Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Filecoin announced its involvement in side events at Consensus 2025, to be held in Toronto, from May 12 to 16. The programme will include sessions such as “Unlocking the Power of Vybe API: Building Next-Gen Solana Applications” and “AI Agent Night” to foster collaboration among participants.

Refer to the official tweet by FIL:

Protocol Labs@protocollabsMay 07, 2025🇨🇦 Headed to Toronto for @consensus2025?

Join the innovation network May 12–16 for a week of collaboration and connection at side events like:

🚀 Unlocking the Power of Vybe API: Building Next-Gen Solana Applications

🤖 AI Agent Night

Full list here. https://t.co/aHYAw7JjYw

FIL Info

Filecoin is a decentralized storage system that aims to "store humanity's most important information". The project raised significant funds via an initial coin offering (ICO) in 2017. Filecoin is the digital token that is used as payment for storage or retrieval of data within the network. The network uses a unique proof-of-storage system where miners earn more by sharing more storage, and the data they store is constantly verified to ensure its correctness. Filecoin competes with centralized storage systems such as Amazon S3, and allows individuals to monetize their spare storage space on the network.

Reserve Rights Token will be represented at Consensus2025, a cryptocurrency conference organized by CoinDesk, scheduled to take place in Toronto from May 14 to May 16.

Refer to the official tweet by RSR:

Reserve 🌐@reserveprotocolMay 07, 2025Do Canadians diversify & chill? We’re about to find out 😏

Come find us next week at @consensus2025 by @CoinDesk and grab the latest Reserve swag 👀

🗓ï¸ May 14-16

🇨🇦 Toronto

See you there 🫡 pic.twitter.com/7N7wwzPmch

RSR Info

Reserve Rights is a stablecoin platform consisting of two tokens, including the Reserve Stablecoin (RSV), which is a value-backed coin, and the Reserve Rights Token (RSR).

The Reserve Rights Token (RSR) is used to maintain the stability of the RSV token. When the price of RSV deviates from the $1 peg, the protocol’s algorithms automatically utilize RSR to buy or sell RSV on the open market until its price is restored to the $1 level.

Therefore, the RSR token plays a crucial role in maintaining the stability of RSV and ensuring its liquidity. RSR holders can also participate in protocol governance and vote on matters related to its development and improvement.

USD1, the stablecoin issued by Trump-affiliated World Liberty Financial (WLFI), has seen its supply significantly increase between late last month and early May. According to CoinGecko, the coin now has over $2.1 billion in market cap, up from less than $130 million on April 27.

Multiple data sources, including CoinGecko, CoinMarketCap, and DefiLlama, showed USD1’s supply jumped over $720 million by April 28. The stablecoin’s supply surpassed $2 billion on April 30. BscScan — the primary block explorer for the Binance Smart Chain, where most of USD1 exists — indicated several large mints within that timeframe. The mints ranged between 50 million and as high as 99 million.

On May 1, Abu Dhabi investment firm MGX announced it would use WLFI’s USD1 to settle a $2 billion investment into Binance. Brandon Kae, research analyst at The Block, explained that USD1's recent supply surge was likely due to the MGX-Binance deal. The Block contacted WLFI for comment.

The Trump-backed WLFI shared plans for its USD1 stablecoin in March, and the product officially launched in April. Like most fiat-pegged crypto offerings, the coin is reportedly fully backed by short-term U.S. Treasuries, U.S. dollar deposits, and cash equivalents. Also, World Liberty Financial intends to airdrop a small portion of USD1 to WLFI token holders as a reward and to test its onchain distribution model.

USD1 became the latest entrant in a $231 billion stablecoin market dominated by Tether (USDT) and Circle (USDC). USDT’s $149 billion and USDC’s $60 billion comprise over 90% of the current U.S. dollar stablecoin sector.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

By Elsa Ohlen

Cryptocurrency-related stocks rose Thursday as Bitcoin gained momentum on hopes of easing global trade tensions.

Crypto trading platform operators Robinhood and Coinbase rose 3.5% and 4.6%, respectively, in premarket trading. MicroStrategy, the largest corporate holder of Bitcoin, gained 5.3%.

Block, a financial-technology company that also holds Bitcoin for investment purposes, rose 1.7%.

Early Thursday, Bitcoin traded around $99,500, again nearing the psychologically important level of $100,000 for the first time since February.

The crypto rally comes as trade tensions appear to be easing. President Donald Trump has said a big trade announcement is coming Thursday, which several media outlets have reported to be a U.S.-U.K. trade framework.

