Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Fold Holdings (ticker FLD), the parent company behind the Fold Bitcoin wallet and app, has secured a $250 million equity purchase facility to expand its Bitcoin treasury, according to an announcement on Tuesday.

The firm says it has “entered into an agreement” to sell up to $250 million worth of newly issued shares to fund its Bitcoin acquisition strategy.

“The Company is not required to use the Facility and controls the timing and amount of any drawdown,” the announcement reads, implying no coins have been purchased as of the date of its filing with the U.S. Securities and Exchange Commission.

Like many recent crypto corporate treasury firms — such as 21 Capital and Nakamoto, both of which took cues from Michael Saylor’s BTC acquisition vehicle, Strategy — Fold is funding its purchase through private placements, which effectively turn its stock into a leveraged play on the price of Bitcoin.

Fold, launched in 2019, began as a wallet company and has since expanded into broader financial services, including the Fold Card — a debit card offering Bitcoin cashback rewards — and a Bitcoin treasury strategy. It has entered into at least one other convertible note agreement to purchase 475 BTC.

According to Bitcoin Treasuries, Fold holds approximately 1,488 BTC worth some $157.23 million, making it one of the larger publicly traded Bitcoin treasury firms.

Fold went public in 2024 through a SPAC merger with Nasdaq-traded FTAC Emerald Acquisition Corp., at a pre-money valuation of $365 million. At the time, it held an estimated 1,000 BTC.

FLD was trading at $4.71 on Tuesday, up 0.43% from around $4.31 at market open, according to The Block’s price data.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

In a fresh development in the Ripple-SEC lawsuit, both parties have requested that the Second Circuit continue to hold the appeals in abeyance, pending a motion for an indicative ruling. The SEC is now expected to file a status update by Aug. 15, 2025.

In the past week, Ripple and the SEC renewed their request for an indicative ruling after Judge Torres's initial denial of the motion in May.

With the next SEC update filing due by mid-August, the XRP community is in a holding pattern. Speculation is growing about whether Judge Torres might alter any part of her ruling and what the outcome of the motion for the indicative ruling would be.

"I really would be baffled if she rejects the refile," one XRP supporter said on X, "Do you think we should tell people that if things go south and one or both proceed with their respective appeals, the case will get kicked back to Torres?"

Marc Fagel@Marc_FagelJun 17, 2025I don't think there's any way to predict whether she will modify her order. I could see it going either way.

Marc Fagel, former SEC regional director, joined the conversation with a measured response. "I don't think there's any way to predict whether she will modify her order. I could see it going either way," Fagel said.

What's next?

Ripple and SEC are winding down the case that began in December 2020, centered on XRP sales as alleged unregistered securities.

Going forward, Judge Torres would need to provide an indicative ruling as to whether the court would dissolve the injunction and release the escrow, with $50 million going to the SEC and $75 million returned to Ripple.

After the injunction is dissolved, the funds distributed and the SEC’s appeal and Ripple’s cross-appeal dismissed, the case would finally be over.

