In today’s fast-moving financial markets, the ability to test strategies in advance and sharpen trading skills often determines a trader’s long-term success. To help traders optimize strategies efficiently and with minimal risk, FastBull introduces Bar Replay, a FREE professional backtesting and training tool that combines historical market data, multi-asset coverage, economic calendar events, and simulated trading.

This article provides a comprehensive overview of FastBull Bar Replay, its training modes, use cases, and the key benefits for traders.

What is FastBull Bar Replay?

FastBull Bar Replay is a trading practice and strategy validation tool built on historical market data. It allows traders to:

● Replay historical market candles as if trading live

● Open, modify, and close trades in a simulated replay account

● Test strategies, patterns, and scenarios in a risk-free environment

Key benefits include:

● Realistic market simulation: Make trading decisions as if the market were live

● Zero-risk environment: All trades are executed in a replay account, leaving real funds unaffected

● Robust strategy testing: Perfect for strategy validation, pattern training, and extreme market scenarios

● Efficient practice: Adjust replay speed to save time while maximizing learning

This makes FastBull Bar Replay a core tool for daily practice and strategy optimization.

1. Training Modes: Flexible Access to Historical Data

FastBull offers three candle selection modes to accommodate different training needs.

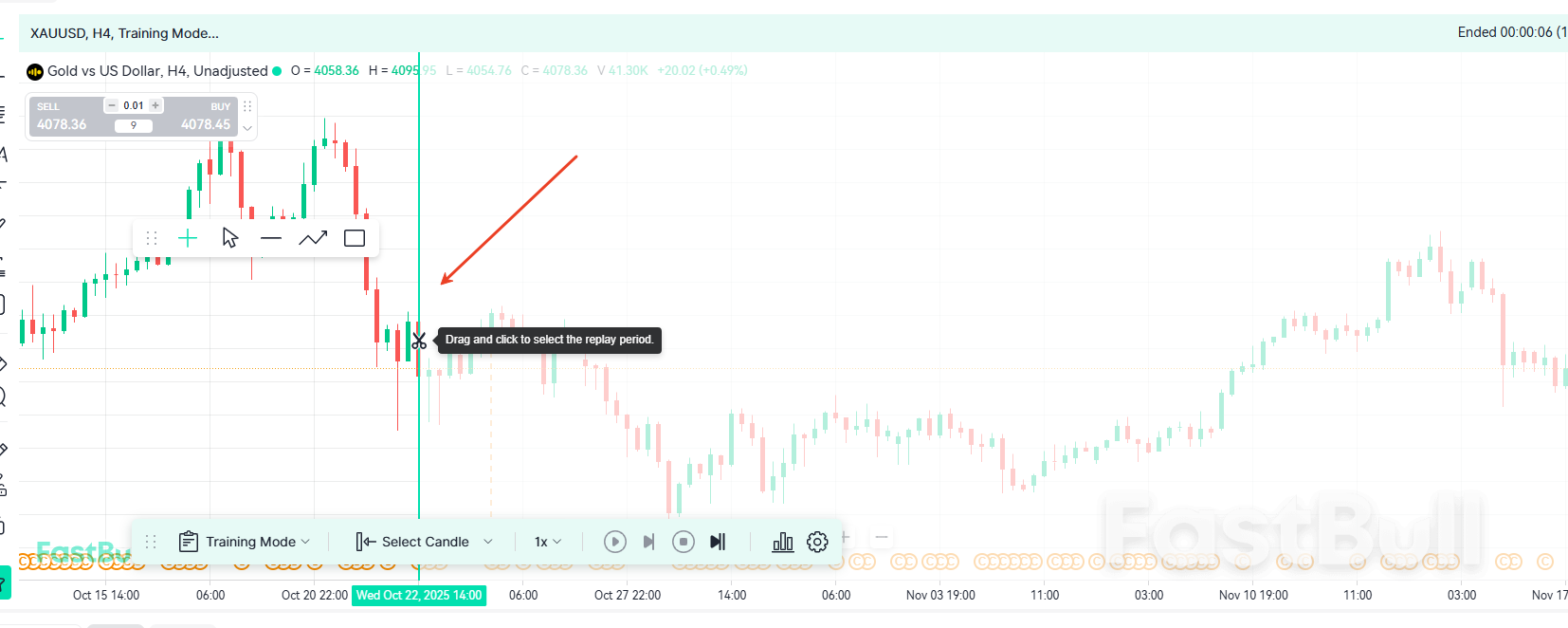

Scissors Mode: Replay from the Latest Data Backwards

● Manually drag candles to any past point

● Precisely locate target periods using date prompts

● Simulate “blind testing” for enhanced decision-making and real-time reaction

Ideal for chart-reading practice.

