Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

F2Pool co-founder Chun Wang, who is known as the first Bitcoiner to travel to space, is convinced that the fears of quantum computing breaking Bitcoin are overblown.

"It turns out those who are panicking about quantum computers may wipe out Bitcoin have never written a single line of quantum code," Wang quipped.

Focusing on interplanetarization

As reported by U.Today, recent advancements within the quantum computing space have led to persistent concerns about the viability of Bitcoin's SHA-256 hashing algorithm.

Google's Willow, Microsoft's Majorana 1, and IBM's Blue Jay projects show that the newfangled technology is moving forward despite remaining somewhat obscure and lacking virtually any real-world use cases that could show off its actual potential.

Recently, Tesla CEO Elon Musk specifically asked Grok, an AI chatbot developed by xAI, to estimate the probability of SHA-256 being cracked.

However, Wang is convinced that quantum computers still will not have cracked Bitcoin by the time humans actually settle on Mars. "Instead of wasting time worrying about quantum computing, it makes far more sense to think about how to make Bitcoin latency-tolerant, so it can serve an interplanetary civilization," he said.

Wang has specifically stressed that he wants Bitcoin to assume the role of the interplanetary settlement currency instead of some "fleeting" altcoins.

Historic space mission

As reported by U.Today, Wang traveled to space as part of the Fram2 mission, flying over the Earth's pole alongside three other crew members.

During the mission, the crew conducted a total of 22 scientific experiments, which included performing X-rays in space for the first time.

Ethereum, the second largest cryptocurrency, has returned to $4,000 following a drop in the week just concluded amid a decline in risk sentiment.

At the time of writing, ETH was up 0.43% in the last 24 hours to $4,008, but down 10.07% weekly.

Ethereum fell for five straight days from Sept. 20 to reach a low of $3,825, its weakest level in nearly seven weeks, before paring the drop.

The major cryptocurrency rebounded to a high of $4,071 on Friday following the release of the PCE report, regarded as the Fed's favored inflation gauge, but this traction was short-lived.

This is as Ethereum's momentum paused, with price showing little to no change in the last 24 hours. ETH's price remains tightly locked between $3,974 and $4,040, with the market awaiting its next move.

Three key levels crucial to watch

While traders watch out for where ETH trends next, whether to the upside or downside, crypto analyst Ali highlights three key levels to watch for the ETH price in the event of an upside move.

Ali@ali_chartsSep 28, 2025Three resistance levels to watch for Ethereum $ETH: $4,158, $4,307, and $4,505. pic.twitter.com/upNx3j6p32

Ali stated in a tweet that the three resistance levels to watch for Ethereum are $4,158, $4,307 and $4,505, with a breach of these key levels ultimately leading ETH to the $5,000 target.

In a recent tweet, Dr Martin Hiesboeck, Uphold's head of research, stated that confidence in Ethereum is rising. Institutional investor BitMine recently increased its stake to 2.42 million ETH, now holding over 2% of the total supply. This accumulation matches major traditional finance moves: REX Shares is launching its REX-Osprey ETH staking ETF, and Morgan Stanley is adding support for ETH trading on E*Trade, offering millions of clients direct access. Further strengthening the market, ETHZilla raised another $350 million specifically to buy more ETH.

Ethereum's scaling efforts are also hitting milestones, with the network achieving a new record of six blobs per block, signifying heavy utilization of the data-availability layer by Layer 2s and confirming the success of the Dencun upgrade.

TL;DR

The Week Ahead for XRP

September is almost over, and although it started on a positive note, it has been mostly downhill for most of the cryptocurrency market in the past ten days or so. XRP, for example, stood close to $3.20 during its monthly peak after the US Fed reduced the key interest rates for the first time in 2025.

However, it failed there and quickly retested the $3 support, which actually didn’t put up much of a fight. The bears kept the pressure on, and once it cracked, XRP experienced another leg down that drove it to $2.70. This level holds significant importance in determining the asset’s future price trajectory, as many analystsbelieveXRP can quickly rebound as long as it remains above it.

When we asked the 3 AIs (ChatGPT, Grok, and Gemini) about their take on what the next week holds for XRP, OpenAI’s solution answered in a somewhat worrisome manner. It noted that the asset is a “strong sell” on multiple websites, such as investing.com, due to the current technical setup.

Grok agreed with the analysts cited above that as long as XRP holds above $2.70, the bulls might remain calm. However, it also noted that the asset needs to quickly reclaim the $2.83 resistance if it wants to challenge $3 next.

Gemini said the current trading volume doesn’t support a big move upward, and it warned that a break above the coveted $3 line seems unlikely at the moment.Something for the Bulls?

All three AIs agreed that after such a volatile and violent trading week, a period of consolidation is to be expected. As such, they noted that Ripple’s token is likely to remain sideways at around $2.7-$2.9 for the next week (maybe even a bit longer).

