Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold was steady as markets opened on Monday, with traders weighing differing views from US Federal Reserve officials on how President Donald Trump’s tariff agenda will impact inflation.

Gold was steady as markets opened on Monday, with traders weighing differing views from US Federal Reserve officials on how President Donald Trump’s tariff agenda will impact inflation.

Bullion traded near $3,350 an ounce — after a small decline last week — as Fed Governor Christopher Waller advocated for a rate cut last week. Governor Michelle Bowman has also expressed an openness to a reduction, while their colleagues remained more cautious due to the risk of persistent inflation triggered by tariffs. Lower borrowing costs tend to benefit gold as it doesn’t pay interest.

The divergence comes as Trump keeps up the pressure on Fed Chair Jerome Powell — whose term as chair expires in May — with the White House evaluating candidates to succeed him and pledging to pick someone who will cut rates. The president also pushed back on a Wall Street Journal report that Treasury Secretary Scott Bessent advised him markets would react badly if he fired Powell.

On the trade front, European Union officials are set to meet as early as this week to formulate a plan to respond to a possible no-deal scenario with Trump. Investors will be watching for progress on talks with a raft of trade partners ahead of Trump’s Aug. 1 deadline for imposing so-called reciprocal tariffs.

Gold has climbed more than a quarter this year, with geopolitical tensions and concerns about dollar-denominated assets sparking flight to the haven asset. The precious metal has been trading within a tight range over the past few months, as investors wait for a clearer sense on global trade talks, the path for rate cuts and the impact of tariffs on the global economy.

Spot gold was slightly higher at $3,353.80 an ounce as of 8:54 a.m. in Singapore. The Bloomberg Dollar Spot Index edged 0.1% lower. Silver and platinum were little changed, while palladium rose.

On Sunday, the Israeli military (IDF) issued new evacuation orders for parts of central Gaza, which even after years of war with Hamas is an area where Israeli ground forces have rarely operated, further restricting access between Deir al-Balah and the southern cities of Rafah and Khan Younis.

This strongly suggests that indirect efforts to achieve another ceasefire are far from producing anything effective, and it points to Prime Minister Netanyahu pursuing his ultra-controversial plan for mass resettlement of Gaza's Palestinian population.

Netanyahu has continued to assert that intensifying military pressure in Gaza could compel Hamas to negotiate on terms favorable to Israel and for the return of remaining hostages.

At this moment, the Israeli military claims to control at least 65% of land in Gaza. This is after 21 months of war triggered by the Oct. 7, 2023 Hamas terror attack, which many have considered to be "Israel's 9/11".

The Hostages Family Forum, which represents many of the families of hostages, has condemned the evacuation announcement - as it signals the going pursuit of a military solution to the crisis. Families have continued to demand that Netanyahu strike a peace deal, for the return of all remaining living and deceased hostages.

"Enough! The Israeli people overwhelmingly want an end to the fighting and a comprehensive agreement that will return all of the hostages," the forum said Saturday on the occasion of tens of thousands of protesters marching in Tel Aviv to the US Embassy location.

Meanwhile, 65 Palestinians were reported killed Sunday while trying to access humanitarian aid, according to local hospitals, amid growing international spotlight on a controversial program which has seen a US security firm try to spearhead aid distribution.

There are also ongoing concerns of famine and unprecedented levels of malnutrition among the Palestinian population, and reports of more children dying.

Most of the Strip's population is now internally displaced, and there's as yet no relief or no end in sight to the conflict which has taken tens of thousands of lives. But Netanyahu is determined to never allow Hamas to rise to rule again - but rooting it out is proving harder than thought.

