Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

From October 3 to 10, 2025, Helium holders will vote on HIP 148. If it passes, rewards from Mobile Mapping will move to the Data Transfer Pool, and Mobile Service Provider rewards will be made simpler. This change could benefit active network users and attract more activity, which may help the HNT price rise. But changes in tokenomics can worry some investors, and prices could drop if they do not like the proposal. Watch the voting results and community feedback for clues. Learn more at source.

Alvara Protocol will fully release BSKT Lab 14.10 to the public on October 14, 2025. This release lets early holders and contributors shape the growing ecosystem as new users join. If the launch goes well and helps ALVA get more users or partners, interest in the ALVA token could increase, pushing the price higher. But if users do not adopt the new system, price impact could be small or negative. It is important to watch how many new users join after the launch. Read more at source.

Alvara@AlvaraProtocolOct 03, 2025Alvara mainnet is live and proven.

Our Pioneers have rigorously stress-tested and validated the platform from day one, while we continuously iterated and optimized.

Now, access expands.

BSKT Lab full public release 14.10

Early BSKT holders and contributors now lead a growing… pic.twitter.com/bVpLRFuIZz

On November 1, 2025, EigenCloud will unlock about 36.82 million EIGEN tokens, which is around 12.1% of its released supply. This large token unlock may put pressure on the price because new tokens can be sold on the market. If many holders decide to sell at the same time, the price can fall quickly. But, if holders trust the project and keep most tokens, the price might stay stable. Traders should watch the market before and after the unlock to see how people react. More details at source.

The price of Bitcoin made a dreamy start to the last quarter of the year, beginning the historically bullish month of October with a reclaim of the $120,000 level. After over a month of choppy price action, the world’s largest cryptocurrency seems to be resuming its bullish uptrend.

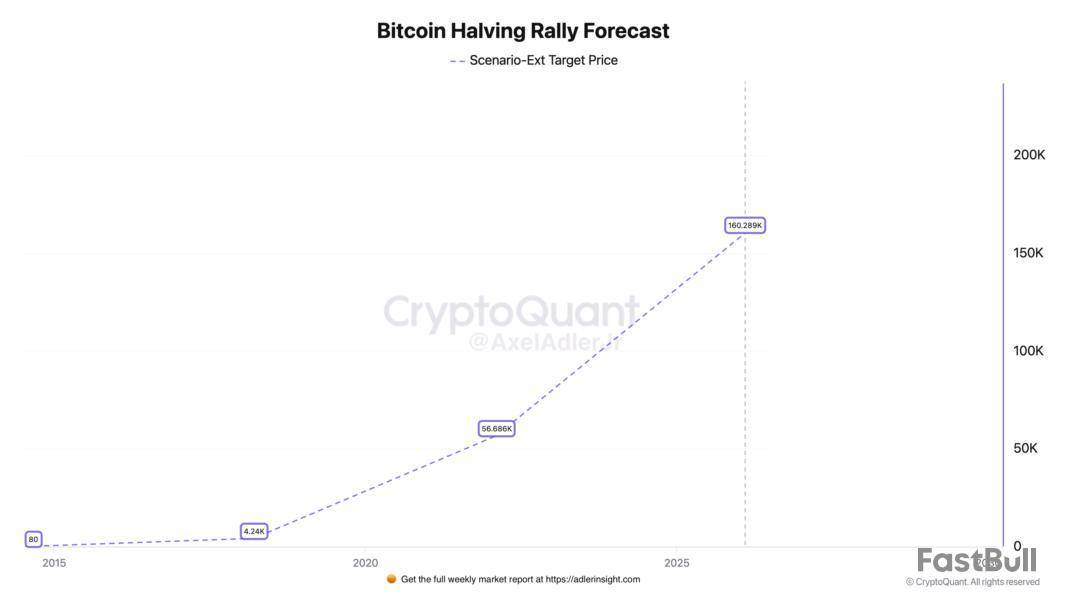

With the price closing in on its all-time high price above $124,000, investors will be looking to see how far and long the premier cryptocurrency can go in the latest leg up. According to an on-chain analyst on social media platform X, the price of BTC could rise as high as $160,000 in the current run.

Why A Break Above $128k Is Critical To BTC’s Bull Run

In an October 3 post on X, crypto analyst Axel Adler Jr. put forward a $160,000 target for the Bitcoin price at the start of next year. According to the online pundit, the sustained progression of BTC’s price action to this unprecedented high hinges on two primary conditions, or two price levels.