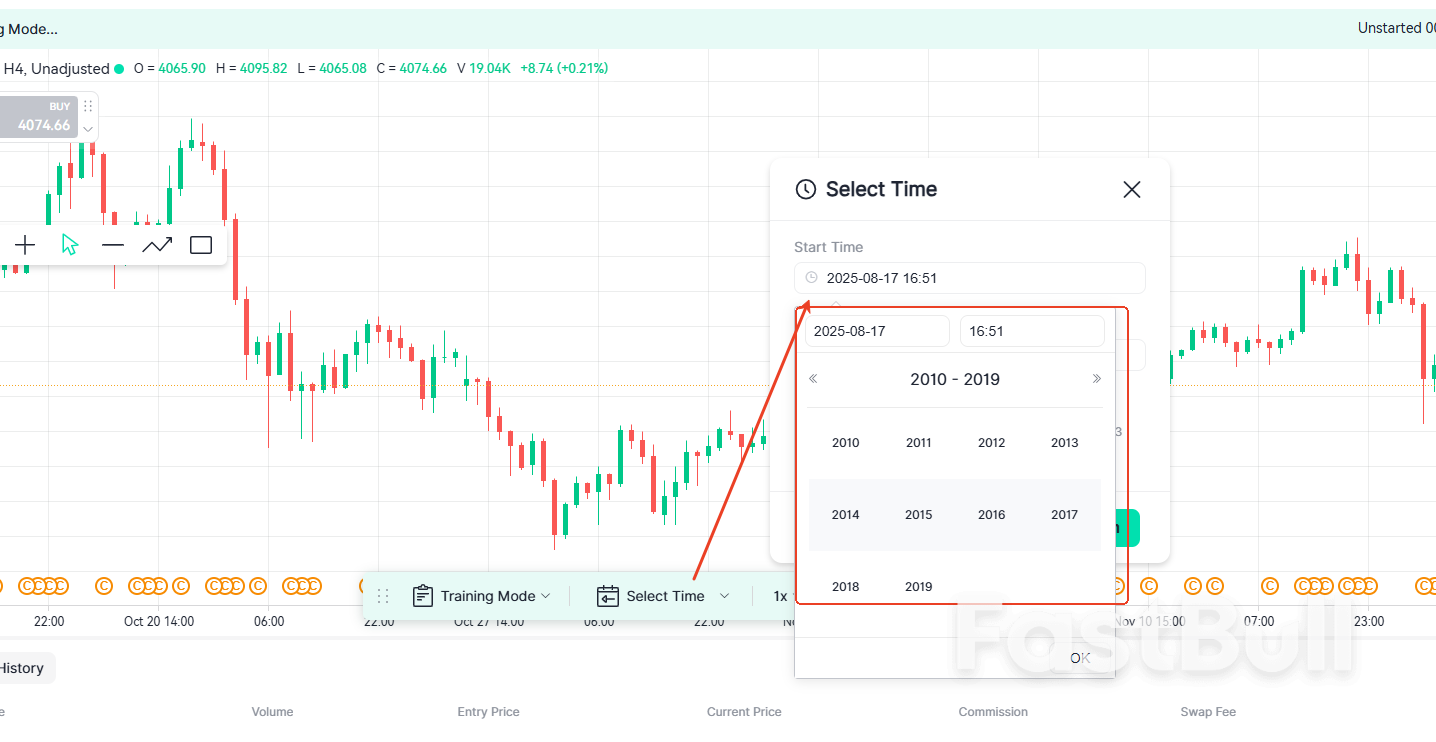

Time Filter Mode: Select Any Timeframe

● Supports all timeframes from minutes to long-term periods

● Minute charts allow scalpers to train high-frequency strategies

● Daily and longer timeframes allow multi-year backtesting for trend and swing strategies

● No need to worry about exact years—simply select the period and timeframe you want to practice

Suitable for all trading styles.