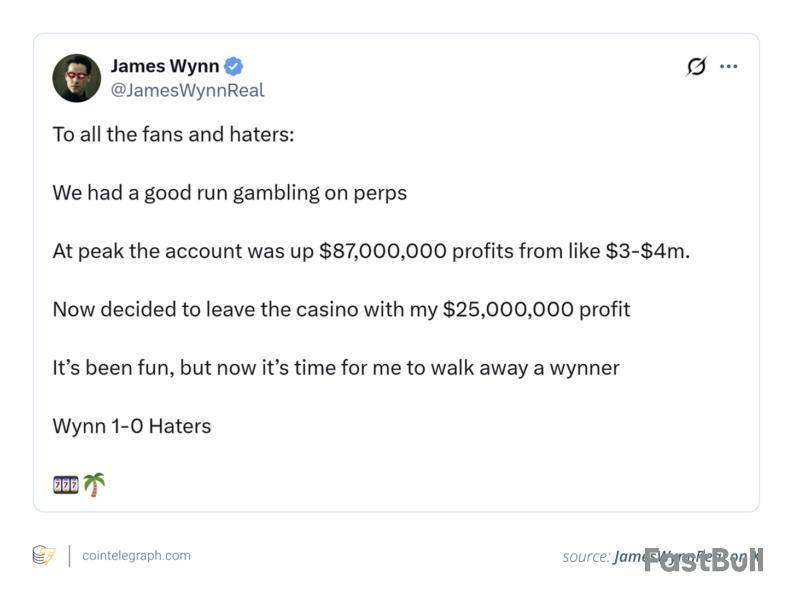

The $100-million fall: James Wynn and the perils of crypto leverage

In the volatile arena of cryptocurrency trading, the saga of James Wynn, a trader on the decentralized exchange (DEX) Hyperliquid, illustrates both the excitement and risks associated with it.

In late May 2025, Wynn suffered nearly $100 million in liquidations after Bitcoin dropped below $105,000. His bold leveraged bets collapsed swiftly, erasing a vast fortune. Bitcoin’s extreme volatility, oscillating between soaring peaks and steep declines, underscores the promise and risk of high leverage.

Despite the severe losses, Wynn remained steadfast, maintaining significant leveraged positions with substantial unrealized losses. His ongoing involvement in risky ventures highlights the strong psychological appeal of cryptocurrency trading, where distinguishing between smart strategy and recklessness can be difficult.

Wynn, an anonymous trader, gained a reputation as a high-risk crypto trader due to his exceptionally large cryptocurrency investments and risky ways of crypto trading. He frequently held positions valued at over $100 million, and his social media often displayed screenshots of impressive profits.

Did you know? Some crypto exchanges offer leverage up to 125x. This means a $1,000 deposit can control a $125,000 position — but with massive risk. Just a 1% price move against the trade can wipe out the entire position in seconds.

Chronology of Wynn’s $100-million Bitcoin liquidation

The following section outlines the key events leading to Wynn’s massive $99.3-million liquidation on Hyperliquid. This chronology traces the rapid unraveling of his highly leveraged positions:

May 24, 2025

May 29, 2025 (first liquidation)

May 30, 2025 (major liquidations)

Total liquidations and losses

Post-liquidation status on May 26, 2025

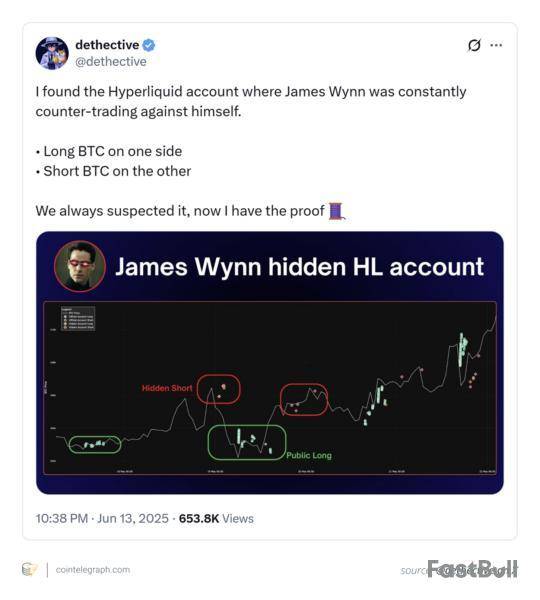

Dethective exposes Wynn

How Wynn’s crypto gamble proved costly

After picking up the whopping loss of $100 million, Wynn alleged that the market was being manipulated against him and went appealing to his followers for donations, hoping to recover the millions he lost in just one week.

Despite earning $85 million earlier through high-leverage trades, Wynn saw $12 million vanish within a few days. In May, he suffered losses of $100 million, and his positions were liquidated again in early June, increasing his losses for the month to over $25 million.

Wynn’s journey from opening $1-billion positions with 40x leverage on Bitcoin to losing $100 million reflects Warren Buffett’s well-known warning about leverage. In a CNBC interview, Buffett quoted his late partner Charlie Munger, saying, “There are only three ways a smart person can go broke: liquor, ladies and leverage.” Buffett also emphasized, “If you don’t have leverage, you don’t get in trouble. If you’re smart, you don’t need it; if you’re dumb, you shouldn’t use it.”

