Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oracle provider RedStone has integrated event-driven market data from the US Commodity Futures Trading Commission (CFTC)-regulated financial exchange and prediction market Kalshi across over 110 blockchains, expanding access to real-world prediction data for decentralized applications (DApps).

RedStone announced the partnership with Kalshi on Thursday, bringing its prediction market data to more than 110 networks, including Ethereum, Solana, Base, The Open Network and Sui. The integration allows DApps to access Kalshi’s data sets that cover events like elections, interest rate decisions and cultural moments like musician Taylor Swift’s live television appearances.

The CFTC regulates Kalshi as a designated contract market (DCM), which means markets listed on Kalshi must receive CFTC approval before trading. On Oct. 10, Kalshi raised $300 million to expand its prediction markets to over 140 countries.

“The regulated nature of Kalshi’s events means we’re unlocking data categories that were previously unavailable onchain, opening entirely new possibilities for how DeFi will evolve,” RedStone co-founder Marcin Kazmierczak told Cointelegraph.

The rollout begins with three initial categories: the New York City mayoral election, the 2028 Democratic Party nominee for US president and the number of interest rate cuts in 2025. More markets are expected to follow, but will depend on developer demand.

RedStone co-founder shares expected use cases

Kazmierczak told Cointelegraph that the first phase of the integration is likely to see existing decentralized finance (DeFi) primitives.

“We can expect utilization of well-known primitives such as derivatives, perpetual DEXs, and eventually lending markets leveraging tokenized Kalshi market positions with RedStone’s onchain data to ensure accurate liquidation mechanics and collateral pricing,” he told Cointelegraph.

Still, he said the most significant innovation may come later, as developers experiment with new concepts.

Kazmierczak told Cointelegraph that with time, the space may witness new ideas and design patterns such as insurance-like protocols and social finance engaging with the mass market.

He told Cointelegraph that insurance may be one of the most promising applications for regulated prediction data.

In May, real-world asset (RWA) tokenization company Securitize selected RedStone as the primary oracle provider for its tokenized contracts, which include asset manager BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) and the Apollo Diversified Credit Securitize Fund (ACRED).

Prediction markets go mainstream

The new integration comes as prediction markets are gaining rapid mainstream recognition, with some saying their simplicity could make them the first DeFi tool to achieve mass adoption.

On Friday, Azuro researcher Mike Rychko argued that prediction markets are entering the real world beyond crypto. He said the accessibility of such platforms is likely to result in them being the first DeFi product to achieve mass adoption.

He said that while most people would not open derivatives exchanges, they are likely to be enticed by the clean and digestible signals that prediction markets provide.

“That simplicity is precisely why prediction markets will find mass adoption faster than most DeFi experiments ever did,” Rychko said.

