Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Iranian President: We Continue To Closely Monitor USA Actions And Have Made All Necessary Preparations For Any Potential Scenario

USA National Tsunami Center Says No Tsunami Warning Issued After 7.1 Magnitude Earthquake Strikes Borneo

[French Foreign Minister Says He Will Summon US Ambassador To France] According To French Sources, French Foreign Minister Barro Said On The 22nd That The French Foreign Ministry Will Summon The US Ambassador To France In Response To Comments Made By The US Regarding The Death Of French Far-right Activist Quentin De Lenc

[Trump Demands Netflix Fire Susan Rice; Justice Department Reviewing Warner Acquisition] On Saturday Evening (February 21), US President Trump Called On Netflix To Fire Board Member Susan Rice Or Face Consequences. This Followed Rice's Statement That She Would Push For Corporate Accountability If Democrats Regain Power In The November Midterm Elections. Trump Described Rice, Who Served As Chief Domestic Policy Advisor In The Biden Administration And A Senior Foreign Policy Official In The Obama Administration, As A "pure Political Henchman" And Said She Had "no Talent Or Skill." "Her Power Is Gone And Will Never Return," Trump Wrote

[Cryptocurrency Market Declines In The Last 24 Hours] In The Last 24 Hours, The Marketvector™ Digital Asset 100 Small Cap Index Fell 2.78%, Currently At 2694.21 Points, Continuing Its Overall Downward Trend. The Marketvector™ Digital Asset 100 Mid Cap Index Fell 2.92%, To 2686.82 Points. The Marketvector™ Digital Asset 100 Index Fell 1.46%, To 13549.32 Points. Currently, Solana Is Down 2.74%, Dogecoin Is Down 3.59%, And XRP Is Down 3.45%. Bitcoin Is Down 1.22%, Currently At $67573.78; Ethereum Is Down 1.65%, Currently At $1950.69

European Central Bank Governor Lagarde: Baseline Is That Will Need Until End Of Term To Consolidate Gains

European Central Bank Governor Lagarde: Am Riveted To Mission Of Price Stability, Want The Euro Zone To Be Strong And Fit For The Future

European Central Bank Governor Lagarde: Have Enormous Respect For Both Fed Chair Powell And Nominee Kevin Warsh

European Central Bank Governor Lagarde: Not Clear What Will Happen Next With Tariffs, Critical That There Is Clarity About Future Relationships Between USA And Europe - CBS Face The Nation

Greenland Prime Minister Says 'No Thanks' To Trump's Idea Of Sending Hospital Ship To Greenland

USTR Greer: Expect To Initiate Investigations Related To Excess Industrial Capacity, Covering A Lot Of Countries In Asia - Abc News

U.S. Real GDP Annualized QoQ Prelim (SA) (Q4)

U.S. Real GDP Annualized QoQ Prelim (SA) (Q4)A:--

F: --

P: --

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q4)

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q4)A:--

F: --

P: --

U.S. GDP Deflator Prelim QoQ (SA) (Q4)

U.S. GDP Deflator Prelim QoQ (SA) (Q4)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Dec)

U.S. Real Personal Consumption Expenditures MoM (Dec)A:--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q4)

U.S. Annualized Real GDP Prelim (Q4)A:--

F: --

P: --

U.S. PCE Price Index MoM (Dec)

U.S. PCE Price Index MoM (Dec)A:--

F: --

P: --

U.S. Personal Income MoM (Dec)

U.S. Personal Income MoM (Dec)A:--

F: --

U.S. PCE Price Index Prelim QoQ (SA) (Q4)

U.S. PCE Price Index Prelim QoQ (SA) (Q4)A:--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q4)

U.S. Core PCE Price Index Prelim YoY (Q4)A:--

F: --

P: --

Canada Industrial Product Price Index YoY (Jan)

Canada Industrial Product Price Index YoY (Jan)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Dec)

Canada Core Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

Canada Industrial Product Price Index MoM (Jan)

Canada Industrial Product Price Index MoM (Jan)A:--

F: --

U.S. PCE Price Index Prelim YoY (Q4)

U.S. PCE Price Index Prelim YoY (Q4)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Dec)

U.S. Core PCE Price Index MoM (Dec)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Dec)

U.S. PCE Price Index YoY (SA) (Dec)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Dec)

U.S. Personal Outlays MoM (SA) (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q4)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q4)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Dec)

U.S. Core PCE Price Index YoY (Dec)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Feb)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Feb)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Feb)

U.S. IHS Markit Composite PMI Prelim (SA) (Feb)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Feb)

U.S. IHS Markit Services PMI Prelim (SA) (Feb)A:--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Dec)

U.S. Dallas Fed PCE Price Index YoY (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Feb)

U.S. UMich Consumer Sentiment Index Final (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Feb)

U.S. UMich Consumer Expectations Index Final (Feb)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Feb)

U.S. UMich Current Economic Conditions Index Final (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Feb)A:--

F: --

P: --

U.S. New Home Sales Annualized MoM (Dec)

U.S. New Home Sales Annualized MoM (Dec)A:--

F: --

U.S. Annual Total New Home Sales (Dec)

U.S. Annual Total New Home Sales (Dec)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Feb)

