Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

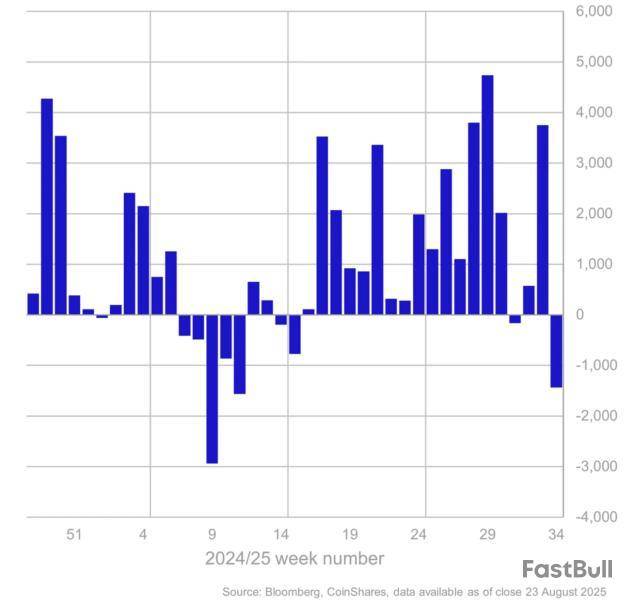

Crypto investment products issued by wealth managers like BlackRock, Grayscale, and Fidelity logged $1.4 billion in net outflows last week, the largest since March, as risk appetite wobbled and flows flipped negative for both bitcoin and ether, according to CoinShares’ latest weekly report.

Bitcoin funds saw the largest withdrawals with roughly $1.0 billion in outflows, while ether products shed about $440 million. Investor exits were concentrated in the U.S., Sweden, and Switzerland, but Germany and Canada posted modest inflows.

James Butterfill, head of research at CoinShares, said flows were volatile through the week. After nearly $2 billion in early redemptions, capital movements stabilized and funds drew about $594 million of net inflows following Fed Chair Jerome Powell’s Jackson Hole remarks.

Weekly crypto asset flows. Images: CoinShares.

The Block reported a surge in crypto prices last week as Powell hinted at potential rate cuts, while also noting potential downside risks from aggressive tariff tactics from President Trump. Despite the initial setback during the week, CoinShares noted that month-to-date tallies still show about $2.5 billion of net inflows to ether products versus an estimated $1.0 billion of net outflows from bitcoin vehicles.

“Sentiment shifted later in the week following Jerome Powell’s address at the Jackson Hole Symposium, which was widely interpreted as more dovish than expected, sparking inflows of US$594m,” Butterfill wrote on Monday. The report adds to evidence that crypto flows remain highly sensitive to macro signals and positioning in listed derivatives, with larger-cap assets bearing the brunt when volatility picks up.

Altcoins showed mixed performance once again. XRP captured about $25 million, Solana drew in approximately $12 million, and Cronos saw an estimated $4.4 million inflow, while Sui and Toncoin saw outflows of about $12.9 million and $1.5 million, respectively.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The Cardano price is bleeding intraday, but its cofounder is making some noise for the asset, building long-term hopes and fueling renewed optimism.

From Charles Hoskinson’s hints of XRP integration in the Lace wallet to the ADA price chart showing a symmetrical triangle breakout, investors are watching closely on these long-term bullish observations.

Therefore, with ADA crypto’s multichain strategy and the Leios upgrade ahead, the question is whether Cardano’s price can revisit 2021 highs.

Cardano’s Lace Wallet Expands to XRP Integration

In terms of fundamental growth, Cardano seems to be on the right track, and this last weekend, one of the biggest catalysts was the hint that Cardano’s multichain wallet Lace could integrate XRP support, probably by late 2025.

In the post, Charles Hoskinson, Cardano’s founder, can be seen confirming discussions with Ripple leaders, noting that Lace would soon allow XRP transactions alongside ADA and Bitcoin .

This move signals an important step in blockchain interoperability, potentially driving liquidity and utility across networks.

For Cardano, expanding beyond ADA and Bitcoin into XRP reflects a growing ecosystem focus and offers investors hope for stronger cross-chain adoption.

Technical Outlook: ADA Breaks Symmetrical Triangle

Beyond ecosystem news, the Cardano price chart has been trending upward after a bullish technical breakout on a symmetrical triangle pattern.

An analyst has also confirmed of this pattern’s breakout on the daily timeframe on the upside, suggesting strong momentum.

