Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

In The Week Ending February 6, The US Stock Market's "interest Rate Cut Winners" Index Rose 4.41% Cumulatively. The "Trump Tariff Losers" Index Rose 4.03% Cumulatively, And The "Trump Financial Index" Rose 2.46% Cumulatively. The Retail Investor-heavy Stock Index/meme Stock Index Fell 3.35% Cumulatively

US Defense Secretary Hegseth: His Dept Is Formally Ending All Professional Military Education, Fellowships, And Certificate Programs With Harvard University

[Deutsche Bank: Large-Cap Tech Stocks Fall To Bottom Of 10-Year Trend Channel Relative To S&P 500] Deutsche Bank Strategists, Including Parag Thatte, Wrote In A Research Report That On Thursday, Large-cap And Tech Stocks Rebounded From The Bottom Of A 10-year Trend Channel Relative To The Rest Of The S&P 500, And Continued Their Rally On Friday. The Strategists Stated That Historically, This Group Has Typically Seen A Rally After Hitting The Bottom Of The Channel, Especially Against A Backdrop Of Rising Earnings. The Report Noted That This Year's Performance "is Entirely Driven By Changes In Valuation Multiples, Rather Than Adjustments In Earnings Expectations, A Stark Contrast To Last Year When It Was Entirely Driven By Upward Revisions In Earnings Expectations."

[German Industrial Output Shrinks For Fourth Consecutive Year] Data Released By The Federal Statistical Office Of Germany On February 6 Showed That, Affected By Factors Such As Weak Production In The Automotive Industry, German Industrial Output Will Decline By 1.1% In 2025 Compared To The Previous Year, Marking The Fourth Consecutive Year Of Decline. Statistics Show That, Excluding The Construction And Energy Sectors, Output In Other German Industrial Sectors Will Decline By 1.3% In 2025. Among Them, Key Sectors Such As The Automotive Industry And Machinery Manufacturing Saw The Most Significant Declines, Falling By 1.7% And 2.6% Respectively

Brazilian President Lula: I Accept The Autonomy (independence) Of The Central Bank And Will Not Cry Over High Interest Rates

On Friday (February 6), In Late New York Trading, The Yield On The Benchmark 10-year U.S. Treasury Note Rose 2.59 Basis Points To 4.2060%, A Cumulative Decline Of 2.95 Basis Points For The Week, Trading Within A Range Of 4.2975% To 4.1563%. The Yield On The Two-year U.S. Treasury Note Rose 4.71 Basis Points To 3.4976%, A Cumulative Decline Of 2.49 Basis Points For The Week, Trading Within A Range Of 3.5901% To 3.4238%

White House: India Intends To Purchase $500 Billion Of USA Energy Products, Aircraft And Aircraft Parts, Precious Metals, Technology Products, And Coking Coal Over Next 5 Years

White House: India Agrees To Eliminate Restrictive Import Licensing Procedures That Delay Market Access For, Or Impose Quantitative Restrictions On, USA Information And Communication Technology (Ict) Goods

India Repo Rate

India Repo RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

No matching data

View All

No data

By Connor Hart

Shares of Galaxy Digital climbed after the company swung to a profit and revenue surged in the third quarter, boosted by a sharp uptick in demand as companies aim to break into the cryptocurrency industry.

The stock jumped 11% to $43.99 in premarket trading Tuesday. Through Monday's close, shares have more than doubled since the beginning of the year.

Galaxy--which bridges traditional finance and the digital economy, in part offering trading and investment-banking services to businesses looking to branch into the industry--reported a profit of $505.1 million, or $1.01 a share. That is compared with a loss of $33.3 million, or 10 cents a share, a year earlier.

Stripping out certain one-time items, adjusted earnings were $1.12 a share. Analysts polled by FactSet expected adjusted earnings of 38 cents a year.

Revenue more than tripled to $28.4 billion and topped the $17.1 billion that Wall Street modeled.

Quarterly digital asset trading volumes surged 140% sequentially, which the company attributed to increased spot and derivatives activity, as well as the sale of more than 80,000 bitcoin on behalf of a client.

New legislation passed under the Trump administration has helped establish long-awaited guardrails for the crypto industry, which has in turn prompted demand to surge, executives previously said.

