Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By Dow Jones Newswires Staff

Global stock markets rose modestly early on Monday, tracking U.S. stock futures. The dollar was broadly steady while U.S. Treasury yields edged lower ahead of U.S. inflation data for July on Tuesday. Weekly jobless claims data are due Thursday, followed by retail sales for July and the University of Michigan preliminary consumer survey for August on Friday. A flurry of official data due Friday will offer the most comprehensive look yet at China's economic momentum in July.

Oil prices eased ahead of President Trump and Russian President Vladimir Putin's meeting in Alaska later this week, while gold futures slumped after Friday's sharp gains.

Write to Barcelona Editors at barcelonaeditors@dowjones.com

By George Glover

Bitcoin was racking up more gains Monday, putting the cryptocurrency on the brink of a record high.

The world's largest token by total market capitalization was up 3.6% to $121,988 over the past 24 hours, according to data from CoinDesk. It's now trading about 1% off the record price it hit in mid-July.

Several factors have driven the latest run higher, including an executive order President Donald Trump signed on Thursday that will open up Americans' 401(k) plans to cryptocurrencies. It's a massive win for digital assets: According to the Investment Company Institute, 401(k)s held $8.9 trillion in assets as of September last year.

Other tokens were also climbing Monday. Ethereum was up 1.6%, Solana was up 1.8%, and XRP was up 0.7% over the past 24 hours, according to data from the crypto exchange Kraken.

Write to George Glover at george.glover@dowjones.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

An early Ethereum ICO participant has re-entered the spotlight after transferring 2,300 ETH, worth about $9.9 million, in a single transaction. As per Lookonchain data, this investor originally bought 20,000 ETH during the 2014 Genesis sale for just $6,200 and still holds 1,623 ETH, valued at roughly $6.99 million. The move comes as Ethereum’s price action heats up, adding to speculation about what’s next for the market.

Big Players Make Big Moves

Ethereum’s largest holders have been active, moving more than $16 million in ETH to Kraken shortly after the cryptocurrency broke out of a multi-year symmetrical triangle pattern that formed since 2021. Many analysts view this breakout as a powerful bullish signal, with price targets as high as $15,000, a potential 372% surge from current levels.

Altcoin Season Gains Momentum

This whale activity is happening alongside a shift in market dynamics. Data shows ETH is now seeing more capital inflows than Bitcoin, signaling the start of altcoin season. Institutional interest in Ethereum is rising, with treasury investments and ETF expectations adding fuel to the rally.

Michaël van de Poppe predicts a volatile week, suggesting Bitcoin could touch $120K before a correction triggers sharp altcoin drops. In the meantime, Ethereum’s recent strength may stall briefly, opening the door for smaller altcoins to run.

Large transfers from dormant wallets often impact market sentiment. This latest move coincides with shrinking ETH supply on exchanges and increased institutional buying, creating a supply squeeze. Many traders see this as a bullish backdrop that could sustain upward price momentum.

Risks Still in Play

Despite the excitement, on-chain analyst CryptoQuant warns of possible turbulence ahead. High leverage, strong resistance levels, and rising ETH inflows to exchanges could spark short-term volatility. However, they note that strong fundamentals, such as institutional demand, ETF interest, and ongoing network upgrades, should keep Ethereum’s broader uptrend intact.

Analyst Ali Martinez points to Ethereum’s MVRV ratio as a key reason why the rally may not be over. The ratio, which compares ETH’s current market price to the average price paid by holders, is not yet at “extreme” levels that typically signal a market top. This suggests Ethereum still has room to climb before hitting its peak in the current cycle.

FAQs

What is the ETH price prediction for 2025?As per our Ethereum price forecast 2025, the ETH price could reach a maximum of $5,925.

Is it better to buy Bitcoin or Ethereum?While Ethereum is trusted for its stout fundamentals, Bitcoin continues to dominate with its widespread adoption.

How much would the price of Ethereum be in 2040?As per our Ethereum price prediction 2040, Ethereum could reach a maximum price of $123,678.

How much will the ETH coin price be in 2050?By 2050, a single Ethereum price could go as high as $255,282.

S&P Global Ratings has assigned a B- issuer credit rating to Sky Protocol, formerly known as Maker Protocol, marking the first time a major credit rating agency has issued a rating for a decentralized finance (DeFi) platform.

The rating is part of S&P’s ongoing assessment of stablecoin issuers, which began in 2023 to evaluate their ability to maintain a stable value relative to fiat currencies. The review covers the creditworthiness of Sky’s liabilities, the USDS (USDS) and DAI stablecoins and the sUSDS and sDAI savings tokens.

Sky Protocol, evaluated for the first time, received a “4” — labeled “constrained” — for USDS’s ability to maintain its peg to the US dollar. The scale runs from “1” for very strong to “5” for weak.

