In terms of daily trading value, Nasdaq hits $362.43 billion, compared with Solana’s $9.61 billion.

Despite the gap, Solana remains confident in its roadmap, aiming to match the scale of Nasdaq through continued network upgrades and expanding influence in capital markets.

Market observers believe the combination of Alpenglow and growing adoption positions Solana to strengthen its competitive edge among traditional financial infrastructures.

With bitcoin already breaking its previous all-time highs on several occasions during this cycle, including a peak of over $124,500 marked just a few days ago, analysts and commentators are now speculating whether the top is already in.

The veteran trader Peter Brandt cited on-chain metrics shared by Colin Talks Crypto and gave it a 30% chance that BTC has already peaked.Peak Is In?

The initial post relied on historical data to determine thatthe BTC tophas previously occurred around the 37th month after the low marked during the preceding bear market. It reads that the cycle bottom this time around was on November 22, 2022, when the cryptocurrency’s price had tumbled to under $16,000 at one point following the collapses of FTX and a few other companies that followed suit.

37 months later would be December 22 this year. If history repeats, the digital asset’s price still has a lot of room to grow as the model predicts a price surge to a top of $200,000. This is still far from the current ATH, as BTC would need to register a 60% surge to achieve that milestone.

Brandt, though, had a different view on the matter. He said there’s a 30% chance BTC has already peaked in this cycle, and what follows would be a painful correction. Every bull market has been followed by a bearish phase, which has driven the asset south hard.

In Brandt’s prediction, bitcoin’s inevitable nosedive will take it to somewhere around $60,000 and $70,000 by November 2026, which would be a lot higher than the previous lows.

The next bull run, though, will be smashing, according to the trader. He believes BTC will fly to a massive target of half a million dollars.

I think there is a 30% chance that BTC has topped for this bull market cycle. Next stop then back to $60k to $70k by Nov 2026, then next bull thrust to $500k https://t.co/xPujqCjp9e

— Peter Brandt (@PeterLBrandt) August 15, 2025

$500K Per BTC?

Given bitcoin’s current circulating supply of 19.9 million BTC, we can calculate that a price tag of $500,000 would rocket the asset’s market capitalization to almost $10 trillion (it would be higher in reality since there will be more units mined at the time). That’s a 325% surge from the current levels.

Such a promising future would turn bitcoin into the second-largest asset by that metric, according to current numbers. CompaniesMarketCap data shows that gold would still be the undisputed leader, with a market cap of $22.7 trillion.

However, companies like NVIDIA ($4.4 trillion), Microsoft ($3.860 trillion), and Apple ($3.4 trillion) would be far behind.

Key takeaways:

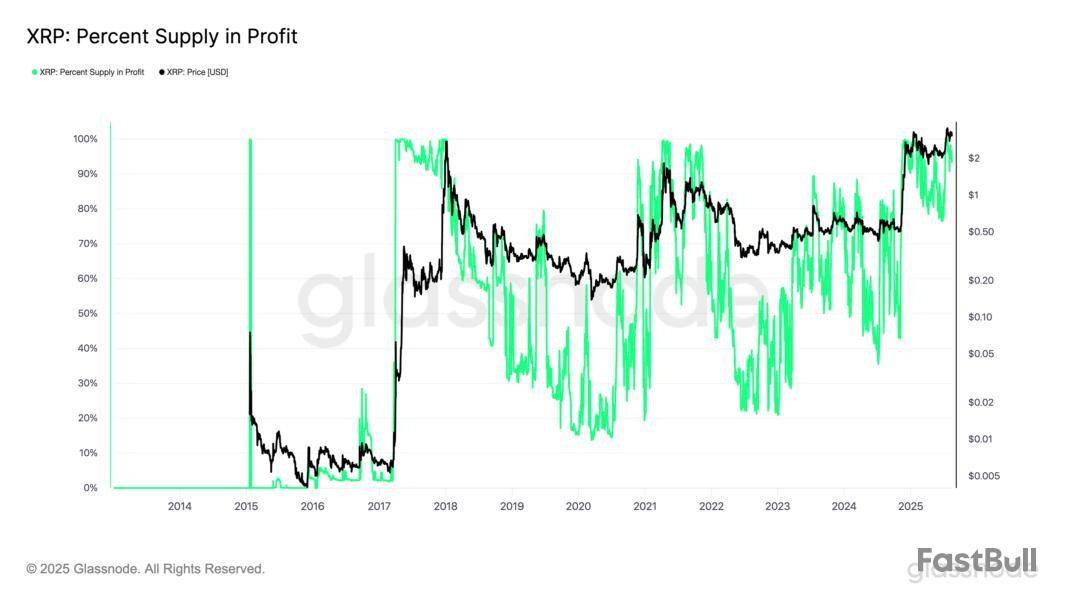

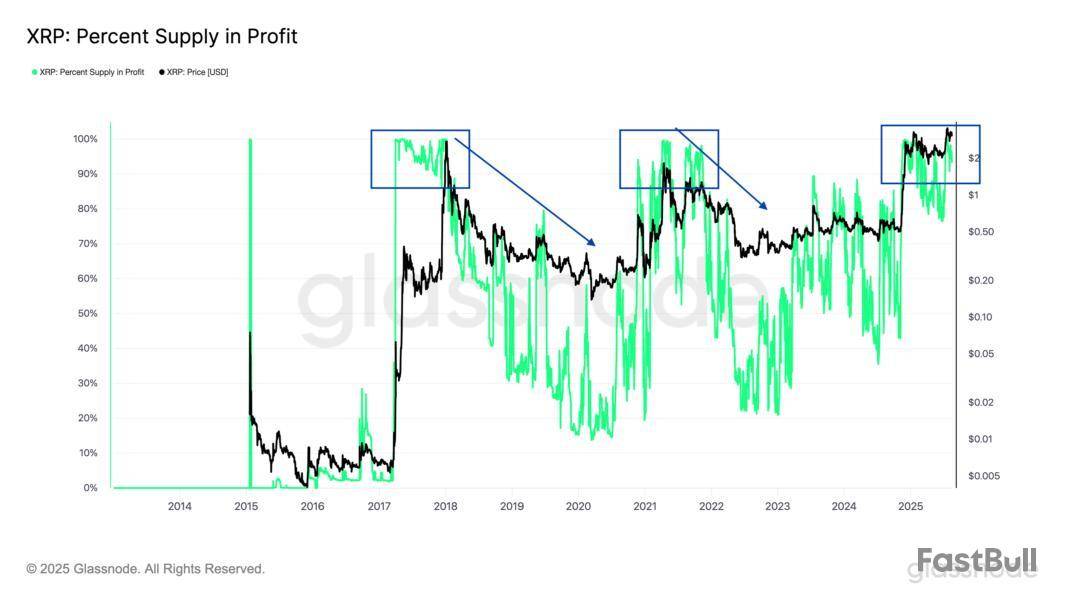

XRP’s rally to $3 has pushed 94% of supply into profit, a level that historically marked macro tops.

XRP is in the “belief–denial” zone, onchain metrics show, echoing peaks in 2017 and 2021.

XRP’s rally to over $3 has pushed nearly 94% of its circulating supply into profit, Glassnode data shows.

As of Sunday, XRP’s percent supply in profit was 93.92%, underscoring strong investor gains as the cryptocurrency rallied by more than 500% in the past nine months to $3.11 from under $0.40.

90%> supply in profit is usually an XRP macro top

Such high profitability has historically signaled overheated conditions.

In early 2018, over 90% of holders were in profit just as XRP peaked near $3.30 before a 95% price reversal. A similar setup appeared in April 2021, when profitability levels above 90% preceded an 85% crash from the top near $1.95.

The broad profitability underscores strong investor gains, which typically heightens the risk of distribution as traders may seek to realize profits. A similar scenario could be unfolding now.