Traders on X forecast that this breakout could fuel a run back to ADA’s 2021 all-time high above $3.

The Long Investor@TheLongInvestAug 24, 2025BINANCE:ADAUSDT Criminally Easy. pic.twitter.com/3dfIHFBgum

Currently, the ADA price today shows resilience despite broader market volatility. If momentum holds, short-term ADA price prediction targets range between $2.50 to $3, making the recent breakout a key signal for traders monitoring Cardano price USD moves.

Leios Upgrade: Cardano’s Big Leap

Adding further strength to the Cardano price forecast, Charles Hoskinson revealed details about the Leios upgrade. He stated that Leios would make Cardano the “safest, fastest, and most powerful blockchain in the world.”

Therefore, just like what Charles Hoskinson says, if the upgrade is realized, then this would not only improve performance but also enhance adoption prospects, especially in the face of growing competition from Ethereum and Solana.

The stablecoin market is rapidly gaining attention from industry leaders, regulators, and Wall Street giants. New regulations, growing institutional interest, and increasing real-world utility are driving its growth.

Let us have a look at what the experts have to say.

Utility and Institutional Demand To Drive The Next Wave

Reece Merrick, Senior Executive Officer and Managing Director in the Middle East and Africa at Ripple, highlights that the stablecoin market, currently valued at around $300 billion, is on track for remarkable growth.

He says that the rapid growth is being driven by new regulations, like the U.S. GENIUS Act, and stronger connections with fintech, showing how stablecoins are becoming increasingly important for stability and liquidity across the volatile financial ecosystems.

Reece Merrick@reece_merrickAug 25, 2025The stablecoin market, currently valued at approximately $300 billion, is projected to experience significant growth, potentially reaching $1.2 trillion by 2028, with some forecasts reaching up to $2.8 trillion by 2028

This robust expansion, underpinned by regulatory…

As stablecoins become central to the global financial system, the next wave of adoption will be driven by real-world use and institutional demand.

Ripple Leading the Push In Stablecoin Market

Ripple is at the forefront, taking full advantage of this growing market.

It recently partnered with SBI VC Trade, a subsidiary of SBI, to bring RLUSD to the Japanese market. SBI VC Trade has been a leader in Japan’s crypto space, handling stablecoins with an official license. This move will make stablecoins more accessible, reliable, and convenient for users in Japan.

Experts Weigh In On Stablecoin Market Potential

Treasury Secretary Scott Bessent believes that stablecoins will increase demand for U.S. Treasuries. He has also highlighted that the GENIUS Act provides the regulatory clarity needed for the stablecoin market to grow into a multitrillion-dollar industry.

Treasury Secretary Scott Bessent@SecScottBessentAug 18, 2025Implementing the GENIUS Act is essential to securing American leadership in digital assets.

Stablecoins will expand dollar access for billions across the globe and lead to a surge in demand for U.S. Treasuries, which back stablecoins.

It’s a win-win-win for everyone involved:… https://t.co/p5nRQpBfnw

“It’s a win-win-win for everyone involved: stablecoin users, stablecoin issuers, and the U.S. Treasury Department,” he said.

Ripple CEO Brad Garlinghouse predicts the stablecoin market could jump nearly tenfold, from $250 billion to $2 trillion, in a few years.

Market Outlook By Wall Street Giants

Goldman Sachs says that we are at the start of a “stablecoin gold rush.” The bank notes that stablecoins currently make up a $271 billion global market, with USDC expected to grow $77 billion by 2027. It also points out that the potential total market for stablecoins is in trillions.

Coinbase predicts that the U.S. dollar-backed stablecoin market could grow to $1.2 trillion by 2028. Standard Chartered is even more bullish, projecting it could hit $2 trillion by 2028.

However, JPMorgan sees stablecoins reaching $500 billion by 2028, driven mostly by crypto trading and DeFi (88%), with payments at just 6%. Overall, it sees moderate, crypto-driven growth, not a mainstream adoption boom.

Whether driven by payments, trading, or institutional demand, the stablecoin industry is on track for a multi-trillion-dollar future.

Bitcoin’s price is currently sitting at a crucial level that could shape market direction in the coming weeks. Buyers and sellers are locked in a tight battle, and the market appears to be standing on the edge of a potential breakdown.BTC Price Technical Side

By ShayanThe Daily Chart

On the daily chart, Bitcoin has recently slipped below the large ascending channel that had been driving its uptrend over the past few months. The failure to hold above $120K is a bearish signal, and with the $110K support and the 100-day moving average now at risk of breaking, the market could be heading for a sharp drop toward the $100K zone, where the 200-day moving average also resides.

