Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Let’s dig into the relative performance of Evolent Health and its peers as we unravel the now-completed Q2 healthcare technology for providers earnings season.

The healthcare technology sector provides software and data analytics to help hospitals and clinics streamline operations and improve patient outcomes, often through value-based care models. Future growth is expected as providers prioritize digital transformation to manage rising costs and patient demands. Tailwinds include the adoption of AI-driven tools and government incentives for digitization. There challenges as well, including long sales cycles and slow adoption by providers, who may be resistance to change. Tightening hospital budgets and cybersecurity threats are additional risks that could slow adoption.

The 5 healthcare technology for providers stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 4% while next quarter’s revenue guidance was in line.

Luckily, healthcare technology for providers stocks have performed well with share prices up 12.1% on average since the latest earnings results.

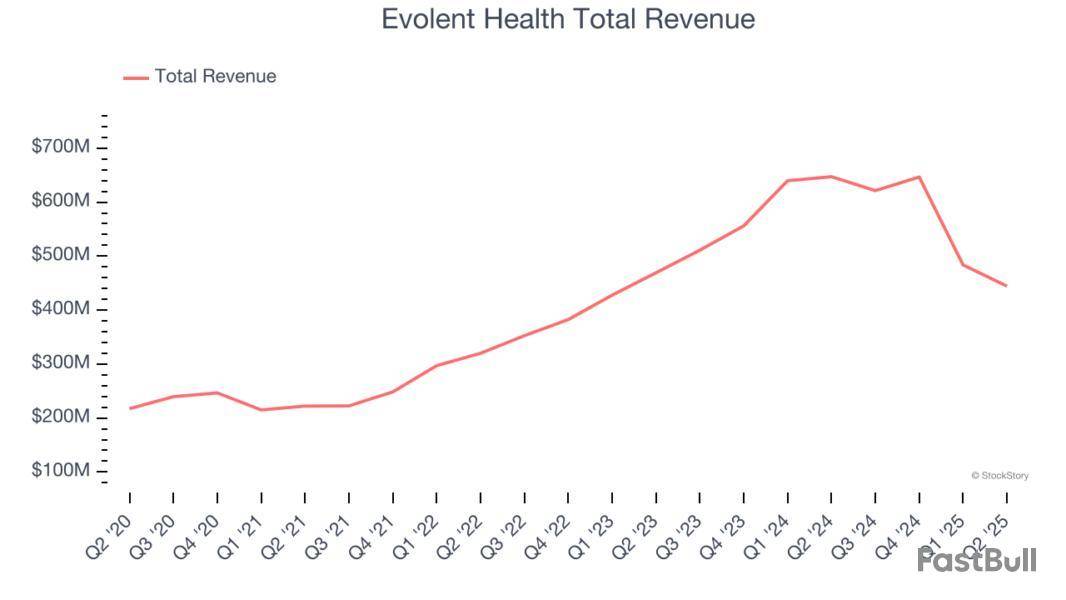

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Evolent Health reported revenues of $444.3 million, down 31.3% year on year. This print fell short of analysts’ expectations by 3.3%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates and a slight miss of analysts’ sales volume estimates.

Seth Blackley, Co-Founder and Chief Executive Officer of Evolent stated, "Evolent exceeded our EBITDA targets for the second quarter and raised our profitability outlook for the full year. In addition, we continue to see a rapidly accelerating pipeline for new business and based on this acceleration we would expect to exceed our historical growth rates for 2026. The combination of these factors we believe demonstrates Evolent's critical role in the system where our solutions seek to simultaneously improve quality for members, reduce administrative burden for providers and manage affordability for the system. Finally, as we mark the one-year anniversary of launching of Auth Intelligence, we remain confident in achieving the near-term AI and automation targets exiting 2025 while also seeing a path to become a leader in the market on the use of clinical data exchange and AI allowing us to continue to innovate on how specialty care is managed."

Evolent Health delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 5.3% since reporting and currently trades at $9.18.

Read our full report on Evolent Health here, it’s free.

