Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gemini, the cryptocurrency exchange founded by the Winklevoss twins, has surpassed Coinbase in the app store charts after launching a XRP-rewards credit card with Ripple Labs and Mastercard.

“This limited edition metal card gives up to 4% back in XRP instantly. No waiting, just stacking,” Gemini said in an X post on Monday.

Sensor Tower data shows Gemini overtook Coinbase in the finance category rankings in the US after the announcement, with Gemini at 16th place at the time of publication, compared to Coinbase at 20th.

The event could be seen as significant as Coinbase has over three times the daily trading volume of Gemini, recent data from Messari shows.

“The flippening is accelerating,” says Tyler Winklevoss

Gemini co-founder Tyler Winklevoss said, “The flippening is accelerating” in an X post on Monday, and other crypto market participants also highlighted the new milestone on social media.

According to App Store intelligence platform App Tweak, rankings on the App Store are mainly influenced by keywords, downloads, user reviews, app performance, and retention.

Ripple Labs CEO Brad Garlinghouse said in an X post on Monday, “An XRP rewards credit card out in the world?! What a time to be alive, XRP family.”

Coinbase posts significantly higher trading volume than Gemini

Coinbase ranks third among crypto exchanges by trading volume, recording $4.54 billion in the past 24 hours, while Gemini sits at 24th with $382.49 million, CoinMarketCap data shows.

It comes just weeks after Gemini filed with the US Securities and Exchange Commission to list its Class A common stock on the Nasdaq Global Select Market under the ticker GEMI.

According to its filing, the IPO will mark the first time its shares are publicly traded, with pricing expected between an undisclosed range. The offering will be led by a syndicate of major banks, including Goldman Sachs, Morgan Stanley, and Citigroup.

Bitcoin has once again left traders guessing. After crashing to $109K with nearly $1 billion in liquidations, the market is split on what comes next. Will September bring another weak month, a surprise rally, or even a deeper crash?

Popular analyst Altcoin Sherpa has outlined three possible paths for Bitcoin—and each one tells a very different story.

Let’s have a look at it!

Scenario 1: September Chop and a Slow Grind Higher

According to Sherpa, the first and most likely scenario is that September could turn into a “chop fest.” Historically, September has been one of the weakest months for Bitcoin, with prices closing red in 8 out of the past 12 times, showing an average drop of 3.6%.

This trend suggests Bitcoin may spend the coming weeks hovering near the $100,000 level if the usual September decline plays out. However, there’s also a chance of a bullish surprise. A Fed rate cut in September could flip the trend and push Bitcoin above $115K.

Scenario 2: Immediate Rebound and Faster Cycle

The second scenario is more aggressive. Here, Bitcoin quickly rebounds and pushes higher, with traders regaining confidence that Jerome Powell will cut rates and with new treasury-backed vehicles entering the market.

Sherpa suggests that if this plays out, we could see a sharp rally in September and October. However, such a fast rebound could also lead to a blow-off top, followed by a painful correction soon after.

Scenario 3: Deeper Macro-Driven Pullback

The most bearish outlook is that Bitcoin’s recent weakness signals the start of a much larger unwind. In this case, macroeconomic pressures worsen, leading to heavy retracements. Sherpa warns that Bitcoin could fall as low as $75,000, creating a cycle similar to the January–May 2025 downturn.

Recovery, in this view, might not arrive until Q2 2026, after a long and grinding consolidation period.

Bitcoin ETF & Whale Wave Hit Hard

Bitcoin’s late-August dip is weighing heavily on institutional markets. Exchange-traded crypto funds saw nearly $1.5 billion in outflows, the largest since March 2025.

On top of that, whale moves added more pressure, a seven-year-old wallet shifted 22,769 BTC worth $2.59 billion into Ether. This sudden move sparked a sharp $4,000 intraday drop in Bitcoin’s price.

As of now, Bitcoin is trading near $110K, down about 3% in the last 24 hours, bringing its market cap to $2.91 trillion.

