Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Federal Reserve Vice Chair for Supervision Michael Barr pushed back on claims that the crypto industry is being shut out of the banking sector and said that the central bank doesn't discourage the activity.

Barr said the Federal Reserve tries to be "straight up the middle," when asked about the topic on Thursday by Dr. Christopher Brummer, a professor of financial technology at Georgetown Law, during an event at Georgetown Law.

"What we have said consistently is, we're trying to be straight up the middle, provide clear guidance and clear guardrails so that banks that want to engage in this activity can do that in a way that's appropriate," Barr said. "We don't tell them that they have to do it, we don't tell them they shouldn't."

The topic around crypto debanking has been cast into the spotlight, particularly over the past several weeks under the new Trump administration, as industry, lawmakers, bank CEO and regulators grapple with the issue. Crypto firms say they face challenges when looking to establish and maintain accounts in the U.S.

Coinbase took a step further and sued the Federal Deposit Insurance Corporation last year, through consultant firm History Associates, accusing the agency of trying to cut off the crypto industry from the banking sector. Big bank CEOs have since opened up about their struggles with crypto.

Barr's comments on Thursday follow statements from the top — Federal Reserve Chair Jerome Powell called for a "fresh look" at debanking during a Senate Banking Committee hearing earlier this month.

Barr, who said he would be stepping down as the vice chair of supervision later this month, said the Fed focuses on banks complying with consumer and terrorism financing protections. Barr will continue to stay on as a member of the Federal Reserve Board of Governors.

"We try to take the position, and have taken the position over all the time that I've been at the Fed — we don't tell a bank to do business with particular clients and we don't tell a bank to do business with particular clients and we don't tell a bank not to do business with a particular client," Barr said on Thursday.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

(TheNewswire)

Vancouver, British Columbia, Canada– February 20, 2025 – TheNewswire - GOATIndustries Ltd. (“Company” or “GOAT”) (FWB: 26B.F) is pleased to announce that it has entered into anon-binding letter of intent dated February 20,2025, to acquire (the “Transaction”) all of the issued and outstanding securitiesof 7RCC Global Inc. (“7RCC”) from the securityholders of 7RCC (the “Vendors”).

7RCC

7RCC is a financial firm focused on bridging digital assets withinnovation focused institutional investors through structuredproducts. 7RCC has forged strategic partnerships with leading entitiesincluding the likes of Gemini, Solactive, Kaiko, and US Bank, ensuringrobust index development, ETF structuring, and trusted custodysolutions.

The leadership team is composed of industry veterans, including CEORali Perduhova, who brings a decade of institutional financeexpertise, with her time spent at BMO Capital Markets and Wells Fargo.Cem Paya, Chief Technology Officer (CTO) brings experience in cryptoassets and digital assets securities. Cem served as Chief Information& Security Officer (CISO) at Brevan Howard, and Chief SecurityOfficer (CSO) at both Gemini and AirBnb. David Abner is Chairman ofthe Advisory Board. David brings ETF industry expertise from his rolesas CEO of WisdomTree Europe and Head of Business Development atGemini, along with his authorship of the ETF Handbook. Their combinedexpertise in blockchain, climate finance, and ETF markets positions7RCC to capitalize on digital asset investing. More information about7RCC can be found at www.7rccglobal.com.

The Transaction will form the basis of GOAT Industries’ enhancedfocus on investing in companies with exposure to unique cryptocurrencyand blockchain verticals. Integrating 7RCC into GOAT Industries’product portfolio represents a significant step in the Company’smission to provide shareholders and potential investors withworld-class exposure to growth-oriented assets.

Transaction Terms

Pursuant to the terms and conditions of the non-binding letter ofintent dated February 20, 2025 between 7RCC andthe Company, the Company will acquire all of the issued andoutstanding securities of 7RCC from the Vendors, in exchange for40,000,000 common shares in the capital of the Company (each, a“Company Share”), issuableto the Vendors, pro rata, onthe close of the Transaction at a deemed price of $0.30 per CompanyShare for an aggregate purchase price of $12,000,000 (the “Purchase Price”). The CompanyShares issuable to the Vendors will be subject to a 36-month voluntaryescrow (the “Escrow”). Inaddition to the escrow, all Company Shares issuable to the Vendors inconnection with the Transaction will be subject to a four month andone day hold period from the date of issue pursuant to NationalInstrument 45-106 – ProspectusExemptions (“NI45-106”).

