Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Tokocrypto will list Hifi Finance (HIFI) on the 17th of September at 03:00 UTC.

HIFI Info

Hifi is a decentralized lending protocol on the Ethereum blockchain, offering fixed interest rate loans. It allows borrowers to leverage the value of their crypto assets without selling them. Lenders, on the other hand, can earn predictable returns due to the fixed interest rates. Hifi also incorporates hTokens, a bond-like financial instrument representing an on-chain obligation with a specific maturity date.

Hifi operates through a series of smart contracts that enable users to deposit collateral and mint hTokens in a trustless environment. These hTokens can be purchased by lenders at a discount and redeemed at full face value at maturity. The protocol maintains a collateralization factor to ensure all debts are over-collateralized. If collateral falls below a certain threshold, it is sold to liquidators at a discount, helping to manage risk and maintain the system’s integrity.

The HIFI token is used within the Hifi ecosystem for governance purposes, with token holders responsible for managing the protocol’s risk parameters and incentives. They have the authority to allocate resources to various aspects such as liquidity, staking rewards, public goods, bug bounties, or a token buyback program, thereby playing a crucial role in the overall functioning and stability of the Hifi protocol.

Tokocrypto will delist BakerySwap (BAKE) on September 17th at 03:00 UTC.

BAKE Info

BakerySwap is a decentralized automated market-making (AMM) exchange protocol built on the Binance Smart Chain (BSC). As one of the pioneering projects on BSC, it differentiates itself by offering altcoin liquidity pools, eliminating the need for traditional order books and promoting direct trades against liquidity pools.

Unlike conventional exchanges, BakerySwap doesn’t rely on order books to match buyers and sellers. Instead, it utilizes liquidity pools where assets are supplied by its users and supporters. In return for providing liquidity, users receive liquidity provider (LP) tokens proportional to their contribution. These LP tokens can subsequently be converted back to the original assets based on the user’s share of the pool, with liquidity providers earning trading fees as compensation.

Central to the BakerySwap ecosystem is the native BEP-20 governance token, BAKE. Users can earn BAKE either by staking the token itself or by providing liquidity to the platform and then staking the resultant BLP tokens. Beyond being a reward mechanism, BAKE tokens allow holders to earn a portion of the platform’s trading fees and play a pivotal role in the governance processes of BakerySwap, ensuring community participation in decision-making.

Cardano is hanging by a thread in the top 10, and Hyperliquid (HYPE) is the reason why. According to CoinMarketCap, ADA is worth $30.44 billion, but HYPE, now at $16.88 billion after a +256% rally this year, is closing in with numbers that make Cardano look stuck in another era.

Daily DEX turnover is $361 million for HYPE against just $2.89 million for ADA, as per DefiLlama. Cardano is still moving, but the scale mismatch makes it look more like a "dino coin" holding its spot by muscle memory than an ecosystem competing at the front.

For Cardano, that is the existential risk. A network without a stablecoin, without competitive DeFi activity and without real fee revenue is defending a top-10 slot, while Hyperliquid builds the exact mechanics that make tokens rise. ADA's survival now looks less like strength and more like inertia.TradingView">

The year-to-date price chart shows this split: HYPE has shot up by 254.9%, while ADA has dropped by 29.7%. One line trends up and to the right, while the other drags sideways at the bottom — proof that liquidity and adoption are already flowing in opposite directions.

Biggest problem

The stablecoin gap is at the core, and even Charles Hoskinson has admitted it. Cardano does not have any, but Hyperliquid is getting ready to release USDH with Paxos, the same company that previously issued $25 billion BUSD for Binance. And Hyperliquid is already processing $5.5 billion in stable liquidity, which is currently enriching Circle.

With its own stable, $200-220 million a year could be put back into its ecosystem, and if adoption grows, could scale to over $1 billion in annual buybacks of HYPE.

Cardano gathers the community across the globe to workshops and discussions, but nothing is shipped. It calls itself decentralized, yet three entities still dominate the ecosystem.

Hoskinson may justify this by saying Cardano is playing the long game, but the risk is obvious: every long game turns short if nothing materializes.

By Chris Wack

Forward Industries shares were 85% higher, at $30.22, after the company received $1.65 billion in cash and stablecoin commitments for a private investment in public equity offering led by Galaxy Digital, Jump Crypto, and Multicoin Capital.