However, they also admitted that one major announcement, such as a positive macro event or an approval of spot XRP ETFs in the US, could send the underlying asset flying. Recall that there are over a dozen Ripple ETF filings sitting on the SEC’s desk and most of their deadlines are set for October.

TL;DR

The Week Ahead for XRP

September is almost over, and although it started on a positive note, it has been mostly downhill for most of the cryptocurrency market in the past ten days or so. XRP, for example, stood close to $3.20 during its monthly peak after the US Fed reduced the key interest rates for the first time in 2025.

However, it failed there and quickly retested the $3 support, which actually didn’t put up much of a fight. The bears kept the pressure on, and once it cracked, XRP experienced another leg down that drove it to $2.70. This level holds significant importance in determining the asset’s future price trajectory, as many analystsbelieveXRP can quickly rebound as long as it remains above it.

When we asked the 3 AIs (ChatGPT, Grok, and Gemini) about their take on what the next week holds for XRP, OpenAI’s solution answered in a somewhat worrisome manner. It noted that the asset is a “strong sell” on multiple websites, such as investing.com, due to the current technical setup.

Grok agreed with the analysts cited above that as long as XRP holds above $2.70, the bulls might remain calm. However, it also noted that the asset needs to quickly reclaim the $2.83 resistance if it wants to challenge $3 next.

Gemini said the current trading volume doesn’t support a big move upward, and it warned that a break above the coveted $3 line seems unlikely at the moment.Something for the Bulls?

All three AIs agreed that after such a volatile and violent trading week, a period of consolidation is to be expected. As such, they noted that Ripple’s token is likely to remain sideways at around $2.7-$2.9 for the next week (maybe even a bit longer).

However, they also admitted that one major announcement, such as a positive macro event or an approval of spot XRP ETFs in the US, could send the underlying asset flying. Recall that there are over a dozen Ripple ETF filings sitting on the SEC’s desk and most of their deadlines are set for October.

Over the last week, XRP slipped below the psychological $3 support level as it lost about 7.02% of its price value. Since then, the altcoin has maintained a steady price consolidation around the $2.78-$2.79 region, without retesting the newly formed resistance level. Meanwhile, recent on-chain data has provided some cautionary market insights, highlighting a key support zone.

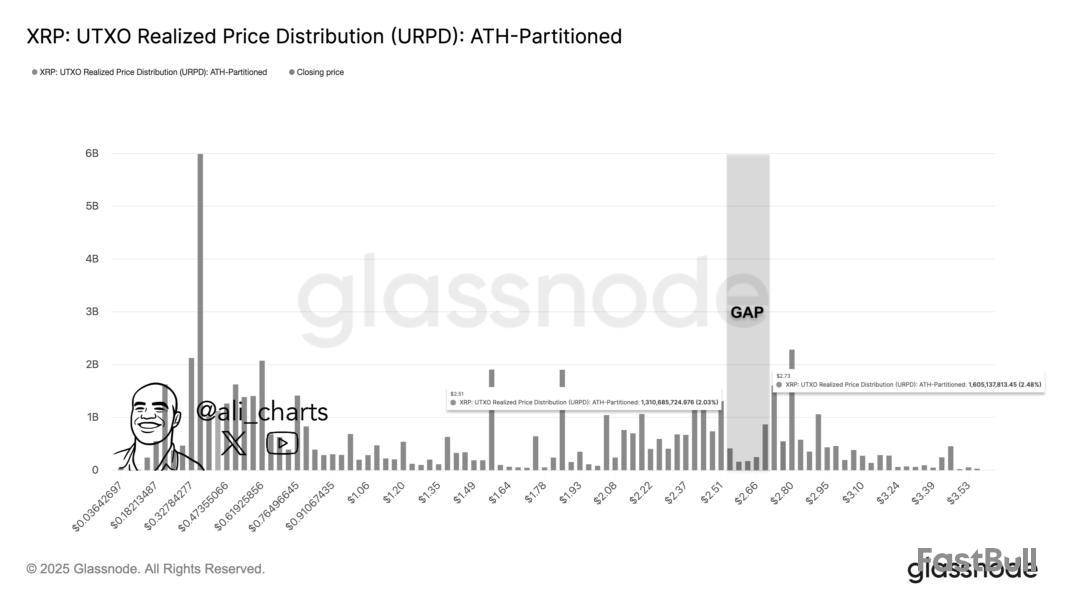

XRP Bulls Must Avoid Crash Below $2.73 – Here’s Why

In an X post on September 27, crypto analyst Ali Martinez revealed the existence of a price gap sitting between the $2.73 and $2.51 price levels. Central to Martinez’s revelation is the UTXO Realized Price Distribution (URPD) metric, which specifies how much XRP was last transacted at different price levels, but in relation to its all-time high.