The Transaction and terms thereto were settled pursuant to arm’slength negotiations. An advisory fee will be payable in connectionwith the Transaction (the “AdvisoryFee”), equal to 10% of the Purchase Price, issuable inCompany Shares. The Advisory Fee shall be subject to a four month andone day hold period under NI 45-106 and will be subject to thepolicies of the CSE and applicable Canadian securities laws.

The Transaction is subject to receipt of all necessary regulatoryapprovals, including, as applicable, all required filings with theCSE, completion of due diligence reasonable or customary in atransaction of a similar nature, and entering into a definitiveagreement. The Transaction will not constitute a fundamental change orchange of business, within the meaning of the policies of the CSE,however, as the Transaction will result in the Company issuing morethan 100% of the current issued and outstanding Company Shares,securityholder approval will be required pursuant to CanadianSecurities Exchange (“CSE”) Policy 4. It is anticipated that the Transaction, ifclosed, will trigger a business acquisition report under NationalInstrument 51-102 – ContinuousDisclosure Obligations.

Private Placement

The Company is also pleased to announce its intention to complete aprivate placement offering of units (each, a “Unit”) for a total target amountof up to $3,000,000 (the “Offering”). The Offering will consist of up to 10,000,000Units priced at $0.30 per Unit. Each Unit will be comprised of oneCompany Share and one half of one common share purchase warrant (eachwhole warrant, a “Warrant”), with each whole Warrant exercisable for a periodof 2 years at a price of $0.75 per Warrant. The Company and 7RCC willuse best efforts to appoint an agent or underwriter in connection withthe Offering.

The proceeds from the Offering will be used to fund the Transaction,to expand and develop the 7RCC business and for general corporate andadministrative purposes. All securities issued pursuant to theOffering are subject to a four-month and one day hold period from thedate of issue pursuant to NI 45-106. Finder’s fees may be paid toeligible persons in connection with the Offering.

Correction on Debt SettlementPricing

The Company previously announced on February 10, 2025, that it hadclosed certain debt settlement agreements in order to settleoutstanding debts owed to arms-length creditors. The Company wouldlike to clarify an clerical error contained in the press release, suchthat the press release should have read that the Company issued anaggregate of 600,000 units (“Units”) at a deemed price of $0.25 per Unit. Each Unitconsisted of one common share of the Company (“Common Share”) and one CommonShare purchase warrant (“Warrant”), with each Warrant being exercisable for oneCommon Share for a period of two years, at a price of $0.325.

ABOUT GOAT INDUSTRIES LTD.

GOAT is an investment issuer focused on investing inhigh-potential companies operating across a variety of industries andsectors. The goal of the Company is to generate maximum returns fromits investments.

For more information about the Company, please visithttps://www.goatindustries.co/. The Company’s final prospectus, financial statements andmanagement's discussion and analysis, among other documents, are allavailable on its profile page on SEDAR+ at www.sedarplus.ca.

ON BEHALF OF THE BOARD OF DIRECTORS

Chief Executive Officer Michael Leahy

Head Office Suite 2300, 550 Burrard Street,Vancouver, BC V6C 2B5 Telephone 1-204-801-3613

Website www.goatindustries.co

Email info@goatindustries.co

The CSE and Information Service Provider have notreviewed and does not accept responsibility for the accuracy oradequacy of this release.

