Markets

Analysis

User

24/7

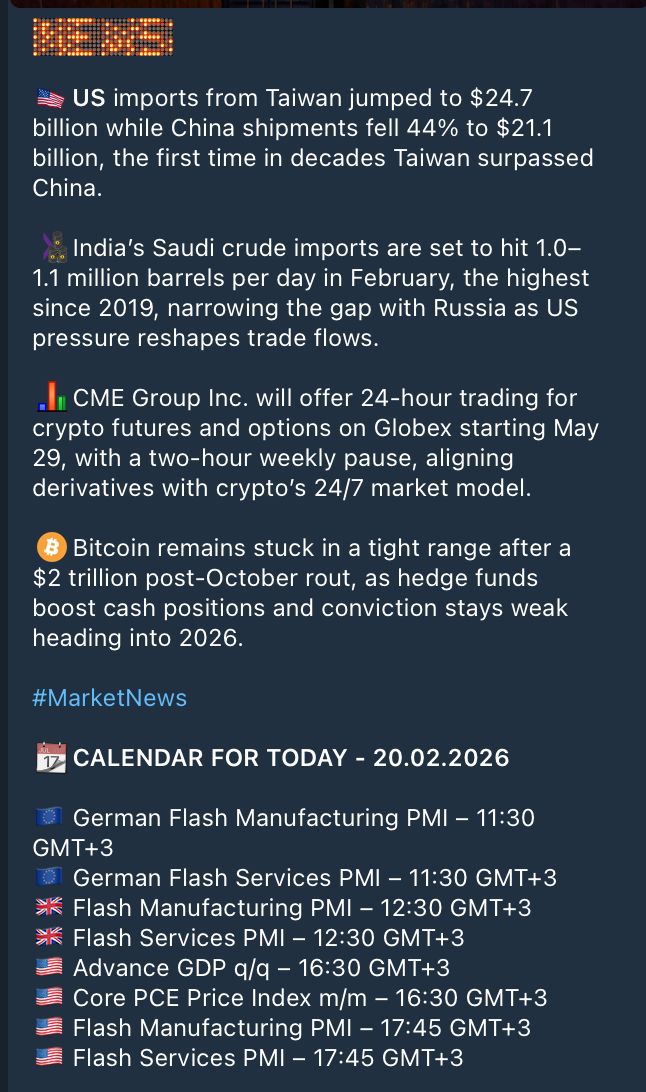

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

South Korea, Canada To Hold Defence And Foreign Ministers' Meeting On February 25 - South Korea Ministry

[Yesterday, The US Ethereum Spot ETF Saw A Net Outflow Of $130.1 Million, While The Solana ETF Saw A Net Inflow Of $6 Million.] February 20, According To Farside Monitoring Data, Yesterday The US Ethereum Spot ETF Saw A Net Outflow Of $130.1 Million, While The Solana ETF Saw A Net Inflow Of $6 Million

Sweden FSA: Will Investigate Whether Swedbank Has Complied With Money Laundering Regulations. The Investigation Will Include The Bank's Customer Due Diligence Measures

Eurostoxx 50 Futures Up 0.41%, DAX Futures Up 0.3%, CAC 40 Futures Up 0.43%, FTSE Futures Up 0.38%

Statistics Denmark - Danish Q3 GDP Data Revised To 2.3 Percent Quarter-On-Quarter Versus Previous Figure Of 2.2 Percent

Hungary Government To Release 250000 Tons Of Crude Oil From Its Strategic Reserves After Oil Flows Stop On Druzhba

USA Ambassador To India: Active Negotiations Underway With India's Energy Ministry On Importing Venezuelan Oil To India

Philippines Foreign Ministry: Will Continue To Champion The Country's Maritime Rights And Interests Through Effective, Principled Diplomacy

Philippines Foreign Ministry: Even As We Deepen Ties With 'Like-Minded Countries', We Maintain Open Lines With China For Candid, Constructive Dialogue

U.S. Pending Home Sales Index (Jan)

U.S. Pending Home Sales Index (Jan)A:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Jan)

U.S. Pending Home Sales Index YoY (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. 30-Year TIPS Auction Avg. Yield