As an extension of its primary function, the indicator quantifies trading activity across different price levels, therefore highlighting potential support and resistance zones. According to the chart shared by Martinez, there is considerable trading activity across several XRP’s price zones. However, there is a price range closest to its current value at $2.78, within which there has been very little trading activity.

This price range, set between $2.51 and $2.73, comprises relatively less market activity, creating what Martinez describes as a price gap, where little support or resistance exists. The higher boundary of the price gap is at the $2.73 level, where about 1.60 billion XRP were transacted. A fall below this price floor would likely result in a straight decline towards $2.51, as any little support lies between both price regions. Notably, XRP last touched $2.51 in July.

XRP Price Outlook

As of this writing, XRP is valued at about $2.78 despite a modest 0.78% gain in the last day. Meanwhile, the altcoin’s daily trading volume is down by 58.95% and valued at $3.02 billion.

According to CoinCodex, XRP is currently facing bearish sentiment, with traders showing caution amid subdued market conditions. Meanwhile, the Fear and Greed Index sits at 33, signaling fear and a lack of strong buying momentum. Over the past 30 trading sessions, XRP has recorded 13 red days, underscoring the weakness in recent performance

Despite this, price predictions suggest little volatility ahead, with no significant change expected in the next five days or over the coming month. This indicates that XRP may remain range-bound as investors await clearer market signals or catalysts. With sentiment leaning negative, short-term traders may exercise caution, while long-term holders continue to monitor for potential shifts in broader crypto market dynamics.

The run is over. Bitcoin spot ETFs saw huge net outflows of $903 million at the end of the trading week of Sept. 22-26, following four weeks of net inflows. Weeks of consistent accumulation are erased by the reversal, which also indicates a change in investor sentiment, as the cryptocurrency market is impacted by profit-taking and macro pressures.

Everyone takes hit

It was not just Bitcoin that was hurting. With all nine funds reporting redemptions for the week, Ethereum spot ETFs also saw significant outflows of $796 million. After months of resiliency, this coordinated withdrawal from the two top digital assets points to a general cooling in institutional crypto products, indicating that risk appetite is waning. Chart by TradingView">

In terms of price, Bitcoin lost traction with its short-term moving averages and traded close to $109,000. The next important support zone is the 200-day EMA, which is around $106,200. The breakdown below the 100-day EMA, which is around $112,800, confirmed weakness. Bitcoin’s long-term defense line has historically been the 200 EMA, whether bulls can hold it will determine how much deeper the correction gets.

ETFs bleeding

ETF and on-chain data now present a cautious picture. The weekly ETF flows chart reveals the biggest withdrawal in months, where billions of net assets have been lost. While weekly net inflows fell to almost -$903 million, total net assets across Bitcoin ETFs fell to $143 billion. Bitcoin volumes surged during the decline, and such sharp withdrawals frequently result in selling pressure on the spot market.

With $796 million leaving ETFs in a single week, Ethereum’s story is similar to Bitcoin’s decline. The coordinated withdrawal from both assets shows that institutional players are removing their entire, at least temporarily, exposure to cryptocurrency rather than just moving their money around.

The stability of Bitcoin above $106,000 to $108,000 will be critical in the future. Losses could reach the psychological threshold of $100,000 if this zone is not maintained. Even after weeks of consistent institutional accumulation, the most recent ETF outflow data demonstrates how quickly sentiment can shift, even though long-term fundamentals are still sound.

During a recent appearance on "The Master Investor Podcast" with veteran business reporter Wilfred Frost, Ark Invest Cathie Wood stated that she favors Bitcoin over Ethereum.

According to Wood, Bitcoin is "the global monetary system," which is alone "a very big idea."

The famed stock picker is also bullish on Bitcoin because of its superior technology, noting that the layer-1 blockchain has never been hacked. "The other blockchains cannot say that," she added.

Lastly, Bitcoin is also viewed as a new asset class. The largest cryptocurrency is currently the ninth biggest asset with a market cap of roughly $2.2 trillion.

Warming up to ETH

With that being said, Wood has also noted that Ethereum plays "a very important role" within the decentralized finance (DeFi) ecosystem.

She has added that a lot of the fees are going to layer-2s of the likes of Coinbase's Base. They, according to Wood, are getting a "disproportionate" amount of fees, and the question is whether or not competing layer-2s will confer more importance to the layer-1. Ark Invest thinks that this could be possible, which is why the Florida-based investment firm is betting on ETH.

Bullish price prediction

Ark Invest, which made its first publicly disclosed Bitcoin bet back in 2017, has been bullish on Bitcoin for years. It has both direct and indirect exposure to the leading cryptocurrency by holding the shares of such companies as Strategy (MSTR).

The investment firm has predicted that the price of the leading cryptocurrency could surge to as high as $2.4 million by the end of the decade.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up