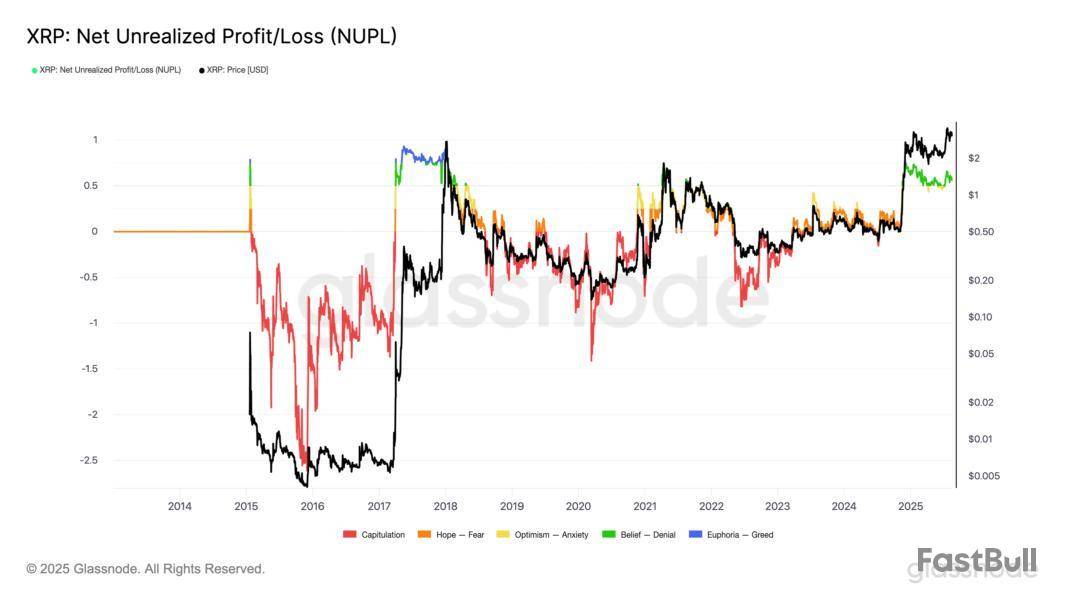

XRP’s NUPL mirros 2017 and 2021 price peaks

XRP’s Net Unrealized Profit/Loss (NUPL) is further signaling top risks.

The indicator, which tracks the difference between unrealized gains and losses across the network, has entered the “belief–denial” zone, a phase historically observed before or during market tops.

For example, in late 2017, XRP’s NUPL spiked to similar levels just as XRP price peaked above $3.30. A comparable pattern unfolded in April 2021, when NUPL readings above 0.5 coincided with XRP’s top near $1.95 before another sharp downturn.

The current trajectory suggests investors are heavily in profit but not yet in full “euphoria.” But the risk of profit-taking and distribution will intensify if NUPL rises toward greed levels for the first time since 2018.

XRP might absorb potential selling pressure and avoid a deeper correction below $3 if it can attract fresh inflows, driven by institutional demand and broader altcoin momentum.

XRP’s classic bearish setup risks 20% drop

XRP price is consolidating inside a descending triangle after rising above $3.

The pattern, typically bearish, is defined by lower highs against horizontal support near $3.05. Earlier this month, XRP briefly broke below the support in a fakeout, only to rebound back inside the structure.

The pressure from repeated retests of the lower trendline raises the risk of a decisive breakdown. A confirmed move below $3.05 could trigger a sell-off toward $2.39 by September, down about 23.50% from current price levels.

On the other hand, the bulls must break above the descending resistance line to regain upside momentum and invalidate the bearish setup. Many believe that the XRP price could rise to $6 in this scenario.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Opinion by: Kony, co-founder and CEO of GAIB

During the gold rush, it wasn’t the fortune-seekers getting rich. While it was assumed that you could take your picks and shovels and become wealthy overnight, it was grueling work with no guaranteed returns. Those who benefited were the infrastructure providers. The landowners, the pick and shovel sellers and the transportation suppliers saw a real return on investment, while the rest searched day and night for gold they never found.

This still rings true today. Those who invest in “boom” infrastructure gain more than those chasing the hype. In Q1 of this year, AI tokens dominated crypto narratives, holding 37.5% of global investor interest in Q1. Degens started jumping in, hoping that the next one would 10x and launch them into early retirement.