This bullish analysis revolves around the historical price performance of Bitcoin following the halving event. Typically, the halving event is viewed as a catalytic event that triggers long-term price rallies for BTC, as it involves slashing by half the volume of the premier cryptocurrency created at a time.

As observed in the chart above, the scenario-based model shows through a trend-based forecast that each halving cycle produces an exponentially higher peak for the Bitcoin price. According to this model, the price of BTC printed a post-halving peak around $57,000 following the 2020 event, beating the previous high of $4,250.

Adler Jr. revealed that the Bitcoin price could head for $160,000 after the 2024 halving event, which saw miner rewards fall from 6.25 BTC to 3.125 BTC. However, for this rally to be confirmed, the first condition is that the flagship cryptocurrency will need to break above the $128,000 and hold above this “base” level on multiple weekly closes.

In the second condition, the on-chain analyst shared that Bitcoin’s upward movement toward the $160,000 mark could be at risk of invalidation should the price fall below the $102,000 level. According to Adler Jr., a breakdown beneath this level could lead to a quick scenario reset, potentially changing the target or overall trend for the Bitcoin price.

Ultimately, the price action of BTC in the short term is one to look out for, as the market leader looks to reclaim its current all-time high. Moreover, a break above the record-high price could clear the path for Bitcoin to reach the ‘base” level of $128,000.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $122,710, reflecting a 2% jump in the past 24 hours. According to data from CoinGecko, the top cryptocurrency is up by more than 12% in the last seven days.

MetaMask, the popular Web3 wallet created by Consensys, will roll out an onchain rewards program "in the next couple of weeks," MetaMask announced on X Saturday.

The program "will yield referral rewards, mUSD incentives, exclusive partner rewards, access to tokens, and more," MetaMask said, and will distribute "over $30M in LINEA token rewards" during its first season. LINEA is the native token of Linea, an Ethereum Layer 2 network also incubated by Consensys, and was launched in September with a 9.4 billion token airdrop.

"Long-time MetaMask users will not be ignored - they'll be given special benefits, and MetaMask Rewards will have meaningful connections with the future MetaMask token," MetaMask wrote in its announcement. MetaMask also said the program is "not a farming play" and represents "a genuine method of regularly giving back to our community."

It is unclear whether users in certain jurisdictions will be restricted from participating in the program, and if any anti-Sybil measures will be enacted by MetaMask. The Block could not immediately reach MetaMask for comment.

MetaMask's planned MASK token was announced by Ethereum co-founder and Consensys CEO Joseph Lubin in mid-September. Lubin said, on The Block's "The Crypto Beat" podcast, that the MASK token "is significantly related to the decentralization of certain aspects of the MetaMask platform."

MetaMask's mUSD stablecoin went live around the same time, issued by Stripe-owned firm Bridge. The token currently has a circulating supply of $87.7 million, according to the token's website, The token was launched on Ethereum and Linea, and is not yield-bearing.

MetaMask's announcement was met with criticism by some X users. "[T]his will go over well and no one will be disgusted and insult you," crypto streamer "Gainzy" wrote in one sarcastic response.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

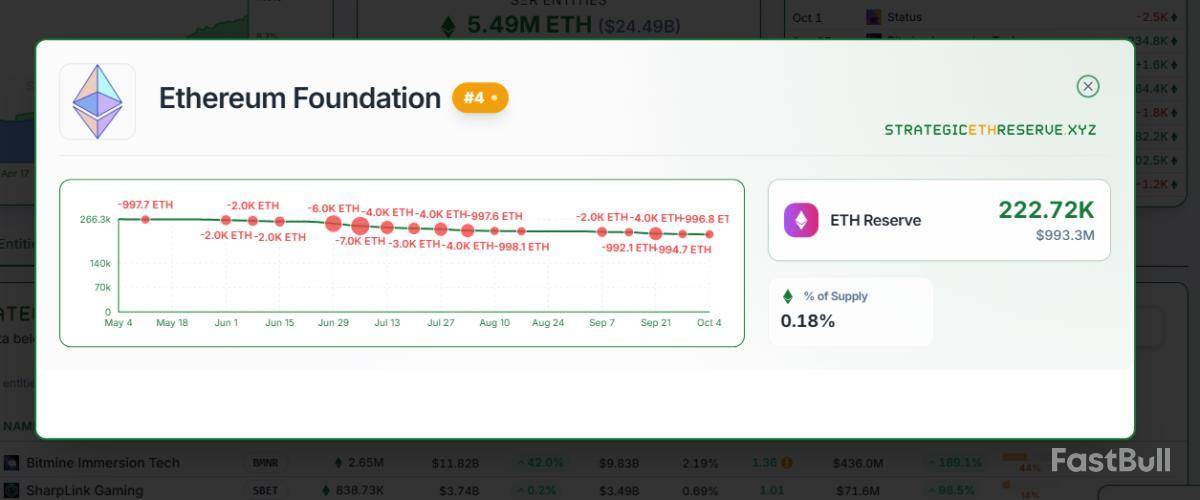

The Ethereum Foundation has announced plans to sell 1,000 ETH, worth roughly $4.5 million, as ETH’s price climbs above $4,500 for the first time since mid-September.

