Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

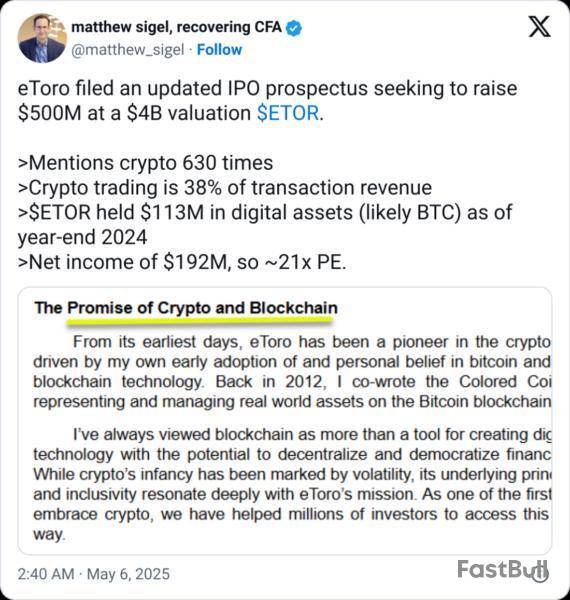

The Israel-based eToro Group says it’s looking for a valuation of up to $4 billion with its initial public offering in the US, as the stock and crypto trading platform forges ahead with listing on the Nasdaq.

The company and existing stockholders are aiming to raise $500 million through offering a total of 10 million shares priced between $46 to $50 apiece, eToro said on May 5.

A filing with the US Securities and Exchange Commission shows eToro is offering 5 million shares, with a further 5 million being put up by the likes of the company’s co-founder and CEO, Yoni Assia; his brother and executive director, Ronen Assia; along with venture firms Spark Capital, BRM Group and Andalusian Private Capital, among others.

The company offers stock and crypto trading targeting retail and plans to list on the tech-heavy Nasdaq Global Select Market under the ticker “ETOR.”

It's slated to compete with Robinhood Markets Inc. (HOOD), which saw crypto trading dip in the first quarter but whose shares have climbed by nearly 30% so far this year, according to Google Finance.

In the filing, eToro said some BlackRock funds and accounts indicated interest in buying up to $100 million worth of shares at IPO. eToro has also put aside 500,000 shares to sell through a directed share program, typically targeted at employees.

The company reported that its revenue from crypto in 2024 was $12.1 billion, up from $3.4 billion in 2023. It expected crypto to account for 37% of its commission from trading activity in the first quarter of 2025, down from 43% in the year-ago quarter.

In a section of its filing listing possible risks to the business, eToro warned its users could leave, or it could struggle to get more users, due to negative perceptions of the cryptocurrencies it lists, “either as a result of media coverage or by experiencing significant losses.”

Other crypto-related risks the eToro flagged included US state-level crypto regulation, which it said “may place strain on our resources and make it difficult to operate in certain jurisdictions, if at all.”

It also said it expects “to continue to incur significant costs” due to the European Union’s Markets in Crypto-Assets (MiCA) laws “on an ongoing basis.”

IPOs ready to push after Trump tariff jolt

EToro initially made confidential filings with the SEC in January for a public offering, before publicly announcing the plans on March 24.

The company reportedly delayed its IPO after President Donald Trump’s April 2 “Liberation Day” tariff announcements tanked global markets and stopped many in-the-works public offerings.

Crypto companies are also lining up to go public, with stablecoin issuer Circle filing on April 1 but then pausing its plans amid the uncertainty.

Crypto exchange Kraken is also reportedly considering a public offering for early next year, which has accelerated its plan with Trump’s election.

EToro’s public offering is led by Goldman Sachs, Jefferies, UBS Investment Bank and Citigroup.

Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Bitcoin and crypto markets could face headwinds preventing new peaks if certain scenarios play out, wrote Bitcoin researcher and author Timothy Peterson.

The economist provided the analysis to counter hisbullish predictionthat BTC could reach $135,000 in the next three months or so. Continued poor or declining sentiment could impact crypto markets should things not improve soon.