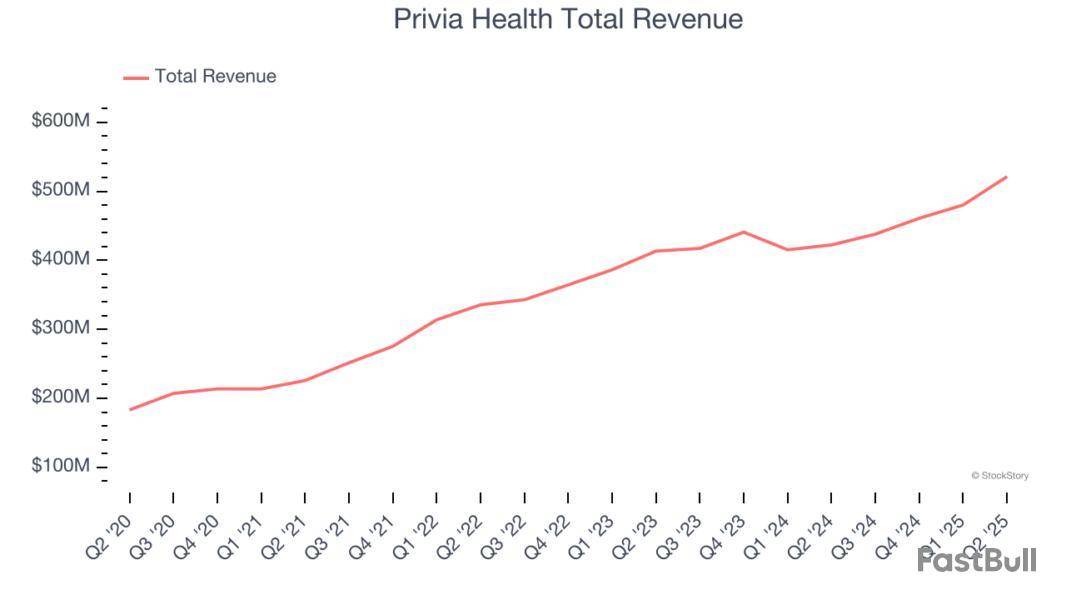

Operating in 13 states and the District of Columbia with over 4,300 providers serving more than 4.8 million patients, Privia Health is a technology-driven company that helps physicians optimize their practices, improve patient experiences, and transition to value-based care models.

Privia Health reported revenues of $521.2 million, up 23.4% year on year, outperforming analysts’ expectations by 10.9%. The business had a very strong quarter with an impressive beat of analysts’ sales volume estimates and a beat of analysts’ EPS estimates.

Privia Health pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 14.5% since reporting. It currently trades at $22.68.

Is now the time to buy Privia Health? Access our full analysis of the earnings results here, it’s free.

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Premier reported revenues of $262.9 million, down 12.5% year on year, exceeding analysts’ expectations by 5%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a beat of analysts’ EPS estimates.

Interestingly, the stock is up 7.3% since the results and currently trades at $26.25.

Read our full analysis of Premier’s results here.

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $654.8 million, up 34.7% year on year. This print beat analysts’ expectations by 2.7%. It was a strong quarter as it also logged a beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

Astrana Health pulled off the fastest revenue growth among its peers. The stock is up 36.9% since reporting and currently trades at $29.37.

Read our full, actionable report on Astrana Health here, it’s free.

Driven by the vision of an "Autonomous Pharmacy" with zero medication errors, Omnicell provides medication management automation and adherence tools that help healthcare systems and pharmacies reduce errors and improve efficiency.

Omnicell reported revenues of $290.6 million, up 5% year on year. This number surpassed analysts’ expectations by 4.9%. Overall, it was a strong quarter as it also put up a beat of analysts’ EPS estimates and a solid beat of analysts’ full-year EPS guidance estimates.

Omnicell achieved the highest full-year guidance raise among its peers. The stock is up 7.1% since reporting and currently trades at $31.86.

Read our full, actionable report on Omnicell here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Over the past six months, Privia Health’s stock price fell to $22.63. Shareholders have lost 11.9% of their capital, which is disappointing considering the S&P 500 has climbed by 11.3%. This may have investors wondering how to approach the situation.

Is now the time to buy Privia Health, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Privia Health Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons you should be careful with PRVA and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.9 billion in revenue over the past 12 months, Privia Health is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Privia Health has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, subpar for a healthcare business.

