Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Federal Reserve is expected to announce the start of its interest rate cut cycle tomorrow, but analysts warn the real market driver will not be the cut itself. Instead, attention is on the Dot Plot the Fed’s projection of how many cuts policymakers expect in 2025, 2026, and 2027.

“The market will not react to today’s rate cut; it will react to the Dot Plot,” analyst Catalina Castro explained.

Why the Dot Plot Matters for Bitcoin

In June, most Fed members projected two cuts for this year, one for 2026, and one for 2027. If tomorrow’s projections reveal more cuts ahead, it could spark a bullish reaction in both stocks and cryptocurrencies.

“Markets don’t react to the present; they react to expectations. The 0.25% cut is already priced in,” Castro noted. “If the Fed signals deeper cuts, it’s giving the green light to liquidity.”

Historical Patterns Favor Bulls

History supports the bullish case. Since 1980, there have been 20 rate cuts when the S&P 500 was near record highs. In every instance, the index posted gains over the next year, with an average return of +13.9%. In 1996, in a similar setup, the S&P surged +22%.

JP Morgan added that when the Fed cuts rates while the S&P 500 trades within 1% of an all-time high, the average one-year gain is +15%. However, short-term volatility often follows: “Stocks end lower in the first month 50% of the time,” Castro cautioned, suggesting any dip could be a buying opportunity.

Liquidity Triggers: Stablecoins, Money Markets, and QT

Beyond the rate decision, several liquidity drivers could fuel risk assets:

Adding fuel to the mix, the AI revolution remains a powerful macro theme.

Castro emphasized, “The biggest revolution since the ‘90s, combined with an expansive Fed, could be pure dynamite for risk assets.”

FAQs

What is the Fed Dot Plot and why does it matter?The Dot Plot is the Fed’s projection of future interest rate changes. It matters more than the actual cut because markets react to future liquidity expectations, not priced-in moves.

How do Fed rate cuts affect Bitcoin?Rate cuts boost liquidity and weaken the dollar, making Bitcoin more attractive. Historical data shows risk assets like crypto often rally post-cut, especially with bullish Dot Plot signals.

What is the historical performance of stocks after rate cuts?Since 1980, when the S&P 500 hit records at the time of a cut, it gained an average of +13.9% over the next year, though short-term volatility is common.

XRP is consolidating above $3 as buyers take a pause. What’s next for Ripple’s token?Ripple (XRP) Price Predictions: Analysis

Key Support levels: $3

Key Resistance levels: $3.2, $3.6, $41. XRP Reclaims $3

In the past week, buyers managed to take XRP above $3 and consolidate the recent gains. This is excellent news, especially because sellers tried to push the price under, but failed. However, this success appears fragile considering the low buy volume after such a move.2. Momentum Consolidates

If we look at the price action since July, we can see that XRP has been hovering around $3. This period could be interpreted as a significant and long consolidation before the next major move. The current resistance is at $3.2 and would have to break to put buyers at an advantage.3. Volume Continues to Fall

While the asset managed to move above $3, the volume did not show excitement when it happened. On the contrary, the volume has been falling for months, and this shows a lack of interest in this cryptocurrency. This also explains why momentum has been relatively flat lately.

MYX Finance has been making waves, and today’s surge is hard to ignore. The token’s price is up 41.47% in the last 24 hours, even though it’s still down 14.65% over the week. With a market cap of $3.09 billion and a massive 133% spike in trading volume, MYX has stepped in as the top gainer among the top 100 cryptos.

What caught my eye, and everyone’s, isn’t just the price action but the fundamentals driving it. MYX’s Matching Pool Mechanism is a clever way of tackling slippage, one of the biggest headaches in decentralized trading. Add in gasless trades across 20+ chains and automatic fee discounts, and you get a platform that feels genuinely user-first. That’s why its latest move higher feels more than just hype.

Whales the Biggest Drivers?

Whale activity has been a major catalyst behind MYX’s price surge. Wallets holding over $1M in MYX increased their positions by 17% last week, accumulating 855,419 tokens. Since 80% of the 1B supply remains locked, this squeeze on circulating supply makes MYX highly sensitive to concentrated buying. While this builds upward pressure, it also raises volatility risks if these large holders decide to trim positions.

