Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By Dow Jones Newswires Staff

Global stock markets rose, tracking gains on Wall Street Wednesday after the Federal Reserve held rates but left open the possibility of cuts down the track.

Fed officials downplayed the impact of tariffs on inflation, which further boosted sentiment. In Europe, the Swiss National Bank cut rates, while Sweden's Riksbank held, with the Bank of England also expected to hold.

Write to Barcelona Editors at barcelonaeditors@dowjones.com

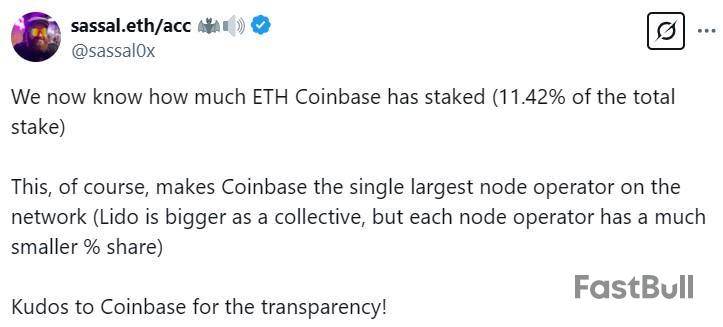

A Coinbase report revealed that the crypto exchange is Ethereum's biggest node operator, having 11.42% of the total staked Ether within the blockchain network.

In a performance report, Coinbase said it had 3.84 million Ether , worth about $6.8 billion, staked to its validators. The exchange said that, as of March 3, it has 11.42% of the total staked ETH.

Anthony Sassano, host of The Daily Gwei, said that Coinbase's stake makes the exchange the “single largest node operator” in the network.

Sassano added that while the staking platform Lido is bigger as a collective, each node operator has a much smaller percentage share.

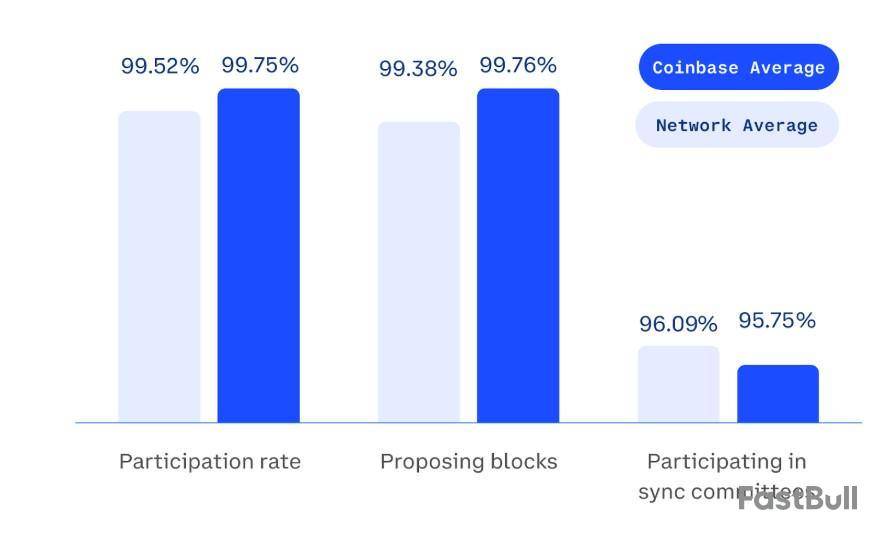

Coinbase validator uptime and participation rate at 99.75%

Coinbase also shared that it exceeded its target for validator uptime, which indicates the percentage of time when validators are operational. It also had a similar figure for its participation rate, a metric that indicates how well validators perform their consensus duties.

Coinbase also reported that its validators had an average uptime of 99.75%. Coinbase said they outperformed their target of 99% uptime without compromising security standards.

The exchange attributed the performance to an upgrade implemented in 2024, which allowed the exchange to keep validators running while performing beacon node maintenance.

Meanwhile, Coinbase validators’ participation rate is also at 99.75%. This exceeds the network average of 99.52%. In addition, the Coinbase average for signing and submitting blocks produced by their MEV relays is 99.76%, higher than the network average of 99.38%.