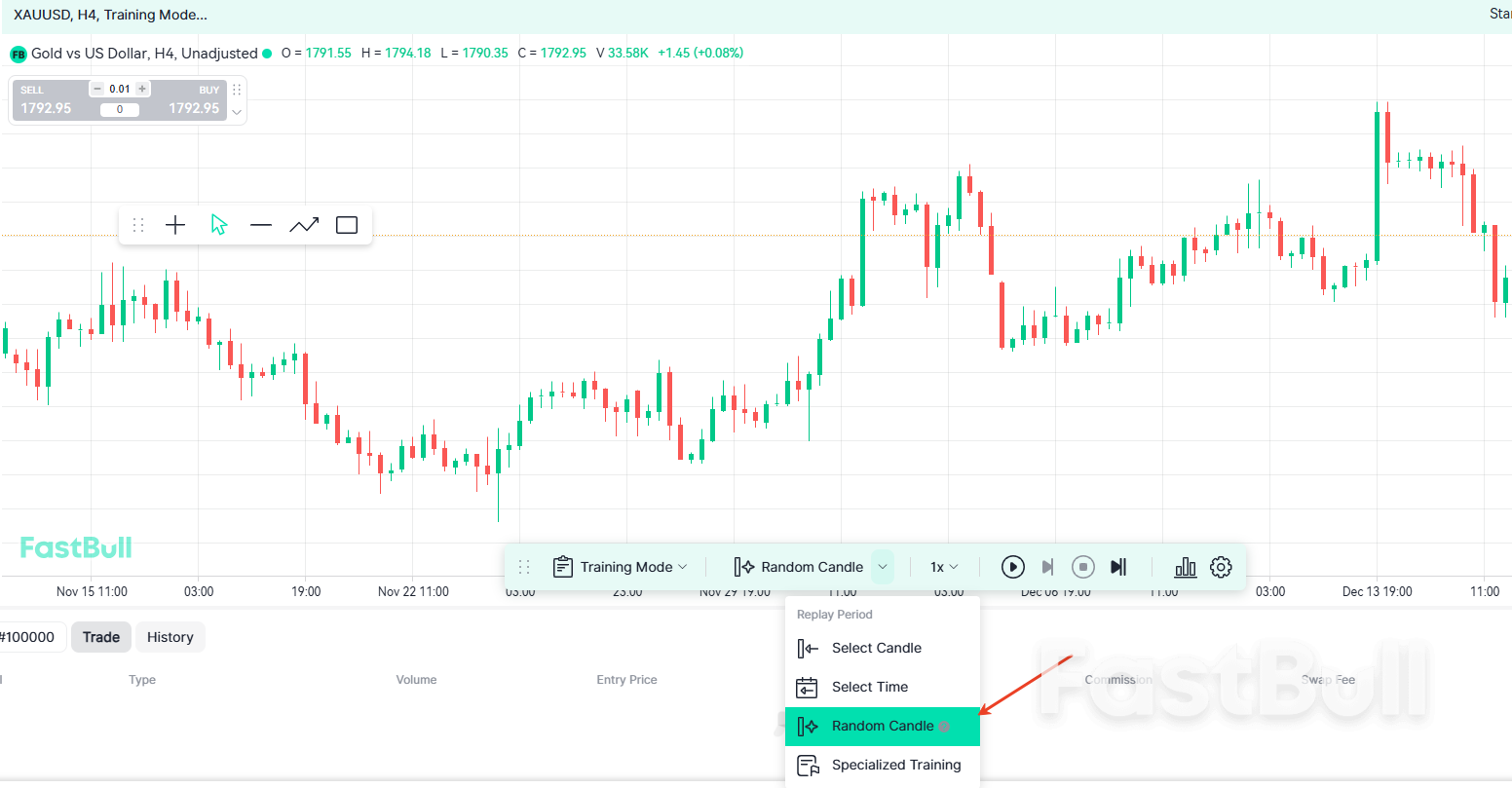

Random Candle Mode: Automatic Selection

● The system randomly selects a segment of historical data

● Eliminates the bias of knowing future price movements

● Strengthens real-time decision-making and trading intuition

A standard method used by professional traders for long-term practice.