Another key driver has been liquidations. Over $53 million worth of shorts were wiped out, amplifying bullish momentum and accelerating the breakout. On top of that, excitement around MYX’s upcoming V2 upgrade is building. The upgrade aims to deliver zero-slippage trading and improved cross-chain functionality, reinforcing investor confidence in the project’s long-term potential.

MYX Price Analysis

MYX is currently trading at $15.36 after bouncing sharply from yesterday’s $10.53 low. It touched $16.47 earlier in the session, inching closer to its all-time high of $19.01 set just six days ago. The RSI sits at 69.8, nearing overbought territory, while the Bollinger Bands suggest high volatility ahead.

Support is forming near $11.26, while the immediate floor sits at $10.77. If MYX slips below that, it risks further downside toward $8.39. On the flip side, resistance lies at $18.64, with a breakout opening the door toward $23.21.

FAQs

Why is MYX Finance price surging today?MYX is up 41% due to whale accumulation, $53M short liquidations, and excitement for its upcoming V2 upgrade featuring zero-slippage trading and cross-chain improvements.

Is MYX Finance a good investment?With strong fundamentals like gasless trading and 80% locked supply reducing sell pressure, MYX has potential, but high volatility requires careful risk management.

What is the price prediction for MYX?If it breaks $18.64 resistance, MYX could target $23+. Support sits at $10.77; a break below may test $8.39. RSI at 69.8 suggests caution near-term.

ADA was rejected by the $0.90 resistance. Can buyers push back?

Key Support levels: $0.77, $0.70

Key Resistance levels: $0.90, $11. Resistance Rejects Buyers

This week, ADA made an attempt at breaking the $0.90 resistance, but was rejected, and the price is now hovering under this key level. This failure to move higher can be interpreted as bearish and may encourage sellers to push this cryptocurrency back to its support at $0.77.2. Momentum is Stalling

With higher price levels out of reach, Cardano is consolidating under the aforementioned $0.90 level. The asset action also appears to be forming a pennant that could indicate a pause in the current uptrend until buyers gather the strength necessary to break above the key resistance.3. RSI Lower Highs

Since July, the RSI has been making lower highs. This is a clear downtrend, which highlights a bearish divergence when compared to the price that made a higher high in August. That’s a warning signal that could take ADA into lower price levels if bulls fail to reclaim $0.90 soon.

