Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

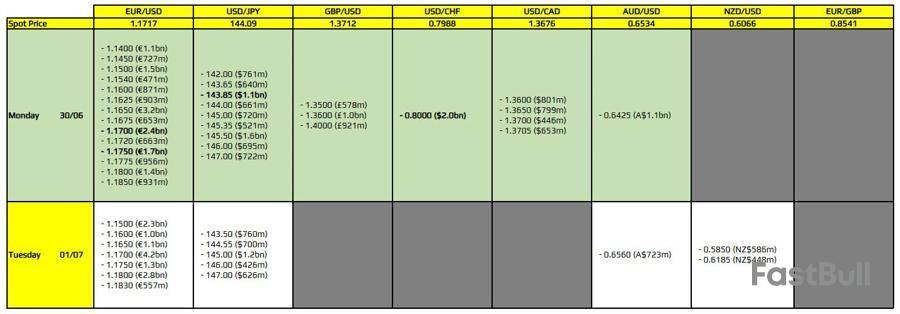

There are a couple to take note of on the day, as highlighted in bold.

The first ones being for EUR/USD at the 1.1700 and 1.1750 levels. The expiry levels don't tie in to any technical significance but they could very well play a role in terms of limiting price action as we look towards the month-end fix later in the day. Keep in mind that there are also large expiries sitting at the same levels tomorrow as well.

Then, there is one for USD/JPY at the 143.85 level. That doesn't really tie to anything either but sits near last week's low at least. That could limit downside but I wouldn't look to the expiries here to have too much impact. Dollar sentiment will remain the bigger driver, especially with month-end in consideration too.

And lastly, there is one for USD/CHF at the 0.8000 level. That is one that could act as a bit of a hold for price action but with the pair dribbling lower last week, the downside momentum remains more favourable. So, that will act as a counterweight to the expiries though we do have month-end to contend with as noted above.

In summary, the expiries could play a minor role in European morning trade but as month-end approaches, dollar sentiment and related flows will take on more importance on a day like this.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at www.forexlive.com.

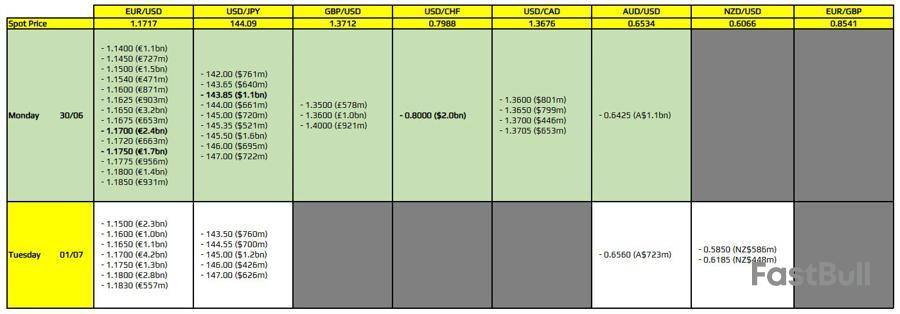

There are a couple to take note of on the day, as highlighted in bold.

The first ones being for EUR/USD at the 1.1700 and 1.1750 levels. The expiry levels don't tie in to any technical significance but they could very well play a role in terms of limiting price action as we look towards the month-end fix later in the day. Keep in mind that there are also large expiries sitting at the same levels tomorrow as well.

Then, there is one for USD/JPY at the 143.85 level. That doesn't really tie to anything either but sits near last week's low at least. That could limit downside but I wouldn't look to the expiries here to have too much impact. Dollar sentiment will remain the bigger driver, especially with month-end in consideration too.

And lastly, there is one for USD/CHF at the 0.8000 level. That is one that could act as a bit of a hold for price action but with the pair dribbling lower last week, the downside momentum remains more favourable. So, that will act as a counterweight to the expiries though we do have month-end to contend with as noted above.

In summary, the expiries could play a minor role in European morning trade but as month-end approaches, dollar sentiment and related flows will take on more importance on a day like this.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at investinglive.com.

EURUSD increased to a near 4-year high of 1.17.

Over the past 4 weeks, Euro US Dollar gained 3.98%, and in the last 12 months, it increased 9.61%.

The US dollar was mixed against its major trading partners early Friday — up versus the yen and Canadian dollar, down versus the euro and pound — ahead of the release of personal income, spending and price data for May at 8:30 am ET.

Federal Reserve Governor Lisa Cook is due to speak at 9:15 am ET, followed by the final University of Michigan consumer sentiment reading for June at 10:00 am ET and the Kansas City Fed's services reading for June at 11:00 am ET.

The Atlanta and St. Louis Fed banks are due to update their gross domestic product Nowcast estimates for Q2 around midday.

A quick summary of foreign exchange activity heading into Friday:

rose to 1.1718 from 1.1706 at the Thursday US close and 1.1708 at the same time Thursday morning. Eurozone consumer confidence and business conditions readings both declined further below the breakeven point in June, according to data released earlier Friday. The next European Central Bank meeting is scheduled for July 24.

rose slightly to 1.3734 from 1.3733 at the Thursday US close and from 1.3723 at the same time Thursday morning. There are no UK data on Friday's schedule. The next Bank of England meeting is scheduled for Aug. 7.

rose to 144.5548 from 144.3770 at the Thursday US close and 144.2528 at the same time Thursday morning. Tokyo year-over-year consumer price growth, an early indicator for Japan's consumer price index, slowed in June while the May unemployment rate held steady and retail sales growth slowed in May. The next Bank of Japan meeting is scheduled for July 30-31.

rose to 1.3658 from 1.3634 at the Thursday US close but was below a level of 1.3686 at the same time Thursday morning. Canadian GDP data for April and May are due to be released at 8:30 am ET, followed by Canadian budget balance data for April at 11:00 am ET. The next Bank of Canada meeting is scheduled for July 30.

