Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Prime Minister Takaichi: Japan Will Establish Its Own Version Of Cfius To Screen Foreign Investments

Japan Prime Minister Takaichi: Necessary Spending Will Be Funded As Much As Possible Through Initial Budget

Norad- Detected And Tracked Two Tu-95S, Two Su-35S, And One A-50 Operating In The Alaskan Air Defense Identification Zone (Adiz)

Lagarde Said The Wef Is “One Of The Many Options” She Is Considering Once She Leaves The Central Bank

U.S. Pending Home Sales Index MoM (SA) (Jan)

U.S. Pending Home Sales Index MoM (SA) (Jan)A:--

F: --

U.S. Pending Home Sales Index (Jan)

U.S. Pending Home Sales Index (Jan)A:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Jan)

U.S. Pending Home Sales Index YoY (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Jan)

U.S. Conference Board Leading Economic Index MoM (Jan)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Jan)

U.S. Conference Board Coincident Economic Index MoM (Jan)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Jan)

U.S. Conference Board Lagging Economic Index MoM (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Jan)

U.S. Conference Board Leading Economic Index (Jan)A:--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Feb)

Euro Zone Consumer Confidence Index Prelim (Feb)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. 30-Year TIPS Auction Avg. Yield

U.S. 30-Year TIPS Auction Avg. YieldA:--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Australia Composite PMI Prelim (Feb)

Australia Composite PMI Prelim (Feb)A:--

F: --

P: --

Australia Services PMI Prelim (Feb)

Australia Services PMI Prelim (Feb)A:--

F: --

P: --

Australia Manufacturing PMI Prelim (Feb)

Australia Manufacturing PMI Prelim (Feb)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Jan)

Japan National CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Jan)

Japan CPI YoY (Excl. Fresh Food & Energy) (Jan)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Jan)

Japan National CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan National CPI YoY (Jan)

Japan National CPI YoY (Jan)A:--

F: --

P: --

Japan National CPI MoM (Jan)

Japan National CPI MoM (Jan)A:--

F: --

P: --

Japan CPI MoM (Jan)

Japan CPI MoM (Jan)A:--

F: --

P: --

Japan National CPI MoM (Not SA) (Jan)

Japan National CPI MoM (Not SA) (Jan)A:--

F: --

P: --

Japan National Core CPI YoY (Jan)

Japan National Core CPI YoY (Jan)A:--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Feb)

Japan Manufacturing PMI Prelim (SA) (Feb)A:--

F: --

P: --

U.K. Retail Sales MoM (SA) (Jan)

U.K. Retail Sales MoM (SA) (Jan)--

F: --

P: --

U.K. Retail Sales YoY (SA) (Jan)

U.K. Retail Sales YoY (SA) (Jan)--

F: --

P: --

Germany PPI YoY (Jan)

Germany PPI YoY (Jan)--

F: --

P: --

U.K. Core Retail Sales YoY (SA) (Jan)

U.K. Core Retail Sales YoY (SA) (Jan)--

F: --

P: --

Germany PPI MoM (Jan)

Germany PPI MoM (Jan)--

F: --

P: --

Turkey Capacity Utilization (Feb)

Turkey Capacity Utilization (Feb)--

F: --

P: --

France Composite PMI Prelim (SA) (Feb)

France Composite PMI Prelim (SA) (Feb)--

F: --

P: --

France Services PMI Prelim (Feb)

France Services PMI Prelim (Feb)--

F: --

P: --

France Manufacturing PMI Prelim (Feb)

France Manufacturing PMI Prelim (Feb)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Feb)

Germany Manufacturing PMI Prelim (SA) (Feb)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Feb)

Germany Composite PMI Prelim (SA) (Feb)--

F: --

P: --

Germany Services PMI Prelim (SA) (Feb)

Germany Services PMI Prelim (SA) (Feb)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Feb)

Euro Zone Composite PMI Prelim (SA) (Feb)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Feb)

Euro Zone Services PMI Prelim (SA) (Feb)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Feb)

Euro Zone Manufacturing PMI Prelim (SA) (Feb)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Feb)

U.K. Manufacturing PMI Prelim (Feb)--

F: --

P: --

U.K. Composite PMI Prelim (Feb)

U.K. Composite PMI Prelim (Feb)--

F: --

P: --

U.K. Services PMI Prelim (Feb)

U.K. Services PMI Prelim (Feb)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Mexico Retail Sales MoM (Dec)

Mexico Retail Sales MoM (Dec)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Dec)

U.S. Building Permits Revised MoM (SA) (Dec)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Dec)

U.S. Building Permits Revised YoY (SA) (Dec)--

F: --

P: --

Canada Retail Sales MoM (SA) (Dec)

Canada Retail Sales MoM (SA) (Dec)--

F: --

P: --

Canada Industrial Product Price Index YoY (Jan)