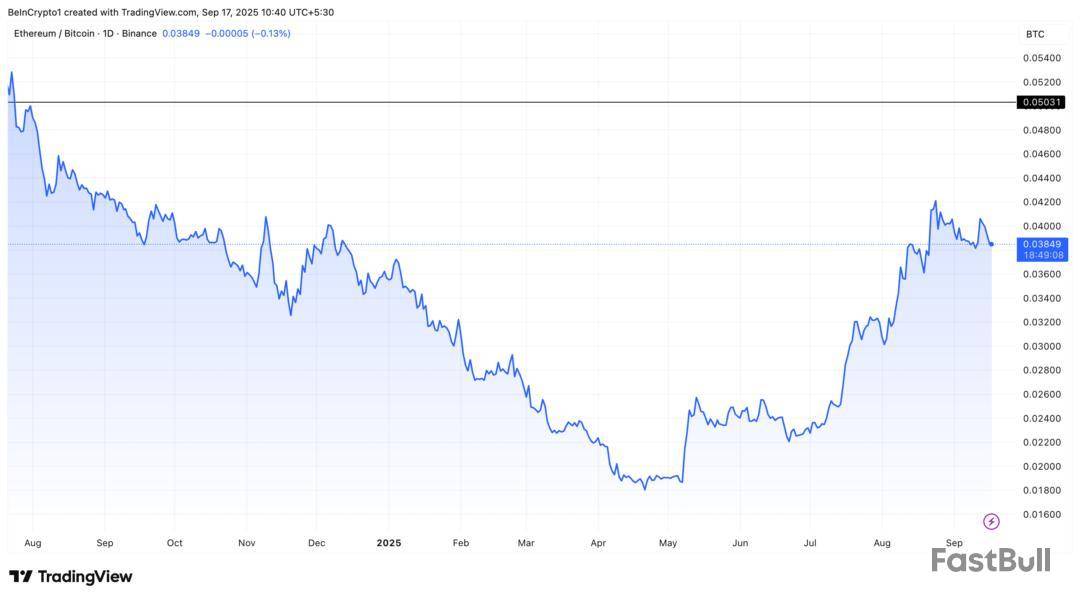

The ETH/BTC ratio, a key measure of Ethereum’s strength against Bitcoin , has stayed below 0.05 for more than a year, highlighting Ethereum’s struggle to gain ground against the largest cryptocurrency even during what many analysts described as an ‘Ethereum season.’

According to Bitget’s Chief Analyst, Ryan Lee, Bitcoin’s role as the market’s ‘anchor asset’ explains why Ethereum continues to lag. He also shared with BeInCrypto what conditions would be needed for ETH to close the gap finally.

Why the ETH/BTC Ratio Remains Depressed After a Year

It is worth noting that the ETH/BTC ratio serves as a barometer for investor sentiment. When the ratio rises, it suggests that investors are favoring Ethereum over Bitcoin, often due to strong demand from developments such as staking, DeFi activity, or broader optimism in altcoins.

Conversely, when the ratio falls, it indicates Bitcoin is outperforming. This may reflect risk-off sentiment, where investors prefer the relative safety of Bitcoin or expect stronger returns from it.

In April, BeInCrypto highlighted that the metric fell to a 5-year low amid ETH’s price struggles. However, what came after was a notable recovery. The ratio even went as high as 0.043 on August 24, coinciding with ETH’s all-time high (ATH).

Still, despite record ETH performance, the ratio could not cross the 0.05 threshold, a level last seen in August 2024. At the time of writing, the metric had fallen slightly to 0.038.

But what’s behind the lag? Bitget’s Chief Analyst Ryan Lee observed that although over $4 billion poured into Ethereum exchange-traded funds (ETFs) in August, the asset’s relative underperformance emphasizes Bitcoin’s greater appeal to cautious investors amid an uncertain macro environment.

This reinforces Bitcoin’s status as the industry’s ‘anchor asset.’ Meanwhile, Ethereum’s long-term potential is tied to the expanding adoption of its DeFi and tokenization ecosystem.

“The ETH/BTC ratio remaining below 0.05 for over a year, even as Ethereum hits record highs and attracts billions in ETF inflows, underscores Bitcoin’s enduring position as crypto’s ultimate store of value,” Lee told BeInCrypto.

The analyst explained that Ethereum’s chances of narrowing the valuation gap may depend on quarterly ETF inflows exceeding $9 billion, the smooth implementation of upcoming network upgrades, and substantial growth in tokenized assets and DeFi volumes.

“Such catalysts would give ETH a platform to outperform BTC, complementing Bitcoin’s store-of-value narrative with utility-driven demand,” he added.

Lee added that broader macro conditions will be crucial in shaping the market outlook. Today, a highly expected 25-basis-point rate cut from the Federal Reserve would lower borrowing costs and inject liquidity, creating a supportive environment for risk assets.

In such a scenario, Bitcoin could move toward the $150,000–$200,000 range by year-end, while Ethereum might rise to $5,800–$8,000, driven by ETF inflows and continued network expansion.

“Together, these trends reflect a maturing market where Bitcoin and Ethereum drive industry growth in tandem, provided inflation stays contained and no major geopolitical shocks disrupt sentiment,” Lee mentioned to BeInCrypto.

ETH/BTC Ratio at a Crossroads: Altcoin Season Ahead or Bearish Breakdown?

He suggested the rally is still intact. Yet, the analyst anticipates Bitcoin will take the lead for a while before Ethereum picks up again, with the next leg higher likely beginning around late October or early November.

Another analyst drew parallels to the 2021 cycle, when similar ETH/BTC formations heralded an altcoin season.

However, not all views are bullish. Analyst Colin Talks Crypto warned of a forming head-and-shoulders pattern, a setup typically seen as bearish. If confirmed, this could point to weakening momentum and the possibility of a trend reversal, signaling that Ethereum may lose ground against Bitcoin in the near term.