The deal would be the first such agreement since Trump announced sweeping so-called reciprocal tariffs on April 2, in what he referred to as "Liberation Day." The bulk of tariffs were put on a 90-day pause shortly after being announced.

Treasury Secretary Scott Bessent is also set to meet Chinese counterparts in Switzerland this week to discuss economic and trade matters.

Companies such as Tesla and GameStop, have also dabbled in crypto investment. In the last quarter of 2024, Tesla reported a boost to its profits due to a gain in digital assets, however some of those gains reversed in the last reported quarter as the value of the assets fell. Shares of Tesla and GameStop were up marginally early Thursday.

Write to Elsa Ohlen at elsa.ohlen@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

Injective Protocol will conduct an AMA on X on May 13th, offering a detailed overview of the rapid expansion of iAssets across the real-world asset segment, including on-chain stocks, commodities and other undisclosed categories.

INJ Info

Injective Protocol is a decentralized exchange (DEX) protocol built on the Cosmos SDK, offering advanced cross-chain trading capabilities.

Key features of Injective Protocol include:

1. Decentralization: On the Injective platform, users have full control over their funds, with no third-party intervention.

2. Cross-chain trading: Injective supports trading between different blockchains, providing users with a wide range of tradable assets.

3. High performance: Injective utilizes the Tendermint consensus system, ensuring high throughput and low transaction latency.

4. Gas-free transactions: Users can trade without the need to pay gas fees.

INJ is the native token of Injective Protocol. The token is used for protocol governance, staking, and participation in voting processes that address key protocol upgrades and management decisions.

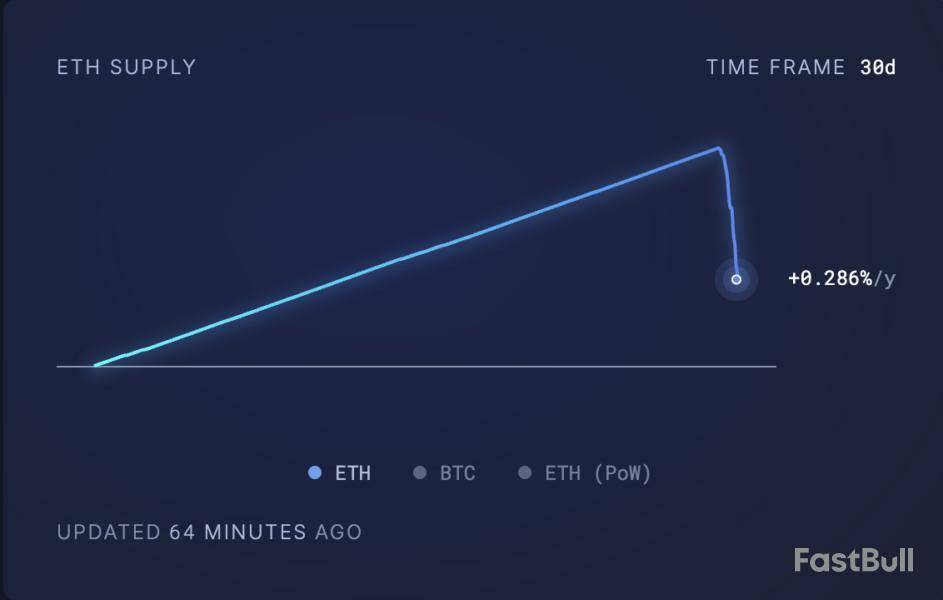

Ethereum’s highly anticipated Pectra upgrade went live yesterday and is already beginning to impact the network’s supply dynamics. On-chain data reveals a sharp dip in the coin’s circulating supply, now at an 18-day low.

This supply crunch is driven by a surge in user activity in the Layer-1 (L1) network over the past day. If this trend continues, ETH’s price could rocket to new highs.

Ethereum Supply Hits 18-Day Low

According to Ultrasoundmoney, ETH’s circulating supply has dropped since Ethereum’s Pectra Upgrade was implemented on Wednesday. As of this writing, it stands at an 18-day low of 120.69 million ETH.

This long-awaited network overhaul, which raises validator limits to 2048 ETH, enables smart wallets and boosts network efficiency, has fueled a spike in network activity, tightening ETH’s supply as user demand climbs.