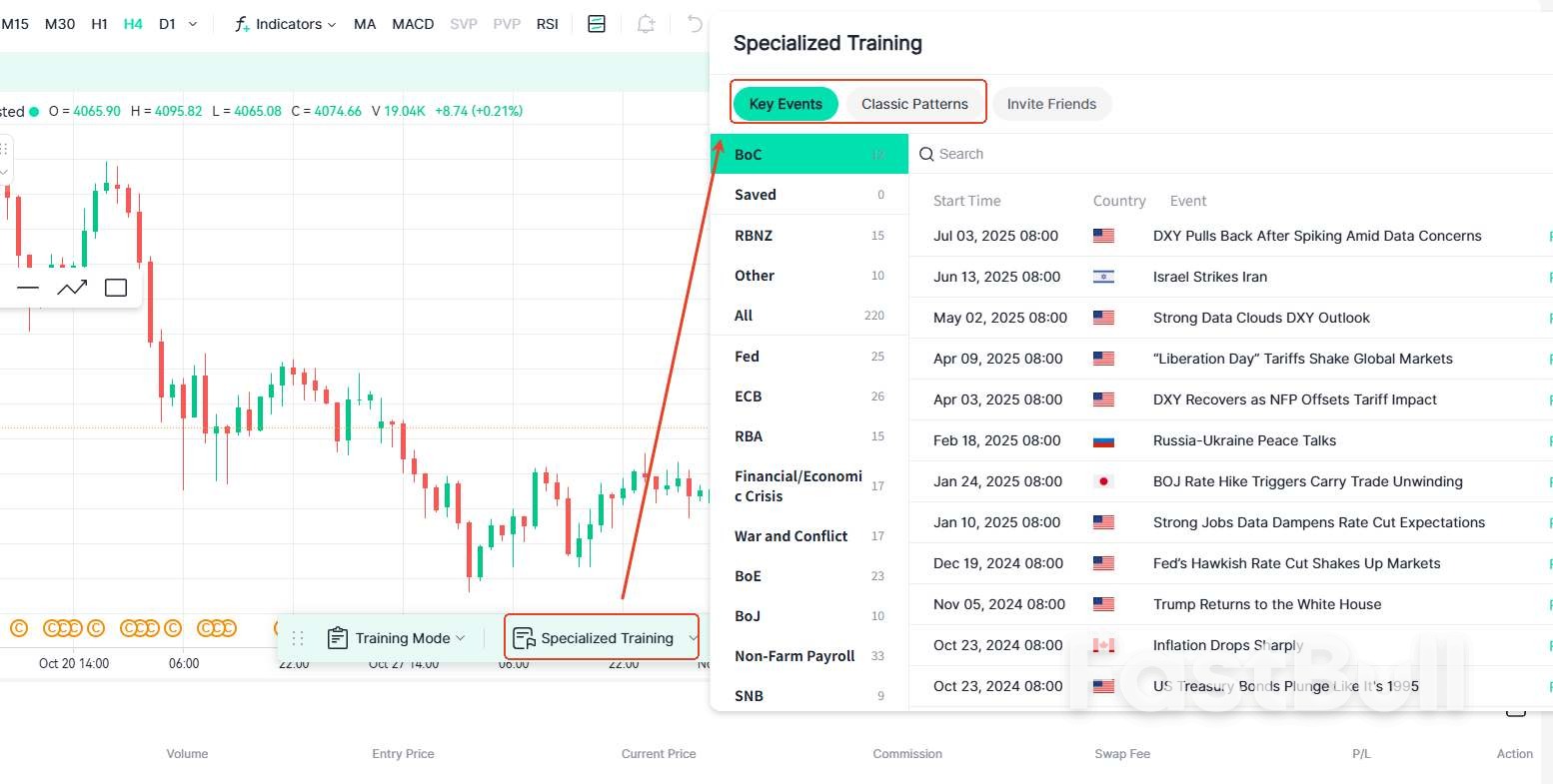

2. Specialized Training: Deep Replay Based on Events and Patterns

Another highlight of FastBull Bar Replay is specialized training, enabling traders to repeatedly practice specific scenarios.

Event-Driven Replay

Traders can focus on historical market events, such as:

● Central bank interest rate decisions

● Key economic releases like NFP, CPI, and GDP

● News events causing significant market volatility

This allows traders to experience how the market reacts at the moment of these events and improve event-driven trading skills.

Crisis Scenario Training

Replay historical periods of major financial crises, including:

● Global financial crises

● Debt crises

● Liquidity crises

● Market turmoil in specific countries or regions

This helps evaluate how strategies perform under extreme conditions.

Geopolitical & Conflict Scenarios

Replay markets during times of international conflict or political risk to understand:

● Price structures during high volatility

● Market risk-off behavior

● Strategy applicability in turbulent environments

Chart Pattern-Based Replay

● Filter and practice across M1 to MN timeframes

● Built-in support for 10+ common chart patterns

● Automatically mark patterns on charts to improve training efficiency. Please remember to apply the indicator “All Chart Pattern” first

Ideal for traders focusing on technical analysis.

