Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The launch of the VSC Mainnet is a major event for Hive and Hive Dollar, as it signals a new beginning for their blockchain ecosystem. Such upgrades typically bring enhancements in speed and security, attracting developers and investors alike. If successful, it can heighten interest and usage, potentially driving up the token's value. The anticipation around this event could see speculative trading increase as traders position themselves for possible gains or declines. However, post-launch, the market will assess the effectiveness of the upgrade. source

Virtual Smart Chain@vsc_ecoMar 25, 2025Breaking News: VSC Mainnet Soft Launch Date Confirmed!

Save the date: March 31st is when a new era begins!

Our journey has been challenging, but we’re excited to share all the details. Check out our latest blog post in the first comment below! pic.twitter.com/XVUMTohMwl

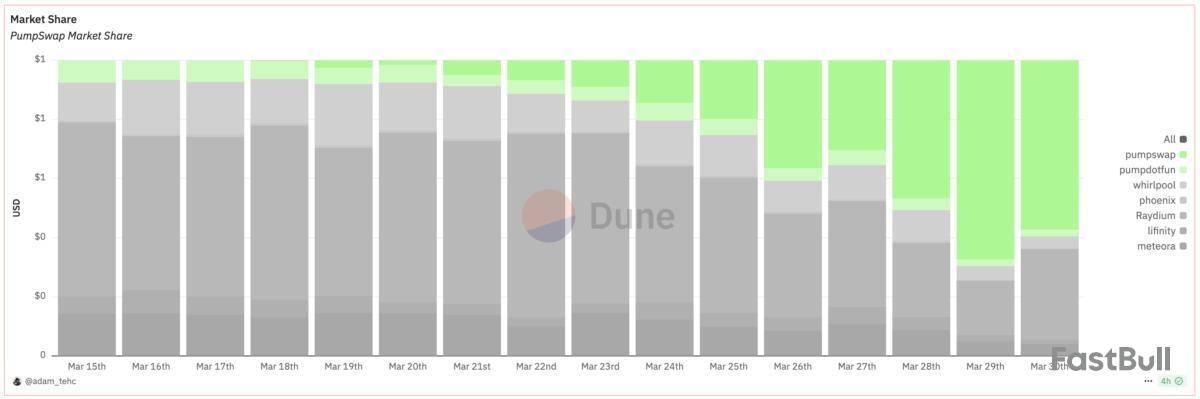

PumpSwap, the new decentralized exchange (DEX) from the creators of memecoin launchpad Pump.fun, has processed $10 billion in cumulative volume in its first ten days since officially launching, according to a Dune Analytics dashboard tracking the exchange.

Pump.fun launched the DEX on March 20 to allow successful memecoins to migrate directly to PumpSwap, bypassing Raydium, among the leading Solana-based exchanges and automated market makers (AMMs). Raydium, in January, processed a quarter of total DEX volume, according to The Block's data, more than any other exchange.

PumpSwap's already established itself as a dominant player among Solana DEXs.

Yet on Saturday, PumpSwap processed 67.4% of the volume processed by several major leading Solana DEXs, with Raydium claiming the second-largest market share at 18.2%. No other exchange claimed more than 5% of the market, according to the dashboard.

PumpSwap has generated over $20 million in protocol fees and its liquidity providers have received over $5 million in fees, according to the dashboard. Nearly 700,000 wallets have already accessed the protocol.

Despite the success of PumpSwap, Pump.fun has lately seen volume across its exchange fall as demand for memecoin trading cools. Pump.fun's team has previously teased plans for a native token launch.

Meanwhile, Raydium is working on a memecoin launchpad of its own called LaunchLab, likely intended to compete with Pump.fun, The Block previously reported.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CORK, Ireland, March 30, 2025 (GLOBE NEWSWIRE) — XRP ($XRP) continues to battle investor uncertainty as its price hovers around $2.16, down significantly from its recent peak at $2.50 just last week.