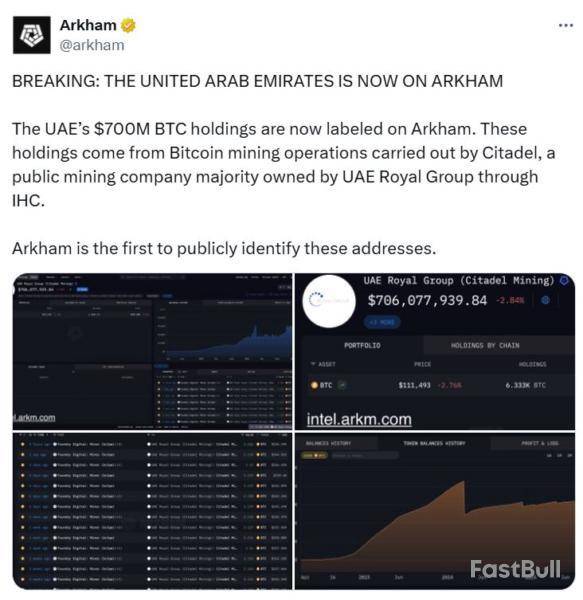

The United Arab Emirates (UAE) holds around $700 million in Bitcoin, which has been largely accumulated from mining operations, according to the blockchain analytics platform Arkham Intelligence.

Arkham said in an X post on Monday that it has become one of the first to publicly identify the UAE government’s wallets, finding that their wallet addresses hold about 6,300 Bitcoin (BTC).

The Bitcoin was mined through Citadel Mining, which is majority owned by the UAE government-owned conglomerate, the International Holding Company (IHC).

“Unlike the US and UK, the UAE’s holdings do not come from police asset seizures but from mining operations with Citadel Mining,” Arkham said.

The reported Bitcoin holdings are far less than what was once rumored. Speculation frequently placed the UAE’s holdings at around 420,000 Bitcoin collected from sources such as criminal seizures, worth $46 billion, which would have made the Emirates the largest nation-state Bitcoin holder in the world.

UAE mining firm connected to royal family

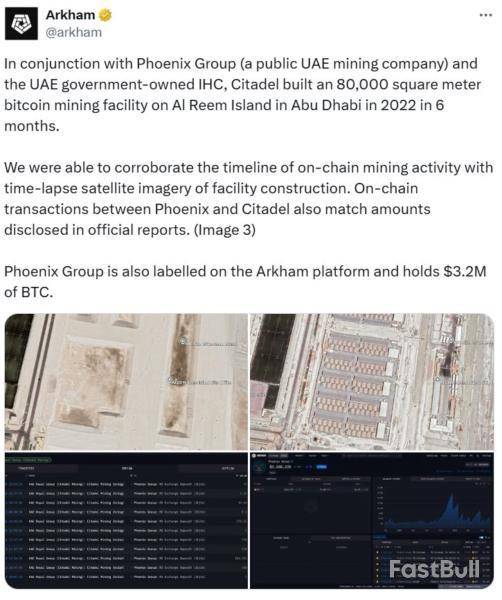

Arkham said in conjunction with Phoenix Group, a public UAE mining company, and the IHC, Citadel built a Bitcoin mining facility in Abu Dhabi in 2022.

“We were able to corroborate the timeline of onchain mining activity with time-lapse satellite imagery of facility construction,” the firm said.

“On-chain transactions between Phoenix and Citadel also match amounts disclosed in official reports.”

In total, Arkham estimates that through Citadel, the UAE has mined a total of 9,300 Bitcoin.

Citadel Mining is 85% owned by 2pointzero, which is owned by the IHC, which the UAE Royal Group, a conglomerate owned by Sheikh Tahnoon bin Zayed Al Nahyan, of Abu Dhabi’s royal family, has a 61% stake in.

How does the UAE stack up to other countries

With its newly reported holdings, the UAE would have the sixth-largest Bitcoin stash out of all countries, behind Bhutan with 11,286 and ahead of El Salvador with 6,246, according to BitBo.

The US is still the largest nation-state holder of Bitcoin, with 198,012, made mostly from criminal seizures. China is second with 194,000, most of which came from its 2019 crackdown on the PlusToken scam. The UK is third with 61,245 Bitcoin.