While Coinbase operates a centralized exchange platform, the company said it distributes its validators across several regions to "help maintain a truly distributed and decentralized Ethereum blockchain." The exchange said its validators operate in Japan, Singapore, Ireland, Germany and Hong Kong.

Ether surges above $2k on March 20

Coinbase’s recent report was followed by a surge in ETH prices as ETH accumulation addresses started stockpiling significantly.

On March 2, Ether hit a weekly high of $2,060.73, surging by 12.3% in seven days. On March 19, the asset’s daily trading volume reached $17.4 billion as its price surpassed $2,000.

The surge comes as ETH price sentiments turned bearish. On March 11, Yuga Labs’ vice president of blockchain suggested that ETH could drop as low as $200 in a prolonged bear market.

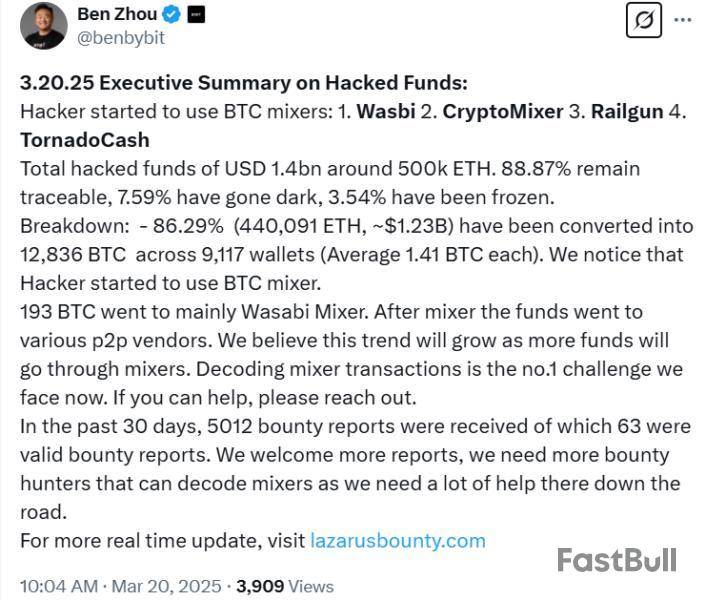

The lion’s share of the hacked Bybit funds is still traceable after the historic cybertheft, as blockchain investigators continue their efforts to freeze and recover these funds.

The crypto industry was rocked by the largest hack in history on Feb. 21, when Bybit lost over $1.4 billion in liquid-staked Ether (stETH), Mantle Staked ETH (mETH) and other digital assets.

Blockchain security firms, including Arkham Intelligence, have identified North Korea’s Lazarus Group as the likely culprit behind the Bybit exploit, as the attackers have continued swapping the funds in an effort to make them untraceable.

Despite the Lazarus Group’s efforts, over 88% of the stolen $1.4 billion remains traceable, according to Ben Zhou, the co-founder and CEO of Bybit exchange.

The CEO wrote in a March 20 X post:

“86.29% (440,091 ETH, ~$1.23B) have been converted into 12,836 BTC across 9,117 wallets (Average 1.41 BTC each),” said the CEO, adding that the funds were mainly funneled through Bitcoin (BTC) mixers including Wasbi, CryptoMixer, Railgun and Tornado Cash.

The CEO’s update comes nearly a month after the exchange was hacked. It took the Lazarus Group 10 days to launder 100% of the stolen Bybit funds through the decentralized crosschain protocol THORChain, Cointelegraph reported on March 4.

Still, blockchain security experts are hopeful that a portion of these funds can be frozen and recovered by Bybit.