U.S. 30-Year TIPS Auction Avg. YieldA:--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Australia Composite PMI Prelim (Feb)

Australia Composite PMI Prelim (Feb)A:--

F: --

P: --

Australia Services PMI Prelim (Feb)

Australia Services PMI Prelim (Feb)A:--

F: --

P: --

Australia Manufacturing PMI Prelim (Feb)

Australia Manufacturing PMI Prelim (Feb)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Jan)

Japan National CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Jan)

Japan CPI YoY (Excl. Fresh Food & Energy) (Jan)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Jan)

Japan National CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan National CPI YoY (Jan)

Japan National CPI YoY (Jan)A:--

F: --

P: --

Japan National CPI MoM (Jan)

Japan National CPI MoM (Jan)A:--

F: --

P: --

Japan CPI MoM (Jan)

Japan CPI MoM (Jan)A:--

F: --

P: --

Japan National CPI MoM (Not SA) (Jan)

Japan National CPI MoM (Not SA) (Jan)A:--

F: --

P: --

Japan National Core CPI YoY (Jan)

Japan National Core CPI YoY (Jan)A:--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Feb)

Japan Manufacturing PMI Prelim (SA) (Feb)A:--

F: --

P: --

U.K. Retail Sales MoM (SA) (Jan)

U.K. Retail Sales MoM (SA) (Jan)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Jan)

U.K. Retail Sales YoY (SA) (Jan)A:--

F: --

Germany PPI YoY (Jan)

Germany PPI YoY (Jan)A:--

F: --

P: --

U.K. Core Retail Sales YoY (SA) (Jan)

U.K. Core Retail Sales YoY (SA) (Jan)A:--

F: --

Germany PPI MoM (Jan)

Germany PPI MoM (Jan)A:--

F: --

P: --

Turkey Capacity Utilization (Feb)

Turkey Capacity Utilization (Feb)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Feb)

France Composite PMI Prelim (SA) (Feb)--

F: --

P: --

France Services PMI Prelim (Feb)

France Services PMI Prelim (Feb)--

F: --

P: --

France Manufacturing PMI Prelim (Feb)

France Manufacturing PMI Prelim (Feb)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Feb)

Germany Manufacturing PMI Prelim (SA) (Feb)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Feb)

Germany Composite PMI Prelim (SA) (Feb)--

F: --

P: --

Germany Services PMI Prelim (SA) (Feb)

Germany Services PMI Prelim (SA) (Feb)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Feb)

Euro Zone Composite PMI Prelim (SA) (Feb)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Feb)

Euro Zone Services PMI Prelim (SA) (Feb)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Feb)

Euro Zone Manufacturing PMI Prelim (SA) (Feb)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Feb)

U.K. Manufacturing PMI Prelim (Feb)--

F: --

P: --

U.K. Composite PMI Prelim (Feb)

U.K. Composite PMI Prelim (Feb)--

F: --

P: --

U.K. Services PMI Prelim (Feb)

U.K. Services PMI Prelim (Feb)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Mexico Retail Sales MoM (Dec)

Mexico Retail Sales MoM (Dec)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Dec)

U.S. Building Permits Revised MoM (SA) (Dec)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Dec)

U.S. Building Permits Revised YoY (SA) (Dec)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Dec)

U.S. Real Personal Consumption Expenditures MoM (Dec)--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q4)

U.S. Annualized Real GDP Prelim (Q4)--

F: --

P: --

U.S. PCE Price Index MoM (Dec)

U.S. PCE Price Index MoM (Dec)--

F: --

P: --

U.S. Personal Income MoM (Dec)

U.S. Personal Income MoM (Dec)--

F: --

P: --

Canada Retail Sales MoM (SA) (Dec)

Canada Retail Sales MoM (SA) (Dec)--

F: --

P: --

Canada Industrial Product Price Index YoY (Jan)

Canada Industrial Product Price Index YoY (Jan)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Dec)

Canada Core Retail Sales MoM (SA) (Dec)--

F: --

P: --

Canada Industrial Product Price Index MoM (Jan)

Canada Industrial Product Price Index MoM (Jan)--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q4)

