Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Is gold trading a gamble of luck or a battle of systems? In this episode, we sit down with Xinxing He, Founder of Xinghuo Trading and a 10-year veteran analyst with futures and fund management experience. Drawing from his professional background, He breaks down how to navigate the 400x leverage environment

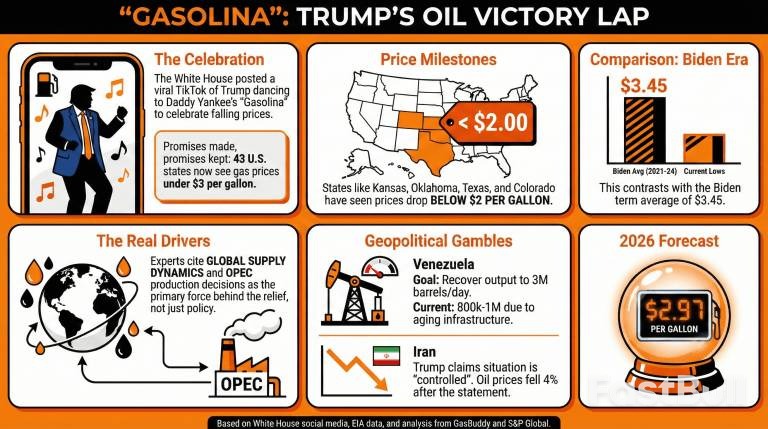

The Trump administration is celebrating a key economic goal: bringing down oil and gas prices for American consumers. To mark the occasion, the official White House TikTok account released a video of Donald Trump dancing to Daddy Yankee's 2004 hit "Gasolina."

Under the banner "promises made, promises kept," the video highlights that gasoline prices have now fallen below $3 per gallon in 43 U.S. states. The White House also claims that prices in some states—including Kansas, Oklahoma, Texas, and Colorado—have dropped to $2 or even lower.

This development stands in contrast to the average gas price during the Biden administration, which the U.S. Energy Information Administration (EIA) calculated at $3.45 per gallon from January 2021 to December 2024.

While the administration has made falling gas prices a priority, experts point to broader market dynamics as the primary cause.

Patrick De Haan, head of petroleum analysis at Gasbuddy, told CNN that "global supply dynamics—particularly OPEC's production decisions—have been the primary force behind the relief drivers are seeing at the pump."

A combination of high-level oil production in the United States and a steady supply from OPEC nations has been instrumental in keeping prices low. However, the Trump administration's foreign policy moves regarding Venezuela and Iran could also play a significant role in maintaining high production levels, potentially offsetting future OPEC cuts.

Two key international situations could further influence the global oil supply and, consequently, prices at the pump.

Venezuela's Uncertain Oil Recovery

The potential return of Venezuelan oil to the U.S. market is a point of debate among analysts. Some argue it would not make a significant difference, while others believe any new supply could have an outsized impact.

"Prices are set on the margin, and small imbalances in volume can lead to large shifts in prices," said Rick Joswick, Head of Near-Term Oil Analytics at S&P Global Energy.

However, this depends on Venezuela's ability to rapidly increase its oil output to over 3 million barrels per day. This is a formidable challenge, as current production is only between 800,000 and 1 million barrels per day, hampered by aging infrastructure and power shortages. Even with a proposed $100 billion investment from private companies, analysts believe it would take years for production to fully recover.

The Impact of Stability in Iran

Another critical factor is the stabilization of Iran. Washington is actively working to de-escalate tensions in the region. Despite prediction markets anticipating a U.S. strike on Iran, President Trump recently stated that the situation in Tehran was under control and the regime would not execute more protesters.

Following these remarks, Brent crude prices fell over 4%, demonstrating the market's sensitivity to potential disruptions in Iranian production. Jim Reid of Deutsche Bank noted that Iran, which produces over 4% of the world's oil and has a well-maintained infrastructure, is a major market mover. He assessed that a conflict there would have "the potential for wider spillovers in the oil market."

Even without major changes in Venezuela or Iran, the downward trend in gas prices is expected to continue. De Haan forecasts that the average price per gallon will reach $2.97 in 2026.