"It's like you took a bunch of third graders and locked them in a gymnasium and fed them candy," Jason Urban, Galaxy's global head of trading, said in July. "We just blew open the doors to the playground, and now everybody's out running around."

Write to Connor Hart at connor.hart@wsj.com

The crypto market is down today, showing a notable dip as total market capitalization fell by 2.3% to $3.76 trillion. Trading volume over the past 24 hours stands at $156.6 billion, reflecting moderate market activity amid continued price corrections across major assets.

TLDR:

Crypto Winners & Losers

At the time of writing, 8 of the top 10 cryptocurrencies by market capitalization are in the red.

Bitcoin (BTC) dropped 2.0% over the past 24 hours, currently trading at $108,562, while Ethereum (ETH) is down 3.5%, sitting at $3,885.73.

Binance Coin (BNB) saw the steepest decline, losing 3.6% to trade at $1,075.93, marking a 10.2% drop over the past week.

Meanwhile, XRP (XRP) slipped 1.8% to $2.42, and Solana (SOL) fell 2.8% to $186.31. Cardano (ADA) is also down 3.4% to $0.6475, extending its weeklong downtrend.

Among the top gainers, SynFutures (SYF) surged 50.9%, followed by Hajimi with a 41.2% rise and BinanceLife up 30%.

In contrast, the trending coins include Zora, FLOKI, and Zcash, with Zcash seeing a modest 7.4% daily gain.

Overall, the market sentiment remains cautious as traders await signs of stabilization after this week’s correction, with Bitcoin holding above the $108,000 support level while altcoins continue to face selling pressure.

However, crypto investor and entrepreneur Ted Pillows sees $100,000 coming into play next if BTC price fails to establish a floor.

is now at a key support level.If $107,000-$108,000 support level holds, a bounceback could happen.If Bitcoin loses this level, it could drop towards $100,000 in the coming days. — Ted (@TedPillows) Bitcoin Slips Toward $107K as Traders Eye CME Gap and $100K Retest

Bitcoin fell to weekly lows near $107,460 on Tuesday, erasing its early rebound as traders turned their focus to the latest unfilled CME futures gap.

The drop, amounting to a 2.5% decline on the day, came amid thin trading volumes and cautious sentiment following last week’s volatility.

Analysts noted that Bitcoin opened the week with a small CME gap below current levels and partially filled it, but a full closure would require a move toward $107,390.

Popular trader Daan Crypto Trades said bulls need to hold the $107K level to avoid signaling further weakness, while another large gap at $110K was already closed last week.

Opened with a small CME gap below this week. Price did come down to close some of it, but there's still a bit left. So good to keep that in mind if price were to trade close to it.Besides that, we did close the big gap at $110K last week. This was a gap that was left… — Daan Crypto Trades (@DaanCrypto)

Market watchers warned that fading momentum and low volume could trigger a deeper pullback toward $100K–$98K, levels not seen since the last major correction.

“The low-volume breakout never confirmed a true reclaim of support,” trader Roman said, suggesting Bitcoin may still revisit lower price zones before finding a firm bottom.

h4Still following this very well. Didn’t trust the low volume “breakout” as volume never validated a true reclaim of support.100-98k here we come! — Roman (@Roman_Trading) Levels & Events to Watch Next

At the time of writing on Tuesday afternoon, Bitcoin (BTC) is trading at $108,645, down 1.75% over the past 24 hours.

The coin saw an intraday high of around $110,500 before sliding to the day’s low near $107,400. Over the last week, BTC has fallen more than 2%, showing persistent weakness after failing to sustain its rebound from early October lows.

Currently, Bitcoin is consolidating in the $107,000–$110,000 range. A breakout above $110,800 could open the door toward $113,200 and possibly $115,000, while losing support at $107,000 may push the price back toward $104,500, levels tested during the last correction.

Meanwhile, Ethereum (ETH) is trading at $3,893, down 2.19% in the past day. The coin reached a daily high near $3,980 before retreating to its current level, with a 7-day low around $3,750.

ETH remains under pressure alongside Bitcoin, slipping over 3% this week and nearly 12% below its late-September peak of $4,420.

If Ethereum drops below $3,850, it could slide toward $3,700 and possibly $3,500. However, a move above $4,000 could trigger a short-term recovery toward $4,200 and $4,350 if buying momentum returns.