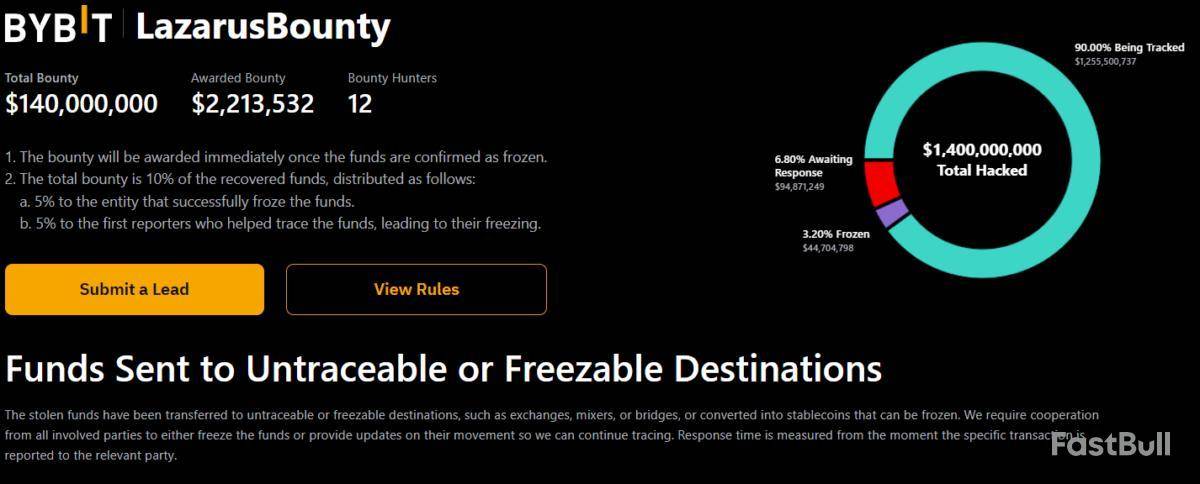

Bybit paid $2.2M for Lazarus “bounty hunters”

The crypto industry needs more blockchain “bounty hunters” and white hat, or ethical hackers, to combat the growing illicit activity from North Korean actors.

Decoding transaction patterns through cryptocurrency mixers remains the biggest challenge in tracing these funds, Bybit’s CEO wrote, adding:

Bybit has awarded over $2.2 million worth of funds to 12 bounty hunters for relevant information that may lead to the freezing of the funds. The exchange is offering 10% of the recovered funds as a bounty for white hat hackers and investigators.

The Bybit attack highlights that even centralized exchanges with strong security measures remain vulnerable to sophisticated cyberattacks, analysts say.

“This incident is another stark reminder that even the strongest security measures can be undone by human error,” Lucien Bourdon, an analyst at Trezor, told Cointelegraph.

Bourdon explained that attackers used a sophisticated social engineering technique, deceiving signers into approving a malicious transaction that drained crypto from one of Bybit's cold wallets.

The Bybit hack is more than twice the size of the $600 million Poly Network hack in August 2021, making it the largest crypto exchange breach to date.

Coinbase has released its first Ethereum Validator Performance Report, providing a detailed breakdown of its staking operations.

It shows that the platform operates 120,000 validators, with 3.84 million ETH staked to them, representing 11.42% of the total staked supply. An additional 581,500 ETH is also staked through its partners.99.75% Validator Uptime and Zero Slashing

“We’re excited to announce our first Ethereum Validator Performance Report, marking a new level of transparency in our ETH staking operations,” the company stated in a March 19 post on X.

According to the report, the platform has maintained zero cases of slashing or double signing since its validators began operating.

In February 2025, they recorded an average uptime of 99.75%, exceeding the 99% uptime target. The platform attributes this performance to a structuralupgrademade last year, which enables beacon node maintenance without downtime. Further, it revealed that it does not pursue 99.9% uptime, as it prioritizes security over additional gains that could introduce slashing risks.

The validator participation rate, which tracks the execution of consensus duties, also stood at 99.75% in February. According to the exchange, its stakers successfully proposed blocks through MEV relays and participated in sync committees, which helped light clients synchronize with the blockchain.

Tosupportdecentralization, Coinbase distributes them across five countries including, Japan, Singapore, Ireland, Germany, and Hong Kong. The platform also uses two cloud providers, AWS and GCP. This ensures redundancy, mitigates failure risks, and accommodates regulatory requirements.

According to the exchange, if a prolonged outage occurs in a region or cloud provider, its validator orchestration system can migrate workloads with minimal downtime. This system has also been used for scheduled maintenance and customer-driven migrations.Client Diversity and Relay Diversification

Client diversity is another part of the staking strategy. Coinbase’s Ethereum validators run two consensus clients (Lighthouse, Prysm) and two execution clients (Geth, Nethermind). It also monitors network-wide client distribution and is evaluating additional implementations to expand the customer range further.