The UMich consumer sentiment survey is bad, trending worse, while the AAII investor sentiment is 20% bullish, 60% bearish, “a huge gap and also trending worse,” he observed.

Meanwhile, the NAAIM Equity Exposure index is a respectable 60% allocation to equity, “but still well below the 80% associated with bull markets,” he said.

Three things that could prevent a new Bitcoin ATH.

Thing 1: Continued poor or declining sentiment. UMich consumer sentiment survey is bad trending worse; AAII investor sentiment is 20% bullish, 60% bearish, a huge gap, and also trending worse. NAAIM Equity Exposure index is a… https://t.co/T3jdA3khyn pic.twitter.com/AOVOra1jBb

— Timothy Peterson (@nsquaredvalue) May 3, 2025

The Fed and Event Risk

The Federal Reserve could also impact Bitcoin prices since markets have already priced in approximately three rate cuts for the remainder of 2025.

“Risk assets have rallied on the expectation that looser monetary policy will return, boosting liquidity and supporting higher multiples,” he said before adding Bitcoin’s recent strength reflects this forward-looking optimism.

However, if the Fed fails to deliver these cuts, the market narrative will shift, choking these speculative flows.

“For Bitcoin, which thrives on liquidity and risk appetite, the absence of rate cuts could stall momentum or even trigger a drawdown.”

The Fed is expected to keep rates unchanged at itsmeetingon Wednesday, May 7.

Finally, event risk, or unforeseen macro-level shocks that cannot be predicted in timing or magnitude, can cause severe disruption to financial markets.

“For Bitcoin, these risks bypass conventional forecasting tools and risk models, creating sharp breaks from trend behavior.”

Peterson cited examples that included nuclear accidents, large-scale terrorist attacks on critical infrastructure, cyberattacks on financial systems, another pandemic, or massive natural disasters.

Bitcoin behaves like a “high-beta asset” under these conditions, “subject to indiscriminate selling, access limitations, and temporary narrative collapse,” he said, concluding the analysis on May 5.BTC Price Outlook

Doom and gloom aside, Bitcoin was still trading within its rangebound channel, where it has been for the past fortnight.

The asset has swung frombelow $93,750in late trading on Monday to retap $95,000 during Tuesday morning trading in Asia.

BTC had retreated slightly at the time of writing when it was changing hands for $94,380, according to CoinGecko.

Kenya's High Court has ordered the World Foundation, formerly known as Worldcoin and co-founded by OpenAI CEO Sam Altman, to delete the biometric data of local users, ruling that its collection violated the right to privacy.

Justice Aburili Roselyne ruled on Monday that the project must permanently delete users' biometric data, including facial images and iris scans, within seven days under the supervision of the data protection officer, according to Katiba Institute, which, together with ICJ Kenya, brought the case against World.

The judge also issued an order prohibiting World from collecting or processing any further biometric data in Kenya. Additionally, the court issued an order of Certiorari nullifying the decision by World and its agents to collect or process biometric data without conducting an adequate data protection impact assessment.

"The judgment rightly underscores that even in the digital age, constitutional rights especially the right to privacy under Article 31 of the Constitution must be upheld," said ICJ Kenya.

Kenya was once one of the largest markets for sign-ups to World, with hundreds of thousands of users registering before the project was suspended by local authorities in August 2023. However, in June 2024, the project announced plans to resume operations after local police dropped their investigation.

World did not immediately respond to The Block's request for comment.

World’s launches in other countries have frequently sparked concerns over data privacy and protection. On Sunday, Indonesia's digital ministry suspended the operating permit of World for alleged violations of electronic system operation regulations.

However, the project announced last week that it is expanding in the U.S., initially launching in six cities — Atlanta, Austin, Los Angeles, Miami, Nashville and San Francisco.

The price of WLD fell 6.99% in the past 24 hours to trade at $0.89 at press time, according to The Block's price page. It has a market capitalization of $1.2 billion.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

In a recent filing with the US Securities and Exchange Commission (SEC), Strategy (formerly Microstrategy), disclosed the purchase of an additional 6,556 Bitcoin (BTC) at an average price of $95,167 per coin between April 28 and May 4.