Germany Ifo Business Expectations Index (SA) (Feb)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Feb)

Germany IFO Business Climate Index (SA) (Feb)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Feb)

Germany Ifo Current Business Situation Index (SA) (Feb)--

F: --

P: --

Mexico Economic Activity Index YoY (Dec)

Mexico Economic Activity Index YoY (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Chicago Fed National Activity Index (Jan)

U.S. Chicago Fed National Activity Index (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks FOMC Member Waller Speaks

FOMC Member Waller Speaks U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Dec)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Dec)--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Dec)

U.S. Factory Orders MoM (Excl. Defense) (Dec)--

F: --

P: --

U.S. Factory Orders MoM (Dec)

U.S. Factory Orders MoM (Dec)--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Dec)

U.S. Factory Orders MoM (Excl. Transport) (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Dec)

U.S. Dallas Fed PCE Price Index YoY (Dec)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Feb)

U.S. Dallas Fed General Business Activity Index (Feb)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Feb)

U.S. Dallas Fed New Orders Index (Feb)--

F: --

P: --

South Korea PPI MoM (Jan)

South Korea PPI MoM (Jan)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Feb)

U.K. CBI Retail Sales Expectations Index (Feb)--

F: --

P: --

U.K. CBI Distributive Trades (Feb)

U.K. CBI Distributive Trades (Feb)--

F: --

P: --

Brazil Current Account (Jan)

Brazil Current Account (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. FHFA House Price Index (Dec)

U.S. FHFA House Price Index (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Dec)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Dec)

U.S. S&P/CS 10-City Home Price Index YoY (Dec)--

F: --

P: --

U.S. FHFA House Price Index YoY (Dec)

U.S. FHFA House Price Index YoY (Dec)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Dec)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Dec)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Dec)--

F: --

P: --

U.S. FHFA House Price Index MoM (Dec)

U.S. FHFA House Price Index MoM (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Dec)--

F: --

P: --

No matching data

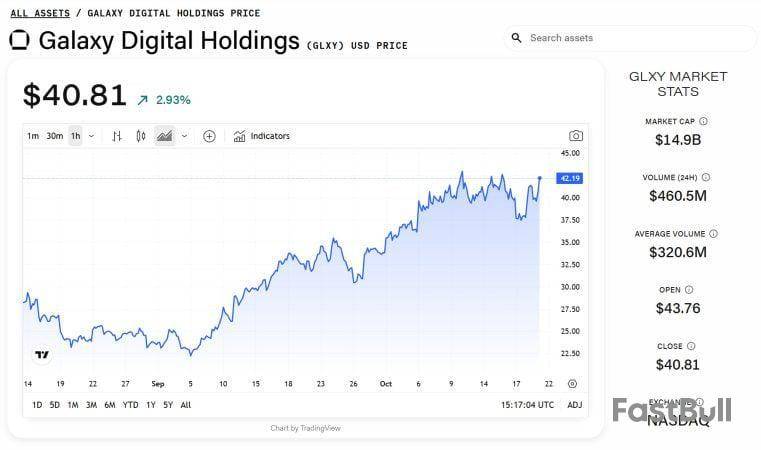

Galaxy Digital reported the best quarter in its history, with profit surging 1,546% to $505 million as record trading volumes and treasury gains combined with momentum in its artificial-intelligence infrastructure business.

Core earnings nearly tripled to $629 million from $211 million in the previous quarter, with total assets up 27% to $11.5 billion, according to Tuesday’s report.

Founder and CEO Mike Novogratz said the results capped eight years of building across both crypto markets and physical infrastructure.

"We're half a data-center company and half a digital-assets company," he told investors. "Helios is the cornerstone of our future."

Galaxy's 800-megawatt Helios campus in Texas was once among North America’s largest bitcoin mines, and is now in the process of being refitted for artificial-intelligence workloads under a long-term lease with CoreWeave. The firm closed $1.4 billion in project financing to fully fund its first-phase build and, earlier this month, raised another $460 million to accelerate the conversion.

The move came ahead of last week’s $40 billion BlackRock-Nvidia acquisition of Aligned Data Centers, which valued power capacity about 160% higher than comparable bitcoin miners, a deal that effectively validated Galaxy’s pivot from mining to AI infrastructure.

'Breakout quarter'

Galaxy’s digital assets division delivered $318 million in adjusted gross profit, driven by a 140% jump in trading volumes and a single $9 billion bitcoin transaction executed for a client. Asset-management inflows also climbed, adding more than $4.5 billion in digital-asset-treasury mandates and pushing total platform assets to $17 billion.

CFO Chris Ferraro called the period "a breakout quarter for Galaxy," citing record results across the trading and investment business as well as Helios' progress. Galaxy ended the quarter with $1.9 billion in cash and stablecoins and $3.2 billion in total equity. Revenue from the Helios facility is expected to begin contributing in the first half of 2026, as Galaxy continues to bridge digital-finance infrastructure with the growing demand for AI-compute capacity.

Galaxy shares hit a record high of $44.30 following the results, but have since eased to around $42 according to The Block's price data. The stock has remained up more than 330% since early April, when it traded below $10.

Galaxy Digital stock price. Source: The Block price page

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up