3. Test Mode: Complete Period Strategy Validation

For full-cycle strategy testing, FastBull offers a professional Test Mode:

● Choose Bar Replay periods ranging from weeks to months or years

● System automatically selects corresponding historical data

● Hide asset names and specific events to avoid bias

● Validate a wide range of strategies: trend-following, range-bound, pattern-based, and breakout strategies

Perfect for systematic strategy stress testing for intermediate and advanced traders.

4. Multi-Asset Coverage: Trade Across All Markets

FastBull Bar Replay supports all major financial markets, including:

● Forex

● Commodities (gold, oil, etc.)

● Stocks (US, Hong Kong, A-shares, Taiwan, Vietnam, etc.)

● Global indices

● Futures

● Cryptocurrencies

No matter which asset class you trade, FastBull provides comprehensive historical data.

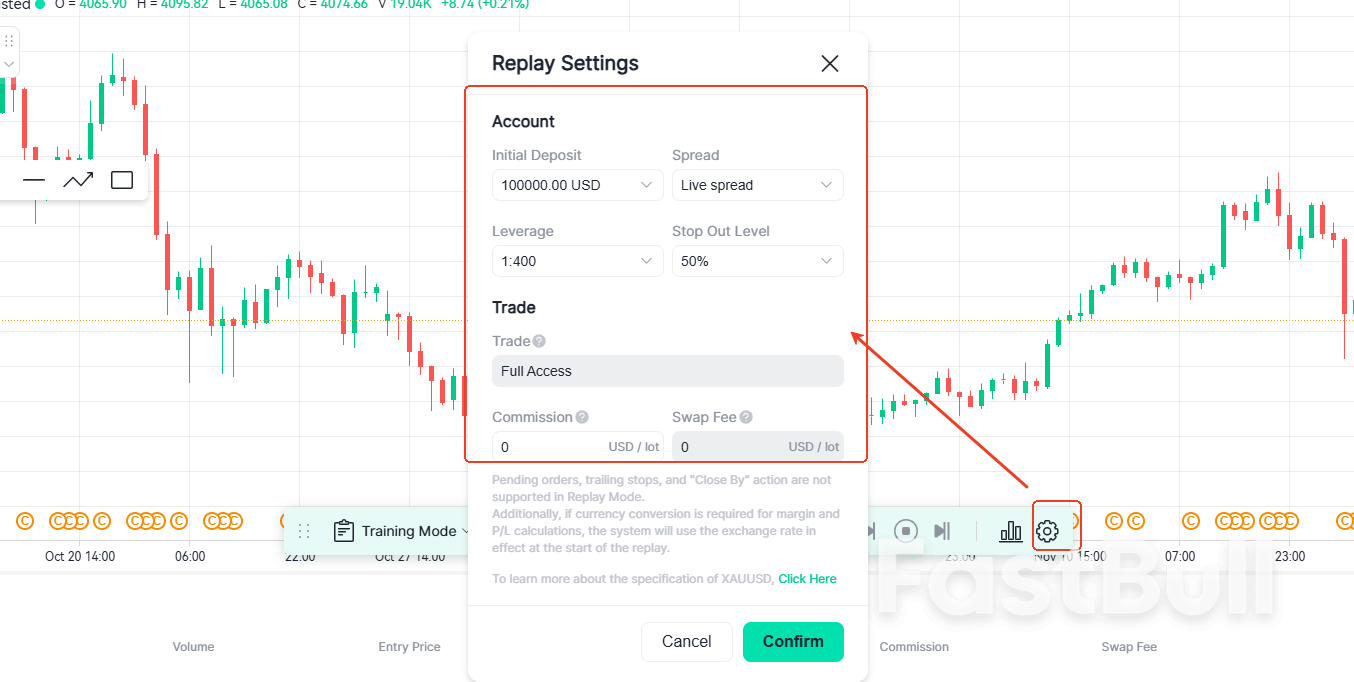

5. Simulated Trading Environment: Experience Realistic Trades

FastBull Bar Replay goes beyond simple chart replay by offering a near-real trading environment.

Traders can customize:

● Initial account balance

● Leverage

● Spread

● Margin call/balance parameters

● Trading Commission

Trades are executed logically as market orders in the replay account.

The system tracks each trade’s P&L, position changes, and overall performance, providing detailed feedback for strategy evaluation.