ING said 1.20 is within reach for , but it's mostly United States factors that hold the key to the next move.

The bank's baseline scenario is actually that will settle just below current levels — around 1.15-1.16 — as markets' dovish bets prove misplaced, but ING concedes that upside risks for the pair remain high before the data endorses its view.

Friday, investors will see the first flash consumer price index estimates in the eurozone. French inflation is expected to remain below 1.0% year-over-year after the recent deceleration, while Spain's harmonized CPI is seen accelerating to just above 2.0% year-over-year. Barring major surprises there, markets will likely wait until Monday's German numbers are published to draw any conclusions for the European Central Bank.

Speaking of the ECB, investors will hear from three Governing Council doves on Friday: Francois Villeroy, Olli Rehn and Piero Cipollone. ING will see whether the drop in oil prices triggers some pushback against the hawkish repricing in the euro (EUR) curve.

Central and Eastern European currencies again saw further gains on Thursday following a weaker US dollar, hawkish central banks in the region and general risk-on sentiment, stated INH. Most interestingly, broke the key 400 level and is getting into territory where the bank is becoming less bullish.

At the same time, Hungary's central bank (MNB) released its inflation report on Thursday, and the details of the new forecast suggest some downside risk to inflation, especially in June and July when the market could begin to get the impression that a dovish turn is imminent. The bank thinks the MNB will ignore the temporary drop in inflation and wait until next year.

However, global conditions led by core rates are pushing Hungary's forint (HUF) rates down already, which should eventually hinder further HUF gains, added ING. Still, this may not be the main driver, and other factors may push down further, but ING is becoming more cautious here.

EUR/USD's upward momentum has improved, based on the daily chart, Quek Ser Leang of UOB's Global Economics & Markets Research says. The currency pair staged a sudden surge this week, with the high so far at 1.1744, the senior technical strategist says in a research report. Further EUR/USD strength isn't ruled out. However, a sustained advance would require a break above 1.1780, the strategist says. The 1.1780 level marks the top of what seems to be an ascending channel formation. If EUR/USD breaks clearly above 1.1780, focus would shift to 1.1900 and then to 1.2000, the strategist adds. EUR/USD is 0.1% lower at 1.1690. (ronnie.harui@wsj.com)

By Renae Dyer

The U.S. dollar is at risk of further losses as the Federal Reserve faces mounting political pressure to cut interest rates, analysts said.

The dollar hit a three-year low against a basket of currencies after the Wall Street Journal reported that President Trump is considering naming his selection to replace Fed Chair Jerome Powell well ahead of his term ending in 11 months' time, a mark of his frustration over Powell's resistance to lower rates.

"A candidate who is perceived as being more open to lowering rates in line with Trump's demands would reinforce the dollar's current weakening trend," MUFG Bank senior currency analyst Lee Hardman said in a note.

The dollar has fallen by more than 10% this year against a basket of currencies due to growing concerns about Trump's tariffs leading to weaker U.S. economic growth and lower interest rates.

The DXY dollar index hit a three-year low of 96.997 earlier Thursday. Weakness in the dollar also propelled the euro to a three-and-a-half-year high of $1.1744, LSEG data show.

The Wall Street Journal reported that Trump could announce and select a replacement by September or October. Trump's ire toward Powell could prompt an even earlier announcement sometime this summer, the report said.

"If the new chair is announced in the coming weeks, then we could see a shadow Fed emerge, which could undermine Powell's message of slow and steady rate cuts," XTB research director Kathleen Brooks said in a note.

Trying to call a bottom for the dollar "seems pointless now," she said.

Fed officials Christopher Waller and Michelle Bowman, both nominated by Trump, have signalled a preference for a rate reduction as soon as July.

With two policymakers now disagreeing with Powell's careful approach, markets could be quick to anticipate further rate cuts if U.S. economic data are weak, ING analyst Francesco Pesole said in a note, which could lift the euro as high as $1.20 against the dollar.

In its mid-year outlook, JP Morgan said expectations for slowing U.S. growth were a key reason why it is forecasting the DXY dollar index to weaken by 5.7% in the next year and for the euro to rise to $1.20 by December from $1.1701 currently.

U.S. money markets currently expect a 24% chance of a July rate cut by the Fed. A rate cut is fully priced in for September and one more by year end, according to LSEG.

Reduced geopolitical risks are weighing further on the dollar after Monday's announcement of a cease-fire between Iran and Israel. Increased tensions in the Middle East had encouraged safe-haven demand for the dollar, while the currency usually benefits when oil prices are higher as the U.S. is a major oil producer.

This week's Natixis Investment Managers Strategists Survey showed investors are increasingly shunning U.S. assets due to concerns about the economic impact of Trump's tariffs.

"Market strategists are once again seeing genuine opportunity beyond the U.S.," Natixis head of market strategy Mabrouk Chetouane said in the survey's press release.

-Write to Renae Dyer at renae.dyer@wsj.com

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up