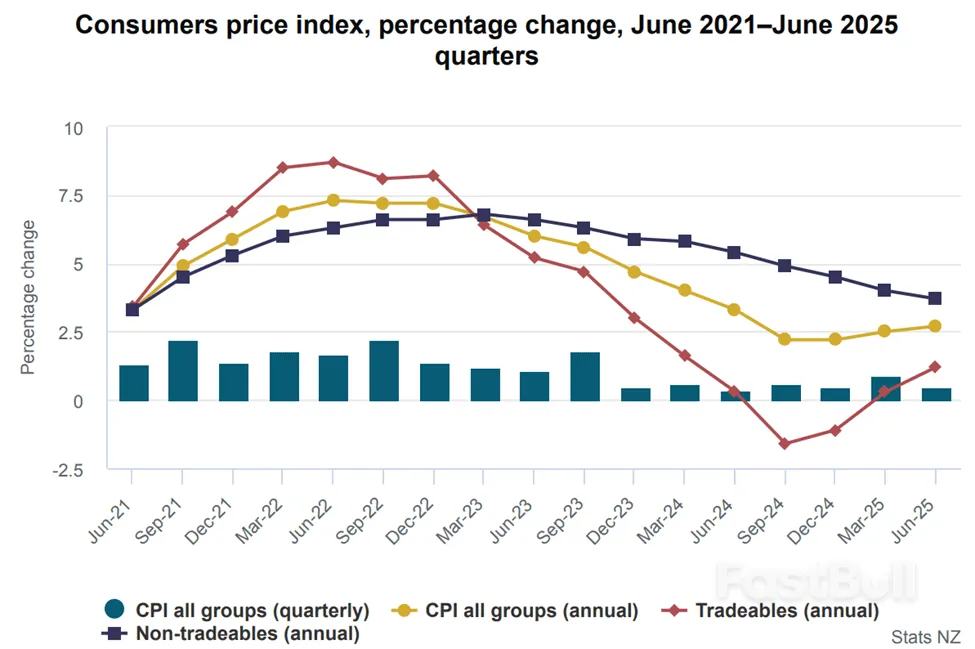

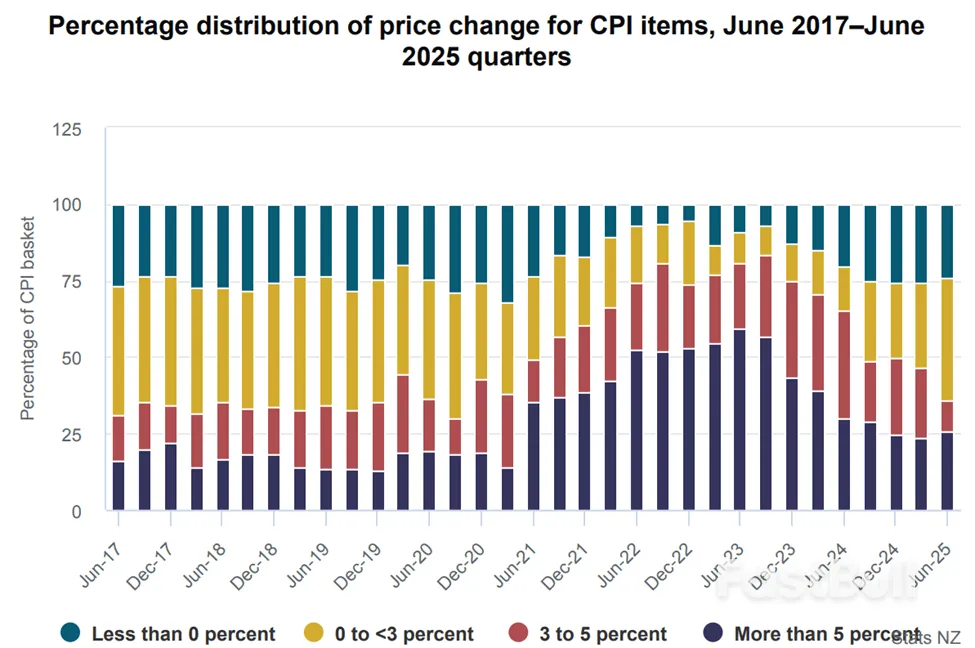

New Zealand's annual consumer inflation accelerated in the second quarter but was below economists' forecasts, leading markets to narrow the odds on a rate cut next month given weakness in the broader economy.

Annual inflation came in at 2.7% in the second quarter, its highest level in a year, and speeding up from the 2.5% rate in the first quarter, Statistics New Zealand said in a statement on Monday. However, economists had forecast inflation at 2.8%.

The statistics agency attributed the uptick to an increase in local government taxes and housing rental prices.

On a quarter-on-quarter basis, the consumer price index rose 0.5%, compared with a 0.9% increase in the first quarter.

Economists in a Reuters poll had forecast a 0.6% rise for the quarter.