Leverage trading in crypto has become a controversial topic, with some platforms offering up to 125x leverage on digital assets. Wynn admitted that the pressure from public attention distorted his decision-making. “With all this new attention, the trading spiraled out of control. I was basically gambling. I got greedy and stopped taking the numbers seriously,” he said.

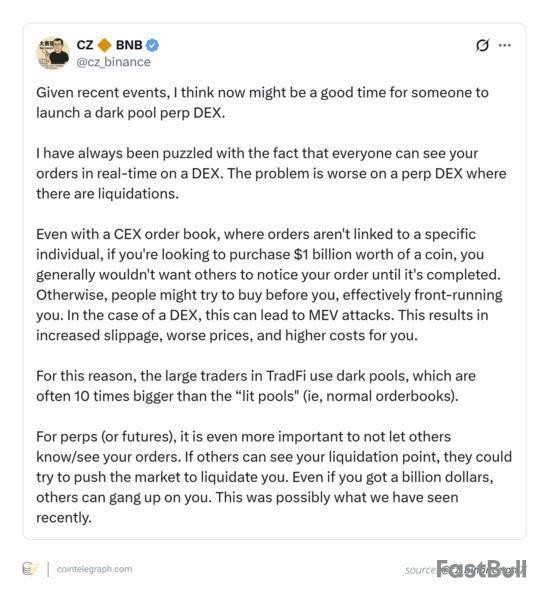

Following Wynn’s liquidation, Binance co-founder Changpeng Zhao proposed introducing a dark pool DEX, which refers to exchanges that don’t show the order book or deposits into smart contracts. Such information could be hidden using zero-knowledge proofs or similar encryptions.

According to Zhao, hiding large orders from real-time order books could reduce front-running and slippage, offering large traders more privacy and fairness during volatile markets.

How Wynn embodies crypto’s high-risk, high-reward ethos

Wynn is well-known within crypto trading circles for his high-risk strategies. His rapid rise began with a daring $7,000 investment in the Pepe (PEPE) memecoin, which grew to nearly $25 million at its peak in 2025, earning him a reputation as a skilled and risk-taking trader.

Wynn’s significant gains encouraged him to pursue even riskier trades, including leveraged positions on platforms like Hyperliquid. His trading style reflects the bold approach he often demonstrates in speculative areas of the crypto market. Just hours before his $99.3-million Bitcoin liquidation on May 30, 2025, Wynn posted on X:

“I do not follow proper risk management, nor do I claim to be a professional; if anything, I claim to be lucky. I’m effectively gambling. And I stand to lose everything. I strongly advise people against what I’m doing!”

This admission highlights the gambling mindset that drives many high-leverage traders. Despite facing massive risks, such traders remain drawn to market volatility, chasing extraordinary returns while fully aware of the potential for heavy losses.

Wynn’s continued trading after significant setbacks reflects a broader crypto culture where risk-takers balance between great success and sudden failure. His story reflects the dynamics of a market where there is a strong probability of seeing your fortunes vanish or making significant gains instantly.

Did you know? Unlike traditional stock markets, Bitcoin trades around the clock, every day of the year. This non-stop market means traders must monitor price movements constantly or use automated bots to avoid missing major moves during off-hours.

Role of macroeconomic uncertainty in Wynn’s $100-million Bitcoin liquidation

External macroeconomic events added pressure to Wynn’s position. Renewed concerns over US tariff policies under President Trump created sudden economic uncertainty, impacting risk assets like Bitcoin.

As markets reacted to Trump’s tariff policies and related trade measures, Bitcoin’s price fell sharply. Around May 23, 2025, Bitcoin dropped approximately 4%, falling to $106,700 from about $111,000 shortly after the announcement, triggering Wynn’s liquidation. This demonstrates how vulnerable leveraged trades are to broader economic shifts, where even small policy changes can lead to major financial losses for overexposed traders.