U.S. PCE Price Index Prelim YoY (Q4)--

F: --

P: --

No matching data

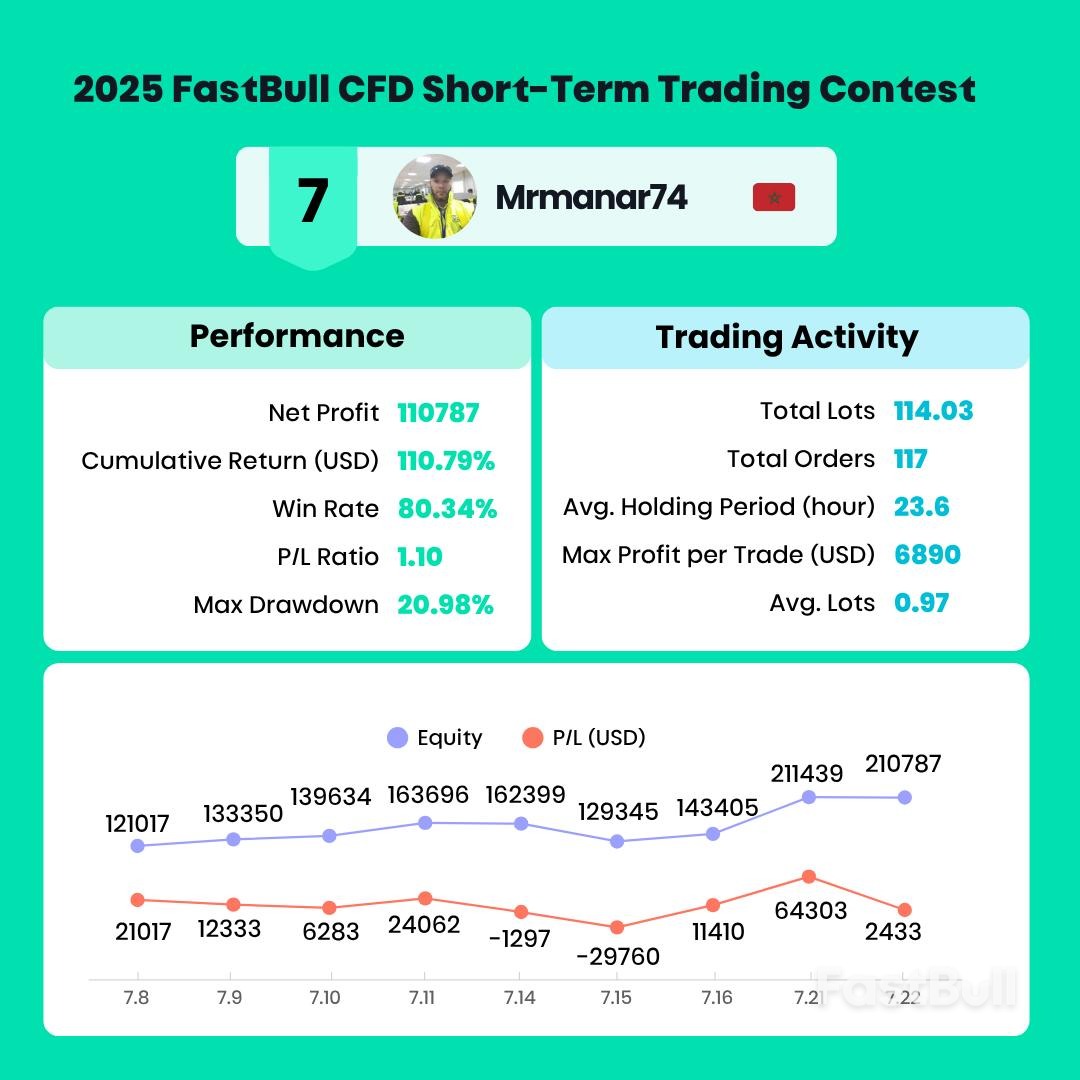

After two weeks of fierce competition, the 2025 FastBull CFD Trading Contest Season 1 has come to a successful close on July 22, 2025. We had an incredible turnout with 7,199 traders from around the globe, all demonstrating their outstanding trading skills and strategies in the FastBull community.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up