Amid ongoing volatility, XRP investors are growing cautious, driven by lingering doubts over regulatory clarity despite the SEC recently dropping its lawsuit against Ripple.

However, while XRP struggles to find its footing, one project within the XRP ecosystem is thriving: ExoraPad ($EXP), the innovative AI-powered IDO launchpad designed specifically for the XRP Ledger.

Join ExoraPad Presale

ExoraPad Presale Rockets Past 100% Softcap Milestone

In stark contrast to XRP’s declining momentum, ExoraPad's $EXP token presale is booming, having already surpassed 100% of its Presale Softcap, raising Almost 50,000 XRP in record time.

This significant milestone underscores strong investor enthusiasm, signaling confidence that ExoraPad might deliver substantial returns post-launch as analysts speculate it could be a potential 100X XRP project.

Why Investors are Choosing ExoraPad Over XRP

ExoraPad is tapping into a critical niche on the XRP Ledger, serving as the first AI-driven launchpad

ExoraPad is designed and dedicated exclusively to projects involving Real-World Asset (RWA) tokenization, Decentralized Physical Infrastructure Networks (DePIN), and premium tier Web3 ventures only.

Advanced AI Integration Fuels Investor FOMO

A core aspect driving investor excitement is ExoraPad’s advanced artificial intelligence analytics.

Its proprietary AI model carefully evaluates projects for sustainability, growth potential, and risk mitigation, ensuring only premium-tier opportunities reach the platform.

Buy $EXP Token

Attractive Staking Rewards and Passive Income Drive $EXP Token Demand

ExoraPad enhances investor appeal with powerful incentives designed for long-term holding:

These compelling rewards strongly incentivize holding $EXP, ensuring continuous demand and growth potential.

How to Join the EXP Token Presale

Joining the ExoraPad presale is straightforward:

Countdown to Exchange Listing—Don’t Miss Out

With the presale now rapidly approaching its target raise and tokens selling fast, investor FOMO continues to escalate.

The urgency for crypto investors to secure $EXP tokens at presale prices is palpable, particularly given the token’s anticipated listing on prominent decentralized exchanges at a guaranteed premium of 25% above presale price.

Official Channels:

Website: https://exorapad.com

Presale: https://exorapad.com/presale

Telegram: https://t.me/exorapad

Twitter/X: https://x.com/Exorapad

Documentation: https://docs.exorapad.com

Contact:

Noah Walsh

hello@exorapad.com

Disclaimer: This press release is provided by the ExoraPad. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.

Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed.

Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/16ed0a22-3940-447f-a72e-b5a87f47ef5d

ExoraPad

ExoraPad

The crypto market is mostly in the red zone today, according to CoinStats.CoinStats">

The price of XRP has risen by 1.30% over the last day.TradingView">

On the hourly chart, the rate of XRP is far from the key levels. Most of the daily ATR has been passed, which means any sharp moves are unlikely to happen by tomorrow.TradingView">

On the bigger time frame, the situation is similar. The price of XRP is trading within yesterday's candle. The volume is low, confirming the absence of buyers' and sellers' energy.

All in all, consolidation in the area of $2.05-$2.20 is the more likely scenario.TradingView">

From the midterm point of view, the rate of XRP is returning to the support level of $1.90. If a breakout of the vital $2 zone happens, there is a chance of an ongoing drop to the $1.60-$1.80 zone.

XRP is trading at $2.1413 at press time.

Stellar (XLM) is showing mild signs of recovery following a two-day decline toward the weekend. At the time of writing, XLM is up 1.01% in the last 24 hours, trading at $0.27.

While XLM’s slight rebound is a positive signal, its sustainability remains uncertain. Stellar started declining since reaching multi-year highs of $0.638 in November 2024. Bulls attempted to revive the uptrend in January this year but met resistance at $0.51, and Stellar has since declined to trade below the daily SMA 50, now at $0.297. Daily Chart, Courtesy: TradingView">

March saw lackluster trading for Stellar, with its price action locked within a range between its daily SMA 50 and 200, currently at $0.297 and $0.28. Although XLM fell below the range in mid-March, the price quickly returned to it.