He attributes this outlook to several factors, including "the unwinding of post-pandemic market distortions, expanding global refining capacity, and more stable supply chains." With these key elements working in its favor, the Trump administration may have more positive news on gas prices to share in the coming year.

Canada and China have brokered a significant agreement to de-escalate their trade dispute, with Beijing set to slash tariffs on Canadian rapeseed and Ottawa lowering barriers for Chinese electric vehicles. The move signals a major thaw in relations after a period of high tariffs disrupted agricultural trade flows.

The deal was announced by Canadian Prime Minister Mark Carney during a visit to China, following months of negotiations aimed at mending economic ties.

The core of the agreement involves reciprocal tariff reductions on key goods:

• China's Concessions: Beijing will lower its tariffs on Canadian rapeseed products to 15% by March 1. It will also suspend duties on other agricultural imports, including canola meal and lobsters.

• Canada's Concessions: Ottawa will permit 49,000 Chinese electric vehicles to enter its market at a tariff rate of approximately 6%, a dramatic reduction from the current 100% rate.

Tensions flared in 2024 when Canada imposed tariffs on Chinese EVs, steel, and aluminum. Beijing swiftly retaliated early last year, imposing 100% duties on Canadian rapeseed oil and meal.

Following this, Beijing launched an anti-dumping investigation into Canadian rapeseed, known as canola, which resulted in initial duties of nearly 76% on the oilseed. A final decision on these levies has been extended until March 9.

The punitive duties effectively closed the Chinese market to Canadian canola products, halting a trade relationship valued at C$4.9 billion ($3.5 billion) in 2024.

This new agreement to suspend tariffs is poised to reopen this crucial market, offering much-needed relief to Canadian growers and exporters who have been struggling with ample supplies and few alternative destinations for their products.

Prime Minister Carney has been actively working to rebuild Canada's relationship with Beijing. This effort is part of a broader strategy to diversify trade and reduce the country's economic reliance on the United States, particularly after the Trump administration imposed its own sweeping tariffs.

Carney has indicated opportunities to expand agriculture and energy trade with China. However, it remains uncertain if Ottawa is prepared to fully ease tariffs on Chinese EVs—a key demand from Beijing but a sensitive issue for Canada's domestic auto and steel industries.

Russia’s critical oil and gas revenues fell to a five-year low in 2025, a significant blow to the nation's finances as it continues to fund its war in Ukraine. The state budget collected 8.48 trillion rubles ($108 billion) from energy taxes last year, a 24% decline from 2024 and the lowest annual intake since the beginning of the decade, according to Finance Ministry data.

This revenue shortfall creates a major challenge for the Kremlin. As one of the world's top oil and gas producers, Russia depends heavily on these taxes to fund state operations. The decline was driven by a mix of lower global oil prices, a stronger ruble, and energy sanctions. With military spending rising well beyond initial plans, the government is now under increased fiscal pressure.

To cover the budget gap, Moscow has drawn down more than half of its National Wellbeing Fund—an emergency reserve—and has resorted to expensive borrowing that will weigh on the economy for years.

Oil revenues, the larger component of the energy income, dropped by over 22% year-on-year to 7.13 trillion rubles, the lowest level recorded since 2023. This was the result of two primary factors: falling crude prices and a less favorable exchange rate.

Weaker Prices and Sanction-Driven Discounts

Concerns over a global crude oversupply and specific Western sanctions targeting Russian barrels weakened the flow of cash to state coffers. The average price of Urals, Russia’s main export blend, was calculated at $57.65 a barrel for tax purposes in 2025, marking a 15% decrease from the previous year.

The discount for Urals crude compared to the Brent international benchmark widened significantly after November, when the US sanctioned major producers Rosneft PJSC and Lukoil PJSC. This discount reached approximately $27 a barrel at the point of export, as buyers demanded steeper price cuts to continue purchasing Russian oil.

The Strong Ruble Problem

A stronger domestic currency also eroded the value of Russia's oil sales. The ruble traded at an average of 85.67 per U.S. dollar in 2025, about 6.4% stronger than in 2024. This combination of lower Urals prices and a stronger ruble meant that for every barrel produced and sold, the Russian budget received fewer rubles.