BitBo estimates 517,000 Bitcoin are held in sovereign vaults, representing about 2.4% of the total supply, with a total worth of over $56 billion.

However, Bitcoin’s pseudonymous creator, Satoshi Nakamoto, is believed to hold 1.096 million Bitcoin across thousands of wallets, according to Arkham, giving them the largest stash, while Michael Saylor’s company, Strategy, is the largest corporate holder with a treasury of 629, 376 Bitcoin, or 2.9% of the total supply, and is still growing.

On August 25, Arkham Intelligence reported that the UAE government holds around 6,300 Bitcoin, valued between $700 million and $740 million. What makes this stash unique is that it wasn’t bought on the open market.

Instead, it was mined directly through Citadel Mining, a publicly listed company majority-owned by Abu Dhabi’s powerful Royal Group. By accumulating Bitcoin through mining rather than market purchases, the UAE has secured reserves while strengthening its role in the global crypto mining landscape.

UAE is now the Fourth-Largest Bitcoin Holder

This move puts the UAE in the spotlight as the fourth-largest holder of Bitcoin, a notable milestone for a nation positioning itself as a global hub for digital assets. The Gulf country has been ramping up efforts to attract crypto companies with favorable regulations, abundant energy resources for mining, and institutional capital eager to diversify into blockchain technology.

Alongside its mined Bitcoin reserves, Abu Dhabi’s sovereign wealth fund has invested $534 million in a Bitcoin ETF, signaling that the UAE’s embrace of cryptocurrency goes beyond mining into mainstream financial instruments. Together, these steps reflect a two-pronged strategy: securing mined reserves while also gaining exposure through regulated investment products.

A New Global Crypto Player

The UAE’s Bitcoin holdings and growing presence in digital assets could reshape the competitive landscape, especially as countries like the U.S. and El Salvador pursue their own Bitcoin strategies. By leveraging financial muscle and energy capacity, the Emirates is carving out a place as a serious global player in the digital asset economy.

For now, Arkham’s disclosure provides the first public confirmation of these sovereign Bitcoin reserves, putting the UAE in the same league as some of the world’s most proactive state adopters. It’s yet another signal that Bitcoin is no longer just a speculative asset; it’s becoming a strategic reserve for nations looking to future-proof their economies.

FAQs

How much Bitcoin does the UAE currently hold?The UAE holds approximately 6,333 BTC, valued at around $740 million, making it the fourth-largest state Bitcoin holder globally.

How did the UAE acquire these Bitcoins?These Bitcoins were mined directly using Citadel Mining, a publicly listed company majority-owned by Abu Dhabi’s Royal Group via the IHC investment arm, not bought on the open market.

Why is the UAE’s Bitcoin reserve considered unique?Unlike many nations that purchase Bitcoin, the UAE built its reserve through state-backed mining operations. This enhances its strategic involvement in global crypto infrastructure rather than just financial exposure.

Can you use crypto to buy real estate or flights in the UAE?Yes. Dubai now allows real estate and flight bookings with cryptocurrencies. Developers such as Emaar, DAMAC, and Nakheel, along with Emirates Airline, are accepting crypto payments, though regulatory measures are being refined to address volatility and risk.

Are cryptocurrency transactions in the UAE taxed?For individual investors, the UAE currently has no income or capital gains tax on crypto. However, goods/services purchased with crypto remain subject to the standard 5% VAT.

Around $205 billion has exited crypto markets over the past 24 hours, sending total market capitalization plummeting back to $3.84 trillion.

It is the lowest level total cap has been since August 6, but it still remains within a six-week sideways channel despite themassive sell-off.

CoinGlass reported that around 205,000 traders were liquidated over the past day, with total liquidations coming in over $930 million as leveraged long Bitcoin positions got flushed. Other analysts were suggesting that exchanges were dumping crypto assets in order to liquidate the long positions.

Today’s painful, but not out of the ordinary, market slump has resulted in a 9% correction for overall crypto markets since their peak on August 14.

Yesterday saw one of the largest #Bitcoin long liquidation events since Dec 2024, with over $150M in longs wiped out as price moved lower. pic.twitter.com/okCNBMWl0j

— glassnode (@glassnode) August 25, 2025

Bitcoin Dragging Markets Down

The big dump has been caused by Bitcoin, which crashed to a seven-week low of under $109,000 in early Asian trading on Tuesday morning on most exchanges.