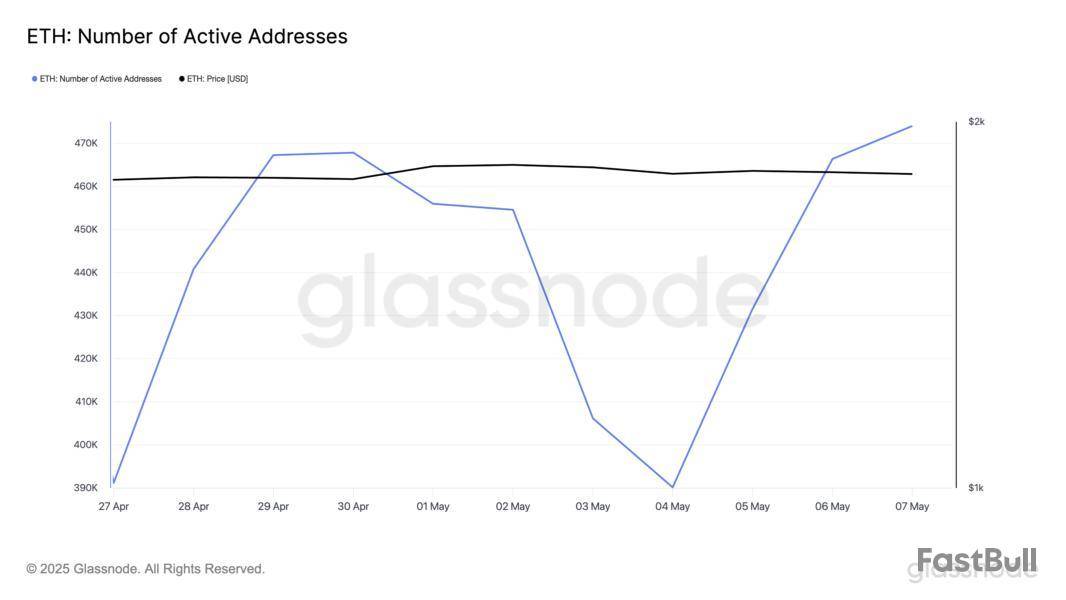

Glassnode data shows Ethereum’s active address count has climbed to a 30-day high, signaling renewed user engagement. According to the data provider, on May 7, the number of unique addresses active in the network, either as a sender or receiver, totaled 474,044.

When Ethereum’s active address count increases, more unique wallets interact with the network. The surge in user activity signals growing demand and network usage, and it often correlates with higher gas fees and increased ETH burning.

This is because with more users on the network, more transactions flow through the network, triggering higher gas fees and accelerating the ETH burn rate. According to Etherscan, ETH’s burn rate is at its highest level since May began.

As more ETH coins are burned, the circulating supply lessens, increasing the upward pressure on the altcoin’s price.

Will It Reclaim $2,000 or Retreat to $1,744?

On the daily chart, ETH trades above the horizontal channel, which kept its price within a range between April 23 and May 7. The altcoin faced resistance at $1,872 during that period and found support at $1,744.

If the breakout continues, ETH could reclaim the psychological $2,000 price zone and continue its rally toward $2,235.

However, a failed retest of this breakout could cause ETH’s price to fall to $1,744. If it fails to hold, the price could drop to $1,564.

Key points:

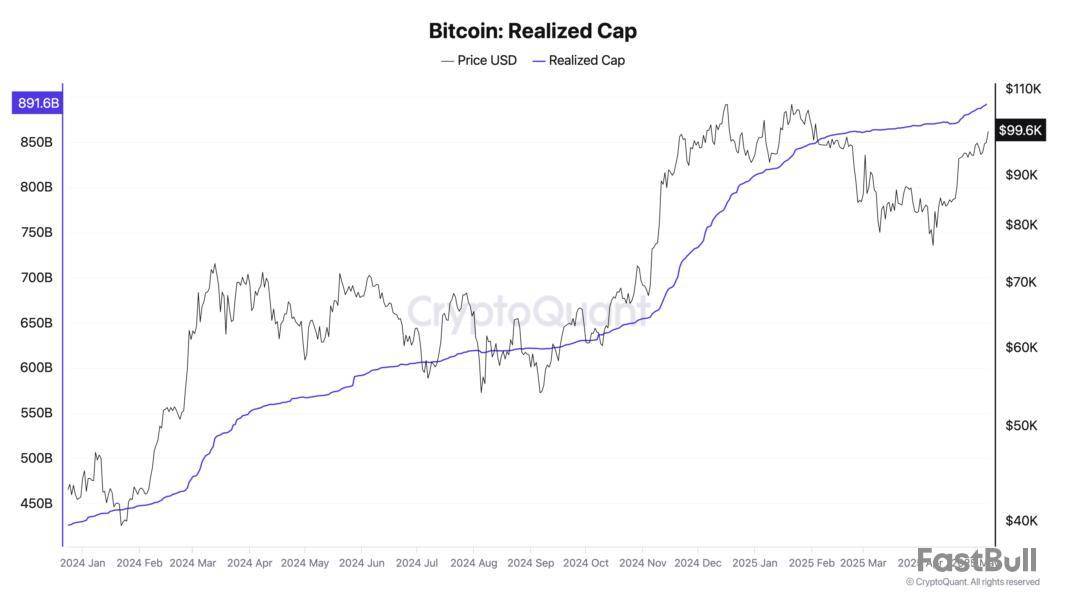

Bitcoin’s realized cap is beating records and has almost reached the $900 billion mark.