Russia’s tax revenues from the natural gas industry experienced an even sharper decline, falling over 30% to 1.35 trillion rubles. This represents the lowest level since the pandemic year of 2020.

The primary cause was the near-total loss of the European market, which Russia once dominated. Since the start of the war in Ukraine, Russia has systematically lost its most valuable clients in the region.

The situation worsened in January 2025 when the gas transit agreement through Ukraine expired, cutting off a key export route to Europe and leaving state-owned Gazprom PJSC with fewer options. While Russia has increased its natural gas exports to China, these sales are not yet large enough to fully compensate for the lost European business.

An old principle of drama holds that a rifle shown in the first act must be fired by the last. The same logic applies to national energy policy: if a country builds nuclear reactors, it will eventually use them.

While Germany and Taiwan are often cited as exceptions after shuttering their nuclear plants, neither has fully decommissioned them. In both nations, debates over restarting reactors have re-emerged due to concerns about energy security, power costs, and geopolitics. Japan is simply further down this path, now preparing to bring the world's largest nuclear power station back online.

Nearly 15 years after the Fukushima Daiichi catastrophe, Japan is moving to restart units at the Kashiwazaki-Kariwa nuclear station on January 20. The official rationale is straightforward: reactivating reactors will help lower electricity bills at a time of high inflation, which has driven up costs for households and businesses.

While the logic is sound, it was just as valid a year or two ago. Inflation in Japan peaked in 2023 and now sits around 3%. The country's nuclear regulator approved the Kashiwazaki-Kariwa restart over eight years ago. The delay, therefore, wasn't just about regulatory caution.

The real explanation lies in a complex mix of technical, political, and societal factors. The first reactors to restart post-Fukushima were located far from Tokyo and the disaster zone. Public distrust of nuclear power only began to soften a decade after the accident. In March 2021, just four reactors were operational; five years later, that number has climbed to 14. The journey has been slow and deliberate, shaped as much by public sentiment as by policy.

But understanding how Japan is reviving its nuclear program is less important than understanding why.

The fundamental arguments for nuclear power are compelling. Large reactors, refueled only once every three years, generate cheaper electricity than plants relying on monthly imports of coal, oil, or liquefied natural gas (LNG). They also offer powerful benefits:

• Energy Security: Nuclear power is far less exposed to volatile fuel markets and shipping risks.

• Reliable Output: Plants deliver continuous power regardless of weather, unlike solar or wind.

• Climate Goals: They produce zero carbon dioxide, helping Japan meet its emissions targets.

Profit vs. Liability on the Balance Sheet

Financial reality adds another layer of pressure. A dormant nuclear plant costs tens of millions of dollars annually in maintenance, safety checks, and staffing. A plant slated for decommissioning becomes a liability stretching over decades. For reactors less than 20 years old, utilities must also absorb significant accounting losses.

In contrast, a large operating reactor can generate roughly 100 billion yen (about $630 million) in profit each year.

This financial pressure is acute for Tokyo Electric Power Co. (TEPCO), the operator of Kashiwazaki-Kariwa. The Japanese government holds a 56% stake in TEPCO, making it effectively state-owned. Every resident has already contributed nearly 100,000 yen toward Fukushima cleanup and compensation. Each year TEPCO's reactors stay idle, the company spends billions without generating revenue, increasing the burden on taxpayers.

If Japan abandoned nuclear power entirely for fossil fuels, electricity prices would jump by an estimated 30% for businesses and 20% for households. This isn't a theoretical exercise—it's precisely what happened after the Fukushima disaster, when idle reactors forced a surge in LNG and coal imports.

If not nuclear, then what? The other options present their own severe challenges.

The High Cost and Geopolitical Risk of Renewables

Replacing nuclear capacity entirely with renewables is a monumental task. A rough estimate suggests building enough solar and wind capacity, backed by battery storage, would require an investment of 35 trillion to 60 trillion yen. This conservative figure doesn't even account for necessary grid upgrades, financing, or operating costs. For perspective, Japan’s entire national budget for fiscal 2026 is 122 trillion yen.

Even if the cost were manageable, a critical geopolitical constraint emerges. China dominates the global supply chain for green technology, controlling:

• Nearly the entire solar panel supply chain.