Meanwhile, the crypto market sentiment , with only a slight improvement since yesterday. The Crypto Fear and Greed Index stands at 33, up from 30 the previous day but still signaling cautious investor behavior.

Compared to last week’s neutral level of 42, sentiment has clearly weakened as traders grow more uncertain about short-term price direction. The index is now hovering close to the lower end of the spectrum, showing that investors are still wary after recent market pullbacks.

The US Bitcoin spot exchange-traded funds (ETFs) recorded another day of outflows on October 20, totaling $40.47 million in net redemptions. The day’s trading volume across all issuers reached $4.87 billion, while cumulative net inflows since launch remain strong at $61.50 billion.

Among the 12 listed funds, the largest outflow came from BlackRock’s iShares Bitcoin Trust (IBIT), which saw $100.65 million leave the fund despite holding the highest net assets at $88.82 billion. On the other hand, VanEck’s HODL ETF led inflows with $21.16 million, followed by Bitwise’s BITB with $12.05 million and Fidelity’s FBTC with $9.67 million.

The US Ethereum spot ETFs also saw heavy outflows on October 20, totaling $145.68 million, marking one of the largest single-day redemptions since launch. Total trading volume across all ETH spot ETFs reached $2.15 billion, while cumulative net inflows remain positive at $14.45 billion.

The majority of the withdrawals came from BlackRock’s ETHA, which recorded $117.86 million in outflows despite leading the category with $15.85 billion in total assets under management. Fidelity’s FETH followed with $27.82 million in redemptions.

In contrast, other issuers, including VanEck, Bitwise, and 21Shares, reported no significant inflows or outflows during the same period.

Meanwhile, a SpaceX-linked wallet has moved $268 million worth of Bitcoin to two separate addresses on Tuesday, Arkham data shows.

According to on-chain analyst Ai Yi, the transfer from SpaceX account follows a 3-month hiatus. The analyst suggested that the move is likely to be an internal management move and not a sale.

“In July, SpaceX’s sudden transfer had its receiving address marked by Arkham as a Coinbase Prime Custody address. This time, it might just be wallet reorganization.”

SpaceX 时隔三个月再次转出价值 2.68 亿美元的 其中 1187 枚 BTC 已转移至地址 bc1qq…4sduw,1208 枚转移至地址 bc1qj7…6kqef,目前两个接收地址都暂未转移或卖出不过需要注意的是:七月时 SpaceX 的突发转账,其接收地址已被 Arkham 标记为 Coinbase Prime Custody… — Ai 姨 (@ai_9684xtpa)

There would normally be panic if a headline claimed that Shiba Inu saw a massive outflow of 81,004,189,771 tokens in a single day. A closer examination of the metrics, however, reveals an unexpectedly optimistic story. This huge movement is a notable exchange outflow, which frequently indicates long-term investor confidence. It is not a market crash or the dumping of tokens.

Direction changing?

Currently, Shiba Inu's ecosystem is exhibiting signs of a direction flip. Exchange outflows happen when investors transfer their holdings into staking, cold or private wallets from trading platforms. This locks up a significant supply, which lessens the immediate selling pressure on the token. Chart by TradingView">

The situation is favorable for price growth since there are fewer SHIB tokens available for purchase on exchanges, meaning that any increase in demand for purchases will be met by a smaller supply.

Moving past the numbers

This tells investors to look past the numbers. The 81 billion SHIB that were taken out of circulation show that holders are choosing to be patient rather than make quick money. This practice, referred to as hodling, is a fundamental component of bullish market cycles. As a result, investors should anticipate more volatility but a stronger base for the price action. In the medium-to-long run, the market's response to these outflows is usually favorable since it shows a shared optimism about the asset's future potential, rather than fear.

Although this metric is not a guarantee of an immediate price spike, it is an essential component of fundamental analysis. It implies that a sizable section of the SHIB army is taking the long view. Naturally, the market's general condition will have an impact, but this large decrease in liquid supply creates a strong tailwind that makes SHIB less vulnerable to abrupt declines and better positioned for the upcoming uptrend.

Key takeaways:

Solana's double-bottom below $180 signals potential price recovery to $250.

Institutional demand for SOL rises with $156 million in weekly ETP inflows, driven by hype for potential Solana ETF approvals.