When Wynn’s $100-million liquidation happened, crypto markets were rattled by macroeconomic uncertainty. Analysts, like Pav Hundal of Swyftx, flagged US President Trump’s tariff rhetoric as a key risk catalyst, exerting downward pressure on risk assets, including Bitcoin.

As trade tensions intensified and talk of tariffs resurfaced, digital-asset markets shed 4%-6%, increasing the vulnerability of leveraged positions.

Wynn’s case illustrates the dual nature of leverage. While it can lead to quick wealth, it also leaves traders open to rapid, severe losses, especially during times of geopolitical or economic instability.

Did you know? In May 2021, Bitcoin briefly crashed by 30% within hours due to a mix of liquidations and panic selling. Such flash crashes are common in crypto and are amplified by high leverage and thin liquidity on some exchanges.

Wynn accused of market manipulation in self-countered trades on Hyperliquid

On June 14, 2025, crypto analyst Dethective published an X post, allegedly exposing Wynn as someone who was counter-trading against himself and not suffering the losses he was claiming. He stated that Wynn’s narrative was just marketing to gain more followers whom he could monetize later.

The analyst examined blockchain data and identified unusual activity regarding Wynn’s trading.

Initially, Wynn’s transactions were typical of a major investor. He made large Bitcoin purchases with high leverage. However, Dethective noticed an irregularity: Wynn was trading against himself on Hyperliquid.

Wynn was simultaneously placing equal-sized long and short positions on Bitcoin, balancing wins and losses with each market shift. Dethective shared this discovery on X, posting:

This revelation eroded trust. Previously impressed by Wynn’s large trades, retail investors began questioning his motives. His reputation suffered as doubts arose: Was he a genuine market influencer or manipulating perceptions? Dethective’s findings exposed the truth.

How crypto traders can protect themselves from FOMO

Crypto traders can safeguard against FOMO (fear of missing out) and greed by adopting disciplined trading practices. Devising a well-thought-out trading plan and diversifying your investments can help.

You need to create a clear trading plan with specific entry and exit points and follow it while keeping market excitement at bay. Using stop-loss and take-profit orders helps reduce emotional decisions during market fluctuations. Spreading investments across multiple assets, rather than focusing on one, lowers the risk of significant losses from impulsive trades.

Regularly reviewing one’s portfolio and performance promotes accountability and discourages reckless actions. Traders should avoid excessive leverage, which magnifies profits and losses, often leading to emotional overtrading.

Learning about market psychology and identifying FOMO triggers can build emotional strength. Withdrawing from constant market monitoring at regular intervals and avoiding social media hype can help maintain clear thinking. Traders can make more thoughtful and sustainable decisions by prioritizing long-term goals over short-term investments.

The golden cross, one of the most potent bullish technical configurations in trading, is currently being displayed by Ethereum. ETH might be positioning itself for a long-term rally toward the $3,000 mark as the 50-day EMA is almost above the 200-day EMA. The golden cross is a long-term momentum indicator that is frequently interpreted as a sign of surging volatility and momentum on both conventional and cryptocurrency markets.

Ethereum is still above a rising support trendline that has served as a base since late April according to the price chart. Although the price momentarily fell twice below the 26-day EMA, buyers swiftly intervened to reject the fakeouts and signal strength. These unsuccessful breakdowns imply that the underlying bullish momentum is still present. The days that follow will be crucial. To keep the current bullish structure intact, ETH needs to hold onto support at about $2,450. Chart by TradingView">

After bouncing off the $2,475 support zone, the price is currently aiming for the $2,600-$2,650 range, which has served as short-term resistance in recent weeks. From here a run toward $2,850 and eventually $3,000 becomes more likely if the golden cross is verified and Ethereum breaks clear above the $2,650 mark. The $2,300 region is still a crucial backstop; if bulls drop below it, the golden cross pattern may not hold and the outlook would shift from neutral to negative.

The volume has remained largely constant despite a minor cooling in recent days. If the golden cross gains official status and attracts wider attention from traders and institutional players observing from the sidelines, this could quickly change. Ethereum finds itself at a pivotal juncture.