Fast forward to the present, crypto prices tumbled on Friday following a hotter-than-expected inflation report; Stellar likewise fell, reaching lows of $0.269 in the session. The drop caused XLM to trade below the daily SMA 200 once again. The sell-off continued on Saturday with XLM reaching lows of $0.261 before slightly rebounding.

Will it last?

In the coming sessions, investors and analysts will be looking to see if this price rebound is the start of a recovery or a dead cat bounce in which the price briefly recovers before heading down.

In the short term, market analysts expect the crypto market to be largely impacted by macroeconomic factors, given that there is no crypto-specific trigger to drive price growth. That said, broader crypto market movements might play a role in determining XLM’s direction. Increased buying pressure in the market could cement XLM’s price recovery.

Also, how the XLM price behaves near key support and resistance levels will be closely watched. In this context, a return above the daily SMA 200 at $0.28 would restore XLM to its previous range and prevent further declines. XLM could consolidate a little while longer above here before making its major move.

The daily SMA 50 at $0.297 remains the short-term hurdle, with targets of $0.375 and $0.514 if breached.

Opinion by: Maksym Sakharov, co-founder and group CEO of WeFi

The current markets are experiencing tailwinds as a result of the tariffs imposed by the US administration and retaliatory measures from trading partners. So far, however, market proponents say that Trump’s tariffs are primarily a negotiation strategy, and their effect on businesses and consumers will remain manageable.

Market uncertainty drives institutional interest

Adding to the uncertainty are the inflationary pressures that could challenge the US Federal Reserve’s rate-cutting outlook. Besides that, an impending fiscal debate in Washington over the federal budget is also causing jitters in the market.

Resolving the debt ceiling remains a pressing issue, as the Treasury currently relies upon “extraordinary measures” to meet US financial obligations. The exact timeline for when these measures will be exhausted is unclear, but analysts anticipate they may run out after the first quarter.

While the administration has proposed eliminating the debt ceiling, this could face resistance from fiscal conservatives in Congress. According to a recent report, one sector experiencing steady growth is stablecoins despite this macroeconomic uncertainty. Much of the volume is driven by flows in Tether’s USDt and USDC .

Dollar-pegged stablecoins dominate the market

Stablecoins started as an experiment — a programmable digital currency that would make it easier for users to enter the crypto market and trade different digital assets. A decade later, they are a critical part of the broader digital financial infrastructure.

The stablecoin market cap currently stands at a record $226 billion and continues to expand. Demand in emerging markets drives this growth. A recent ARK Invest report states that dollar-pegged stablecoins dominate the market. They account for over 98% of the stablecoin supply, with gold- and euro-backed stablecoins only sharing a small portion of the market.

In addition to this, Tether’s USDt accounts for over 60% of the total market. ARK’s research suggests that the market will expand and include Asian currency-backed stablecoins.

Recent: US will use stablecoins to ensure dollar hegemony — Scott Bessent

Besides that, digital assets are going through a shift marked by “stablecoinization” and “dollarization.” Asian nations like China and Japan have offloaded record amounts of US Treasurys. Saudi Arabia has ended its 45-year petrodollar agreement, and BRICS nations are increasingly bypassing the SWIFT network to reduce reliance on the US dollar.

Bitcoin and Ether were traditionally the primary entry points into the digital asset ecosystem. Stablecoins have, however, taken the lead over the past two years, now representing 35%–50% of onchain transaction volumes.

Despite global regulatory headwinds, emerging markets have been adopting stablecoins. In Brazil, 90% of crypto transactions are undertaken via stablecoins, primarily used for international purchases.