This was caused by a Bitcoin whale selling an entire batch of 24,000 BTC worth over $2.7 billion, causing the asset to plummet $4,000 a few hours that followed.

According to Glassnode, Bitcoin has dropped below the average cost basis ($110,800) of one to three-month-old investors who accumulated during the May to July rally. “Historically, failure to hold above this level has often led to multi-month market weakness and potential deeper corrections,” it cautioned.

The total BTC correction now stands at 12%, which is still much shallower than the pullbacks in September 2017 and 2021, during the bull market years when the asset retreated by 36% and 24%, respectively.

A retreat between these two levels this September could see Bitcoin prices back at $87,000 before the bull market resumes.Altcoins Bleed Out

As usual, the altcoins are suffering much more with major losses for Solana dumping over 11% to $186, Dogecoin dropping 10% in a fall to $0.21, Cardano sliding 9% to $0.83, and Chainlink tanking 11% to $23.30.

Other altcoins in pain include Hyperliquid, Sui, Avalanche, and Litecoin. Ethereum haslost 7%on the day, but it remains within its sideways channel and had already started to recover at the time of writing, trading above $4,400 again. However, ETH has lost over 11% since its all-time high just two days ago.

“It never “feels good” when you buy the dip. The dip comes when sentiment drops. Writing the number down can be a good form of discipline,” advised Bitwise CIO Matt Hougan.

When the crypto market rips, everyone says: “I’ll buy bitcoin if it just pulls back to [insert number here].”

Then, when the dip happens, they don’t act because the market doesn’t “feel” good at that point.

One solution: Write the price at which you want to buy on a sticky note…

— Matt Hougan (@Matt_Hougan) August 25, 2025

David Bailey, Bitcoin Magazine CEO and advisor to US President Donald Trump, predicted that Bitcoin will not experience any further bear markets. He believes the price will continue to rise significantly as institutional adoption grows.

Contrary to Bailey’s views, several industry experts expect continued or upcoming bear markets in Bitcoin.

In a recent post on X, Bailey’s statement suggested that increased institutional involvement will increase Bitcoin’s price and prevent future extended bear markets. He also said that institutions like sovereign nations, banks, and insurance companies will eventually hold Bitcoin, and their adoption process has already begun.

He wrote, “There’s not going to be another Bitcoin bear market for several years. Every Sovereign, Bank, Insurer, Corporate, Pension, and more will own Bitcoin. The process has already begun in earnest, yet we haven’t even captured 0.01% of the TAM.”

Bear Market to End in Bitcoin

Another expert who believes in an end to the bear market in BTC is Ryan McMillin, co-founder and chief investment officer of Merkle Tree Capital. He told Cointelegraph that there is a possibility there will be no bear market, “similar to gold post the early 2000s ETF launch as the asset was financialized and up only for eight years.”

He also said that without a bull market, there can’t be a bear market, as the bull market precedes any bear market. McMillin said, “If this structure persists, then there is no bear market; there will be regular corrections, which are great buying opportunities.”

Experts Who Foresee Bearish Market in BTC

While Bailey expects the era of Bitcoin’s bear markets to end, several experts, including John Glover, CIO at Ledn, forecast a bear market. In early August, Glover, who is known for his application of Elliott Wave Theory, predicted BTC to reach $140,000 by the end of 2025 but expected a bear market in 2026 following that rally.

Kadan Stadelmann, CTO of Komodo Platform, said that it’s time to buy BTC over the next six months before it returns to a bear market. He said, “If we continue to follow history, I expect the peak around Q1 of 2026 and a bear market to follow,” as quoted in the report.

Some other experts also implied that bearish risks remain in Bitcoin.

FAQs

How volatile is Bitcoin in 2025 compared to previous years?2025 is expected to see high volatility but potentially less than earlier cycles due to institutional involvement, though sharp price swings will remain common.

Can institutional adoption prevent Bitcoin bear markets?Not necessarily. While institutions may reduce volatility, experts note that bull markets are always followed by corrections, meaning regular bear phases are still possible.