The market is laying the foundations for a “potentially significant price breakout,” new analysis says.

Profit-taking is not hindering the overall bull market rebound.

Bitcoin is setting new all-time highs in network value as BTC price action eyes a return to six figures.

Data from onchain analytics platform CryptoQuant confirms new record highs for Bitcoin’s realized cap.

Bitcoin realized cap reflects “growing conviction”

Bitcoin is worth more than ever in US dollar terms if its market cap is measured by the value at which the extant supply last moved onchain.

Known as realized cap, this figure has seen continued all-time highs since mid-April as stages a sustained recovery, and as of May 7 stood at $891 billion.

“Bitcoin has experienced a steady flow of capital inflows in recent weeks, reflecting renewed interest from investors,” CryptoQuant contributor Carmelo Alemán summarized in one of its “Quicktake” blog posts on May 7.

Alemán argued that the realized cap uptrend reflects a long-term market shift across the Bitcoin investor spectrum.

“This new all-time high in Realized Cap not only reflects a surge in invested capital but also a growing conviction in Bitcoin's long-term potential as a financial asset,” the post concluded.

BTC capital influx ongoing since 2023

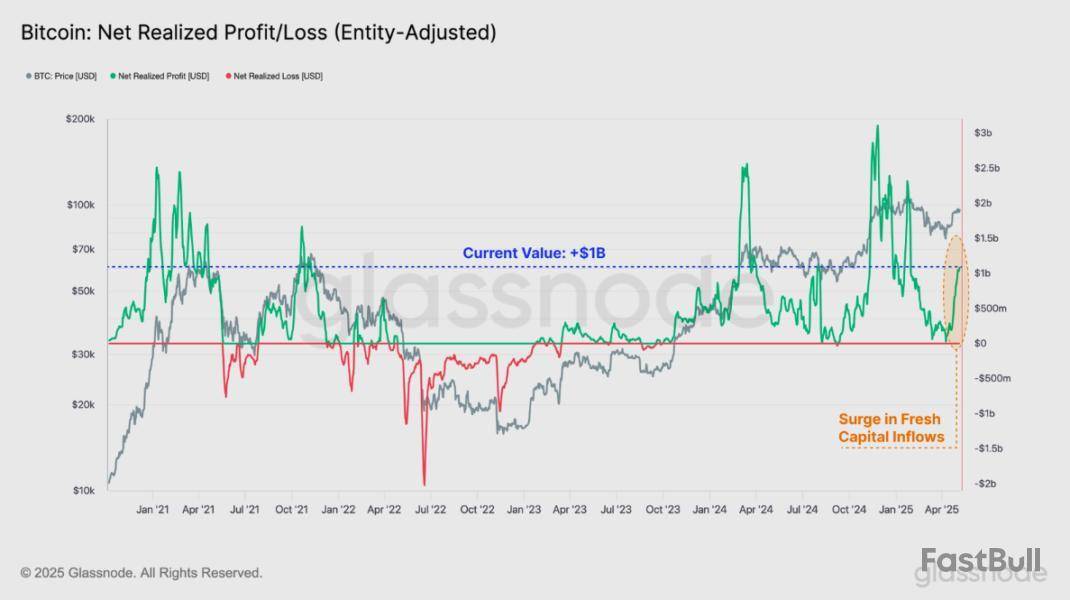

As Cointelegraph reported, concerns remain over the fate of the current market rebound.

Misgivings over profit-taking in particular form grounds to suspect that higher prices may not last — both LTH and STH entities have seized the opportunity to lock in profits, with these averaging $1 billion daily.

In the latest edition of its regular newsletter, “The Week Onchain,” research firm Glassnode nonetheless argues that buy and sell-side conditions are balanced at around $100,000.

“A surge in profit taking can be observed in recent weeks, with the recent rally drawing in over $1B/day in net capital inflows,” it wrote.

Glassnode added that the quest for profits has, in fact, extended for over 18 months.

“Notably, the market has sustained a profit-driven regime since October 2023, with capital inflows consistently exceeding outflows. This steady influx of fresh capital serves as an overall constructive signal,” it stated.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up