Thus, the ETH/BTC ratio remains at a crossroads. While ETF inflows, DeFi growth, and macro liquidity could provide Ethereum the momentum to challenge Bitcoin’s dominance, chart patterns and investor caution suggest risks remain. For now, the ratio reflects a market still weighing whether Ethereum’s utility can overcome Bitcoin’s anchor role as the crypto industry’s store of value.

A new meme coin from China, Pudgy Pandas ($PANDA), raised over $300K in one day on presale, gaining significant attention in the Asian crypto market via social platforms like WeChat.

With a real-world cause (#FreeThePandas campaign) fuelling its momentum, this new meme coin on presale proves there’s room for more at the party

Pudgy Pandas challenges the Pudgy Penguins ($PENGU) franchise, which has dominated the year so far with a market cap of over $2B.

Speaking of, the $PENGU ETF with the SEC, as well as the $DOGE ETF, signal the rise of meme coins as serious investment products.

That, combined with the growing buzz around projects like Pudgy Pandas, and Pudgy Penguins, is spilling over into newer projects, with degens hunting for the next breakout token.

Maxi Doge ($MAXI) is pumped up and ready to ride this wave, already soaring past $2.2M in its presale.

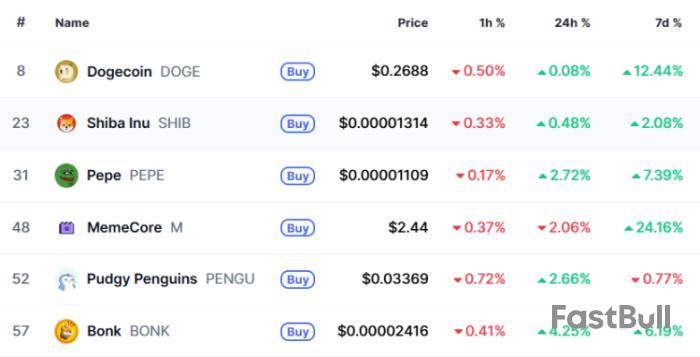

Meme Coin Mania Isn’t Stopping – Here Are the Tokens Degens Are Watching Now

The meme coin market has surged over the past seven days, with several tokens reaching new highs. Dogecoin led the market with a 12.3% increase, followed by Pepe at 5.27%, signaling that the major meme plays still command the spotlight.

In the lower cap range, MemeCore exploded by 20%, Bonk saw a 4% gain, and Pudgy Penguins inched up by +0.06%, highlighting how degens may be piling into newer, high-volatility tokens.

Riding the meme coin wave, here are the top meme coins that our experts believe could surge in value in 2025.

Historically, meme coins have shown the potential to deliver gains ranging from 10x to 100x during bullish periods.

This is particularly true when investors enter early in a project’s cycle, as seen with the Maxi Doge ($MAXI) presale, which is drawing significant attention from early adopters eager to capitalize on the current meme coin mania.

Meme Coin Frenzy Pushes Maxi Doge Presale to New Heights

Maxi Doge ($MAXI) is a high-octane trading meme token built for ultra-leveraged strategies. The token rewards traders who love to time entries, ride market swings, and turn each green candle into an opportunity for massive gains.

Besides high-leverage plays and relentless market action, here’s why $MAXI could be the next moonshot bag:

Plans for integration with larger DeFi platforms, including swaps, liquidity, and partner events, as the ecosystem expands.

Maxi Doge is flexing hard right now. At just $0.0002575 per token, the presale has already raised over $2.2M; though the next price surge is set to occur once it reaches $2.4M, most likely tomorrow.

The $MAXI vibe is MAX RIPPED. MAX GAINZ. MAX MENTALITY – a mantra so strong it;s seen some whales drop as much as $37K on $MAXI. Pure meme-fuelled early entries like this are where the real degens play, which can turn them into mega moonshots. Feeling the FOMO? If you ape in with $500 today, you’ll get about 1.94M $MAXI tokens plus an additional ~2.79M tokens in staking rewards at 144% APY p/a. That means your buy could stack serious passive gains, even before the next pump kicks in

With over $5.2B $MAXI already staked, the community is clearly riding this bull wave. If meme coin momentum keeps raging, $MAXI could be the next crypto to explode.