The RSI is holding below 50, further confirming bearish momentum and strengthening the case for continued downside. At this stage, only a strong wave of buying pressure could prevent a deeper decline and stabilize the market.

The 4-hour chart shows a clear fake breakout and rejection around the $116K resistance, signaling that even the anticipation of lower interest rates has not been enough to spark a new rally. This is a bearish sign, as markets failing to react positively to good news often suggest underlying weakness.

Currently, the $111K support is breaking down, which could pave the way for a swift decline toward the critical $100K zone. While the previous accumulation between $105K and $110K may generate some buying interest and temporary support, the overall market structure points to a higher probability of further downside.

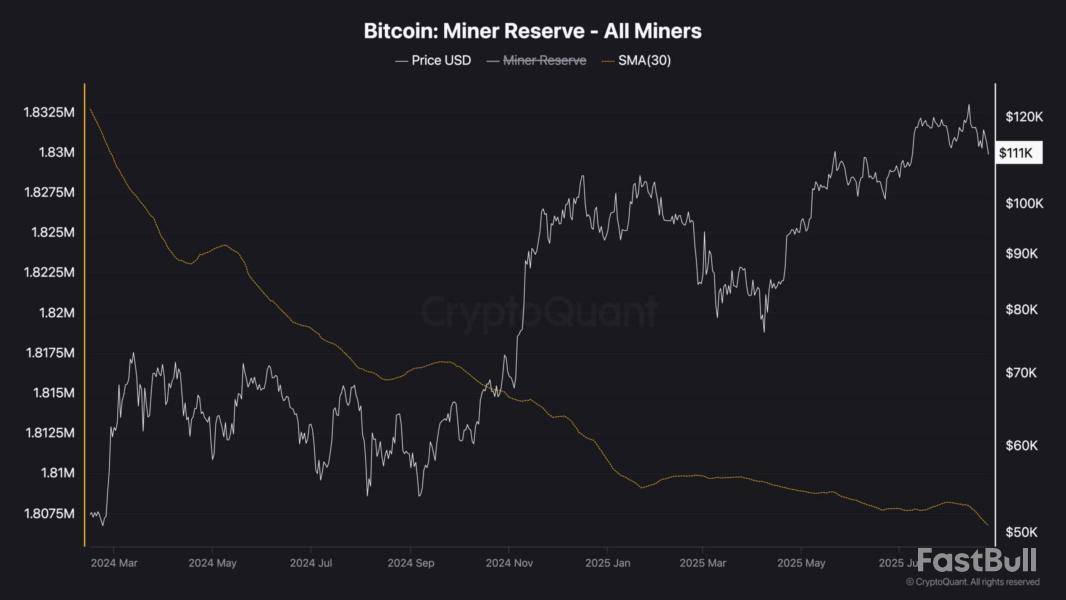

Bitcoin miners have been consistently selling their holdings over the past couple of years, mainly to cover operational costs. While expected, this steady outflow adds extra selling pressure to the market, which can weigh on price performance.

In recent days, the decline in miner reserves has accelerated, signaling an increase in selling activity. This surge in supply is likely one of the factors contributing to the recent downturn following Bitcoin’s new all-time high a few weeks ago. If this trend continues and demand fails to absorb the additional supply, the market could face deeper downside pressure.

TL;DR

Ethereum Price Action

Ethereum surged to a new all-time high of $4,950 on August 24 before losing momentum. The token has since pulled back to around $4,550, down 4.5% over the past 24 hours, though still up 8% on the week. Since early August, ETH has climbed 26% and remains more than 220% above its yearly low.

Meanwhile, the reversal came during a wave ofliquidationsacross the market. More than $720 million in positions were wiped out in the last day, with nearly $500 million tied to Bitcoin and Ethereum longs. The rejection near $4,950 triggered much of the flush.Liquidity Grab and Support Levels

Analyst Lennaert Snyder said Ethereum “took liquidity above $4,880 and flushed leveraged longs.” He added that ETH is “currently testing ~$4,500 support, but it doesn’t look strong.”

Snyder pointed to $4,693 as the key range low for bulls to reclaim quickly. Arecoveryabove that level could open another move toward $4,880. If $4,500 fails, the chart suggests ETH could slide to $4,300, which marked the start of its last impulse higher.