The way to $3,000 would be unobstructed by a verified golden cross and consistent strength above $2,600. However, if current supports are not held, the rally may be delayed, and the bullish outlook may be invalidated. Watch $2,475, $2,650 and $2,850 — they will provide the details.

While proof of stake (PoS) becomes the dominant type of consensus for blockchains, proof of work still remains the basis for many of the largest cryptocurrencies, including Bitcoin , Litecoin (LTC) and Dogecoin .

That is why understanding the concept of cryptocurrency mining is essential for researching opportunities for income in cryptocurrency in 2025.

In this guide, U.Today gives an overview of the status of the cryptocurrency mining segment in 2025 and indicates top Bitcoin mining pools for newcomers and pros.

Best crypto mining pools in 2025: Highlights

A cryptocurrency mining pool is an entity (group of miners) working together to solve cryptographic puzzles and compete against rivals in the process of crypto mining.

Foundry USA Pool, Antpool, EMCD, Braiins Pool and Binance Pool are among the most popular and influential cryptocurrency mining pools in 2025.

Top crypto mining pools: Ranking

In 2025, these cryptocurrency mining pools are best based on multiple indicators:

1. Foundry USA Pool

2. EMCD

3. Antpool

4. Braiins Pool

5. Binance Pool

All of them offer diverse mining programs, support a variety of Proof-of-Work cryptos and extra features for miners.

Top 5 cryptocurrency mining pools in 2025: Overview

Now we will look at the biggest and most credible cryptocurrency mining pools for various cryptos.

Foundry USA Pool

widgetU

Managed by Foundry, a subsidiary of Digital Currency Group (DCG), Foundry USA Pool launched in October 2020. With a heavy focus on institutions, Foundry USA Pool is the most influential pool for the global Bitcoin mining ecosystem.

As of June 2025, it is responsible for 273.9 EH/s, or about one third of the global Bitcoin hashrate. Simply put, this means that one out of three hashes mined on the Bitcoin network is solved by a participant in the Foundry USA Pool.

Foundry USA Pool offers an FPPS payout mode for every contributor. It also maintains industry-level SOC compliance and KYC for Bitcoin mining pool members. Foundry USA Pool is a U.S.-compliant company with tiered account permissions and fully transparent tax and accounting data.

Foundry, the operator of this pool, is also the developer of Foundry Optifleet, Bitcoin mining resource management software for maximum efficiency and security of mining operations.

EMCD

widgetU

EMCD is a crypto platform based on one of the 10 largest Bitcoin mining pools operating since 2018. Helmed by cryptocurrency veteran Michael Jerlis, the Singapore-headquartered pool delivers comprehensive cryptocurrency mining pool services to over 400,000 individual and corporate clients worldwide.EMCD">

In over seven years of operations, EMCD’s participants managed to mine over 1,200 Bitcoins . In the corresponding period, that means that over 2% of every Bitcoin added to the circulation supply was mined by an EMCD miner. The sophisticated tech architecture tailored for maximum resource efficiency allowed EMCD to hit a whopping 22.1 EH/s of aggregate hashrate.

As of press time, according to public tracking resources, EMCD is among the top 10 most influential Bitcoin mining pools in the world.

EMCD mining services are integrated with a feature-rich ecosystem of applications to ensure a holistic experience for every customer regardless of their contribution. EMCD is seamlessly integrated with Coinhold, a one-stop app for digital money. Coinhold allows secure, fast and cost-effective holding, storing, exchanging and trading of cryptocurrencies. It also offers up to 14% APY on cryptocurrency deposits, which is much better than market benchmarks for centralized services.

EMCD is also running one of the most vibrant and active peer-to-peer exchange services on the market, allowing crypto holders to exchange their assets with zero fees.

Antpool

widgetU

Founded by Bitcoin mining hardware heavyweight Bitmain in 2014, Antpool is the second most influential BTC mining entity in the world. Roughly, it controls over 20% of the aggregated Bitcoin network hashrate, solving 172.3 EH/s.