Bulk up on the $MAXI presale before the next pump.

This is not financial advice. The cryptocurrency market can be highly volatile and speculative. Please do your own research before making any investments.

Authored by Aaron Walker, NewsBTC – [url]

0735 GMT - Bitcoin rises to a nearly four-week high as markets bet on the Federal Reserve kick-starting consecutive interest-rate cuts ahead of Wednesday's policy decision. The Fed is widely expected to cut rates by 25 basis points in a decision at 1800 GMT followed by further cuts. The prospect of policy easing supports risky assets, including cryptocurrencies. The market is focused on how much weight Fed Chair Jerome Powell puts on the recent slowdown in the labor market versus inflation risks and uncertainty surrounding economic projections, Jefferies economist Mohit Kumar says in a note. There could also be some policymakers calling for larger rate cuts, he says. Bitcoin rises to a high of $117,308, LSEG data show.(renae.dyer@wsj.com)

0732 GMT - Yields on U.K. government bonds fall after U.K. data showed inflation remained high but services inflation decelerated. The annual headline inflation for August remained unchanged at 3.8% while annual services inflation slowed to 4.7% from 5.0% in July. Although inflation remains relatively elevated, the downward movement raises the possibility of the Bank of England cutting interest rates in the last quarter of 2025, EFG Asset Management's Joaquin Thul says in a note. The 10-year gilt yield falls 2 basis points to last trade at 4.626%, Tradeweb data show. (miriam.mukuru@wsj.com)

0723 GMT - The dollar edges higher but hovers near two-and-a-half-month lows as investors brace for a widely-anticipated interest-rate cut from the Federal Reserve. The market prices a 97% chance of the Fed cutting rates by 25 basis points and a 3% chance of a 50bp cut in a decision at 1800 GMT, LSEG data show. A larger rate cut would put significant pressure on the dollar, Commerzbank's Thu Lan Nguyen says in a note. This is because inflation is rising and a larger rate cut could raise concerns that aggressive monetary easing is being pursued due to political pressure, she says. The DXY dollar index rises 0.1% to 96.745 but stays near a low of 96.556 reached Tuesday. (renae.dyer@wsj.com)

0712 GMT - Eurozone government bond yields edge marginally lower after market opening with focus on German and Greek bond issuance and the Federal Reserve's policy decision. Germany will tap 2048- and 2056-dated Bunds, while Greece will reopen a 2035-dated bond. The 10-year German Bund yield falls 0.7 basis points to 2.690%, while Greece's 10-year bond yield declines 1.9 basis points to 3.338%, according to Tradeweb. For German bonds, markets also await the German Finance Agency's quarterly borrowing revision on Thursday, with a potential upward revision of the preliminary quarterly issuance target. (emese.bartha@wsj.com)

0658 GMT - Sterling falls marginally against the dollar and stays higher versus the euro, showing little reaction after U.K. inflation data came in slightly lower than expected. Inflation held at 3.8% year-on-year in August, below the 3.9% expected by economists in a WSJ survey but well above the Bank of England's 2% target. Core inflation eased to 3.6% from 3.8%, as anticipated. There's still "little doubt" the BOE will leave interest rates unchanged on Thursday, Aberdeen economist Luke Bartholomew says in a note. Food price growth remains elevated and inflation could rise in the near term, he says. Sterling falls to $1.3637 against a stronger dollar, compared to $1.3647 before the data. The euro falls 0.1% to 0.8688 pounds, little changed after the data. (renae.dyer@wsj.com)

0604 GMT - Yields on U.S. Treasurys are stable in Asian trade as markets await the Federal Reserve's rate decision, most likely a 25-basis-point reduction. "The probability is very high that the Fed will cut by 25 basis points tonight, and a 50-basis point cut cannot fully be ruled out," says SEB Research's FX and fixed income strategist Amanda Sundstrom in a note. SEB expects the majority of FOMC to vote for 25-basis-point steps and that Fed Chair Jerome Powell will signal that there is scope for another cut at the next meeting, in October, the strategist says. The two-year Treasury yield trades at 3.507%, the 10-year yield is at 4.023%, while the 30-year yield trades at 4.643%, according to Tradeweb. (emese.bartha@wsj.com)