The company also uses relay diversification to optimize staking rewards and reduce centralization risks. Participants connect to six MEV relays, including Flashbots MEV-Boost Relay, bloXroute Max Profit Relay, and four non-censoring relays including, ultra-sound relay, Agnostic Relay, Aestus MEV-Boost Relay, and Titan Relay. This structure enhances redundancy and broadens access to block pools.

Data provided by the Shibburn blockchain tracker has revealed that the burn rate has logged an impressive rise of 857%, with more than half a billion meme coins locked in dead-end wallets.

Meanwhile, the price of the second most popular meme cryptocurrency has attempted a recovery this week and regained roughly 4% after its recent losses so far.

SHIB burns spike 857%, but there's a catch

The aforesaid data source reported that a total of 551,362,754 SHIB meme coins have been burned over the past seven days, i.e., transferred to unspendable blockchain wallets. The weekly burn rate skyrocketed by 856.72%.

The largest SHIB batch from that half a billion coins was burned on March 15; that burn transaction carried a massive 459,294,504 SHIB to a zero wallet. On that day, daily burns surged by 27,660%.

Shibburn@shibburnMar 20, 2025HOURLY SHIB UPDATE$SHIB Price: $0.00001289 (1hr 0.56% ▲ | 24hr 2.37% ▲ )

Market Cap: $7,556,992,093 (1.70% ▲)

Total Supply: 589,254,627,612,826

TOKENS BURNT

Past 24Hrs: 2,359,521 (-75.68% ▼)

Past 7 Days: 551,362,754 (856.72% ▲)

As for the past 24 hours, the daily burns have plunged by 75.68%, taking as little as 2,359,521 SHIB out of the circulating supply.

The ambitious goal of SHIB burns is to reduce the circulating supply of the dog-themed meme coin to the point that it becomes so scarce that the SHIB price will skyrocket to $1, or at least $0.01.

According to the Shibburn website data, 410,745,372,387,173 SHIB coins have been torched in virtual furnaces so far. A total of 4,904,847,020,312 SHIB has been staked, meaning it is not only circulating temporarily. At the moment, 584,349,780,592,513 SHIB remain in circulation.

SHIB burns continue to thrive thanks to Shibarium

Two days ago, the Shibarium Updates X account, affiliated with the SHIB team, spread the word about SHIB burns, assuring that the layer-2 solution Shibarium will continue to actively participate in removing meme coins from the circulating supply.

The tweet published by that account on that day reminded the community that the SHIB team burns meme coins thanks to all transactions taking place on Shibarium, i.e., using gas fees paid in BONE token.

Thirty percent (30%) of the gas fee will be set aside for supporting Shibarium, the tweet said, and 70% of BONE fees will be converted into SHIB and then burned. The tweet also shared a link to the SHIB website page, which shows all the burns conducted thanks to those transaction fees.

Currently, according to the site, 13,209,679.60 SHIB is about to be transferred to dead wallets.

VICTORIA, Seychelles, March 20, 2025 (GLOBE NEWSWIRE) — MEXC, a global cryptocurrency exchange, has reaffirmed its leadership in token listings, surpassing competitors in speed, volume, and market positioning, according to the latest TokenInsight Crypto Exchange report. Covering the period from November 1, 2024, to February 15, 2025, the report provides key insights into how centralized exchanges (CEXs) adapt to shifting market narratives during the latest bull run and how these changes influence their listing strategies.

Key Takeaways

MEXC Leads in Token Listings and Market Agility

Over the past three months, MEXC has listed 461 new spot trading pairs—1.5 times more than Gate.io and 4.5 times more than Bitget—demonstrating its superior ability to capture market momentum. The exchange has maintained a consistent two-week listing cycle, ensuring that traders gain early access to promising assets before they reach mainstream markets.

This agility is particularly evident in key industry trends, as MEXC has emerged as the first major exchange to list tokens tied to the four dominant narratives of the current market: Meme, DeSci, AI Agent, and Celebrity Tokens.

A Leader in Early Listings

The TokenInsight report recognizes MEXC as a "Trend Capturer" for positioning its traders ahead of major market moves. By listing tokens early in their lifecycle, the exchange enables traders to capitalize on rapid growth opportunities.