The stock hit its 52-week high of $31.97 just after the market opened, and is up 736% in the past 12 months.

The company said the investment will initiate a Solana-focused digital asset treasury strategy.

C/M Capital Partners, one of the company's largest existing shareholders, is also a participant in this transaction.

Galaxy, Jump Crypto, and Multicoin will provide both capital and strategic support to help Forward Industries structure and execute its Solana treasury strategy.

Upon the closing of the PIPE, Kyle Samani, co-founder and managing partner of Multicoin, is expected to become chairman of the board of directors.

Write to Chris Wack at chris.wack@wsj.com

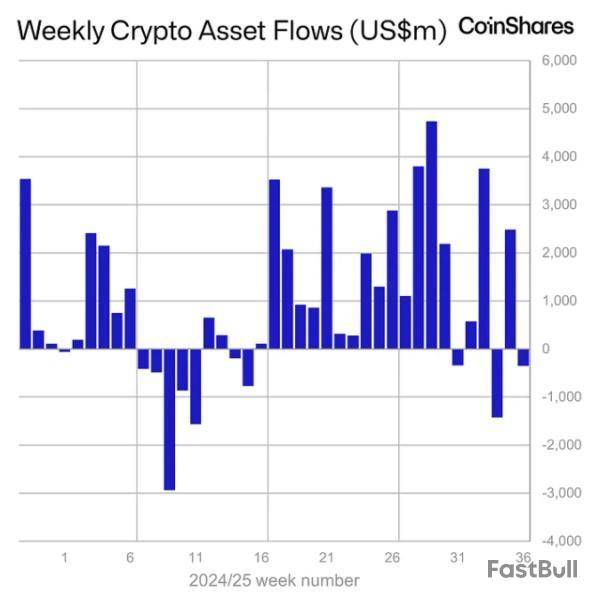

Global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares generated net outflows of $352 million last week, reversing the trend once again after the prior week's $2.5 billion inflows, according to CoinShares' data.

Weaker payroll figures and improving prospects for a September interest rate cut in the U.S. failed to bolster sentiment, CoinShares Head of Research James Butterfill said in a Monday report.

Trading volume also fell 27% week-over-week, suggesting the appetite for digital assets has cooled, Butterfill added. Nevertheless, with year-to-date inflows of $35.2 billion, 4.2% ahead of last year's total on an annualized basis, broader sentiment remains intact, he said.

Weekly crypto asset flows. Images: CoinShares.

Ethereum investment products lead outflows

Regionally, sentiment was polarized, Butterfill noted, with U.S.-based digital asset investment products witnessing $440 million in net outflows, while crypto funds in Germany and Hong Kong saw inflows of around $85 million and $8 million, respectively.

Despite softer sentiment and modest outflows later in the week, Bitcoin funds still recorded $524 million in net inflows.

In contrast, Ethereum products drove last week's net outflows, with $912 million exiting across a broad set of ETP issuers. Still, year-to-date inflows remain strong at $11.2 billion, Butterfill said.

The U.S. spot Ethereum ETFs accounted for $787.6 million of last week's net outflow figure, according to data compiled by The Block, while the U.S. spot Bitcoin ETFs brought in $250.3 million.

Meanwhile, Solana and XRP-based investment products continued to witness modest but steady inflows of $16.1 million and $14.7 million, respectively. Solana investment products have now logged 21 consecutive weeks of inflows totaling $1.16 billion, while XRP funds have attracted $1.22 billion over the same period, Butterfill noted.

Earlier on Monday, CoinShares announced it is set to go public in the U.S. via a $1.2 billion merger with special purpose acquisition company Vine Hill that will see it listed on the Nasdaq.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