$ETH took liquidity above $4,880 and flushed leveraged longs.

Currently testing ~$4,500 support, but is doesn’t look strong.

Best case scenario for the bulls is to reclaim $4,693 rangelow asap.

If we lose here, Ethereum will probably retest the $4,300 start impulse. pic.twitter.com/Mkl4BtFizy

— Lennaert Snyder (@LennaertSnyder) August 25, 2025

The $4,880 zone now acts as immediate resistance, while $4,500 remains under pressure.Whale Buying and Institutional Flows

Large players have been active in recent sessions. Wise Crypto noted that whales added more than $1.6 billion worth of ETH this week, even as volatility increased. They described $4,590–$4,760 as a demand area that aligns with the 0.5 Fibonacci retracement at $4,780.

Wise Crypto highlighted $4,950 (0.618 Fib) as the resistance to clear. A break above that line could set a path toward $5,500, with checkpoints at $5,190 and $5,500.

At the same time, CryptoQuant analyst Darkfost pointed to continued whale accumulation on Binance.

“Since July, we have seen a significant increase in demand coming from Binance whales,” they wrote.

According to the analyst, their activity shows a preference for building positions after explicit trend confirmation, which could provide extra support if ETH attempts another push toward $5,000.

Ethereum’s rally in August has been strong, but historical trends indicate that September often brings corrections after a profitable August. Data from CoinGlass suggests the same could apply this year.

For now, ETH sits between critical levels: $4,690 on the upside and $4,500–$4,300 on the downside. A reclaim could reignite momentum toward $5,000, while failure may reinforce seasonal weakness.

Opinion by: Sasha Shilina, founder of Episteme and researcher at Paradigm Research Institute

In 2024, Nature reported a record-breaking number of scientific paper retractions: over 10,000 papers pulled from journals due to fraud, duplication or flawed methodology. Peer review, the long-revered backbone of academic legitimacy, is under siege. It’s too slow, too opaque and too easily gamed.

Meanwhile, artificial intelligence models trained on this flawed data set generate confident but nonsensical output. Papers cite nonexistent studies. Research decisions are guided by influence, not inference. The internet, once hailed as a democratizing force for knowledge, is now a battleground of misinformation, clickbait and manipulated metrics.

We are living in an epistemic crisis.

And yet, buried in the unlikely corners of Crypto X and decentralized autonomous organization (DAO) forums, a new architecture is forming. Not for transferring value, but for verifying truth.

A layer 2 for knowledge

In the crypto world, layer 2s address the scalability issue. They help Ethereum process more transactions faster and cheaper. But what if the real scalability bottleneck isn’t financial — it’s epistemological?

Science isn’t scaling. Reputation hierarchies, legacy journals and funding gatekeepers bottleneck it. Brilliant hypotheses die in grant purgatory. Replications go unrewarded. Errors take years to correct, if ever.

What does a “layer 2 for truth” actually look like? This system transforms scientific hypotheses into onchain objects, public, persistent and open to scrutiny. Instead of broadcasting belief on social media, participants stake it, putting skin in the game and exposing their convictions to real risk. Resolution becomes a hybrid process: AI models parse and score evidence, human validators contest or affirm outcomes, and decentralized oracles record the result transparently. Crucially, incentives shift away from prestige and toward precision, rewarding those who are right, not just well-positioned.

This is not decentralized finance (DeFi). It’s not even decentralized science (DeSci). It’s agentic, decentralized science (DeScAI). More radically, however, it’s epistemic finance: Markets built not around coins but claims.

Betting on reality

This isn’t just science gambling. It’s a structural inversion. Today, the academic economy rewards being interesting, not correct. Flashy papers get media attention and grant renewals, whether or not their findings replicate. Meanwhile, replication studies, null results and quiet work often vanish.

Prediction markets can flip the script. They pay you to be right. Not to be loud, famous or institutionally blessed, but simply correct about the world. If a biotech researcher predicts that a particular compound will reduce tumor growth by 20% in mice, and they’re right, they win. If they’re wrong, they lose. Simple. Transparent. Brutally honest.

In this model, belief becomes a measurable asset. Knowledge becomes liquid. The marketplace doesn’t just trade tokens; it trades epistemic confidence.

The oracle problem reimagined

In crypto, the “oracle problem” is getting real-world data onto the blockchain trustlessly. In this epistemic architecture, the oracle isn’t just a price feed. It mediates what is accepted as truth.