Canada Industrial Product Price Index YoY (Jan)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Dec)

Canada Core Retail Sales MoM (SA) (Dec)--

F: --

P: --

Canada Industrial Product Price Index MoM (Jan)

Canada Industrial Product Price Index MoM (Jan)--

F: --

P: --

U.S. Core PCE Price Index MoM (Dec)

U.S. Core PCE Price Index MoM (Dec)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Dec)

U.S. Personal Outlays MoM (SA) (Dec)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q4)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q4)--

F: --

P: --

U.S. Core PCE Price Index YoY (Dec)

U.S. Core PCE Price Index YoY (Dec)--

F: --

P: --

No matching data

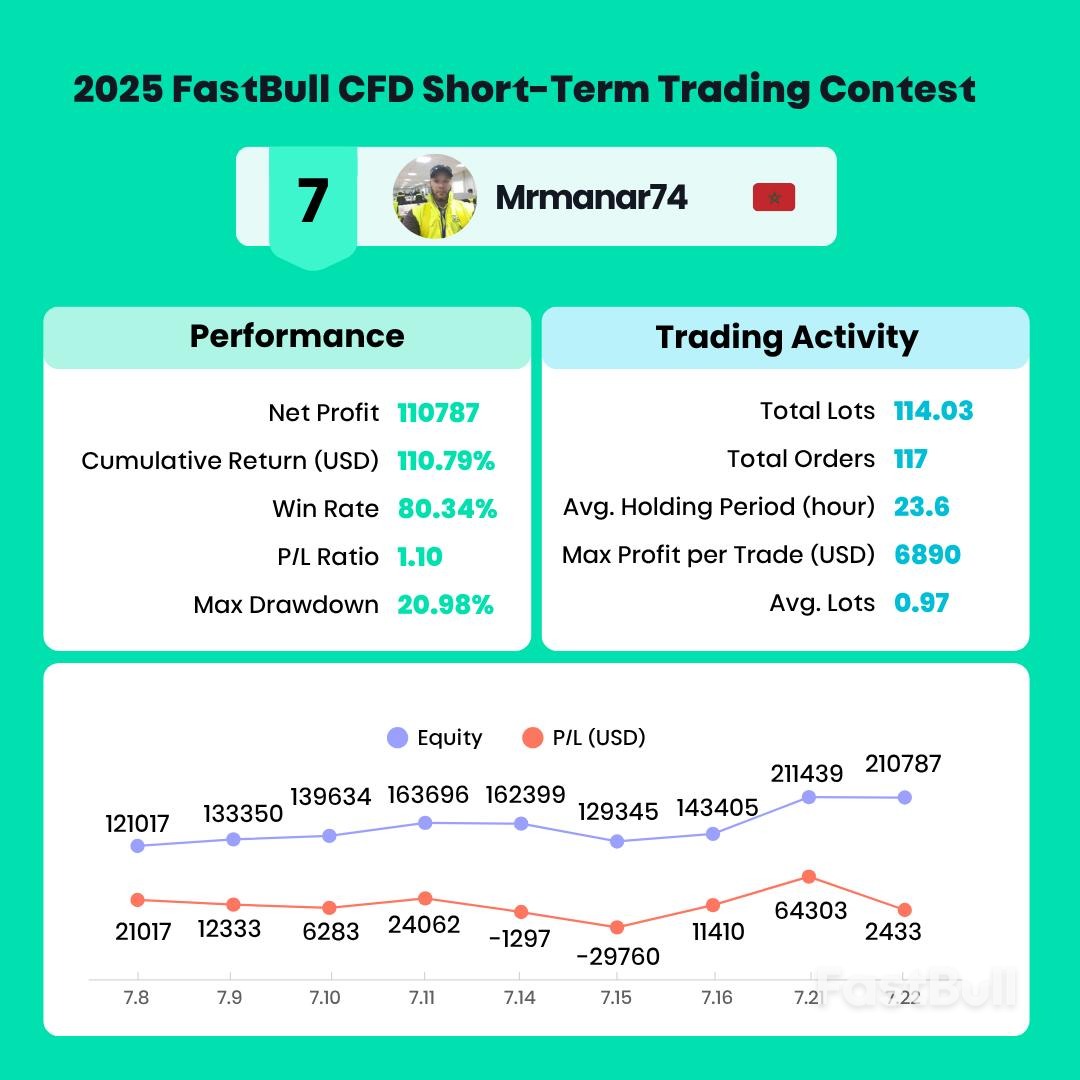

The markets closed, the charts told their stories, and the champions have emerged - the 2025 FastBull CFD Trading Contest has officially wrapped up. After two weeks of fast-paced action and high-stakes strategies, 7,199 traders from around the world put their skills to the test in one of the most dynamic short-term trading contests of the year.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up