This latest acquisition brings the company’s total Bitcoin holdings to 555,450 BTC, valued at approximately $38.08 billion, with an average purchase price of $68,550 per BTC.

Strategy Announces New $21 Billion ATM Offering

The acquisition was financed through a strategic combination of common and preferred stock sales. Specifically, Strategy raised $128.5 million through its common stock at-the-market (ATM) program and an additional $51.8 million from the sale of STRK preferred shares. Notably, this latest transaction exhausts the company’s previous $21 billion ATM offering that was initiated last year.

Michael Saylor, co-founder of Strategy and a well-known advocate for BTC, also shared on social media that the company has achieved a year-to-date Bitcoin yield of 14.0% as of May 4, 2025. He emphasized that the firm currently holds 555,450 BTC, acquired for approximately $38.08 billion.

In a bid to further bolster its BTC accumulation strategy, Strategy announced last week plans to double its capital raising capacity. This includes introducing a new $21 billion ATM offering and expanding its debt purchase program to $42 billion.

These initiatives indicate the company’s commitment to enhancing its BTC-heavy balance sheet, even in light of recent financial challenges, including five consecutive quarterly net losses.

Institutional Demand For Bitcoin Surges

During its latest earnings call, Strategy unveiled the “42/42 Plan,” a roadmap aimed at raising $84 billion in capital over the next two years. The plan involves splitting the funding equally between equity and fixed-income instruments, all earmarked for future BTC acquisitions.

Despite reporting ongoing losses, investor sentiment remains optimistic. Strategy continues to be the largest corporate holder of BTC, with its holdings representing nearly 3% of Bitcoin’s maximum supply. At current market prices around $94,000, the company’s bitcoin assets are valued at over $52 billion.

This recent purchase comes amid a backdrop of strong institutional demand for BTC, particularly through regulated investment vehicles. Notably, BlackRock’s iShares Bitcoin Trust ETF (IBIT) has experienced significant inflows in the past two weeks, reflecting growing interest from institutional investors.

However, despite the positive outlook on its BTC strategy, Strategy’s shares were down 2.7% in pre-market trading on Monday, following a gain of over 3% last Thursday.

Bitcoin, on the other hand, is trading at $94,596, a slight decrease of 0.2% in the 24-hour time frame, and gains of up to 13% in the monthly period for the market’s largest cryptocurrency.

Featured image from DALL-E, chart from TradingView.com

Ripple CEO Brad Garlinghouse has announced that the enterprise blockchain company will no longer release its XRP markets reports on a quarterly basis.

From now on, Ripple's XRP holdings will still be published on the company's official website.

The community will now be able to receive updates about the company and XRP via a series of social media and blog posts. They will no longer be bundled within a single report, which will potentially reduce the legal weight of such disclosures.

Ripple originally started publishing the reports back in 2017 in order to ensure greater transparency.

Garlinghouse claims that the transparency that was provided by the report was "weaponized" by the U.S. Securities and Exchange Commission (SEC). It is worth noting that the regulator, which sued Ripple back in 2020, referenced some of the company's disclosures in order to make its case that XRP is not sufficiently decentralized.

"As some may remember, the objective of publishing these reports starting in 2017 was transparency into Ripple’s holdings of XRP, which unfortunately was then used against us by the SEC and others," he said.

As reported by U.Today, Ripple's latest report, the last one released in the traditional format, revealed that the company holds nearly 45.86 billion tokens. This sum includes both Ripple's XRP holdings and the tokens that are currently locked in escrow. The tokens controlled by the company are worth close to $99 billion at current prices.

Despite ditching the traditional format, Ripple is still "committed to transparency."

A Russian-Israeli citizen allegedly involved in the $190 million Nomad bridge hack will soon be extradited to the US after he was reportedly arrested at an Israeli airport while boarding a flight to Russia.