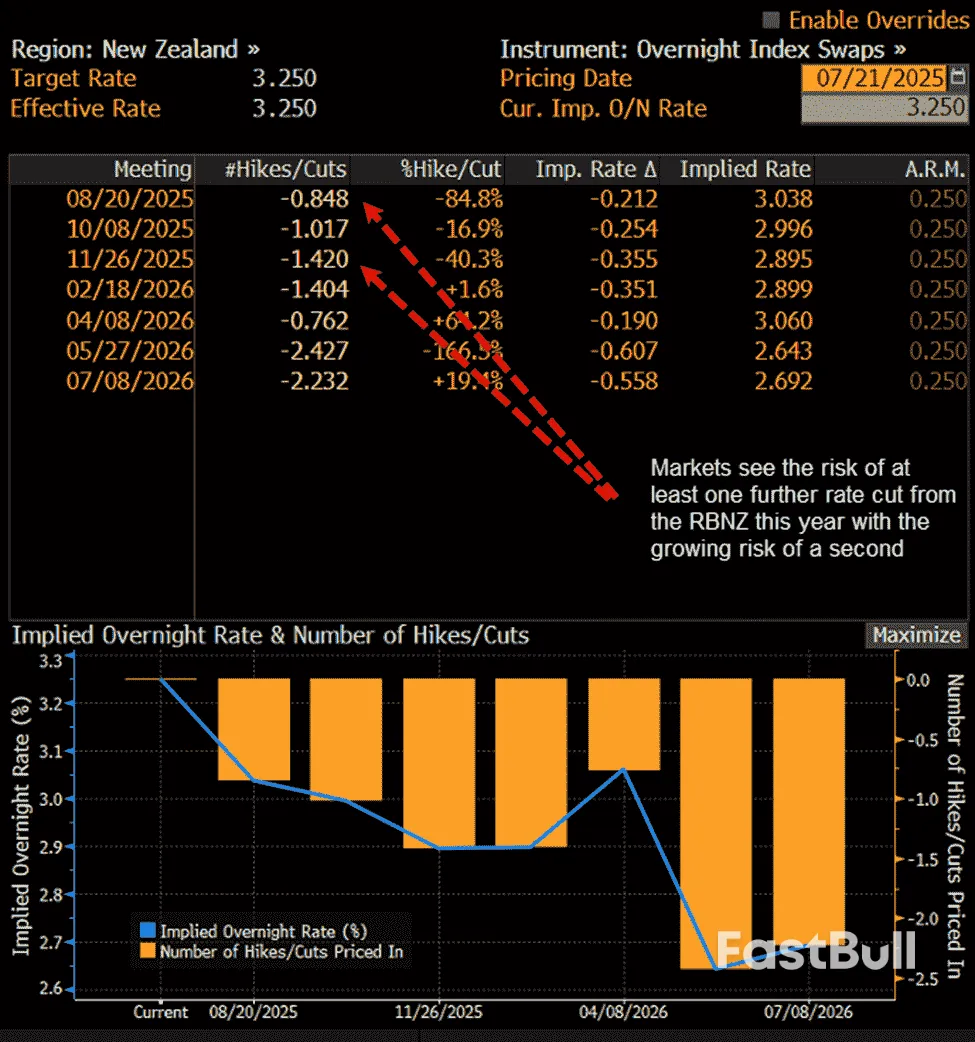

The New Zealand dollar dipped 0.3% to $0.5941 following the data release. Markets are now pricing in a 75% chance that the central bank will cut by 25 basis points in August, up from a 61% chance ahead of the data.

The Reserve Bank of New Zealand, which in May forecast annual inflation for the quarter at 2.6%, held interest rates steady at this month's policy meeting partly due to near-term price risks.

It was the first pause in the RBNZ's easing cycle that began in August 2024, a period in which it slashed rates by 225 basis points to 3.25%.

The uncertainty around U.S. President Donald Trump's tariff policies and the impact on global growth and prices have kept most policymakers, including the RBNZ, on edge.

New Zealand's annual inflation is nudging nearer to the upper end of the central bank's 1% to 3% target band. But economists say that with medium-term inflation expected to remain contained and considerable spare capacity in the economy, a rate cut in August remains likely.

ASB Bank senior economist Mark Smith said ASB's core judgment is that the RBNZ will accommodate or look through the tick up in near-term inflation as the weakening global outlook and the large margin of spare capacity imply a lower medium-term inflation outlook.