Antpool offers the widest ranges of cryptocurrencies to mine, including Bitcoin , Bitcoin Cash (BCH), Litecoin (LTC), Ethereum Classic (ETC), Zcash (ZEC) and Kadena (KDA).

Antpool is integrated with an industry-level ecosystem of crypto services, including ANTPOOL BAO, a tool for reinvesting of mining rewards, and Antpool Shop, the world’s biggest second hand store for mining equipment, plus a fixed Incomi crypto deposit service with 0.6-0.8% APY in Bitcoin and a popular cloud mining platform for newbie-level users.

Antpool also offers a Bitcoin transaction accelerator, a sophisticated instrument for transaction reprioritization in the BTC mempool. Not unlike Foundry USA Pool, Antpool adheres to SOC and AICPA security standards and certification policies.

Braiins Pool

widgetU

Braiins Pool, initially known as Bitcoin.cz Mining Pool and later Slush Pool, has been operating since December 2010. Launched by Marek "Slush" Palatinus in Prague, Czech Republic, Braiins Pool is one of the oldest cryptocurrency businesses in the world and the most reputable Bitcoin mining pool. It has been working under its current name since 2022.

Currently, Braiins Pool is responsible for 12.30 EH per second, which is among the top 10 most influential Bitcoin mining pools globally. In total, since its launch in 2010, Braiins Pool mined almost 1.3 million BTC.

Braiins Pool leverages the FPPS rewards scheme with seamless API access and one-click export of all tax and legal documents via its API. Contributors can operate their hashrate clusters via dedicated mobile applications. As of June 2025, Braiins Pool delivers its services to 10,800 customers across the globe, operating 90,000 mining rigs of all recent generations.

Binance Pool

widgetU

Binance Crypto Mining Pool, an integral element of the world’s biggest cryptocurrency ecosystem Binance (BNB), supports proof-of-work (PoW) mining operations for Bitcoin , Bitcoin Cash (BCH), Litecoin (LTC), Ethereum Classic (ETC), ZCash (ZEC), Revencoin (RVN), Nervos Network (CKB), Kaspa (KAS) and Conflux (CFX).

With 66.33 Eh/s, Binance Pool is responsible for 7% of the global Bitcoin mining hashrate. Binance Pool is well known for its straightforward interface, clear UX/UI and the biggest collection of integrations.

With the Super Mine campaign, contributors to the service can boost their rewards. Also, Binance Crypto Mining Pool allows full transparency and tracking of all of its 250,000+ workers (mining computers) across all supported networks. Also, the pool by Binance (BNB) supports a powerful transaction accelerator for Bitcoin's blockchain mempool.

What is cryptocurrency mining?

In cryptocurrency, mining refers to the process of adding the next block to the blockchain via solving cryptographic puzzles. All computers on the network compete against each other to solve the puzzle first and “mine” the hash of the upcoming block. For doing so, the luckiest miners get periodic rewards every block.