The sale, disclosed on October 4, will be executed using CowSwap’s Time-Weighted Average Price (TWAP) feature. This automated tool spreads large transactions over time to prevent sudden market disruptions.

Ethereum Foundation’s 17th ETH Sale This Year Renews Market Debate

By using TWAP, the Foundation aims to reduce price volatility, minimize slippage, and secure more balanced execution prices.

Institutional investors and crypto treasuries often rely on similar strategies to offload large holdings without triggering sharp price swings.

As a result, the proceeds will be converted into stablecoins to fund ongoing operations such as ecosystem research, developer grants, and community donations.

According to the Foundation, this sale aligns with its broader strategy of managing its treasury more efficiently while leveraging DeFi tools.

Meanwhile, according to data from the Strategic ETH Reserve, this marks the Foundation’s 17th ETH sale in 2025. Its remaining balance now stands near 222,720 ETH—worth approximately $1 billion at current prices.

The frequent sales have raised concerns among community members, who argue that such activity can create bearish sentiment and weaken investor confidence.

While some critics have questioned the optics of repeated sales during bullish momentum, others view the move as a necessary step toward responsible treasury management.

Crypto researcher Naly suggested that the Foundation could “highlight the power of DeFi” by using decentralized tools to generate liquidity rather than selling tokens outright.

Naly proposed an alternative: “Supply ETH on Aave, earn interest, borrow stablecoins, and fund operations using DeFi-generated capital.”

Advocates say this method would allow the Foundation to maintain exposure to ETH’s potential upside while still accessing liquidity for expenses.

Still, not all feedback has been negative.

Several community members have praised the Foundation’s transparency for announcing its sales publicly. According to them, this practice is uncommon among large crypto organizations.

As of press time, Ethereum trades around $4,500, up 12% from last week’s low near $4,000, according to BeInCrypto data.

Token2049, the organization behind the high-profile crypto conference of the same name that recently wrapped up in Singapore, scrubbed references on its website to A7A5, a stablecoin project sanctioned by the U.S. and UK, which presented at the conference and was listed as a "platinum sponsor," according to Reuters.

The project had a booth at the conference, according to the Reuters report, and several staff members were present. Oleg Ogienko, the project's director of international development, spoke about the future of stablecoins, saying A7A5 holds 44% of the non-USD stablecoin market with a $1.2 billion market cap.

The entities behind the ruble-backed A7A5 stablecoin were sanctioned by the U.S. Office of Foreign Assets Control (OFAC) in August, which alleged the token "was created for Russian customers of A7 Limited Liability Company (A7), a Russian firm that provides cross-border settlement platforms used for sanctions evasion." The UK soon followed suit with its own sanctions against the project's backers, claiming the token was "specifically designed as an attempt to evade western sanctions."

Ogienko corroborated this account to Reuters, telling the publication, "we were sanctioned several times," but denying the project had anything to do with money laundering and claiming to be regulated properly by Kyrgyzstan’s virtual-asset regime. The project's backers have not been sanctioned by Singapore, where the conference took place. The Block could not immediately reach Token2049 or A7A5 for comment.

After Reuters reached out to Token2049 for comment, the report states, references to A7A5's sponsorship and Ogienko's speech were scrubbed from the Token2049 website. The token has been closely linked to Grinex, a successor of the shuttered Russian-based Garantex exchange, which had previously been sanctioned by OFAC.

Researchers at blockchain firm Elliptic told Reuters that as much as $70.8 billion of A7A5 has been transferred since the token's launch in January of this year. Elliptic has previously published analysis using leaked documents to draw links between A7 founder Ilan Shor, the A7A5 stablecoin, and allegedly even the president of Kyrgyzstan, Sadyr Japarov.

"USD stablecoins carry wallet-blocking risks based on nationality, which infringes on user rights," the A7A5 X account said in a summary of Ogienko's talk. "The future of finance is multipolar, where regional stablecoins become a real alternative to the digital dollar."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up