Solana price formed a potential double-bottom pattern below $180 on the daily chart, a setup that could help SOL price recover toward $250 in the weeks ahead.

Solana Bollinger Bands could lead to a recovery

Veteran chartist John Bollinger says it may be “time to pay attention,” spotting potential W-bottom reversals on Ether and Solana using his Bollinger Bands framework.

The call follows SOL price double-dipping near the $175 area before stabilizing, implying a bigger move may be in the cards.

This is an encouraging sign from Solana, according to Bollinger. The Bollinger Bands (BB) indicator uses standard deviation around a simple moving average to determine both likely price ranges and volatility.

Bollinger Bands are forming the second low of a W-shaped pattern formation — a double-pronged bottom followed by an exit to the upside — on the daily chart.

In this situation, SOL’s drop to $172 on Oct. 11 was the first bottom, and Friday’s drop to $174 was the second, retesting the lower boundary of the BB.

If confirmed, Solana's price could recover from the current levels, first toward the neckline of the W-shaped pattern at $210, before rising toward the target of the prevailing chart pattern at $250.

“Solana is looking very constructive here, with the RSI nearing a momentum breakout and the MACD heading for a bullish cross,” said crypto YouTuber Lark Davis in an X post on Monday.

An accompanying chart showed SOL price forming a potential W (double-bottom) in the daily time frame.

The key thing now is for “bulls to hold the 200-day EMA,” Lark Davis added.

As Cointelegraph reported, a new uptrend will begin once buyers drive the price above the 20-day EMA, currently sitting at $200.

Investors increase exposure to Solana

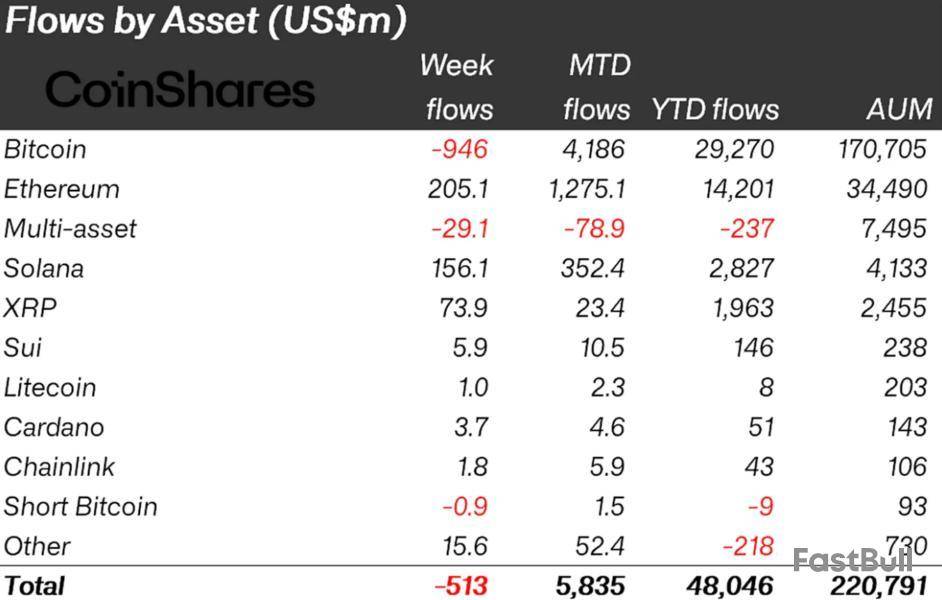

Institutional demand for SOL investment products appears to be increasing, according to data from CoinShares.

SOL exchange-traded products (ETPs) posted weekly inflows of $156.1 million in the week ending Oct. 17, bringing their inflows for the year to $2.8 billion.

Conversely, global crypto investment products recorded net outflows of $513 million, with investors particularly de-risking from Bitcoin (BTC), the only major asset to see outflows totaling $946 million last week.

CoinShares’ head of research, James Butterfill, said:

The US Securities and Exchange Commission (SEC) is expected to decide on nine spot Solana ETF applications, which have been delayed by the government lockdown.