Forward-Looking Information

This news release contains "forward-lookinginformation" within the meaning of applicable Canadian securitieslegislation, including in relation to the Company’s intention toobtain security holder approval for and implement the RevisedInvestment Policy. Generally, forward-looking information can beidentified by the use of forward-looking terminology such as"plans", "expects" or "does not expect","is expected", "budget", "scheduled","estimates", "forecasts", "intends","anticipates" or "does not anticipate", or"believes", or variations of such words and phrases or statethat certain acts, events or results "may","could", "would", "might" or "willbe taken", "occur" or "be achieved".Forward-looking information is subject to known and unknown risks,uncertainties and other factors that may cause the actual results,level of activity, performance or achievements of the Company, as thecase may be, to be materially different from those expressed orimplied by such forward-looking information. Although the Company hasattempted to identify important factors that could cause actualresults to differ materially from those contained in forward-lookinginformation, there may be other factors that cause results not to beas anticipated, estimated or intended. There can be no assurance thatsuch information will prove to be accurate, as actual results andfuture events could differ materially from those anticipated in suchstatements. Accordingly, readers should not place undue reliance onforward-looking information. Actual results and developments maydiffer materially from those contemplated by these statementsdepending on, among other things, the risks relating to theTransaction, 7RCC achieving expected results, the shareholders of theCompany approving the Transaction, the Offering. The Company does notundertake to update any forward-looking information, except inaccordance with applicable securities laws.

NOT FOR DISTRIBUTION TO UNITED STATESNEWS WIRE SERVICES

OR FOR DISSEMINATION IN THE UNITED STATES

Copyright (c) 2025 TheNewswire - All rights reserved.

Ethereum is up $18.59 today or 0.69% to $2728.59

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

Bitcoin mining shadow tenants leave Malaysian landlords with million-dollar electricity nightmares

Landlords across Malaysia are facing massive financial losses after their tenants illegally mined cryptocurrency to rack up electricity bills before leaving property owners to bear the cost.

In one case, a landlord identified as Jason was reportedly handed a 1.7 million Malaysian ringgit (about $382,000) penalty by electricity provider Tenaga Nasional Berhad (TNB) after a tenant stole electricity to power their secret crypto mining operations. After four years of legal battles, the fine was reduced to 825,000 ringgit ($185,722).

His ordeal began in July 2020 when he rented out his property to a tenant who claimed to work with computers. Three months later, the entire building suffered power outages due to illegally installed power cables used for crypto mining. When authorities discovered the theft, Jason was held liable, while the tenant had vanished.

Jason attempted to fight the fine in court, arguing that he was not responsible for his tenants illegal activities. But after two years of litigation, he lost the case, leaving him to deal with mounting legal fees and a 5% interest rate on the outstanding amount. Now, he is preparing to appeal.

Jasons case is not isolated. Forty-five homeowners and business operators have reported a combined 8.5 million ringgit ($1.9 million) in fraudulent electricity bills, with tenants using stolen identities to carry out illegal Bitcoin mining. Some only realized the deception after receiving notices from TNB, leaving them financially crippled.

One victim, a 57-year-old landlord who relies on rental income, now faces a 300,000 ringgit ($67,720) bill after his tenant used a fake identity to rent his property. Another victim was blindsided by a 73,000 ringgit ($16,386) bill and has already paid 70,000 ringgit ($15,756).

Malaysia has been grappling with the issue of stolen electricity, with TNB blaming crypto mining for the 441 million ringgit ($100 million) loss it has suffered from electricity theft since 2020.