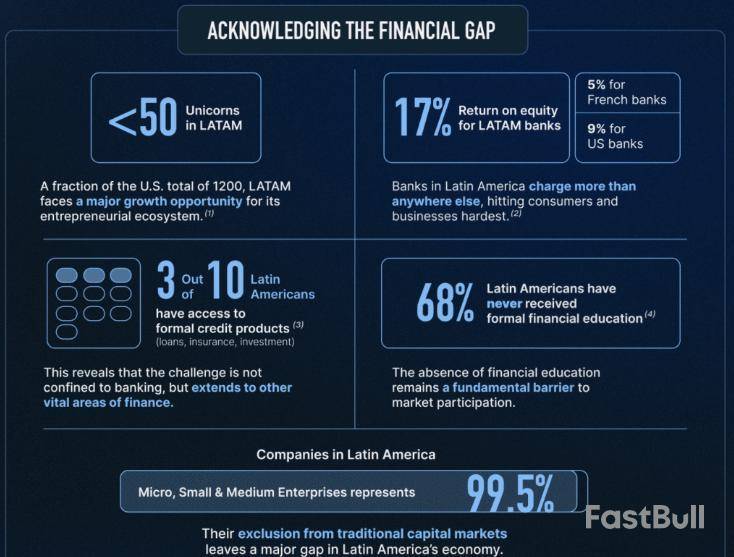

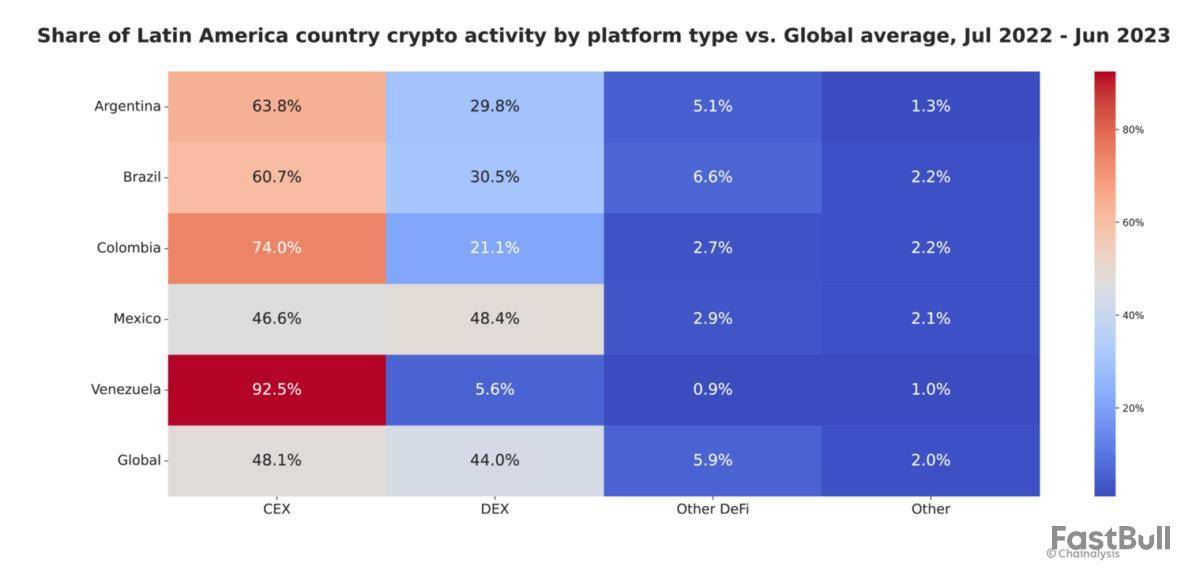

The Latin American region is tapping into blockchain-based services for payments and access to financial services, signaling that the crypto industry serves more than just financial speculators chasing the next memecoin pump.

Latin American citizens are increasingly using cryptocurrency to replace the region’s inadequate banking infrastructure, allowing them to facilitate digital payments and create stablecoin-based savings accounts.

“LATAM adoption is quite high. People are using stablecoins for daily life, so it’s a whole different market,” said Patricio Mesri, co-CEO of cryptocurrency exchange Bybit’s Latin American division. “Crypto is actually changing the lives of people. You see adoption in Argentina, Venezuela, Bolivia and Mexico increasing rapidly,” he told Cointelegraph during an interview at the European Blockchain Convention 2025 in Barcelona.

Some of the most interesting use cases include stablecoin payments to circumvent the high remittance fees of the SWIFT banking network, and taking up crypto-based loans for major purchases such as cars or homes, he added.

Fiat money inflation is driving Latin American regions to stablecoins

Countries like Argentina, where annual inflation surpassed 100%, have seen a surge in demand for US dollar-backed stablecoins such as USDC (USDC) and USDt (USDT).

On local crypto exchange Bitso, stablecoin transactions accounted for 39% of total purchases in 2024 as the most sought-after digital assets, Cointelegraph reported in March.

The lack of banking access has also created systemic inefficiencies in the region, including technological barriers and high startup costs, which are slowing the flow of investment into Latin American capital markets.

However, the region’s liquidity latency issues may be improved by adopting blockchain-based instruments, such as real-world asset (RWA) tokenization, according to an August report from Bitfinex Securities.

Tokenized products could expand investor access and bring more capital to the region, as they can reduce issuance costs for capital raises by up to 4% while reducing listing times by up to 90 days, according to Bitfinex.

“For decades, businesses and individuals, particularly in emerging economies and industries, have struggled to access capital through legacy markets and organisations,” said Paolo Ardoino, CEO of Tether and chief technology officer of Bitfinex Securities.

“Tokenisation actively removes these barriers,” he said, adding that RWAs can unlock capital more efficiently than traditional financial products.

Latin America was the seventh-largest crypto economy in the world back in 2023, trailing the Middle East and North America (MENA), Eastern Asia and Eastern Europe, according to blockchain analytics firm Chainalysis.

Arbitrum has scheduled its flagship “ArbiVerse” event for November 19 in Buenos Aires, coinciding with the Devconnect gathering.

Refer to the official tweet by ARB:

Arbitrum@arbitrumOct 22, 2025ArbiVerse is coming to Devconnect in Buenos Aires! 🇦🇷

Join us on Nov 19 for Arbitrum’s massive flagship event with interactive builder showcases, talks, fun mini games, live music and food

And there's more 👀👇

Register todayhttps://t.co/4ei34h66Bh pic.twitter.com/oCRGBOuRI8

ARB Info

Arbitrum is a layer 2 scaling solution designed for the Ethereum network. Its goal is to increase the scalability of Ethereum while preserving its decentralization and security.

Arbitrum operates by batching many transactions together off-chain and then submitting a single, combined proof of all these transactions to the Ethereum base layer. This greatly reduces the amount of computation and storage that the Ethereum network has to handle, allowing it to support a much higher throughput of transactions.

DexTools will host an AMA on X on October 31st at 16:00 UTC to examine the Satoshi15 tSAT initiative and its proposal to value holdings in satoshis and enable rapid transfers.