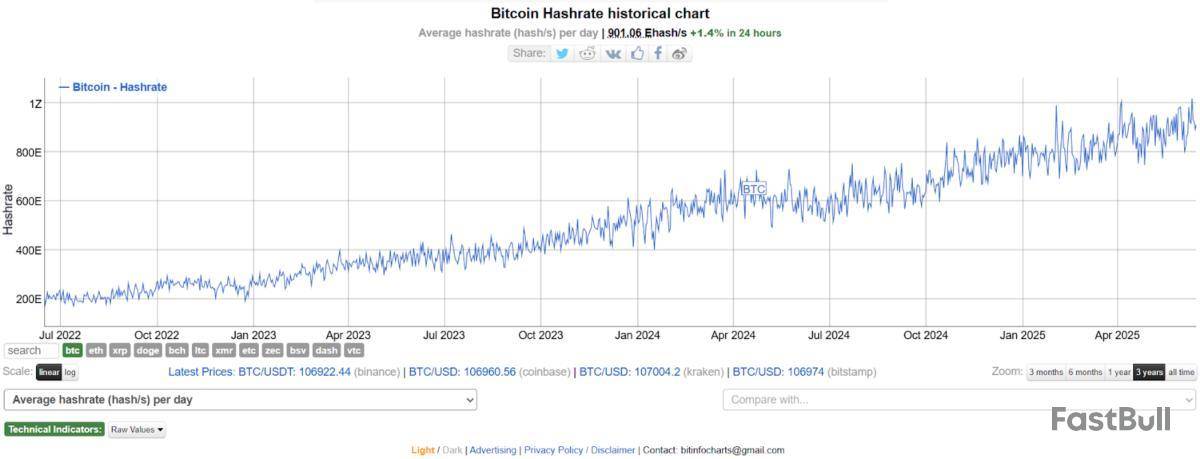

BINANCE:BTCUSD network // Souce: https://bitinfocharts.com/comparison/bitcoin-hashrate.html#3y">

While initially, cryptocurrency mining was available on entry-level computers — desktop and even laptops — in 2025, you can mine mainstream cryptocurrency only on sophisticated miners based on application-specific integrated circuits (ASICs).

Thus, cryptocurrency miners secure the networks and keep them operable by investing their computational resources. This type of consensus is called “proof of work.” It laid the foundation for the entire concept of blockchain with the inception of Bitcoin in 2009.

Mining versus staking: Key differences

Mining and staking represent two ways of contributing to the operations of a blockchain network; proof-of-work blockchains rely on miners, while proof-of-stake blockchains rely on stakers.

Staking is less resource efficient, while mining is battle-tested and extremely difficult to attack. Also, mining consumes a large volume of electricity and is more whale-dominated thanks to high barriers to entry.

Best cryptocurrency to mine in 2025

Despite the majority of cryptocurrencies moving to the proof-of-stake consensus, the mining of some proof-of-work coins remains profitable in 2025.

Bitcoin is the first-ever cryptocurrency and the largest digital asset by market capitalization. Bitcoin was invented by anonymous developer Satoshi Nakamoto and launched in 2009. The “orange coin” was the first realization of the cryptocurrency concept as such.

Bitcoin is also the most popular and expensive cryptocurrency. In May 2025, it set a new price record north of $110,000 per coin. Bitcoin is accessible to both retail and institutional traders as it is included in spot ETFs in the U.S.

Bitcoin has the largest mining ecosystem; its miners create 900 Ehashes (quintillions of hashes) per second.

Litecoin (LTC)

Litecoin (LTC) is an alternative cryptocurrency (altcoin) created by Charlie Lee, a former Google engineer. Litecoin (LTC) forked from Bitcoin in Q4, 2011. Designed as a "lite" version of Bitcoin, it offers faster transaction times and lower fees.

Litecoin uses the Scrypt hashing algorithm, which is more memory-intensive and was originally intended to be ASIC-resistant, promoting more decentralized mining. It operates on a proof-of-work (PoW) consensus mechanism, similar to Bitcoin. With a block time of 2.5 minutes and a maximum supply of 84 million coins, Litecoin aims to be a faster and more convenient version of the first cryptocurrency.

Dogecoin, the largest meme cryptocurrency, was created by Billy Markus and Jackson Palmer as a semi-ironic alternative to “serious” cryptos like Bitcoin and Litecoin (LTC). It was launched Dec. 6, 2013, and featured the popular early 2010s Shiba Inu "Doge" meme, a phenomenon of internet culture.

Originally started as a joke, Dogecoin quickly gained a strong online community and real-world use. It also utilizes the Scrypt hashing algorithm and operates on a proof-of-work (PoW) consensus mechanism. Unlike Bitcoin, Dogecoin has no maximum supply, making it inflationary by design. In 2021, Dogecoin became extremely popular thanks to support from Elon Musk.

Kaspa (KAS)

Kaspa (KAS) is a high‑performance layer-1 cryptocurrency launched on Nov. 7, 2021, with no ICO or premine.

Kaspa (KAS) was created by a community led by Yonatan Sompolinsky (known for the GhostDAG protocol). Kaspa leverages the kHeavyHash algorithm for proof‑of‑work (PoW) mining.