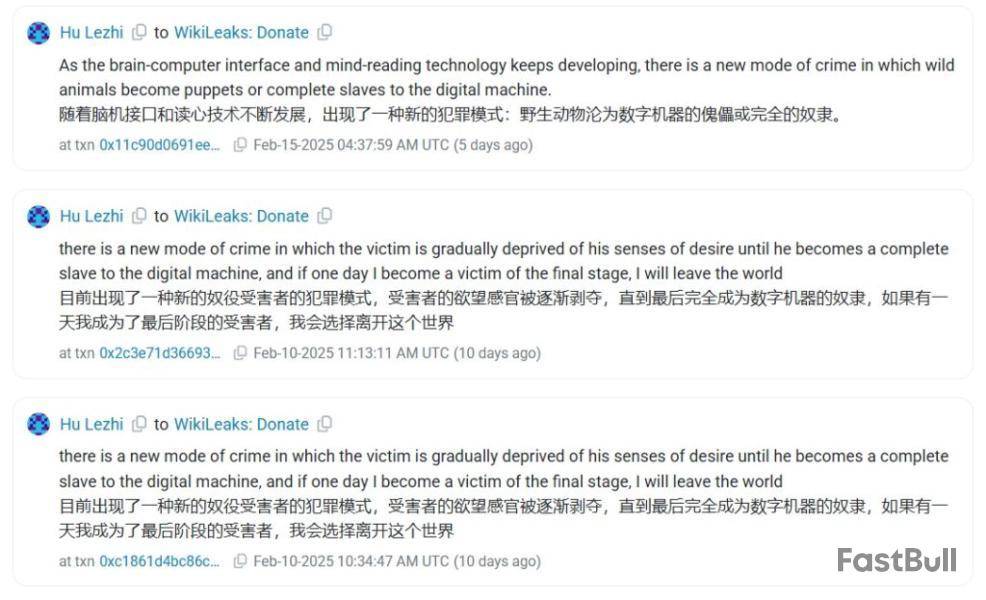

Chinese programmer burns $6.8M in ETH, claims brain-computer weapons control people

A Chinese programmer self-identified as Hu Lezhi has burned and transferred millions of dollars worth of Ether to publicize his wild claims that Chinese corporations and military forces are using “brain-computer tech to manipulate and control citizens.

Between Feb. 10 and Feb. 17, Lezhi transferred more than 2,553 ETH (worth $6.8 million at the time) to various addresses, including Ethereums burn address and WikiLeaks. His transactions contained onchain messages that state nano-computer chips and radio waves are being used to turn individuals into puppets or complete slaves to the digital machine.

Hus largest transactions included 500 ETH ($1.35 million) sent to a burn address, effectively removing the funds from circulation. He also donated 711.5 ETH ($2 million) to WikiLeaks across several transactions, claiming in a message that “brain-computer chips have been deployed militarily on a large scale.”

Among his allegations, Hu specifically called out Feng Xin and Xu Yuzhi, hedge fund executives at Kuande Investment, accusing them of using this technology to control employees. He went as far as to claim that the two executives themselves were victims of the same technology.

Hu described himself as a computer programmer who had only recently realized he was being monitored and manipulated his entire life. Their last message claims that they have completely lost their dignity as a human being. Hus Ethereum wallet has since remained inactive.

Neither Kuande Investment nor any Chinese authorities have publicly responded to Hus claims. Cointelegraph has reached out to Kuande Investment.

Read also FeaturesSinger Vrits fan-first approach to Web3, music NFTs and community building

Features DeFi abandons Ponzi farms for real yieldRobinhood to enter the Singapore crypto market via Bitstamp

Trading platform Robinhood is reportedly pushing into Singapores cryptocurrency market, aiming to roll out trading services through its Bitstamp subsidiary by late 2025.

The companys $200 million acquisition of Bitstamp, announced in 2024, is still awaiting final regulatory approval and is expected to close in 2025.

Meanwhile, Kraken is preparing to re-enter India, two years after being banned over Anti-Money Laundering violations. The shift comes as a senior Indian official signaled that the government is reassessing its stance on crypto, potentially clearing the way for offshore exchanges.

Coinbase is also eyeing a return, having previously exited when regulators cut off access to Indias Unified Payments Interface the countrys dominant financial rail, controlled by the Reserve Bank of India.

India had long restricted crypto firms from using RBI-linked services, arguing that digital assets lacked legal recognition. But with global regulations evolving, the country appears to be rethinking its approach, potentially reopening the market to major exchanges.

Read also Features NFT collapse and monster egos feature in new Murakami exhibition Features 7 ICO alternatives for blockchain fundraising: Crypto airdrops, IDOs & moreHong Kong turns on regulatory spurt on the global stage

Hong Kong is expanding its virtual asset regulatory framework, unveiling a new five-part initiative aimed at adjusting market policies, increasing liquidity and shaping the citys role in the global digital asset sector.

The Securities and Futures Commission has introduced the ASPIRe initiative, a strategy focused on market access, investor safeguards, financial products, regulatory infrastructure, and industry engagement. The announcement coincided with Consensus Hong Kong, a major crypto event where the city granted its 10th virtual asset trading platform license to Bullish, the parent company of CoinDesk, the events host.

The new framework explores the possibility of introducing regulated staking, derivatives trading, and margin lending for certain investors while reinforcing Anti-Money Laundering measures to align with global oversight standards.

