Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

European Central Bank Deputy Governor Guindos: European Central Bank Could Change Its Policy Stance If Inflation Expectations Change As A Result Of The Iran War

Turkish Defence Ministry: Actions Of Kurdish Separatist Pjak Militant Group Threaten Iran's Security And Region's Stability

European Central Bank Deputy Governor Guindos: Other Scenario Is That It Will Be More Protracted

European Central Bank Deputy Governor Guindos: We Have To Use Different Scenarios After Iran Attacks

Barclays Discloses 5.56% Stake In Wizz Air Holdings Plc As Of Feb 27 Versus Prior Stake Of 0.16%

Azerbaijan's Foreign Ministry: Azerbaijan Condemns The Attacks And Reserves Right To Retaliate

Ukraine President Zelenskiy: Ukraine Spoke To American Side About Possibility Of Changing Location And Postponing Next Round Of Talks With Russia Due To Events In Middle East

[Israel Plans To Reopen Airspace On March 8] Israeli Transport Minister Miri Regev Announced That Israel Is Preparing To Reopen Its Airspace On March 8, Allowing Outbound Flights To Resume. Regev Stated, "After Assessment, We Have Decided To Begin Reopening Outbound Flights On Sunday (March 8), But The Specific Arrangements Will Depend On The Development Of The Security Situation. We Will Provide Updates Throughout The Day."

Grafton CFO: Underlying Level Of Price Inflation Passed On To Customers In 2025 Was Quite Modest At 1%

Azerbaijani Source Close To Government: Missiles And Drones Flying From Iran Have Fallen Near Nakhchivan Airport

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Feb)

Brazil IHS Markit Composite PMI (Feb)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Feb)

Brazil IHS Markit Services PMI (Feb)A:--

F: --

P: --

U.S. ADP Employment (Feb)

U.S. ADP Employment (Feb)A:--

F: --

Canada Labor Productivity QoQ (SA) (Q4)

Canada Labor Productivity QoQ (SA) (Q4)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Feb)

U.S. IHS Markit Services PMI Final (Feb)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Final (Feb)

U.S. IHS Markit Composite PMI Final (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Feb)

U.S. ISM Non-Manufacturing Employment Index (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Feb)

U.S. ISM Non-Manufacturing Inventories Index (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Feb)

U.S. ISM Non-Manufacturing Price Index (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Feb)

U.S. ISM Non-Manufacturing New Orders Index (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Feb)

U.S. ISM Non-Manufacturing PMI (Feb)A:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Russia Retail Sales YoY (Jan)

Russia Retail Sales YoY (Jan)A:--

F: --

P: --

Russia Unemployment Rate (Jan)

Russia Unemployment Rate (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech The U.S. Senate held its first vote on Iran's "war powers resolution."

The U.S. Senate held its first vote on Iran's "war powers resolution." Australia Exports MoM (SA) (Jan)

Australia Exports MoM (SA) (Jan)A:--

F: --

Australia Trade Balance (SA) (Jan)

Australia Trade Balance (SA) (Jan)A:--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction YieldA:--

F: --

P: --

France Industrial Output MoM (SA) (Jan)

France Industrial Output MoM (SA) (Jan)A:--

F: --

Germany Construction PMI (SA) (Feb)

Germany Construction PMI (SA) (Feb)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Feb)

Euro Zone IHS Markit Construction PMI (Feb)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Feb)

Italy IHS Markit Construction PMI (Feb)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Jan)

Italy Retail Sales MoM (SA) (Jan)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Feb)

U.K. Markit/CIPS Construction PMI (Feb)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales MoM (Jan)

Euro Zone Retail Sales MoM (Jan)--

F: --

P: --

Euro Zone Retail Sales YoY (Jan)

Euro Zone Retail Sales YoY (Jan)--

F: --

P: --

Brazil Unemployment Rate (Jan)

Brazil Unemployment Rate (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Feb)

U.S. Challenger Job Cuts YoY (Feb)--

F: --

P: --

U.S. Challenger Job Cuts (Feb)

U.S. Challenger Job Cuts (Feb)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Feb)

U.S. Challenger Job Cuts MoM (Feb)--

F: --

P: --

U.S. Import Price Index YoY (Jan)

U.S. Import Price Index YoY (Jan)--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q4)

U.S. Unit Labor Cost Prelim (SA) (Q4)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Export Price Index YoY (Jan)

U.S. Export Price Index YoY (Jan)--

F: --

P: --

U.S. Import Price Index MoM (Jan)

U.S. Import Price Index MoM (Jan)--

F: --

P: --

U.S. Export Price Index MoM (Jan)

U.S. Export Price Index MoM (Jan)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

South Korea CPI YoY (Feb)

South Korea CPI YoY (Feb)--

F: --

P: --

Euro Zone GDP Final YoY (Q4)

Euro Zone GDP Final YoY (Q4)--

F: --

P: --

Euro Zone GDP Final QoQ (Q4)

Euro Zone GDP Final QoQ (Q4)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q4)

Euro Zone Employment Final QoQ (SA) (Q4)--

F: --

P: --

Euro Zone Employment Final (SA) (Q4)

Euro Zone Employment Final (SA) (Q4)--

F: --

Euro Zone Employment YoY (SA) (Q4)

Euro Zone Employment YoY (SA) (Q4)--

F: --

P: --

Canada Leading Index MoM (Feb)

Canada Leading Index MoM (Feb)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Jan)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Jan)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Jan)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Jan)--

F: --

P: --

U.S. Retail Sales MoM (Jan)

U.S. Retail Sales MoM (Jan)--

F: --

P: --

No matching data

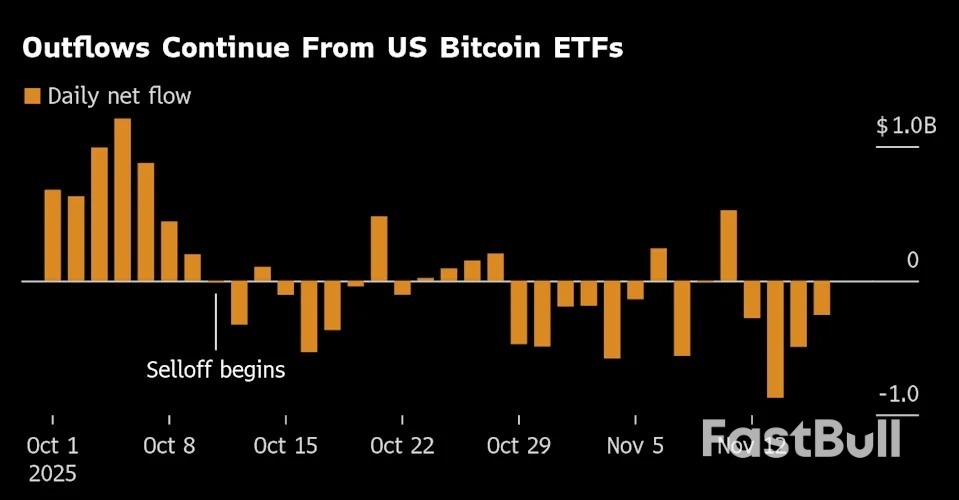

Demand for downside protection around the $85,000 and $80,000 levels has surged, and options data suggest less than a 5% chance of Bitcoin revisiting its record high above $126,000 by year-end.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up