A Visa report ranks Nigeria, India, Indonesia, Turkey and Brazil as the most active stablecoin markets, and Argentina ranks second in stablecoin holdings. Additionally, six out of every 10 purchases in the country were made using stablecoins pegged to the dollar, with near parity between USDC and USDT.

This shift toward stablecoins in Argentina is driven by high inflation and the need to protect against the devaluation of the Argentine peso. People in countries with unstable currencies turn to stablecoins, like USDT, to safeguard their wealth.

Deobanks and their role in high-risk areas

Stablecoins have paved the way for a new generation of financial services. For example, stablecoins have provided the foundation for decentralized onchain banks, or deobanks, that embrace stablecoins as their native currency.

Deobanks make digital banking and financial services accessible to everyone, even people who do not meet strict account opening criteria. They also attract people who do not trust traditional institutions with their money. Users keep complete control of their funds through non-custodial accounts and enjoy real-time transaction transparency.

Deobanks’ decentralized nature replaces intermediaries with smart contracts that connect personal wallets directly to digital bank accounts. This approach cuts costs and speeds up transactions. Onchain data transparently preserves every transaction detail. The result is a financial model that is both efficient and inclusive.

What lies ahead

Analysts predict the stablecoin market cap will surpass $400 billion in 2025. Deobanks bring a new edge to this growth, using stablecoins to drive economic growth and expand digital payment networks. They open fresh avenues for cross-border commerce and new opportunities for financial inclusion.

In the next few years, the combined rise of stablecoins and next-generation onchain banks will transform how money moves across borders and transactions are processed. The blockchain integration at the back end and stablecoin foundation will promote lower fees, faster payments and broader access to financial services. The trend represents a shift away from outdated systems and signals a more resilient financial ecosystem.

Opinion by: Maksym Sakharov, co-founder and group CEO of WeFi .

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Dog-themed cryptocurrency Shiba Inu is facing selling pressure alongside the rest of the crypto market, with its price decreasing in the last 24 hours.

At the time of writing, Shiba Inu was in red amid an extended sell-off since the past week. SHIB is currently down 1.53% in the last 24 hours to $0.00001262, according to CoinMarketCap, and is on track for its fourth day of drop since achieving highs of $0.00001567 on March 26.

Top coins fell to their lowest levels in at least a week as stock markets were roiled by macroeconomic concerns. The sell-off continued throughout the weekend following hotter-than-expected inflation data released on Friday.

Profit-taking also likely contributed to the price drop after Shiba Inu rallied for five straight days between March 22 and 26. The recent movement in SHIB price has wiped off weekly gains, with SHIB down 2.42% in the last seven days.

Crucial warning issued

A crucial warning has been issued to the Shiba Inu community regarding a phishing scam targeting crypto users.

Susbarium, a Shiba Inu-focused X account dedicated to uncovering scams and protecting the community, stated that it had been alerted to a phishing scam in which scammers send fake messages to users about suspicious account activity.

Susbarium | Shibarium Trustwatch@susbariumMar 29, 2025🔥⚠️ SCAM ALERT!⚠️ 🔥

🐾 Attention #ShibArmy, let’s stay safe worldwide! 🐾

We’ve been alerted to a scam where fake messages claim:

"[Binance] Alert: A new device (e.g., Google Pixel 9) has been registered. If this was NOT you, call us immediately at: +351 300 609 081."… pic.twitter.com/oWPkIylIBb

Susbarium offered an example of such: The user receives a message claiming to be from Binance, reporting that a new device has been registered. The message asks the victim to call a number to "secure" their account.

Susbarium stated that this was a phishing attempt designed to steal personal data and crypto assets and urged users not to call or share information.

As a precaution, Susbarium urges the Shiba Inu community to ignore and delete suspicious messages or calls, report scams to local fraud or scam monitoring authorities, and spread awareness to help others avoid falling victim. Lastly, they should only connect with official channels to avoid scams.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up