• Roughly 70% of battery storage manufacturing.

• Around two-thirds of global wind turbine installation.

Switching from nuclear to renewables would mean sending a sum equivalent to a third or more of Japan's annual budget abroad, largely to China. At the same time, Japanese manufacturers would face structurally higher energy costs than their Chinese competitors. This is why Prime Minister Sanae Takaichi has pushed to focus Japan’s solar strategy on next-generation technologies where domestic firms can compete.

The Volatility of Fossil Fuel Dependence

Relying more on LNG and coal is neither cheap nor sustainable. It would require spending an extra 3 trillion to 5 trillion yen annually on fuel imports and expose Japan’s economy even more to volatile global energy markets.

This brings us back to the rifle on the wall. Japan is not alone in its predicament. Germany and Taiwan have both learned that shutting down reactors is far easier than dismantling them and replacing their output. With 19 GW of nuclear capacity still idle and another 4 GW under construction, Japan faces the same reality. If most of those plants were running, they would supply over a fifth of the nation's electricity.

This does not ignore the real risks of nuclear power, from unresolved waste disposal to public anxiety in an earthquake-prone nation. However, the core issue is no longer whether Japan will restart its reactors, but how much more it will cost to pretend it has another choice.

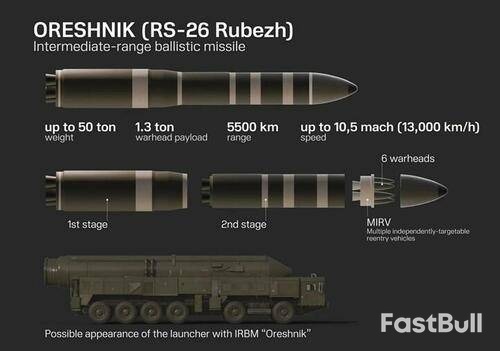

French President Emmanuel Macron has called for Europe to develop its own hypersonic weapons, a direct response to the growing threat posed by Russia's advanced military technology. Speaking to military personnel at the Istres airbase in southern France, Macron specifically highlighted Russia's Oreshnik hypersonic missile as a game-changing weapon that demands a European counter.

The French president's remarks follow at least two known launches of Russia's Oreshnik missile against Ukraine. This weapon, capable of exceeding speeds of Mach 10, has shifted the strategic landscape.

"We must also acquire such weapons, capable of changing the situation in the short term," Macron stated in a speech broadcast by the Elysee Palace. He emphasized the urgency of the situation, noting that "France is within the range of the 'Oreshnik'."

Macron argued that for Europe to maintain its geopolitical standing, it must possess similar capabilities. "We Europeans must acquire these new weapons, capable of changing the balance of power, if we want to remain credible," he explained, vowing to continue work on ultra-long-range weapons with European partners.

The Oreshnik's impact has been noted internationally. The New York Times described it as a "warning delivered to Europe at Mach 10," framing its use in Ukraine as a clear message from Moscow. The publication highlighted that the nuclear-capable missile was previously banned under international treaty.

The Oreshnik is part of a broader showcase of Russian military technology unveiled in 2025. Moscow has presented several advanced systems that redefine modern warfare:

• Oreshnik: A hypersonic missile already battle-tested in Ukraine.

• Burevestnik: A nuclear-powered cruise missile with theoretically unlimited range.

• Poseidon: A nuclear-powered torpedo designed to loiter undetected before striking coastal targets with a nuclear payload, potentially causing a radioactive tsunami. Its destructive power is considered to exceed that of Russia's largest ICBM, the Sarmat.

• Khabarovsk: A nuclear submarine capable of carrying and deploying at least six Poseidon torpedoes.

Adding to regional tensions, Russia has announced plans to station Oreshnik missiles within Belarus, a territory part of the "Union State." This move is widely seen as a response to several factors, including an increase in long-range drone attacks on Russian territory originating from Ukraine and U.S. actions against Russian-linked oil tankers on the high seas. The deployment places these advanced hypersonic weapons on Europe's doorstep, underscoring the strategic challenge Macron's initiative aims to address.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up