Approvals could unlock billions in institutional capital, as seen with REX-Osprey Solana Staking ETF, SSK, which debuted on July 2 with over $33 million in first-day volume.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Belgrade, Serbia, October 21st, 2025, Chainwire

Neon Labs, the core developing partner contributing to the first Solana network extension Neon EVM, today announced the appointment of Ivan Bjelajac as the company’s new Chief Executive Officer. A serial entrepreneur, infrastructure visionary, and internationally recognized Web3 leader, Bjelajac takes the helm to steer Neon through its next chapter of enhancing the technical excellence of the team, lead research on Solana and commercial focus. He is taking over the role from Marina Guryeva.

Ivan started out as an engineer and later became a serial entrepreneur with deep expertise in business strategy, execution, fundraising, networking, investor relations, and go-to-market strategy; he was a part of bringing six different startups from 0 to a successful exit.

With over 20 years of leadership experience across web2, deep tech, and blockchain infrastructure, Ivan Bjelajac is no stranger to bold bets and complex systems, with his most recent role being scaling revenue as VP of Strategy at Tenderly and running Polygon Edge development in its early days. Tenderly currently supports over a 100 EVM networks with tooling and infrastructure, while Polygon Edge was used in over 300 public and private network deployments. Both of these experiences give Ivan an unique type of view over the EVM landscape, its pain points and needs.

The leadership transition comes at a strategic inflection point. The Neon ecosystem, in which Neon Labs serves as a technology contributor, is poised to scale developer adoption, unlock Solana-native use cases for Ethereum assets, and position itself as a foundational piece of infrastructure for institutions entering the Solana ecosystem.

Marina Guryeva, co-founder and outgoing CEO of Neon Labs, expressed strong confidence in Bjelajac’s appointment:

With Bjelajac at the helm, Neon Labs will focus its development on supporting the Neon ecosystem priorities, including:

About Neon Labs

Neon Labs acts as an independent software developing partner to Neon Foundation, supporting the Neon EVM open-source project - the first of its kind Network Extension on Solana designed to seamlessly integrate Ethereum Virtual Machine (EVM) compatibility into Solana’s high-performance ecosystem.

By operating natively within Solana’s base layer, Neon EVM provides Ethereum developers with a fast, high-throughput pathway to deploy their EVM dApps on Solana, without the need to rewrite their contracts in Rust.

Neon Labs operates independently from Neon Foundation and provides its R&D services to support the Neon EVM project.

Contact

Head of Marketing

Vanina Ivanova

Neon EVM

vanina.ivanova@neonfoundation.io

Popular Solana contributor Mert from Helius was the first major builder this cycle, alongside Naval Ravikant, to put Zcash (ZEC) back at the center of the crypto market discussion this year. His posts pulled the old privacy "dino coin" out of years of irrelevance and got crypto enthusiasts speculating on ZEC again.

But Mert actually went further and now ties ZEC supremacy with something stronger — a reminder of what Satoshi Nakamoto, the mysterious creator of Bitcoin, himself once wrote.

Long story short, in 2010, on the old Bitcoin forum, Satoshi said that if zero-knowledge proofs were ever made practical, Bitcoin could be built in a much better and easier way. He admitted that he did not know how to do it.

mert | helius.dev@0xMert_Oct 21, 2025if you want to understand why certain Bitcoin maxis are violently coping and lashing out about a small 3B coin

they are threatened and have lost the plot

Satoshi in 2010: if we could add ZK to Bitcoin, a much better BiTC would be possible. Sadly, I don't know how. pic.twitter.com/2c4Y5SIhT6

For Mert, that is exactly what Zcash did. Bitcoin is locked in scarcity, but ZEC added privacy at the protocol level, and that makes it look a lot like the upgrade Satoshi imagined but never managed to create.

ZEC price rockets 750% in just two months

The market certainly enjoys the privacy narrative by ZEC, and how it picked up on that idea fast is visible on the ZEC price chart that has ripped more than 750% since August, jumping over $270 after years of being written off. BINANCE:ZECUSD by TradingView">

And it is not just quick flips; more holders are moving coins into shielded addresses, where zk-SNARKs hide amounts and senders inside the chain itself. Data from Zechub shows this trend growing, which means less liquid supply and less pressure from fast sellers.

Put it together and you see why this rally feels different. Zcash is not being treated as a dead altcoin bouncing on hype. With Mert pointing back to Satoshi’s own words, the case being made is simple: ZEC looks like the version of Bitcoin its creator wished for, only delivered years later under a different name.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up