The expansion comes as other financial hubs, including the US, Singapore and the Middle East, continue developing their own digital asset strategies. In the US, President Donald Trumps administration has taken a pro-crypto stance, shifting sentiment after years of regulatory uncertainty.

SFC Chief Executive Julia Leung argued that Hong Kong intends to offer more consistent regulation compared to the USs fragmented approach.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

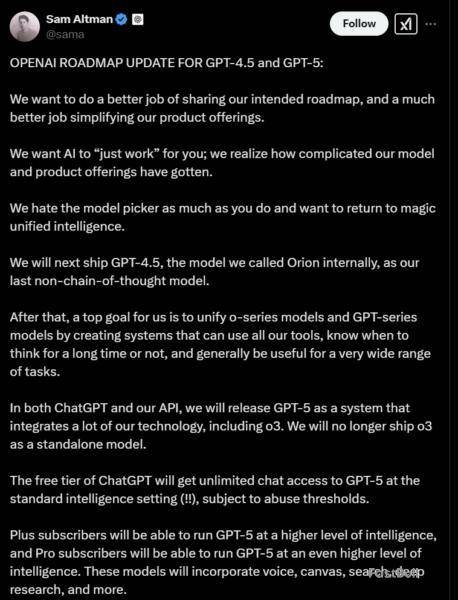

Engineers at Microsoft are boosting infrastructure capacity in preparation for the latest iterations of OpenAI’s large language models, the first of which could be implemented by the end of February.

Sources close to Microsoft informed Tom Warren of The Verge that the software giant is planning to host OpenAI’s newest GPT-4.5 as early as next week.

OpenAI CEO Sam Altman recently disclosed that the company plans to “next ship GPT-4.5,” but didn’t provide an exact date.

Although GPT-4.5 has been described as a “mid-generation” update, OpenAI has reportedly been training the model with synthetic data, which, according to IBM, can overcome data scarcity when training and fine-tuning AI models. OpenAI’s use of synthetic data to train GPT-4.5 was initially reported by The Information.

In addition to expecting GPT-4.5 any day now, The Verge’s source said Microsoft expects to receive the more powerful GPT-5 in late May.

Altman described GPT-5 “as a system that integrates a lot of our technology, including o3,” which refers to OpenAI’s latest reasoning model. On Jan. 31, the company released a smaller o3 model called o3-mini.

Microsoft currently hosts OpenAI’s models on its Azure platform. However, Microsoft clarified that the service does not interact with any tools operated by OpenAI, including ChatGPT.

Microsoft and OpenAI expanded their partnership last month through President Donald Trump’s $500 billion AI venture called Stargate.

OpenAI has also “made a new, large Azure commitment that will continue to support all OpenAI products as well as training,” Microsoft said.

AI race heats up

Since launching in November 2022, ChatGPT has set records as the world’s fastest-growing consumer software platform. By February 2025, it had amassed roughly 400 million weekly active users, which marked a 33% jump in less than three months, according to OpenAI’s chief operating officer Brad Lightcap.

This remarkable growth has allowed OpenAI to seek funding at a $340 billion valuation, according to CNBC.

However, competition is heating up with the recent launch of DeepSeek, an open-source AI model with Chinese origins that was developed at a tiny fraction of ChatGPT’s cost.

The launch of DeepSeek threatened the prevailing paradigm that OpenAI — and the United States — would remain the dominant player in the AI market.

Venture capitalist Marc Andreessen dubbed DeepSeek as “AI’s Sputnik moment,” which refers to a society’s realization that it needs to play catch up with rapid technological developments made elsewhere in the world.

Markets certainly reacted with that collective awe as tech stocks, Bitcoin (BTC) and the broader cryptocurrency market plunged in the wake of DeepSeek’s release.

Magazine: Train AI agents to make better predictions… for token rewards

Former FTX CEO Sam “SBF” Bankman-Fried has spoken out from prison about his political donations, citing a political shift following high-profile contributions during the 2020 United States elections.

In an interview with The New York Sun, SBF said he gave money to the Democratic Party in the 2020 election to prevent the political faction from “Becoming the party of Bernie Sanders” — a Democrat Senator from Vermont famous for his socialist views.