While not all integrations are shallow, and true advancements are coming from certain players, degens are noise-chasing and flocking to AI tokens like settlers running into the mine.

The compute bottleneck no one’s watching

By 2030, data centers will require nearly $7 trillion to keep up with the compute demand. Without compute, AI projects (or tokens) cannot exist. Like infrastructure in the gold rush, it’s the bottleneck that nobody is watching. Compute is AI’s lifeblood: revenue-generating and essential, but a scarce resource nonetheless. Crypto may not have noticed this yet, but TradFi institutions certainly have. Major institutional moves are taking place, with Big Tech hoarding chips and investing in data centers. Yet, at the same time, they’re struggling to underwrite these deals, leading to a lack of capital flow for AI operators.

Here’s where the opportunity lies for crypto, and why the industry has been playing it wrong so far. Crypto’s original ideals were to turn infrastructure into open markets, and we’ve done this for financial plumbing. Why not consider it for AI infra, too? Retail is buying the headlines while institutions are buying the hardware. A market built on attention is not sustainable, but a market built on ownership allows us to take control into our own hands and create something long-lasting.

Compute as the first truly live RWA

Looking beyond speculative token design, real yield from productive assets is within our reach. Compute is digital-native, composable and has measurable output. It’s uniquely positioned as a prime real-world asset (RWA). Instead of betting on the latest GPT memecoin, investors can go straight to the source and own a slice of what’s powering the next ChatGPT. This tech is real, exists and is ready to build markets around the infrastructure powering this new economy. As users, all we have to do is shift our attention and note what it could potentially achieve for both the investor and society.

Compute is active. It stands out among traditional and passive RWAs, like bonds, real estate, art and collectibles, etc. They hold “real value” but typically mimic TradFi instruments. Compute, on the other hand, powers live demand, feeds AI models and generates yield in real time, which can be passed to those who participate in these capital markets as real, sustainable onchain yield. Rather than being just a tokenized paper asset, it provides the raw economic materials of the AI age. If crypto wants to matter in the AI stack, it must start here and jump into a new class of RWA.

If crypto wants to shape AI, it has to fund the rails

The gold rush made one thing clear: Infrastructure always outlives hype. Crypto’s true power has never been chasing hype but building open, unstoppable markets. AI might feel new, but the lesson is timeless. Those who control the rails shape the future.

Opinion by: Kony, co-founder and CEO of GAIB.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

For his latest X post, Strategy chief Michael Saylor got all dressed up in a tuxedo, with a touch of AI as always, posting "Make the Winning Bet" as his firm's Bitcoin campaign hits the five-year mark. This is a bit of stagecraft that is often delivered by Saylor on Sundays and comes right before an update to the software company's holdings.

What started Aug. 11, 2020, looks like a running list of convictions now. The balance shows 628,946 BTC accumulated at an average entry of $73,288 per coin. At current marks, that's about $74.45 billion in value and a stated gain of 61.52%.

The summer tape shows methodical additions in size: 10,100 BTC on June 16, 4,980 on June 30, 4,225 on July 14, 6,220 on July 21 and a larger 21,021 on July 29, followed by a 155 BTC uptick recorded Aug. 11. The related cost basis is currently at $46,094,194,448, with the latest snapshot showing a market price of $119,309.

Those numbers are now the foundation for the MSTR equity.

Numbers

Strategy trades under MSTR at $366 per share with a market capitalization of $104 billion and an enterprise value of $115 billion. The firm's dashboard shows that Bitcoin makes up 71.7% of the market cap, and the NAV multiple is at 1.395.

This shows that the stock usually sells for more than the market value of its Bitcoin stack. Each time there's a purchase wave, that spread can change a bit because the equity supply is fixed while the treasury grows.

The new post doesn't promise a filing, but it is still a challenge. You have to pick the side of the table Saylor's been on for the last five years, expect the spreadsheet to do the talking and assume the policy hasn't changed: Accumulate on schedule, let the disclosures confirm it and treat the anniversary as a cue rather than a curtain call.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up