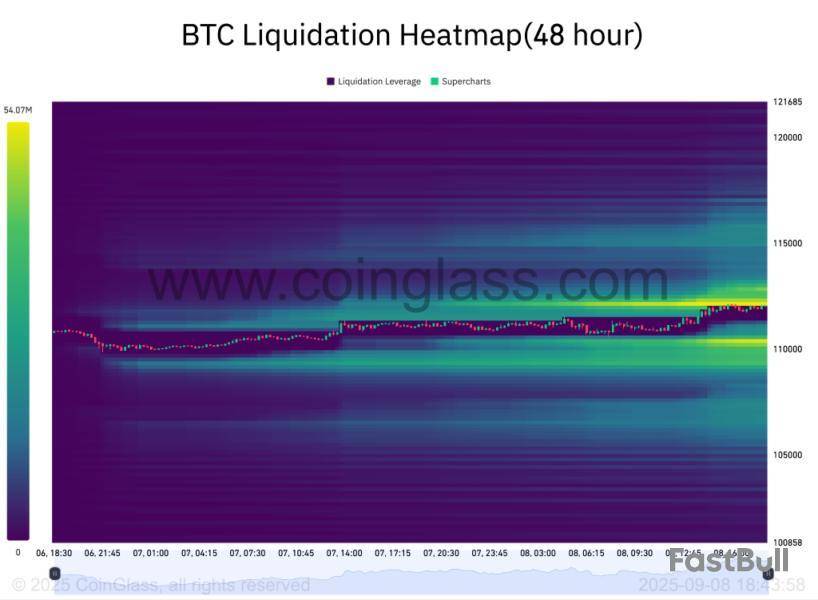

Bitcoin price has been trading in a tight consolidation range, leaving traders wondering whether the next move will be a strong breakout or a deceptive fakeout. After weeks of sideways price action, market participants are closely watching key support and resistance levels for signs of momentum. With sentiment shifting and trading volumes fluctuating, every move now carries significance. In this delicate phase, BTC’s next direction could set the tone for the broader crypto market, making it a critical juncture for investors and traders alike.

Bitcoin Consolidating Within Major Liquidation Zone

The current price action seems to have compelled the investors to create a safe cluster around the range. The liquidation heatmap of Bitcoin shows the price trading between the liquidity cluster, which is accumulated between $112,100 and $112,300 and around $110,800. The bulls are failing to break the upper cluster, which is expected to drag the levels lower to squash the sellers.

On the other hand, the Open Interest has been consistently plunging from over $87 billion to close to $80 billion. This suggests the future traders are either not opening new positions or closing their positions. Now that money is flowing out of the market, signalling the beginning of the exhaustion phase, the BTC price is now believed to reverse the trend as well. Additionally, the Coinbase premium is also negative and the US inflation data is coming this week. With this, the Bitcoin price is expected to sweep the lower liquidity.

Will Bitcoin Price Test the Support at $108,000?

Although the price has rebounded from the local support at $107,300, the rally, in the wider perspective, remains consolidated within a descending channel. Meanwhile, the bulls are attempting to break the resistance and if they are successful in doing so, the price is believed to rise above $113,400, paving the way to test the higher targets. However, the current price action displays a diverse price action, indicating a potential pullback.

As seen in the above chart, the BTC price is trading within a descending parallel channel and is trying to break the upper resistance. Moreover, it is trading within the Ichimoku cloud, hinting towards an extended consolidation. A breakout followed by a retest hints towards a bullish confirmation; however, the chart pattern suggests the possibility of a rejection.

The RSI and CMF are incremental, which is a bullish signal, but the previous pattern pushed the price lower after testing the resistance zone at $116,800, hinting towards a potential pullback to $110,000. Therefore, the next few days are pretty crucial for the Bitcoin price rally as a rejection before the breakout could activate the lower targets around $110,000 or lower.