This raises uncomfortable questions: Who gets to decide what’s true? Can AI serve as a reliable resolver? What happens when markets are wrong?

The answer is that there’s no singular oracle. There’s a protocol. Resolution becomes a process: part-automated, part-contested and part-historical. Participants challenge, update and refine claims. Truth becomes iterative, open-source and adversarial, like code.

Yes, this opens the door to epistemic volatility. In a world where even Nobel laureates get it wrong, isn’t volatility better than stagnation?

From publishing to protocols

The internet disrupted publishing. Blockchains disrupted finance. Now, a third disruption is underway: the protocolization of knowledge.

In this emerging paradigm, the architecture of knowledge itself is being reimagined. Papers are no longer static PDFs but dynamic contracts embedded with predictive weight, designed to inform and be tested. Citations become more than scholarly gestures; they’re transformed into onchain links annotated with confidence scores and traceable influence. Once a closed gatekeeping ritual, peer review evolves into an open, adversarial verification market where claims can be challenged, revised and resolved in public view.

In this model, science stops being a static archive and becomes an economic, dynamic and plural living system.

Truth is the next asset class

We’ve priced money, time and attention. We’ve never truly priced belief. Not until now.

A new kind of market emerges, one that doesn’t reward speculation but verification — a civic instrument for aligning incentives around truth in an age of noise. The question isn’t whether these markets are risky. All markets are. The question is: Can we afford not to try?

If crypto is a new internet, we need more than memes, memecoins and monkey JPEGs. We need infrastructure for the next epistemic era: for validating what matters, when it matters, in public.

The next big layer isn’t for money. It’s for the truth.

Opinion by: Sasha Shilina, founder of Episteme and researcher at Paradigm Research Institute.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Global central bank digital currency (CBDC) efforts are threatening to give financial institutions more control over the money supply and personal savings, as the transatlantic divide between the US and Europe widens in terms of financial technology.

CBDCs are digital versions of fiat money issued on a permissioned, private blockchain, usually controlled by a central bank, as opposed to decentralized blockchain networks.

“Not all digital currencies are the same,” said Susie Violet Ward, financial analyst, co-founder and CEO of think tank Bitcoin Policy UK, warning that CBDCs represent the "weaponization of money in its purest form.”

This new form of programmable money threatens increased central bank control over spending, including a potential “expiry date” on personal savings, Ward said during Cointelegraph’s Chain Reaction daily X spaces show on Thursday, adding:

“Even George Orwell did not predict that programmable money might come into this. That almost closes the 1984 loop perfectly,” she added, referring to Orwell’s dystopian novel, which depicts a world where an oppressive central government controls major aspects of human life, including public opinion and free speech.

Cointelegraph@CointelegraphAug 21, 2025Escaping the Death of Privacy with Bitcoin #CHAINREACTION https://t.co/nNncxdfFaj

Europe pushes ahead with digital euro after Trump bans US CBDC

The transatlantic divide between Europe and the US is growing, with the former pushing ahead with digital euro plans while the latter is doubling down on stablecoin innovation and banning the creation of CBDCs.

On Friday, the US House added a provision banning the Federal Reserve from issuing a CBDC into an almost 1,300-page bill setting the country’s defense policy for the 2026 fiscal year, Cointelegraph reported.

The provision in the defense policy bill would ban the Fed from issuing any digital currency or asset and stop the central bank from offering financial products or services directly to individuals.

The House passed a similar Republican-backed bill, the Anti-CBDC Surveillance State Act, in July with a slim majority of 219 to 210, which is now awaiting a Senate vote.

On Jan. 23, US President Donald Trump signed an executive order that prohibits the establishment, issuance, circulation or use of CBDCs, citing concerns over their potential to threaten financial system stability, individual privacy and national sovereignty.

Still, the European Union is pushing ahead with its digital euro plans, reportedly exploring major public blockchains like Ethereum for its CBDC, rather than a private one, where data is limited to authorized entities.

The digital euro is expected to roll out in October 2025, European Central Bank President Christine Lagarde said during a news conference, emphasizing that the CBDC will coexist with cash and offer privacy protections to address government overreach concerns.

While CBDCs have been praised for their potential to increase financial inclusion, critics have raised concerns about their surveillance capabilities.

In July 2023, Brazil’s central bank published the source code for its CBDC pilot, and it took just four days for people to notice the surveillance and control mechanisms embedded within its code, allowing the central bank to freeze or reduce user funds within CBDC wallets.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up