“After earlier tapping the monetary policy brakes, the RBNZ is expected to press the accelerator and actively provide policy support," Smith said in a note.

Annual non-tradeable inflation rose 3.7% in the second quarter, its lowest level since the second quarter of 2021, according to Statistics New Zealand.

The fringe far-right Sanseito party emerged as one of the biggest winners in Japan's upper house election on Sunday, gaining support with warnings of a "silent invasion" of immigrants, and pledges for tax cuts and welfare spending.

Birthed on YouTube during the COVID-19 pandemic spreading conspiracy theories about vaccinations and a cabal of global elites, the party broke into mainstream politics with its "Japanese First" campaign.

The party won 14 seats adding to the single lawmaker it secured in the 248-seat chamber three years ago. It has only three seats in the more powerful lower house.

"The phrase Japanese First was meant to express rebuilding Japanese people's livelihoods by resisting globalism. I am not saying that we should completely ban foreigners or that every foreigner should get out of Japan," Sohei Kamiya, the party's 47-year-old leader, said in an interview with local broadcaster Nippon Television after the election.

Prime Minister Shigeru Ishiba's Liberal Democratic Party and its coalition partner Komeito lost their majority in the upper house, leaving them further beholden to opposition support following a lower house defeat in October.

"Sanseito has become the talk of the town, and particularly here in America, because of the whole populist and anti-foreign sentiment. It's more of a weakness of the LDP and Ishiba than anything else," said Joshua Walker, head of the U.S. non-profit Japan Society.

In polling ahead of Sunday's election, 29% of voters told NHK that social security and a declining birthrate were their biggest concern. A total of 28% said they worried about rising rice prices, which have doubled in the past year. Immigration was in joint fifth place with 7% of respondents pointing to it.

"We were criticized as being xenophobic and discriminatory. The public came to understand that the media was wrong and Sanseito was right," Kamiya said.

Kamiya's message grabbed voters frustrated with a weak economy and currency that has lured tourists in record numbers in recent years, further driving up prices that Japanese can ill afford, political analysts say.

Japan's fast-ageing society has also seen foreign-born residents hit a record of about 3.8 million last year, though that is just 3% of the total population, a fraction of the corresponding proportion in the United States and Europe.

Kamiya, a former supermarket manager and English teacher, told Reuters before the election that he had drawn inspiration from U.S. President Donald Trump's "bold political style".

He has also drawn comparisons with Germany's AfD and Reform UK although right-wing populist policies have yet to take root in Japan as they have in Europe and the United States.

Post-election, Kamiya said he plans to follow the example of Europe's emerging populist parties by building alliances with other small parties rather than work with an LDP administration, which has ruled for most of Japan's postwar history.

Sanseito’s focus on immigration has already shifted Japan's politics to the right. Just days before the vote, Ishiba’s administration announced a new government taskforce to fight "crimes and disorderly conduct" by foreign nationals and his party has promised a target of "zero illegal foreigners".

Kamiya, who won the party's first seat in 2022 after gaining notoriety for appearing to call for Japan's emperor to take concubines, has tried to tone down some controversial ideas formerly embraced by the party.

During the campaign, Kamiya, however, faced a backlash for branding gender equality policies a mistake that encourage women to work and keep them from having children.

To soften what he said was his "hot-blooded" image and to broaden support beyond the men in their twenties and thirties that form the core of Sanseito's support, Kamiya fielded a raft of female candidates on Sunday.

Those included the single-named singer Saya, who clinched a seat in Tokyo.

Like other opposition parties, Sanseito called for tax cuts and an increase in child benefits, policies that led investors to fret about Japan's fiscal health and massive debt pile, but unlike them it has a far bigger online presence from where it can attack Japan's political establishment.

Its YouTube channel has 400,000 followers, more than any other party on the platform and three times that of the LDP, according to socialcounts.org.

Sanseito's upper house breakthrough, Kamiya said, is just the beginning.

"We are gradually increasing our numbers and living up to people's expectations. By building a solid organization and securing 50 or 60 seats, I believe our policies will finally become reality," he said.

Reporting by Tim Kelly and John Geddie and Kantaro Komiya; Editing by Clarence Fernandez, Dale Hudson and Lincoln Feast.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up