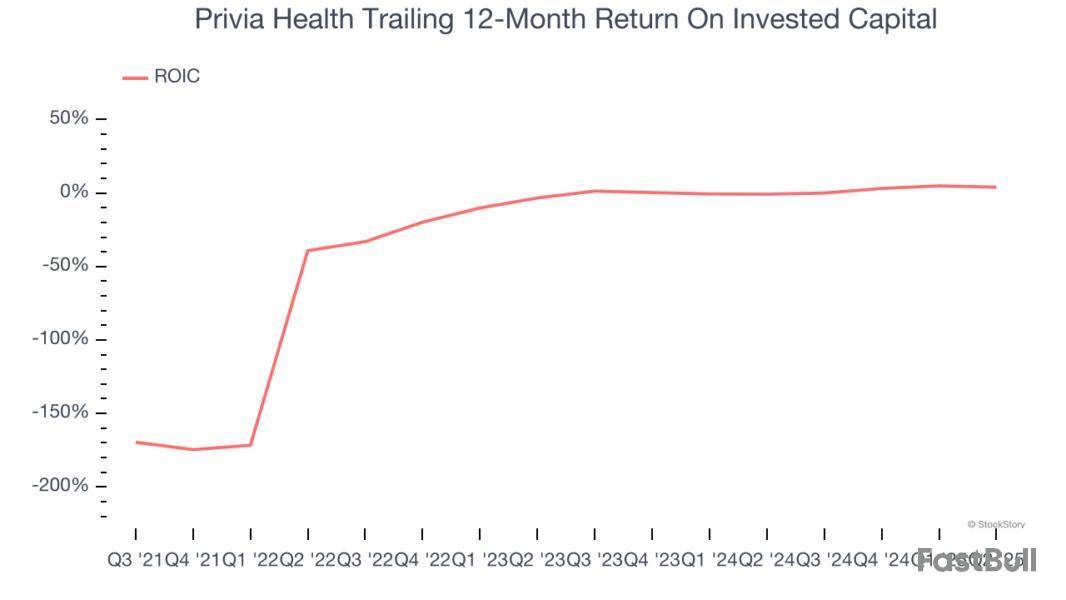

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Privia Health’s five-year average ROIC was negative 9.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

Privia Health isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 26.2× forward P/E (or $22.63 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Like More Than Privia Health

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

By Dean Seal

Shares of Privia Health rose after the company said its networks of hospitals and healthcare providers generated $233 million in savings for 2024 through a Medicare program.

The stock was up 6% at $23.12 on Friday. Shares are now up 18% since the start of the year.

The company, which provides tools and technology to doctors and health systems, said its Accountable Care Organizations notched shared savings of $233.1 million through the Medicare Shared Savings Program for 2024. That's up 32% from 2023.

The program allows Accountable Care Organizations, or groups of doctors and hospitals, to work on lowering costs for Medicare beneficiaries and then share the savings they achieve.

Based on the savings achieved, Privia bumped up its full-year guidance for adjusted earnings before interest, taxes, depreciation and amortization to a range of $113 million to $116 million. It was previously targeting about $110 million.

The outlook raise is preliminary, given that Privia is only halfway through the third quarter, the company said. It expects to provide another update on guidance when it next reports quarterly results in early November.

Write to Dean Seal at dean.seal@wsj.com

What Happened?

Shares of healthcare tech company Privia Health Group jumped 6.4% in the morning session after the company announced its Accountable Care Organizations (ACOs) achieved $233.1 million in Medicare shared savings for 2024, a 32% year-over-year increase.

This strong performance, which significantly outpaces industry benchmarks, prompted the company to raise its full-year 2025 Adjusted EBITDA guidance to a range of $113 million to $116 million. An Accountable Care Organization is a group of healthcare providers who work together to provide coordinated, high-quality care to their Medicare patients. The positive results also drew a favorable reaction from Wall Street. Analysts at JMP Securities raised their price target on the stock to $30 from $29, maintaining a Market Outperform rating and citing the impressive savings growth.

Is now the time to buy Privia Health? Access our full analysis report here, it’s free.

What Is The Market Telling Us

Privia Health’s shares are somewhat volatile and have had 11 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The biggest move we wrote about over the last year was about 1 month ago when the stock dropped 5.2% as several negative developments weighed on the sector.

Weakness in managed care providers was a significant factor, with companies like Elevance Health and Humana seeing declines due to an analyst downgrade and a lost lawsuit regarding Medicare bonus payments, respectively.

Additionally, some pharmaceutical and biotech companies experienced sharp drops following unfavorable news; for instance, Sarepta Therapeutics plunged after a report indicated another patient death tied to its experimental gene therapy, and GSK's blood cancer drug dosage was voted against by the FDA advisory committee. Broader market sentiment, including concerns about rising costs and inadequate pricing for 2025 plans among health insurers, also contributed to the downward pressure on healthcare equities.

Privia Health is up 17.6% since the beginning of the year, but at $23.10 per share, it is still trading 10.1% below its 52-week high of $25.69 from March 2025. Investors who bought $1,000 worth of Privia Health’s shares at the IPO in April 2021 would now be looking at an investment worth $664.79.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up