0559 GMT - There are worries about a repeat of September 2024 when longer-maturity Treasurys yields rose after the Federal Reserve's larger-than-usual 50-basis point rate cut, says Julius Baer's Dario Messi in a note. However, the risks of that repeating are limited this time around, says the head of fixed income. Despite some valid arguments, the current starting point offers more cushion against such a development and risks are more limited at this point, Messi says. The 10-year Treasury yield is currently higher than it was in Sept. 2024 when the Fed started its rate cuts. (emese.bartha@wsj.com)

0534 GMT - A rate-cutting environment is potentially good news for those invested in U.S. bonds through globally diversified fixed income portfolios, says Insight Investment's Harley Bradley in a note. The Federal Reserve is set to cut interest rates on Wednesday, even as tariffs could still lead to higher inflation, the co-head of global rates says. Given relatively stubborn inflation in the U.S., markets will be closely watching the Fed's latest 'dot plot' projections for future rate cuts beyond September, he says. "In our view, while inflation could complicate the outcome, we believe [the] central bank will be prepared to 'look through' higher than target inflation to protect the labor market." (emese.bartha@wsj.com)

0503 GMT - The Malaysian government is expected to narrow the fiscal deficit to 3.6% of GDP in its 2026 budget, from an estimated 3.8% in 2025, UOB economists Julia Goh and Loke Siew Ting say in a note. No new broad-based taxes are expected, but selective increases in indirect taxes, such as sin taxes and stamp duties, are possible, and a carbon tax is set to be introduced in 2026, they say. Higher government spending to ease living costs will offset the revenue gains, they reckon. The expansionary fiscal stance will continue, supported by fiscal reforms, alongside accommodative monetary policy, they add. UOB expects a GDP growth target of 4.5%-5.5% for 2026, compared with an estimated 4.0%-4.8% in 2025. The budget is due to be presented to the Parliament on Oct. 10. (yingxian.wong@wsj.com)

0320 GMT - Indonesia's recent fiscal measures could lead to BofA Securities raising its growth estimates if executed effectively. BofA Securities currently projects growth of 5% for Indonesia in 2025 and 5.2% for 2026. A special ministerial team is fast-tracking flagship programs, alongside fiscal measures worth 16 trillion rupiah targeting low-income households, gig workers and the tourism sector in 4Q, economists Kai Wei Ang and Rahul Bajoria say in a note. The finance ministry has deployed 200 trillion rupiah of excess cash to five state-owned banks. Combined with Bank Indonesia's rate cuts, this could lower lending rates, though overall loan growth may take time to pick up as companies remain cautious. Plans for a separate revenue agency are advancing and fiscal legislation could be updated next year, keeping investors and credit rating agencies closely watching fiscal developments, they add. (yingxian.wong@wsj.com)

0306 GMT - August's export slump is unlikely to push the Monetary Authority of Singapore into further easing, Barclays economist Brian Tan writes in a note. The August print "remains one data point in a year when the NODX data has been quite volatile," Tan says. With the October policy review approaching, the data doesn't provide enough evidence that the output gap will turn significantly negative in 2026 unless the global economic outlook worsens. Barclays expects MAS to leave policy unchanged in October.(amanda.lee@wsj.com)

0247 GMT - The Bank of Japan's communication at this week's meeting may stoke expectations of a rate increase in October, SMBC Nikko Securities' Financial Market & Economic Research team says in a recent note. Although a change in the policy rate is unlikely at this week's meeting, the BOJ could structure its communication to instill such rate-hike prospects, while noting that it's monitoring factors including downward pressure on the yen from U.S. policy developments, the team says. Meanwhile, the press conferences by candidates for the Liberal Democratic Party's leadership election are expected, which may set the stage for further steepening of the JGB yield curve if candidates signal potential for future fiscal expansion, the team adds. (ronnie.harui@wsj.com)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up