Refer to the official tweet by DEXT:

DEXTools@DEXToolsAppOct 22, 2025He called Bitcoin at $1 and now he’s back! 🔥

Join @Davincij15 next Friday for an exclusive AMA with us, diving into Satoshi15 $tSAT which is redefining Bitcoin ownership. Measure your wealth in sats, move in seconds.

🗓 Friday Oct 31 | 4PM UTC / 8PM GST

💰 $500 Giveaway for… pic.twitter.com/vTeq2p7xwX

DEXT Info

DEXTools is a comprehensive application designed for traders that consolidates information from decentralized markets into a unified user interface. The platform facilitates a clearer understanding of trading activities, investments, and the overall status of the cryptocurrency market.

The DEXTools ecosystem offers a range of functionalities, including the Pool Explorer for monitoring liquidity movements and new pool formations on decentralized exchanges. The Pair Explorer provides insights into token charts, transactions, trust, and other project metrics. Additionally, users can track specific trader’s wallets using Wallet info, monitor large transactions through Big Swap Explorer, and utilize Multiswap to access multiple DEX portals, enhancing trading efficiency.

DEXT, the native utility token of the platform, offers users access to advanced features of the app, either by holding the token or through a monthly subscription. Furthermore, DEXT allows entry to premium trading groups, community initiatives, and exclusive ventures like DEXT Force Ventures.

Injective is preparing to roll out a new INJ Community BuyBack Program on October 29th. The initiative allows users to commit their INJ tokens, share ecosystem rewards, and observe token burns executed directly on-chain.

Refer to the official tweet by INJ:

Injective 🥷@injectiveOct 22, 2025In 7 days, the entire Injective community becomes part of the all new INJ BuyBack Program.

Commit INJ, share ecosystem rewards and watch every token be burned onchain.

Built for the people. Powered by $INJ pic.twitter.com/HNs5BfnnRy

INJ Info

Injective Protocol is a decentralized exchange (DEX) protocol built on the Cosmos SDK, offering advanced cross-chain trading capabilities.

Key features of Injective Protocol include:

1. Decentralization: On the Injective platform, users have full control over their funds, with no third-party intervention.

2. Cross-chain trading: Injective supports trading between different blockchains, providing users with a wide range of tradable assets.

3. High performance: Injective utilizes the Tendermint consensus system, ensuring high throughput and low transaction latency.

4. Gas-free transactions: Users can trade without the need to pay gas fees.

INJ is the native token of Injective Protocol. The token is used for protocol governance, staking, and participation in voting processes that address key protocol upgrades and management decisions.

Render Network and OTOY will participate in the first-ever XR Motion Conference, taking place on October 25, in New York. The event will feature demos powered by Render Network and talks from creators, as well as workshops. The conference aims to explore advances in extended reality, 3D motion design, and AI-driven rendering technologies.

Refer to the official tweet by RENDER:

The Render Network@rendernetworkOct 22, 2025.@XR_MOTION is hosting its first ever conference this weekend in NYC and @OTOY is proud to be backing it with demos of @rendernetwork!

Get your tickets today to hear talks by @eyedesyn, @ellecortese & @Patrick_4d + workshops from @danny_behar & more.

RENDER Info

Render Token, also known as RNDR, is a project aiming to democratize the process of rendering 3D content. Built on the Ethereum blockchain, the platform enables anyone in the world to use their computational resources to assist in rendering processes and be rewarded for their work in the form of RNDR tokens.

Typically, rendering 3D content can be a highly resource-intensive process, requiring significant processor time and energy. For many individuals and organizations, especially those working in industries where 3D rendering is important (like gaming, film, virtual and augmented reality), this can pose a significant challenge.

The Render Token platform addresses this issue by providing a path to a decentralized rendering network, where anyone with suitable hardware can participate. Users can “rent out” their computational resources to assist in rendering 3D content, and be rewarded for it in RNDR tokens. This creates a more democratized and efficient system, which can enhance the accessibility and speed of 3D content rendering.

Moreover, Render Token is working on innovating new uses of blockchain in the realm of digital art and graphics, including the creation and distribution of NFTs (non-fungible tokens) and other forms of digital content.

Yield Guild Games (YGG), in collaboration with ItPlaysOut, launches PLAYGG, a weekly interactive mini-game series. Each episode offers players short gaming challenges, live music, and real rewards. The first episode is set to air on October 24 at 14:00 UTC, bringing together entertainment and Web3 gaming participation in a casual format.

YGG Info

Yield Guild Games (YGG) is a decentralized autonomous organization (DAO) that uses blockchain to provide access to play-to-earn (P2E) games worldwide. YGG invests in NFTs used in blockchain games.

Yield Guild Games is based on the idea that games can be a source of income. Using the P2E model, players can earn assets by playing games. These assets can then be converted into real money.

The YGG token is used within the ecosystem for voting and community governance. YGG token holders can vote on various issues related to community management, including the buying and selling of NFT assets.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up