The Sky Protocol is a decentralized lending platform that enables users to borrow cryptocurrency-backed loans. Its USDS stablecoin, used to facilitate lending and borrowing transactions, is the fourth-largest by market cap, with roughly $5.36 billion at the time of writing, according to CoinMarketCap.

S&P defines a default on the protocol’s liabilities as “a haircut imposed on token holders.” It highlights key risks that could trigger such a default, including depositor withdrawals exceeding the liquidity available in the peg stability module and credit losses surpassing the available capital.

Government, capitalization and regulatory risk are main concerns

The S&P rating pointed to weaknesses in the protocol, including high depositor concentration, centralized governance, reliance on the founder, regulatory uncertainty and weak capitalization. These risks are partly offset by the protocol’s minimal credit losses and earnings since 2020.

Andrew O’Neil, S&P Global’s digital assets analytical lead, told Cointelegraph, “A ‘B-‘ rating means that we believe the protocol currently can meet its financial obligations, but it would be vulnerable in adverse business, financial and economic conditions.”

The Sky Ecosystem Asset-Liability Committee said the process gave it a chance to examine both traditional counterparty risks and DeFi-specific vulnerabilities such as smart contract, oracle, bridge and governance risks.

“As part of the interviews and documentation we shared with S&P, we had the opportunity to revisit and challenge some of the analytical assumptions behind counterparty risks that are typical of TradFi but don’t necessarily apply on‑chain, and we also examined novel, DeFi‑native, risks - smart‑contract, oracle, bridge and governance risks - that must be monitored and mitigated carefully,” they told Cointelegraph.

Sky co-founder Rune Christensen holds nearly 9% of governance tokens. S&P’s assessment stated that “the protocol’s governance process remains highly centralized due to low voter turnout during key decisions.”

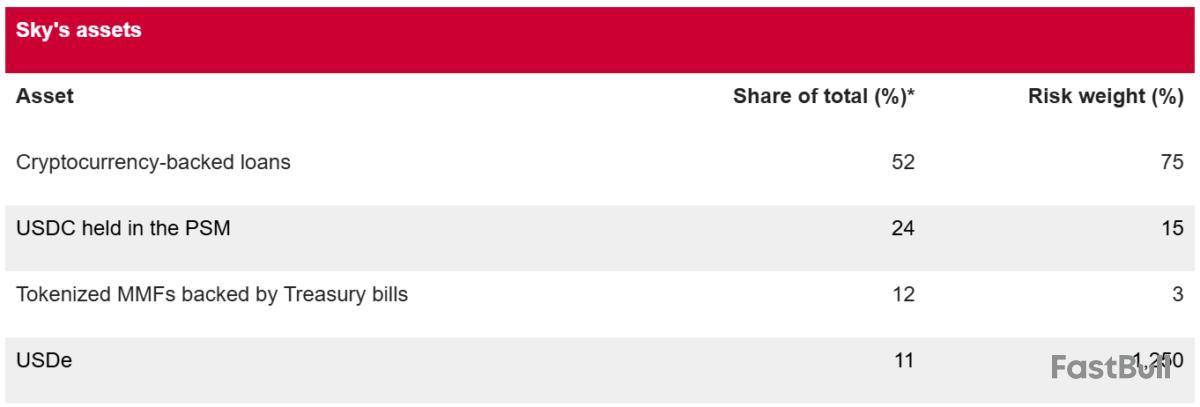

Sky’s capitalization is another primary concern. According to the assessment, with a risk-adjusted capital ratio of 0.4% as of July 27, the protocol has a limited surplus reserve buffer to cover potential credit losses.

S&P’s assessment also lowered the protocol’s anchor rating to “bb,” four notches below the US bank anchor of “bbb+,” citing regulatory uncertainty in the DeFi sector.

Stablecoin issuers under increased scrutiny

As cryptocurrency continues to deepen its engagement with traditional financial markets, more institutions within the crypto space are being brought into the formal credit rating system.

S&P Global launched its stablecoin stability assessment in December 2023. As per the report, Circle USDC received a rating of 2 (strong), while Tether and USDS ranked 4 (constrained).

“Tether’s weaknesses are more around transparency, whereas USDS has a more complex asset base compared to USDC. And indeed, the relatively weak capital position is also something that drives that relative ranking,” O’Neil said.

The first blockchain-based mortgage securitization to receive a rating from S&P Global was Figure Technology Solutions, a technology platform that powers a blockchain-based marketplace for financial products. In June, Figure’s latest securitization of mortgage assets, totaling $355 million, was awarded an “AAA” rating by S&P Global.