For example, CHILLGUY was listed when its market cap was below $150 million and surged to $600 million within just ten days. MEXC's reputation for early-market foresight has been reinforced by its rapid listing of high-performing tokens, including PNUT, CHILLGUY, AIXBT, BIO, RIFSOL, TRUMP, and VINE. Many of these tokens experienced significant price surges post-listing.

A standout case is TRUMP, which MEXC listed on January 18 at 03:20 UTC, just 2 hours and 20 minutes after its initial on-chain liquidity injection—well ahead of other exchanges, which didn’t follow until after 10:00 UTC. This ultra-fast turnaround underscores MEXC's sharp market responsiveness, allowing traders to access high-momentum tokens before broader adoption.

Quality in On-Chain Listings

Unlike platforms that focus solely on token volume, MEXC takes a selective approach, prioritizing high-potential on-chain assets. TokenInsight's data reveals that MEXC's 82.46% conversion rate from on-chain listings to its primary spot market far surpasses Gate.io's 11.76%, highlighting its ability to identify sustainable projects.

Largest Market Share and Top 5 CEX Ranking

With its ability to identify and list emerging trends faster than competitors, MEXC continues to solidify its position among top-tier exchanges. Beyond leading in new listings, CoinDesk data confirms that MEXC captured the largest market share among centralized exchanges in February 2025 and secured a top-five ranking based on overall market share.

The full report is available on TokenInsight's official website.

About MEXC

Founded in 2018, MEXC is dedicated to being "Your Easiest Way to Crypto." Known for its extensive selection of trending tokens, airdrop opportunities, and low fees, MEXC serves over 34 million users across 170+ countries. With a focus on accessibility and efficiency, our advanced trading platform appeals to both new traders and seasoned investors alike. MEXC provides a seamless, secure, and rewarding gateway to the world of digital assets.

For more information, visit: MEXC Website | X | Telegram | How to Sign Up on MEXC

For media inquiries, please contact MEXC PR Manager Lucia Hu: lucia.hu@mexc.com

About TokenInsight

TokenInsight is a leading research and data analytics firm focused on the cryptocurrency and blockchain industry. Through detailed market reports and data-driven insights, TokenInsight provides actionable intelligence to investors, exchanges, and industry participants.

Disclaimer: This press release is provided by MEXC. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining related opportunities involves significant risks, including the potential loss of capital. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector--including cryptocurrency, NFTs, and mining--complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.Speculate only with funds that you can afford to lose.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7fc75310-f85c-45f9-b803-96869eb2c148

MEXC

MEXC

The recent price fluctuations of XRP have placed the asset at a complicated point. With the recent successful conclusion of the ongoing legal dispute between Ripple and the SEC, XRP now has no fundamental reasons that would hold it back. But the market is still not strong enough, and there are three possible paths for XRP's next move.

Scenario 1: Bullish breakout to $3

A rise toward $3 becomes a feasible goal if XRP is able to overcome the descending resistance level. A key factor that might spur this rally is the settlement of Ripple's lawsuit against the SEC, which would draw in institutional investors and traders who had been wary because of regulatory uncertainty. Technically speaking, a break above the $2.60-$2.70 range would validate bullish momentum and pave the way for a move toward $3. For this move to be maintained, volume must rise noticeably. Chart by TradingView">

Scenario 2: Consolidation

The entry of XRP into a phase of sideways consolidation between $2.20 and $2.60 would be a more neutral outcome. The fact that the asset has tested the $2.20 support zone multiple times indicates that buyers are still there.

A prolonged period of low volatility is more than a possibility due to the lack of liquidity on the market. If XRP is unable to break major resistance levels, there are some crucial supports that will let it hang and create a period of consolidation while it gains power for future moves.

Scenario 3: Bearish decline below $2

Even with encouraging legal developments, XRP is still susceptible to general market declines. In the event of a correction of Bitcoin or the larger cryptocurrency market, XRP might not be able to maintain its critical support levels. Concerningly, a decline below $2 might lead to panic-selling and push the market down to lower levels, like $1.80 or even $1.50.

The 200-day EMA serves as the final significant barrier against a further decline; if it is breached, the bearish scenario takes precedence. What happens to XRP in the near future is mostly determined by how the market responds to the settlement of the SEC case. Although hesitancy or weakness on the external market could cause consolidation or even a breakdown below $2, a strong push above important resistances could send it soaring to $3.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up