The former FTX executive briefly outlined his rightward political shift over the last several years. SBF told the interviewer:

“The Biden administration was just incredibly destructive and difficult to work with, and frankly, the Republican Party was far more reasonable,” SBF continued. “I became really frustrated and disappointed with what I saw of the Biden admin and the Democratic Party.”

Bankman-Fried reportedly donated roughly $40 million directly to political candidates and PACs in 2022 before FTX’s downfall, seeking to influence the US government’s policies on crypto. The comments come amid a clemency push by the former executive’s parents, Joseph Bankman and Barbara Fried, to secure a pardon for their son from Republican President Donald Trump.

SBF’s chances of a pardon are slim

Bankman-Fried was sentenced to 25 years in prison on March 28, 2024, for his role in the collapse of the FTX exchange — a now-defunct centralized cryptocurrency trading platform.

The “Punishment must fit the seriousness of the crime, and this was a serious crime,” Judge Lewis A. Kaplan said upon issuing the sentence.

Judge Kaplan added that SBF was “evasive” and “hair-splitting” during the trial. “I have been doing this job for close to 30 years. I have never seen a performance like that,” Kaplan continued.

According to William Livolsi, executive director of White Collar Support Group — an organization that advocates for balanced sentences for convicted individuals — SBF’s chances of obtaining a pardon are slim.

The advocate said that the presidential pardon of Silk Road founder Ross Ulbricht was a high-profile campaign promise made by President Donald Trump during the 2024 election — a luxury that SBF does not have.

Livolsi added that differences between the individual cases and the extremely harsh sentence imposed on Ross Ulbricht also differentiate the two situations.

The PEPE price is currently trading within a Falling Wedge pattern, a historically bullish indicator that suggests an imminent breakout. A crypto analyst predicts that a decisive move above key resistance levels could trigger a 150% rally towards new all-time highs for PEPE.

Key Resistance To Ignite PEPE Price Rally

Over the past few weeks, Pepe, the popular frog-themed meme coin, has been stuck in a downtrend, consistently rejecting off of a descending resistance trendline. The meme coin had initially experienced significant gains earlier this year. However, with the recent volatility and the decline in the broader market, PEPE and many other cryptocurrencies have recorded severe losses.

Despite the bearish performance, a pseudonymous TradingView analyst called ‘MyCryptoParadise’ has shared a bullish forecast for the PEPE price. The analyst projects that it could experience a massive 150% price surge, pushing it to $0.00003 and marking new all-time highs.

For this prediction to become a reality, Pepe will have to confirm a price reversal by breaking above the descending resistance and claiming a new support, as seen on the chart. The TradingView analyst has asserted that Pepe must surpass the $0.000015 resistance, claiming it as new support and a potential launch pad to the bullish $0.00003 target.

While breaking above a key resistance may seem like an easy feat, the PEPE price has failed to do so over the past few weeks. The meme coin has rejected multiple breakout attempts; however, technical indicators reveal that Pepe’s current price fundamentals remain bullish.

Notably, Pepe is trapped inside a Falling Wedge on its price chart, a pattern known to precede significant upward momentum once resistance is broken. If demand from buyers successfully pushes PEPE above its $0.000015 resistance level, the analyst believes that a parabolic rally may be in store for the meme coin.

Pepe also forms a bullish divergence on the histogram in its chart, signaling a possible shift in momentum to the upside. The analyst has indicated that for Pepe to reach its projected ATH target, bulls will have to take control, helping to push the meme coin above the Falling Wedge pattern.

Currently, the asset is sitting at $0.000006 and $0.000012, where buyers have historically stepped in to defend prices and avoid further breakdowns. A surge from its current price of $0.00000945 to $0.00003 would represent an over 150% increase.

Bearish Scenario Unveiled

While he shared his bullish projection for the PEPE price, the TradingView analyst also presented an alternative bearish outlook for the meme coin. The analyst urged traders to remain cautious, as failing to hold the $0.000006 and $0.000012 could invalidate the previous bullish setup.

The analyst predicts that if the meme coin fails to break this zone, it could trigger increased downside pressure, exposing the meme coin to more risks and possibly triggering a deeper sell-off that would put bears in complete control.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up