6. Professional Efficiency Tools: Faster and Smarter Replay

To maximize training efficiency, FastBull includes advanced replay tools:

1. Adjustable Replay Speeds

● Slow: Analyze critical reversals, candlestick patterns, and breakout details

● Fast: Speed through trending periods to save time

2. Forward Fast-Advance

Skip periods of low activity to focus on strategy trigger points and increase training density.

3. Economic Calendar Integration

4. Smooth, Lightweight Interface

No lag or delays, perfect for long practice sessions.

5. Multi-Timeframe Replay

Simultaneously view multiple timeframes from M1 to MN to understand market structure more efficiently.

Key Benefits of Using FastBull Bar Replay

1. Sharpen Trading Skills and Market Intuition

Continuous replay allows traders to accumulate significant “real market experience” in a short time, building more consistent decision-making.

2. Test Strategies in a Risk-Free Environment

All practice is conducted in a simulated account, allowing traders to adjust and refine strategies without risking real funds.

3.Understand Strategy Performance Across Different Market Conditions

Test strategies under:

● Extreme market conditions

● High-volatility periods

● Ranging markets

● Trending markets

Avoid strategies that only perform well under specific conditions.

4. Suitable for All Trading Styles

Supports:

● Scalping

● Intraday trading

● Swing trading

● Trend-following

● Event-driven trading

● Pattern-based trading

Every trader can find the training mode that fits their style.

5. Accelerate Learning

In live markets, one daily candle forms in a day.In FastBull Bar Replay, multiple days or even weeks can be practiced in minutes, dramatically speeding up learning.

6. Improve Strategy Stability and Reduce Emotional Impact

Repeated testing clarifies:

● Which conditions suit your strategy

● When strategies are prone to losses

● How to adjust stops and targets

● How to avoid emotional decisions

A key factor for achieving long-term trading consistency.

Conclusion

FastBull Bar Replay is an essential tool for every trader. Stable trading comes from:

● Extensive replay practice

● Systematic training

● Rigorous strategy validation

● Deep understanding of market structure

FastBull Bar Replay is designed precisely for this purpose.Whether you are a beginner, an advanced trader, or a professional strategy developer, FastBull provides a highly efficient, safe, and professional training environment, accelerating growth and improving long-term stability.

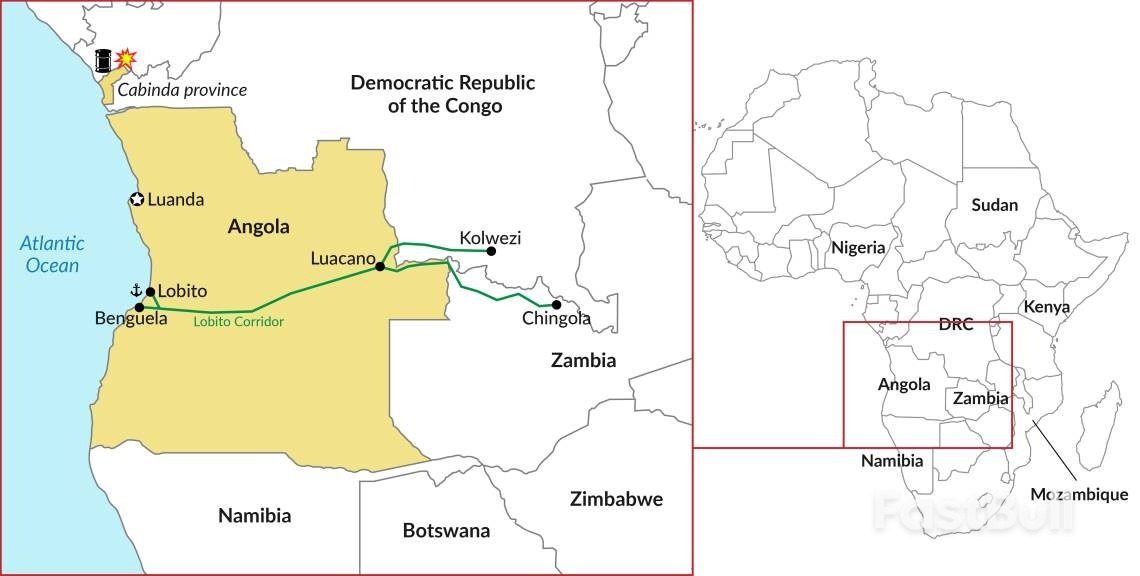

The exclave of Cabinda is home to roughly half of Angola's oil production and has been the site of recent domestic clashes. © GIS

The exclave of Cabinda is home to roughly half of Angola's oil production and has been the site of recent domestic clashes. © GIS