An Ethereum initial coin offering participant has sold 2,300 ETH, worth about $9.9 million, early Monday morning, onchain data shows.

Onchain data analytics provider Lookonchain reported Monday that the address "0x845…a210c" transferred 2,300 ETH to Kraken, leaving the address with 1,623 ETH remaining.

The Ethereum ICO whale originally received 20,000 ETH for $6,200, which is now valued at around $86 million, according to Lookonchain.

In addition to Monday's transfer, the address made several previous outbound transfers: 250 ETH in December 2024, 1,000 ETH in February 2024, and 3,000 ETH in late November 2023, among others.

Ethereum climbed 1.64% in the past 24 hours to trade above $4,300 at the time of writing, reaching its highest levels since December 2021, according to The Block's Ethereum price page.

The Ethereum ICO, held from July 22 to September 2, 2014, raised about $18.3 million by selling over 60 million ETH tokens at an average price of $0.31 per ETH, with 1 BTC initially buying 2,000 ETH and later 1,337 ETH due to price adjustments.

The funds, equivalent to 31,531 BTC, supported the development of Ethereum, which launched in July 2015 with a total initial supply of 72 million ETH, 83% of which went to ICO investors.

This ICO, accessible globally without investor restrictions, yielded an ROI of more than 12,000-fold for early investors, based on Ethereum's current price.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The corporate race into crypto has just gotten hotter, starting with Bitcoin, then Ethereum, XRP, and now coming down to BNB. Nasdaq-listed company BNC (formerly VAPE) has announced a $160 million purchase of 200k BNB.

This huge purchase makes BNC the largest corporate holder of BNB in the world. Following the news, the BNB price jumped to $819, marking an 8% gain in just a week.

From VAPE to Crypto Power Player

According to Wu Blockchain, Nasdaq-listed BNB Network Company — formerly known as VAPE, has made a bold entry into the Binance ecosystem, spending $160 million to buy 200,000 BNB tokens.

This wasn’t just a casual market buy. The purchase was backed by a $500 million private funding round led by 10X Capital and YZi Labs, signaling strong confidence from heavyweight investors.

Wu Blockchain@WuBlockchainAug 11, 2025Nasdaq-listed company BNC (formerly VAPE) has announced a $160 million purchase of 200k BNB, making it the largest corporate holder of BNB globally. The acquisition was funded through a $500 million private placement led by 10X Capital and YZi Labs. BNC plans to continue…

While many public companies are still experimenting with Bitcoin or Ethereum, BNC has gone straight for a high-stakes bet on BNB, a token deeply tied to the Binance ecosystem.

Plans to Keep Buying

BNC isn’t stopping here. With its warrant structure, it could boost its BNB investment to $1.25 billion, gaining huge influence over corporate holdings. If they follow through, that would put the company in a position of massive influence over BNB’s corporate ownership.

If more corporations follow this path, BNB could move from being primarily an exchange utility token to a recognized strategic asset for big institutions.

Impact on BNB Price

BNB’s market momentum has been undeniable. The token price has climbed 18% over the past month, trading between $750 and $838 in the last week.

Meanwhile, the Relative Strength Index (RSI) is at 65.88, suggesting more room for growth before hitting overbought territory.

However, technical analysis suggests that breaking above $825 could send prices to $850–$875

On the flip side, if resistance holds, prices may drop to $790, with $750 as strong support

In the crypto world, Chainlink and XRP are often discussed side-by-side, but not because they are in direct competition. The two projects simply serve very different purposes.

XRP’s technology is widely used for cross-border payments, especially by banks and payment providers. Chainlink, on the other hand, is less visible to the general public but plays an important role in connecting blockchains with real-world data.

A Viral Debate on X

A recent post on X (formerly Twitter) sparked a discussion between the two communities.

One expert opened up about Chainlink, saying they had “I’ve never seen it work in real life” or met anyone building with it. He argued that developers on the ground know what works better than influencers promoting projects.

Dom | EasyA@dom_kwokAug 10, 2025i have actually seen @ripple’s tech work in real life.

i’ve never seen @chainlink work in real life, nor have i met anyone building with chainlink either.

when you spend every day on the ground with developers you understand what tech works much better than an influencer who’s… https://t.co/0SIbExpvPf

However, another analyst replied, stressing that the two projects serve completely different purposes. XRP, through RippleNet, focuses on fast, low-cost global payments. Chainlink ensures authenticity and data accuracy for blockchains.

They also pointed out that the LINK token is mainly for payments, is not native to Chainlink, and runs on Ethereum as an ERC-20 token. “You can’t compare chain and XRPL, it’s like comparing MS Word with PHOTSHOP,” (sic) Vincent Van Code wrote.

Key Differences Between Chainlink and XRP

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up