Alexander Gurevich will be investigated for his alleged involvement in several “computer crimes,” including laundering millions of dollars and transferring stolen property allegedly connected to the Nomad Bridge hack in 2022, The Jerusalem Post reported on May 5.

Gurevich returned to Israel from an overseas trip on April 19 but was ordered to appear before the Jerusalem District Court for an extradition hearing soon after, according to the report.

On April 29, Gurevich changed his name in Israel’s Population Registry to “Alexander Block” and received a passport under that name at Israel’s Ben-Gurion Airport the next day.

He was arrested at the same airport two days later, on May 1, while waiting to board a flight to Russia.

Gurevich allegedly identified a vulnerability in the Nomad bridge, which he exploited and stole roughly $2.89 million worth of tokens from in August 2022.

Dozens of copycat hackers discovered and capitalized on the security vulnerability soon after, leading to a total loss of $190 million.

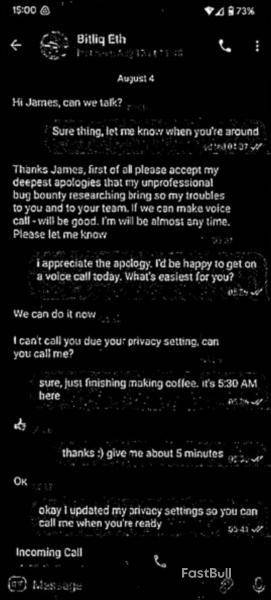

Gurevich allegedly reached out to a Nomad executive on Telegram

Prosecutors allege that shortly after the hack, Gurevich messaged Nomad’s chief technology officer, James Prestwich, on Telegram using a fake identity, admitting that he had been “amateurishly” seeking a crypto protocol to exploit.

He allegedly apologized for “the trouble he caused Prestwich and his team” and voluntarily transferred about $162,000 into a recovery wallet the company had set up.

Prestwich told Gurevich that Nomad would pay him 10% of the value of the assets he had stolen, to which Gurevich responded that he would consult his lawyer. However, Nomad never heard back from him after that.

At some point during the negotiations, Gurevich demanded a reward of $500,000 for identifying the vulnerability.

US federal authorities filed an eight-count indictment against Gurevich in the Northern District of California on Aug. 16, 2023, in addition to obtaining a warrant for his arrest. California is where the team behind the Nomad bridge is based.

The US submitted a formal extradition request in December 2024, the Post noted.

The money laundering charges that Gurevich faces carry a maximum of 20 years, significantly harsher than what he would face in Israel.

Gurevich is believed to have arrived in Israel a few days before the $190 million exploit occurred, prompting Israeli officials to believe he carried out the attack while in Israel.

Solana started a fresh decline from the $155 zone. SOL price is now consolidating near $145 and might extend losses below the $142 support.

Solana Price Consolidates Gains

Solana price formed a base above the $142 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $145 and $150 resistance levels.

However, the bears were active below the $155 resistance zone. A high was formed at $153.90 and the price started a fresh decline. The price dipped below $150 and $148. A low was formed at $142.64 and the price is now consolidating losses.

There was a minor move above the 23.6% Fib retracement level of the downward move from the $153.90 swing high to the $142.64 low. Solana is now trading below $150 and the 100-hourly simple moving average. There is also a short-term rising channel or a continuation pattern forming with support at $144 on the hourly chart of the SOL/USD pair.

On the upside, the price is facing resistance near the $147 level. The next major resistance is near the $150 level and the 61.8% Fib retracement level of the downward move from the $153.90 swing high to the $142.64 low. The main resistance could be $155. A successful close above the $155 resistance zone could set the pace for another steady increase. The next key resistance is $165. Any more gains might send the price toward the $180 level.

More Losses in SOL?

If SOL fails to rise above the $150 resistance, it could start another decline. Initial support on the downside is near the $145 zone. The first major support is near the $142 level.

A break below the $142 level might send the price toward the $135 zone. If there is a close below the $135 support, the price could decline toward the $122 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $145 and $142.

Major Resistance Levels – $147 and $150.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up