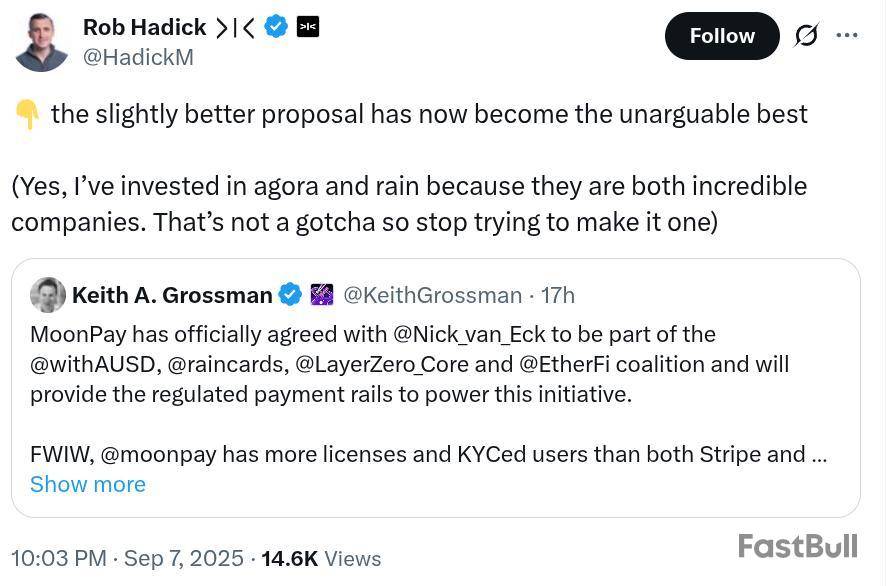

Stripe is facing pushback in its bid to issue Hyperliquid’s planned USDH stablecoin, as a coalition of crypto firms, including MoonPay, Agora and Rain lined up competing proposals alongside Paxos and Frax.

In a Friday Discord message, the Hyperliquid team announced it wants to create a “Hyperliquid-first, Hyperliquid-aligned, and compliant USD stablecoin” with the USDH ticker. This was followed by the Native Markets teams submitting the first proposal, which would see Stripe’s stablecoin payment processor, Bridge, issue USDH.

Native Market’s proposal promised to contribute “a meaningful share of its reserve proceeds” to Hyperliquid’s Assistance Fund treasury, mint directly on the ecosystem and be regulatory compliant. Still, Agora co-founder and CEO Nick Van Eck submitted an alternative proposal, arguing against the Stripe-linked alternative:

“If Hyperliquid relinquishes its canonical stablecoin to Stripe, a vertically integrated issuer with clear conflicts, what are we all even doing?” asked Van Eck. He added that Agora “strongly urges caution against the utilization of Stripe (Bridge) as an issuer.”

Against Bridge issuing USDH

Van Eck claimed that Bridge has insufficient financial infrastructure and product experience and also pointed to Stripe’s announcement of plans for its own Tempo blockchain as a potential conflict of interest. “Stripe is committed to driving activity to this ecosystem,” he said, asking:

On Sunday, MoonPay president and board member Keyth Grossman announced that the payment processor is joining Agora’s proposal to issue USDH for Hyperliquid and “provide the regulated payment rails to power this initiative.” Just like Van Eck, he harshly criticized the Native Markets proposal. “USDH deserves scale, credibility and alignment — not BS capture. That is this coalition, not Stripe,” he said.

Rob Hadick, general partner at venture capital firm Dragonfly.xyz, shared his enthusiasm. In a Sunday X post, he wrote that the addition of MoonPay to the coalition made this the “unarguable best” proposal for USDH issuance.

Aside from the Stripe-linked proposal, the coalition must compete with stablecoin issuer Paxos. On Sunday, the firm also submitted a proposal to launch USDH, promising to direct a percentage of the interest earned from USDH reserves to buy back Hyperliquid’s native token, HYPE, and redistribute it to users, validators and partner protocols.

Another competing proposal is the one by the Frax blockchain, which promises to give all earnings of USDH — backed by its frxUSD — back to the community. “We’re proposing something no one else will match: give everything back to the community,” the proposal stated.

Stablecoins are an active battleground

The competition underscores growing activity in the stablecoin sector as regulators and financial institutions step in. HSBC and ICBC are reportedly preparing to apply for stablecoin licenses in Hong Kong, where a new framework took effect Aug. 1.

Adoption is also moving fast, with Kazakhstan’s financial regulators recently allowing license and supervision fees to be paid in US dollar-pegged stablecoins.

The US state of Wyoming also plans to launch the Frontier Stable Token (FRNT), a stablecoin authorized by the local government. 1Money, a company building a layer-1 blockchain for stablecoin payments, recently announced that it has secured as many as 34 US money transmitter licenses, alongside a Bermuda license.

Earlier this month, European Central Bank President Christine Lagarde called for EU lawmakers to address gaps in stablecoin regulation. “[The US government’s policies] could potentially result not just in further losses of fees and data, but also in euro deposits being moved to the United States,” said ECB executive board member Piero Cipollone in April.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up