Unlike traditional chains, Kaspa operates via a blockDAG/GhostDAG consensus, allowing multiple blocks per second and near‑instant (~10 s) confirmations, boosting scalability while retaining PoW security.

Monero (XMR)

Monero is a privacy-focused cryptocurrency launched on April 18, 2014, by a group of anonymous developers, originally based on Bytecoin's CryptoNote protocol. It uses the RandomX algorithm.

Monero emphasizes strong on-chain privacy through features like stealth addresses, ring signatures and confidential transactions, making all transactions untraceable and balances hidden. Its developers remain anonymous to uphold decentralization and censorship resistance. Riccardo “Fluffy Pony” Spagni is the only public key figurehead of Monero (XMR).

Due to its focus on privacy, Monero faces regulatory limitations. Some exchanges in the U.S. and EU have delisted it, and certain jurisdictions scrutinize it closely, citing concerns over illicit use.

Other notable examples of proof-of-work (PoW) cryptocurrencies with profitable mining strategies in 2025 include Bitcoin Cash (BCH), ZCash (ZEC), Ravencoin (RVN) and Ergo (ERG).

What is a cryptocurrency mining pool?

A cryptocurrency mining pool is a conglomerate of mining computers competing to solve cryptographic puzzles in a coordinated manner. Technically, it is a group (cluster) of mining hardware units involved in cryptocurrency mining.

Crypto mining pools are a decentralized and inclusive blockchain business: It allows individuals to join coordinated platforms and share rewards for every block found. Cryptocurrency mining pools are far more powerful than solo miners, i.e., individuals running isolated mining rigs (farms) themselves.

Launched in 2010, Bitcoin-specific Slush Pool was the first-ever cryptocurrency mining pool, which laid the framework for the entire business of coordinated mining.

Choosing cryptocurrency mining pool: Things to consider

While selecting a cryptocurrency mining pool for investing, one should consider the scope of algorithms this or that pool supports, its payouts scheme and integration with other cryptocurrency services.

Algorithm

Cryptocurrency mining pools use various hashing algorithms depending on the blockchain they support.

The most popular options include SHA-256 (used by Bitcoin, Bitcoin Cash), known for its high security but requiring expensive ASICs to join. Scrypt (used by Litecoin, Dogecoin) is memory-intensive, but can be run without ASICs.

Ethash (Ergo, pre-Merge Ethereum) is GPU-friendly and also memory-heavy. RandomX (used by Monero) is optimized for CPUs and resists ASICs.

KHeavyHash (used by Kaspa) is lightweight and guarantees faster block times compared to previous-gen solutions.

Other algorithms include Equihash (Zcash), X11 (Dash) and Cryptonight (older Monero versions). While selecting the algorithm, investors should consider their resources, goals and strategy specifications.

Payouts scheme

Cryptocurrency mining pools use various payout schemes to fairly distribute rewards among participants.

Each method comes with its own pros and cons, balancing risk, fairness and predictability in various ways.

Ecosystem

While selecting cryptocurrency pools for investing, potential crypto mining pool participants should check out whether it supports necessary ecosystem tooling for comfortable, predictable and resource-effective journeys.

Element |

Why would I need it? |

Built-in crypto wallet |

For secure allocation of rewards |

Deposit instrument |

To seamlessly enjoy yield rewards on crypto mining pool payouts |

P2P exchange |

To exchange rewards for other cryptos such as BTC, ETH and USDT |

24/7 support |

To solve all issues and leave feedback on operations |

All of these elements should be thoroughly researched while choosing a mining pool strategy, the amount and the term of investment.

Wrapping up: Are cryptocurrency mining pools still relevant in 2025?

A cryptocurrency mining pool is a form of proof-of-work hash mining business in which individual computers join a coordinated group to compete against rival miners. Compared to solo miners, cryptocurrency mining pools offer the greatest chances of adding the next block, but their rewards are shared between all participants.

Foundry USA Pool, Antpool, EMCD, Braiins Pool and Binance Pool are among the most influential cryptocurrency mining pools in 2025.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up