What risks could trigger a future Bitcoin bear market?Key risks include a major macroeconomic crisis, stringent new government regulations, or a large-scale security failure undermining market confidence.

How have regulations impacted Bitcoin’s market cycles?Regulatory announcements have historically caused significant volatility, often triggering sharp corrections or extended bear markets by impacting investor sentiment and access.

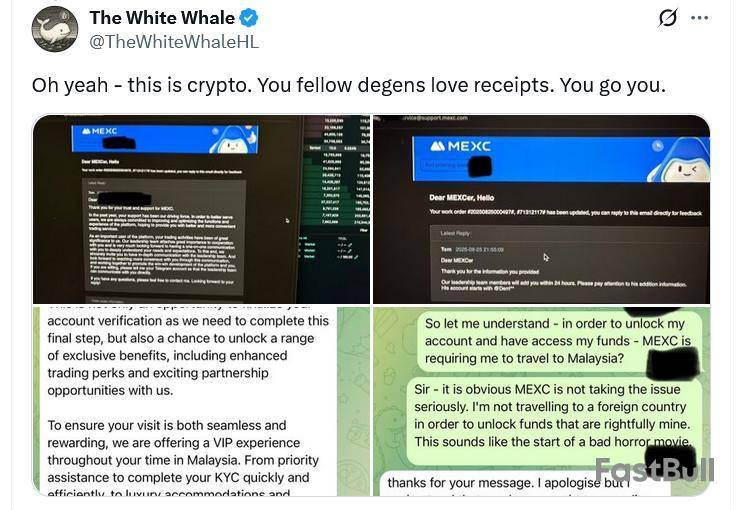

A crypto whale who has $3.1 million in funds frozen on crypto exchange MEXC claims he was told to fly to Malaysia to prove his identity in person to have his funds released quickly.

According to screenshots shared by the pseudonymous crypto trader “White Whale” MEXC’s global head of customer service offered him an “exclusive invitation” to Malaysia to have an “in-depth communication with the leadership team” about the frozen assets.

The reported move would be outside the norm for crypto exchanges. Know Your Customer solutions typically involve proof of address, verification of source of funds, identification, and other documents that can be sent online.

Screenshots of emails and Telegram chats shared by the trader also suggest that MEXC tried to lure them with a potential partnership and “trading perks,” but the crypto trader rejected the offer, criticizing MEXC for using coercive tactics while flagging safety concerns about flying to a foreign country under the circumstances.

MEXC says it doesn’t freeze assets without reason

A MEXC spokesperson told Cointelegraph that it “strictly adheres to risk management policies and does not freeze assets without valid reasons.”

MEXC said it may take measures in response to price manipulation, wash trading, self-trading, front-running, fraudulent trading and false quoting.

The spokesperson did not address the trader’s claims of being offered to fly to Malaysia to resolve the situation.

Crypto trader has been pressuring MEXC to release funds

The crypto whale added he has completed all other KYC checks, including face verification, phone number, and home address, and noted that MEXC’s Terms of Service makes no mention of in-person KYC.

Earlier on Monday, White Whale launched a $2 million social media pressure campaign against MEXC in an attempt to make them hand the funds over.

The campaign involves crypto traders minting a free non-fungible token (NFT) on the Base network and tagging MEXC or its chief operating officer’s X account with the “#FreeTheWhiteWhale” tag.

For completing the tasks, a $1 million USDC (USDC) bounty will be split equally between the first 20,000 NFT holders, provided that MEXC releases the frozen funds.

White Whale isn’t the first MEXC user to complain

MEXC’s comments to Cointelegraph were similar to the company’s statement in March, in response to a series of “ungrounded allegations” regarding the freezing of customer assets.

Another MEXC user, Pablo Ruiz, said over $2 million worth of the Tether (USDT) stablecoin was frozen in April due to a “risk control” protocol without prior notice, explanation, or an opportunity to cooperate.

Ruiz said he was met with automated-looking copy-paste responses, with one line stating: “Due to risk control activation, your account review will take 365 days. Contact us again on 04/17/2026.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up